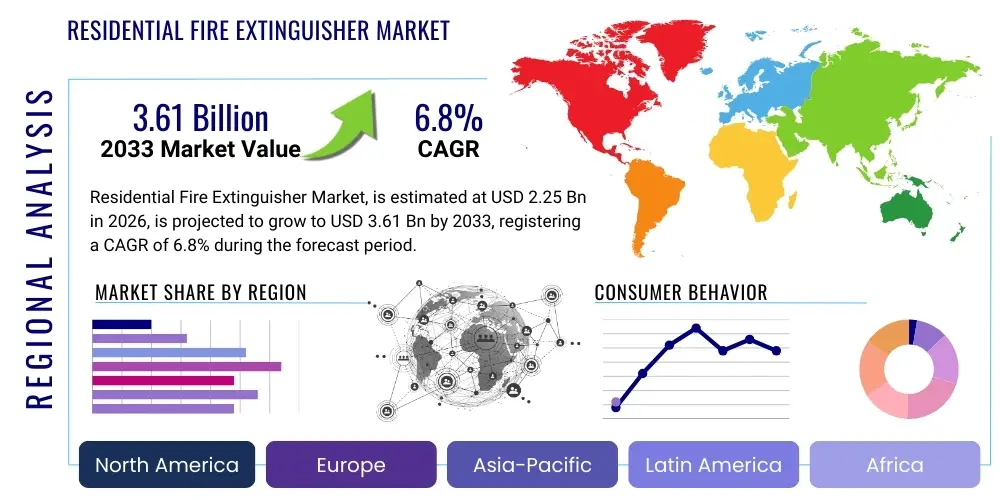

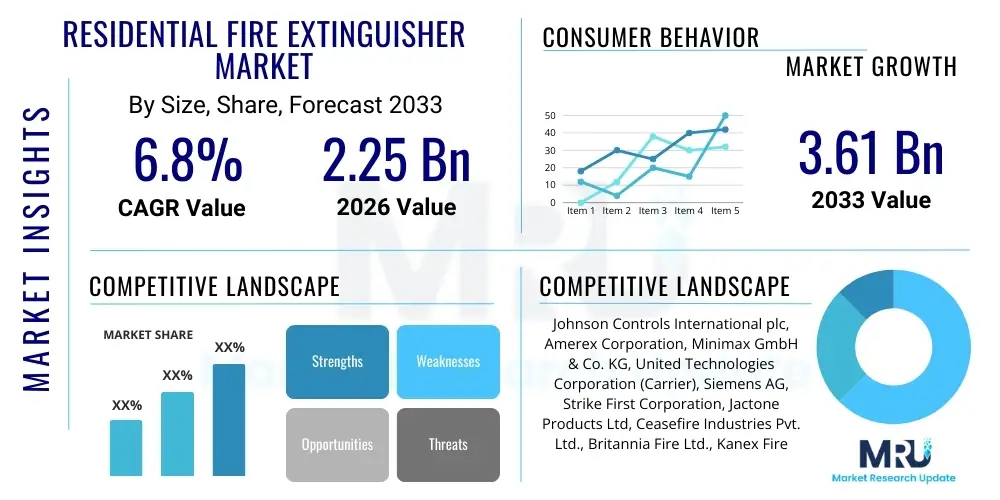

Residential Fire Extinguisher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438469 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Residential Fire Extinguisher Market Size

The Residential Fire Extinguisher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.25 Billion in 2026 and is projected to reach USD 3.61 Billion by the end of the forecast period in 2033.

Residential Fire Extinguisher Market introduction

The Residential Fire Extinguisher Market encompasses the manufacturing, distribution, and sale of portable fire suppression devices specifically designed for use within private dwellings, apartments, and other residential structures. These critical safety tools are categorized primarily based on the type of extinguishing agent employed, such as dry chemical (ABC rated), water, foam, carbon dioxide, or specialized agents suitable for kitchen fires (Class K). The primary function of these devices is to provide homeowners and occupants with the immediate capability to suppress small, incipient fires, thereby preventing property damage, minimizing structural loss, and, most crucially, ensuring life safety until professional firefighting services arrive.

Major applications of residential fire extinguishers include kitchens, where grease and electrical fires are common; garages, where flammable liquids and vehicle fires pose a risk; and living areas, where electrical faults or misplaced heating elements can trigger combustion. The paramount benefits derived from the deployment of these products include the rapid mitigation of fire risks, compliance with evolving local and national residential safety codes, and substantial reductions in insurance premiums for properties deemed high-safety. The efficacy and accessibility of these systems are constantly being improved through advancements in lightweight, user-friendly designs and enhanced suppression capabilities, making them an indispensable component of modern home security infrastructure.

Driving factors propelling the expansion of this market include increasing regulatory mandates globally, particularly in developed economies, which require the installation of certified extinguishers in new residential construction and remodeled properties. Furthermore, heightened consumer awareness campaigns launched by governmental bodies and insurance providers emphasize the essential role of immediate suppression tools. Technological innovations, such as smart fire extinguishers equipped with pressure monitoring and IoT connectivity features that alert homeowners to maintenance needs or discharge events, are creating premium segments and stimulating replacement demand, contributing significantly to the market's robust projected growth over the forecast period.

Residential Fire Extinguisher Market Executive Summary

The global Residential Fire Extinguisher Market is characterized by steady regulatory pressure and technological integration, driving consistent growth across all geographical regions. Business trends indicate a strong shift toward environmentally safer and less corrosive extinguishing agents, alongside a significant uptick in demand for intuitive, aesthetically pleasing, and technologically integrated units, often featuring digital gauges and integrated smart home compatibility. Key market participants are focusing their strategies on streamlining distribution channels, emphasizing direct-to-consumer online sales alongside traditional retail partnerships, and securing long-term contracts with large-scale residential developers who prioritize premium, certified safety equipment in mass housing projects. Product innovation remains centered on improving the ease of use for non-professionals, reducing the weight of the units, and extending the shelf life of extinguishing agents while maintaining superior performance.

Regionally, North America and Europe currently dominate the market share, attributed to stringent and well-enforced building codes, high rates of homeowner insurance coverage necessitating certified safety equipment, and a general cultural emphasis on proactive home safety. However, the Asia Pacific (APAC) region is poised for the highest growth trajectory, primarily fueled by rapid urbanization, massive residential infrastructure development, and the increasing adoption of Western safety standards in rapidly expanding economies like China, India, and Southeast Asian nations. This regional growth is slightly tempered by price sensitivity in mass-market segments, requiring manufacturers to develop cost-effective, high-volume production strategies tailored for these emerging markets.

Segment trends highlight the persistent dominance of the Dry Chemical (ABC) extinguisher type due to its versatility and affordability, making it the standard choice for general residential use. However, the market is observing accelerated growth in specialized segments, such as Clean Agent and Water Mist extinguishers, which appeal to high-end residential users seeking solutions that minimize collateral damage to sensitive electronics or valuable furnishings. The distribution segment is witnessing a digital transformation, with e-commerce platforms increasingly serving as the preferred avenue for replacement units and consumer education, thereby challenging the established market dominance of traditional big-box retailers and specialized safety equipment providers. This digital migration is particularly influential in driving brand recognition and transparency regarding product certification and regulatory compliance.

AI Impact Analysis on Residential Fire Extinguisher Market

User inquiries regarding the impact of Artificial Intelligence (AI) on residential fire safety primarily revolve around two key areas: the integration of AI-driven predictive analytics into traditional fire suppression systems and the efficacy of IoT-enabled, connected fire extinguishers. Consumers are frequently asking whether AI can truly prevent fires before they start by analyzing ambient data (temperature fluctuations, smoke particle detection patterns, humidity changes) from integrated smart detectors, and how such sophisticated systems could reduce false alarms, which remain a significant user frustration with current smoke detector technology. Furthermore, there is strong user interest concerning the maintenance lifecycle of extinguishers—specifically, how embedded sensors connected to AI platforms can provide real-time status updates on pressure levels and functionality, ensuring the device is always operational when needed, thereby shifting the paradigm from passive safety devices to actively monitored assets.

The influence of AI is most pronounced in developing the next generation of smart safety hubs that integrate detection, warning, and initial suppression monitoring. While AI is not directly used within the physical fire extinguisher itself (which remains a mechanical device), it profoundly affects the surrounding ecosystem. AI algorithms enhance the performance of connected safety systems by optimizing decision-making processes, distinguishing between actual fire threats and nuisance factors (like steam or burnt toast), substantially improving response reliability and reducing emergency service strain. The utilization of machine learning models allows safety system providers to analyze aggregated data on residential fire incidents, optimizing the placement, type, and maintenance schedules of extinguishers recommended to specific households based on demographic, structural, and behavioral risk profiles, leading to more tailored and effective safety installations.

Looking forward, the deployment of advanced AI-powered diagnostics will standardize preventative maintenance within residential settings. For instance, AI could interpret subtle data streams from pressure transducers embedded in an extinguisher's valve assembly, predicting potential leakage or structural compromise long before a manual inspection would reveal the fault. This capability transitions the residential extinguisher from a rarely used passive tool to an integral, intelligent component of a comprehensive, proactive home safety network. This continuous monitoring and predictive maintenance, driven by sophisticated analytical capabilities, promise to significantly increase the reliability rate of residential extinguishers and build greater user confidence in maintaining these essential life safety devices.

- AI optimizes sensor data fusion (smoke, heat, CO) to dramatically lower the incidence of false alarms in integrated safety systems.

- Predictive maintenance analytics, powered by machine learning, forecast potential pressure loss or mechanical failure in connected extinguishers.

- AI facilitates customized safety risk assessments for homeowners, recommending optimal extinguisher types and placement based on home layout and usage patterns.

- Integration with smart home platforms allows AI to coordinate shutdown procedures (e.g., HVAC system cut-off) simultaneously upon fire detection.

- Natural Language Processing (NLP) is used in customer service chatbots to guide homeowners through complex safety regulations and basic extinguisher operation/maintenance procedures.

- Automated monitoring of certification dates and replacement cycles driven by AI ensures compliance and minimizes operational safety risk.

DRO & Impact Forces Of Residential Fire Extinguisher Market

The market dynamics of the Residential Fire Extinguisher Market are profoundly shaped by regulatory drivers and persistent consumer behavioral restraints, alongside substantial technological and demographic opportunities. The primary driver is the pervasive and tightening regulatory framework across developed and rapidly developing nations, mandating minimum fire safety equipment in residential buildings, often aligning with international standards such as NFPA codes. This regulatory push, frequently updated in response to major fire incidents, provides a non-cyclical, consistent baseline demand for certified products. Coupled with this are macroeconomic factors such as rising disposable incomes in emerging markets, allowing homeowners to shift from non-compliant or rudimentary suppression tools to certified, higher-quality extinguishers. Educational initiatives and increased insurance industry pressure further amplify awareness, directly correlating positive safety compliance with lower financial risk premiums for property owners.

Conversely, the market faces significant restraints, chiefly rooted in consumer inertia and the long replacement cycle characteristic of these products. Unlike consumable goods, a fire extinguisher is a capital expenditure that is rarely replaced before its mandatory service date unless discharged or obviously damaged. Furthermore, the perceived cost burden of professional inspection and maintenance, especially for multi-unit dwellings, can lead to neglect and non-compliance among individual homeowners. A secondary restraint includes aesthetic considerations; many homeowners are reluctant to place bulky, industrial-looking safety devices in visible, accessible areas, sometimes compromising safety for interior design, although manufacturers are increasingly addressing this through design innovation and compact form factors. Counterfeit products, particularly prevalent in regions with weaker regulatory oversight, also dilute market integrity and depress prices for certified manufacturers, posing a safety risk to the end-user.

Opportunities for growth are concentrated in the rapid convergence of safety devices with the Internet of Things (IoT) and smart home technology. Developing smart fire extinguishers that communicate maintenance status, location, and discharge events in real-time offers manufacturers a strong avenue for premium pricing and proactive engagement in the product's lifecycle, addressing the core restraint of long replacement cycles. Moreover, the increasing adoption of sustainable and environmentally friendly extinguishing agents (such as advanced water mist or biodegradable foam) presents a crucial opportunity for differentiation, particularly in environmentally conscious European markets. Finally, focusing on vast, untapped residential construction markets in APAC and Latin America, coupled with strategic partnerships with major property management firms and home improvement retail chains, provides significant leverage for future market penetration and sustained revenue growth.

Segmentation Analysis

The Residential Fire Extinguisher Market is comprehensively segmented based on three critical axes: the Type of Extinguishing Agent, the primary Application Area within the dwelling, and the Distribution Channel used for sales and marketing. This granular segmentation allows manufacturers and strategists to precisely target marketing efforts and product development toward specific consumer needs and regulatory requirements. For example, segmentation by agent type dictates performance and regulatory compliance, while segmentation by application area highlights the critical need for specialized products, such as those designed specifically for kitchen grease fires (Class K or F), which require different chemical compositions than those used for common combustibles or electrical faults.

Analysis of the segmentation reveals that Dry Chemical extinguishers (primarily ABC rated) command the largest volume share globally, owing to their versatility, wide acceptance by safety standards, and relatively low cost, making them the default choice for budget-conscious homeowners. However, segmentation by distribution channel shows a dynamic transition; while traditional brick-and-mortar retail still holds a significant share for initial purchases and consumer interaction, the e-commerce segment is accelerating rapidly, capitalizing on convenience, transparent pricing, and direct shipping of replacement units. The trend toward multi-segment offerings, where developers install specialized extinguishers in high-risk zones (e.g., kitchen) and general-purpose extinguishers elsewhere, underscores the growing sophistication of residential safety planning.

Furthermore, segmentation by application area is crucial for targeting consumer education. The kitchen segment consistently generates the highest demand due to the recognized high risk of grease and electrical fires in that specific location, necessitating highly effective and accessible small units. Other segments, such as garages and utility rooms, drive demand for larger, higher-capacity extinguishers designed to handle fuel or structural material fires. Understanding these nuanced demands facilitates product portfolio diversification, enabling companies to optimize their inventory and service offerings to residential customers seeking tailored, comprehensive safety solutions rather than a generic, one-size-fits-all product.

- Type of Extinguishing Agent

- Dry Chemical (ABC/BC)

- Water and Water Mist

- Foam

- Carbon Dioxide (CO2)

- Clean Agent (Halotron, FM-200 substitutes)

- Capacity/Size

- Under 5 lbs (Small, portable)

- 5 lbs to 10 lbs (Standard household)

- Above 10 lbs (Garage/Utility Room use)

- Application Area

- Kitchen/Dining Area

- Living Areas and Bedrooms

- Garage and Workshop

- Utility and Storage Rooms

- Distribution Channel

- Retail Stores (Home Improvement Centers, Department Stores)

- Online Sales and E-commerce Platforms

- Contractors and Developers (B2B channel)

- Specialized Safety Equipment Suppliers

Value Chain Analysis For Residential Fire Extinguisher Market

The value chain for residential fire extinguishers is initiated at the upstream stage, which involves the meticulous procurement and processing of raw materials. Key inputs include high-grade steel or aluminum alloys for the cylinder bodies, specialized chemical compounds (such as monoammonium phosphate or potassium bicarbonate) for the extinguishing agents, complex plastic polymers for valves and hoses, and precision pressure gauges. The quality and sourcing of these materials are paramount, as they directly impact the extinguisher's regulatory compliance, operational lifespan, and overall safety rating. Manufacturers often maintain integrated supply chains or develop strategic long-term partnerships with certified chemical and metal suppliers to ensure material integrity and manage price volatility associated with global commodity markets, particularly concerning steel and aluminum.

The manufacturing and assembly phase constitutes the core midstream activity, involving precision engineering for cylinder welding, agent formulation, valve assembly, and rigorous pressure testing and certification processes (e.g., UL, CE, BSI marks). Efficiency and adherence to strict quality control protocols are essential to optimize production costs while ensuring compliance with stringent safety standards. Downstream activities focus heavily on distribution, which is bifurcated into direct and indirect channels. Direct channels often involve high-volume sales to residential property developers, construction firms, and governmental housing authorities. These B2B sales typically require comprehensive safety consulting and bulk delivery logistics, often managed by the manufacturer or large master distributors.

Indirect distribution relies primarily on retail networks, encompassing major home improvement centers (e.g., Home Depot, Lowe's), mass merchandisers (e.g., Walmart), and increasingly, e-commerce platforms (e.g., Amazon). The success of the indirect channel hinges on efficient warehousing, effective merchandising, and strong relationships with large retailers who manage inventory and consumer education at the point of sale. Specialized safety equipment suppliers also play a niche role, catering to consumers or businesses requiring specific classes of extinguishers or professional installation advice. The final stage involves the end-user (homeowner) utilization and subsequent service/maintenance, which includes mandatory inspections and hydrostatic testing, creating a secondary revenue stream for service providers and specialized distributors throughout the product's extended operational lifecycle.

Residential Fire Extinguisher Market Potential Customers

The primary customer base for the Residential Fire Extinguisher Market is highly diversified, encompassing individual homeowners, large-scale residential property developers, and entities within the insurance and real estate sectors. Individual homeowners represent the largest volume segment, purchasing extinguishers either as mandatory safety compliance items (driven by local codes or insurance requirements) or as proactive safety investments. This segment is highly sensitive to product usability, ease of maintenance, and aesthetic design, and is increasingly serviced via online retail channels which provide extensive product comparisons and consumer reviews. Demand from this group is further stimulated by seasonal safety campaigns and educational initiatives that promote replacement of expired or outdated units.

A second crucial segment consists of residential building developers and general contractors responsible for new construction or major renovations of single-family homes, apartment complexes, and condominiums. This B2B segment prioritizes compliance, scalability, and long-term reliability. Developers often purchase extinguishers in bulk directly from manufacturers or specialized distributors to meet safety code requirements before occupancy permits are issued. The decision-making process in this segment is heavily influenced by price, certified regulatory compliance documentation, and the ability of the supplier to handle complex logistics and bulk delivery schedules, often leading to long-term supplier agreements for standardized equipment.

Furthermore, auxiliary potential customers include property management companies overseeing large portfolios of rental properties, who must ensure all units are compliant and regularly maintained, driving predictable demand for inspection and replacement services. Insurance companies also act as influential indirect customers; while they do not purchase the product directly, their underwriting policies and mandates regarding certified fire safety equipment significantly influence homeowners' purchasing decisions, particularly for premium properties or those located in high-risk zones. Additionally, providers of smart home security and automation services often bundle fire safety equipment, including extinguishers, into their offerings, creating integrated safety packages that target high-value, tech-savvy residential consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.25 Billion |

| Market Forecast in 2033 | USD 3.61 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Controls International plc, Amerex Corporation, Minimax GmbH & Co. KG, United Technologies Corporation (Carrier), Siemens AG, Strike First Corporation, Jactone Products Ltd, Ceasefire Industries Pvt. Ltd., Britannia Fire Ltd., Kanex Fire, Fike Corporation, Feuerschutz Jockel GmbH & Co. KG, Master Fire Prevention, Mueller Co. (TYCO), Naffco FZCO, First Alert (Resideo Technologies), Hochiki Corporation, MSA Safety Incorporated, Kidde (Carrier Global Corporation), Buckeye Fire Equipment Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residential Fire Extinguisher Market Key Technology Landscape

The technological landscape of the residential fire extinguisher market is evolving beyond simple mechanical pressure vessels towards integrated, intelligent safety systems, although the fundamental suppression mechanism remains largely consistent. A core area of innovation involves the development and wider adoption of Clean Agents, which are non-toxic, leave minimal residue, and are optimized for protecting sensitive residential electronics and valuable interiors. These chemical advancements seek to replace legacy Halon-based agents and reduce the highly corrosive and damaging nature associated with standard dry chemicals, thereby increasing their appeal to high-end residential users and those with sophisticated home office or entertainment setups. Concurrently, advancements in Water Mist technology are making these systems more effective and cost-efficient for residential applications, leveraging fine water atomization to cool and smother fires with significantly less water volume than traditional water-based units, minimizing water damage.

Another significant technological shift is the application of embedded sensor technology to monitor the operational readiness of the extinguisher. Smart fire extinguishers are equipped with wireless pressure transducers and micro-sensors that continuously monitor the internal pressure, temperature, and nozzle integrity. This data is transmitted via Wi-Fi or Bluetooth to a homeowner's smartphone or an integrated smart home hub, providing real-time alerts regarding the need for servicing or replacement due to low pressure or tampering. This capability directly addresses one of the market's major restraints—the lack of assurance that an extinguisher will function correctly when required—by automating compliance checks and proactively notifying the user, ensuring the device remains a reliable first line of defense.

Furthermore, material science improvements are focusing on creating lighter, more durable, and aesthetically appealing casings and components. Innovations in lightweight aluminum and high-strength composite materials allow for larger capacity extinguishers that are still manageable for the average residential user, improving usability during emergency situations. Design modifications are also integrating features like simple, intuitive operational instructions and enhanced ergonomic handles to facilitate use by individuals with limited experience or mobility. The convergence of these material and smart technologies is repositioning the residential fire extinguisher not merely as a safety requirement, but as a sophisticated, digitally monitored asset within the modern connected home ecosystem, substantially improving overall residential resilience against fire incidents.

Regional Highlights

Regional dynamics heavily influence the Residential Fire Extinguisher Market, with regulatory environments and construction standards serving as primary market determinants. North America, encompassing the United States and Canada, represents the most mature and dominant market segment. This region is characterized by exceptionally stringent and consistently enforced safety standards, notably those dictated by the National Fire Protection Association (NFPA) codes, which are frequently adopted into state and municipal building regulations. The high rate of home ownership, coupled with demanding insurance requirements that often necessitate the installation of multiple certified extinguishers per dwelling, drives high per-capita demand. Technological adoption, especially concerning smart and IoT-enabled safety devices, is also high in North America, allowing premium products to gain significant traction among consumers prioritizing advanced home security.

Europe constitutes another major market, defined by strong environmental regulations and a preference for sustainable and non-toxic extinguishing agents. European safety standards (such as EN standards) prioritize minimizing environmental impact, leading to higher adoption rates for water mist and specialized clean agent extinguishers compared to traditional dry chemical types. Western European countries, particularly Germany, the UK, and France, exhibit stable, high-value markets driven by older housing stock requiring retrofitting and rigorous fire inspection regimes. The Eastern European segment, while currently smaller, is showing substantial growth due to accelerating harmonization with EU safety directives and increased foreign direct investment in residential infrastructure, requiring compliance with modern fire safety protocols.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, presenting immense untapped potential driven by unprecedented rates of urbanization and the massive scale of new residential construction, particularly in China, India, and Southeast Asia. As middle-class populations expand and adopt higher safety expectations, there is a definitive shift away from uncertified, low-cost safety devices toward internationally recognized and reliable fire extinguishers. While the market remains sensitive to pricing, the sheer volume of new residential units being added annually creates a colossal demand baseline. However, market penetration is often hindered by the diversity of local regulations and enforcement consistency, requiring manufacturers to adapt products and certification strategies on a country-by-country basis.

Latin America (LATAM) and the Middle East & Africa (MEA) represent evolving markets. In LATAM, growth is driven by increasing public safety awareness and slowly modernizing building codes, particularly in urban centers like São Paulo and Mexico City. The economic stability and enforcement of regulations remain variable, leading to a fragmented market structure. The MEA region is characterized by significant investment in high-density, smart residential complexes (especially in the Gulf Cooperation Council states like UAE and Saudi Arabia), which demand state-of-the-art fire suppression systems, including premium, high-capacity, and frequently smart-enabled extinguishers, often stipulated by strict government mandates aimed at world-class safety infrastructure.

- North America: Market leader due to strict NFPA regulations, high insurance mandates, and strong uptake of smart, connected fire safety solutions.

- Europe: High focus on environmental compliance drives demand for eco-friendly agents like water mist and non-residual clean agents; market stabilized by mature regulatory frameworks.

- Asia Pacific (APAC): Highest growth rate driven by rapid urbanization, vast residential construction projects, and improving adoption of international safety standards, despite price sensitivity.

- Latin America: Emerging market growth linked to modernization of national building codes and increased consumer safety education in major metropolitan areas.

- Middle East & Africa (MEA): Growth concentrated in GCC countries due to mandatory, advanced safety requirements for high-end, large-scale residential developments and infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residential Fire Extinguisher Market.- Johnson Controls International plc

- Amerex Corporation

- Minimax GmbH & Co. KG

- United Technologies Corporation (Carrier Global Corporation)

- Siemens AG

- Strike First Corporation

- Jactone Products Ltd

- Ceasefire Industries Pvt. Ltd.

- Britannia Fire Ltd.

- Kanex Fire

- Fike Corporation

- Feuerschutz Jockel GmbH & Co. KG

- Master Fire Prevention

- Mueller Co. (TYCO)

- Naffco FZCO

- First Alert (Resideo Technologies)

- Hochiki Corporation

- MSA Safety Incorporated

- Kidde (Carrier Global Corporation)

- Buckeye Fire Equipment Company

Frequently Asked Questions

Analyze common user questions about the Residential Fire Extinguisher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical safety rating to look for when purchasing a residential fire extinguisher?

The most critical rating is the ABC classification, meaning the extinguisher is effective against Class A (ordinary combustibles like wood, paper), Class B (flammable liquids like grease, gasoline), and Class C (electrical equipment). For kitchens, look for ABC rated units that may also carry specific Class K or F agent recommendations for cooking oils and fats, ensuring broad protective capability within the home.

How often must a fire extinguisher be professionally inspected or replaced in a residential setting?

While the required service life varies by manufacturer and agent type, most dry chemical residential extinguishers have a non-rechargeable lifespan of 10 to 12 years before requiring replacement. It is mandatory for homeowners to visually inspect the pressure gauge monthly to ensure the needle is in the green zone, and professional maintenance or hydrostatic testing is typically recommended every five to six years for rechargeable units to ensure operational integrity and compliance with local safety codes.

What are the primary advantages of smart or IoT-enabled residential fire extinguishers?

Smart fire extinguishers leverage IoT technology to provide proactive safety management by continuously monitoring internal pressure and battery status. Their primary advantage is the ability to send real-time alerts to the homeowner's smartphone or security hub if the unit's pressure drops below an acceptable threshold, if it is moved from its designated location, or if the unit is nearing its mandated expiration date, addressing the common issue of maintenance neglect.

Which geographical region is experiencing the fastest growth in demand for residential fire extinguishers and why?

The Asia Pacific (APAC) region is currently exhibiting the fastest market growth. This acceleration is driven by rapid, large-scale residential construction spurred by urbanization, coupled with the increasing adoption of standardized international building and safety codes in key developing economies, substantially raising the baseline requirements for certified fire suppression equipment in new housing units.

Are there environmentally friendly alternatives to standard dry chemical fire extinguishers for home use?

Yes, consumers are increasingly adopting environmentally benign extinguishing technologies. Water mist extinguishers are highly effective, non-toxic, and minimize cleanup and property damage by using minimal, atomized water. Clean Agent extinguishers, which utilize chemical substitutes that are safe for the ozone and leave no residue, are also gaining popularity, particularly in European markets driven by stringent environmental regulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager