Residue Wax Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435878 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Residue Wax Market Size

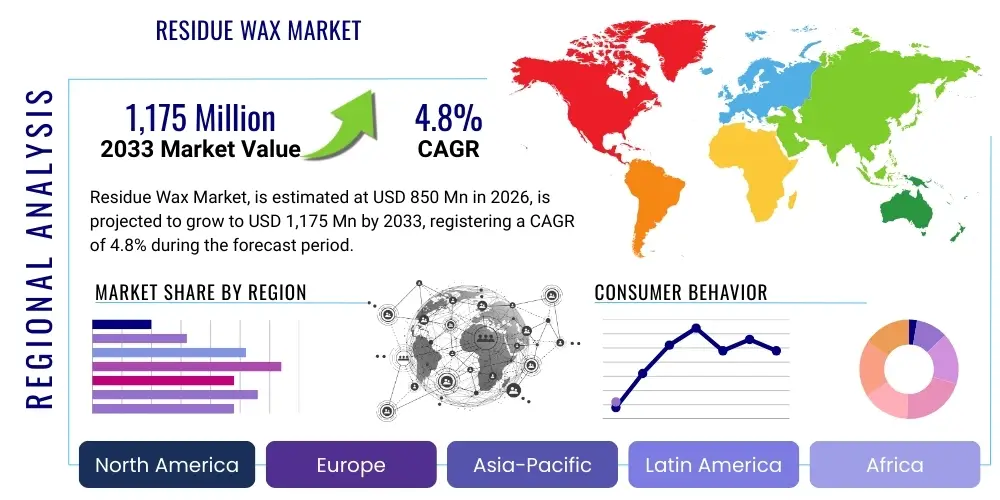

The Residue Wax Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,175 Million by the end of the forecast period in 2033.

Residue Wax Market introduction

The Residue Wax Market encompasses the trade of petroleum-derived waxes that remain after the distillation and refining processes of crude oil, specifically the heavier fractions. Residue wax, often characterized by higher oil content and a broad molecular weight distribution compared to fully refined paraffin or microcrystalline waxes, serves as a versatile raw material in numerous industrial applications where purity requirements are less stringent but specific physical properties, such as water resistance and binding capabilities, are essential. This product is intrinsically linked to the global petroleum refining industry, with its availability and pricing strongly influenced by crude oil dynamics and the efficiency of solvent refining and deoiling technologies used by major integrated oil companies. The functional versatility of residue wax—offering beneficial characteristics like insulation properties, moisture barrier attributes, and lubrication—positions it as a crucial intermediate chemical compound supporting various downstream manufacturing sectors.

The primary product characteristics of residue wax include a relatively high melting point and viscosity, making it highly effective for compounding and formulation in robust industrial applications. Major applications driving market demand include its use in the production of low-cost candles, where its lower cost offsets the need for high-purity waxes, and increasingly in the construction sector for moisture proofing and specialized coatings. Furthermore, the rubber and plastics industries utilize residue wax as a processing aid, mold release agent, and an additive to improve surface finish and flexibility. The inherent benefits of using residue wax often revolve around cost-effectiveness and performance parity in applications that do not require ultra-pure white waxes, offering manufacturers a competitive edge in pricing finished goods, especially in high-volume commodity markets.

Market growth is substantially driven by the robust expansion of the packaging and construction industries in emerging economies, particularly in the Asia Pacific region, where infrastructural development demands high volumes of cost-effective protective coatings and sealing materials. Additionally, the increasing demand for specialized industrial lubricants and rust preventatives, leveraging the protective film properties of residue wax, contributes significantly to market momentum. Regulatory shifts concerning environmental sustainability and the push toward minimizing industrial waste also favor the utilization of residue wax, as it represents a valuable byproduct of the petroleum refining process, optimizing resource utilization. However, the market must navigate volatility in crude oil prices and the rising interest in bio-based wax alternatives, which could pose long-term competitive challenges requiring continuous innovation in refining techniques and product formulation to maintain market relevance.

Residue Wax Market Executive Summary

The Residue Wax Market Executive Summary highlights a steady, albeit sensitive, growth trajectory influenced predominantly by fluctuations in crude oil feedstock costs and sustained demand from key manufacturing segments. Current business trends indicate a critical focus among key players on optimizing refining processes, particularly the efficiency of deoiling units, to maximize yield and control the quality of residue wax fractions. Companies are strategically investing in vertical integration, ensuring stable supply chains from crude input to end-product distribution, mitigating risks associated with external market volatility. A noteworthy business development is the increasing partnership between large refining corporations and specialty chemical formulators to develop customized wax blends specifically tailored for high-performance applications in the adhesives and specialized industrial coatings sectors, thereby shifting the market dynamic slightly towards value-added products rather than purely commodity sales.

Regional trends reveal the Asia Pacific region as the indisputable powerhouse of market growth, driven by massive consumption in China and India, fueled by rapid urbanization, construction booms, and expanding manufacturing bases requiring industrial waxes for various processes. North America and Europe, while mature markets, maintain significant demand, largely concentrated in specialized segments like automotive underbody coatings and pharmaceutical applications, adhering to stringent quality specifications. These developed regions are increasingly focusing on sustainable sourcing and waste reduction, indirectly boosting the appeal of highly utilized petroleum byproducts like residue wax. Conversely, regions in Latin America and the Middle East and Africa are witnessing gradual market expansion, primarily aligning with localized infrastructure projects and the establishment of independent refining capacities that generate this valuable residue byproduct.

Segment trends underscore the dominance of the coatings and polishes application sector, requiring high volumes of wax for gloss, moisture protection, and scuff resistance on various surfaces. Within the product type segmentation, the Heavy Residue Wax category is showing accelerated growth due to its superior binding capabilities and viscosity, making it indispensable in asphalt modification and heavy-duty industrial sealants. Light Residue Wax, while abundant, faces higher competition from semi-refined paraffin wax substitutes. The critical segment insight is the growing emphasis on functionalization; manufacturers are treating residue wax with additives to enhance UV stability or thermal resistance, effectively bridging the gap between commodity waxes and premium specialty chemical inputs, thereby stabilizing price points and expanding the range of applicable end-uses.

AI Impact Analysis on Residue Wax Market

Common user questions regarding AI’s impact on the Residue Wax Market frequently center around process optimization, demand forecasting accuracy, and the potential for AI-driven quality control in complex refining environments. Users are primarily concerned with how Artificial Intelligence can stabilize volatile supply chains, specifically managing crude input variability which directly affects residue wax yield and quality. Key themes emerging from these queries include the deployment of predictive maintenance protocols on wax refining equipment, optimizing energy consumption during the labor-intensive deoiling process, and leveraging machine learning models to forecast application-specific demand from diverse sectors like construction and packaging, ensuring inventory alignment with expected consumption spikes. Users express a strong expectation that AI will lead to higher operational efficiencies and reduction in off-spec product batches, indirectly lowering overall production costs.

The implementation of advanced analytical platforms powered by AI and Machine Learning (ML) is fundamentally changing how residue wax producers approach their operations. AI algorithms are now deployed to analyze vast datasets encompassing crude oil composition, process temperatures, solvent ratios, and filter performance in real-time. This sophisticated analysis allows for instantaneous adjustments in the solvent dewaxing units and hydrotreating reactors, maximizing the recovery of marketable residue wax while minimizing the presence of undesirable oil contaminants. By achieving tighter control over the refining parameters, AI ensures consistent product specifications, which is vital for end-users in sensitive applications like cosmetic bases or specialized industrial lubricants, where batch variation is strictly unacceptable.

Furthermore, AI is instrumental in enhancing the market's response to volatile external factors. Generative models and advanced time-series forecasting are utilized to predict shifts in crude oil pricing and geopolitical events that impact transportation and supply logistics, providing producers with critical lead time for hedging and inventory management. In the commercial sphere, AI-driven customer relationship management systems analyze procurement patterns of major industrial buyers—such as large candle manufacturers or road construction contractors—to anticipate purchasing cycles and volume requirements. This allows suppliers to optimize their sales channels and inventory distribution, enhancing market penetration and reducing storage overheads, ultimately fostering a more responsive and economically efficient supply chain for residue wax.

- AI-driven optimization of deoiling and solvent refining processes for maximum yield efficiency.

- Predictive maintenance schedules for refining equipment minimizing downtime and ensuring continuous supply.

- Machine learning algorithms enhance quality control by identifying process deviations impacting wax consistency.

- Advanced demand forecasting improves inventory management and minimizes financial exposure to commodity price volatility.

- Automated market analysis and competitor intelligence for strategic pricing and geographic expansion decisions.

DRO & Impact Forces Of Residue Wax Market

The Residue Wax Market is governed by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), collectively shaping the Impact Forces (I) that dictate market movement and competitive dynamics. The fundamental driver remains the burgeoning demand from high-volume, cost-sensitive manufacturing sectors, particularly the packaging and infrastructure industries in Asia and Latin America, where residue wax provides a highly effective and economically viable barrier and binding agent. This demand is intrinsically linked to global industrial output growth and consumer spending. Simultaneously, the market faces significant restraints, primarily centered on the inherent dependency on petroleum refining outputs, subjecting the supply chain to crude oil price volatility and the broader global push towards decarbonization, which necessitates investment in alternative, non-fossil fuel sources. These contrasting forces establish a complex equilibrium where maximizing efficiency in existing production is paramount to sustaining growth.

Opportunities for market expansion are largely concentrated in technological advancements, focusing on further purification techniques to broaden the scope of residue wax utilization into higher-value applications currently dominated by fully refined waxes. Developing specialized residue wax derivatives—through controlled hydrogenation or functionalization—that meet stricter cosmetic or pharmaceutical standards represents a lucrative pathway. Furthermore, embracing circular economy principles offers an opportunity: utilizing residue streams from secondary processing activities (like lubrication oil re-refining) to supplement traditional supply, diversifying the feedstock sources and enhancing sustainability credentials. The integration of advanced supply chain digitization also provides a chance to optimize logistics, reducing time-to-market and distribution costs, making the product more competitive against synthetic wax alternatives.

The key impact forces currently driving competition include intense pressure from substitute products, particularly bio-waxes (such as soy, palm, and candelilla waxes) which are gaining favor due to environmental mandates, demanding continuous cost optimization from petroleum wax producers. Regulatory scrutiny over industrial emissions and manufacturing waste also acts as a powerful force, compelling refiners to implement cleaner production methods or risk operational constraints. Furthermore, the bargaining power of large industrial buyers remains high, necessitating competitive pricing and flexible contract terms. Successful market navigation requires producers not only to focus on minimizing operational costs through efficiency gains but also to proactively invest in R&D to enhance the technical performance attributes of residue wax, securing its position as a reliable industrial commodity despite environmental headwinds.

Segmentation Analysis

The Residue Wax Market segmentation is critical for strategic analysis, allowing for differentiated market targeting based on product characteristics and specific end-user requirements. The market is primarily segmented by Type (Light Residue Wax, Heavy Residue Wax, Mixed Residue Wax) and by Application (Candles, Coatings and Polishes, Adhesives and Sealants, Rubber and Plastics, Pharmaceuticals and Cosmetics, and Others). This structural breakdown allows stakeholders to understand where growth potential is highest and how product specifications must be tailored to meet industrial standards. For instance, the distinction between light and heavy residue waxes fundamentally dictates their appropriate end-use, with heavy variants being preferred for high-viscosity formulations like asphalt modifiers, while lighter grades are often suitable for processing aids in plastics and rubber manufacturing.

Analyzing these segments reveals varied growth dynamics. The Coatings and Polishes segment typically accounts for the largest market share due to the widespread application of residue wax in protective and water-resistant formulations utilized in construction and automotive industries. However, the Pharmaceuticals and Cosmetics segment, despite its smaller volume, exhibits the fastest growth rate, fueled by increased consumer demand for cost-effective skincare and personal care products where refined residue waxes or their derivatives serve as excellent emollients and structuring agents. Understanding the interdependencies between the intrinsic properties of each wax type and the functional requirements of the specific application segments enables companies to prioritize investment in R&D, focusing on purification techniques that elevate product quality to penetrate these higher-margin sectors effectively.

- By Type:

- Light Residue Wax

- Heavy Residue Wax

- Mixed Residue Wax

- By Application:

- Candles

- Coatings and Polishes

- Adhesives and Sealants

- Rubber and Plastics

- Pharmaceuticals and Cosmetics

- Others (including Insulation, Corrosion Protection)

Value Chain Analysis For Residue Wax Market

The value chain for the Residue Wax Market begins with the upstream segment, which is dominated by crude oil exploration, extraction, and critically, the refining process. Integrated oil companies are the primary actors here, performing the initial atmospheric and vacuum distillation of crude oil. Residue wax, or slack wax, is generated during the solvent dewaxing stage of lube oil base stock production. The efficiency and quality of the upstream process—particularly the selection of crude feedstock and the solvent refining technology employed—directly determine the volume and initial quality (oil content) of the residue wax produced. High-quality upstream output is crucial as it reduces the need for extensive, costly downstream purification, thereby defining the profitability margin for the entire chain. Control over this upstream segment grants significant power to major petrochemical and refining giants.

Moving downstream, the value chain involves secondary processors, blenders, and specialty chemical formulators who take the raw residue wax and modify it to meet specific end-user requirements. This includes reducing oil content, adjusting melting points through blending, or adding performance-enhancing additives. The downstream process adds significant value by transforming a commodity byproduct into an industrial ingredient suitable for specialized applications. Distribution channels play a vital role, often categorized into direct and indirect routes. Direct sales typically involve large volume contracts between major refiners and industrial consumers (e.g., asphalt producers, large chemical blenders). Conversely, indirect channels rely heavily on specialized chemical distributors and regional traders who manage smaller volumes, provide localized inventory, and handle technical support for medium and small-scale manufacturing clients across diverse geographic locations.

The complexity of the distribution network is driven by the diverse applications of residue wax. Direct channels are preferred for high-volume, bulk deliveries to end-users like tire manufacturers or major coating producers, ensuring lower transportation costs and greater supply stability. Indirect channels are crucial for market penetration in fragmented industries such as small-batch cosmetics manufacturing or niche artisanal candle production, requiring specialized packaging and warehousing services. Effective management of this distribution ecosystem, leveraging optimized logistics and storage solutions to handle the unique physical properties of wax (which requires temperature control), is essential for maintaining product integrity and ensuring timely delivery, ultimately impacting customer satisfaction and market share. The efficiency of the entire value chain hinges on seamless coordination between refining output, secondary processing capability, and robust distribution logistics.

Residue Wax Market Potential Customers

The potential customer base for the Residue Wax Market is highly diversified, encompassing a broad range of industrial sectors that utilize waxes for functional performance, cost reduction, and aesthetic enhancement. Primary end-users include high-volume industries such as the packaging sector, where the wax is used for moisture barrier coatings on corrugated cardboard and food wrappers, and the construction industry, utilizing it extensively in asphalt modification and waterproofing compounds for roads and roofing materials. These sectors prioritize bulk supply, competitive pricing, and reliable long-term contracts. The purchasing decisions are often driven by technical specifications, such as penetration value and oil content, ensuring the wax meets mandatory quality standards required for infrastructural and protective applications.

Secondary but rapidly growing customer segments include the rubber and plastics manufacturing industries, utilizing residue wax as an anti-ozonant in tire production and as a lubricant or mold release agent in polymer processing. For these applications, the consistency and chemical inertness of the wax are critical buying factors. Furthermore, the candle manufacturing industry remains a cornerstone customer, particularly for low-cost, high-volume decorative and functional candles, utilizing residue wax to enhance burn time and structure when blended with other waxes. Potential customers in these segments seek suppliers offering customized blends and technical support to optimize their formulation processes, ensuring the final product meets consumer expectations regarding scent retention, color stability, and structural integrity.

A notable high-growth segment comprises the Pharmaceuticals and Cosmetics manufacturers. Although demanding higher purity grades, these buyers are increasingly incorporating specialized, highly refined derivatives of residue wax (or microcrystalline waxes derived from heavy residues) into personal care products, including balms, creams, and pharmaceutical excipients. These customers impose the strictest regulatory and quality controls, requiring suppliers to provide extensive documentation regarding trace elements and refining processes. The attraction here is the functionality of the wax as a thickening agent, stabilizer, and moisture retainer. Strategic targeting of these high-value buyers requires suppliers to invest heavily in advanced hydrotreating and purification technologies to elevate the perceived value and performance characteristics of the residue wax product offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,175 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Shell, Sinopec, PetroChina, TotalEnergies, Chevron, Lukoil, HollyFrontier, Repsol, Suncor Energy, Nippon Seiro, Sasol, Cepsa, ENI, Indian Oil Corporation, Phillips 66, Valero Energy, Kuwait Petroleum Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Residue Wax Market Key Technology Landscape

The technological landscape of the Residue Wax Market is primarily characterized by advancements in refining and purification processes aimed at improving product quality, reducing oil content, and optimizing energy consumption. The core technology remains solvent dewaxing, where a solvent (such as methyl ethyl ketone (MEK) or propane) is used to separate the desirable wax component from the high-oil slack wax residue. Recent technological innovations focus on enhancing the efficiency of filtration and crystallization stages within this process. Techniques like modern static filtration systems and continuous rotary vacuum filters allow for higher throughput and superior separation efficiency, critical for producing residue waxes with consistent, low oil percentages necessary for specialized industrial formulations. Furthermore, process optimization through advanced control systems utilizing IoT sensors and real-time data analysis minimizes operational variances, ensuring better yield control and reduced operational expenditure, key differentiators in a competitive commodity market.

Beyond standard dewaxing, the market increasingly leverages sophisticated hydrotreating and hydrofinishing technologies, particularly for residue waxes destined for higher-purity applications, such as food-contact packaging materials or pharmaceutical bases. Hydrotreating involves using hydrogen under high pressure and temperature, catalyzed by noble metals, to remove residual unsaturated hydrocarbons, sulfur, nitrogen compounds, and color bodies. This process significantly improves the wax's oxidation stability, color, and odor, effectively upgrading the residue wax toward the quality of microcrystalline waxes. Companies are investing heavily in customized catalyst development to achieve targeted purity levels cost-effectively, positioning their residue wax products to compete directly in markets previously inaccessible due to stringent regulatory demands on purity and safety profiles. This technological migration is crucial for long-term value creation.

A burgeoning technological area involves the development of specialized blending and functionalization techniques. This involves using twin-screw extruders or high-shear mixers to incorporate performance additives (e.g., polymer modifiers, antioxidants, or UV stabilizers) directly into the residue wax matrix. This creates composite materials with enhanced physical properties, such as increased tensile strength, flexibility, or thermal resistance. For instance, modified residue waxes are essential for hot-melt adhesive formulations where stability and specific melt indices are mandatory. Furthermore, waste valorization technologies are emerging, focusing on utilizing low-grade or off-spec residue wax streams from refining operations through advanced cracking or blending with bitumen, maximizing the economic utilization of all petroleum byproducts and aligning with modern resource efficiency mandates.

Regional Highlights

Regional dynamics heavily influence the Residue Wax Market, reflecting varied industrial development rates, refining capacities, and regulatory environments. Asia Pacific (APAC) dominates the global market, both in production capacity and consumption volume. This dominance is attributed to the presence of large-scale refining hubs, particularly in China and India, which produce substantial quantities of petroleum residue byproducts. The robust construction and manufacturing sectors in these nations act as massive anchors for residue wax demand, primarily for use in low-cost coatings, packaging, and infrastructure development materials. Continued high rates of urbanization and infrastructure investment are expected to maintain APAC’s leading position throughout the forecast period, driving demand for cost-effective binding and waterproofing agents.

North America and Europe represent mature, high-value markets characterized by stringent quality standards and a higher consumption rate of specialized wax derivatives rather than pure commodity wax. While the overall volume growth may be slower compared to APAC, the demand remains stable, driven by specialized applications in high-performance automotive coatings, advanced cosmetics, and industrial lubricant formulations. European refiners, in particular, are focusing on adopting the most advanced purification technologies (hydrotreating) to meet strict EU chemical regulations (REACH), positioning their products at the higher end of the residue wax value spectrum. Furthermore, the push towards sustainability in these regions creates complex market pressure, simultaneously driving investment in bio-based alternatives while optimizing the reuse of petroleum byproducts.

The Middle East and Africa (MEA) region is gradually increasing its market share, driven primarily by expanding regional refining capacity and domestic downstream utilization. The strategic geopolitical positioning and abundant crude oil reserves enable MEA countries to become crucial exporters of petroleum products, including residue wax, supplying both Asian and European markets. Latin America shows steady growth, particularly in Brazil and Mexico, linked to localized packaging, candle production, and construction activities. Market growth in these regions is highly dependent on foreign investment in industrial infrastructure and the stability of regional economic policies, which influence local manufacturing output and the subsequent requirement for industrial raw materials like residue wax.

- Asia Pacific (APAC) leads in consumption due to infrastructure expansion and large-scale manufacturing output.

- North America and Europe emphasize high-purity, specialized residue wax derivatives for automotive and cosmetic uses.

- The Middle East and Africa (MEA) are emerging as significant production hubs, capitalizing on abundant crude resources.

- Latin America demonstrates consistent demand linked to localized packaging and domestic industrial growth.

- Regulatory harmonization efforts, particularly in Europe, dictate technological investment in purification standards across all regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Residue Wax Market.- ExxonMobil

- Shell

- Sinopec

- PetroChina

- TotalEnergies

- Chevron

- Lukoil

- HollyFrontier

- Repsol

- Suncor Energy

- Nippon Seiro

- Sasol

- Cepsa

- ENI

- Indian Oil Corporation

- Phillips 66

- Valero Energy

Frequently Asked Questions

Analyze common user questions about the Residue Wax market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Residue Wax and Paraffin Wax?

Residue wax, often called slack wax, is a less-refined petroleum byproduct characterized by a significantly higher oil content (typically 5% to 30%) and a broader molecular weight distribution, making it generally softer and oilier than fully refined paraffin wax (which typically has oil content below 0.5%).

Which industrial application drives the largest volume demand for Residue Wax?

The coatings and polishes application sector, particularly within the construction and packaging industries, represents the largest volume driver. Residue wax is widely used in asphalt modification, roofing materials, and moisture-barrier coatings due to its cost-effectiveness and excellent waterproofing characteristics.

How does crude oil volatility affect the Residue Wax Market?

The market is highly sensitive to crude oil price volatility because residue wax is a byproduct of crude oil refining. Fluctuations in crude input costs directly impact the manufacturing expenses for residue wax, affecting final market pricing and profitability margins for refiners and downstream formulators.

Are bio-based waxes considered a significant threat to the Residue Wax Market?

Yes, bio-based waxes (such as soy and palm wax) pose a growing competitive threat, particularly in consumer-facing applications like candles and personal care, driven by increasing regulatory support for sustainability and consumer demand for renewable materials.

What technological advancements are improving the quality of Residue Wax?

Key technological improvements include enhanced solvent dewaxing filtration systems and advanced hydrotreating (hydrofinishing) processes. These technologies effectively reduce the oil content, improve color stability, and remove impurities, allowing residue wax to meet higher-grade industrial specifications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager