Residential Grinder Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432300 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Residential Grinder Pump Market Size

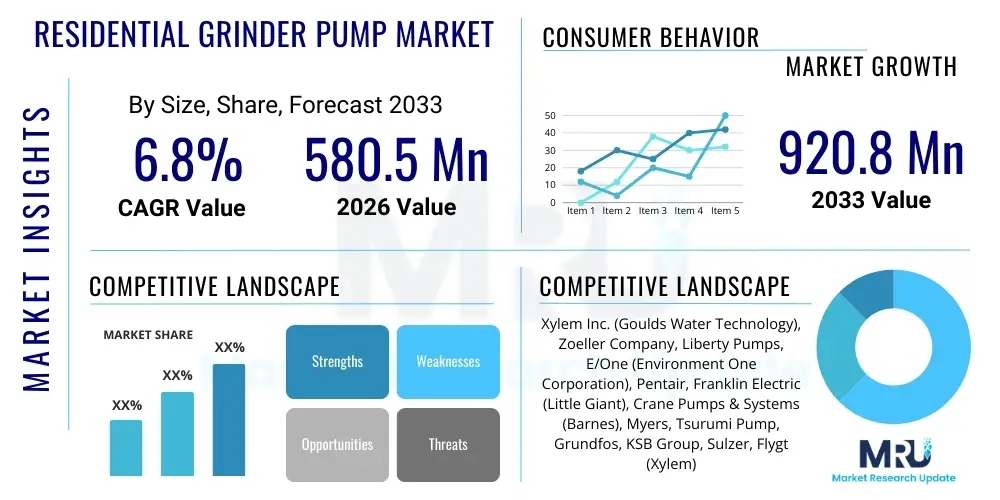

The Residential Grinder Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $580.5 Million USD in 2026 and is projected to reach $920.8 Million USD by the end of the forecast period in 2033.

Residential Grinder Pump Market introduction

The Residential Grinder Pump Market encompasses the sale, installation, and maintenance of specialized submersible pumps designed to handle domestic wastewater containing solids. These pumps are essential for homes, particularly those situated in areas with challenging topography, low-lying landscapes, or long distances from the main municipal sewer system. A grinder pump operates by macerating sewage solids into a fine slurry before pressurizing and pumping the wastewater through small-diameter discharge pipes, making them crucial infrastructure components for decentralized wastewater management in suburban and rural developments.

Residential grinder pumps typically feature powerful motors and robust grinding mechanisms capable of handling materials that standard sewage ejector pumps cannot manage, thereby preventing clogs in pressurized sewer systems. Major applications include single-family homes, vacation rentals, multi-family housing units not connected to gravity sewers, and properties utilizing low-pressure sewer (LPS) systems mandated by regulatory bodies. The inherent benefits of these systems include the ability to traverse uneven terrain, minimize excavation costs associated with deep trenching required for gravity sewers, and ensure efficient, reliable wastewater transport over long distances.

Market growth is predominantly driven by increasing residential development in challenging geographic locations, the escalating need for modernizing aging septic systems in developed economies, and stringent environmental regulations promoting safe and contained sewage disposal. Furthermore, continuous product innovation focusing on energy efficiency, smart monitoring capabilities, and enhanced grinding reliability is expanding the adoption rates of these sophisticated pumping solutions globally. The structural shift toward decentralized infrastructure in rapidly urbanizing peripheral areas also significantly underpins the market trajectory.

Residential Grinder Pump Market Executive Summary

The Residential Grinder Pump Market is experiencing robust expansion, fundamentally driven by sustained housing starts in non-traditional sewered areas and the necessity of upgrading legacy wastewater infrastructure. Business trends indicate a strong move towards integrated pumping stations offering IoT connectivity for remote diagnostics and predictive maintenance, thereby reducing overall lifetime operational costs for homeowners and municipalities managing these assets. Key market players are concentrating on developing highly durable components and environmentally conscious materials to comply with evolving water quality standards and consumer demands for sustainable solutions. Consolidation activities and strategic partnerships focused on distribution networks are enhancing market penetration, particularly in regions experiencing rapid peri-urban growth.

Regionally, North America remains a dominant market due to a high rate of decentralized housing developments and stringent regulatory frameworks mandating proper sewage conveyance in coastal and environmentally sensitive zones. However, the Asia Pacific region, led by China and India, is projected to register the fastest growth rate, fueled by massive government investments in sanitation infrastructure and the rapid expansion of multi-family residential projects in areas lacking conventional gravity sewer access. European market stability is maintained by continuous system replacements and regulatory mandates supporting low-pressure sewer systems as an alternative to outdated septic tanks.

Segment trends highlight the dominance of the hardwired pump type, favored for its reliability and direct electrical integration, though plug-and-play models are gaining traction due to easier installation processes. In terms of application, single-residence housing units constitute the largest segment, reflecting the core necessity of decentralized solutions. Future growth is anticipated in the small-diameter discharge segment (e.g., 1.25 inches) as advancements allow smaller pipes to handle highly pressurized, finely ground effluent, leading to further reductions in installation complexity and material costs, making LPS systems more cost-competitive against traditional gravity sewers.

AI Impact Analysis on Residential Grinder Pump Market

Users commonly inquire about how artificial intelligence (AI) and machine learning (ML) can improve the reliability and reduce the maintenance burden associated with residential grinder pumps. The primary themes center around predictive failure detection, optimization of pump operational cycles, and integration with smart home automation platforms. Users are concerned about avoiding expensive backups and understanding how AI can provide real-time status monitoring, especially concerning motor load irregularities, vibration analysis, and anticipating potential clogs before they cause service interruptions. This widespread user expectation confirms that the future trajectory of the residential grinder pump market heavily relies on implementing smart, data-driven diagnostics to transition from reactive repair models to proactive preventative maintenance.

The integration of AI algorithms fundamentally transforms the management of grinder pump assets. By analyzing continuous flow data, power consumption signatures, and historical failure patterns across a distributed network of pumps, AI systems can accurately predict the remaining useful life (RUL) of critical components, such as the grinding mechanism or the motor windings. This capability allows service providers and homeowners to schedule maintenance precisely when necessary, maximizing efficiency and minimizing downtime. This operational refinement not only enhances customer satisfaction but also significantly extends the lifespan of the equipment, providing substantial long-term cost savings compared to traditional time-based maintenance schedules.

Furthermore, AI-powered systems facilitate advanced energy management. By learning the typical diurnal usage patterns of a residence or a neighborhood cluster, ML models can optimize pump activation timing and duration, ensuring that pumping occurs during off-peak energy hours or optimizing the cycle length to maximize efficiency while maintaining required reserve capacity. This smart operation translates directly into reduced electricity bills and decreased wear and tear. As connectivity platforms become standard, the data collected from millions of residential installations worldwide will further train these algorithms, creating a feedback loop that continually refines pump design, diagnostic precision, and overall system resilience.

- Enhanced Predictive Maintenance (PdM) through ML analysis of motor current and vibration data.

- Optimized operational efficiency by using AI to schedule pumping cycles during low-cost or low-stress periods.

- Real-time clog detection and proactive alerts based on anomaly detection in pressure and flow rates.

- Improved inventory management for service companies by predicting which parts (e.g., cutters, seals) will require replacement regionally.

- Development of self-diagnosing pumps that automatically recalibrate or initiate preventative cleaning cycles.

- Integration with Smart Home ecosystems (e.g., generating alerts via connected applications).

DRO & Impact Forces Of Residential Grinder Pump Market

The dynamics of the Residential Grinder Pump Market are shaped by a complex interplay of regulatory drivers, infrastructure restraints, technological opportunities, and critical impact forces such as urbanization patterns and environmental awareness. The key drivers include accelerated residential construction in areas unsuitable for gravity sewers, heightened focus on sustainable wastewater management, and government mandates supporting low-pressure systems as a cost-effective alternative to costly deep gravity pipelines. These forces collectively push market growth by expanding the addressable base for decentralized pumping solutions.

However, the market faces significant restraints, including the relatively higher initial installation cost compared to traditional septic systems, the reliance on continuous electrical power supply (necessitating battery backup systems), and the general lack of public awareness regarding the long-term operational benefits and maintenance requirements of grinder pumps. Furthermore, the longevity and reliability of proprietary grinding mechanisms present ongoing competition challenges. These constraints often require extensive educational efforts by manufacturers and strong governmental incentives to overcome initial resistance from homeowners and developers accustomed to conventional wastewater solutions.

Opportunities abound in leveraging digitalization for remote monitoring and predictive fault analysis, which drastically improves system reliability and reduces total cost of ownership. The burgeoning demand for eco-friendly building practices and the necessity for resilience against extreme weather events (e.g., floods requiring robust backflow prevention) create new avenues for specialized product development. The primary impact forces—rapid demographic shifts towards peri-urban living, increasingly stringent environmental discharge standards, and technological advances in material science leading to lighter, more corrosion-resistant components—are collectively accelerating market adoption and pushing manufacturers toward higher efficiency and greater component robustness.

Segmentation Analysis

The Residential Grinder Pump Market is systematically segmented based on application, pump type, discharge diameter, and motor capability, allowing for precise market sizing and strategic targeting. Segmentation by application distinguishes between single-residence units, which represent the traditional core market for decentralized solutions, and multi-family housing complexes, where the requirement for robust, centralized pumping stations to handle higher volumes is increasing. Analyzing these segments helps manufacturers tailor product capacity and feature sets, from small, intermittent pumps for vacation homes to continuous duty systems for communal residential use.

Segmentation by pump type, particularly hardwired versus plug-and-play, dictates installation complexity and consumer preference. Hardwired systems offer permanent integration and are often preferred in new constructions for their reliability, while plug-and-play systems appeal to the retrofit market or non-specialized installers due to their simplicity. Furthermore, classifying the market based on discharge diameter (e.g., 1.25 inches vs. 2 inches) reflects technological advancement; smaller diameters require finer grinding capabilities but allow for the use of less expensive and more flexible pipe materials, making low-pressure systems highly adaptable to difficult terrain.

The detailed segmentation structure facilitates a granular understanding of purchasing trends and infrastructure demands. For example, municipalities often prefer robust hardwired systems with higher horsepower motors (segmentation by motor capacity) for communal developments, whereas individual homeowners might prioritize the low-maintenance features of specific grinding technologies. This comprehensive segmentation is critical for developing focused marketing strategies and ensuring product specifications align precisely with diverse end-user requirements and regulatory specifications across different geographical regions.

- By Application:

- Single Residence

- Multi-Family Housing (Duplexes, Townhomes, Small Developments)

- By Type:

- Hardwired Grinder Pumps (Permanent Installation)

- Plug-and-Play Grinder Pumps (Ease of Retrofit)

- By Discharge Diameter:

- 1.25 Inch Discharge

- 2.0 Inch Discharge and Above

- By Technology:

- Macerating Grinder Pumps

- Vortex Grinder Pumps

- By Motor Horsepower:

- 0.5 HP to 1.5 HP

- Above 1.5 HP (Heavy Duty Residential/Cluster Use)

Value Chain Analysis For Residential Grinder Pump Market

The value chain for the residential grinder pump market begins with raw material sourcing and component manufacturing, followed by assembly, distribution, installation, and finally, maintenance and after-sales support. Upstream analysis focuses on the procurement of critical materials such as cast iron or stainless steel for pump casings, high-performance polymers for impellers, and sophisticated electrical components for motors and control panels. Cost optimization at this stage is crucial, as the fluctuating prices of metals and energy directly influence the final product cost. Manufacturers often engage in strategic partnerships with specialized motor and control panel suppliers to ensure quality, efficiency, and compliance with varying international electrical standards.

The midstream segment involves the core manufacturing, quality control, and testing processes. Efficiency in assembly line operations and the integration of advanced testing protocols ensure product reliability, which is paramount given the critical nature of wastewater infrastructure. Distribution channels represent a pivotal point in the value chain, categorized into direct and indirect routes. Direct sales often involve large municipal contracts or relationships with major housing developers, providing bulk sales and installation expertise. Indirect channels, which dominate the residential aftermarket and individual home construction sectors, rely heavily on a network of wholesale distributors, specialized plumbing suppliers, and local service contractors who manage the final delivery and installation.

Downstream analysis centers on installation, maintenance, and end-user engagement. Installation is typically managed by licensed plumbing contractors who are also responsible for routine inspections and emergency repairs. The effectiveness of the after-market service network—including the rapid availability of spare parts and trained technicians—significantly impacts brand reputation and customer loyalty. The increasing adoption of smart pumps introduces a data-driven service element, where manufacturers or specialized service providers manage remote diagnostics, creating a recurring revenue stream and reinforcing the overall value proposition of higher reliability and proactive service delivery to the end-user.

Residential Grinder Pump Market Potential Customers

The potential customer base for the Residential Grinder Pump Market is diverse yet distinctly focused on entities requiring robust sewage transport solutions where traditional gravity systems are unfeasible or uneconomical. The largest segment of end-users consists of individual homeowners in rural, semi-rural, or coastal areas where septic systems are failing, or the property is located downhill or significantly distant from the main sewer line. These individual buyers are motivated by the need for reliable, permanent sewage infrastructure and are heavily influenced by local regulatory requirements and the recommendations of professional plumbers and builders.

A second major customer category includes residential housing developers and builders responsible for constructing new subdivisions and multi-family units in peripheral urban zones. These developers prioritize cost-effectiveness, scalability, and ease of installation in challenging terrains. They seek bulk purchasing agreements and reliable, energy-efficient systems that meet municipal approval standards, often driving the adoption of standardized LPS systems across new developments. Their buying decisions are influenced by total project costs, long-term maintenance liabilities, and the system's ability to minimize expensive earthworks.

Furthermore, municipalities and regional utility authorities act as critical indirect customers, as they often dictate the standards, approve the systems, and sometimes manage the maintenance contracts for cluster grinder pump installations. While not always the direct purchaser of the residential unit, their regulatory framework and investment in broader Low-Pressure Sewer (LPS) systems create the market demand. Finally, professional plumbing and engineering firms serve as key intermediaries, acting as trusted advisors who specify the type and brand of grinder pump to be installed, making them crucial targets for manufacturer sales and training initiatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580.5 Million USD |

| Market Forecast in 2033 | $920.8 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Xylem Inc. (Goulds Water Technology), Zoeller Company, Liberty Pumps, E/One (Environment One Corporation), Pentair, Franklin Electric (Little Giant), Crane Pumps & Systems (Barnes), Myers, Tsurumi Pump, Grundfos, KSB Group, Sulzer, Flygt (Xylem), SumpPal, Shanghai Kaiyuan Pump Industrial Co., Ltd., DAB Pumps, FluiDyne Fluid Power, Saniflo, Wilo SE, Barmesa Pumps |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residential Grinder Pump Market Key Technology Landscape

The technology landscape in the residential grinder pump market is characterized by continuous refinement aimed at enhancing grinding efficacy, optimizing energy consumption, and improving remote diagnostic capabilities. A primary focus is on the cutter technology, with manufacturers investing heavily in developing advanced hardened materials (such as stainless steel alloys or carbide inserts) and unique cutter geometries designed to handle increasingly difficult materials found in modern wastewater streams, including non-woven wipes and sanitary products. Efficient maceration is critical to ensure that solids are reduced to a fine slurry, preventing clogs in the narrow diameter pipes of low-pressure sewer systems and maintaining consistent system flow.

Another significant technological advancement involves the motor and control systems. The shift towards high-efficiency motors, often incorporating permanent magnet technology or variable frequency drives (VFDs), allows pumps to operate precisely at the required speed and torque, leading to substantial energy savings, particularly in applications with fluctuating demand. These advanced control systems are integral to protecting the pump from dry running, overheating, and excessive current draw, thereby extending the motor life and reducing the frequency of mechanical failures. The integration of sensors for monitoring temperature, vibration, and seal integrity provides localized feedback essential for preventative maintenance.

The most transformative trend is the incorporation of IoT (Internet of Things) and sophisticated communication protocols. Modern grinder pumps are increasingly equipped with integrated cellular or Wi-Fi modules that transmit operational data to cloud-based platforms. This technology enables homeowners and service providers to remotely monitor pump status, receive immediate alerts for fault conditions (such as high liquid level alarms or motor faults), and access detailed historical performance logs. This connectivity shifts the paradigm of service from reactive response to proactive, data-driven maintenance scheduling, dramatically improving asset uptime and overall infrastructure reliability within the residential context.

Regional Highlights

Regional variations in topography, housing density, climate, and regulatory adherence significantly influence the demand and adoption patterns of residential grinder pumps globally. North America, specifically the United States and Canada, represents the mature market segment, driven by vast suburban expansion into geographically challenging areas (rocky terrain, high water tables) and the critical need to replace outdated, decentralized septic systems with standardized low-pressure sewer infrastructure. Regulatory incentives and municipal acceptance of LPS systems are high, leading to continuous investment in pump technology and robust aftermarket service networks. Manufacturers often use North America as a testing ground for high-reliability, heavy-duty residential units due to strict quality and longevity expectations.

Europe demonstrates stable demand, focusing predominantly on system upgrades and energy efficiency compliance. Countries like Germany and the Scandinavian nations prioritize highly efficient, compact systems suitable for retrofit installations in densely populated rural environments. European demand is bolstered by environmental directives promoting the protection of groundwater resources, making reliable, contained sewage pumping solutions mandatory for properties previously relying on substandard or failing sewage disposal methods. The focus here is often on low-noise operation and aesthetic integration within residential landscapes, complementing the strong emphasis on sustainable building practices.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, primarily due to accelerated urbanization, massive public spending on sanitation infrastructure in emerging economies (China, India, Southeast Asia), and the rapid development of large-scale residential complexes in areas where installing gravity sewers is cost-prohibitive due to complex urban congestion or varied topography. Demand here is characterized by the need for cost-effective, high-volume solutions capable of handling rapidly increasing loads and often harsher operating environments. Latin America and the Middle East & Africa (MEA) are also emerging as key markets, stimulated by infrastructure modernization projects and addressing basic sanitation needs in peripheral urban areas, often supported by international development financing.

- North America: Dominant market share due to widespread suburban sprawl, high regulatory acceptance of LPS, and continuous replacement of aging septic fields.

- Europe: High demand for energy-efficient, compact retrofit solutions driven by stringent environmental protection directives and groundwater quality standards.

- Asia Pacific (APAC): Highest growth potential fueled by rapid urbanization, large-scale residential construction projects, and significant government investment in primary sanitation infrastructure.

- Latin America: Growing adoption driven by infrastructure modernization initiatives aimed at improving public health and addressing sewage challenges in diverse topographies (e.g., mountainous or coastal regions).

- Middle East & Africa (MEA): Emerging market characterized by government investment in new city developments and coastal infrastructure where high water tables or desert conditions necessitate pressurized wastewater conveyance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residential Grinder Pump Market.- Xylem Inc. (Goulds Water Technology)

- Zoeller Company

- Liberty Pumps

- E/One (Environment One Corporation)

- Pentair plc

- Franklin Electric (Little Giant)

- Crane Pumps & Systems (Barnes)

- Myers (A Brand of Pentair)

- Tsurumi Pump

- Grundfos Holding A/S

- KSB Group

- Sulzer Ltd.

- Flygt (Xylem Inc.)

- SumpPal

- Shanghai Kaiyuan Pump Industrial Co., Ltd.

- DAB Pumps SpA

- FluiDyne Fluid Power

- Saniflo (SFA Group)

- Wilo SE

- Barmesa Pumps

Frequently Asked Questions

Analyze common user questions about the Residential Grinder Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the residential grinder pump market?

The primary driver is the accelerating construction of residential properties in areas with challenging topography or high water tables, making traditional gravity-fed sewer systems technically or economically unfeasible. This necessitates the adoption of reliable low-pressure sewer (LPS) systems that utilize grinder pumps.

How do residential grinder pumps differ from standard sewage ejector pumps?

Residential grinder pumps contain a robust cutter mechanism that macerates solids (including non-flushable items) into a fine slurry before pumping, enabling transport through small-diameter pressure pipes. Standard ejector pumps only handle softer solids and require larger discharge lines.

What role does IoT technology play in modern residential grinder pumps?

IoT integration enables remote monitoring and diagnostics, allowing pumps to transmit operational data (e.g., flow rate, motor status, alarm conditions) to the cloud. This facilitates predictive maintenance, reduces downtime, and allows homeowners/service providers to manage the system proactively.

Which geographical region is expected to show the highest growth rate?

The Asia Pacific (APAC) region is projected to experience the highest growth rate. This is primarily attributed to substantial government investment in sanitation infrastructure, rapid urbanization, and extensive new residential developments in developing economies across the region.

What are the main disadvantages associated with residential grinder pump systems?

The main disadvantages include reliance on continuous electrical power (necessitating backup systems), higher initial installation costs compared to septic tanks, and the requirement for specialized periodic maintenance to ensure the longevity of the grinding mechanism and seals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager