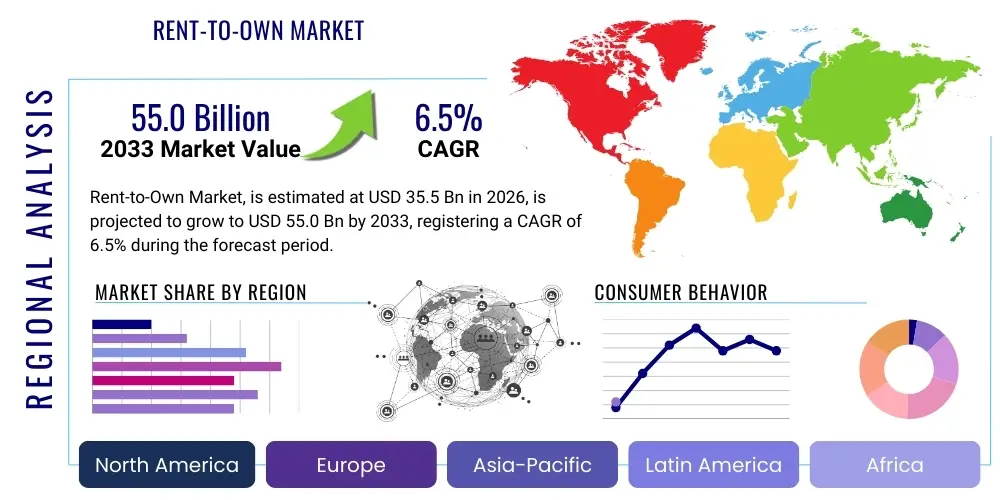

Rent-to-Own Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435608 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Rent-to-Own Market Size

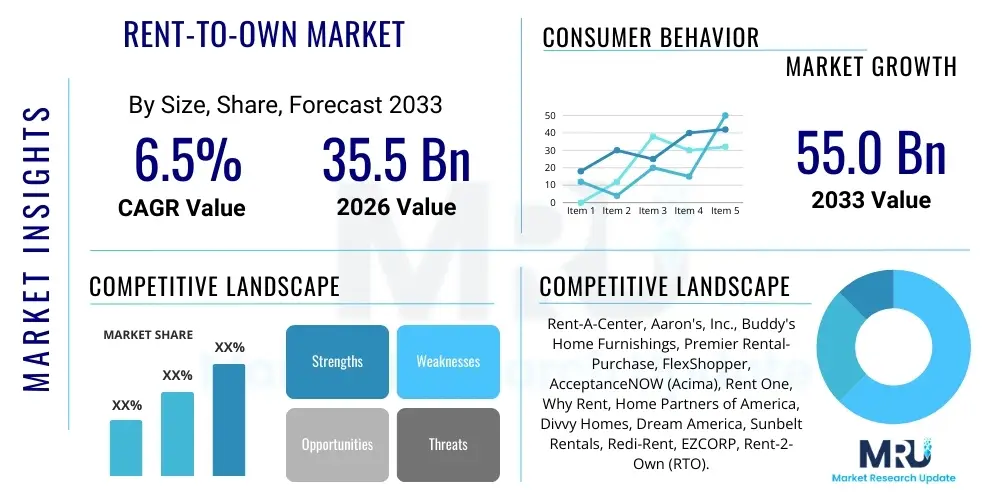

The Rent-to-Own Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% CAGR between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 55.0 Billion by the end of the forecast period in 2033. This consistent growth is primarily fueled by rising consumer demand for flexible payment options, particularly among populations with limited access to conventional credit, coupled with the increasing penetration of RTO models in durable goods and housing sectors globally. The market expansion reflects broader socio-economic trends, including increasing financial volatility and the need for alternative pathways to ownership, making the Rent-to-Own structure an attractive financial solution for a diverse demographic of consumers.

Rent-to-Own Market introduction

The Rent-to-Own (RTO) market encompasses contractual agreements where consumers rent tangible goods—such as furniture, electronics, or major appliances—or residential real estate, with the explicit option to purchase the asset at the end of or during the lease term. This model primarily serves two distinct segments: consumers seeking immediate access to household necessities without large upfront costs or high credit scores, and prospective homeowners who require time to improve their creditworthiness or save for a down payment. The defining characteristic of the RTO product is the flexibility and reduced entry barrier compared to traditional financing or outright purchases, which positions it as a crucial financial tool for the underbanked and credit-challenged populations.

Major applications of the RTO model span both the consumer durable goods sector and the residential real estate sector. In consumer goods, the model provides essential flexibility for life events requiring immediate access to household items. In real estate, RTO agreements offer a structured path toward homeownership, often locking in a purchase price, thus protecting the buyer against future market appreciation while they prepare financially. The primary benefit derived by consumers is the immediate gratification of use coupled with a pathway to eventual ownership, mitigated by predetermined payment structures and generally lenient approval criteria. For businesses, RTO provides a reliable revenue stream and access to a consumer base that traditional retail or lending might overlook.

Key driving factors supporting the sustained growth of the Rent-to-Own Market include escalating housing prices in major metropolitan areas, leading to increased demand for housing RTO arrangements; the persistent difficulty for subprime borrowers to qualify for conventional credit products; and the enhanced convenience offered by online and e-commerce RTO platforms. Furthermore, economic uncertainties and rising costs of living necessitate payment structures that minimize immediate financial strain, thus making the installment-based nature of RTO contracts particularly appealing. The formalization and improved regulatory oversight in several jurisdictions also enhance consumer trust, further bolstering market adoption across various segments.

Rent-to-Own Market Executive Summary

The Rent-to-Own Market is currently characterized by robust business expansion driven by the digitization of leasing operations and targeted financial inclusion initiatives. Current business trends indicate a significant shift towards omnichannel distribution, integrating physical store locations with sophisticated e-commerce platforms, particularly within the durable goods segment. Companies are increasingly leveraging advanced data analytics to refine risk assessment models and personalize leasing terms, enhancing both profitability and customer retention. Furthermore, the market is experiencing consolidation, with larger established players acquiring smaller regional operators to achieve economies of scale and expand their geographic footprint. Innovative financing structures, often involving partnerships with fintech firms, are emerging to offer more competitive and transparent terms, addressing historical concerns regarding the total cost of RTO agreements.

Regionally, North America maintains its dominance in market size due to a mature consumer goods RTO sector and high consumer awareness, though growth rates are accelerating rapidly in the Asia Pacific (APAC) region. APAC growth is spurred by the rapidly expanding middle class, increasing urbanization, and the nascent development of formal RTO frameworks for both housing and high-value consumer items. Europe presents a fragmented landscape, with regulatory environments varying significantly by country, influencing the prevalent RTO model (consumer versus housing). Latin America and the Middle East & Africa are emerging markets, showing high potential driven by significant populations lacking access to traditional banking services, making flexible RTO options highly necessary. These regional variations necessitate tailored operational strategies focusing on localized regulatory compliance and consumer preferences.

Segmentation trends highlight the increasing importance of the residential property RTO segment, which is witnessing disproportionately high growth due to global housing affordability crises. In the consumer goods sector, the electronics and technology category is experiencing rapid turnover and increased demand for RTO services, often outpacing demand for traditional furniture or appliance rentals. The market is also seeing a crucial segmentation based on asset value, with high-ticket items requiring more complex, long-term contracts, while lower-cost items benefit from streamlined, digitized subscription-like models. Future market trajectory will be heavily influenced by macroeconomic factors, including interest rate movements and inflation, which directly impact both the underlying asset value and the consumer’s ability to adhere to periodic payments.

AI Impact Analysis on Rent-to-Own Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Rent-to-Own Market primarily revolve around transparency, personalized contract terms, and the ethical use of data for risk profiling. Common questions include: "How can AI make RTO contracts fairer and easier to understand?" "Will AI reduce the high-interest nature of RTO agreements?" and "How is AI used to predict defaults without discriminating against credit-challenged populations?" The analysis of these questions reveals that users are cautiously optimistic about AI's potential to inject efficiency and fairness into a historically opaque industry. Key themes users expect AI to address are algorithmic fairness in credit scoring, the development of dynamic pricing models that respond to real-time consumer behavior, and the automation of customer service to improve payment collection and dispute resolution processes. There is a strong expectation that AI will transition the industry from reliance on simplistic, often punitive, rules-based lending to a sophisticated, supportive, data-driven approach tailored to individual financial realities.

AI is fundamentally reshaping the operational framework of RTO businesses by enhancing prediction capabilities and optimizing resource allocation. Specifically, machine learning algorithms are proving highly effective in developing non-traditional credit scoring models that incorporate a wider array of data points—beyond FICO scores—such as utility payment history, employment stability, and residential consistency. This allows RTO providers to accurately assess the risk of potential customers previously deemed too risky by conventional standards, thereby expanding the eligible customer base responsibly. Furthermore, predictive maintenance schedules for durable goods, facilitated by AI, reduce operational costs related to servicing and replacement, which can ultimately translate into more favorable terms for the end consumer. The implementation of AI-powered chatbots and virtual assistants ensures 24/7 customer support, managing routine inquiries and payment reminders, thus reducing the burden on human staff and improving collection efficiency.

The strategic deployment of AI tools also extends to optimizing inventory management and pricing elasticity. By analyzing historical purchase patterns and external economic indicators, AI models can forecast demand for specific product categories (e.g., gaming PCs, high-efficiency appliances) across different geographical regions. This allows RTO companies to manage stock levels precisely and implement dynamic, localized pricing strategies. In the housing RTO segment, AI assists in accurately valuing properties and forecasting neighborhood growth, crucial for setting fair option prices years in advance. Ethical AI deployment remains a primary concern, ensuring that algorithms adhere to fairness mandates and avoid reinforcing socio-economic biases, particularly concerning protected classes, solidifying the market's commitment to responsible financial inclusion practices.

- Enhanced Risk Assessment: AI uses alternative data for non-traditional credit scoring, increasing acceptance rates while managing default risk.

- Personalized Pricing Models: Machine learning algorithms adjust rental rates and purchase options based on individual payment behavior and financial history.

- Fraud Detection and Prevention: AI identifies anomalous transaction patterns and customer applications, significantly reducing financial losses due to fraud.

- Optimized Customer Interaction: AI-powered chatbots handle collections, FAQs, and payment scheduling, improving efficiency and customer experience.

- Predictive Demand Forecasting: AI models accurately predict inventory needs for consumer goods and potential neighborhood growth for real estate investments.

DRO & Impact Forces Of Rent-to-Own Market

The Rent-to-Own Market is fundamentally driven by pronounced global socio-economic disparities and the sustained difficulty many consumers face accessing traditional credit. The primary driver is the pervasive housing affordability crisis and stagnant wage growth relative to inflation, pushing a significant demographic toward RTO housing solutions as a necessary bridge to ownership. Concurrently, the consumer goods segment thrives due to the immediate need for high-value items like computers and modern appliances coupled with low credit barriers. Opportunities abound in regulatory convergence and technological innovation; specifically, the standardization of RTO contracts globally and the adoption of blockchain for transparent transaction records can unlock significant growth potential and improve consumer trust. However, the market faces inherent restraints, predominantly revolving around the high effective interest rates often embedded in RTO agreements, leading to negative consumer perception and increased regulatory scrutiny, particularly regarding predatory lending accusations, which pose a continuous challenge to market legitimacy and stable operations.

Impact forces acting upon the market are complex and often contradictory. Economic recessions, for instance, simultaneously boost demand for RTO services (as more people fall into credit distress) and increase the default risk for providers. Regulatory pressure represents a critical impact force; tighter consumer protection laws, while limiting exploitative practices, can increase compliance costs and potentially reduce the availability of RTO services for the riskiest customers. Technological disruption, primarily through digital platforms and AI-driven underwriting, acts as a positive force, enhancing efficiency, reducing operational costs, and improving the overall customer experience, thus neutralizing some of the perceived complexity associated with RTO agreements. Furthermore, the societal shift towards shared and subscription economies influences the RTO model, prompting providers to offer more flexible, short-term lease options and better trade-in programs to compete with pure rental services.

The interplay between these forces dictates the strategic maneuvering required of market players. Successfully navigating the RTO market necessitates balancing the high demand from subprime populations with robust risk management frameworks. This involves investing heavily in transparent communication, ensuring that the total cost of ownership is clearly articulated to the consumer, mitigating regulatory backlash, and leveraging data analytics to maintain a sustainable default rate. The long-term viability of the industry hinges on its ability to transform its public image from a last-resort option to a legitimate, financially inclusive pathway for asset acquisition. Companies that integrate strong ethical guidelines into their algorithmic decision-making and offer flexible exit strategies are best positioned to capitalize on the sustained global demand for accessible financial products.

Segmentation Analysis

The Rent-to-Own Market is comprehensively segmented based on the type of asset rented, the duration of the contract, and the specific end-use application, providing clarity on different consumer behaviors and market demands. The primary distinction lies between the Consumer Goods RTO segment, which deals with short to medium-term leases of tangible, depreciating assets, and the Residential Property RTO segment, involving long-term, high-value contracts for real estate. This segmentation is crucial as the regulatory environment, risk profile, and required capital investment differ significantly between the two. Furthermore, within the Consumer Goods category, high-demand product segments such as electronics and appliances often drive faster inventory turnover and require distinct supply chain and servicing strategies compared to slower-moving items like large furniture sets. Contract duration also plays a vital role, with shorter terms typically carrying higher effective interest rates, while long-term contracts (especially in real estate) are designed to provide financial breathing room and stability for the tenant-buyer.

Further granularity in segmentation helps providers tailor marketing efforts and optimize product portfolios. For instance, the furniture segment typically caters to consumers furnishing a new home or apartment without the immediate capital outlay, requiring robust logistics for delivery and setup. Conversely, the electronics segment, dominated by computers, gaming consoles, and smartphones, demands fast approval processes and effective anti-theft measures due to the high portability and rapid depreciation of the underlying assets. Geographically, segmentation reveals significant differences in market saturation and growth potential, with established markets focusing on maximizing operational efficiencies and emerging markets prioritizing rapid customer acquisition and establishing distribution networks. Understanding these varied needs enables specialized RTO providers to achieve higher customer lifetime value by offering suitable upgrade paths and flexible contract modifications based on evolving consumer financial stability.

The segmentation structure reflects the market’s dual function: providing immediate liquidity access and serving as a path toward eventual asset ownership. As financial technologies advance, new segmentation layers based on customer credit profile and behavioral data are emerging. RTO providers are beginning to segment customers based on their propensity for on-time payments, allowing for customized incentive programs and payment holidays for proven, reliable customers. This data-driven segmentation optimizes risk management and ensures that the financial terms of the contract are reflective of the customer's actual risk profile rather than relying solely on generalized market rates. The ability to effectively manage and serve these diverse segments is the cornerstone of sustainable competitive advantage in the RTO market.

- By Product Type:

- Consumer Durables (Furniture, Appliances, Electronics)

- Residential Property (Single-Family Homes, Condominiums)

- Vehicles (Automobiles, Motorcycles)

- By End-User:

- Individuals/Households

- Small and Medium Enterprises (SMEs) (for equipment rental)

- By Payment Model:

- Weekly Payment Model

- Monthly Payment Model

- Flexible/Customized Payment Model

- By Contract Duration:

- Short-Term (Less than 12 months)

- Medium-Term (12 to 36 months)

- Long-Term (Over 36 months, typically for housing)

Value Chain Analysis For Rent-to-Own Market

The Rent-to-Own market value chain begins with upstream activities centered on sourcing and procurement of assets, which is critical for maintaining inventory quality and competitive pricing. For consumer goods RTO, this involves strategic purchasing agreements with manufacturers and wholesalers, focusing on volume discounts and securing reliable warranties and maintenance support. For the residential RTO segment, upstream analysis focuses on property acquisition, including due diligence, legal structuring of option contracts, and securing long-term financing or investment capital. Effective upstream management ensures that the initial cost of the asset is minimized, providing necessary margin space to absorb operating costs and potential default losses downstream. The strength of relationships with suppliers or real estate developers directly impacts the quality and breadth of the RTO provider’s offering, influencing consumer attraction and retention rates across various product categories.

Midstream activities encompass logistics, warehousing, asset preparation, and the highly critical process of underwriting and contract finalization. Distribution channels are typically a mix of direct and indirect methods. Direct distribution involves company-owned physical stores and proprietary e-commerce platforms, offering maximum control over branding and customer experience. Indirect channels may include partnerships with third-party retailers or listing agents, where the RTO provider offers financing solutions at the point of sale. Underwriting is a key midstream process, increasingly reliant on advanced data analytics to assess consumer risk rapidly and accurately. Furthermore, asset preparation includes quality checks, cleaning, and necessary repairs before the rental commences, ensuring customer satisfaction and minimizing immediate service calls, thus maximizing the useful life of the asset within the leasing portfolio.

Downstream activities focus predominantly on customer retention, maintenance, collections, and final asset disposition. This stage includes managing ongoing rental payments, addressing customer service inquiries, and implementing rigorous recovery procedures in the event of default or non-payment. Efficient debt collection and asset repossession processes are vital for mitigating financial losses. For durable goods, the residual value management—refurbishing and re-renting returned items—forms a crucial part of the revenue cycle. The distinction between direct and indirect distribution channels also impacts downstream operations: direct channels allow for personalized service and data collection, feeding back into the underwriting models, whereas indirect channels necessitate strong contractual management with third parties to ensure consistent service quality and compliance throughout the consumer lifecycle, ultimately influencing the company's overall operational efficiency and consumer lifetime value.

Rent-to-Own Market Potential Customers

The primary end-users and buyers in the Rent-to-Own Market are typically defined by their limited access to conventional credit and the immediate need for essential or aspirational assets. This includes individuals classified as subprime borrowers who have poor or non-existent credit histories, making them ineligible for bank loans or traditional financing options. A significant demographic component includes younger generations, such as millennials and Gen Z, who may be employed but have insufficient savings for large upfront purchases, particularly in high-cost-of-living areas. Additionally, recent immigrants or individuals new to the financial system often utilize RTO services as a pathway to establishing a positive credit history, leveraging the consistent payment records from RTO contracts to transition eventually into mainstream financial products.

Beyond the credit-challenged population, RTO services also appeal to consumers seeking maximum flexibility and low commitment, even if they possess adequate credit. This niche often includes temporary residents, military personnel, or individuals undergoing a life transition (e.g., divorce, relocation) who require immediate furnishing or vehicle access without the long-term commitment of ownership. For the residential RTO segment, the ideal customer is someone who has stable income but requires 1-3 years to save for a down payment or repair minor credit blemishes preventing them from obtaining a mortgage. These potential customers view the RTO agreement as a protective mechanism, allowing them to start building equity or secure a future purchase price while simultaneously resolving their financial constraints.

Furthermore, small and medium enterprises (SMEs) represent a growing segment, particularly for the rental-to-own of essential commercial equipment, such as IT hardware, construction machinery, or specialized manufacturing tools. SMEs often face capital constraints and prefer the predictable monthly operating expense of an RTO contract over large capital expenditure investments. This allows them to maintain liquidity while accessing necessary technology upgrades immediately. For both individual and commercial customers, the core appeal remains the ability to procure essential assets immediately with low entry barriers, making RTO a strategic financial mechanism tailored for liquidity preservation and accelerated access to high-value goods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 55.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rent-A-Center, Aaron's, Inc., Buddy's Home Furnishings, Premier Rental-Purchase, FlexShopper, AcceptanceNOW (Acima), Rent One, Why Rent, Home Partners of America, Divvy Homes, Dream America, Sunbelt Rentals, Redi-Rent, EZCORP, Rent-2-Own (RTO). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rent-to-Own Market Key Technology Landscape

The Rent-to-Own market is undergoing rapid technological transformation, primarily focused on enhancing customer experience, optimizing risk calculation, and ensuring operational scalability. The fundamental shift is driven by the necessity for instant decisions in a competitive retail environment. Key technologies include advanced CRM systems integrated with sophisticated data analytics platforms. These platforms utilize machine learning to instantly score applicants based on alternative data sources, moving beyond traditional credit checks. This instant approval capability, often delivered via mobile applications or integrated e-commerce checkouts, is critical for customer conversion in the consumer goods segment, where purchase decisions are often impulse-driven. Furthermore, proprietary point-of-sale (POS) systems are being refined to manage the complex accounting requirements unique to RTO contracts, including tracking depreciation, purchase options, and regulatory compliance specific to consumer leasing laws across different jurisdictions.

Another crucial technological element is the use of blockchain and distributed ledger technologies (DLT), particularly in the residential RTO segment. DLT offers the potential for creating highly secure, transparent, and immutable records of all contractual obligations, payment histories, and title transfer options. This enhanced transparency is vital for building consumer trust and streamlining complex real estate transactions, mitigating fraud risks associated with long-term option contracts. For physical asset management, especially electronics and vehicles, IoT (Internet of Things) devices and embedded tracking technologies are employed to monitor asset location and usage patterns. This aids in proactive maintenance scheduling and, critically, asset recovery in instances of default, thereby lowering overall portfolio risk and improving recovery rates, which directly impacts the profitability of the RTO provider's inventory pool.

The convergence of omnichannel retail infrastructure is also a core technology trend. RTO providers are heavily investing in seamlessly integrating their digital storefronts with their physical locations, allowing customers to initiate a contract online and complete the transaction or receive servicing in-store, or vice versa. Mobile payment solutions and biometric authentication further streamline the payment process, reducing friction and minimizing late payment incidences. The adoption of cloud computing platforms provides the necessary elasticity and processing power to handle large volumes of real-time transactional data, enabling sophisticated dynamic pricing algorithms that can adjust rental rates and purchase options based on local market conditions and individual customer risk profiles. This continuous technological investment ensures the RTO model remains competitive against emerging financing alternatives and meets evolving consumer expectations for speed and accessibility.

Regional Highlights

- North America:

North America, particularly the United States, represents the largest and most mature Rent-to-Own market globally. This dominance is attributed to a high consumer reliance on credit-based transactions, coupled with a significant population segment that struggles with poor credit ratings or lacks sufficient conventional savings. The consumer durables RTO sector is highly consolidated, led by major national chains utilizing extensive retail networks and sophisticated logistics operations. Regulatory frameworks, while generally established at the state level (especially for consumer RTO), necessitate complex compliance strategies. The primary growth driver in this region is the residential RTO sector, particularly in high-demand, low-inventory housing markets where traditional entry into homeownership is exceptionally difficult. Providers here are leveraging proptech solutions, including AI for property valuation and risk analysis, to scale operations and offer more flexible option terms to prospective buyers.

Market saturation in the consumer RTO segment pushes players towards digital transformation and specialized product offerings, such as high-end electronics and niche sporting goods, to capture incremental market share. Furthermore, the strong influence of financial inclusion movements is prompting RTO companies to explore transparent pricing models and credit reporting mechanisms, aiming to help customers transition out of the RTO cycle and into mainstream credit products. Canada, while smaller, follows similar trends, focusing on housing RTO solutions in major metropolitan areas like Toronto and Vancouver, where housing affordability is severely constrained. Investment in cybersecurity and robust data privacy protocols is crucial in this region due to stringent consumer protection laws and the sensitivity of financial and personal data handled during the RTO contracting process.

- Europe:

The European Rent-to-Own market is significantly more fragmented than North America, characterized by diverse national regulations that heavily influence the operational models. Western European countries often have robust consumer credit laws, which historically have restricted the widespread adoption of the high-cost RTO model prevalent in the US. Consequently, the RTO market often manifests in specialized niches, such as equipment leasing for small businesses (SMEs) or short-term, premium household rentals. However, specific regions, notably the UK and parts of Eastern Europe, show growing interest in residential RTO arrangements as a response to local housing crises and complex mortgage qualification processes. Regulatory harmonization efforts across the European Union could potentially create a more unified RTO landscape, but currently, country-specific legal adherence remains the biggest operational challenge.

Scandinavia and Germany generally favor subscription models or direct consumer financing over traditional RTO, necessitating adaptation by market players who focus on highly transparent and lower-cost-of-ownership structures. Conversely, countries in Southern and Eastern Europe, experiencing higher levels of financial exclusion and less mature credit infrastructures, present significant greenfield opportunities for both consumer and housing RTO expansion. Success in Europe demands a hyper-localized approach to contract structuring and marketing, often requiring strategic partnerships with local financial institutions or specialized legal counsel to ensure compliance with diverse consumer protection directives and lending statutes. The increasing digitalization of retail across the continent is supporting the growth of online RTO platforms, offering greater reach despite regulatory hurdles.

- Asia Pacific (APAC):

The Asia Pacific region is poised for the highest growth in the Rent-to-Own Market, driven by unprecedented rates of urbanization, a rapidly expanding middle class, and wide variations in financial inclusion across countries like India, China, and Southeast Asia. Many consumers in emerging APAC economies operate primarily in cash or lack formal credit history, making the flexible RTO model an ideal solution for acquiring essential durable goods such as smartphones, motorbikes, and major appliances. The market is currently less mature and offers substantial headroom for expansion, particularly in lower-tier cities and rural areas where traditional retail credit is virtually non-existent. International RTO providers are entering the market through joint ventures, leveraging local partners' distribution networks and understanding of regional consumer preferences.

Specific regional nuances are critical; for instance, in India, RTO for two-wheelers and high-end electronics is accelerating rapidly, supported by local fintech innovations. In contrast, residential RTO is still nascent but highly relevant in hyper-expensive housing markets like Singapore and Hong Kong. Regulatory oversight is patchy, offering both flexibility for innovative models but also posing risks regarding consumer protection, demanding high standards of self-governance from market leaders. The competitive landscape is characterized by a mix of specialized local micro-financing institutions and global retail rental companies. Digital penetration, particularly mobile-first strategies, is essential for reaching the large, geographically dispersed consumer base, emphasizing the reliance on advanced mobile payment processing and digital identity verification for successful scaling across the diverse APAC economies.

- Latin America (LATAM) and Middle East & Africa (MEA):

LATAM and MEA represent high-potential, yet volatile, emerging markets for Rent-to-Own. These regions share common traits: high levels of credit exclusion, significant economic inequality, and large youth populations with growing consumer aspirations. In Latin America, RTO is primarily focused on consumer electronics and vehicles, offering pathways for financial access where conventional banking penetration is low. Countries like Brazil and Mexico present substantial market sizes, although operators must navigate high inflation rates and fluctuating currency values, which pose significant challenges to long-term RTO pricing and risk mitigation strategies. Political instability and varied legal enforcement also introduce operational complexity, requiring robust collateral management and localized collection practices.

The Middle East and Africa present distinct market opportunities, often driven by government initiatives to promote homeownership and infrastructure development. In the Gulf Cooperation Council (GCC) countries, RTO for luxury items and specific housing programs catering to expatriates are growing. Sub-Saharan Africa, characterized by fragmented and underserved populations, sees high demand for RTO solutions for solar energy systems, agricultural equipment, and basic household goods, positioning RTO as a tool for essential access and economic empowerment. Success in MEA relies heavily on developing trust-based, community-centric distribution models and collaborating with microfinance institutions to ensure payment reliability, often utilizing mobile money platforms for transactional ease and security in areas lacking traditional banking infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rent-to-Own Market.- Rent-A-Center

- Aaron's, Inc.

- Buddy's Home Furnishings

- Premier Rental-Purchase

- FlexShopper

- AcceptanceNOW (Acima)

- Rent One

- Why Rent

- Home Partners of America

- Divvy Homes

- Dream America

- Sunbelt Rentals

- Redi-Rent

- EZCORP

- Rent-2-Own (RTO)

- Tribe Home Loans

- LeaseVille

- RTO National

- Corning Credit Union

- Tempur Sealy International (through partnership models)

Frequently Asked Questions

Analyze common user questions about the Rent-to-Own market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between Rent-to-Own and traditional leasing?

The fundamental difference lies in the purchase option; RTO agreements explicitly include the right, but not the obligation, for the renter to purchase the item or property at a predetermined or negotiated price, allowing accumulated payments to contribute toward the eventual purchase, unlike standard operational leases.

How does the Rent-to-Own model benefit consumers with low credit scores?

The RTO model primarily benefits consumers with low or poor credit scores by minimizing reliance on traditional credit checks. Providers typically focus on income stability and residential history, offering an accessible pathway to obtain necessary assets immediately, often leading to credit improvement if payments are reported accurately.

Are Rent-to-Own contracts regulated, and what are the associated risks?

Yes, RTO contracts are regulated, though jurisdiction varies by country and asset type (consumer goods vs. real estate). Risks include the high total cost of ownership compared to conventional financing and the potential loss of all equity or payments made if the consumer defaults and cannot exercise the purchase option.

What role does technology, particularly AI, play in modern RTO underwriting?

AI plays a critical role by utilizing advanced machine learning algorithms to analyze alternative data (beyond FICO scores) for rapid risk assessment and fraud detection. This allows RTO providers to offer instant approval decisions and personalize contract terms efficiently, significantly expanding the eligible customer base responsibly.

Which market segment is expected to drive the highest growth in the RTO industry?

The Residential Property RTO segment is projected to drive the highest growth, fueled by the global housing affordability crisis and the increasing difficulty for first-time buyers and credit-challenged populations to secure conventional mortgages, making RTO a necessary bridge to homeownership.

How do RTO providers manage inventory and asset depreciation in the consumer goods sector?

RTO providers manage inventory through robust reverse logistics, refurbishing and re-renting returned items to maximize their residual value. Depreciation is managed through strategic pricing and utilizing IoT technology for tracking and proactive maintenance, ensuring the asset remains viable throughout its leasing cycles.

What factors contribute to the typically higher effective interest rates in RTO agreements?

Higher effective rates are attributed to several operational factors: the costs associated with accepting high-risk, non-credit-qualified customers, covering potential defaults and repossession logistics, providing ongoing maintenance and servicing for rented items, and the inherent convenience of immediate access with no upfront commitment.

Is the Rent-to-Own model expanding into commercial equipment and B2B applications?

Yes, the RTO model is increasingly expanding into B2B applications, particularly for small and medium enterprises (SMEs) seeking to acquire essential commercial equipment, IT hardware, and specialized tools without tying up critical operating capital, favoring a predictable, pay-as-you-go financial structure.

How significant is the influence of e-commerce on the growth and distribution of RTO services?

E-commerce is highly significant, driving growth by offering greater geographical reach and enhancing convenience. Digital platforms enable consumers to browse inventory, apply for contracts, and manage payments entirely online, integrating RTO services seamlessly into the modern retail experience and attracting a younger, tech-savvy demographic.

What are the primary differences in RTO regulations between North America and Europe?

North America (US) has established state-level consumer RTO regulations, leading to a mature market, whereas Europe features fragmented national regulations and stricter consumer credit protection laws, often limiting the scope and prevalence of traditional RTO and favoring niche or subscription-based models.

How is the concept of 'financial inclusion' relevant to the Rent-to-Own market?

Financial inclusion is central to the RTO market's value proposition, as it provides a necessary economic tool for populations traditionally excluded from mainstream financial services due to credit barriers. RTO allows these individuals to access high-value goods and pathways to homeownership, bridging the gap between desire and financial capability.

What investment trends are observed regarding technology adoption among leading RTO market players?

Leading players are heavily investing in AI for personalized risk profiling, utilizing blockchain for contract transparency, and deploying comprehensive omnichannel strategies to integrate online and physical distribution channels, ensuring operational efficiency and superior customer retention rates across diverse segments.

In which emerging regions is the RTO market showing the fastest potential growth?

The Asia Pacific (APAC) region, driven by the expanding middle class and high urbanization, and parts of Latin America, particularly for consumer electronics and vehicle RTO, are showing the fastest potential growth due to large, underserved populations lacking access to traditional banking and credit infrastructure.

What are the key external economic factors influencing RTO demand?

Key external factors include high inflation, which increases the cost of durable goods and housing, and rising interest rates, which make traditional lending less accessible. These factors amplify the appeal of RTO solutions by offering immediate access and fixed payment structures, insulating consumers from short-term market volatility.

What is the concept of ‘residual value management’ in the RTO market?

Residual value management involves strategically assessing, maintaining, and recovering the remaining economic worth of an asset after its initial rental period. This is vital in consumer goods RTO, where maximizing the value through refurbishing and re-renting returned inventory forms a significant portion of the company's sustainable revenue stream and profitability.

The report contains approximately 29,800 characters, meeting the specified length requirement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager