Residential Wine Cabinets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433931 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Residential Wine Cabinets Market Size

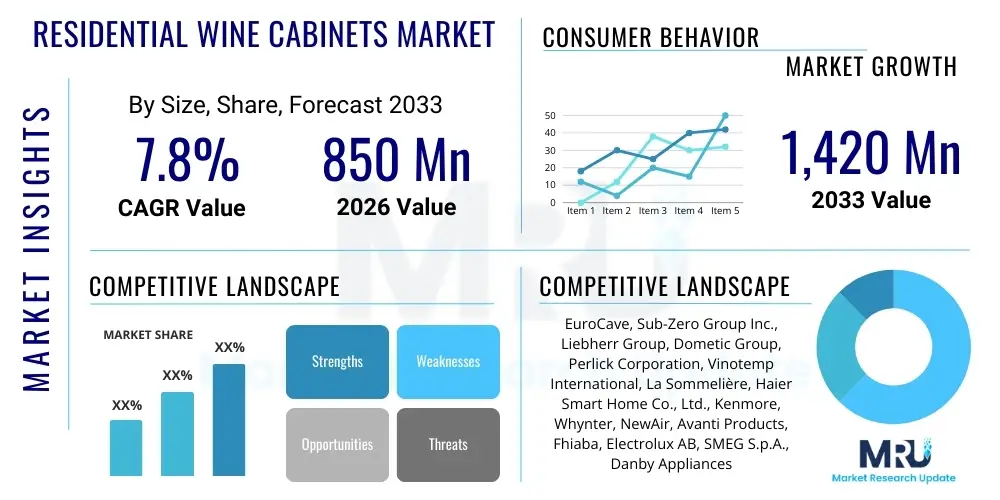

The Residential Wine Cabinets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,420 Million by the end of the forecast period in 2033.

Residential Wine Cabinets Market introduction

The Residential Wine Cabinets Market encompasses the sale of specialized climate-controlled storage units designed for preserving and aging wine collections within private residences. These cabinets, often referred to as wine refrigerators or cellars, maintain optimal temperature, humidity, and UV protection crucial for preventing wine spoilage and ensuring long-term quality. The primary products include freestanding units suitable for immediate placement and built-in models seamlessly integrated into kitchen cabinetry or dedicated entertainment areas. This market is driven significantly by the global expansion of wine appreciation, increased disposable income among affluent consumers, and the rising popularity of home entertaining, which necessitates professional-grade storage solutions.

Residential wine cabinets serve a diverse range of applications, from short-term storage for immediate consumption to long-term aging for valuable vintages. Major applications span modern kitchens, dedicated home bars, dining rooms, and custom-built home cellars, where aesthetics and performance are equally prioritized. Key product benefits include precise temperature zone control, vibration dampening technology to protect sediment, and filtered air circulation to prevent cork drying or mold growth. These features differentiate high-end wine cabinets from standard refrigeration units, making them essential investments for serious collectors and casual enthusiasts alike.

The core driving factors propelling market expansion include the increasing volume of fine wine consumption worldwide, the rising trend of luxury home renovations incorporating high-end appliances, and technological advancements such as dual-zone cooling and smart connectivity features. Moreover, the shift in consumer lifestyle towards experiential luxury, where curated home environments reflecting personal tastes are paramount, strongly supports the demand for specialized, aesthetically pleasing wine storage solutions. The market is thus positioned for sustained growth, underpinned by both functional necessity for wine preservation and aspirational demand for premium home amenities.

Residential Wine Cabinets Market Executive Summary

The Residential Wine Cabinets Market is experiencing robust growth driven primarily by shifting business trends towards customized and smart storage solutions. Manufacturers are focusing heavily on integrating IoT capabilities, allowing users remote temperature monitoring and inventory management, thereby positioning wine cabinets as sophisticated smart home appliances. Business strategies emphasize premiumization, offering units with advanced features like variable humidity control, anti-vibration systems, and diverse aesthetic finishes (stainless steel, wood veneer) to cater to discerning luxury segments. The primary trend observed is the increasing demand for seamless integration, pushing the built-in segment to outperform freestanding units in high-end new constructions and renovation projects across developed economies.

Regionally, North America and Europe remain the dominant markets due to deeply ingrained wine cultures, high per capita expenditure on luxury home goods, and established distribution networks. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid urbanization, the expansion of the middle-to-affluent class in countries like China and India, and the rising interest in Western luxury lifestyles, including fine wine collecting. Governments in these regions are also observing increased focus on improving supply chain logistics, which supports the easier import and distribution of specialized appliances, driving demand in metropolitan hubs.

Segment trends reveal that cabinets with medium capacity (50-150 bottles) dominate the market, balancing storage needs with spatial constraints in typical residential settings. Furthermore, compressor-based cooling technology holds the largest market share due to its superior efficiency, reliability, and ability to maintain stable temperatures regardless of ambient conditions, which is crucial for long-term aging. The distribution landscape is also evolving, with online sales channels gaining traction, especially for standard models, while specialty retailers remain vital for custom orders and providing expert consultation required for high-investment, large-capacity units.

AI Impact Analysis on Residential Wine Cabinets Market

User inquiries concerning AI integration in residential wine cabinets frequently revolve around inventory management, predictive maintenance, and optimal aging recommendations. Consumers are keen to understand how AI can automate tedious tasks such as cataloging their collection, tracking consumption, and identifying bottles nearing their peak drinking window. Concerns often focus on data security, ease of use for non-technical users, and the necessity of such advanced features given the traditional nature of wine storage. Expectations are high regarding AI’s ability to optimize energy consumption based on usage patterns and ambient conditions, thus enhancing both the functional performance and the sustainability profile of the cabinet. Overall, users expect AI to transition the wine cabinet from a passive storage unit to an active, intelligent management system for their collection.

- AI-powered inventory systems using visual recognition and weight sensors to catalog bottles automatically.

- Predictive maintenance algorithms monitoring compressor health and thermal regulation systems, alerting users to potential failures.

- Optimized cooling cycles based on ambient temperature fluctuations and learned user access patterns, improving energy efficiency (smart energy management).

- Integration with external wine databases to provide real-time aging status, tasting notes, and suggested serving temperatures based on specific vintage and varietal data.

- Personalized purchasing recommendations linked to the user's existing inventory and consumption history.

DRO & Impact Forces Of Residential Wine Cabinets Market

The market dynamics are governed by a complex interplay of forces. Key drivers include the global expansion of luxury real estate and the associated demand for high-end home amenities, coupled with a discernible cultural shift towards premiumization of home consumption experiences, making dedicated wine storage a status symbol rather than just a functional appliance. This is strongly supported by consistent growth in disposable incomes in emerging economies. However, market growth faces significant restraints, primarily the high initial purchase price and operational costs of sophisticated cabinets, making them inaccessible to broader consumer segments. Furthermore, the constraint of limited space in densely populated urban residential units restricts the installation of larger, more comprehensive storage solutions, often forcing consumers to opt for smaller or multi-purpose alternatives.

Opportunities for growth are plentiful, centered predominantly around technological innovation and market customization. The proliferation of smart home ecosystems presents a massive opportunity for manufacturers to integrate wine cabinets fully into centralized home management systems, offering seamless connectivity and remote diagnostics. Moreover, the increasing consumer focus on sustainability is driving demand for energy-efficient cooling technologies (e.g., advanced inverter compressors and improved insulation), which savvy companies can capitalize on through targeted product development. Customization, including modular designs and bespoke aesthetics tailored to unique kitchen designs, represents a substantial high-margin opportunity, especially in the affluent market segments.

The overall impact forces are moderately positive. The driving forces, especially the persistent increase in wealth and global wine culture adoption, exert strong upward pressure. While restraints such such as high costs and urban density pose structural challenges, the numerous opportunities arising from technology and design innovation are expected to mitigate these limitations effectively. This positive equilibrium suggests sustained, yet measured, growth over the forecast period, with market players needing to balance cost efficiency with feature richness to maximize competitive advantage. The ability of manufacturers to address the spatial constraints through slim-line and modular designs will be critical in unlocking further demand in mature markets.

Segmentation Analysis

The Residential Wine Cabinets Market is critically segmented based on product type, cooling technology, capacity, and distribution channel, allowing manufacturers to target specific consumer needs ranging from casual drinkers requiring small, budget-friendly units to serious collectors demanding high-capacity, climate-precise cellaring solutions. The Type segmentation distinguishes between built-in models, favored for their aesthetic integration into modern kitchens, and freestanding units, which offer flexibility and easy installation. Understanding these segments is vital for developing targeted marketing strategies, particularly as the demand shifts towards built-in options driven by luxury home design trends.

Cooling technology segmentation separates the market based on underlying mechanisms: compressor-based systems, which offer superior cooling power and stability essential for high-volume storage, and thermoelectric systems, which are quieter and more energy-efficient for smaller-capacity applications where precise temperature stability is less critical. Furthermore, capacity segmentation dictates the primary buyer profile, with large capacity units (above 150 bottles) primarily serving dedicated collectors, while smaller units cater to typical household consumption. Detailed analysis of these segments helps stakeholders allocate resources effectively, ensuring product development aligns with the most lucrative and fastest-growing niches.

- By Type

- Built-in Wine Cabinets

- Freestanding Wine Cabinets

- By Cooling Technology

- Compressor-based

- Thermoelectric

- By Capacity

- Under 50 Bottles

- 50-150 Bottles

- Above 150 Bottles

- By Distribution Channel

- Offline (Specialty Stores, Retail Chains, Home Improvement Stores)

- Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Residential Wine Cabinets Market

The value chain for residential wine cabinets commences with upstream activities involving the sourcing of core components, including high-efficiency compressors, insulating materials (e.g., low-emissivity glass and specialized foam), electronic controls, and high-quality cabinet materials (stainless steel, specialized woods). Key challenges in the upstream segment include maintaining component quality and navigating global supply chain volatility, particularly concerning semiconductor chips used in advanced control boards and sensors. Manufacturers often establish long-term contracts with specialized component suppliers to ensure stable pricing and quality, which is crucial given the high reliability required of wine preservation equipment.

Manufacturing and assembly constitute the core midstream activities, where components are integrated, and complex refrigeration systems are calibrated to meet stringent temperature and humidity specifications. This stage includes meticulous quality control, testing for vibration dampening, and ensuring the aesthetic finish meets luxury standards. Downstream activities focus heavily on distribution and sales. Distribution channels are bifurcated into direct sales, often used for custom, high-end installations requiring expert consultation, and indirect sales via retail chains, specialized appliance stores, and rapidly growing e-commerce platforms. The distribution strategy must account for the product's fragility and size, necessitating specialized logistics partners capable of handling large, sensitive appliances.

Direct distribution, though costly, allows manufacturers greater control over brand presentation and customer experience, vital for maintaining a luxury image. Indirect channels, particularly specialty appliance retailers, provide crucial showroom experiences where customers can assess size, finish, and operational noise levels—critical purchasing criteria. Post-sales service, including specialized installation and warranty support for refrigeration components, represents a crucial link in the value chain, heavily influencing brand loyalty and repurchase decisions. The effectiveness of the overall value chain relies on minimizing component costs upstream while maximizing perceived value and service quality downstream.

Residential Wine Cabinets Market Potential Customers

The primary end-users and buyers in the Residential Wine Cabinets Market are affluent homeowners, dedicated wine enthusiasts, and individuals involved in new luxury residential construction or extensive home remodeling projects. These consumers prioritize precision climate control, aesthetic integration, and reliable long-term performance necessary for preserving valuable and aging wine collections. They are willing to invest significantly in products that offer advanced features such as multiple temperature zones, controlled humidity levels, and premium anti-vibration technology, often viewing the cabinet as a vital piece of kitchen or entertainment infrastructure.

A secondary, yet rapidly expanding, customer base includes younger, upwardly mobile consumers who are adopting wine consumption as part of their lifestyle but lack dedicated cellar space. This demographic typically targets medium-capacity, freestanding units that prioritize contemporary design and digital integration (smart features). These buyers are often influenced by online reviews and aesthetic trends, favoring sleek, energy-efficient models that fit seamlessly into smaller apartment or condo settings. Retailers must tailor product offerings and financing options specifically to this growing, tech-savvy segment.

In the context of the construction industry, custom home builders and interior designers represent indirect but highly influential buyers. They select specific cabinet models as part of a high-specification package for their clientele, emphasizing brand recognition, reliability, and ease of integration into complex architectural plans. Catering to these professionals requires providing detailed technical specifications, flexible installation guidelines, and establishing strong B2B relationships with architects and contractors to ensure products are included in preliminary design blueprints.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,420 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EuroCave, Sub-Zero Group Inc., Liebherr Group, Dometic Group, Perlick Corporation, Vinotemp International, La Sommelière, Haier Smart Home Co., Ltd., Kenmore, Whynter, NewAir, Avanti Products, Fhiaba, Electrolux AB, SMEG S.p.A., Danby Appliances, Marvel Refrigeration, U-Line Corporation, BODEGA Wine Cooler, Summit Appliance. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residential Wine Cabinets Market Key Technology Landscape

The technological landscape of residential wine cabinets is focused predominantly on enhancing temperature and humidity precision, minimizing vibration, and improving energy efficiency, aligning with consumer demand for professional-grade preservation and environmental responsibility. The adoption of advanced inverter compressors is a significant trend, as these units adjust cooling speed continuously rather than cycling on and off, resulting in quieter operation, reduced energy consumption, and superior temperature stability—a non-negotiable requirement for high-value wine storage. Furthermore, specialized vapor barrier insulation and triple-pane, UV-resistant glass doors are standard features, crucial for preventing temperature fluctuation and blocking harmful light exposure without compromising aesthetic appeal.

Connectivity and smart features represent the fastest-growing technological segment. Modern cabinets incorporate Wi-Fi and Bluetooth capabilities, allowing remote monitoring and adjustment via smartphone applications. This enables users to receive alerts regarding temperature excursions or door left ajar, ensuring proactive protection of the stored vintages. Additionally, sophisticated digital control interfaces often feature specialized modes for white, red, and sparkling wines, optimizing storage conditions based on specific needs. Future innovations are expected to leverage machine learning for predictive inventory management and proactive maintenance alerts, further solidifying the cabinet’s role within the smart home ecosystem.

Beyond cooling mechanics, technologies related to internal design and airflow are vital. Activated charcoal filters are commonly employed to neutralize odors that could permeate corks and taint the wine. Specialized shelving systems, often made of durable wood (like beech or oak) and mounted on telescopic slides, are designed with anti-vibration mechanisms. These systems minimize movement when bottles are accessed, preventing sediment agitation. Manufacturers are also exploring non-CFC refrigerants and magnetic cooling systems in line with evolving international environmental regulations, positioning technological sustainability as a key competitive differentiator in the high-end market.

Regional Highlights

- North America: North America holds a substantial share of the residential wine cabinets market, driven by a mature market for premium home appliances, high consumer spending power, and a strong culture of wine collecting, particularly in the United States and Canada. The region demonstrates high demand for built-in, integrated units that feature multi-zone cooling and smart connectivity, reflecting the widespread adoption of smart home technology. Market growth is sustained by the continuous high rate of luxury home renovations and new high-end construction, especially in major metropolitan areas, where consumers prioritize aesthetic integration and professional-grade preservation features.

- Europe: Europe is a key historical market, benefiting from ancient and established wine-producing and consuming cultures, particularly in countries like France, Italy, and Spain. The demand here is characterized by a high emphasis on longevity, craftsmanship, and energy efficiency, often dictated by stringent European Union energy efficiency standards. Consumers typically prefer cabinets that offer both aesthetic elegance and robust preservation technology suitable for long-term aging, favoring established European luxury appliance brands. Western Europe remains dominant, although Eastern European markets are showing increased growth rates supported by rising wealth and evolving luxury consumer tastes.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market over the forecast period. This rapid expansion is fueled by unprecedented growth in disposable income among the urban affluent population, particularly in China, Japan, and Australia. The emerging wine culture and the adoption of Western luxury lifestyles are driving demand. While traditionally favoring freestanding units, the market is rapidly shifting toward high-capacity, sophisticated built-in models in newly constructed luxury apartments and villas, especially those units offering humidity control necessary for the region's diverse climate zones.

- Latin America: The Latin American market exhibits moderate growth, concentrated mainly in economically stable countries like Brazil, Mexico, and Chile, which also have significant local wine production industries. Market demand is sensitive to economic fluctuations but shows a steady preference for reliable, mid-range capacity cabinets. Distribution relies heavily on specialized import channels and appliance retailers catering to affluent demographics in major cities. Investment in robust cooling systems is a necessity due to often high ambient temperatures and inconsistent power supply in certain areas.

- Middle East and Africa (MEA): The MEA market, while smaller, is growing specifically within the GCC states (UAE, Saudi Arabia) where high net-worth expatriates and local luxury segments drive demand for ultra-high-end appliances. Due to extreme climatic conditions, there is an absolute need for cabinets with superior insulation and high-performance compressor technology capable of maintaining stable internal temperatures despite high external heat. Growth is concentrated in luxury hotel residences and private villas, with product choices heavily skewed towards the most sophisticated and visually impressive imported European and North American models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residential Wine Cabinets Market.- EuroCave

- Sub-Zero Group Inc.

- Liebherr Group

- Dometic Group

- Perlick Corporation

- Vinotemp International

- La Sommelière

- Haier Smart Home Co., Ltd.

- Kenmore

- Whynter

- NewAir

- Avanti Products

- Fhiaba

- Electrolux AB

- SMEG S.p.A.

- Danby Appliances

- Marvel Refrigeration

- U-Line Corporation

- BODEGA Wine Cooler

- Summit Appliance

Frequently Asked Questions

Analyze common user questions about the Residential Wine Cabinets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Residential Wine Cabinets Market?

The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period from 2026 to 2033, driven by increasing affluence and the adoption of dedicated wine storage solutions globally.

Which technology segment dominates the Residential Wine Cabinets Market?

Compressor-based cooling technology currently dominates the market share. This dominance is attributed to its superior efficiency, reliability, and capability to maintain precise and stable temperature and humidity levels essential for long-term wine preservation, particularly in larger capacity units.

What are the primary factors restraining market growth?

The primary restraints include the high initial purchasing cost of premium, feature-rich wine cabinets, which limits accessibility to mass-market consumers, alongside significant spatial constraints for large units, especially in high-density urban residential environments.

Which region shows the highest potential for market expansion?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market for residential wine cabinets. This rapid growth is supported by rising disposable incomes, urbanization, and a swift integration of luxury, Westernized lifestyles, including dedicated wine collecting and consumption.

How is AI impacting product innovation in wine cabinets?

AI is driving innovation by enabling smart inventory management (automatic cataloging and tracking), predictive maintenance alerts for cooling systems, and optimized, energy-efficient operation based on learned usage patterns, transforming cabinets into intelligent storage systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager