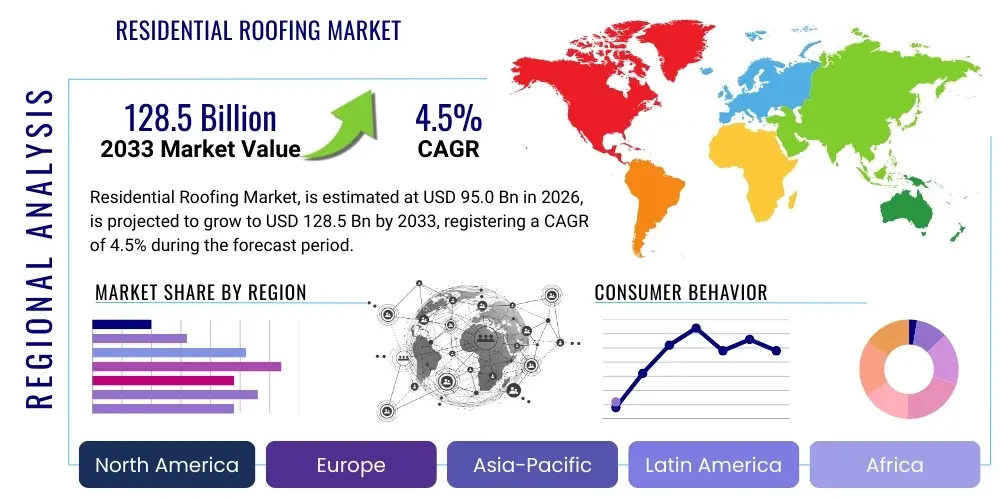

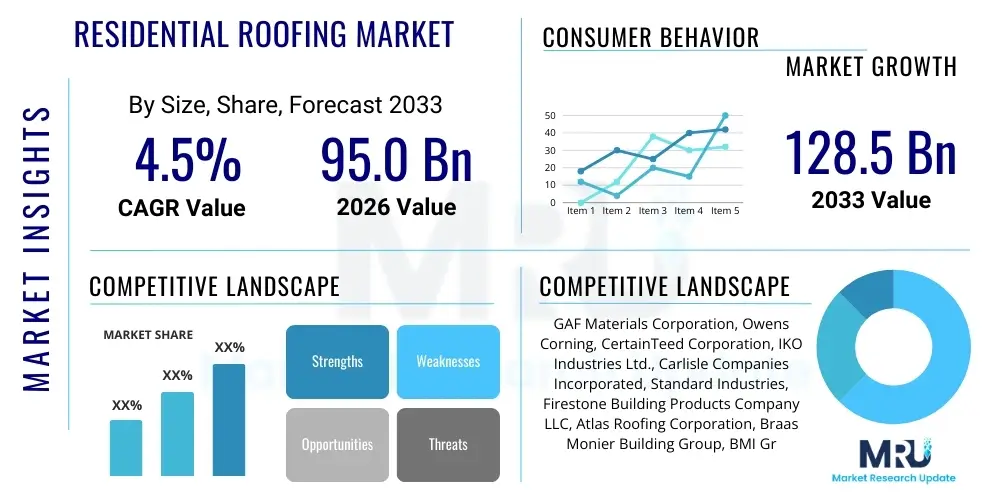

Residential Roofing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435544 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Residential Roofing Market Size

The Residential Roofing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 95.0 Billion in 2026 and is projected to reach USD 128.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by robust housing starts in developing economies, coupled with significant renovation and reroofing activities necessitated by aging housing stock and increasingly severe weather patterns across North America and Europe. The mandatory replacement cycle for traditional asphalt shingles, typically spanning 15 to 30 years, provides a consistent baseline demand, which is amplified by a growing consumer preference for premium, high-durability roofing systems such as metal roofing, concrete tiles, and integrated solar shingles that offer enhanced longevity and energy efficiency benefits.

The valuation reflects a shift in consumer spending habits, prioritizing long-term value over initial cost. Homeowners are increasingly viewing the roof not merely as a protective layer but as a critical component of the overall home energy management system and aesthetic appeal. Furthermore, government incentives promoting energy-efficient structures, especially in developed markets, accelerate the adoption of reflective and cool roofing solutions. The market size calculation incorporates the value generated by both new construction applications and the substantially larger reroofing segment, which often accounts for over 70% of the total residential roofing market volume in mature markets.

Regional dynamics play a crucial role in the market size breakdown; while North America and Europe remain the largest contributors due to high average housing values and stringent building codes, the fastest expansion is anticipated in the Asia Pacific region. This rapid increase is attributed to urbanization, rising disposable incomes, and large-scale infrastructure and residential development projects in countries like China, India, and Indonesia. These factors collectively ensure that the market sustains a moderate yet stable CAGR, translating into billions of dollars of incremental revenue opportunity for material manufacturers and specialized installation contractors globally through 2033.

Residential Roofing Market introduction

The Residential Roofing Market encompasses the manufacturing, distribution, and installation of materials and systems designed to protect single-family homes, multi-family dwellings, and other low-rise residential structures from environmental elements while contributing to structural integrity and thermal performance. The primary product scope ranges from conventional materials like asphalt shingles and clay tiles to modern, high-performance options such as metal roofing, concrete tiles, synthetic polymers, and advanced photovoltaic (PV) integrated roofing systems. These products serve the essential application of shelter and protection, simultaneously enhancing the building's aesthetic value and overall energy envelope, directly impacting heating and cooling costs for homeowners.

Major applications within this market include initial installations for new residential construction and, more significantly, reroofing projects undertaken for replacement or cosmetic upgrades. The key benefit derived from modern roofing systems lies in their enhanced durability, superior weather resistance against extreme events (hail, high winds, fire), and improved insulation properties, which align with evolving sustainability mandates. Furthermore, the increasing integration of technologies, such as reflective coatings and solar power generation capabilities, transforms the roof from a passive component into an active energy management asset. The market is propelled by macro-environmental factors, including population growth, resilient post-pandemic home renovation spending, and stringent regulatory requirements mandating the use of fire-resistant and wind-resistant materials, particularly in disaster-prone areas.

Driving factors critical to market expansion include favorable demographic trends, particularly the high demand for single-family housing driven by Millennial and Gen Z buyers entering the market, and government policies encouraging investment in building envelope efficiency to meet decarbonization targets. However, the market structure remains highly dependent on the stability of the construction sector and the fluctuating costs of petrochemical derivatives used in asphalt-based products. Despite these challenges, the long-term outlook remains positive, fueled by continuous innovation in lightweight, modular, and aesthetically versatile roofing solutions designed for rapid installation and maximum structural integrity.

Residential Roofing Market Executive Summary

The Residential Roofing Market is characterized by robust business trends centered on sustainability and premiumization. Manufacturers are heavily investing in research and development to offer materials with lower environmental footprints, such as recycled content shingles and durable, long-life metal and polymer systems, responding directly to heightened consumer environmental consciousness and regulatory pressures for green building certifications. A prominent business trend is the consolidation of the fragmented contractor base, alongside strategic vertical integration by material producers aimed at securing supply chains and controlling distribution channels. Digital transformation is also critical, with firms leveraging Building Information Modeling (BIM) and specialized roofing software for precise project management, estimating, and enhanced customer visualization, thereby improving efficiency and reducing waste across complex reroofing projects.

Regional trends indicate North America maintaining market dominance, largely owing to high insurance recovery rates driving frequent storm-related reroofing and a strong culture of home maintenance. Conversely, the Asia Pacific region exhibits the highest growth potential, where rapid urbanization fuels new construction, demanding scalable and cost-effective roofing solutions. European markets, particularly Western Europe, focus intensely on thermal performance and cool roof technology adoption, driven by the European Union’s energy performance directives for buildings. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by increasing adoption of durable materials like concrete tiles and customized solutions tailored for high heat and localized extreme weather conditions.

Segmentation trends highlight the enduring dominance of the Asphalt Shingles segment due to cost-effectiveness and ease of installation, though its market share is gradually being eroded by the Metal Roofing segment, which is experiencing accelerated growth due to its superior durability, lifespan, and recyclability. The segment for specialized materials, including solar tiles and synthetic rubber, is poised for exponential growth as technology costs decrease and regulatory incentives for renewable energy integration become widespread. Furthermore, the repair and maintenance segment is outpacing new construction growth, underscoring the shift toward maximizing the lifespan of existing housing stock and deferred maintenance catch-up following economic uncertainties.

AI Impact Analysis on Residential Roofing Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Residential Roofing Market primarily revolve around operational efficiency, job security for traditional laborers, and the potential for enhanced property protection. Key user themes center on how AI can automate time-consuming processes like initial property inspection and damage assessment—specifically, "Can AI accurately identify hail damage from drone imagery?" and "How quickly can AI generate a precise material takeoff list?" Concerns frequently address the cost-benefit analysis for small to mid-sized contractors regarding AI adoption, asking, "Is AI technology currently affordable for local roofing companies, or is it only for large enterprises?" and questioning the reliability of automated systems versus experienced human inspection.

The synthesis of user queries reveals a high expectation for AI to revolutionize the pre-installation phase. Users anticipate that AI-powered image recognition, coupled with drone technology, will provide rapid, hyper-accurate diagnostics of roof conditions, thereby streamlining the insurance claims process and reducing errors in project scoping. This demand for precision and speed is critical in high-volume reroofing markets. Furthermore, users are keenly interested in how machine learning algorithms can optimize inventory management and logistical planning—specifically, predicting material shortages and recommending optimal delivery schedules based on localized weather forecasts. However, there is underlying skepticism regarding the necessary technical skills required to operate and maintain these sophisticated systems, alongside concerns about data security related to storing high-resolution property images and sensitive homeowner information.

In summary, the key themes indicate users view AI as a powerful tool for risk mitigation, efficiency gains, and professionalizing the quoting and damage assessment workflow. They expect AI to reduce human error, speed up project timelines, and offer predictive maintenance advice, ultimately enhancing customer satisfaction. The primary expectation is cost reduction and efficiency, while the primary concern remains the accessibility of the technology to smaller players and its potential disruptive effect on the skilled labor segment of the market, necessitating retraining initiatives to transition installers into operators and analysts of AI-driven systems.

- AI enhances roof inspection and damage assessment through drone-captured imagery analysis, offering rapid identification of subtle defects like hail impact and structural fatigue.

- Predictive maintenance algorithms use historical weather data and material performance metrics to forecast potential failure points, allowing for proactive, scheduled repairs.

- Machine learning optimizes supply chain logistics by accurately predicting material consumption rates and adjusting procurement schedules to mitigate inventory holding costs and prevent construction delays.

- AI-powered tools automate the generation of accurate project estimates, including precise material takeoffs and labor allocation, significantly reducing quoting time and improving proposal accuracy.

- Generative AI assists in personalized design visualization, allowing homeowners to instantly preview various material and color options on their specific property before making a purchase decision.

- Robotics and AI-guided equipment are beginning to assist in highly repetitive installation tasks, improving safety standards and installation consistency on large, simple roof surfaces.

- AI algorithms analyze insurance claim data to identify fraud patterns and streamline the approval process for legitimate claims, benefitting both insurers and reputable contractors.

DRO & Impact Forces Of Residential Roofing Market

The Residential Roofing Market is shaped by a potent combination of macroeconomic, technological, and environmental forces encapsulated in its Drivers, Restraints, and Opportunities (DRO). Key drivers include the necessity for storm damage replacement, driven by escalating frequency and intensity of extreme weather events attributed to climate change, making highly durable and resilient materials mandatory rather than optional. Alongside this, favorable interest rate environments occasionally stimulate new residential construction and renovation cycles, directly boosting demand. Conversely, the market is restrained by significant volatility in the costs of raw materials, particularly asphalt and petroleum-based polymers, which directly pressures manufacturer margins and retail pricing, potentially leading to deferral of non-essential reroofing projects by homeowners. Furthermore, the persistent shortage of skilled installation labor remains a critical bottleneck, hindering project completion timelines and increasing labor costs across the industry.

Opportunities for growth are significant, primarily centered on sustainability and energy efficiency mandates. The increasing consumer and regulatory push for Net-Zero energy homes provides a fertile ground for high-value segments like solar roofing tiles and integrated photovoltaic systems, offering contractors a chance to diversify beyond traditional materials into integrated energy solutions. The adoption of smart roofing technology, involving embedded sensors for leak detection and thermal monitoring, presents a nascent but high-potential market segment that integrates the roof into the smart home ecosystem. Strategic impact forces include stringent governmental building codes focused on fire resistance and hurricane resilience (e.g., stricter requirements in Florida and California), which favor high-end, compliant materials, effectively pushing out lower-quality alternatives from mature markets.

The collective impact of these forces suggests a future market characterized by higher material quality, reduced installation timelines through technological assistance (drones, AI), and increased total project value due to the bundling of energy generation and resilience features with the core roofing product. The ability of market participants to successfully mitigate raw material cost fluctuations through diversified sourcing and navigate the labor shortage via innovative training and automation will be key determinants of competitive success. Ultimately, the emphasis is shifting from low-cost replacement to investment in long-term, high-performance building envelope systems that provide sustained ROI through energy savings and increased property resilience against increasingly unpredictable environmental challenges.

- Drivers

- Increasing severity and frequency of extreme weather events necessitating robust, durable roofing replacements.

- Favorable trends in residential repair and remodeling expenditure fueled by aging housing stock and rising property values.

- Growing consumer awareness and governmental mandates promoting energy-efficient building standards (e.g., cool roofs, reflective coatings).

- Technological advancements leading to lighter, more durable, and aesthetically appealing roofing materials (e.g., synthetic polymers and advanced metal alloys).

- Expansion of new residential construction activities, particularly in emerging economies undergoing rapid urbanization.

- Availability of insurance payouts and governmental grants supporting disaster recovery and home energy efficiency upgrades.

- Long-term durability and lower maintenance requirements offered by premium materials like metal and concrete tiles attracting higher lifetime value consumers.

- Restraints

- Significant volatility and escalating prices of key raw materials, including asphalt, petrochemical derivatives, steel, and aluminum, impacting manufacturing costs.

- Acute shortage of skilled labor in the roofing installation sector, leading to project delays and increased labor expenses.

- High initial installation cost associated with premium, high-performance roofing systems such as solar tiles and specialized polymer composites.

- Economic uncertainties and fluctuating interest rates potentially dampening the pace of new housing construction and homeowner renovation decisions.

- Regulatory complexities and time-consuming permitting processes required for certain advanced roofing installations, especially solar integrations.

- The high barrier to entry for innovative materials requiring specialized equipment and training for installation, slowing market adoption.

- Dependence on regional climate patterns and construction seasonality which impacts labor force deployment and project scheduling throughout the year.

- Opportunity

- Widespread integration of solar photovoltaic (PV) technology into roofing structures, moving towards fully integrated Building-Integrated Photovoltaics (BIPV).

- Development and commercialization of sustainable and bio-based roofing materials with reduced carbon footprints and high recyclability.

- Expansion of the "Smart Roofing" concept through embedded sensors for real-time monitoring of leaks, temperature, and structural performance.

- Untapped potential in utilizing advanced manufacturing techniques, such as 3D printing, for customized and geometrically complex roofing components.

- Targeting the substantial market for commercializing and deploying high-performance roof coatings that extend the life of existing roof systems.

- Penetration into emerging markets (APAC, MEA) where urbanization and growing middle-class segments demand modern, durable roofing solutions.

- Leveraging digital platforms and augmented reality (AR) tools to enhance customer experience, simplify material selection, and improve remote project management efficiency.

Segmentation Analysis

The Residential Roofing Market is primarily segmented based on material type, application (new construction vs. repair/reroofing), and regional distribution. This segmentation is crucial for understanding specific market dynamics, identifying high-growth sub-segments, and tailoring competitive strategies. The material segmentation reveals a dual market structure: volume dominance by traditional, cost-effective options like asphalt shingles, and value dominance by high-performance, higher-priced materials such as metal, concrete tiles, and specialty products like BIPV and synthetic roofing. This divergence is driven by differing consumer priorities regarding upfront cost versus long-term durability and energy performance, with regulatory influences increasingly pushing consumers toward the premium, sustainable segments.

Analyzing the application segment highlights the strategic importance of the reroofing and repair market, which consistently surpasses new construction in most developed regions. Replacement cycles, driven by storm damage, aging housing stock, and insurance claim processes, ensure a stable and predictable revenue stream for contractors and material suppliers. New construction, while essential, is more susceptible to macroeconomic cycles, interest rate changes, and volatile housing starts. Understanding the product lifecycle within the reroofing segment—from basic replacement to high-end performance upgrades—is critical for inventory planning and forecasting future material demand, specifically noting the tendency of homeowners to upgrade material types during a replacement cycle.

Geographically, the market segmentation illustrates pronounced differences in material preferences dictated by climate and building codes. For instance, in hurricane-prone coastal regions, highly durable, interlocking tiles or specialized metal systems dominate, whereas in less extreme climates, asphalt shingles maintain a strong foothold due to their lower procurement cost. Manufacturers must therefore maintain diverse product portfolios capable of addressing the localized requirements of different climate zones and adhering to specific regional building standards, which ultimately dictates the success of segmented marketing and distribution strategies across the global residential roofing landscape.

- By Material Type

- Asphalt Shingles (Fiberglass, Organic Mat)

- Metal Roofing (Aluminum, Steel, Copper, Zinc)

- Concrete and Clay Tiles (Flat, Profiled, Interlocking)

- Wood Shingles and Shakes

- Synthetic and Polymer Roofing (Plastic/Rubber Polymers)

- Specialty Roofing (Solar Tiles, Green Roofs, Slate)

- By Application

- New Residential Construction

- Repair and Reroofing/Replacement

- By End-User

- Single-Family Homes

- Multi-Family Dwellings (Apartments, Townhomes)

- By Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (Saudi Arabia, UAE, South Africa, Rest of MEA)

Value Chain Analysis For Residential Roofing Market

The value chain for the Residential Roofing Market is highly complex, beginning with the upstream sourcing of crucial raw materials, progressing through manufacturing, and culminating in installation and post-sales service. The upstream segment involves the extraction and processing of materials such as crude oil derivatives (for asphalt), iron ore and bauxite (for metal roofing), clay, concrete aggregates, and specialized polymers. Volatility in the commodity markets significantly impacts the profitability of manufacturers, forcing strategic long-term procurement contracts and hedging strategies. Manufacturers themselves often engage in extensive R&D to optimize material composition for longevity, weather resistance, and sustainability, representing a critical value-add stage where brand reputation and technological differentiation are established, particularly for high-performance materials like BIPV and specialized coatings.

The distribution channel forms the link between manufacturers and the fragmented downstream market. This involves a mix of direct sales channels, where large manufacturers supply major national contractors or custom home builders directly, and indirect channels, which utilize wholesale distributors, specialized roofing supply houses, and large national home improvement retail chains (like Home Depot or Lowe's). Distributors play a vital role by providing inventory management, localized logistics, and technical support to smaller contractors, facilitating efficient material flow. The indirect channel dominates for standard materials like asphalt shingles, leveraging the broad reach of retail and wholesale networks, while complex, specialty products often rely more on direct, technical sales support and specialized distribution networks.

The downstream segment is dominated by professional roofing contractors, who are responsible for the final installation, which is a major determinant of product performance and warranty validity. Their expertise, certification, and reputation directly influence customer satisfaction. Post-sales services, including warranty fulfillment and routine maintenance contracts, complete the chain, establishing long-term customer relationships and generating recurring revenue. The efficiency and quality control across this chain, from material processing to installation, are paramount, as roofing failures can lead to expensive liability claims, underlining the necessity for stringent certification programs and continuous professional training for all downstream participants.

Residential Roofing Market Potential Customers

The primary end-users and buyers of residential roofing products and services fall into two main categories: existing homeowners driving the reroofing market and residential property developers and builders driving the new construction market. Existing homeowners represent the largest and most frequent customer base, often requiring services due to mandatory lifecycle replacement (after 15-30 years), damage from severe weather, or cosmetic upgrades to increase property resale value. These customers are highly sensitive to perceived quality, warranty length, curb appeal, and increasingly, energy efficiency and storm resilience features. Their purchasing decisions are often highly influenced by insurance claims processes, contractor recommendations, and local energy incentive programs, necessitating tailored marketing focused on durability and return on investment (ROI).

Residential property developers and custom home builders constitute the second major customer segment, primarily focused on new construction projects, ranging from single-family detached homes to large multi-family complexes. These buyers prioritize materials that offer cost-effectiveness, speed of installation, adherence to strict building codes, and consistency in supply volume. While less concerned with individual aesthetic preferences than private homeowners, builders increasingly value materials that enhance the home’s energy rating (e.g., cool roofs) and minimize future liability through high-quality, warrantied systems. Their purchasing is typically centralized and contract-based, favoring manufacturers and suppliers who can guarantee substantial volume and timely delivery throughout the construction cycle.

A growing niche of potential customers includes property management companies and institutional investors who own portfolios of rental homes or multi-family properties. These buyers focus intensely on minimizing maintenance costs and maximizing durability to reduce vacancy rates and operational expenditures over the long term. They often opt for highly robust, low-maintenance materials like metal or concrete tiles, even if the initial cost is higher. Effective targeting of this segment requires demonstrating quantifiable long-term cost savings, reduced insurance premiums, and extended product lifespan, providing a strong B2B value proposition that differs significantly from the emotional and aesthetic drivers of the private homeowner market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 95.0 Billion |

| Market Forecast in 2033 | USD 128.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GAF Materials Corporation, Owens Corning, CertainTeed Corporation, IKO Industries Ltd., Carlisle Companies Incorporated, Standard Industries, Firestone Building Products Company LLC, Atlas Roofing Corporation, Braas Monier Building Group, BMI Group, Boral Limited, RGS Energy, Tesla (Solar Roof Division), Dow, Holcim Group, Etex, Fletcher Building, Polyglass USA Inc., Malarkey Roofing Products, Soprema Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residential Roofing Market Key Technology Landscape

The technological landscape of the Residential Roofing Market is rapidly evolving, moving beyond simple material science into integrated, high-tech systems designed for durability, energy generation, and remote monitoring. One of the most significant advancements is the proliferation of Building-Integrated Photovoltaics (BIPV), where solar cells are seamlessly incorporated into roofing materials like shingles or tiles, eliminating the need for bulky rack-mounted solar panels. This technology is driven by aesthetics and the push for residential self-sufficiency in energy production. Complementary material technologies include advanced polymer composites and specialized metal alloys that offer superior resistance to hail, fire, and wind loads, often surpassing the durability of traditional materials while being significantly lighter and fully recyclable, addressing key environmental and structural load concerns in modern construction.

Beyond materials, the adoption of digital technologies is redefining installation and maintenance workflows. Drone technology equipped with high-resolution and thermal imaging cameras is now standard practice for pre-installation inspection and post-storm damage assessment, providing contractors and insurers with rapid, high-precision data. This data is often fed into AI-powered software platforms that automate damage identification, material quantity estimation (takeoffs), and 3D modeling of the roof structure, significantly accelerating the sales and quoting process. These digital tools improve accuracy, reduce labor time spent on hazardous roof walking, and enhance the overall professionalism of contractor interaction with homeowners and insurance carriers.

Furthermore, the emergence of "Smart Roofing" components represents a future growth avenue. This includes embedding passive or active sensors directly into the roofing system to monitor critical parameters such as moisture intrusion, temperature gradients, and structural integrity in real-time. These sensors communicate wirelessly, providing homeowners and property managers with proactive alerts regarding potential leaks or thermal inefficiencies before they lead to major damage. The convergence of smart material science with IoT (Internet of Things) infrastructure positions the roof as a critical, interconnected node in the residential smart home ecosystem, offering not just protection, but active performance management and enhanced property security.

Regional Highlights

- North America (U.S. and Canada): This region is the largest and most mature market, characterized by a large installed base of asphalt shingles and the highest frequency of storm-related reroofing due to severe weather patterns (hurricanes, tornadoes, major hail events). The market is defined by high per-capita spending on home improvement, strict state-level building codes (especially in coastal and seismic zones), and rapid adoption of premium materials like metal roofing and integrated solar solutions, driven by both insurance requirements and strong consumer demand for high-durability, warrantied products. The U.S. represents the critical demand engine, with renovation and replacement cycles dictating the majority of market activity.

- Europe (Germany, U.K., France): European residential roofing markets are primarily driven by ambitious energy efficiency directives from the EU, favoring materials that enhance thermal insulation, such as specialized insulation panels integrated under tiles, and cool roof coatings. Aesthetic appeal and historical preservation also play a major role, maintaining strong demand for traditional materials like clay tiles and slate, often requiring specialized, high-quality installation techniques. The focus on sustainability means there is a high penetration rate of green roof systems and BIPV in new construction and major renovation projects, particularly in Northern and Central European urban centers.

- Asia Pacific (China, India, Japan): APAC is the fastest-growing region, fueled by massive urbanization, rising middle-class disposable income, and large-scale public and private housing development programs. China and India are major volume drivers for both new construction and repair, utilizing a mix of cost-effective materials like concrete tiles and galvanized steel, balanced with robust materials needed for typhoon and monsoon resistance in coastal areas. Japan, a mature sub-market, emphasizes lightweight, seismic-resistant roofing materials and highly advanced solar integration technologies due to stringent earthquake resilience standards.

- Latin America (Brazil, Mexico): This region exhibits strong demand for durable and aesthetically flexible materials, primarily concrete and clay tiles, preferred for their thermal properties in hot climates and suitability for local architectural styles. The market growth is tied closely to local economic stability and affordable housing initiatives. Demand is highly localized, with significant opportunities in both high-end custom homes seeking imported, premium materials and the mass market requiring durable, locally sourced, cost-efficient solutions.

- Middle East and Africa (MEA): The MEA market is characterized by rapid construction growth, particularly in the UAE and Saudi Arabia, necessitating roofing materials designed to withstand extreme, sustained high temperatures and intense solar radiation. Reflective coatings and highly durable concrete tiles dominate to mitigate heat absorption and reduce cooling loads. The African segment is more nascent but shows potential for materials offering low cost and high thermal mass, essential for improving living conditions in fast-growing urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residential Roofing Market.- GAF Materials Corporation

- Owens Corning

- CertainTeed Corporation (Saint-Gobain)

- IKO Industries Ltd.

- Carlisle Companies Incorporated

- Standard Industries (BMI Group, Icopal)

- Firestone Building Products Company LLC (Holcim Group)

- Atlas Roofing Corporation

- Boral Limited

- Fletcher Building

- Malarkey Roofing Products

- TAMKO Building Products LLC

- Soprema Group

- Dow (DOW Chemical Company)

- Etex Group

- PABCO Roofing Products

- Polyglass USA Inc.

- DECRA Roofing Systems Inc.

- Tesla (Solar Roof Division)

- RGS Energy

Frequently Asked Questions

Analyze common user questions about the Residential Roofing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the shift towards metal and synthetic roofing materials?

The shift is primarily driven by the need for enhanced durability, significantly longer lifespan (50+ years for metal), superior resistance to extreme weather events (hail, high winds), and growing homeowner demand for sustainable, highly recyclable, and energy-efficient roofing solutions. Furthermore, the lower lifecycle maintenance costs associated with premium materials justify the higher initial investment, a critical factor for AEO.

How is AI and drone technology influencing residential roofing installation and inspection processes?

AI and drone technology are streamlining pre-installation phases by enabling rapid, highly accurate digital roof inspections and damage assessments. This speeds up material takeoff generation, improves quoting precision, accelerates insurance claim approvals, and enhances contractor safety by reducing the need for manual, physical roof inspections, leading to overall project efficiency gains.

Which geographic region currently dominates the residential roofing market, and why is this the case?

North America, particularly the United States, dominates the market share due to its vast existing housing stock, high average property value, robust renovation market, and the high frequency of weather-related catastrophic events that necessitate mandatory reroofing cycles driven by insurance reimbursement and increasingly strict local building codes.

What major challenges are restraining the market growth for residential roofing?

Market growth is significantly constrained by persistent volatility in the costs of key raw materials, especially petrochemical derivatives like asphalt, and the chronic shortage of skilled roofing installation labor. These restraints increase operational costs, extend project timelines, and potentially force homeowners to defer necessary maintenance or replacement projects.

What is the significance of Building-Integrated Photovoltaics (BIPV) in the future of residential roofing?

BIPV systems, such as solar shingles and tiles, are highly significant as they seamlessly merge roofing aesthetics with renewable energy generation, transforming the roof from a static structure into an active power source. This technology meets the increasing consumer and regulatory demand for energy independence and net-zero energy home construction, representing a critical long-term growth opportunity in the premium segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager