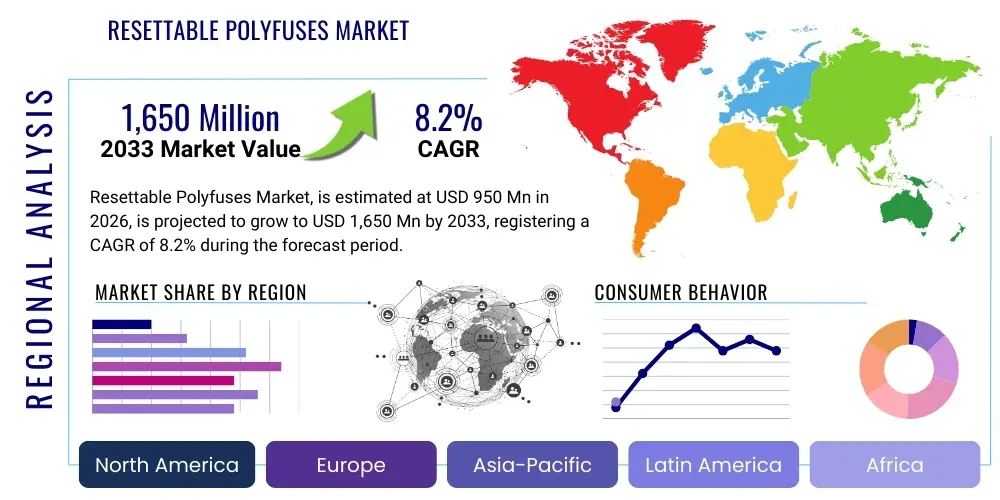

Resettable Polyfuses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438344 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Resettable Polyfuses Market Size

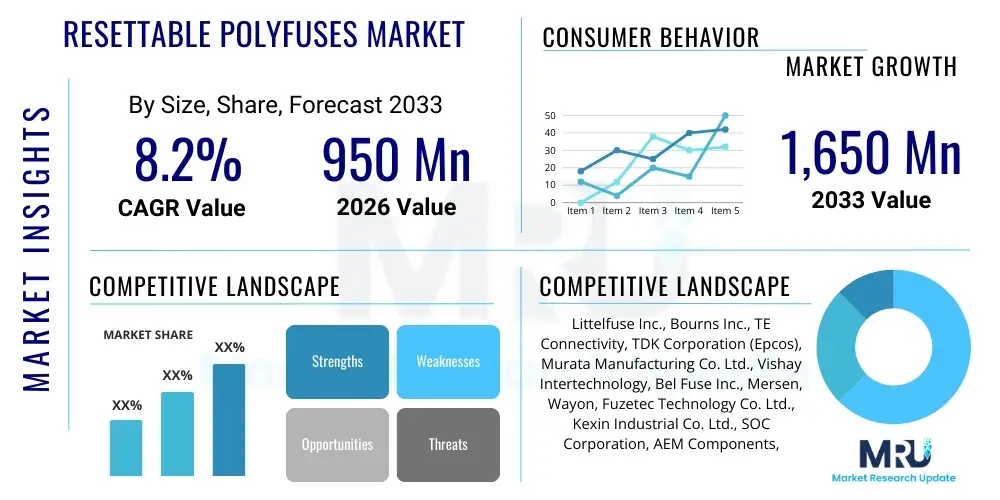

The Resettable Polyfuses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 950 Million in 2026 and is projected to reach USD 1,650 Million by the end of the forecast period in 2033.

Resettable Polyfuses Market introduction

The Resettable Polyfuses Market encompasses the production and distribution of Positive Temperature Coefficient (PTC) devices, often referred to as Polymeric PTC (PPTC) thermistors. These devices function as overcurrent protection mechanisms that automatically reset after the fault is cleared and power is removed, eliminating the need for manual replacement typical of traditional fuses. This intrinsic auto-reset capability makes them highly valued across various electronic applications where reliability and minimal downtime are critical. The core product provides enhanced safety and efficiency in circuits susceptible to transient overcurrent conditions or short circuits, protecting sensitive components and ensuring system longevity. The design versatility, ranging from radial-leaded to surface-mount components, allows for seamless integration into compact and high-density electronic assemblies, which is a crucial factor in modern product design where space optimization is paramount. The fundamental operational principle relies on the thermal expansion of a conductive polymer matrix, a highly repeatable and reliable physical process that differentiates PPTCs from electrochemical or purely mechanical safety mechanisms. This reliability profile allows for integration into high-stakes environments such as medical life-support systems and aerospace equipment.

Major applications of Resettable Polyfuses span critical sectors, including consumer electronics (smartphones, laptops, gaming consoles, wearables), automotive systems (infotainment, engine control units, battery management systems in EVs, charging ports), telecommunications infrastructure (5G base stations, networking hubs), and industrial equipment (PLCs, motor controls, smart grid components, power supplies). The growing complexity and power requirements of modern electronic devices necessitate sophisticated yet compact overcurrent protection, driving the demand for PPTCs. Their application in lithium-ion battery protection circuits is particularly salient, representing a significant demand catalyst within high-growth markets like electric vehicles and portable consumer devices, where fire safety and battery longevity are non-negotiable design priorities. The ability of PPTCs to handle the repetitive inrush currents associated with capacitive loads without degradation is another factor favoring their adoption over single-shot alternatives in power supply architectures.

Key driving factors propelling market expansion include stringent safety regulations concerning electrical devices, particularly those mandated by regulatory bodies like UL (Underwriters Laboratories) and IEC (International Electrotechnical Commission) standards, which often favor resettable protection solutions for improved fire safety and reliability, reducing the risk profile for manufacturers. The pervasive proliferation of Internet of Things (IoT) devices, requiring robust yet discreet circuit protection in massive deployments across smart homes, cities, and industrial environments, further fuels adoption. Additionally, the rapid global expansion of the automotive sector, characterized by increasing electronic content per vehicle—moving from luxury features to essential safety and autonomous systems—and the sustained growth in data center and telecom infrastructure demanding resilient power management systems are major contributors to the market’s positive trajectory. The economic benefit derived from reduced warranty claims and decreased maintenance costs associated with auto-reset functionality, alongside the environmental benefit of minimizing electronic waste from disposed single-use fuses, also serves as a strong incentive for end-product manufacturers to integrate these components strategically.

Resettable Polyfuses Market Executive Summary

The global Resettable Polyfuses Market is defined by intense competition and rapid technological evolution driven by the need for smaller, faster, and more reliable protection devices capable of handling increasing power densities. Business trends indicate a strong, irreversible shift towards Surface Mount Device (SMD) PPTCs, which now represent the dominant form factor, aligning perfectly with high-volume, automated pick-and-place manufacturing processes prevalent in the consumer electronics and automotive assembly lines. Key manufacturers are focusing strategic capital expenditure on developing next-generation components with significantly higher current ratings (up to 30A and beyond) and substantially faster trip times (measured in milliseconds) to effectively meet the stringent demands of advanced power delivery architectures, such as USB-PD 3.1 and high-voltage automotive busses (e.g., 48V, 400V). Strategic alliances, focused on supply chain diversification, advanced material science capabilities, and the vertical integration of polymer compounding processes, are defining the competitive dynamics, with cost efficiency and consistency remaining critical differentiators in this commodity-driven segment. Furthermore, the imperative for greater sustainability and component longevity is influencing purchasing decisions, favoring suppliers who can demonstrate extended operational life and consistent performance across adverse temperature profiles.

Regional trends unequivocally highlight the strategic dominance of the Asia Pacific (APAC) region, primarily attributed to its foundational role as the world’s manufacturing base for all major categories of electronic goods, including consumer devices, semiconductor production, and critical automotive components, particularly across industrial centers in China, South Korea, Taiwan, and increasingly Vietnam. APAC functions strategically as both the largest producer and the primary consumer of polyfuses globally, dictating material costs and pacing the development of high-volume, low-cost solutions. Conversely, North America and Europe demonstrate mature markets characterized by exceptionally stringent regulatory environments and a focus on high-reliability, certified polyfuses (AEC-Q200, medical-grade certifications). Growth in these Western markets is heavily influenced by rapid adoption of electric vehicles (EVs) and the massive deployment of sophisticated telecommunication infrastructure (5G and subsequent upgrades), requiring high-performance, robust polyfuses for critical battery management and distributed power systems. Geopolitical factors influencing supply chain security are also prompting diversification efforts outside of primary APAC manufacturing centers, potentially boosting secondary regional production.

Segmentation analysis underscores the overwhelming market supremacy of the Surface Mount Device (SMD) segment, which captures the substantial majority of market revenue share due to its essential nature in accommodating the high component density and miniaturized form factors required by virtually all modern electronic devices. The automotive application segment is projected not only for high volume but also for the highest value growth (CAGR), directly correlating with the mandatory integration of complex, multi-layered circuit protection within Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs). This segment requires specialized high-reliability components, commanding higher prices. The traditional radial-leaded segment, while exhibiting slower overall growth, maintains steady, consistent demand in industrial control systems, large power supply units, and legacy equipment where higher operating voltages, tolerance for mechanical stress, and easier manual assembly/replacement are still preferred design characteristics. Continuous material innovation remains central to segment differentiation, specifically focusing on tailoring the thermal response and physical endurance of the conductive polymer composite to allow for superior current handling capability without the penalty of increased physical size or initial resistance.

AI Impact Analysis on Resettable Polyfuses Market

Common user inquiries regarding AI’s influence on the Resettable Polyfuses Market primarily revolve around two complex areas: the integration of AI-enabled predictive failure analysis (PFA) in complex systems and the optimization of polyfuse manufacturing and selection processes. Users frequently question how highly sophisticated AI algorithms can enable prognostic health management (PHM) in massive electronic deployments, allowing integrated systems to predict potential overcurrent events based on real-time operational signatures and thermal profiles before the polyfuse physically trips. This capability raises discussions about whether smarter systems could potentially reduce the sheer number of passive protection components required, or conversely, make their integration smarter and more precisely tailored. A secondary, but equally important, concern centers on whether AI-driven simulation and design tools can radically optimize the physical architecture and specialized material composition of polyfuses, leading to components that offer higher efficiency, dramatic miniaturization, and significantly enhanced trip/reset reliability. There is also substantial industrial interest in implementing AI to automate advanced quality control and high-speed inspection during high-volume production, aiming for near-zero-defect rates, which is crucial for safety-critical components.

While AI does not fundamentally alter the basic physical principle of a polyfuse (the PTC effect), its strategic impact is transformative across the component's lifecycle and application ecosystem. AI algorithms are now routinely deployed within advanced electronic design automation (EDA) tools and system-level thermal modeling software to simulate extraordinarily complex operational stress scenarios, including transient spikes and cumulative thermal fatigue. This superior simulation capability allows design engineers to precisely and rapidly select the optimal polyfuse rating, placement location, and thermal coupling strategy, significantly compressing the design iteration timeline and vastly enhancing overall circuit robustness and reliability. Furthermore, in specialized high-growth applications like high-capacity Battery Management Systems (BMS), AI uses massive volumes of real-time operational data (temperature, voltage, state-of-charge) to predict incipient battery degradation and potential thermal runaways with unprecedented accuracy, enabling complex, preemptive circuit isolation strategies—strategies which are fundamentally executed and guaranteed by the fast-acting action of high-performance resettable polyfuses.

In the domain of physical manufacturing, AI-powered computer vision and machine learning systems are revolutionizing quality inspection and process control. High-speed cameras capture images of the conductive polymer matrix and internal electrode structure during critical production steps (compounding, lamination). Machine learning models analyze microscopic details related to filler dispersion, polymer uniformity, and physical dimensions, predicting potential defects or inconsistencies far more accurately and rapidly than traditional human or simple automated inspections. This results in demonstrable improvements in manufacturing yield rates, a reduction in production costs, and, crucially, significantly improved component consistency and reliability—a non-negotiable requirement for highly regulated applications such as medical devices, military hardware, and critical high-voltage automotive systems. Ultimately, AI elevates the entire application environment by enabling smarter system management and ensures the fundamental component itself is produced with the highest level of consistency and performance predictability.

- AI-driven Predictive Maintenance Systems: Enabling smarter tripping logic and preemptive system shutdown supported by polyfuse action based on predicted system faults rather than immediate current overload.

- Optimized Component Selection: Using machine learning models to precisely simulate and model complex thermal runaway characteristics and select the exact ideal PPTC specifications (hold current, trip time, thermal derating).

- Enhanced Manufacturing Quality: Implementation of AI-powered computer vision for ultra-high-speed defect detection, quality assurance, and statistical process control during polymer compounding and lamination.

- Accelerated Design Cycles: Utilization of advanced Electronic Design Automation (EDA) tools integrated with AI for rapid, multi-physics thermal and electrical stress simulation, drastically cutting time-to-market.

- Miniaturization Guidance: AI algorithms assisting in specialized material science optimization, analyzing composite structures to achieve significantly higher current ratings (Amps per square millimeter) in dramatically smaller physical form factors.

- Supply Chain Optimization: Leveraging AI for predictive demand forecasting to manage the volatile supply of raw polymer resins and conductive fillers, ensuring stable production capacity.

DRO & Impact Forces Of Resettable Polyfuses Market

The Resettable Polyfuses Market is intrinsically shaped by a complex interplay of robust drivers, entrenched technological restraints, compelling long-term opportunities, and potent impact forces that collectively dictate its market valuation, structural growth trajectory, and competitive structure. The foundational driver is the pervasive and non-stop increase in electronic content across every major industrial sector, coupled with stringent, globally harmonized safety and regulatory requirements (such as UL 497, IEC 60950, and AEC-Q200) that mandate reliable, tested overcurrent protection mechanisms. Restraints primarily revolve around the inherent physical limitations of current PPTC technology, notably its characteristic slower response time when compared directly to ultra-fast traditional fuses, and the persistent challenge of accurately managing potential nuisance tripping caused by high ambient temperature fluctuations or operational heat cycles, which necessitates complex thermal derating practices by designers. Opportunities are strategically concentrated in high-growth, high-value sectors, dominated by the explosive global proliferation of the Electric Vehicle (EV) sector, which mandates specialized high-voltage, high-current polyfuses for sophisticated battery management systems (BMS), and the relentless, ongoing worldwide expansion of 5G and future telecommunication infrastructure requiring extremely robust protection in complex base stations and distributed edge computing devices. The key enduring impact forces include continuous, intensive technological advancements in specialized conductive polymer composites and the intense, continuous price competition fostered by high-volume, cost-optimized Asian manufacturers who control a majority share of the global production capacity.

Market drivers are fundamentally and inextricably linked to macro-technological mega-trends, especially the rapid adoption of higher power density devices (requiring more protection in smaller spaces) and the industry-wide shift towards complex, sophisticated power delivery standards (like USB Type-C Power Delivery, which requires protection against various misconfigurations). As electronic devices become progressively more compact, operate at significantly higher current levels, and handle higher power throughput, the inherent risk of catastrophic failure stemming from short circuits or sustained overloads increases exponentially, making the auto-reset functionality of polyfuses an indispensable asset for ensuring user safety, maximizing operational convenience, and guaranteeing system resilience. The sustained, massive investment and widespread deployment in distributed IoT devices, including industrial IoT (IIoT) sensors and smart home systems, further amplifies the total accessible market, as these vast networks rely critically on millions of small, distributed electronic modules, all requiring passive, tamper-proof circuit protection. Furthermore, the mandated use of fail-safe overcurrent protection in complex medical electronics, highly regulated industrial equipment, and advanced aerospace systems—where any failure is catastrophic and legally unacceptable—provides a stable, high-value, and margin-rich segment for specialized PPTC suppliers.

Key market challenges, acting as restraints, fundamentally stem from technological performance trade-offs inherent in the PTC effect. While polyfuses offer the distinct advantage of auto-reset capabilities, their intrinsic reliance on thermal energy generation and subsequent physical expansion for tripping dictates that they react inherently slower than single-shot ceramic or glass fuses, which operate on immediate material failure (melting). This slow response profile can be significantly problematic in ultra-sensitive, high-speed circuit applications requiring nanosecond reaction times. Furthermore, the specialized material science governing conductive polymers requires continuous, high-cost innovation to significantly enhance voltage tolerance, minimize power loss due to high internal resistance, and—critically—mitigate the detrimental effect of external environmental factors, such as extreme humidity and wide temperature drift, on consistent component performance. Overcoming these fundamental technical restraints through focused advanced material engineering (e.g., development of novel doping strategies, integration of highly stable nanocomposites, and sophisticated polymer molecular architecture design) represents the most critical and capital-intensive pathway for sustaining high-margin growth and successfully penetrating the most technically demanding markets, such as advanced military and high-reliability industrial automation sectors.

Segmentation Analysis

The Resettable Polyfuses Market is structurally and strategically segmented based on product type, fundamental electrical specifications (voltage rating), end-use application, and primary geography, which collectively enables sophisticated market analysis tailored precisely to end-user technological requirements and specific operational environments. The segmentation by physical product type (e.g., SMD vs. Radial) is absolutely crucial, distinguishing between form factors optimized for different manufacturing automation levels, physical constraints, and specific power handling requirements. Surface Mount Devices (SMDs) currently dominate the market volume by a significant margin due to their seamless compatibility with high-speed automated manufacturing lines (pick-and-place) and their essential suitability for the high-density Printed Circuit Boards (PCBs) prevalent across all consumer electronics. Application segmentation provides deep insights into the most critical areas of demand acceleration, with Automotive and Consumer Electronics collectively emerging as the largest, most dynamic contributors, perfectly reflecting global mega-trends in vehicle electrification, ubiquitous connectivity, and rapid portable device proliferation. Geographic segmentation emphasizes the overwhelming and strategically vital role of the Asia Pacific region as both the global epicenter of electronic manufacturing and the largest volume consumer base.

The product type segmentation is further significantly refined by core electrical parameters, specifically operating voltage and maximum current ratings, which directly correlate to the structural complexity, material investment, and final unit cost of the polyfuse. High-voltage, high-current PPTCs—specifically engineered for demanding applications like high-power 48V automotive systems, critical industrial motor controls, or sophisticated telecom power supplies—command a substantial price premium and require specialized manufacturing techniques compared to standard low-voltage polyfuses commonly used in general-purpose USB ports or low-power toys. This rigorous technical stratification fundamentally guides global product development and manufacturer R&D investments, prioritizing efforts on achieving highly aggressive performance characteristics—such as maintaining exceptionally low initial resistance (Rinitial), increasing hold current density, and ensuring extremely stable reset performance—all within specialized voltage categories explicitly demanded by evolving international industry standards (e.g., USB-PD, specific automotive bus standards). The underlying material composition, which overwhelmingly focuses on Polymer PTCs (PPTC) composed of engineered blends, remains the foundational technology, though continuous, marginal innovations in the specific polymer blends and conductive filler ratios are absolutely essential for achieving meaningful performance differentiation in a highly competitive market.

Application-based segmentation vividly highlights significant differential growth rates and technical demands. While the Consumer Electronics segment maintains its perennial role as the volume leader due to sheer unit numbers (billions of devices), the Automotive segment is forecast to demonstrate the highest value growth percentage (CAGR), a projection driven entirely by the necessity for extremely stringent reliability requirements and the surging global adoption of electric and hybrid vehicles, where complex, highly critical battery protection circuits necessitate the deployment of multiple, certified, and robust polyfuses per vehicle. Conversely, the Medical Devices segment, although typically smaller in terms of total market volume, enforces the most demanding quality assurance protocols and component certification levels (e.g., ISO 13485 compliance), making it a highly lucrative and defensible niche market requiring long-term material stability and impeccable failure documentation. A sophisticated understanding of these nuanced segment dynamics is profoundly vital for market players to effectively allocate scarce resources, guiding product development to target specific segments where specialized technical expertise and the provision of certified, high-performance components yield the greatest sustainable competitive advantage and return on investment.

- By Type:

- Surface Mount Devices (SMD) - Dominant volume segment optimized for automation and miniaturization.

- Radial Leaded Devices - Preferred in industrial, power supply, and legacy applications requiring high voltage and ruggedness.

- Strap Devices - Used primarily for high-current applications, especially in battery protection architectures.

- Disc Devices - Specialized, often ceramic or composite construction, utilized in niche temperature sensing roles.

- By Voltage Rating:

- Low Voltage (<= 30V) - Typically used in consumer electronics, USB ports, and general low-power circuits.

- Medium Voltage (31V - 60V) - Common in industrial automation, 48V telecom systems, and specific automotive auxiliary circuits.

- High Voltage (> 60V) - Essential for EV battery management systems, high-power industrial devices, and high-voltage power supplies.

- By Application:

- Consumer Electronics (Smartphones, Tablets, PCs, Wearables) - Volume leader.

- Automotive (BMS, Infotainment, Engine Control, ADAS) - Highest CAGR segment.

- Industrial (Power Supplies, Motor Protection, PLCs, Factory Automation) - Requires high robustness.

- Telecommunication (Networking Equipment, Base Stations, PoE systems) - Needs protection against surges.

- Medical Devices (Diagnostics, Life Support) - Highest reliability requirements.

- Aerospace & Defense - Niche market demanding specialized, highly rugged components.

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Resettable Polyfuses Market

The intricate value chain for the Resettable Polyfuses Market commences deeply upstream with the highly specialized procurement of raw materials and extends systematically through highly specialized manufacturing processes, complex global distribution networks, and culminates in the final integration into increasingly complex electronic and electrical systems. Upstream activities are fundamentally defined by sourcing specialized polymer resins (typically highly consistent crystalline thermoplastics such as specialized polyolefins), precise conductive filler materials (ultra-fine carbon black particles, nickel, or silver metallic powders), and high-conductivity electrode and termination materials (copper, nickel-plated alloys). Success in this crucial initial stage relies heavily upon securing long-term supply agreements for high-quality, consistent material inputs, given that the final operational performance characteristics (initial resistance, trip time, reset reliability) are almost entirely dictated by the precise formulation, quality, and homogeneity of the final conductive composite blend. Major international material suppliers often enter into strategic, long-term contracts with large polyfuse manufacturers to ensure stable pricing, guaranteed volume supply, and joint material innovation efforts, reflecting the high technological and capital barrier to entry in specialized conductive polymer synthesis.

The midstream process is overwhelmingly dominated by sophisticated, specialized manufacturing steps that convert raw materials into finished components. These processes include precision compounding of the polymer-conductive filler mixture under controlled environments, forming the device structure (e.g., high-pressure pressing or extrusion for specific geometries), specialized multi-stage curing processes, precise lamination of protective layers, and the high-precision attachment of electrodes or leads. This entire midstream operation demands exceptionally high levels of precision engineering, proprietary processing techniques (often trade secrets), and rigorous environmental control to ensure the delicate PTC effect is accurately and consistently controlled across high-volume batches. Leading direct manufacturers, such as Littelfuse and Bourns, invest relentlessly in advanced R&D to optimize compounding ratios, develop proprietary surface treatments, and perfect device architecture, aiming simultaneously to significantly enhance current rating density (Amps per mm²) and drastically reduce parasitic resistance (I²R losses). Stringent quality control checkpoints and mandatory compliance testing for international certifications (UL, TUV, VDE) add substantial, non-negotiable value at this crucial manufacturing level.

Downstream activities involve the highly critical flow through distribution channels, which are typically structured via a dual approach: direct sales engagement with major, high-volume Original Equipment Manufacturers (OEMs) such as global automotive companies (e.g., Volkswagen, GM, Tesla) or Tier 1 consumer electronics giants (e.g., Samsung, HP), and indirect sales managed via global and regional electronic component distributors (e.g., Avnet, Arrow Electronics, Future Electronics, TTI). Direct sales channels are consistently preferred for high-volume, highly customized, and proprietary component orders in the tightly regulated automotive and leading-edge consumer electronics sectors. Conversely, indirect distribution channels provide essential local market access, comprehensive inventory management, crucial just-in-time logistical support, and technical assistance for smaller electronics manufacturers, specialized industrial integrators, and maintenance-repair-operations (MRO) customers. The final, critical integration step is performed by the end-user (OEM or integrator), where the polyfuse is accurately positioned and soldered onto the final Printed Circuit Board (PCB), thereby establishing the essential last line of defense in the comprehensive circuit protection strategy.

Resettable Polyfuses Market Potential Customers

Potential customers for Resettable Polyfuses constitute a geographically and industrially diverse group, predominantly concentrated within sectors involved in the high-volume production of electronic apparatus and the development of highly complex, advanced power management and control systems. The single largest and most dynamic customer segment is comprised of Consumer Electronics Manufacturers (OEMs), who embed these essential components into virtually every category of modern portable device, including smartphones, laptops, dedicated gaming consoles, specialized wearables, and high-speed data storage units, primarily to protect sensitive internal circuitry, crucial battery interfaces, and external I/O ports (like USB and HDMI). Given the intense, continuous design pressure for miniaturization and sleek aesthetics in this specific segment, these customers exhibit an overwhelming preference for Surface Mount Devices (SMD) that offer the smallest practical footprint, ultra-low profile, and guaranteed high reliability across high-speed signal integrity channels.

The second most strategically important customer group comprises sophisticated Automotive Tier 1 suppliers and major global Vehicle Manufacturers (OEMs). Driven by the irreversible global transition toward Electric Vehicles (EVs, BEVs, PHEVs) and the integration of highly complex Advanced Driver-Assistance Systems (ADAS), the demand for specialized, high-voltage, and high-current polyfuses specifically engineered for sophisticated Battery Management Systems (BMS), critical on-board charging circuits, and numerous distributed Electronic Control Units (ECUs) is accelerating at a dramatic pace. These high-value buyers place paramount importance on suppliers who can guarantee components with rigorous, non-negotiable AEC-Q200 qualification, demanding exceptional operational durability, mechanical stability, and consistent performance under the severe environmental and thermal conditions characteristic of automotive applications. Due to the criticality and customization required, this group typically functions as direct purchasers, requiring comprehensive joint development agreements, strict quality documentation, and dedicated supply chain oversight.

In addition to these two giants, major Telecommunications Equipment Manufacturers (including infrastructure providers like Cisco, Ericsson, Nokia, and Huawei) and large Industrial Automation and Machinery Companies constitute substantial, stable customer bases. Telecom customers deploy resilient polyfuses extensively in complex networking equipment, centralized server power units, massive data centers, and advanced 5G base stations to safeguard sophisticated microprocessors and power input stages against severe power surges, transients, and lightning strike effects on long communication lines and Power over Ethernet (PoE) circuits. Industrial buyers predominantly utilize highly robust, often radial-leaded devices in high-power process control systems, factory floor automation equipment, specialized industrial power supply racks, and heavy-duty motor controls, where component longevity, exceptional resistance to mechanical vibration, and the ability for field replacement (in non-SMD form factors) are the primary, non-negotiable purchasing criteria. This varied portfolio of demanding end-users ensures a stable, diversified, and technologically segmented demand stream across the entire spectrum of available component types and performance specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 Million |

| Market Forecast in 2033 | USD 1,650 Million |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Littelfuse Inc., Bourns Inc., TE Connectivity, TDK Corporation (Epcos), Murata Manufacturing Co. Ltd., Vishay Intertechnology, Bel Fuse Inc., Mersen, Wayon, Fuzetec Technology Co. Ltd., Kexin Industrial Co. Ltd., SOC Corporation, AEM Components, Semitec Corporation, Sea & Land Technologies, Pro-Wave Electronics Corporation, Polytronics Technology (PTTC), Brightking, Amphenol, EATON Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Resettable Polyfuses Market Key Technology Landscape

The technological foundation of the Resettable Polyfuses Market is intrinsically based on the precise and reliable utilization of the Positive Temperature Coefficient (PTC) phenomenon, which is specifically engineered into Polymeric PTC (PPTC) materials. These critical circuit protection devices are complex composites, primarily constituted by a matrix of semi-crystalline non-conductive polymer resin that is heavily infused with highly specialized conductive filler particles, most commonly ultra-fine carbon black or metallic powders. Under normal, safe operating conditions, the physical proximity of the conductive filler particles forms a dense network of electrical pathways, allowing the current to flow through the device with minimal impedance and extremely low initial resistance. However, when a potentially dangerous overcurrent event occurs, the resulting intense heat generated internally (Joule heating) causes the polymer matrix to rapidly undergo a phase transition, leading to significant, swift volumetric expansion. This physical expansion dramatically increases the minute distances separating the conductive particles, catastrophically breaking the critical electrical pathways and forcing the resistance of the device to increase by several orders of magnitude (often from milliohms to megaohms), thereby effectively limiting the dangerous fault current and safely protecting the downstream circuit components. Once the fault condition is cleared and the internal heat source is removed, the polymer matrix cools, contracts back to its original state, and the conductive paths are reliably restored, permitting the component to automatically reset and resume normal operation.

Current technological innovation across the industry is intensely focused on the complex optimization of the core performance parameters of these material composites to meet the escalating demands of ultra-modern, high-power-density electronic systems. A paramount research objective is the development of next-generation conductive composites, frequently incorporating advanced nanoscale fillers (like carbon nanotubes or graphene derivatives) or proprietary polymer blends, explicitly aimed at achieving two simultaneous, critical performance improvements: substantially lowering the initial resistance (Rinitial) to enhance overall energy efficiency (reducing I²R losses) and significantly reducing the trip-to-reset time to enable much faster circuit protection response rates for high-speed systems. Manufacturers are heavily investing in proprietary methods to precisely control the internal molecular structure and crystalline morphology of the polymer blends to ensure highly reliable, highly repeatable, and non-degrading expansion/contraction characteristics across thousands of trip cycles—a factor which is absolutely crucial for guaranteeing component longevity and safety in mission-critical applications such as advanced automotive electronics (AEC-Q200) and industrial machinery exposed to continuous cycling. Achieving consistently stable and predictable performance across an extremely wide and challenging operating temperature range (e.g., -40°C to +125°C), particularly challenging in engine compartments and outdoor industrial enclosures, remains an enduring, high-priority research and development objective for leading firms.

Furthermore, the relentless, exponential trend toward technology scaling and physical miniaturization is the primary force driving the development of specialized, high-density surface mount packages capable of safely handling significantly higher currents (with new components rated routinely up to 40 Amps in development) while rigidly adhering to a minimal physical footprint demanded by compact designs. This level of performance and size compression mandates the implementation of extremely advanced manufacturing techniques, including complex multi-layer lamination processes, specialized metal bonding techniques for termination, and thermal management optimization to ensure efficient heat dissipation and robust mechanical integrity under sustained stress. Another critically significant technological area involves the localized integration of micro-polyfuses into complex semiconductor packages (System-in-Package, SiP, or chip-level solutions) for localized, highly responsive protection adjacent to microprocessors or sensitive power integrated circuits. Finally, the dramatic shift towards significantly higher-voltage power systems, most notably in advanced Electric Vehicle battery applications (transitioning to 800V architectures) and large-scale industrial drives, necessitates the development of entirely new, specialized high-voltage PTC solutions engineered with significantly robust insulation layers, proprietary arc suppression capabilities, and materials that can reliably withstand high potential differences, constantly pushing the established operational limits of current polymer-based technology and requiring exploration into alternative ceramic or composite PTC materials for high voltage handling.

Regional Highlights

The comprehensive regional analysis of the Resettable Polyfuses Market clearly highlights distinct market maturity levels, dominant growth drivers, and specific consumption patterns across the major geographical areas, which are fundamentally influenced by established electronic manufacturing infrastructure, stringent regulatory environments, and localized technology adoption rates, particularly in automotive electrification.

- Asia Pacific (APAC): APAC maintains its position as the unequivocally dominant region globally, driving both the highest production volumes and the largest consumption share. This market leadership is fundamentally attributable to the massive concentration of the world’s consumer electronics and IT manufacturing base (centered in China, South Korea, Taiwan, and Japan) and the rapid, state-backed growth of the electric vehicle market, especially in mainland China. The region benefits substantially from inherent supply chain efficiencies, competitive manufacturing costs, and an extensive, specialized technical workforce, leading to consistently intense, high-volume demand primarily for SMD polyfuses. Emerging economies within APAC, such as India and various Southeast Asian nations, are experiencing aggressive, government-supported industrialization and massive investment in digital infrastructure and telecommunication networks, further accelerating sustained regional market expansion. The intense focus on high-volume production requires continuous, relentless supply chain optimization and highly cost-effective component sourcing strategies to maintain global price competitiveness.

- North America: This region is strategically characterized by a high intrinsic demand for premium quality, guaranteed reliability, and sophisticated application in highly specialized, high-end sectors including defense and aerospace electronics, advanced automotive safety systems, and innovative medical devices. North America prioritizes value-driven market growth over sheer volume, strongly emphasizing components that meet the highest certification standards (e.g., stringent UL listings, MIL-spec, automotive AEC-Q200) and exhibit robust, predictable performance under the most challenging operational extremes. The ongoing, substantial build-out of high-speed 5G networks and significant federal and private investment supporting domestic Electric Vehicle production capacity and supporting infrastructure are the principal market drivers, necessitating continuous supply of highly reliable, advanced polyfuses for critical infrastructure protection and complex battery management systems, often involving custom specifications.

- Europe: Europe is a technologically mature market segment defined by exceptionally stringent environmental protection and product safety regulations (e.g., RoHS, REACH), particularly impacting the high-value automotive, industrial machinery, and renewable energy sectors. The European Union’s determined legislative commitment to aggressive vehicle electrification targets and large-scale investment in robust renewable energy infrastructure (including advanced solar inverters and complex grid stabilization equipment) intensely fuels the specialized demand for medium- to high-voltage PPTCs. Key markets, notably Germany, France, and Italy, focus strongly on precision engineering and the integration of highly robust industrial applications, consistently favoring manufacturers who can demonstrate flawless compliance with complex regional directives and a firm commitment to advanced material sustainability and proven component longevity under continuous operational load.

- Latin America (LATAM) and Middle East & Africa (MEA): These distinct geographical regions are strategically categorized as emerging markets, currently experiencing steady, consistent growth rates, largely driven by fundamental economic factors such as the essential modernization of aging telecommunications and digital infrastructure, and the rapidly increasing penetration of globally sourced consumer electronics. Market growth in the MEA region is strongly bolstered by massive governmental and private sector investment in large-scale industrial infrastructure projects, major smart city developments, and expansion within the petrochemical sector, all of which require highly robust, often explosion-proof, and ruggedized industrial electrical equipment. LATAM market growth is closely tied to domestic vehicle production assembly operations (Mexico, Brazil) and the local expansion of electronic manufacturing services (EMS). Demand across both LATAM and MEA tends to be highly price-sensitive, balancing mandatory safety requirements against competitive cost considerations, often favoring established, high-volume manufacturers from APAC who can offer attractive pricing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Resettable Polyfuses Market.- Littelfuse Inc.

- Bourns Inc.

- TE Connectivity

- TDK Corporation (Epcos)

- Murata Manufacturing Co. Ltd.

- Vishay Intertechnology

- Bel Fuse Inc.

- Mersen

- Wayon

- Fuzetec Technology Co. Ltd.

- Kexin Industrial Co. Ltd.

- SOC Corporation

- AEM Components

- Semitec Corporation

- Sea & Land Technologies

- Pro-Wave Electronics Corporation

- Polytronics Technology (PTTC)

- Brightking

- Amphenol

- EATON Corporation

- Schurter AG

- Koch Industries (Molex)

- Shanghai Chensheng Electronics

- Suzhou Huadong Electronics

Frequently Asked Questions

Analyze common user questions about the Resettable Polyfuses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Resettable Polyfuse (PPTC) and how does it differ from traditional fuses?

A Resettable Polyfuse, or PPTC (Polymeric Positive Temperature Coefficient) device, is a non-linear thermistor that protects circuits from overcurrent by dramatically increasing its internal resistance when excessive current heats the conductive polymer composite. Distinct from traditional single-shot fuses which require manual replacement after tripping, the PPTC automatically resets (returns to a functional low resistance state) once the fault condition is cleared and the device is allowed to cool, offering superior long-term reliability and significant reduction in operational maintenance costs.

Which application segment is forecast to drive the highest value growth rate (CAGR) for Resettable Polyfuses?

The Automotive segment is unequivocally projected to exhibit the highest Compound Annual Growth Rate (CAGR) in value terms. This growth is directly attributable to the aggressive global transition towards advanced Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs), which mandates the extensive integration of high-voltage, high-current PPTCs for critical Battery Management Systems (BMS), power distribution networks, and sophisticated onboard electronics, all requiring stringent AEC-Q200 certification.

What are the primary technological restraints currently affecting the market growth of PPTCs?

The main technological restraints stem from the inherent performance characteristics of the PTC materials. These include their characteristic slower response time compared to ultra-fast chemical fuses, which is a major limitation in high-speed applications. Additionally, PPTC performance is sensitive to variations in ambient temperature, which necessitates complex thermal derating practices by design engineers to prevent nuisance tripping or ensure consistent protection limits across the device's operational temperature envelope.

How is the current trend of miniaturization impacting the physical design of Resettable Polyfuses?

Miniaturization is the central driver for the explosive demand in Surface Mount Devices (SMD) polyfuses with significantly reduced dimensions and ultra-low profiles. Manufacturers are focusing intensive R&D efforts on material science innovations (e.g., utilizing highly conductive nanoscale fillers and engineered polymer matrices) to reliably achieve substantially higher current handling capabilities (hold current) and minimal initial resistance within increasingly small physical packages, which is essential for seamless integration into compact consumer electronics, such medical devices, and high-density computing hardware.

Why does the Asia Pacific region maintain a dominant strategic position in the global Resettable Polyfuses Market?

APAC sustains its market dominance due to its strategic and critical role as the global manufacturing hub for electronic finished goods, including smartphones, PCs, and high-volume automotive components. This high concentration of electronic assembly and production (primarily in China, South Korea, and Taiwan) provides immense scale benefits, driving both the lowest production costs and establishing APAC as the overwhelmingly largest regional consumer base for these high-volume circuit protection components worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager