Residential Solar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432636 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Residential Solar Market Size

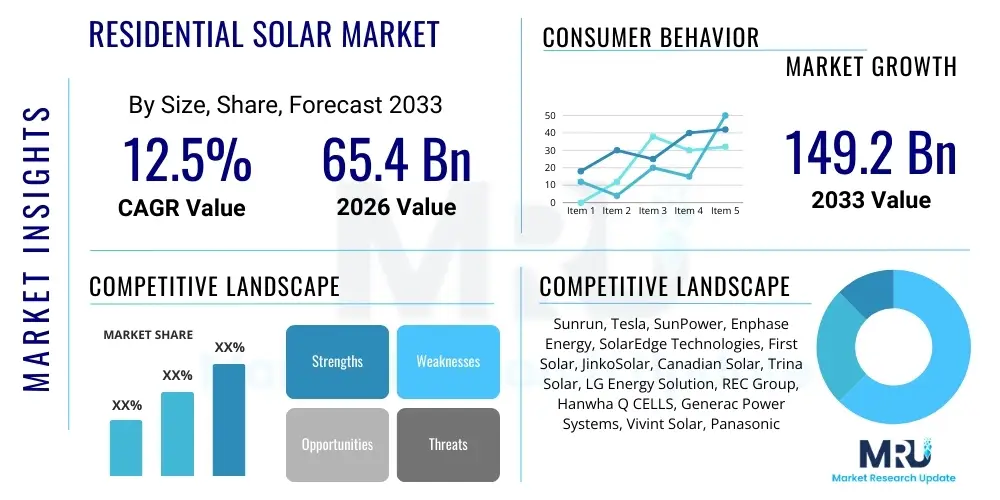

The Residential Solar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 65.4 Billion in 2026 and is projected to reach USD 149.2 Billion by the end of the forecast period in 2033. This robust expansion is fundamentally driven by global governmental mandates favoring renewable energy adoption, coupled with declining system costs facilitated by manufacturing scale efficiencies and technological advancements in photovoltaic (PV) cell efficiency and energy storage integration. The increasing consumer awareness regarding carbon footprints and long-term energy independence further fuels the sustained demand across mature and emerging economies.

The acceleration of the market size is highly dependent on effective policy frameworks, such as feed-in tariffs and net metering policies, which provide financial stability and predictable returns on investment for homeowners. Furthermore, the residential sector is increasingly adopting hybrid solar systems that incorporate battery energy storage systems (BESS), moving beyond simple grid parity towards energy resilience and arbitrage opportunities. This technological shift, combined with competitive financing options like third-party ownership models and Power Purchase Agreements (PPAs), significantly lowers the barrier to entry for a wider demographic of residential consumers, ensuring continuous market scale-up through the forecast horizon.

Residential Solar Market introduction

The Residential Solar Market encompasses the sale, installation, and maintenance of photovoltaic (PV) systems designed specifically for single-family homes and small residential dwellings, converting sunlight directly into electricity. These systems typically comprise solar panels (modules), inverters (to convert DC to usable AC power), mounting structures, and often, integrated battery storage solutions for enhanced self-consumption and backup power during grid outages. Major applications include household electricity generation, water heating, and integration with electric vehicle (EV) charging infrastructure, thereby significantly reducing or eliminating reliance on conventional utility grids. Key benefits derived from residential solar adoption include substantial reductions in monthly electricity bills, increased property value, mitigation of exposure to volatile utility rate hikes, and the environmental advantage of reducing greenhouse gas emissions.

Driving factors propelling this market include favorable regulatory environments globally, particularly tax credits and rebates designed to incentivize solar uptake, such as the Investment Tax Credit (ITC) in the United States and similar schemes across Europe and Asia Pacific. Technological progress leading to higher efficiency modules, particularly the shift towards Monocrystalline PERC (Passivated Emitter Rear Cell) and emerging N-type cell technologies, continually improves the cost-effectiveness of installations. Moreover, the increasing frequency of extreme weather events and grid instability issues emphasizes the essential role of distributed generation, positioning residential solar coupled with storage as a critical component of modern resilient energy infrastructure for homeowners seeking reliability and autonomy from centralized utility services.

Residential Solar Market Executive Summary

The Residential Solar Market is undergoing a rapid transformation characterized by robust business trends focusing on vertical integration and the bundling of solar generation with sophisticated energy management solutions. A primary trend involves major solar installers transitioning into comprehensive home energy service providers, offering integrated PV systems, smart inverters, advanced battery storage, and energy monitoring software under unified contracts. Regionally, the market exhibits divergent growth patterns: North America and Europe demonstrate maturity with high adoption rates driven by established net metering policies and high electricity costs, while the Asia Pacific region, particularly India and Australia, displays explosive growth fueled by new electrification targets, favorable governmental schemes, and increasing urbanization demanding resilient decentralized power sources. Segment trends highlight a significant pivot towards hybrid systems (grid-tied with storage), moving away from basic grid-tied configurations, and a strong preference for high-efficiency Monocrystalline technology, reflecting consumer demand for maximized power output in limited rooftop spaces.

Financial dynamics within the market are leaning towards innovative financing mechanisms, including solar loans and leases, which effectively bypass the high initial capital expenditure challenge for consumers, ensuring widespread market accessibility. Furthermore, supply chain resilience remains a critical factor, with increasing focus on diversified manufacturing outside of traditional hubs to mitigate geopolitical and logistical risks. The integration of digital tools, specifically AI-driven platform solutions for complex project management, site assessment, and performance optimization, is becoming standard practice, enhancing operational efficiency for installers and improving long-term system performance for residential consumers. These concerted business, regional, and segment movements collectively underscore a market moving towards integrated, smart, and highly efficient distributed energy resources tailored specifically for the residential sector.

AI Impact Analysis on Residential Solar Market

User queries regarding the impact of Artificial Intelligence (AI) on the Residential Solar Market primarily center around how AI can reduce soft costs, enhance system performance, and optimize energy management for the homeowner. Common concerns include the reliability of AI-driven forecasting, the security of interconnected smart home energy systems, and the potential for AI to democratize system design and sizing for non-experts. Users specifically seek information on AI's ability to accurately predict solar generation based on localized weather patterns and historical consumption data, optimizing when to store, use, or sell electricity back to the grid. Furthermore, there is strong interest in AI tools that streamline the complex permitting, sales, and installation process, which currently constitute a significant portion of overall installation costs (soft costs), alongside utilizing AI for predictive maintenance and fault detection in installed systems.

The integration of AI is fundamentally transforming the residential solar value chain from initial customer acquisition and system design to long-term operational optimization and maintenance. AI-driven algorithms are enabling highly accurate rooftop suitability assessments using satellite imagery and complex 3D modeling, automating the proposal generation process, thereby significantly compressing sales cycles and reducing labor costs associated with preliminary site visits. Crucially, in post-installation operations, AI algorithms residing within smart inverters and energy management platforms analyze real-time household consumption patterns and dynamic grid pricing signals, allowing the residential battery storage system to intelligently manage energy flow. This optimization maximizes economic return for the homeowner by prioritizing self-consumption during peak utility rates and facilitating participation in emerging virtual power plant (VPP) initiatives, significantly enhancing the overall utility and resilience of residential solar investments.

- AI optimizes system sizing and layout by analyzing geospatial data and shading patterns, minimizing design errors and maximizing energy harvest.

- Predictive maintenance schedules are generated by AI, identifying potential component degradation or faults (e.g., micro-cracks in panels, inverter anomalies) before system failure occurs, thereby increasing uptime.

- AI-enabled energy management systems dynamically control battery charging/discharging based on utility time-of-use rates and forecasted production, maximizing economic savings (arbitrage).

- Automated customer service interfaces and proposal generation tools utilizing Natural Language Processing (NLP) reduce administrative soft costs associated with sales and permitting.

- Sophisticated AI models enhance grid stability by enabling accurate forecasting of residential solar generation variability, crucial for Virtual Power Plant (VPP) aggregation and grid harmonization.

DRO & Impact Forces Of Residential Solar Market

The dynamics of the Residential Solar Market are intensely governed by a combination of powerful drivers (D) and significant restraints (R), creating compelling opportunities (O) and determining the ultimate impact forces that shape adoption curves and technological pathways. Primary drivers include the global mandate for decarbonization, favorable government incentives like tax credits and net metering laws, and the persistent increase in residential electricity tariffs, making solar an economically compelling alternative. Conversely, major restraints encompass the high upfront capital expenditure required for installation, extended and complex permitting and interconnection procedures (soft costs), and the dependence on favorable weather conditions for optimal power generation. These opposing forces dictate market momentum, requiring policy interventions and technological innovations, particularly in financing and installation efficiency, to overcome inherent structural barriers and realize the immense untapped potential within suburban and urban housing landscapes globally.

Opportunities in the sector are abundant, particularly in the realm of integrated solutions, where solar PV systems are coupled with advanced lithium-ion battery storage and smart home energy management platforms, providing homeowners with unparalleled energy autonomy and resilience against grid failures. Furthermore, the expansion into emerging markets, coupled with the rising adoption of electric vehicles (EVs), creates a symbiotic relationship where solar power can directly fuel home transportation needs, acting as a crucial load management tool. Impact forces include the accelerating consumer shift towards sustainable living and the increasing competitive pressure among manufacturers driving down component costs. The critical impact force, however, remains regulatory stability; consistent, long-term policy support is essential for maintaining investor confidence, facilitating large-scale manufacturing expansion, and ensuring continued technological improvements that benefit the residential end-user.

The industry's growth trajectory is largely determined by its ability to address the "soft costs" which, unlike module prices, have proven resistant to rapid decline. These costs, including permitting, inspection, and customer acquisition, represent a substantial restraint, disproportionately affecting profitability and consumer adoption speed. Overcoming this requires standardization of regulatory processes across jurisdictions, coupled with technological solutions like AI-driven site assessment tools and streamlined digital paperwork processing. The most significant opportunity lies in capitalizing on the need for grid decentralization; as centralized grids become more strained, residential solar acts as a vital buffer, providing crucial peak-shaving capacity and forming the basis for resilient, aggregated VPPs, fundamentally changing the relationship between the homeowner and the utility provider from passive consumer to active energy producer and manager.

Segmentation Analysis

The Residential Solar Market is structurally segmented based on how the system interacts with the main utility grid (System Type), the fundamental materials and cell construction used in the modules (Technology), and the specific location of the physical installation (Installation Type). Understanding these segments is crucial for manufacturers and installers to tailor offerings that meet diverse consumer needs, whether prioritizing maximized efficiency in limited space (Monocrystalline technology), seeking maximum reliability through battery integration (Hybrid systems), or optimizing for structural constraints (Roof-Mounted vs. Ground-Mounted). The highest growth is observed in the Hybrid System Type due to rising demand for energy independence and the decreasing cost of battery storage, validating the trend towards holistic residential energy solutions rather than standalone generation assets.

- By System Type:

- Grid-Tied Systems: Systems interconnected with the utility grid, relying on net metering or feed-in tariffs.

- Off-Grid Systems: Standalone systems independent of the grid, requiring mandatory battery storage.

- Hybrid Systems: Systems connected to the grid but also incorporating battery storage for backup and optimized self-consumption.

- By Technology:

- Monocrystalline Silicon: High efficiency, premium cost, suitable for space-constrained rooftops.

- Polycrystalline Silicon: Moderate efficiency, lower cost, historically dominant but declining share.

- Thin Film (Cadmium Telluride, Amorphous Silicon): Lower efficiency, lightweight, niche applications in specific aesthetics or weight restrictions.

- By Installation Type:

- Roof-Mounted Systems: Most common installation, utilizing existing residential structure space.

- Ground-Mounted Systems: Used when sufficient land is available, often allowing optimal tilt and azimuth angles.

Value Chain Analysis For Residential Solar Market

The Residential Solar Market value chain begins with highly capital-intensive upstream activities, primarily involving the sourcing and processing of raw silicon materials, followed by the manufacturing of wafers, cells, and final PV modules. This upstream segment is characterized by global competition, high technological flux, and economies of scale, dominated by major Asian manufacturers who control the majority of global solar cell and module production capacity. Downstream activities involve distribution, marketing, system design, financing, installation, and long-term operations and maintenance (O&M). The crucial link in the chain is the system integrator and installer, who manage logistics, customer relationship management, and regulatory compliance, translating standardized components into a bespoke, functional energy asset for the homeowner, often impacting overall system cost more than the hardware itself.

Distribution channels in the residential segment are multifaceted, ranging from direct sales models where vertically integrated companies handle every step from manufacturing representation to installation (Direct Channel), to indirect models relying heavily on a network of authorized dealers, regional distributors, and independent local installers (Indirect Channel). The trend is increasingly moving towards hybrid models where manufacturers establish strategic partnerships with large regional installers or finance companies to penetrate markets rapidly. The efficiency of the downstream operations, specifically project management and soft cost mitigation, is critical for profitability, as hardware margins have compressed significantly. Successful participants often leverage sophisticated software platforms to automate site assessments, manage inventory, and standardize permitting submissions, creating efficiencies that bypass traditional logistical bottlenecks and significantly enhance customer experience.

Analyzing the critical flow, upstream analysis focuses on polysilicon production and ingot slicing, which dictate the raw material costs and technological advancements like N-type doping for higher efficiency cells. Downstream analysis emphasizes financing innovation—the availability and competitiveness of solar loan products, leases, and PPAs—as these directly influence consumer adoption speed. The transition from upstream component manufacturing towards downstream service provision and integration is evident, highlighting that future market advantage will lie less in module production capacity and more in the ability to aggregate consumer demand, provide attractive financing, and ensure high-quality, streamlined installation services coupled with smart energy management software.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.4 Billion |

| Market Forecast in 2033 | USD 149.2 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sunrun, Tesla, SunPower, Enphase Energy, SolarEdge Technologies, First Solar, JinkoSolar, Canadian Solar, Trina Solar, LG Energy Solution, REC Group, Hanwha Q CELLS, Generac Power Systems, Vivint Solar, Panasonic |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residential Solar Market Key Technology Landscape

The current technology landscape in the residential solar sector is defined by three interconnected pillars: maximizing photovoltaic conversion efficiency, enhancing power electronics intelligence, and ensuring robust energy storage integration. The dominant trend in modules is the rapid adoption of Monocrystalline PERC technology, which is now yielding market share to emerging N-type cells, including TOPCon (Tunnel Oxide Passivated Contact) and HJT (Heterojunction Technology). These next-generation cells promise higher efficiencies (upwards of 25%) and superior performance stability under high temperatures and low light conditions, directly addressing the constraints of limited rooftop space. Concurrently, the increasing deployment of microinverters and DC optimizers (Module-Level Power Electronics, MLPEs) at the module level is critical, as they maximize energy harvest by mitigating the impact of shading and enabling precise remote monitoring of individual panel performance, thereby significantly enhancing system safety and reliability compared to traditional string inverters.

The integration of Battery Energy Storage Systems (BESS) is no longer a niche addition but a fundamental technology component, driving the shift towards hybrid solar solutions. Lithium-ion battery chemistry, predominantly NMC (Nickel Manganese Cobalt) and LFP (Lithium Iron Phosphate), continues to advance, offering increasing energy density, longer cycle life, and improved safety profiles suitable for residential environments. LFP, known for its thermal stability and extended lifespan, is rapidly becoming the preferred choice for home installations. Furthermore, sophisticated energy management software, often utilizing AI and machine learning algorithms, works in conjunction with smart inverters and BESS to optimize the flow of electricity, predicting consumption patterns and responding dynamically to variable utility rates or grid events, thereby realizing the full economic potential of the solar investment.

Future technology focuses on perovskite-silicon tandem cells, promising a theoretical efficiency breakthrough far exceeding the limits of silicon alone, though large-scale commercial viability and durability in residential settings are still under development. Another critical technological advancement involves achieving grid harmonization through highly intelligent, two-way inverters capable of providing services back to the utility grid, such as voltage support and frequency regulation (known as Grid-Forming inverters). This technological evolution positions residential solar systems not just as passive generators but as active, vital components of a modern, decentralized, and highly responsive power grid infrastructure, facilitating greater renewable penetration without compromising network stability.

Regional Highlights

Regional dynamics within the Residential Solar Market showcase significant disparities in adoption maturity, regulatory environments, and consumer preferences, which dictate growth velocity and segmentation leadership across major continents. North America, specifically the United States, represents a mature but continually expanding market, driven primarily by strong federal incentives like the Investment Tax Credit (ITC) and high regional electricity costs, particularly in states like California, Texas, and Florida. The focus here is on high-efficiency rooftop systems coupled with increasingly mandatory battery storage solutions due to frequent power outage events and the phasing out of advantageous net metering structures in key states. Canadian provinces also show steady growth, primarily focusing on cold weather resilience and grid integration.

Europe stands as a leading region for sustainable energy policy, with Germany, the UK, and the Netherlands demonstrating exemplary adoption rates. European growth is highly subsidized by stringent national decarbonization goals, attractive feed-in tariffs (where still implemented), and strong incentives for residential battery storage integration to maximize self-consumption. The high population density often mandates the use of aesthetically integrated, roof-mounted solutions, fueling demand for high-performance, visually appealing modules. Conversely, the Asia Pacific (APAC) region is poised for the most explosive growth, particularly in populous developing nations like India and high-penetration markets like Australia. Australia maintains one of the highest per-capita solar adoption rates globally, driven by abundant sunshine and high electricity prices, while India's massive national solar targets and rural electrification initiatives provide unparalleled growth potential, albeit often utilizing smaller, cost-optimized systems.

Latin America and the Middle East & Africa (MEA) represent emerging frontiers where growth is highly dependent on overcoming infrastructure challenges and securing stable financing mechanisms. Brazil is a notable leader in Latin America, benefiting from net metering and high solar irradiation. The MEA region, while having immense solar potential, requires significant governmental and foreign investment to establish robust residential infrastructure and consumer trust. Overall, regulatory stability, the availability of competitive financing, and regional electricity prices remain the most critical determinants of market performance across all geographies, with the most accelerated growth occurring in regions successfully transitioning away from solely reliance on net metering toward solar-plus-storage models.

- North America (USA & Canada): High maturity, driven by ITC extension, high electricity rates, and mandatory shift towards solar-plus-storage solutions for grid resilience.

- Europe (Germany, UK, Netherlands): Policy-driven growth, strong emphasis on self-consumption optimization, advanced battery integration, and high demand for aesthetically integrated PV solutions.

- Asia Pacific (Australia, India, Japan): Fastest growing region; Australia leads in per-capita adoption; India driven by large-scale governmental renewable energy targets and rural electrification.

- Latin America (Brazil, Mexico): Emerging market potential, supported by excellent irradiation levels, but constrained by financing availability and varying local regulations.

- Middle East and Africa (MEA): Significant untapped potential due to high solar irradiance, requiring large-scale capital investment and policy frameworks to stabilize residential adoption pathways.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residential Solar Market.- Sunrun

- Tesla (Solar Roof and Powerwall)

- SunPower Corporation

- Enphase Energy, Inc.

- SolarEdge Technologies, Inc.

- First Solar, Inc.

- JinkoSolar Holding Co., Ltd.

- Canadian Solar Inc.

- Trina Solar Co., Ltd.

- LG Energy Solution

- REC Group

- Hanwha Q CELLS Co., Ltd.

- Generac Power Systems

- Vivint Solar (now integrated into Sunrun)

- Panasonic Corporation

- Aptos Solar Technology

- Swell Energy

- GoodWe Technologies Co., Ltd.

- Fronius International GmbH

- Meyer Burger Technology AG

Frequently Asked Questions

Analyze common user questions about the Residential Solar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current average payback period for a residential solar system?

The average payback period typically ranges between 5 to 10 years, heavily dependent on regional electricity rates, the scale of federal and state incentives received (like the US ITC), system cost, and the efficiency of the installation. Optimization through self-consumption maximization using battery storage can often shorten this period by avoiding high peak-rate utility charges.

How is the integration of Battery Energy Storage Systems (BESS) changing the residential solar market?

BESS integration is transitioning residential solar from a simple power generator to a resilient energy management system. It allows homeowners to store excess electricity for use during evening peak hours or grid outages, maximizing financial savings through arbitrage, ensuring energy independence, and facilitating participation in Virtual Power Plants (VPPs).

What technological advancements are currently driving down the Levelized Cost of Electricity (LCOE) for residential solar?

Key advancements include the widespread adoption of high-efficiency N-type solar cells (like TOPCon and HJT) which boost power output per square meter. Additionally, sophisticated Module-Level Power Electronics (MLPEs) and AI-driven design optimization software reduce system losses and "soft costs" (labor, permitting), collectively lowering the LCOE.

What is the primary impact of changing net metering policies on new residential solar installations?

As favorable net metering policies are modified or replaced (e.g., NEM 3.0 in California), the financial incentive shifts from selling excess power back to the grid at retail rates towards maximizing self-consumption. This directly drives increased demand for integrated battery storage and sophisticated home energy management systems to ensure economic viability.

What role does financing play in accelerating residential solar adoption?

Innovative financing, including long-term solar loans, leases, and Power Purchase Agreements (PPAs), eliminates the high upfront capital requirement, which is the single largest barrier to entry for many homeowners. These flexible options allow immediate realization of electricity savings, making solar accessible to a broader consumer base and driving rapid market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Lithium Ion Residential Solar Energy Storage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- On Grid Residential Solar PV Module Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Residential Solar Water Heaters Market Statistics 2025 Analysis By Application (Project Contractors, Individual Buyers), By Type (Evacuated Tube Collector, Flat Plate Collector, Unglazed Water Collector), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Residential Solar Power Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Off-grid, Off-grid with Grid Support, Grid-tied, Grid-tied with Battery Back Up), By Application (Cabin, Villa), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Residential Solar Power Generation Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Centralized PV Power Plant, Decentralized PV Power Plant), By Application (Countryside, City), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager