Renewable Energy Storage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432579 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Renewable Energy Storage Market Size

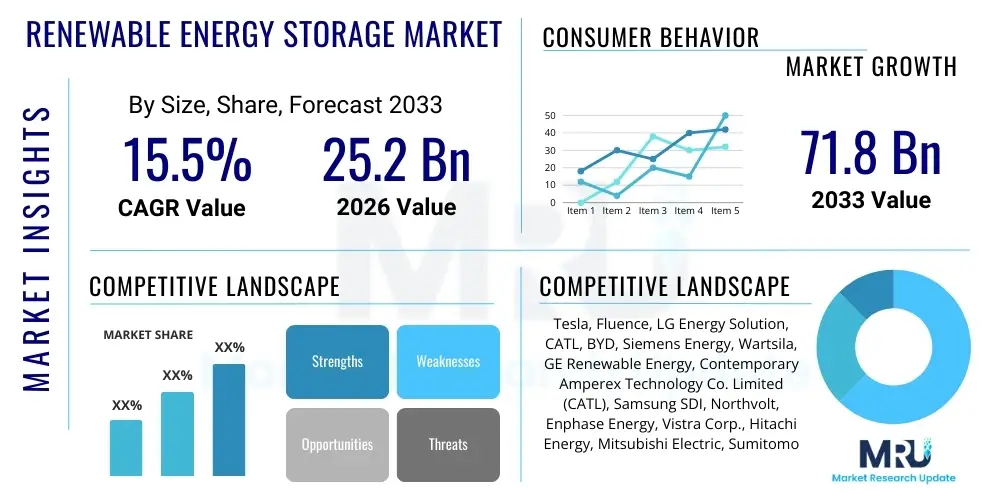

The Renewable Energy Storage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 25.2 Billion in 2026 and is projected to reach USD 71.8 Billion by the end of the forecast period in 2033.

Renewable Energy Storage Market introduction

The Renewable Energy Storage Market encompasses technologies and systems designed to capture energy generated from intermittent renewable sources, primarily solar and wind power, and release it when needed, thereby ensuring grid stability and reliable energy supply. These systems are crucial components of the global transition towards decarbonization and include diverse technologies such as electrochemical batteries (notably Lithium-ion), pumped hydro storage (PHS), mechanical storage (compressed air energy storage, CAES), and thermal energy storage (TES). The core objective of these products is to decouple renewable generation time from energy demand time, mitigating the inherent variability of solar and wind resources and facilitating higher penetration rates of clean energy into existing power grids.

Major applications for renewable energy storage systems span across the utility sector, commercial and industrial (C&I) installations, and residential use cases. Utility-scale deployment focuses heavily on grid stabilization, frequency regulation, peak shifting, and capacity firming, often involving large lithium-ion battery energy storage systems (BESS). C&I applications leverage storage for demand charge reduction, load management, and enhanced energy resilience, particularly in areas prone to grid outages. The integration of these storage solutions is driven by their multifaceted benefits, which include improving power quality, reducing reliance on fossil fuel peaking plants, and maximizing the financial returns on renewable generation assets, thus supporting a more flexible and efficient electricity infrastructure globally.

The market is experiencing exponential growth propelled by several converging driving factors. Foremost among these are aggressive governmental mandates and regulatory frameworks supporting renewable portfolio standards (RPS) and energy storage deployment targets across North America, Europe, and Asia Pacific. Furthermore, the substantial and continued decline in the cost of lithium-ion battery technology, coupled with breakthroughs in long-duration storage alternatives like flow batteries and green hydrogen storage, makes deployment increasingly economically viable. The necessity for grid modernization and hardening against climate change impacts and cyber threats also accelerates the adoption of resilient, decentralized energy storage solutions, establishing this market as foundational to future energy security.

Renewable Energy Storage Market Executive Summary

The Renewable Energy Storage Market is defined by intense technological competition and rapid capacity expansion, primarily driven by utility-scale BESS projects in high-growth regional hubs such as China, the United States, and Germany. Current business trends indicate a significant consolidation among system integrators and increased focus on vertical integration by battery manufacturers aiming to secure supply chains, particularly for critical materials like lithium, cobalt, and nickel. Investment is heavily skewed towards enhancing power density and safety features in Li-ion systems, although strategic attention is shifting towards commercializing non-Li-ion alternatives, specifically long-duration energy storage (LDES) technologies, which promise durations exceeding four hours, addressing a key limitation of current technology.

Regional trends highlight Asia Pacific (APAC) as the dominant market, characterized by immense governmental investment in grid-scale storage to manage vast solar and wind buildouts, particularly in China and India. North America and Europe follow closely, distinguished by sophisticated regulatory structures favoring market mechanisms like frequency response services and capacity markets that incentivize storage deployment. Europe is particularly focused on achieving ambitious net-zero targets, driving investment in coupled renewable generation and storage projects, while North America’s growth is spurred by state-level mandates and federal tax credits designed to reduce reliance on aging thermal generation infrastructure and enhance grid reliability.

Segmentation trends reveal Lithium-ion technology maintaining market supremacy due to its proven performance, scalability, and decreasing cost curve, although flow batteries and solid-state batteries are gaining traction for specific commercial and LDES applications, respectively. Application-wise, the Utility-Scale segment holds the largest market share, reflecting the immediate need for transmission and distribution (T&D) infrastructure support and resource adequacy. However, the Commercial & Industrial (C&I) segment is projected to exhibit the fastest growth rate, fueled by favorable regulations allowing businesses to manage peak demand charges and improve operational resilience through localized energy management systems coupled with rooftop solar installations.

AI Impact Analysis on Renewable Energy Storage Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Renewable Energy Storage Market reveals a primary focus on optimization, predictive capabilities, and smart grid integration. Users are keen to understand how AI can improve the efficiency and lifespan of expensive battery assets, specifically addressing concerns about thermal runaway, degradation rates, and optimal charging/discharging cycles. Key themes emerging include the potential for AI-driven energy trading and market participation strategies, maximizing revenue streams, and ensuring seamless coordination between distributed energy resources (DERs) and centralized grid operations. The expectation is that AI will move storage systems beyond simple hardware components into intelligent, autonomous assets capable of complex decision-making in real-time within volatile energy markets.

AI’s transformative influence is most pronounced in battery management systems (BMS), where sophisticated algorithms process vast datasets on cell performance, temperature fluctuations, and usage patterns to optimize operational parameters. This data-driven approach allows operators to precisely predict remaining useful life (RUL) and state of health (SOH), enabling proactive maintenance and scheduling that significantly extends asset longevity and improves safety. Furthermore, AI facilitates highly granular forecasting of renewable generation intermittency and load demand profiles. By achieving superior predictive accuracy, storage operators can participate more effectively in ancillary service markets, maximizing the economic value derived from each cycle of the storage system.

In the context of grid integration, AI serves as the central intelligence orchestrating complex, decentralized energy systems. Advanced AI platforms manage the dispatch of fleets of distributed energy storage systems (DESS) across different locations to balance supply and demand dynamically, achieving true virtual power plant (VPP) functionality. This level of optimization minimizes curtailment of renewable energy, enhances grid resilience during extreme weather events, and reduces congestion in transmission lines. Ultimately, AI accelerates the feasibility of 100% renewable energy grids by providing the necessary software layer to manage the inherent complexity and variability introduced by widespread renewable energy storage deployment.

- AI-driven Predictive Maintenance: Maximizing asset lifespan and reliability by anticipating component failure and degradation rates.

- Optimized Energy Dispatch: Using machine learning to forecast demand, pricing, and renewable generation for optimal charge/discharge scheduling.

- Enhanced Battery Safety: Real-time monitoring and anomaly detection to prevent thermal runaway and ensure operational safety of BESS.

- Grid Stability and Frequency Regulation: AI algorithms enabling ultra-fast response times for ancillary services and precise frequency control.

- Virtual Power Plant (VPP) Management: Aggregating and controlling diverse distributed storage resources as a single, coordinated asset.

DRO & Impact Forces Of Renewable Energy Storage Market

The dynamics of the Renewable Energy Storage Market are shaped by powerful Drivers and substantial Opportunities that are currently outweighing persistent Restraints, leading to strong market momentum and high impact forces. Key drivers include global decarbonization targets and supportive government policies, specifically tax incentives and feed-in tariffs that make storage deployment financially attractive. The growing necessity for grid resilience, driven by increasing frequency of extreme weather events and grid vulnerability, further compels utilities and consumers to adopt storage solutions. Simultaneously, the continuous cost reduction in battery technologies, particularly lithium-ion, makes energy storage a competitive alternative to traditional peaking power plants, accelerating large-scale deployment.

However, the market faces notable restraints, primarily high upfront capital costs associated with certain emerging technologies, regulatory hurdles related to permitting and interconnection standards, and inherent risks within the supply chain, including geopolitical dependencies for critical materials and price volatility. Another significant restraint is the technological limitation concerning long-duration storage (LDS) solutions, where Li-ion batteries remain cost-prohibitive for storage durations exceeding 8 to 12 hours, slowing down the transition to 24/7 renewable grids. These constraints require strategic mitigation through innovation and diversification of material sourcing.

Opportunities in the market are abundant, centered around the rapid innovation in long-duration energy storage (LDES) technologies such as green hydrogen, flow batteries, and advanced compressed air systems, which promise to unlock multi-day storage capability crucial for grid independence. Furthermore, the integration of energy storage with electric vehicle (EV) infrastructure, enabling vehicle-to-grid (V2G) services, presents a massive untapped resource. The high impact forces resulting from these drivers and opportunities dictate aggressive infrastructure spending, technological maturation, and a rapid shift in regulatory perception, positioning energy storage as a mandatory, rather than optional, component of modern electricity networks.

Segmentation Analysis

The Renewable Energy Storage Market is comprehensively segmented based on technology, application, and deployment scale, reflecting the diverse requirements of the energy ecosystem. Segmentation by technology is crucial, as it dictates performance characteristics such as energy density, cycle life, response time, and duration, influencing suitability for specific uses, whether it be short-duration frequency response or long-duration energy shifting. Application segmentation delineates the end-use sectors, including utility-scale projects focused on transmission and distribution assets, Commercial & Industrial entities utilizing storage for operational efficiency and resiliency, and residential consumers focused on self-consumption optimization and backup power.

The dominance of lithium-ion battery technology, particularly its various chemistries like NMC (Nickel Manganese Cobalt) and LFP (Lithium Iron Phosphate), defines the current competitive landscape in the short-to-medium duration segment (up to 4 hours). However, the market is structurally diversifying, with mechanical storage (Pumped Hydro and CAES) remaining significant for large, established infrastructure, and flow batteries (e.g., Vanadium redox) gaining commercial traction due to their enhanced scalability, longer lifespan, and inherent safety advantages, positioning them competitively for medium-to-long duration requirements in demanding operational environments. This diversification ensures that a fit-for-purpose storage solution is available across the entire spectrum of grid needs.

Deployment scale segmentation—utility, residential, and C&I—allows for tailored market strategies. Utility-scale projects are characterized by large capital investments, adherence to stringent grid codes, and long-term contracts, primarily focusing on capacity firming and ancillary services. Conversely, the C&I and residential segments are driven by consumer economics, focusing on maximizing self-consumption of renewable generation, managing peak demand charges, and providing reliable backup power during outages, typically involving smaller, modular, and highly integrated systems often paired with photovoltaic solar installations. Understanding these distinct segment characteristics is essential for stakeholders developing business strategies across the decentralized and centralized energy infrastructure spectrum.

- Technology:

- Lithium-ion Batteries (NMC, LFP)

- Pumped Hydro Storage (PHS)

- Flow Batteries (Vanadium, Zinc-Bromine)

- Thermal Energy Storage (TES)

- Compressed Air Energy Storage (CAES)

- Flywheels

- Other Emerging Technologies (Solid-State, Green Hydrogen)

- Application:

- Utility-Scale Storage (Ancillary Services, Capacity Firming)

- Commercial & Industrial (Demand Charge Reduction, Backup Power)

- Residential Storage (Self-Consumption, Resilience)

- Deployment:

- On-Grid Connected

- Off-Grid/Microgrid

Value Chain Analysis For Renewable Energy Storage Market

The Renewable Energy Storage value chain is complex and highly interdependent, beginning with upstream analysis focused on raw material extraction and processing. This stage is dominated by the mining and refining of critical minerals, particularly lithium, cobalt, nickel, and manganese, which are essential for electrochemical storage manufacturing. Geopolitical concentration risks are high at this stage, requiring manufacturers to prioritize long-term supply agreements and investigate recycling pathways to ensure material security. The subsequent manufacturing phase involves cell production, module assembly, and integration into full battery racks, where companies like CATL, LG Energy Solution, and Samsung SDI wield significant market influence due to their technological expertise and economies of scale in gigafactories.

Midstream analysis primarily covers the system integration and distribution channels. System integrators, such as Fluence and Wartsila, specialize in combining battery hardware, power conversion systems (PCS), and sophisticated battery management systems (BMS) into functional, reliable BESS units tailored to specific grid requirements. The distribution channel is bifurcated into direct sales to large utilities and Independent Power Producers (IPPs) for utility-scale projects, and indirect sales through installers, developers, and energy service companies (ESCOs) for the distributed residential and C&I markets. The effectiveness of the indirect channel is highly dependent on streamlined regulatory processes and efficient installer training programs to maintain product quality and safety across widespread deployments.

Downstream analysis focuses on deployment, operations, and end-of-life management. Deployment involves site preparation, installation, and grid interconnection, often requiring extensive regulatory approvals and specialized engineering procurement and construction (EPC) services. Operations are increasingly reliant on digital services, utilizing AI and advanced analytics for performance monitoring, predictive maintenance, and optimizing revenue stacking (participating in multiple markets simultaneously). Finally, end-of-life management, including battery recycling and repurposing (second life applications), is becoming a critical segment, driven by environmental mandates and the necessity to close the material loop and minimize waste generation from large battery installations.

Renewable Energy Storage Market Potential Customers

The Renewable Energy Storage Market serves a diverse base of potential customers, segmented predominantly by their objectives concerning energy reliability, cost management, and regulatory compliance. The largest end-user segment is Utility Companies and Transmission System Operators (TSOs). These customers purchase large-scale storage solutions for fundamental grid purposes: stabilizing fluctuating renewable generation, providing fast-acting ancillary services (like frequency response), deferring costly transmission upgrades, and ensuring resource adequacy to meet peak demand reliably. Their procurement decisions are characterized by large volume, long-term contracts, and high requirements for technical specifications and safety certifications, often driven by government mandates and regulatory oversight.

The second major customer group encompasses Commercial and Industrial (C&I) entities, including factories, data centers, retail chains, and large campuses. These buyers primarily seek energy storage to reduce operational expenditures, specifically minimizing high demand charges imposed during peak load periods, and achieving greater energy independence. For critical operations like data centers and healthcare facilities, storage serves as essential backup power, providing crucial resilience against grid failures. C&I customers often prioritize systems that integrate seamlessly with existing building energy management systems (BEMS) and renewable generation assets, focusing on rapid return on investment (ROI) through sophisticated load shifting strategies.

Finally, Residential consumers represent a high-growth segment, driven by the desire for energy bill reduction through solar self-consumption optimization and increasing necessity for home backup power, particularly in regions experiencing frequent power outages due to aging infrastructure or extreme weather. These potential customers prioritize user-friendly interfaces, compact design, warranty terms, and brand reliability. The buying process for residential customers is often facilitated through solar installers and authorized distributors, making efficient channel management and strong consumer trust vital components for market penetration in this decentralized segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.2 Billion |

| Market Forecast in 2033 | USD 71.8 Billion |

| Growth Rate | CAGR 15.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tesla, Fluence, LG Energy Solution, CATL, BYD, Siemens Energy, Wartsila, GE Renewable Energy, Contemporary Amperex Technology Co. Limited (CATL), Samsung SDI, Northvolt, Enphase Energy, Vistra Corp., Hitachi Energy, Mitsubishi Electric, Sumitomo Electric, Eos Energy Enterprises, Energy Vault, NEXTracker, Toshiba |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Renewable Energy Storage Market Key Technology Landscape

The technology landscape of the Renewable Energy Storage Market is dominated by electrochemical storage, primarily Lithium-ion (Li-ion) batteries, which represent the current benchmark for performance due to their high energy density, modularity, and rapid response time, making them ideal for short-to-medium duration applications like frequency regulation and arbitrage. Significant R&D is focused on improving Li-ion safety (e.g., LFP chemistry’s thermal stability), cycle life, and reducing material cost. Furthermore, advancements in solid-state battery technology promise higher energy density and enhanced safety without the use of flammable liquid electrolytes, although their commercial readiness for large-scale grid applications is still maturing. This segment dictates the market's pace of cost reduction and scaling capability globally, underpinned by massive investments in gigafactory production capacity.

Beyond Li-ion, the market is actively pursuing diverse alternatives to address the critical need for Long-Duration Energy Storage (LDES), which requires systems capable of storing energy for 10 hours up to several weeks. Flow Batteries, specifically Vanadium Redox Flow Batteries (VRFBs), offer a compelling solution due to their decoupled power and energy capacities, inherent non-flammability, and minimal degradation over thousands of cycles, making them highly suitable for multi-hour daily cycling. Mechanical storage, including traditional Pumped Hydro Storage (PHS) and modern Compressed Air Energy Storage (CAES), continues to play a vital role, especially PHS, which currently accounts for the vast majority of installed storage capacity worldwide, despite its geographic limitations and high upfront environmental impact.

Emerging technologies, critical for future decarbonization pathways, include Thermal Energy Storage (TES) and the integration of Power-to-Gas solutions, specifically Green Hydrogen. TES utilizes materials like molten salts or packed beds to store heat generated from excess renewable electricity, offering cost-effective LDES, especially when coupled with concentrating solar power plants. Green Hydrogen, produced via electrolysis using renewable electricity, allows energy to be stored chemically and repurposed for power generation, heating, or transportation, serving as the ultimate solution for seasonal storage. The technological landscape is therefore shifting towards a hybrid future where optimal storage portfolios integrate short-duration, high-power batteries with long-duration, high-energy non-battery solutions to meet all facets of grid reliability and flexibility demands.

Regional Highlights

- North America (U.S., Canada, Mexico): The North American market is characterized by strong regulatory push from key states, notably California and Texas, which have mandated significant storage procurement targets to manage high solar penetration and grid intermittency. Federal incentives, such as the Inflation Reduction Act (IRA) in the U.S., provide critical investment tax credits (ITCs) for standalone storage projects, accelerating utility-scale BESS deployment and spurring rapid growth in the C&I segment. The region exhibits high complexity due to diverse Independent System Operators (ISOs) and their unique market rules, demanding sophisticated software and integration capabilities from storage providers to maximize revenue streams through participation in ancillary services and capacity markets. The focus is increasingly on addressing aging infrastructure and enhancing resilience against severe weather events, driving demand for microgrids and decentralized storage solutions. This necessitates robust partnerships between technology providers and local utilities to navigate stringent interconnection standards and fast-track deployment timelines, establishing the U.S. as a critical innovation hub for system integration and sophisticated energy management software.

- Europe (Germany, U.K., France, Spain): Europe is driven by ambitious 2030 renewable energy targets and the urgent need to phase out coal and gas power plants, creating a strong market pull for energy storage. Germany leads in decentralized storage adoption, particularly in the residential sector where storage is frequently paired with rooftop PV systems to maximize self-consumption and reduce reliance on high electricity costs. The U.K. market excels in rapid deployment of frequency response and ancillary service storage, supported by highly monetized flexibility markets that reward quick response times. Southern European countries like Spain are rapidly investing in co-located storage with large-scale solar farms. Key challenges involve harmonizing grid codes across member states and ensuring a secure supply chain for battery materials amid geopolitical tensions. European Union initiatives, such as the European Battery Alliance, are actively working to establish a domestic, resilient battery manufacturing ecosystem, shifting reliance away from Asian manufacturers and ensuring long-term technological sovereignty within the energy transition landscape.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC remains the largest and fastest-growing market globally, primarily fueled by massive infrastructure expansion and electrification needs in China and India. China dominates both the manufacturing and deployment aspects, utilizing storage extensively to stabilize its vast solar and wind projects and to support its expansive EV battery manufacturing base. India is emerging as a critical growth center, driven by renewable energy targets, rural electrification, and substantial government tenders for grid-scale storage capacity to manage grid congestion and intermittency in diverse geographical areas. Japan and South Korea, established technology leaders, focus heavily on improving battery safety, developing next-generation chemistries, and integrating storage for sophisticated urban grid management and disaster preparedness due to their high population density and vulnerability to natural disasters. The sheer scale of generation capacity being installed in this region mandates commensurate investments in storage to maintain stability, solidifying APAC's role as the primary demand center for global BESS capacity.

- Latin America (LATAM) (Brazil, Chile, Mexico): The LATAM market is growing steadily, propelled by specific regional needs, including grid isolation, high transmission losses, and the need for energy access in remote areas. Chile stands out due to its high solar irradiation and regulatory frameworks encouraging storage integration to firm up renewable generation and provide reliable capacity for mining operations. Brazil is focusing on distributed generation and associated storage, particularly in response to high electricity tariffs and unreliable hydro-based power generation during dry seasons. Mexico presents substantial opportunity, particularly in the C&I sector, where businesses seek to stabilize power quality and reduce reliance on unreliable state-run infrastructure. Market growth is often dependent on successful political stability and clear, transparent regulatory frameworks that de-risk private sector investments in complex energy infrastructure projects, paving the way for international system integrators and developers to participate actively in emerging tender processes across the continent.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Middle East, driven by ambitious diversification agendas away from oil dependency and significant investment in large-scale renewable projects, particularly in Saudi Arabia and the UAE. Projects like NEOM in Saudi Arabia are pioneering massive, integrated green hydrogen and storage solutions aiming for 100% renewable energy grids, setting a global benchmark for sustainable urban development. Africa's market demand is centered on off-grid and microgrid solutions, addressing severe energy access deficits and the need for resilient power in remote communities, often utilizing solar-plus-storage mini-grids. While capital limitations remain a challenge, international development aid and private equity are increasingly focusing on utility-scale solar and storage projects to stabilize national grids and provide essential power reliability to critical infrastructure, indicating a strong trajectory for decentralized storage deployment over the next decade.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Renewable Energy Storage Market.- Tesla

- Fluence (Siemens & AES JV)

- LG Energy Solution

- Contemporary Amperex Technology Co. Limited (CATL)

- BYD Company Ltd.

- Siemens Energy

- Wartsila

- General Electric (GE) Renewable Energy

- Samsung SDI

- Northvolt

- Enphase Energy

- Vistra Corp.

- Hitachi Energy

- Mitsubishi Electric

- Sumitomo Electric Industries, Ltd.

- Eos Energy Enterprises

- Energy Vault

- NEXTracker (Flex)

- Toshiba Corporation

- Honeywell International Inc.

Frequently Asked Questions

Analyze common user questions about the Renewable Energy Storage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the adoption of Renewable Energy Storage systems?

The primary driving force is the imperative for grid stability and reliability when integrating high penetrations of intermittent renewable energy sources like solar and wind. Storage systems mitigate variability, allowing utilities to accurately forecast and dispatch clean power, thereby reducing reliance on carbon-intensive peaking power plants and meeting aggressive global decarbonization mandates.

How is the market addressing the need for Long-Duration Energy Storage (LDES)?

The market is addressing LDES through significant investment in non-lithium-ion technologies. This includes the commercialization of flow batteries (e.g., vanadium redox), which offer scalable energy capacity and long cycle life, and advanced mechanical solutions like compressed air and gravity-based storage. Furthermore, the development of green hydrogen production for seasonal and multi-day storage is gaining strategic importance as the long-term solution.

Which battery chemistry currently dominates the Renewable Energy Storage Market, and why?

Lithium-ion (Li-ion) batteries, particularly the LFP (Lithium Iron Phosphate) chemistry, currently dominate the market. LFP is favored for grid-scale applications due to its lower cost per kilowatt-hour, enhanced thermal stability (safety), and long cycle life compared to higher energy density chemistries like NMC, making it the most proven and scalable technology for short-to-medium duration grid support.

What role does Artificial Intelligence (AI) play in maximizing the value of energy storage assets?

AI maximizes storage value by enabling sophisticated operational optimization. AI-driven software forecasts renewable generation and load profiles with high accuracy, optimizing charge/discharge cycles for revenue stacking (participating in multiple ancillary markets). Additionally, AI manages predictive maintenance, extending the overall asset lifespan and improving operational safety.

What are the key differences between utility-scale and commercial & industrial (C&I) storage applications?

Utility-scale storage focuses on grid services like frequency regulation, capacity firming, and transmission deferral, often involving multi-megawatt installations driven by regulatory mandates. C&I storage focuses on economic value for the business, specifically reducing peak demand charges, optimizing solar self-consumption, and providing resilience against localized power outages, typically involving smaller, customer-owned modular systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager