Residential Generators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433836 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Residential Generators Market Size

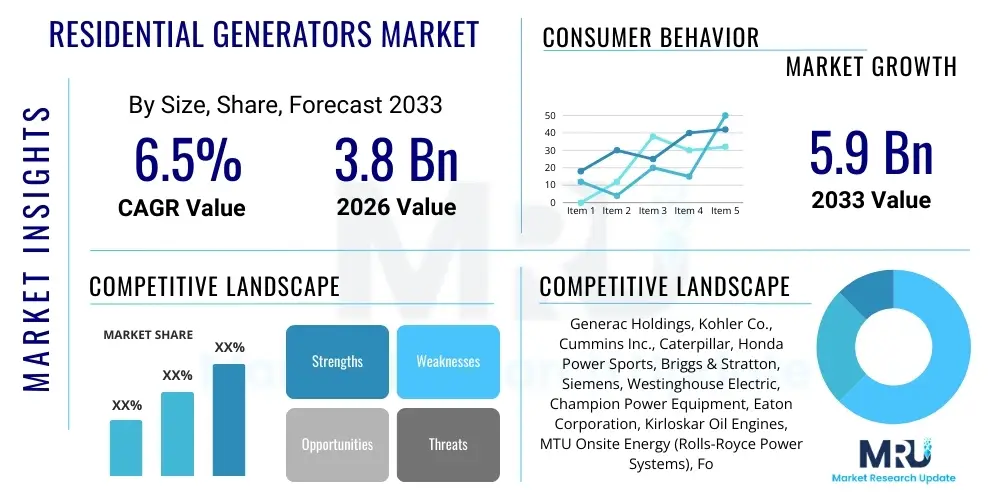

The Residential Generators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033. This growth is primarily fueled by increasing frequency and severity of extreme weather events causing widespread power outages, coupled with growing consumer adoption of smart home technology that necessitates continuous power supply for critical functions. Furthermore, advancements in cleaner fuel options, such as natural gas and propane generators, are making standby power solutions more accessible and environmentally compliant for urban and suburban homeowners.

Residential Generators Market introduction

The Residential Generators Market encompasses devices designed to provide backup electrical power to homes during utility outages or to supply electricity in off-grid locations. These systems range from portable units used for essential appliances to large, fixed standby generators capable of powering an entire household, including HVAC systems and high-demand electronics. The primary objective of these products is to enhance residential resilience, ensuring comfort, security, and the functionality of essential services, particularly in areas prone to grid instability or natural disasters. Technological evolution is leading to quieter operation, increased fuel efficiency, and integration with home energy management systems.

Major applications include emergency backup power for lights, refrigeration, medical equipment, and security systems. The increasing reliance on digital infrastructure, especially during work-from-home trends, has cemented generators as a necessity rather than a luxury. Key benefits derived from these generators include enhanced safety, reduced food spoilage, uninterrupted operation of critical infrastructure (like sump pumps), and increased property value. The driving factors behind market expansion include aging power grids, regulatory support for resilient infrastructure, and a noticeable shift in consumer preparedness planning across developed and developing economies.

The market landscape is highly competitive, characterized by continuous innovation in fuel sources—moving away from solely diesel and gasoline towards natural gas and propane for standby units—and the incorporation of inverter technology for cleaner power suitable for sensitive electronics. Moreover, the integration of monitoring and remote diagnostic capabilities via mobile applications is standardizing the smart generator segment. This technological push is vital for maintaining growth, especially as the market seeks to address increasing concerns regarding noise pollution and carbon footprints associated with traditional generator operation.

Residential Generators Market Executive Summary

The Residential Generators Market is currently experiencing robust expansion driven by pronounced structural instability in power grids globally and heightened climate volatility. Business trends indicate a strong pivot toward automated standby generators (primarily natural gas and propane) over manual portable units, reflecting consumer preference for seamless and hands-off backup solutions. Manufacturers are focusing heavily on developing highly efficient, low-emission models that are compatible with smart home ecosystems, enabling remote monitoring and automatic load shedding. The competitive strategy involves optimizing the dealer and installation network, as professional installation and long-term maintenance contracts are critical value differentiators in the standby segment. Furthermore, hybrid solutions combining generators with battery storage systems are emerging, providing enhanced resilience and optimizing fuel consumption.

Regionally, North America remains the dominant market due to frequent severe weather events, established infrastructure for natural gas delivery, and high consumer spending on home improvements and resilience. However, Asia Pacific (APAC) is projected to exhibit the fastest growth, propelled by rapid urbanization, substantial power deficits in emerging economies like India and Southeast Asia, and increasing disposable incomes leading to greater adoption of reliable backup power. European growth is steady, largely regulated by stringent emission standards favoring highly efficient and quiet inverter technologies, particularly in dense urban environments. Regulatory environments across all key regions are increasingly promoting units that meet stricter noise and emissions thresholds, influencing product development cycles significantly.

Segment trends highlight the dominance of natural gas generators within the standby segment due to the convenience of direct utility connection, eliminating the need for manual refueling. The power rating segment between 10 kW and 20 kW is seeing the highest demand, as this range effectively handles the power requirements of an average suburban home, including essential and non-essential loads. Smart connectivity is no longer a niche feature but a standard expectation, driving the market toward integrated digital controls that allow homeowners to manage their systems remotely, diagnose issues, and receive predictive maintenance alerts, thereby significantly improving the user experience and reliability of the units.

AI Impact Analysis on Residential Generators Market

Common user questions regarding AI's impact on residential generators frequently revolve around predictive maintenance, optimization of fuel consumption, and seamless integration with the wider smart home grid, including battery storage and solar inputs. Users are keen to understand how AI can reduce operational costs, preempt component failures before they cause outages, and automate load management to prioritize critical circuits during extended power events. There is also significant curiosity about AI’s role in optimizing generator startup testing cycles to comply with local regulations while minimizing unnecessary fuel usage. The underlying theme is enhancing reliability and efficiency through intelligent automation, moving generators beyond simple mechanical devices into sophisticated, interconnected energy management assets.

- AI-driven Predictive Maintenance: Analyzing sensor data (temperature, vibration, fluid levels) to forecast component failure and schedule preventative maintenance, significantly reducing unexpected downtime.

- Optimized Fuel Management: Using machine learning algorithms to assess historical usage patterns, weather forecasts, and grid stability reports to adjust fuel consumption rates and test cycle frequency.

- Smart Load Shedding and Prioritization: AI controllers automatically prioritizing essential loads (e.g., HVAC, medical devices) and temporarily disconnecting non-essential loads (e.g., pool pumps) during high-demand backup scenarios, extending operational time.

- Seamless Grid Integration (VPP Readiness): Enabling generators to participate in Virtual Power Plants (VPPs) by intelligently managing power flow in conjunction with solar panels and residential battery storage, responding dynamically to utility signals.

- Enhanced Diagnostics and Remote Control: Improving accuracy of remote diagnostics through AI pattern recognition, allowing service technicians to address issues remotely or arrive with the correct parts.

- Noise and Emission Control Optimization: Dynamically adjusting engine speed and operation based on real-time power demand and ambient noise constraints, particularly in urban areas.

DRO & Impact Forces Of Residential Generators Market

The market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities. The primary Drivers include increasing grid vulnerabilities due to aging infrastructure and escalating occurrences of climate-related power disruptions. Restraints largely center around high initial installation costs, especially for fully automated standby units requiring professional gas line and electrical connections, and stringent regulatory pressures concerning noise and carbon emissions, particularly in highly populated regions. Opportunities arise from the rapidly expanding hybrid power solutions market, integrating generators with renewable energy sources and battery storage, and the widespread adoption of IoT and smart connectivity features enhancing user experience and efficiency. These factors collectively create impact forces that necessitate continuous innovation in cleaner fuel technologies and installation simplification to maintain market momentum.

Specific market Drivers include the expansion of residential construction and renovation activities, coupled with the rising consumer awareness regarding disaster preparedness. The shift toward natural gas and propane as cleaner and more convenient fuel sources compared to traditional gasoline or diesel is a major catalyst, as these fuels allow for extended, uninterrupted operation without manual refueling. Furthermore, technological advancements leading to quieter operation (inverter technology) and smaller footprints make installation more palatable for suburban homeowners. Government incentives and rebates aimed at promoting energy resilience in storm-prone regions also significantly stimulate demand, particularly in coastal areas of North America.

Conversely, significant Restraints persist, including the complex permitting process required for permanent standby installations in many municipalities, which often delays adoption. The rising cost of key raw materials, such as copper and specialized engine components, puts upward pressure on pricing, potentially limiting growth among lower-income demographics. Additionally, competition from alternative backup solutions, specifically the accelerating adoption of high-capacity residential battery storage systems (like those offered by Tesla and Enphase), poses a long-term challenge, particularly where solar generation is feasible. Opportunities are substantial, focusing on the development of highly modular, plug-and-play generator solutions, expanding service and maintenance offerings for recurring revenue, and tapping into underdeveloped markets in APAC and MEA where power reliability is critically low.

Segmentation Analysis

The Residential Generators Market is comprehensively segmented based on fuel type, power rating, application, and connectivity features, allowing for targeted product development and marketing strategies. This segmentation reveals distinct consumer behavior patterns and technological requirements across various geographical regions. The market’s segmentation is crucial for understanding the current demand dynamics, with a notable shift towards convenient and integrated solutions like natural gas standby units that offer superior convenience and extended operational capability compared to portable gasoline alternatives. The increasing focus on sustainability is also driving the growth of propane and potentially bi-fuel or hydrogen-ready generator segments, particularly in environmentally conscious markets.

- By Fuel Type:

- Natural Gas: Dominant in the standby segment due to continuous fuel supply.

- Propane: Preferred in areas without natural gas access; offers longer shelf life than gasoline.

- Gasoline: Primary fuel for portable, smaller generators.

- Diesel: Used primarily for larger residential applications or certain high-load requirements.

- Others (Bi-fuel, Solar/Hybrid): Emerging segment driven by efficiency and environmental concerns.

- By Power Rating:

- Less than 10 kW: Typically portable units or small standby generators for essential circuits only.

- 10 kW – 20 kW: The core segment for whole-house backup in average-sized homes.

- Above 20 kW: High-capacity units for large homes or luxury residences with extensive power needs (e.g., geothermal heating, multiple HVAC units).

- By Application:

- Standby: Permanently installed, automatically activated, providing seamless power transition.

- Portable: Manual operation, flexible use (home, recreation, job sites), usually fueled by gasoline.

- Inverter: Subset of portable, offering clean, consistent power crucial for sensitive electronics.

- By Connectivity:

- Smart/Connected Generators: Integrated with Wi-Fi/Cellular for remote monitoring, diagnostics, and smart home systems integration.

- Non-Smart/Traditional Generators: Basic operation without remote connectivity features.

Value Chain Analysis For Residential Generators Market

The value chain for residential generators begins with upstream activities involving the sourcing and processing of raw materials such as steel, copper, and specialized engine components (alternators, engines, fuel systems). Key upstream players include specialized engine manufacturers (e.g., Kohler Engines, Mitsubishi, Kawasaki) and component suppliers. Effective supplier management and robust contracts are crucial due to global supply chain volatility affecting material costs and availability. Manufacturers then assemble and integrate these components, focusing on R&D for inverter technology, noise reduction enclosures, and control panel sophistication to enhance product competitiveness and regulatory compliance.

Downstream activities involve distribution, sales, installation, and aftermarket services. Distribution channels are bifurcated into direct and indirect routes. Direct distribution often involves large national retailers (e.g., Home Depot, Lowe's) or e-commerce platforms for portable units, while complex standby units rely heavily on indirect channels. The primary indirect route involves authorized dealer networks and certified electricians/installers who provide crucial site assessments, complex installation (gas line and electrical tie-in), and localized maintenance support. These dealers are critical as they bridge the gap between manufacturer and homeowner, ensuring correct sizing and safe installation.

The service component—installation, warranty, and maintenance—is a significant value driver, often generating higher margins than the initial product sale. Potential customers rely heavily on the professionalism and certification of these installation partners. Manufacturers must maintain high standards for their certified installer base to uphold brand reputation. Furthermore, the increasing complexity of smart generators necessitates specialized technician training. The entire chain is highly influenced by regulatory compliance at the installation phase (local codes and permits), underscoring the importance of seamless coordination between manufacturers, distributors, and certified installation professionals.

Residential Generators Market Potential Customers

The primary end-users or buyers in the Residential Generators Market are homeowners seeking enhanced energy security and resilience. This includes two main demographic profiles: suburban families in regions highly susceptible to severe weather events (e.g., coastal US, regions experiencing intense heat waves or freezing winters) and luxury homeowners requiring uninterrupted power for extensive smart home systems and high-demand amenities. A significant secondary customer base includes individuals relying on critical in-home medical equipment (e.g., oxygen concentrators, specialized refrigeration), for whom power reliability is a matter of life safety.

In terms of product focus, buyers of portable generators tend to be budget-conscious consumers who require temporary power for essential loads or recreational use, prioritizing portability and immediate availability over automatic operation. Conversely, buyers of standby generators are typically affluent homeowners seeking premium, permanent solutions that offer whole-house backup, prioritizing convenience, seamless operation, quiet performance, and integration with natural gas lines. The rise of remote work has also created a new customer segment: professionals who require absolute assurance against internet or computer system disruption caused by outages, driving demand for high-quality inverter generators or standby systems.

Market expansion is also being fueled by residential developers who are increasingly offering standby generator installation as a premium upgrade in new construction projects, particularly in master-planned communities. Insurance companies and local governments, recognizing the cost savings associated with reduced disaster recovery efforts, sometimes incentivize or mandate generator installation in high-risk zones, further driving demand among specific geographical populations. These customer groups collectively represent a sustained demand curve emphasizing reliability, lower emissions, and intelligent automation in their backup power solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Generac Holdings, Kohler Co., Cummins Inc., Caterpillar, Honda Power Sports, Briggs & Stratton, Siemens, Westinghouse Electric, Champion Power Equipment, Eaton Corporation, Kirloskar Oil Engines, MTU Onsite Energy (Rolls-Royce Power Systems), Fortress Power, Schneider Electric, Yamaha Motor, Winco Inc., SunPower, Pulsar Products, Firman Power Equipment, Duromax Power Equipment |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residential Generators Market Key Technology Landscape

The technology landscape for residential generators is rapidly evolving, moving from basic motor-alternator sets to highly integrated, digitally controlled power management systems. Inverter technology represents one of the most significant advancements, allowing generators to produce clean, stable AC power regardless of engine speed, which is crucial for sensitive home electronics and improved fuel efficiency. This technology involves converting AC power generated by the engine into DC, then back into a precise AC waveform (pure sine wave), resulting in quieter operation and optimized fuel consumption based on load demand, a stark contrast to older, conventional generators.

Another dominant technological trend is the proliferation of IoT and smart connectivity, primarily facilitated through integrated Wi-Fi and cellular modules. This allows homeowners to monitor the generator's status, fuel level, operational hours, and error codes remotely via mobile applications. Furthermore, smart generators are increasingly designed for seamless integration with Automatic Transfer Switches (ATS) that incorporate advanced digital controllers. These controllers not only manage the power transition during an outage but also communicate with home energy management systems, enabling sophisticated load prioritization and coordination with residential battery storage and solar PV installations, creating a genuine micro-grid ecosystem within the home.

From an environmental and efficiency perspective, manufacturers are investing heavily in cleaner engine technology. This includes developing optimized engines specifically for natural gas and propane, which burn cleaner than traditional liquid fuels, meeting increasingly strict EPA and local emission standards. There is also emerging interest in hydrogen-ready or bi-fuel systems to future-proof products against evolving energy transition policies. Noise reduction remains a core technology focus, involving advanced sound-dampening enclosures, specialized muffler design, and vibration isolation mounting, significantly enhancing the acceptability of standby units in densely populated suburban environments.

Regional Highlights

- North America: This region holds the largest market share due to extreme weather events (hurricanes, ice storms, wildfires) that frequently destabilize the grid. High consumer purchasing power and well-established infrastructure for natural gas connections make standby generators the preferred choice. The US and Canada represent a mature but still rapidly expanding market focused heavily on smart, high-capacity, and low-emission units.

- Asia Pacific (APAC): Expected to register the highest CAGR, driven by infrastructural deficits and rapid electrification needs in emerging economies like India, China, and Southeast Asia. Power reliability remains a major concern, fostering strong demand for both portable and commercial-grade generators for residential use. Growth is slightly hampered by lower adoption rates of centralized natural gas supply, making gasoline and diesel models prevalent, though propane is gaining traction.

- Europe: Characterized by stringent regulatory environments, particularly regarding noise pollution and emissions (Euro Stage V standards). The market is mature, focusing on highly efficient, quiet inverter technology. Growth is steady, driven by increasing energy prices and localized grid reliability concerns, especially in Scandinavian countries and the UK.

- Latin America: This region is heavily reliant on generators due to widespread grid instability and frequent blackouts. The market is primarily price-sensitive, with strong demand for basic, robust portable units, although urbanization and economic development are gradually increasing the demand for automated standby systems in affluent communities.

- Middle East and Africa (MEA): Growth is tied closely to oil revenue fluctuations and large-scale residential projects. High temperatures necessitate backup power for continuous air conditioning. The market is mixed, with standby units common in the wealthier GCC countries, and diesel-fueled generators dominating in regions with poor grid coverage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residential Generators Market.- Generac Holdings

- Kohler Co.

- Cummins Inc.

- Caterpillar

- Honda Power Sports

- Briggs & Stratton

- Siemens

- Westinghouse Electric

- Champion Power Equipment

- Eaton Corporation

- Kirloskar Oil Engines

- MTU Onsite Energy (Rolls-Royce Power Systems)

- Fortress Power

- Schneider Electric

- Yamaha Motor

- Winco Inc.

- Pulsar Products

- Firman Power Equipment

- Duromax Power Equipment

- Himoinsa (Yanmar Group)

Frequently Asked Questions

Analyze common user questions about the Residential Generators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a standby and a portable residential generator?

A standby generator is a permanently installed unit connected directly to the home’s electrical system and automatically activates upon power loss, offering seamless, hands-off backup. A portable generator must be manually started, refueled, and connected to appliances or transfer switches via extension cords or specialized inlets.

Which fuel type is dominating the residential generator market?

Natural gas is currently dominating the standby residential generator market, primarily in North America, due to its continuous, unlimited fuel supply via existing utility lines, eliminating the need for manual refueling and storage considerations required by propane, gasoline, or diesel units.

How does inverter technology improve generator performance?

Inverter technology produces clean, high-quality electrical power (pure sine wave) necessary for sensitive modern electronics, while also allowing the engine speed to adjust based on the load demand, significantly reducing noise levels and improving fuel efficiency compared to conventional generator designs.

What are the main growth drivers for the residential generator industry?

The main growth drivers are the increasing frequency and intensity of severe weather events causing grid instability, aging utility infrastructure in developed nations, and the growing consumer demand for energy resilience driven by the proliferation of smart home devices and reliance on remote work capabilities.

Are smart generators compatible with residential solar and battery storage systems?

Yes, modern smart generators are increasingly designed with advanced controllers that allow them to integrate seamlessly with residential solar photovoltaic systems and battery energy storage solutions, forming a hybrid home micro-grid optimized for energy efficiency and extended backup duration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager