Residential Water Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433943 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Residential Water Pump Market Size

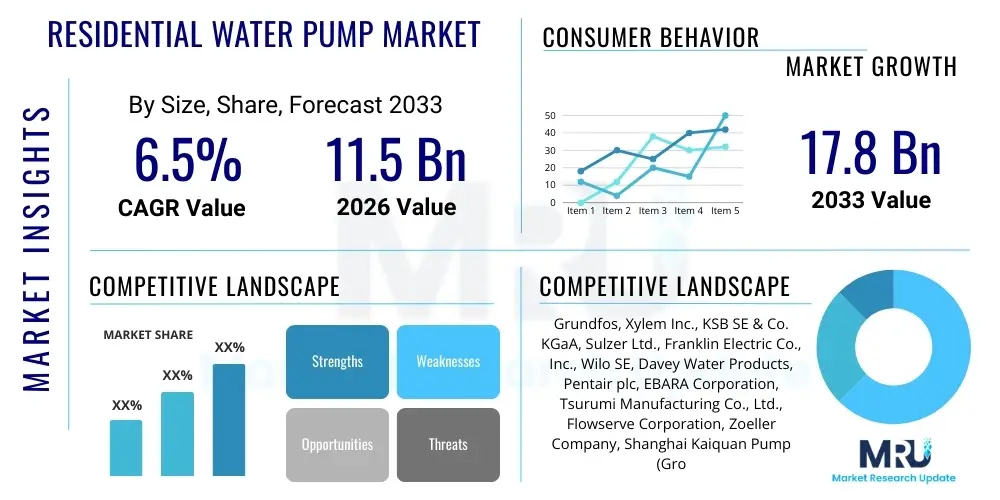

The Residential Water Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 17.8 Billion by the end of the forecast period in 2033.

Residential Water Pump Market introduction

The Residential Water Pump Market encompasses the manufacturing, distribution, and sale of various pumping systems designed specifically for domestic use, primarily addressing needs related to water supply, drainage, pressure boosting, and HVAC circulation within residential properties. These pumps are crucial components in modern household infrastructure, facilitating essential functions such as drawing water from wells or reservoirs (submersible and jet pumps), managing sewage and greywater disposal (sump and sewage pumps), and ensuring optimal water pressure for showers and appliances (booster pumps). The operational efficiency, reliability, and low energy consumption of these systems are primary factors driving consumer choice and technological advancements in this sector. Global urbanization and the expansion of residential construction, particularly in developing economies, underpin the steady demand for reliable water pumping solutions.

Product categories within this market are highly diversified, ranging from centrifugal pumps, which are widely used for general water transfer, to positive displacement pumps, utilized in specific applications requiring consistent flow rates regardless of pressure. Key applications include private residential wells, domestic irrigation systems, rainwater harvesting integration, heating and cooling system circulation, and basement flood prevention. The longevity and maintenance requirements of residential pumps are critical differentiators, prompting manufacturers to invest in materials science and smart diagnostics to extend product lifespan and reduce the total cost of ownership for homeowners. Furthermore, increasing regulatory focus on water conservation and energy efficiency compels manufacturers to develop highly efficient, variable speed drive (VSD) pumps, minimizing environmental impact while maximizing utility for the end-user.

The benefits derived from high-quality residential water pumps are multifaceted, encompassing enhanced water security, improved indoor comfort through consistent water pressure, and protection against property damage from flooding. Driving factors include rapid population growth and the resultant surge in housing starts globally, particularly the trend toward independent and sustainable water sources in rural and peri-urban areas. Additionally, the replacement cycle of older, less efficient pumps, coupled with stringent building codes requiring specific pump types for drainage and sewage management, continuously renews market demand. The integration of IoT capabilities for remote monitoring and predictive maintenance represents a significant technological uplift, further solidifying the market’s growth trajectory and appeal to tech-savvy consumers seeking automated home management solutions.

Residential Water Pump Market Executive Summary

The Residential Water Pump Market demonstrates robust expansion driven by sustained residential construction activity and the increasing global need for efficient water management infrastructure. Business trends indicate a strong shift towards intelligent pumping solutions, characterized by the adoption of Variable Frequency Drives (VFDs) and smart connectivity features that optimize energy usage and provide real-time performance data to homeowners. Major market players are focusing heavily on mergers and acquisitions to consolidate market share and leverage specialized technologies, particularly those relating to sustainable materials and noise reduction. Supply chain resilience, following recent global disruptions, has become a core strategic focus, leading to regionalized manufacturing and dual-sourcing strategies to ensure consistent product availability in high-demand markets. Furthermore, the competitive landscape is intensifying, with differentiation focusing on extended warranties and integrated service models rather than just initial product cost.

Regional trends reveal Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by massive housing development projects, high rates of urbanization, and significant infrastructural investment in countries like China and India, where the demand for basic sanitation and reliable water access remains paramount. North America and Europe, while mature, exhibit strong demand for high-efficiency, premium pumps, driven by stringent energy efficiency standards and consumer preference for sophisticated, silent operation systems suitable for smart home integration. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, spurred by rapid population expansion and government initiatives aimed at improving residential water distribution and pressure management infrastructure, often utilizing standardized, robust pump models.

Segmentation trends highlight the submersible pump category maintaining significant market share, primarily due to its widespread use in boreholes and deep wells across rural areas and self-sufficient properties. However, the booster pump segment is exhibiting the fastest growth, propelled by the renovation market and the demand in multi-story residential buildings to overcome insufficient municipal water pressure. Based on end-use application, the dedicated water supply segment—covering potable water and irrigation—remains the largest, although the wastewater management segment is growing rapidly, reflecting the increasing global necessity for effective domestic sewage and sump management solutions. Technological advancements are continuously blurring the lines between traditional pump types, with manufacturers integrating electronic controls across all segments to enhance operational flexibility and diagnostic capabilities.

AI Impact Analysis on Residential Water Pump Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Residential Water Pump Market commonly revolve around achieving unprecedented levels of energy efficiency, predicting system failures before they occur, and enhancing the seamless integration of pumps within broader smart home ecosystems. Consumers and industry professionals frequently question how AI algorithms can interpret complex operational data (such as pressure fluctuations, vibration patterns, and current draw) to dynamically adjust pump speed and optimize performance under varying conditions, thereby extending component lifespan and reducing utility costs. There is significant interest in AI-powered predictive maintenance frameworks that utilize machine learning models trained on historical failure data to alert homeowners or service providers about impending issues, transforming maintenance from reactive to proactive. Additionally, questions often arise about the feasibility of AI allowing pumps to communicate autonomously with other smart appliances, such as water heaters or irrigation controllers, to coordinate usage and minimize peak load demands. The core theme is leveraging AI to move beyond standard automation toward truly autonomous, optimized, and failure-resistant residential water management.

The integration of AI into residential water pump controllers facilitates a paradigm shift in how these devices operate and interact with the home environment. AI algorithms enable pumps to learn the unique water consumption patterns of a household, distinguishing between normal usage fluctuations and potential leaks or system anomalies. This learning capability allows the pump to operate only at the required pressure and flow rate, minimizing wasted energy that fixed-speed pumps often incur. For instance, an AI-driven pump can analyze historical data to anticipate peak usage times and pre-prime the system, or conversely, enter deep sleep mode when usage is historically low, ensuring optimal system response time and substantial energy savings. This intelligent management not only cuts costs but also positions the pump as a central, proactive component of the home's water infrastructure.

Furthermore, AI significantly enhances diagnostic capabilities, moving beyond simple error codes to sophisticated root cause analysis. Embedded AI systems monitor multiple performance metrics simultaneously, detecting subtle deviations that might indicate wear and tear, cavitation, or blockages long before they lead to catastrophic failure. This predictive capacity is highly valuable in residential settings where unexpected pump failure can lead to significant inconvenience or property damage, especially with sump or sewage pumps. The collected data, processed via cloud-based AI services, also feeds back into manufacturing, accelerating product iteration and improving the reliability of future pump models, creating a continuous improvement loop that benefits the entire market ecosystem by raising the overall standard of residential water technology reliability.

- AI enables Predictive Maintenance by analyzing vibration and performance data to forecast component failure.

- Implementation of Dynamic Efficiency Optimization using machine learning to match pump output precisely to real-time household demand.

- Facilitates seamless IoT and Smart Home Integration, allowing pumps to communicate with central home automation hubs and conservation systems.

- Enhances Leak Detection Capabilities through pattern recognition, identifying unusual consumption spikes indicative of plumbing issues.

- Drives development of Self-Calibrating Systems that automatically adjust settings post-installation or during seasonal usage changes.

DRO & Impact Forces Of Residential Water Pump Market

The Residential Water Pump Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively shape the competitive landscape and technological trajectory. Primary drivers center on accelerating global urbanization trends, which necessitate the deployment of reliable pumping infrastructure in new housing developments and the continuous upgrading of aging urban water systems. The increasing scarcity and fluctuating pressure of municipal water supplies in many regions push homeowners towards independent water solutions, such as borewells and rainwater harvesting, directly driving demand for submersible and small centrifugal pumps. Furthermore, heightened consumer awareness regarding energy costs and environmental sustainability acts as a crucial propellant, making high-efficiency pumps with VFD technology increasingly desirable, thereby accelerating the replacement cycle of older, less efficient units currently installed in millions of homes globally. Regulatory mandates concerning building efficiency and water discharge standards provide a non-negotiable floor for technological advancement and market expansion.

However, the market faces significant restraints that temper its growth potential. High initial investment costs associated with premium, smart, and VFD-equipped pumps often deter budget-conscious consumers, particularly in price-sensitive emerging economies, leading to continued reliance on cheaper, less efficient alternatives that ultimately increase long-term operational costs. Moreover, the lack of standardized installation and maintenance skills across certain geographies poses a logistical challenge; incorrect installation can drastically reduce pump lifespan and efficiency, generating negative consumer perception. Fluctuations in raw material prices, particularly for critical components like copper, stainless steel, and specialized plastics used in pump casings and impellers, introduce volatility in manufacturing costs and final product pricing, complicating strategic forecasting for market players. Intellectual property disputes related to advanced pump hydraulics and control mechanisms also present occasional legal friction within the industry.

Despite these restraints, substantial opportunities exist, predominantly fueled by innovation and unmet infrastructural needs. The greatest opportunity lies in the further development and mass-market deployment of smart, connected pumps that integrate seamlessly with smart grid technology, allowing pumps to operate during off-peak electricity hours, enhancing overall grid stability and reducing household energy expenditure. The massive potential in retrofitting existing residential structures with modern, sustainable water solutions, particularly in drought-prone areas, offers a long-term revenue stream for service providers and manufacturers alike. Additionally, the market for specialized pumps catering to renewable energy-powered systems, such as solar water pumping for off-grid homes or remote residential complexes, represents a burgeoning niche with high growth potential, capitalizing on the broader global transition towards decentralized energy sources. Successfully navigating the balance between optimizing supply chains and achieving cost competitiveness while embedding advanced smart technology will determine the long-term winners in this evolving market.

Segmentation Analysis

The Residential Water Pump Market is segmented based on critical attributes that define product usage, technology, and application scope, providing a detailed view of demand patterns across various residential settings. Key segmentation criteria include the type of pump mechanism, the power source utilized, and the specific application the pump serves within the home. This comprehensive segmentation allows market participants to tailor their product offerings and marketing strategies to specific end-user needs, addressing the divergent demands for high-pressure boosting in urban apartments versus high-volume water extraction in rural properties. The core segments reflect the functional necessity of the pump, whether it is for clean water supply, circulation management, or efficient wastewater disposal.

Analyzing these segments reveals shifts in consumer preference driven by efficiency and convenience. For example, while standard centrifugal pumps dominate general transfer applications due to their cost-effectiveness and robustness, the Variable Speed Pump (VSP) segment is rapidly gaining traction due as regulatory pushes and consumer demands for energy optimization intensify, despite higher initial purchasing costs. Application-wise, irrigation and lawn care pumps, especially those integrated with smart scheduling and weather data, show promising growth as water conservation becomes a high priority for homeowners globally. Understanding the interconnected growth rates between technology segments (like VFD integration) and application segments (like residential fire suppression systems or dedicated rainwater harvesting) is vital for accurate market forecasting and capital investment decisions in R&D.

- By Product Type:

- Centrifugal Pumps

- Submersible Pumps (Borehole, Sump, Utility)

- Jet Pumps

- Booster Pumps (Pressure Control Systems)

- Circulator Pumps (HVAC, Solar Hot Water)

- Positive Displacement Pumps (Diaphragm, Peristaltic)

- By Technology:

- Conventional Fixed Speed Pumps

- Variable Speed Drive (VSD) Pumps

- Solar Powered Pumps

- Smart/IoT Enabled Pumps

- By Application:

- Water Supply from Wells/Boreholes

- Pressure Boosting (Domestic Water Systems)

- Wastewater Management (Sump, Sewage, Effluent)

- Rainwater Harvesting and Transfer

- HVAC Circulation (Heating and Cooling)

- By Power Rating:

- Below 1 HP

- 1 HP to 5 HP

- Above 5 HP

- By Installation Type:

- Surface Mounted

- Submersible

Value Chain Analysis For Residential Water Pump Market

The value chain for the Residential Water Pump Market commences with the upstream activities centered on the procurement and processing of fundamental raw materials, including specialized plastics, cast iron, stainless steel, aluminum, and copper for motor windings. Key upstream suppliers include metallurgy firms, electronic component manufacturers (for VFDs and controllers), and specialized rubber and seal producers. The quality and cost volatility of these inputs directly influence the final manufacturing cost and the durability of the finished pump product. Manufacturers rely heavily on strategic partnerships with these suppliers to ensure material specifications meet stringent performance and regulatory requirements, particularly concerning potable water safety standards and energy efficiency mandates. Effective inventory management and risk mitigation strategies against supply chain disruptions are crucial at this initial stage.

The core manufacturing stage involves design, assembly, and quality assurance, where raw materials are transformed into finished pump systems. Design innovation, particularly in hydraulic efficiency, noise reduction, and smart controls integration, adds significant value here. Manufacturers range from large multinational corporations with vertically integrated operations to smaller, specialized pump makers focusing on niche applications or specific geographies. Midstream activities also encompass extensive testing and certification to meet regional standards (e.g., NSF, UL, CE) before the products enter the distribution network. The move towards modular design and standardized components is a continuous effort to streamline manufacturing processes and reduce production lead times, enhancing market responsiveness.

Downstream distribution channels are multifaceted, utilizing both direct and indirect routes to reach the end consumer. Indirect channels, which include wholesalers, specialized plumbing distributors, hardware retailers (DIY stores), and e-commerce platforms, represent the bulk of residential sales, leveraging established networks for volume distribution. Direct channels typically involve sales through dedicated contractor networks, authorized service centers, and, increasingly, direct-to-consumer online sales for specialized or high-end smart pump systems. The selection of distribution channel depends on the product complexity and target demographic; commodity pumps are highly reliant on retail chains, whereas complex VFD systems often require specialized contractors for installation and commissioning, making professional distribution networks paramount for effective market penetration and after-sales support. The final stage involves installation, commissioning, and subsequent maintenance and repair services provided by licensed plumbing professionals, which constitute a vital component of the aftermarket value stream.

Residential Water Pump Market Potential Customers

The primary consumers and end-users of residential water pumps are homeowners, real estate developers, and construction companies involved in building new residential structures, ranging from single-family homes to large multi-unit apartment complexes. Homeowners represent a significant portion of the aftermarket, driving demand for replacement pumps, upgrades (such as shifting from conventional to VFD-equipped booster pumps to improve water pressure and save energy), and new installations required for home additions, well drilling projects, or specialized systems like rainwater harvesting. Their purchasing decisions are highly influenced by product reliability, energy rating, noise level, and ease of maintenance, often relying on the advice of professional plumbers or contractors. This segment is increasingly focused on smart, integrated solutions that offer remote monitoring and diagnostic capabilities via mobile applications.

Real estate developers and large-scale builders constitute the original equipment manufacturer (OEM) market segment, demanding pumps in bulk for new construction projects. Their focus is primarily on competitive pricing, compliance with strict building codes, consistency in performance, and long-term warranties that minimize liability after installation. For multi-story residential buildings, the demand is particularly high for sophisticated multi-stage booster pump sets that ensure adequate pressure on the highest floors. Suppliers that can offer comprehensive product portfolios, covering everything from sewage ejectors to potable water supply, and provide technical support throughout the construction phase, are highly favored in this segment.

A secondary, yet crucial, segment of potential customers includes local governments, housing associations, and non-profit organizations involved in public housing and community development projects, particularly in emerging markets where improving access to clean water and sanitation is a priority. These institutional buyers typically purchase robust, standardized pump systems designed for longevity and resilience in challenging operating environments. Furthermore, plumbing contractors and specialized system integrators act as critical indirect customers, as they are the direct purchasers and specifiers of pumps for their residential clients, making them key influencers in the final purchasing decision across both the new construction and retrofit markets. Engaging with and training these professional installers is essential for achieving broad market adoption of new pump technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 17.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grundfos, Xylem Inc., KSB SE & Co. KGaA, Sulzer Ltd., Franklin Electric Co., Inc., Wilo SE, Davey Water Products, Pentair plc, EBARA Corporation, Tsurumi Manufacturing Co., Ltd., Flowserve Corporation, Zoeller Company, Shanghai Kaiquan Pump (Group) Co., Ltd., The Gorman-Rupp Company, VOGELSANG GmbH & Co. KG, CNP Pumps, CRI Pumps, LEO Group, Pedrollo S.p.A., DAB PUMPS S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residential Water Pump Market Key Technology Landscape

The technological landscape of the residential water pump market is rapidly evolving, moving decisively towards intelligent, energy-saving systems. The most critical technological shift is the widespread adoption of Variable Speed Drive (VSD) or Variable Frequency Drive (VFD) technology. VSD pumps utilize sophisticated electronic controls to adjust the motor speed continuously in response to real-time water demand, ensuring the pump only uses the exact energy required, unlike conventional fixed-speed pumps which run at maximum power regardless of the load. This not only results in significant energy savings—often reducing consumption by 30% to 50%—but also minimizes wear and tear on mechanical components, leading to an extended service life and reduced maintenance frequency. Manufacturers are embedding these VSD controls directly into the motor housing, making them compact and easy to install for residential applications, thereby accelerating their acceptance in both new construction and retrofit projects.

A parallel significant trend is the integration of Internet of Things (IoT) and smart connectivity features. Modern residential pumps are increasingly equipped with built-in Wi-Fi or Bluetooth modules, allowing them to connect to home networks and cloud platforms. This connectivity facilitates remote monitoring, enabling homeowners to track operational status, energy consumption, and set personalized schedules via mobile applications. Furthermore, these smart pumps can self-diagnose minor faults and send proactive alerts about necessary maintenance, shifting the burden of system oversight away from the user. This level of connectivity is essential for integrating the pump into broader smart home automation systems, optimizing water usage based on weather forecasts, or coordinating pump operation with energy management systems to minimize utility costs.

Material science innovation also plays a vital role in enhancing pump performance and durability. There is an increasing focus on using corrosion-resistant materials such as high-grade stainless steel, specialized engineering plastics, and composite materials for impellers and pump casings. This advancement is particularly important for pumps handling challenging fluids, such as abrasive well water or corrosive sewage effluent. Furthermore, advancements in motor technology, including the adoption of Permanent Magnet Synchronous Motors (PMSMs), offer higher power density and efficiency compared to traditional induction motors. Collectively, these technological advancements are transforming the residential water pump from a basic mechanical device into a sophisticated, energy-managing, and digitally connected appliance, justifying the premium price points associated with the next generation of residential pumping solutions.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, primarily driven by rapid urbanization, massive infrastructure development, and a booming residential construction sector in countries like China, India, and Southeast Asian nations. The region exhibits high demand for basic submersible pumps for groundwater access and an accelerating demand for booster pumps in rapidly growing urban high-rises to manage water pressure inconsistencies. Government initiatives focused on improving sanitation and clean water access also heavily subsidize pump adoption, particularly in peri-urban and rural residential zones.

- North America: This region is characterized by high demand for advanced, premium products, with a strong emphasis on energy efficiency (driven by Energy Star ratings) and smart features. The market sees steady demand for replacement pumps in mature housing stock and significant uptake of high-efficiency VFD booster pumps and sophisticated sump pump systems (often with battery backups) due to severe weather events and flood risk in many areas. The US leads in the adoption of smart home-integrated pump controls.

- Europe: Europe represents a mature market focused heavily on sustainability and strict regulatory compliance (e.g., the Ecodesign Directive). Demand is robust for highly efficient circulator pumps used in domestic heating and cooling systems (HVAC), driven by the transition away from fossil fuels towards heat pump technology in residential buildings. Germany, France, and the UK are key markets favoring quiet, reliable, and highly engineered residential pumps, often incorporating sophisticated pressure control systems.

- Latin America (LATAM): The LATAM market is experiencing significant growth fueled by infrastructure investment and housing needs in metropolitan areas like Brazil and Mexico. Demand is generally split between affordable, robust standard pumps for basic water supply and high-pressure booster systems required to overcome low municipal pressure in densely populated, older urban centers. Market penetration of smart pump technology is increasing but remains secondary to reliability and cost-effectiveness.

- Middle East and Africa (MEA): This region offers high growth potential, particularly in the GCC countries (due to massive luxury residential developments) and rapidly developing African nations seeking to improve household water security. The extreme reliance on groundwater in many parts of the Middle East drives substantial demand for durable, high-head submersible pumps. Solar-powered residential pumps are gaining significant traction in remote and off-grid residential areas of Africa due to unreliable grid infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residential Water Pump Market.- Grundfos

- Xylem Inc.

- KSB SE & Co. KGaA

- Sulzer Ltd.

- Franklin Electric Co., Inc.

- Wilo SE

- Davey Water Products

- Pentair plc

- EBARA Corporation

- Tsurumi Manufacturing Co., Ltd.

- Flowserve Corporation

- Zoeller Company

- Shanghai Kaiquan Pump (Group) Co., Ltd.

- The Gorman-Rupp Company

- VOGELSANG GmbH & Co. KG

- CNP Pumps

- CRI Pumps

- LEO Group

- Pedrollo S.p.A.

- DAB PUMPS S.p.A.

Frequently Asked Questions

Analyze common user questions about the Residential Water Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Variable Speed Drive (VSD) residential pumps?

The primary driver for VSD pump adoption is enhanced energy efficiency and substantial long-term cost savings. VSD technology dynamically adjusts motor speed to match fluctuating household water demand, minimizing wasted energy inherent in fixed-speed pumps that always run at maximum capacity. This optimization not only reduces utility bills but also extends the pump's operational life by reducing stress on internal components.

How do smart residential pumps integrate into the broader smart home ecosystem?

Smart residential pumps integrate using IoT connectivity (Wi-Fi/Bluetooth) to communicate performance data and status updates to central smart home hubs and mobile apps. This allows for remote control, system diagnostics, and coordination with other appliances, such as irrigation controllers or water filtration systems, ensuring optimized scheduling and proactive maintenance alerts for potential issues like leaks or system wear.

Which regional market shows the highest growth potential for new residential pump installations?

The Asia Pacific (APAC) region exhibits the highest growth potential, particularly driven by rapid urbanization and extensive residential development in emerging economies like India and China. The sheer volume of new housing units, coupled with ongoing infrastructure investment to improve water supply and sanitation, ensures sustained, high demand across all pump categories in this region throughout the forecast period.

What are the key differences between submersible pumps and jet pumps for residential well applications?

Submersible pumps are installed inside the well below the water line, pushing water upwards, making them highly effective for deep wells as they utilize natural water pressure to aid operation. Jet pumps, conversely, are installed above ground and utilize suction and pressure jet systems to draw water. While jet pumps are easier to service, submersible pumps are generally more efficient for deeper applications and operate significantly quieter.

What major restraints impede the faster technological transition in the residential pump market?

The primary restraint is the higher initial capital expenditure required for advanced technologies, such as VSD and AI-enabled smart pumps, compared to conventional fixed-speed models. This cost barrier is significant for consumers in price-sensitive markets. Additionally, the lack of widespread standardization and the need for specialized training for installers sometimes hinders the smooth adoption and optimal utilization of these complex systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager