Renewable Energy and Energy-Efficient Technologies in Building Applications Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433992 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Renewable Energy and Energy-Efficient Technologies in Building Applications Market Size

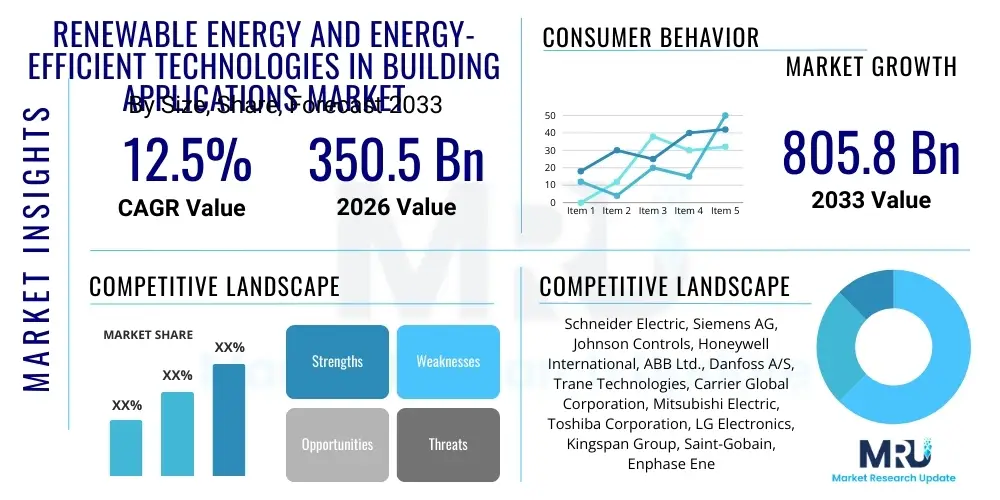

The Renewable Energy and Energy-Efficient Technologies in Building Applications Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 350.5 Billion in 2026 and is projected to reach USD 805.8 Billion by the end of the forecast period in 2033.

The market expansion is fundamentally driven by global legislative mandates aimed at decarbonizing the built environment and significantly reducing operational energy consumption in both commercial and residential structures. Government incentives, such as tax credits, rebates, and feed-in tariffs across major economies, bolster the adoption of technologies like building-integrated photovoltaics (BIPV), high-efficiency HVAC systems, smart windows, and advanced Building Energy Management Systems (BEMS). The escalating focus on achieving net-zero energy goals, particularly in developed regions like Europe and North America, necessitates comprehensive retrofitting strategies for existing building stock and stringent energy performance standards for new constructions, thereby creating substantial sustained demand for innovative energy solutions.

Furthermore, rapid urbanization in the Asia Pacific region, coupled with growing awareness of sustainable practices and rising energy costs, is accelerating the deployment of these integrated technologies. Consumers and commercial entities are increasingly recognizing the long-term economic benefits associated with reduced utility expenses and improved asset valuation resulting from energy efficiency upgrades. Technological advancements, particularly in smart building integration, energy storage systems optimized for load shifting, and high-performance insulation materials, continue to lower the total cost of ownership (TCO) for renewable installations, making them more financially viable and driving market penetration across diverse climate zones and building typologies.

Renewable Energy and Energy-Efficient Technologies in Building Applications Market introduction

The Renewable Energy and Energy-Efficient Technologies in Building Applications Market encompasses the sale, installation, and maintenance of integrated systems designed to significantly decrease the energy demand of buildings while supplying clean energy from onsite or near-site sources. This market scope includes highly efficient heating, ventilation, and air conditioning (HVAC) systems, advanced lighting controls (e.g., LED and daylight harvesting), high-performance insulation, smart metering infrastructure, and renewable generation sources such as solar photovoltaic (PV) panels, solar thermal collectors, and geothermal heat pumps. These technologies are crucial for meeting international climate targets, enhancing energy independence, and ensuring occupant comfort and health.

Major applications span across residential dwellings, commercial spaces (offices, retail, hospitality), public buildings (schools, hospitals), and industrial facilities, all seeking optimized energy profiles. The primary benefit derived from the adoption of these solutions is the drastic reduction in operational carbon footprint, leading to compliance with stringent green building certifications like LEED, BREEAM, and Green Star. Economically, these technologies offer substantial benefits through lower lifetime energy bills, hedging against volatile fossil fuel prices, and increased property value. Socially, they contribute to reduced air pollution and provide enhanced resilience against power outages when integrated with storage systems.

Driving factors for this market include supportive regulatory frameworks establishing minimum energy performance standards (MEPS) for appliances and buildings; escalating corporate sustainability commitments (ESG criteria) mandating energy reduction across global real estate portfolios; and continuous technological innovation leading to more cost-effective and highly integrated solutions. Furthermore, consumer preferences are shifting towards sustainable living and working environments, compelling developers and property managers to prioritize energy performance as a core competitive differentiator in the modern construction landscape. The convergence of IoT and building controls facilitates unprecedented optimization, further accelerating market growth.

Renewable Energy and Energy-Efficient Technologies in Building Applications Market Executive Summary

The global market for Renewable Energy and Energy-Efficient Technologies in Building Applications is experiencing robust expansion, characterized by strong governmental support and significant private sector investment focused on decarbonization targets. Business trends indicate a marked shift towards integrated solutions, where solar generation, battery storage, and smart building management systems (BEMS) are packaged together to maximize efficiency and resilience, moving beyond siloed technology adoption. Strategic partnerships between traditional HVAC manufacturers and cutting-edge software providers are becoming critical to deliver comprehensive energy ecosystems rather than just individual components, focusing on performance-based contracts and guaranteed energy savings for end-users.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, propelled by massive infrastructure development and the urgent need to address energy security challenges, particularly in rapidly urbanizing economies like China and India, where deployment of energy-efficient lighting and high-efficiency cooling is paramount. Europe maintains its leadership in setting the pace for stringent energy standards, driven by the EU’s Green Deal, fostering advanced adoption of heat pump technologies and deep building retrofits. North America shows accelerated growth, particularly in commercial and industrial sectors, spurred by favorable Inflation Reduction Act (IRA) policies supporting local manufacturing and deployment of solar and storage technologies.

Segment trends underscore the dominance of the energy efficiency segment, led by high-efficiency HVAC and advanced building envelope components, given their fundamental role in reducing baseline energy demand before renewable integration. However, the renewable energy segment, specifically decentralized solar PV and associated microgrids, is projected to register the highest growth rate due to dramatic cost reductions and advancements in energy storage integration capabilities. Within the application vertical, the commercial and industrial sector holds the largest market share, owing to the scale of energy consumption and greater availability of capital for large-scale energy conservation measures (ECMs) and renewable investments, although the residential sector is increasingly adopting smaller, packaged solutions driven by consumer incentives.

AI Impact Analysis on Renewable Energy and Energy-Efficient Technologies in Building Applications Market

Common user questions regarding AI's impact typically revolve around how artificial intelligence can move the industry beyond static efficiency measures to dynamic, predictive optimization. Users frequently inquire about the feasibility of AI-driven predictive maintenance for complex HVAC systems, the ability of machine learning algorithms to optimize energy storage charge/discharge cycles based on real-time grid conditions and weather forecasts, and the potential for AI to personalize energy consumption patterns within residential and commercial settings without compromising occupant comfort. Key themes emerging from these queries include concerns about data privacy, the required sophistication for successful implementation, integration costs with legacy building infrastructure, and the measurable return on investment (ROI) derived from AI-enhanced BEMS platforms that learn and adapt continuously to complex building loads and external environmental variability.

AI is fundamentally transforming the operational paradigm of energy systems within buildings by providing predictive capabilities that far exceed traditional control methods. By analyzing massive datasets related to occupancy schedules, weather variability, utility pricing structures, and equipment performance history, AI algorithms can dynamically adjust setpoints, manage daylighting, control ventilation rates, and optimize the generation and consumption of onsite renewables. This shift facilitates 'proactive' energy management, identifying potential equipment failures before they occur, scheduling preventative maintenance precisely when needed, and ensuring peak performance of integrated renewable assets like solar inverters and battery systems, thereby extending asset lifespan and maximizing energy yield.

The deployment of AI-powered platforms is enhancing the value proposition of energy-efficient technologies by making their performance more predictable and measurable. For instance, in demand response scenarios, AI enables buildings to participate actively in grid balancing by intelligently shedding non-critical loads or utilizing stored energy during peak times, turning the building from a passive consumer into an active grid partner. This sophisticated management capability is critical for integrating large-scale intermittent renewable energy sources into the grid infrastructure, effectively accelerating the overall adoption rate of both energy efficiency measures and decentralized renewable generation technologies across the built environment.

- AI enables real-time predictive control of HVAC and lighting systems, reducing energy waste by up to 30%.

- Machine learning algorithms optimize battery storage operation for peak shaving and utility arbitrage.

- AI facilitates automated fault detection and diagnostics (AFDD) in complex building systems, minimizing downtime.

- Enhanced energy modeling and simulation tools powered by AI improve design phase efficiency predictions.

- AI supports dynamic pricing and localized energy trading within microgrids and smart communities.

- Predictive maintenance schedules based on operational data extend the life and efficiency of renewable equipment.

- Optimized integration of BIPV and thermal storage systems driven by weather forecasting models.

DRO & Impact Forces Of Renewable Energy and Energy-Efficient Technologies in Building Applications Market

The market is predominantly influenced by robust governmental drivers aimed at achieving carbon neutrality and improving national energy security, counterbalanced by initial capital expenditure restraints and complexities in retrofitting legacy infrastructure. The overarching opportunity lies in the digitalization of the built environment, leveraging IoT and advanced data analytics to create 'smart' net-zero buildings that function as integrated elements of the modern grid. The cumulative impact forces, including regulatory pressures, technology costs, and consumer awareness, collectively push the market towards sustainable and decentralized energy solutions.

Key drivers include stringent building codes (e.g., Passive House standards, nearly Zero-Energy Buildings mandates in the EU), substantial financial incentives (tax credits, R&D grants), and the rapidly falling cost curve of renewable technologies, particularly solar PV and lithium-ion battery storage. Restraints primarily involve the high upfront costs associated with comprehensive retrofitting, the significant initial investment required for high-performance insulation and advanced heat pump systems, and the shortage of skilled labor needed for complex installation and integration of these specialized systems. Furthermore, regulatory hurdles, such as fragmented permitting processes and interconnection standards for distributed generation, can sometimes slow project deployment, particularly in decentralized energy generation schemes.

Opportunities are abundant in the development of modular, integrated energy solutions tailored for deep renovation projects, especially utilizing innovative materials like aerogels and vacuum insulation panels for minimal structural impact. The emergence of the circular economy in construction offers opportunities for sustainable material sourcing and end-of-life recycling for building components and renewable systems. Impact forces are overwhelmingly positive, driven by the irreversible global commitment to climate action and the growing corporate acceptance of ESG performance metrics as non-negotiable business imperatives, forcing property owners and developers to prioritize deep energy efficiency and renewable generation capabilities to maintain competitiveness and attract investment.

Segmentation Analysis

The Renewable Energy and Energy-Efficient Technologies in Building Applications market is systematically segmented based on the type of technology deployed, the specific application within the building environment, and the end-user category. The primary division distinguishes between technologies that reduce energy consumption (Energy Efficiency) and those that generate clean power (Renewable Energy). Understanding these segments is crucial for strategic market positioning, as integrated solutions increasingly bridge this gap, offering combined performance and synergistic benefits, particularly in new construction and deep renovation projects where both demand reduction and clean supply are prioritized.

Key technologies within the energy efficiency segment include high-efficiency systems for heating, cooling, and ventilation, advanced building envelope components (insulation, windows), and smart control systems. The renewable energy segment is dominated by decentralized generation systems such as building-integrated photovoltaics (BIPV), rooftop PV, and geothermal systems. The market is further categorized by end-use application—spanning residential, commercial, and industrial structures—each requiring specialized product specifications and deployment strategies tailored to varying energy load profiles, operational hours, and regulatory compliance standards.

The analysis also considers segmentation by component (hardware vs. software/services), recognizing the increasing monetization of energy data and optimization services provided by smart BEMS platforms. The service segment, including energy consulting, maintenance, and performance monitoring, is growing rapidly, reflecting the transition from product sales to long-term energy performance contracts. Geographical segmentation remains vital, with regional variations in climate (driving demand for specialized heating or cooling solutions) and regulatory incentives profoundly impacting the market penetration rates of specific technologies.

- By Technology Type:

- Energy Efficiency Technologies (HVAC, Lighting, Building Envelope, BEMS)

- Renewable Energy Technologies (Solar PV, Solar Thermal, Geothermal Heat Pumps, Wind)

- By Application:

- Residential Buildings

- Commercial Buildings (Offices, Retail, Hospitality)

- Industrial Buildings

- Public/Institutional Buildings (Healthcare, Education)

- By Component:

- Hardware (Equipment, Materials, Installation Components)

- Software and Services (BEMS Software, Energy Auditing, Maintenance Contracts)

Value Chain Analysis For Renewable Energy and Energy-Efficient Technologies in Building Applications Market

The value chain for this market is highly complex and integrated, starting from upstream raw material sourcing and component manufacturing, extending through system integration and installation, and culminating in downstream services and maintenance. Upstream analysis focuses on the manufacturing of core components, such as high-purity silicon for PV cells, specialized thermal insulation materials, high-efficiency compressor units for heat pumps, and sensor technology for BEMS. Key participants here include specialized chemical companies, electronic component suppliers, and material science firms, where optimizing supply chain resilience and ensuring ethical sourcing of critical minerals (e.g., copper, lithium) are paramount considerations.

Midstream activities involve the design, fabrication, and integration of these components into deployable systems. This stage is dominated by large, integrated technology providers (OEMs) who assemble HVAC units, PV modules, and advanced glazing systems. Crucially, system integrators, engineering, procurement, and construction (EPC) firms play a pivotal role in tailoring these standard components into customized, high-performance building solutions that meet specific regional codes and client performance requirements. Certification and standardization bodies also exert significant influence here, ensuring system quality, longevity, and interoperability—a key factor for successful smart building deployment.

Downstream activities center on distribution, installation, and long-term asset management. Distribution channels include specialized distributors, wholesale electrical suppliers, and direct sales teams targeting large commercial or institutional clients. Installation is typically managed by certified mechanical and electrical contractors who must possess specialized training in integrating both traditional construction methods with complex digital and energy systems. The service component, including proactive maintenance, energy performance contracting (EPCs), and software updates for BEMS, represents a rapidly growing revenue stream, often managed directly by the technology vendors or specialized energy service companies (ESCOs), emphasizing the importance of securing recurring revenue through high-value operational support.

Renewable Energy and Energy-Efficient Technologies in Building Applications Market Potential Customers

Potential customers for renewable energy and energy-efficient technologies are primarily categorized across three major end-user segments: residential, commercial, and institutional/governmental bodies, each driven by distinct investment criteria and motivations. The residential segment, consisting of individual homeowners and multi-family developers, is motivated by reducing utility bills, improving indoor air quality, and enhancing property resale value, often favoring simpler, standardized solutions like rooftop solar PV, smart thermostats, and high-efficiency windows, frequently leveraging government incentives and financing mechanisms.

The commercial sector, which includes offices, retail chains, data centers, and the hospitality industry, represents the largest customer base in terms of overall spending power and complexity. These entities are primarily motivated by operational cost reduction, regulatory compliance, corporate sustainability mandates (ESG goals), and maintaining a competitive edge through energy-efficient, green-certified properties. This segment typically invests in sophisticated BEMS, centralized high-efficiency HVAC infrastructure, large-scale geothermal systems, and battery storage to ensure business continuity and optimize energy procurement strategies.

Institutional and Governmental customers, encompassing healthcare facilities, educational campuses, and municipal buildings, prioritize long-term budget stability, resilience, and public demonstration of environmental stewardship. Their procurement decisions often involve detailed life cycle cost analysis (LCCA) and require systems that offer high reliability and extended operational guarantees. These large campus environments are ideal buyers for decentralized microgrids, district heating and cooling systems utilizing renewable sources, and major deep-retrofit projects funded by public bonds or energy efficiency mandates, reflecting a commitment to stable, secure energy infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Billion |

| Market Forecast in 2033 | USD 805.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric, Siemens AG, Johnson Controls, Honeywell International, ABB Ltd., Danfoss A/S, Trane Technologies, Carrier Global Corporation, Mitsubishi Electric, Toshiba Corporation, LG Electronics, Kingspan Group, Saint-Gobain, Enphase Energy, Tesla, Inc., Generac Holdings, SunPower Corporation, JinkoSolar Holding, Canadian Solar, Daikin Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Renewable Energy and Energy-Efficient Technologies in Building Applications Market Key Technology Landscape

The technological landscape is highly dynamic, characterized by the convergence of hardware efficiency and software intelligence. Key technologies driving market transformation include advanced high-efficiency heat pumps (air source and geothermal), which are rapidly replacing fossil fuel boilers as the primary heating source due to improved coefficient of performance (COP) and cold-climate suitability. Simultaneously, Building Energy Management Systems (BEMS) integrated with Internet of Things (IoT) sensors are becoming standard, moving beyond simple scheduling to incorporate predictive algorithms and machine learning for dynamic load optimization based on real-time data inputs like occupancy, daylight intensity, and localized weather patterns.

In the renewable generation space, advancements in Building-Integrated Photovoltaics (BIPV) are blurring the line between building materials and energy generation, allowing facades, roofing, and windows to contribute actively to power generation without compromising aesthetic appeal or structural integrity. Complementing BIPV is the proliferation of modular battery energy storage systems (BESS), which are essential for maximizing the self-consumption of onsite renewables, providing critical backup power, and enabling buildings to actively participate in lucrative grid services such such as frequency regulation and peak demand reduction through effective load shifting capabilities.

Furthermore, innovations in building envelope materials, such as smart windows that dynamically adjust tinting based on solar gain and highly insulative materials like phase-change materials (PCMs) and vacuum insulation panels (VIPs), significantly reduce the baseline energy required for heating and cooling. The overall trajectory points toward greater system interoperability, facilitated by open communication protocols and cloud-based platforms, enabling seamless communication between renewable sources, storage units, and efficiency technologies, ultimately realizing the vision of a truly smart, autonomous, and net-zero energy building (NZEB).

Regional Highlights

North America (NA) is a mature market undergoing significant acceleration, primarily fueled by supportive federal legislation such as the Inflation Reduction Act (IRA) and state-level renewable portfolio standards. The United States and Canada exhibit high adoption rates in the commercial sector, focusing heavily on BEMS integration, high-efficiency commercial HVAC (driven by escalating cooling needs), and large-scale rooftop solar PV complemented by significant battery storage capacity. The residential market is characterized by robust adoption of smart thermostats and solar installations incentivized by federal tax credits. Resilience is a major driver, particularly in regions prone to extreme weather, boosting the demand for microgrid-ready solutions and hybrid renewable systems.

Europe leads the global transition, mandated by the European Green Deal and the Energy Performance of Buildings Directive (EPBD), which drives mandatory renovation waves and sets stringent standards for Nearly Zero-Energy Buildings (NZEBs). The market is heavily focused on replacing gas boilers with high-performance heat pumps and executing deep retrofits across vast, aging building stock. Germany, the UK, and the Nordic countries are pioneers, emphasizing district heating powered by renewable energy and thermal storage solutions. European policies prioritize holistic building performance, fostering strong demand for advanced insulation, smart metering, and decentralized renewable heat solutions.

Asia Pacific (APAC) represents the fastest-growing market globally, driven by massive new construction volumes, rapid urbanization, and an urgent need for energy security. China and India are the dominant markets, where the focus is balanced between large-scale solar deployment on commercial and industrial roofs and the widespread adoption of energy-efficient technologies, notably highly efficient cooling systems (air conditioning) due to intense summer heat. Government programs supporting green building certifications and smart city initiatives accelerate technology uptake, though challenges remain regarding grid stability and financing mechanisms for decentralized solutions in emerging urban areas. The shift in APAC is less about deep retrofit and more about ensuring that new construction adheres to increasingly higher efficiency standards.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets with significant potential. In LATAM, countries like Brazil and Mexico are increasing solar PV installations, driven by favorable solar resources and rising electricity costs, focusing mainly on the industrial and large commercial sectors. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is strategically investing in energy efficiency measures to reduce domestic oil consumption for power generation, focusing on high-efficiency cooling, advanced glass technology, and large-scale solar thermal and PV installations integrated into ambitious smart city projects like NEOM, prioritizing resilience and sustainable cooling infrastructure development.

- North America: Focus on BEMS, high-efficiency HVAC, and solar + storage integration (IRA driven).

- Europe: Driven by NZEB mandates, deep retrofits, high heat pump adoption, and district energy renewal.

- Asia Pacific (APAC): Highest growth, concentrated in new construction, efficient cooling, and mass market PV adoption (China, India).

- Latin America: Growing adoption of solar PV in industrial sectors due to high insolation and energy prices.

- Middle East and Africa (MEA): Strong investment in large-scale cooling efficiency and solar technologies within new smart city developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Renewable Energy and Energy-Efficient Technologies in Building Applications Market.- Schneider Electric

- Siemens AG

- Johnson Controls

- Honeywell International

- ABB Ltd.

- Danfoss A/S

- Trane Technologies

- Carrier Global Corporation

- Mitsubishi Electric

- Toshiba Corporation

- LG Electronics

- Kingspan Group

- Saint-Gobain

- Enphase Energy

- Tesla, Inc.

- Generac Holdings

- SunPower Corporation

- JinkoSolar Holding

- Canadian Solar

- Daikin Industries

Frequently Asked Questions

Analyze common user questions about the Renewable Energy and Energy-Efficient Technologies in Building Applications market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the current market growth of energy-efficient technologies in buildings?

The primary driver is increasingly stringent governmental regulations and building codes, particularly in developed economies, which mandate significant reductions in operational energy consumption and carbon emissions, coupled with financial incentives like tax credits and rebates for energy-saving upgrades and renewable installations.

How significant is the role of smart Building Energy Management Systems (BEMS) in achieving net-zero goals?

BEMS, particularly those integrated with IoT and AI, are crucial because they move energy efficiency from passive measures to dynamic, predictive optimization. They are essential for managing complex loads, integrating intermittent renewable sources, and optimizing energy storage, enabling buildings to effectively reach and maintain net-zero energy targets.

Which technology segment exhibits the highest projected growth rate through 2033?

The distributed renewable energy generation segment, specifically solar photovoltaic (PV) and integrated battery energy storage systems (BESS), is anticipated to show the highest Compound Annual Growth Rate (CAGR) due to declining hardware costs, increasing grid instability, and higher demand for self-consumption and resilience.

What major challenges restrict the widespread adoption of deep building retrofits?

Major restrictions include the high initial capital investment required for deep retrofits (e.g., comprehensive envelope upgrades and system replacement), complexity in integrating new technologies into legacy structures, and a persistent shortage of highly skilled technical labor necessary for advanced installation and commissioning.

How does the shift toward 'Energy as a Service' (EaaS) impact the market dynamics?

EaaS transforms the market by shifting the financial burden and performance risk away from the end-user. Customers pay for energy performance and outcomes rather than assets, lowering the upfront barrier to entry for expensive renewable and efficiency projects, accelerating adoption, and guaranteeing long-term system optimization and maintenance provided by specialized service companies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager