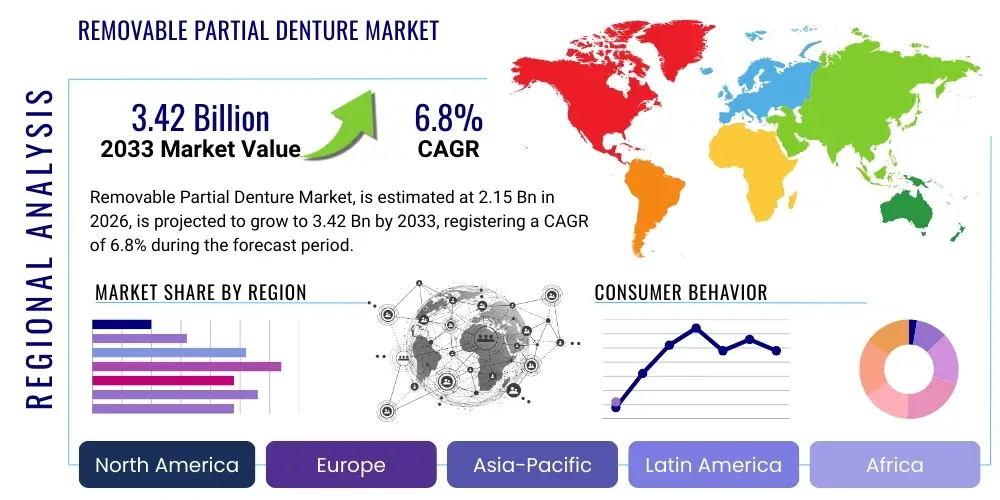

Removable Partial Denture Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439200 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Removable Partial Denture Market Size

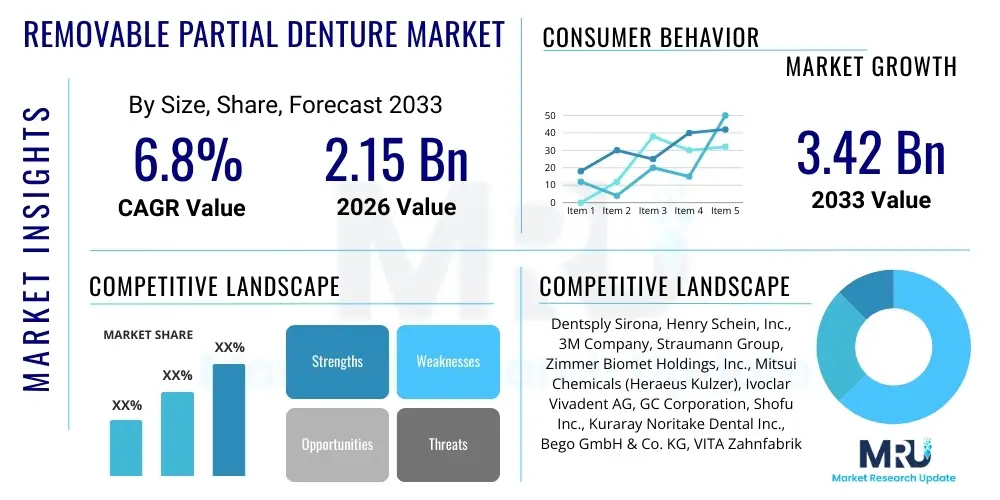

The Removable Partial Denture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 3.42 Billion by the end of the forecast period in 2033.

Removable Partial Denture Market introduction

The Removable Partial Denture (RPD) market encompasses the global landscape of dental prostheses designed to replace one or more missing teeth while retaining some natural teeth. These devices are custom-fabricated to restore oral function, improve aesthetics, and maintain the integrity of the remaining dentition. RPDs are typically composed of a metal framework, acrylic base, and artificial teeth, or entirely from flexible thermoplastic materials, offering various solutions tailored to patient needs and clinical conditions. Their primary applications include the restoration of masticatory efficiency, support for existing teeth, prevention of further tooth migration, and significant enhancement of facial aesthetics, thereby improving patients' quality of life.

The benefits associated with Removable Partial Dentures are multifaceted, ranging from their relative affordability compared to fixed prostheses like bridges or implants, to their non-invasive nature, as they generally do not require alteration of adjacent healthy teeth. They provide a versatile solution for patients who may not be candidates for implants due to bone loss or systemic health issues, or for those seeking a less permanent and more economical option. Modern RPDs are designed for enhanced comfort and aesthetics, leveraging advancements in material science and digital manufacturing techniques to offer improved fit and a natural appearance. They serve as a crucial restorative option within general dentistry, catering to a significant demographic facing partial edentulism.

Several driving factors are propelling the growth of the Removable Partial Denture market. A rapidly aging global population, characterized by a higher prevalence of tooth loss, is a primary demographic driver. Coupled with this, increasing awareness regarding oral health and the availability of diverse treatment options is encouraging more individuals to seek prosthetic solutions. The rising incidence of dental caries, periodontal diseases, and traumatic injuries leading to tooth extraction further contributes to the demand for RPDs. Moreover, improvements in dental technology, including advanced materials that offer better biocompatibility and durability, alongside streamlined fabrication processes, are making RPDs more appealing and accessible to a broader patient base worldwide, including those in emerging economies where dental care infrastructure is expanding.

Removable Partial Denture Market Executive Summary

The Removable Partial Denture market is undergoing significant transformation, driven by a confluence of evolving business trends, shifting regional dynamics, and innovative segment developments. Business trends indicate a strong move towards digitalization in dentistry, with an increasing adoption of CAD/CAM technologies and 3D printing for RPD design and fabrication, leading to enhanced precision, efficiency, and customization. Furthermore, there is a notable emphasis on material innovation, with new flexible thermoplastics and advanced metal alloys offering improved comfort, aesthetics, and longevity. The market also sees a growing trend in direct-to-consumer models for certain dental prosthetics, though RPDs largely remain within professional dental channels, focusing on personalized patient care and high-quality outcomes. Strategic partnerships between dental material suppliers, laboratories, and technology providers are becoming crucial for market penetration and innovation.

Regional trends highlight dynamic growth across various geographies. North America and Europe continue to represent mature markets, characterized by high disposable incomes, advanced dental healthcare infrastructure, and a strong preference for aesthetic dentistry. These regions are early adopters of new technologies and premium materials. Conversely, the Asia Pacific (APAC) region, particularly countries like China, India, and Japan, is emerging as a significant growth engine for the RPD market. This growth is fueled by a large and aging population, increasing dental tourism, improving economic conditions, and expanding access to dental care services. Latin America and the Middle East & Africa (MEA) are also demonstrating promising growth trajectories, driven by rising health awareness and governmental initiatives aimed at enhancing oral healthcare accessibility. The differing regulatory environments and economic capabilities across regions influence product adoption rates and market penetration strategies.

Segmentation trends within the RPD market reveal distinct areas of growth and innovation. The material segment is seeing a shift towards flexible thermoplastics (e.g., Valplast, PEEK) due to their aesthetic appeal, biocompatibility, and comfort, although conventional metal-acrylic RPDs remain widely used for their durability and cost-effectiveness. The end-user segment continues to be dominated by dental clinics, which serve as the primary point of patient contact and RPD delivery. However, the role of large dental service organizations (DSOs) and specialized dental laboratories equipped with advanced manufacturing capabilities is expanding. From a design perspective, customized solutions leveraging digital impressions and CAD/CAM are becoming standard, allowing for more precise fits and reduced chairside adjustments. These segment-specific developments collectively contribute to a robust and adaptive market, poised for sustained growth through innovation and expanded access.

AI Impact Analysis on Removable Partial Denture Market

The impact of Artificial Intelligence (AI) on the Removable Partial Denture (RPD) market is anticipated to be transformative, addressing key user questions related to design precision, material selection, manufacturing efficiency, and overall patient experience. Common inquiries revolve around how AI can enhance the accuracy of RPD fabrication, optimize material usage to reduce costs, and personalize prostheses for superior fit and comfort. Users are keen to understand AI's role in predictive analytics for RPD longevity, its potential to simplify complex design processes, and its implications for dental laboratory workflows. The overarching expectation is that AI will streamline the entire RPD lifecycle, from initial diagnosis and treatment planning to final product delivery, ultimately leading to higher quality restorations and improved patient satisfaction.

- AI-powered diagnostic tools can analyze patient scans (CBCT, intraoral) to identify optimal retention areas, bone density, and soft tissue contours, leading to more accurate RPD design proposals.

- Generative design algorithms can automatically create multiple RPD framework designs based on patient-specific data, dental arch geometry, and biomechanical principles, drastically reducing design time and improving structural integrity.

- Machine learning models can predict the optimal material selection for RPDs by considering factors such as patient biting forces, aesthetic requirements, potential allergic reactions, and cost-effectiveness, thereby enhancing durability and patient comfort.

- AI integration with CAD/CAM systems enables automated milling and 3D printing of RPD components, ensuring higher precision, reduced human error, and faster production cycles compared to traditional methods.

- Predictive analytics can forecast potential failure points or areas of wear in RPDs based on patient habits and material properties, allowing for proactive adjustments or maintenance recommendations.

- AI-driven patient communication platforms can educate patients about RPD care, maintenance, and expected lifespan, improving compliance and contributing to the longevity of the prosthesis.

- Virtual reality and augmented reality applications, potentially powered by AI, can offer patients a visual preview of their RPDs, allowing for adjustments to aesthetics and fit before physical fabrication, leading to higher patient acceptance.

- Optimization of manufacturing workflows through AI scheduling and resource allocation can minimize material waste, improve operational efficiency in dental labs, and reduce overall production costs for RPDs.

- Personalized fit and function can be enhanced by AI analyzing minute discrepancies between digital impressions and proposed RPD designs, suggesting micro-adjustments for unparalleled comfort and stability.

- AI can assist in developing new, biocompatible materials for RPDs by simulating molecular interactions and predicting material performance under various oral conditions, accelerating R&D cycles.

DRO & Impact Forces Of Removable Partial Denture Market

The Removable Partial Denture (RPD) market is significantly shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the global demographic shift towards an aging population, which inherently experiences a higher prevalence of partial edentulism and seeks affordable and less invasive tooth replacement solutions. Concurrently, increasing awareness about oral hygiene and the availability of advanced dental treatments are encouraging more individuals to seek prosthetic interventions. Technological advancements, particularly in material science with the development of flexible and more aesthetic thermoplastics, alongside the integration of digital dentistry tools like CAD/CAM and 3D printing, are enhancing RPD quality and accessibility. Furthermore, the rising cost of fixed prostheses such as dental implants makes RPDs an attractive alternative for a large segment of the population, especially in developing economies where healthcare budgets may be limited, while dental tourism also plays a role in driving demand for cost-effective dental solutions.

Despite these strong drivers, the RPD market faces several notable restraints. Patient discomfort, particularly during the initial adaptation period, and potential issues with stability and retention remain significant concerns. The perceived bulkiness or aesthetic compromise of some RPD designs can deter patients, leading them to explore alternative options. Moreover, the lifespan of RPDs is generally shorter than that of fixed prostheses, requiring periodic adjustments, repairs, or replacements, which adds to the long-term cost and inconvenience for patients. The learning curve for dentists and technicians in mastering new digital design and fabrication techniques for RPDs can also be a barrier to rapid adoption. In some regions, a lack of adequate reimbursement policies for RPDs from insurance providers can limit patient access, especially for higher-quality or more advanced material options. Patient compliance with cleaning and maintenance instructions is also crucial for RPD longevity, and non-compliance can lead to oral health complications.

Opportunities for growth in the RPD market are abundant, driven by innovations in materials and digital workflows. The continuous development of biocompatible, lightweight, and highly aesthetic flexible thermoplastic materials (e.g., PEEK, advanced nylons) offers the potential to overcome traditional RPD limitations in comfort and appearance. The expansion of digital dentistry, including intraoral scanners and advanced CAD/CAM software, promises greater precision, faster production times, and highly customized RPDs, attracting both clinicians and patients. Emerging economies, with their large untapped patient populations and improving dental infrastructure, represent significant market expansion opportunities. Furthermore, the integration of AI for optimized design and manufacturing, alongside targeted educational campaigns for both patients and practitioners, can enhance RPD acceptance and utilization. The growing trend of teledentistry could also open new avenues for initial consultations and follow-ups related to RPD treatment.

Impact forces influencing the RPD market include evolving regulatory frameworks governing dental devices, which can affect product development and market entry. Shifting socio-economic conditions, including global economic stability and healthcare spending patterns, directly influence patient affordability and access to dental care. The increasing focus on value-based healthcare models pushes for cost-effective yet high-quality treatment options like RPDs. Public health initiatives promoting oral hygiene can reduce the incidence of tooth loss in some segments, while also increasing awareness of prosthetic options. The competitive landscape, characterized by continuous innovation in dental implants and bridges, necessitates RPD manufacturers to continually improve their offerings. Furthermore, global supply chain disruptions, as experienced during recent crises, can impact the availability and cost of raw materials and components for RPD fabrication, influencing market dynamics and pricing strategies across the industry.

Segmentation Analysis

The Removable Partial Denture market is comprehensively segmented to provide granular insights into its diverse components, allowing for a detailed understanding of market dynamics, consumer preferences, and technological adoption across various categories. These segmentations typically include analyses by material type, product type, end-user, and design, each reflecting distinct characteristics and growth trajectories within the broader market. Understanding these segments is crucial for stakeholders to identify niche opportunities, tailor product development strategies, and optimize marketing and distribution efforts. The interplay between material science advancements, evolving digital manufacturing processes, and specific patient needs defines the landscape of each segment, illustrating the market's adaptability and potential for innovation.

- By Material: This segment analyzes the RPD market based on the primary materials used in their construction, significantly influencing their properties, aesthetics, and cost.

- Metal (e.g., Cobalt-Chromium, Titanium, Gold): Traditionally used for frameworks due to strength and durability.

- Acrylic (e.g., Polymethyl Methacrylate - PMMA): Commonly used for the denture base and artificial teeth, known for its aesthetics and ease of fabrication.

- Flexible (e.g., Nylon, Polycarbonate, Thermoplastic Resins like Valplast, PEEK): Gaining popularity for comfort, aesthetics, and reduced bulkiness, particularly in cases of allergy to metals or monomers.

- Combination (Metal-Acrylic): The most common type, combining a metal framework for strength with an acrylic base for aesthetics.

- By Product Type: This segmentation differentiates RPDs based on their primary construction method and intended use, reflecting various clinical applications and patient requirements.

- Cast Metal RPDs: Feature a cast metal framework, known for superior strength, retention, and stability.

- Acrylic RPDs (Flipper, Interim): Often used as temporary prostheses or for immediate tooth replacement, primarily made of acrylic resin.

- Flexible RPDs: Made from thermoplastic materials, offering excellent aesthetics and comfort without a visible metal framework.

- Hybrid RPDs: Incorporate elements from different material types or fabrication techniques to achieve specific clinical outcomes.

- By End-User: This segment categorizes the market based on the primary settings or entities that procure and utilize RPDs, reflecting the distribution channels and service providers.

- Dental Clinics: The largest end-user segment, where most RPDs are prescribed, fitted, and maintained.

- Hospitals: Dental departments within hospitals provide RPD services, particularly for complex cases or inpatients.

- Academic & Research Institutes: Involved in RPD education, research, and advanced clinical applications.

- By Design: This segment differentiates RPDs based on their support mechanism and interaction with remaining teeth and tissues, impacting their stability and biomechanics.

- Tooth-Supported RPDs: Rely primarily on natural teeth for support and retention.

- Tooth and Tissue-Supported RPDs: Derive support from both natural teeth and the underlying soft tissues.

- Implant-Retained RPDs: Utilize dental implants for enhanced stability and retention, offering a hybrid solution.

Value Chain Analysis For Removable Partial Denture Market

The value chain for the Removable Partial Denture (RPD) market is a complex ecosystem involving multiple stages, from raw material sourcing to final patient delivery, each contributing to the creation of value. At the upstream stage, the process begins with the procurement of essential raw materials, which include dental alloys (such as cobalt-chromium, titanium), acrylic resins (polymethyl methacrylate - PMMA), flexible thermoplastic polymers (like nylon, PEEK, acetal resin), and artificial teeth. Key suppliers in this segment are specialized chemical companies, metal foundries, and dental material manufacturers who provide high-grade, biocompatible components meeting stringent regulatory standards. Research and development activities also form a crucial upstream component, focusing on developing new materials with enhanced strength, aesthetics, and patient compatibility, as well as refining digital design and manufacturing processes. These upstream activities lay the foundation for the quality and characteristics of the final RPD product, emphasizing precision and material integrity.

Moving downstream, the value chain encompasses manufacturing, distribution, and direct service provision. Manufacturers, often specialized dental laboratories or large dental corporations, utilize advanced technologies such as CAD/CAM systems, 3D printers, and traditional casting and molding techniques to fabricate the RPDs based on prescriptions from dental professionals. This stage involves skilled technicians who interpret dental impressions, design the prosthesis, and meticulously construct it to ensure accurate fit and optimal function. Distribution channels for RPDs are primarily indirect, involving a network of dental distributors, wholesalers, and sales representatives who supply dental clinics, hospitals, and independent dental laboratories with the necessary materials, equipment, and sometimes pre-fabricated components. These distributors play a vital role in ensuring timely delivery and access to a wide range of products, often providing technical support and training to their clients. The efficiency of these distribution networks is critical for market reach and customer satisfaction, especially for specialized and custom-made devices.

The final stage of the value chain involves the direct interaction with the end-user – the patient. Dental clinics and hospitals serve as the primary direct channel where dentists examine patients, take impressions, design treatment plans, and ultimately fit the RPDs. These healthcare providers are responsible for ensuring patient comfort, proper function, and aesthetic outcomes, as well as providing post-insertion care instructions and follow-up appointments. Indirect channels also exist, where patients might initially consult with a general practitioner who then refers them to a prosthodontist or a specialized dental lab for the RPD fabrication process, sometimes even involving dental schools for educational and treatment purposes. The effectiveness of the entire value chain hinges on seamless communication and collaboration between each stage, from material innovation and precise manufacturing to efficient distribution and expert clinical application, all aimed at delivering high-quality, customized Removable Partial Dentures that restore oral health and enhance patient well-being.

Removable Partial Denture Market Potential Customers

The primary potential customers for Removable Partial Dentures (RPDs) are individuals experiencing partial edentulism, a condition characterized by the loss of one or more, but not all, natural teeth in an arch. This demographic is vast and diverse, encompassing a wide range of ages, socio-economic backgrounds, and oral health profiles. Key segments include the elderly population, who are more susceptible to tooth loss due to age-related factors such as periodontal disease, dental caries, and the cumulative effects of wear and tear over a lifetime. Patients who cannot afford or are not candidates for dental implants or fixed bridges due to medical conditions, bone loss, or financial constraints also represent a significant customer base. Furthermore, individuals seeking a less invasive tooth replacement option or those needing an interim solution while awaiting more permanent treatments are also strong candidates for RPDs. The increasing global awareness about the importance of oral health and the desire to maintain quality of life through restored chewing function and aesthetics are continually expanding this customer base, making RPDs a widely sought-after dental prosthetic solution.

Beyond individual patients, the immediate buyers of Removable Partial Denture products and services are primarily dental professionals and healthcare institutions. Dental clinics, ranging from independent private practices to large group practices and specialized prosthodontic offices, form the largest segment of direct customers. These clinics purchase RPDs from dental laboratories or manufacturers, or they may fabricate certain components in-house using advanced digital technologies. Hospitals with dental departments also serve as significant buyers, especially those catering to a diverse patient population, including medically compromised individuals or those requiring complex oral rehabilitation. Dental schools and academic institutions also constitute a segment of potential customers, as they utilize RPDs for educational purposes, clinical training, and sometimes offer treatment to the public at reduced costs, contributing to both the consumption and advancement of RPD technology and practice.

The motivations behind these end-users/buyers selecting RPDs are multifaceted. For patients, the decision is often driven by a desire to restore chewing function, improve speech, enhance facial aesthetics, and prevent the migration of remaining teeth. The affordability and non-invasiveness of RPDs compared to other prosthetic options are significant drawcards for many. For dental professionals, the choice to prescribe RPDs is based on clinical indications, patient suitability, ease of fabrication, and cost-effectiveness for the patient. Dentists prioritize RPDs that offer good retention, stability, patient comfort, and durability. As such, manufacturers and laboratories catering to the RPD market must focus on delivering high-quality, customizable, and technologically advanced products that meet both the clinical requirements of dental practitioners and the functional and aesthetic expectations of the ultimate end-users—the patients. Marketing efforts are often dual-faceted, targeting both the dental community with product features and benefits, and the general public with awareness campaigns on the advantages of RPDs for restoring oral health.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.42 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces | >|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, Henry Schein, Inc., 3M Company, Straumann Group, Zimmer Biomet Holdings, Inc., Mitsui Chemicals (Heraeus Kulzer), Ivoclar Vivadent AG, GC Corporation, Shofu Inc., Kuraray Noritake Dental Inc., Bego GmbH & Co. KG, VITA Zahnfabrik H. Rauter GmbH & Co. KG, Formlabs Inc., SprintRay Inc., Dental Wings, Candulor AG, Vertex-Dental B.V., Keystone Dental Group, Myerson Tooth Company, Acryline, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Removable Partial Denture Market Key Technology Landscape

The Removable Partial Denture (RPD) market is experiencing a significant technological evolution, moving beyond traditional analog methods towards a digitally integrated workflow that promises enhanced precision, efficiency, and customization. One of the most impactful technologies is Computer-Aided Design and Computer-Aided Manufacturing (CAD/CAM). CAD software allows dental technicians to digitally design RPD frameworks and bases based on intraoral scans or digitized physical impressions, enabling meticulous contouring and fitting. CAM systems then translate these digital designs into physical prostheses through subtractive manufacturing (milling) or additive manufacturing (3D printing). This digital workflow minimizes human error, reduces fabrication time, and allows for the creation of complex geometries with superior accuracy compared to conventional wax-up and casting methods, leading to better patient outcomes and reduced chairside adjustments.

Building upon CAD/CAM, 3D printing technology, particularly Stereolithography (SLA), Digital Light Processing (DLP), and Selective Laser Melting (SLM), is revolutionizing RPD fabrication. SLA and DLP are widely used for printing resin-based RPD patterns, temporary RPDs, and even definitive flexible RPDs using biocompatible polymers. SLM, on the other hand, is increasingly employed for directly fabricating metal RPD frameworks from powders like cobalt-chromium or titanium, offering exceptional strength, lightweight designs, and intricate lattice structures impossible with traditional casting. These additive manufacturing techniques enable mass customization, allowing dental laboratories to produce multiple unique RPDs simultaneously with high consistency and reduced material waste. The continuous development of new printable resins and metal powders with enhanced mechanical and aesthetic properties is further expanding the capabilities and applications of 3D printing in the RPD market, paving the way for more diverse and advanced prosthetic solutions.

Furthermore, digital impressioning using intraoral scanners is a foundational technology that underpins the entire digital RPD workflow. These scanners capture highly accurate 3D images of a patient's oral cavity, eliminating the need for uncomfortable traditional impression materials and reducing impression errors. This digital data is then directly transferable to CAD software for design, streamlining the entire process from patient intake to RPD fabrication. Alongside these core technologies, advancements in material science are also critical. The development of new flexible thermoplastics such as PEEK (Polyether Ether Ketone) and advanced polyamide (nylon) resins offers RPDs that are metal-free, lightweight, highly aesthetic, and biocompatible, catering to patients with metal allergies or those seeking superior comfort. Predictive analytics and AI algorithms are emerging to optimize RPD design for biomechanical stability and longevity, analyze occlusal forces, and even suggest ideal clasp positions, further enhancing the precision and functional success of these prostheses. These integrated technological advancements collectively drive innovation in the Removable Partial Denture market, addressing historical limitations and improving the overall patient experience.

Regional Highlights

- North America: This region stands as a mature and technologically advanced market for Removable Partial Dentures, characterized by high healthcare expenditure, significant disposable income, and a strong preference for sophisticated dental solutions. The United States and Canada are leading adopters of digital dentistry technologies, including CAD/CAM and 3D printing for RPD fabrication, which ensures high precision and customized patient care. An aging population, coupled with a high awareness of oral health and access to comprehensive dental insurance plans, drives consistent demand. The presence of major dental companies and research institutions also fosters continuous innovation in materials and techniques, maintaining North America's position at the forefront of the RPD market, focusing on both aesthetic outcomes and long-term functional stability for patients seeking quality dental restorations.

- Europe: Europe represents another significant market for RPDs, demonstrating a robust healthcare infrastructure and a high standard of dental care across countries like Germany, the UK, France, and Italy. The market is driven by an increasing elderly population, a strong emphasis on evidence-based dentistry, and a readiness to adopt advanced materials and digital workflows. While traditional RPDs remain prevalent, there is a growing trend towards flexible and metal-free prostheses, reflecting patient demands for improved aesthetics and comfort. Strict regulatory frameworks for dental devices ensure high product quality and safety, which in turn builds patient trust. Furthermore, dental tourism into certain European countries for cost-effective, high-quality treatments also contributes to the RPD market's sustained growth and technological adoption.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for Removable Partial Dentures, fueled by several powerful factors. A vast and rapidly aging population in countries such as China, India, and Japan presents a massive patient pool requiring prosthetic solutions. Economic growth, increasing disposable incomes, and the expansion of dental healthcare infrastructure, particularly in emerging economies, are enhancing access to dental treatments. There's a growing awareness of oral health and a rising demand for affordable yet effective tooth replacement options, making RPDs a highly viable choice. Furthermore, government initiatives aimed at improving public health and the increasing adoption of modern dental technologies by local practitioners and laboratories are propelling market expansion and technological integration across the region.

- Latin America: The Removable Partial Denture market in Latin America is witnessing steady growth, primarily driven by improving economic conditions, increasing access to dental care, and a growing middle class. Countries like Brazil, Mexico, and Argentina are key contributors, characterized by a significant patient base with unmet dental needs. While cost-effectiveness remains a crucial factor influencing treatment choices, there is a gradual shift towards adopting more advanced materials and digital techniques, especially in urban areas. The rise of dental education and training programs is also enhancing the quality of dental professionals, leading to a broader acceptance and application of modern RPD solutions, though infrastructure disparities between urban and rural areas still present challenges to uniform market penetration.

- Middle East and Africa (MEA): The MEA region presents a developing yet promising market for Removable Partial Dentures. Growth is largely propelled by rising healthcare expenditure, increasing dental tourism in countries like the UAE, and a growing awareness of oral health benefits. While the market in Africa is still nascent in many areas, economic development and improving healthcare access are creating new opportunities for RPD adoption, particularly for basic and cost-effective solutions. The Middle East, with its advanced healthcare facilities and higher disposable incomes, is witnessing a greater demand for premium materials and digitally fabricated RPDs, reflecting a blend of traditional and modern prosthetic approaches across the diverse sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Removable Partial Denture Market.- Dentsply Sirona

- Henry Schein, Inc.

- 3M Company

- Straumann Group

- Zimmer Biomet Holdings, Inc.

- Mitsui Chemicals (Heraeus Kulzer)

- Ivoclar Vivadent AG

- GC Corporation

- Shofu Inc.

- Kuraray Noritake Dental Inc.

- Bego GmbH & Co. KG

- VITA Zahnfabrik H. Rauter GmbH & Co. KG

- Formlabs Inc.

- SprintRay Inc.

- Dental Wings

- Candulor AG

- Vertex-Dental B.V.

- Keystone Dental Group

- Myerson Tooth Company

- Acryline, Inc.

Frequently Asked Questions

Analyze common user questions about the Removable Partial Denture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Removable Partial Dentures (RPDs) and what are their main types?

Removable Partial Dentures are dental prostheses designed to replace one or more missing teeth, supported by the remaining natural teeth and/or gums. Common types include cast metal RPDs (with a strong metal framework), acrylic RPDs (often interim or flippers), and flexible RPDs (made from thermoplastic materials for comfort and aesthetics).

How long do Removable Partial Dentures typically last, and what affects their lifespan?

The lifespan of an RPD typically ranges from 5 to 10 years, though this can vary significantly. Factors affecting longevity include the material used, the patient's oral hygiene practices, regular maintenance and adjustments, chewing habits, and the overall health of the supporting natural teeth and tissues.

What are the primary advantages and disadvantages of Removable Partial Dentures compared to other tooth replacement options?

RPDs offer advantages such as being less invasive and generally more affordable than dental implants or fixed bridges. They can be removed for cleaning and are suitable for patients with insufficient bone for implants. Disadvantages may include an initial adaptation period, potential for discomfort or instability, and typically a shorter lifespan compared to fixed prostheses.

Are there different materials available for RPDs, and how do they impact comfort and aesthetics?

Yes, RPDs are made from various materials. Metal alloys (like cobalt-chromium) provide strength and durability but can be less aesthetic. Acrylic resins are more aesthetic and cost-effective but may be bulkier. Flexible thermoplastics (e.g., Valplast, PEEK) offer excellent comfort, high aesthetics (often metal-free), and are lightweight, making them popular for specific patient needs.

How is technology, such as CAD/CAM and 3D printing, transforming the Removable Partial Denture market?

CAD/CAM and 3D printing are revolutionizing RPDs by enabling highly precise digital design and fabrication. These technologies reduce design and manufacturing time, improve fit and accuracy, allow for complex geometries, and facilitate the use of advanced materials, leading to more customized, comfortable, and aesthetically pleasing prostheses for patients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager