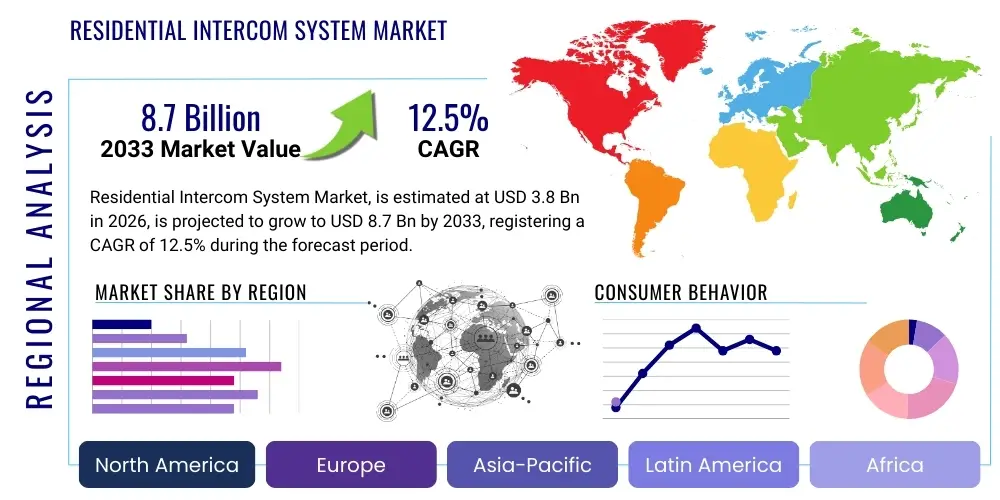

Residential Intercom System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437411 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Residential Intercom System Market Size

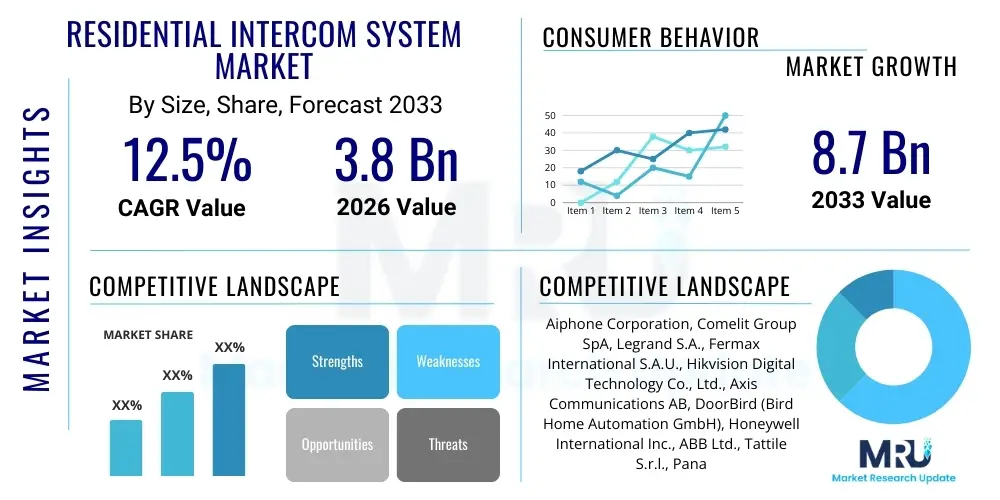

The Residential Intercom System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033.

Residential Intercom System Market introduction

The Residential Intercom System Market encompasses devices and networks designed for communication and access control within and surrounding residential properties, ranging from single-family homes to large multi-dwelling units (MDUs). These systems facilitate seamless two-way audio and often video communication between residents, visitors, and property management, significantly enhancing security and convenience. Historically dominated by traditional analog audio-only systems, the market has undergone a radical transformation, now prioritizing Internet Protocol (IP) based, wireless, and integrated smart home solutions. Modern intercom systems are not merely communication tools; they are integral components of comprehensive residential security ecosystems, offering features like remote monitoring, mobile app integration, and advanced video analytics, making them indispensable in the contemporary connected home environment.

The core product offerings within this sector include wired and wireless video door phones, multi-tenant IP video intercoms, and integrated access control systems utilizing proximity cards, keypads, or biometric authentication. Major applications are concentrated in new residential construction projects, which increasingly mandate high-tech security infrastructure, and the retrofit market, where older homes and apartment buildings are upgrading outdated infrastructure to meet modern resident expectations for digital amenities. The primary benefits driving consumer adoption are enhanced property security through visual verification of visitors, unparalleled convenience provided by remote access capabilities, and seamless integration with other smart home devices such as surveillance cameras and smart locks. This convergence of security, connectivity, and convenience is fundamentally reshaping the market landscape.

Key driving factors propelling the market growth include the explosive global adoption of smart home technology, rising consumer awareness regarding personal and property security, and rapid urbanization leading to an increase in high-density multi-dwelling projects globally. Furthermore, technological advancements such as high-definition video capture, robust cloud-based storage solutions, and the implementation of noise cancellation and echo suppression technologies have significantly improved user experience, further stimulating demand. The transition from complex, proprietary wiring protocols to standardized IP and Wi-Fi architectures has lowered installation barriers, making advanced systems more accessible to a broader consumer base, especially in regions experiencing rapid economic development and infrastructure expansion.

Residential Intercom System Market Executive Summary

The Residential Intercom System Market is characterized by a strong shift toward digitalization, driven primarily by the adoption of wireless and IP-based solutions which are replacing legacy analog infrastructure. Current business trends indicate intense competition among manufacturers focusing on developing highly scalable, interoperable systems that can function seamlessly within diverse smart home ecosystems, such as those governed by protocols like Matter and Thread. Investment in cloud computing infrastructure is paramount, enabling sophisticated remote management, over-the-air firmware updates, and subscription-based security services, which represent a crucial revenue stream beyond hardware sales. Furthermore, merger and acquisition activities are prevalent as large security conglomerates seek to integrate specialized intercom and access control technologies to offer comprehensive, end-to-end security portfolios to property developers and homeowners.

Regional trends highlight North America and Europe as highly mature markets, dominating in terms of installed base and characterized by a strong consumer preference for premium, feature-rich video intercoms integrated with sophisticated home automation platforms. These regions exhibit high replacement demand driven by continuous technological refresh cycles. Conversely, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid urbanization, massive residential infrastructure development, particularly in countries like China and India, and a growing middle class that prioritizes safety technology in new residential projects. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily adopting basic and mid-range video intercom solutions but showing increasing potential as smart city initiatives gain momentum and governmental regulations mandate higher security standards in residential buildings.

Segmentation analysis reveals that the Video Intercom Systems segment maintains market leadership due to increased consumer demand for visual verification capabilities, which mitigate security risks associated with unknown visitors. Technology-wise, the Wireless/IP segment is expected to register the fastest growth rate, significantly surpassing wired systems, owing to easier installation, reduced infrastructure costs, and enhanced functionality derived from internet connectivity. Within the end-user segment, the Multi-Dwelling Unit (MDU) sector is a substantial growth engine, as large apartment complexes and housing societies require integrated, centralized access management systems that benefit immensely from scalable IP network solutions and cloud hosting services for visitor management and resident communication.

AI Impact Analysis on Residential Intercom System Market

User inquiries concerning AI's impact on residential intercom systems predominantly center around several critical themes: enhanced security capabilities, data privacy concerns, ease of integration, and the replacement of human intervention. Consumers frequently ask how AI can differentiate between residents, known delivery personnel, and unauthorized visitors, reflecting a demand for sophisticated detection algorithms. There is also keen interest in how AI models handle false positives, such as pets or environmental disturbances, and how integrated machine learning can reduce system complexity and improve personalization. Finally, significant questions revolve around the ethical use of biometric data (facial recognition) captured by these systems and the necessity of local, on-device processing to protect user privacy against cloud vulnerabilities.

Artificial Intelligence, particularly through machine learning (ML) and computer vision, is fundamentally redefining the utility and intelligence of modern residential intercom systems. AI algorithms enable advanced features such as highly accurate facial recognition for keyless entry, which drastically improves user convenience and security by providing rapid authentication without physical keys or input codes. Furthermore, AI-powered video analytics can interpret complex visual scenes, allowing the system to detect abnormal or suspicious behavior, such as loitering or package theft, triggering proactive alerts before a breach occurs. This shift moves the intercom from a reactive communication device to a proactive component of the security infrastructure, significantly enhancing the safety profile of residential environments by automating threat assessment.

The implementation of edge computing—processing AI models directly on the intercom device rather than relying solely on cloud processing—is addressing major user concerns regarding latency and data privacy. Edge AI ensures that sensitive biometric and visual data remain localized, minimizing transmission risk and allowing for immediate decision-making, crucial for rapid access control operations. This technological advancement also allows manufacturers to offer sophisticated customization options, where the system learns the habitual patterns of household members and approved guests, optimizing access permissions over time and ensuring a tailored security experience. However, the complexity of deploying and maintaining these advanced ML models necessitates improved user interfaces and robust technical support to ensure broad consumer acceptance and effective utilization of the technology's full potential.

- AI-Powered Facial Recognition: Enables rapid, keyless, and secure access for residents and pre-approved visitors, substantially improving ingress efficiency.

- Behavioral Anomaly Detection: Utilizes machine learning to identify suspicious activities like loitering, unusual movements, or unauthorized entry attempts near entry points.

- Advanced Noise and Voice Filtering: Improves audio clarity by distinguishing human speech from environmental disturbances (e.g., wind, traffic), enhancing communication quality.

- Package Delivery Verification: AI vision systems confirm the successful placement of packages and track removal, helping mitigate porch piracy risks.

- Reduced False Alarms: Algorithms accurately differentiate between human visitors, pets, vehicles, and weather events, minimizing unnecessary resident alerts.

- Personalized Access Control: Machine learning continually refines resident profiles and access schedules based on learned patterns and habits.

- On-Device (Edge) Processing: Enhances privacy and speed by performing complex computations locally, reducing reliance on external cloud servers for basic decision-making.

DRO & Impact Forces Of Residential Intercom System Market

The market dynamics are governed by a complex interplay of internal and external forces synthesized in the Drivers, Restraints, and Opportunities (DRO) framework, all contributing to the overall Impact Forces shaping investment and adoption. Primary drivers include the inexorable rise in demand for integrated smart home ecosystems, where the intercom acts as a central hub for entrance management and connectivity, coupled with increasing consumer awareness and prioritization of physical home security. These factors collectively push manufacturers toward innovation in wireless technology and high-definition video capabilities. Conversely, significant restraints impede growth, notably the high initial capital investment required for comprehensive IP-based video systems compared to legacy audio-only models, compounded by the complexity of integrating diverse third-party smart devices, often requiring professional installation and extensive configuration, which deters non-technical users.

Opportunities for market expansion are largely concentrated in the proliferation of cloud-based Software as a Service (SaaS) models for access control management, which offer recurring revenue streams through features like remote guest authorization, virtual concierge services, and long-term data storage. The market is also finding significant untapped potential in the retrofit segment within established housing markets, where the shift to wireless infrastructure enables upgrades without extensive structural modifications. The primary impact force driving current growth is the convergence of IoT and security, positioning the intercom not just as a device for identifying visitors but as a critical node in a larger digital security network. This transition demands open standards and protocol compatibility (e.g., ONVIF, SIP) to ensure seamless integration, making interoperability a critical competitive differentiator among major vendors, especially in the MDU sector.

Restraints are further amplified by ongoing concerns regarding cybersecurity vulnerabilities inherent in networked devices. A compromised IP intercom can serve as an entry point for cyber threats targeting the entire home network, requiring manufacturers to continuously invest heavily in encryption protocols and secure firmware updates. The balance between offering advanced features (like biometrics) and maintaining user trust regarding data privacy presents a persistent challenge. Overcoming these restraints necessitates industry-wide standardization on security protocols and improved consumer education. Ultimately, the cumulative positive impact forces—driven by rapid technological advancements and increasing regulatory pressure for safer residential environments—are poised to outweigh the current restrictive elements, ensuring sustained high growth in the projected forecast period, particularly for feature-rich, scalable video solutions targeting the booming MDU construction segment globally.

Segmentation Analysis

The Residential Intercom System Market is systematically segmented based on Type, Technology, Product, and End-User, providing a granular view of demand patterns and strategic focus areas for market participants. The Type segmentation primarily distinguishes between Audio and Video systems, reflecting the fundamental difference in communication modality and feature sets, with video systems commanding a higher premium and experiencing accelerated growth due to superior visual verification capabilities. Technology segregation separates traditional Wired systems, which offer reliability in established structures, from the rapidly expanding Wireless and IP-based systems, which provide flexibility, scalability, and internet-enabled functions, catering heavily to smart home integration requirements.

The market’s structure also highlights specialization in product offerings, including Door Phone, Handheld, and Master Station categories, each serving distinct functional needs within the residential environment, from simple entry monitoring to multi-room communication. Crucially, the End-User segmentation differentiates demand between Single-Family Units (SFUs), which often opt for high-end, bespoke smart home integration, and Multi-Dwelling Units (MDUs), which require robust, centralized, and highly scalable systems capable of managing hundreds of tenants and numerous access points efficiently. Analyzing these segments is vital for vendors to tailor their product development, marketing efforts, and distribution channel strategies to maximize penetration across diverse housing types and consumer needs globally.

- By Type

- Audio Intercom Systems

- Video Intercom Systems (Leading and fastest-growing segment)

- By Technology

- Wired Intercom Systems (Traditional installations)

- Wireless Intercom Systems (Wi-Fi, RF)

- IP-Based Intercom Systems (VoIP/SIP protocols)

- By Product

- Door Phone (Outdoor units)

- Handheld Devices/Monitors (Portable indoor units)

- Master Station (Central control units, often integrated with smart hubs)

- By End-User

- Single-Family Units (SFU)

- Multi-Dwelling Units (MDU) (Apartments, condominiums, gated communities)

Value Chain Analysis For Residential Intercom System Market

The value chain for the Residential Intercom System Market begins with the upstream segment, dominated by component suppliers that provide essential technology building blocks. This includes manufacturers of high-performance sensors (CMOS/CCD), microprocessors and chipsets (critical for AI and video processing), specialized audio components (microphones, speakers), and networking modules (Wi-Fi/PoE). The quality and cost of these components directly impact the final product's performance, durability, and retail price point. Strong supplier relationships are essential for ensuring a stable supply of high-end components, especially given the continuous technological evolution demanding frequent hardware refreshes, particularly in video and processing power, making vertical integration or strategic partnerships highly advantageous for major system manufacturers.

The core of the value chain is the manufacturing and assembly phase, where Original Equipment Manufacturers (OEMs) design, integrate, and assemble the final intercom units, including both the outdoor entry panels and the indoor monitor stations. This phase involves substantial research and development investment focused on industrial design, software development (firmware, mobile apps), and ensuring compatibility with various industry protocols and smart home platforms. Following manufacturing, the distribution channel determines market reach. Distribution is highly segmented into direct and indirect routes. Direct channels primarily involve large-scale sales to major residential property developers and professional security integrators (B2B), particularly vital in the lucrative Multi-Dwelling Unit (MDU) segment where volume sales and custom system deployment are standard.

The downstream segment, comprising installation, system integration, and end-user engagement, is critical. Indirect distribution channels rely heavily on electrical wholesalers, specialty security equipment distributors, and increasingly, large e-commerce platforms and mass-market retailers for sales to Single-Family Units (SFUs) and DIY enthusiasts. Professional installers and certified system integrators play a crucial role, providing complex wiring, network setup, and initial configuration, often bundling intercom systems with other security services like CCTV and alarm monitoring. The final link involves post-sales support, maintenance, and the crucial aspect of subscription-based services, which leverage the internet connectivity of IP systems to offer ongoing value, ensuring long-term customer loyalty and recurring revenue essential for the sustained profitability of the entire value chain.

Residential Intercom System Market Potential Customers

The residential intercom system market targets two distinct but equally valuable segments of end-users and buyers: the Business-to-Business (B2B) market, primarily consisting of institutional purchasers such as real estate developers and property management companies, and the Business-to-Consumer (B2C) market, which encompasses individual homeowners and residents. B2B customers, particularly developers of new Multi-Dwelling Units (MDUs) and high-end gated communities, represent the largest volume purchasers, prioritizing scalable, centralized, and robust IP-based video solutions that seamlessly integrate with facility-wide access control and visitor management software. These professional buyers are motivated by the need for regulatory compliance, enhanced resident security amenities as a competitive differentiator, and long-term maintainability and operational efficiency provided by integrated systems.

Property management firms and Homeowners' Associations (HOAs) constitute another critical B2B subset, focusing on upgrading existing infrastructure (retrofit market) to enhance the security and convenience offered to current tenants. Their purchasing decisions are often driven by total cost of ownership (TCO), reliability, and the ease of remote system management and updates. They typically prefer cloud-managed systems that allow for centralized user registration, credential management, and logging of access events. Successful engagement with this customer group requires demonstrating clear return on investment (ROI) through reduced security incidents and improved tenant satisfaction and retention rates, necessitating systems that are both resilient and highly scalable to accommodate fluctuating occupancy rates.

The B2C potential customers are individual homeowners residing in Single-Family Units (SFUs), who seek easy-to-install, wireless video door phones integrated into their personalized smart home ecosystems (e.g., Google Home, Amazon Alexa). This segment places a premium on aesthetic design, ease of use (via mobile application), immediate security notifications, and strong interoperability with smart locks and security cameras. The rise of sophisticated DIY solutions has made this segment increasingly accessible, though professional installation remains common for premium, fully wired, or complex integrated setups. Marketing efforts targeting B2C customers emphasize convenience, peace of mind, and the practical utility of remote interaction with visitors and delivery personnel.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aiphone Corporation, Comelit Group SpA, Legrand S.A., Fermax International S.A.U., Hikvision Digital Technology Co., Ltd., Axis Communications AB, DoorBird (Bird Home Automation GmbH), Honeywell International Inc., ABB Ltd., Tattile S.r.l., Panasonic Corporation, L&M Electric Inc., Ring LLC (Amazon), Google LLC (Nest), Siedle & Söhne Telefon- und Telegrafenwerke OHG, Zicom Electronic Security Systems Ltd., Kocom Co., Ltd., Akuvox (Xiamen) Networks Co., Ltd., Dahua Technology Co., Ltd., Bpt S.p.A. (Came Group) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residential Intercom System Market Key Technology Landscape

The current technological landscape of the residential intercom market is defined by a rapid migration toward networked, highly intelligent systems that leverage Internet of Things (IoT) connectivity and advanced digital processing capabilities. Internet Protocol (IP) communication standards, often utilizing Session Initiation Protocol (SIP), have become the foundational architecture, allowing intercoms to operate on standard network infrastructure (PoE enabled) and communicate seamlessly with cloud services and other smart devices. This shift away from proprietary analog wiring enables features previously unattainable, such as high-definition (HD) video streaming, two-way audio with noise cancellation, and remote accessibility via mobile applications, ensuring residents can manage access and communications from anywhere in the world, dramatically improving security responsiveness and convenience.

Cloud-based technology represents another monumental shift, offering significant benefits, particularly for Multi-Dwelling Units (MDUs). Cloud platforms facilitate centralized management of user databases, access credentials (digital keys), and visitor logs, simplifying the complex administrative tasks faced by property managers. Moreover, the cloud enables manufacturers to deliver Over-The-Air (OTA) firmware updates, ensuring systems remain protected against evolving cybersecurity threats and benefit instantly from new features and performance enhancements without requiring manual intervention. This Software-as-a-Service (SaaS) model is also generating stable, recurring revenue streams for companies, transforming the market from a purely hardware-focused industry into a service-oriented sector with continuous engagement.

Further technological differentiation is provided by the integration of sophisticated computer vision and biometric authentication technologies. High-resolution camera modules (often 1080p or 4K) are paired with AI engines to provide features like facial recognition, allowing for rapid, hands-free entry for residents, and advanced object detection to distinguish between people, animals, and packages. Secure credentialing technology, including Near Field Communication (NFC) and advanced encryption for digital keys (e.g., Bluetooth Low Energy), is replacing traditional physical key fobs. The convergence of these technologies underscores the market's trajectory towards highly integrated, multimodal authentication platforms that prioritize user experience without compromising stringent security standards, demanding continuous innovation in embedded systems and data security protocols.

Regional Highlights

The market exhibits distinct growth and adoption profiles across major geographic regions, influenced by urbanization rates, technological readiness, and local regulatory frameworks concerning building security. North America, characterized by a high penetration of smart home technologies and significant discretionary spending, remains a leading market for high-end, integrated IP video intercom systems. The demand here is largely driven by both new luxury MDU developments prioritizing premium amenities and a substantial retrofit market focused on integrating video doorbells and access control into existing single-family smart homes. Key growth is focused on seamless integration capabilities with leading smart platforms like Amazon Alexa and Google Assistant, and high adoption rates of cloud-managed services for centralized property security.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, owing to massive population density, rapid industrialization, and subsequent large-scale MDU construction across major urban hubs like Beijing, Mumbai, and Jakarta. Government initiatives promoting smart city development and increased consumer concerns over residential security are fueling immense demand. While price sensitivity remains a factor, the rapid expansion of network infrastructure (fiber and 5G) is accelerating the adoption of cost-effective, scalable IP-based video solutions, making regional vendors specializing in high-volume production highly competitive. APAC market growth is heavily concentrated in standardized, functional systems for new apartment complexes.

Europe represents a mature but technologically discerning market, where growth is stable and driven primarily by stringent EU privacy regulations (GDPR) and an emphasis on architectural preservation, leading to strong demand for aesthetically pleasing, often custom-designed systems. Germany, the UK, and the Nordic countries are leaders in adopting sophisticated IP-based and biometric systems, often replacing older systems in historical buildings without extensive modification. European consumers demand high quality, robust security features, and strict adherence to local data protection laws, favoring vendors who offer localized data storage and strong end-to-end encryption solutions that comply with regional privacy mandates.

- North America: Market leader in revenue share; driven by high consumer tech adoption, luxury MDU projects, and robust smart home integration demand.

- Asia Pacific (APAC): Highest projected CAGR; fueled by rapid urbanization, massive MDU construction volumes, and increasing middle-class income driving security spending.

- Europe: Stable growth focusing on high-quality, aesthetic, and privacy-compliant (GDPR) IP systems, with strong retrofit activity in established urban centers.

- Latin America: Emerging market with growing security concerns; increasing adoption of mid-range video intercoms, supported by rising infrastructure investment.

- Middle East & Africa (MEA): Growth driven by smart city initiatives and large-scale, high-security residential projects in the GCC states (e.g., UAE, Saudi Arabia).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residential Intercom System Market.- Aiphone Corporation

- Comelit Group SpA

- Legrand S.A.

- Fermax International S.A.U.

- Hikvision Digital Technology Co., Ltd.

- Axis Communications AB

- DoorBird (Bird Home Automation GmbH)

- Honeywell International Inc.

- ABB Ltd.

- Tattile S.r.l.

- Panasonic Corporation

- L&M Electric Inc.

- Ring LLC (Amazon)

- Google LLC (Nest)

- Siedle & Söhne Telefon- und Telegrafenwerke OHG

- Zicom Electronic Security Systems Ltd.

- Kocom Co., Ltd.

- Akuvox (Xiamen) Networks Co., Ltd.

- Dahua Technology Co., Ltd.

- Bpt S.p.A. (Came Group)

Frequently Asked Questions

Analyze common user questions about the Residential Intercom System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between IP and analog residential intercom systems?

IP intercom systems utilize standard networking protocols (Internet Protocol) for power and data transmission, offering high-definition video, remote access via mobile apps, and integration with cloud services and smart home platforms. Analog systems, conversely, rely on dedicated wiring, are typically limited to audio or lower-resolution video, and lack internet connectivity or advanced integration capabilities, making IP systems the preferred choice for modern, smart residences.

How does AI technology enhance the security features of modern residential intercoms?

AI enhances security by providing advanced capabilities such as facial recognition for keyless access, behavioral anomaly detection (identifying suspicious loitering or activity), and superior object classification to minimize false alarms triggered by pets or weather. This allows the intercom system to proactively manage access and alert residents only to verified security concerns, optimizing vigilance and convenience.

Which market segment (SFU or MDU) is experiencing the fastest growth in intercom adoption?

The Multi-Dwelling Unit (MDU) segment is currently experiencing the fastest growth rate. This is driven by global urbanization and high-volume residential construction, particularly in the Asia Pacific region, necessitating scalable, centrally managed IP video intercom systems that efficiently handle shared access control for large numbers of residents and visitors.

What are the main factors restraining the wider adoption of high-end residential intercoms?

The primary restraints include the significant initial investment cost for premium, feature-rich IP video systems, which can be prohibitive for budget-conscious homeowners. Additionally, complexity regarding installation and integration with proprietary smart home ecosystems, as well as ongoing cybersecurity concerns related to internet-connected devices, slow down market penetration among non-technical consumers.

What role does cloud connectivity play in the residential intercom system market?

Cloud connectivity enables critical features such as remote access and communication via mobile devices, centralized management of user credentials (essential for property managers in MDUs), secure data storage for video logs, and subscription-based services like remote monitoring. This functionality transforms the intercom into a service delivery platform, providing continuous, updated security value to residents.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager