Resistance Welding Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433734 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Resistance Welding Machinery Market Size

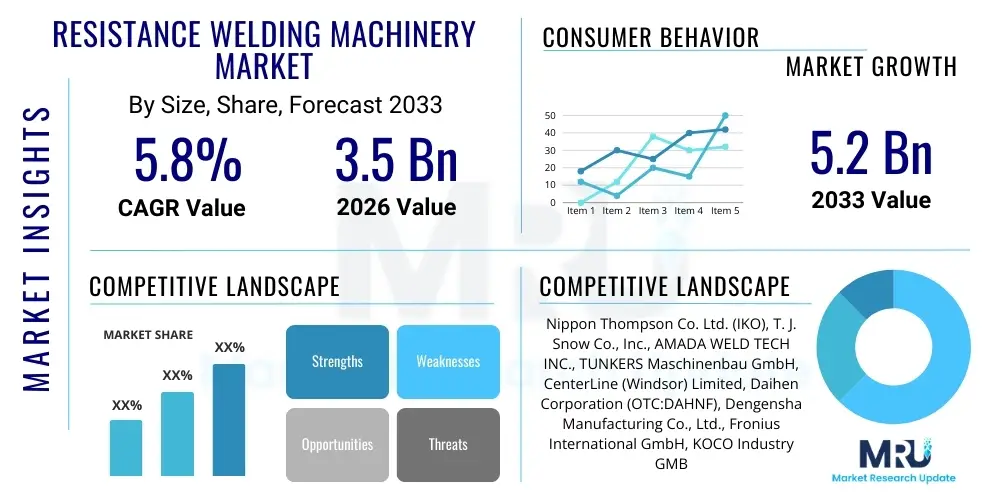

The Resistance Welding Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Resistance Welding Machinery Market introduction

The Resistance Welding Machinery Market encompasses equipment utilized in joining metals by applying pressure and passing a high electric current through the contact area to generate heat, leveraging the resistance properties of the materials. This robust process is fundamental in high-volume manufacturing sectors where speed, reliability, and precision are paramount, offering a permanent metallurgical bond without the use of filler material. Key product types include spot welding, seam welding, projection welding, and flash welding machines, each tailored for specific geometries and material thicknesses. The machinery features sophisticated control systems, often utilizing medium-frequency direct current (MFDC) technology for enhanced energy efficiency and superior weld quality, particularly important when joining dissimilar metals or modern high-strength steels.

Major applications of resistance welding machinery span critical industries such as automotive manufacturing, where it is essential for chassis construction, body panels, and increasingly, battery pack assembly in electric vehicles (EVs). Other significant end-users include the aerospace industry for structural components, electronics manufacturing for fine-wire connections and battery tab welding, and the general fabrication sector for appliance and infrastructure components. The inherent benefits of resistance welding, such as rapid cycle times, ease of automation, clean operation, and high repeatability, solidify its position as a preferred joining technique over traditional methods like arc welding or mechanical fastening in many high-throughput environments.

The market is currently being driven by several macro-economic and technological factors. The global shift toward electromobility has generated significant demand for high-precision battery welding solutions, which frequently employ resistance welding techniques for connecting tabs and internal components of battery cells. Furthermore, the persistent push for lightweight vehicle construction necessitates machinery capable of reliably welding advanced high-strength steels and aluminum alloys, materials that require highly controlled heat input. Increased labor costs and the global manufacturing trend toward Industry 4.0 adoption are also fueling the integration of automated resistance welding systems and robotics, enhancing production capacity and operational efficiency across diverse geographical locations.

Resistance Welding Machinery Market Executive Summary

The global Resistance Welding Machinery market demonstrates robust growth, primarily propelled by the exponential expansion of the electric vehicle sector and the corresponding need for automated battery manufacturing systems. Business trends indicate a strong industry focus on innovation, particularly the transition from traditional alternating current (AC) systems to high-efficiency inverter-based technologies, such as MFDC welders, which provide better control over the welding process, reduced energy consumption, and flexibility in welding complex materials. Key market players are investing heavily in software integration and process monitoring tools to capitalize on the increasing demand for precision and data traceability in critical applications.

Regionally, the Asia Pacific (APAC) region continues to dominate the market share, driven by massive manufacturing bases in China, Japan, and South Korea, particularly within the automotive and consumer electronics sectors. However, North America and Europe are experiencing accelerated growth rates, spurred by significant investment in domestic EV battery gigafactories and regulatory emphasis on manufacturing quality and efficiency. These Western markets are prioritizing high-end automated systems and robotic welding cells that seamlessly integrate resistance welding processes, contributing substantially to the overall market valuation through the sale of premium, sophisticated equipment.

In terms of segmentation, the spot welding machine segment retains the largest market share due to its versatility and widespread use in vehicle body assembly, while projection welding is seeing specialized growth in applications requiring multiple joints simultaneously, such as nut and bolt affixation. Technology segmentation highlights the dominance of inverter technology, which is rapidly replacing older AC technologies across most industrial applications due to its superior power factor and stability. The end-user analysis confirms the automotive industry as the perennial largest consumer, though the electronics and renewable energy sectors are emerging as high-growth potential segments, demanding smaller, faster, and more precise micro-resistance welding equipment.

AI Impact Analysis on Resistance Welding Machinery Market

Common user inquiries concerning the integration of Artificial Intelligence (AI) in resistance welding machinery frequently revolve around two core themes: optimizing weld quality consistency in high-speed production environments and implementing predictive maintenance to minimize unplanned downtime. Users seek assurance that AI can autonomously adjust parameters to compensate for real-time material variations (like slight differences in material thickness or surface coating), thereby eliminating the need for constant manual recalibration and reducing defect rates. There is significant interest in how AI algorithms can analyze vast amounts of data—current, voltage, pressure, and displacement—to predict electrode wear and schedule maintenance proactively. The key theme is the shift from reactive or statistical process control to fully adaptive, self-optimizing welding systems, ensuring near-zero defects and maximum machine utilization, ultimately lowering the total cost of ownership for complex robotic welding cells.

AI's influence is transforming resistance welding from a purely electrical process into a data-driven manufacturing discipline. By employing machine learning models trained on millions of successful and failed weld data points, AI systems can accurately model complex welding dynamics that are traditionally difficult to control using conventional closed-loop feedback systems. This capability is particularly critical for sensitive applications like EV battery module construction, where weld integrity is directly linked to the safety and longevity of the final product. Furthermore, AI facilitates non-destructive quality assessment by analyzing the instantaneous electrical signatures during the weld sequence, providing immediate feedback superior to slower, post-weld inspection methods.

The adoption of AI is leading to the development of 'smart welders' capable of diagnosing their own malfunctions, suggesting corrective actions, and continuously improving process recipes based on historical performance metrics. This intellectualization of the machinery reduces reliance on highly specialized operators and accelerates the deployment time for new manufacturing lines. Expectations center on AI enabling flexible manufacturing environments where resistance welding equipment can seamlessly switch between different material types and product configurations with minimal setup time, offering unparalleled adaptability for modern, diversified production schedules.

- AI-powered predictive maintenance reduces machine downtime by anticipating electrode changes and component failures based on vibration and performance anomalies.

- Real-time quality monitoring and closed-loop control adjustments ensure consistent weld nugget formation despite fluctuations in material properties or power supply.

- Optimized parameter setting accelerates job setup and changeover times, leveraging historical data to automatically generate ideal weld schedules for new material combinations.

- Enhanced energy efficiency through AI algorithms that precisely modulate power delivery, minimizing unnecessary current expenditure while maximizing heat input effectiveness.

- Automated defect classification and root cause analysis improve process traceability and compliance with stringent industry standards, especially in automotive and aerospace applications.

DRO & Impact Forces Of Resistance Welding Machinery Market

The dynamics of the Resistance Welding Machinery Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and structural Impact Forces. The primary driver is the accelerating production of electric vehicles globally, requiring high-volume, precision welding for lithium-ion battery packs and structural elements made of specialized alloys. This demand is coupled with the broader industrial shift towards fully automated and robotized manufacturing systems, boosting sales of integrated welding cells. The main restraint is the high initial capital expenditure required for sophisticated MFDC and servo-controlled welding systems, which can be prohibitive for smaller manufacturing enterprises, alongside the technical complexity involved in accurately welding new, high-strength, lightweight materials like specialized aluminum grades and advanced carbon steels.

Significant opportunities arise from the convergence of resistance welding technology with Industry 4.0 paradigms, specifically the implementation of the Industrial Internet of Things (IIoT). This integration allows for comprehensive data collection, remote monitoring, and predictive analytics, enhancing operational efficiencies and enabling global remote diagnostics. Furthermore, the increasing demand for micro-welding capabilities in the consumer electronics and medical device industries presents a niche but high-value opportunity for specialized equipment manufacturers focusing on precision, low-energy resistance welding techniques. The relentless competitive pressure to reduce manufacturing cycle times and enhance product safety standards acts as a pervasive impact force, compelling manufacturers to continually invest in faster, more reliable, and better-controlled welding solutions.

Another crucial impact force is the stringent regulatory environment governing structural integrity in automotive and aerospace fabrication, which mandates superior quality control and verifiable process documentation, thereby favoring advanced, inverter-based resistance welding equipment capable of precise parameter logging. While the initial investment cost acts as a barrier, the long-term operational cost savings derived from energy efficiency (MFDC technology) and minimized rework due to superior quality control effectively mitigate this restraint over the machinery's lifecycle. Consequently, the overall market trajectory is highly positive, with technological advancements rapidly overcoming traditional adoption hurdles and reinforcing resistance welding as an indispensable manufacturing technology.

Segmentation Analysis

The Resistance Welding Machinery Market is meticulously segmented based on machine type, welding technology employed, and the primary end-use industry served. This structured segmentation provides a granular view of market dynamics, identifying specific high-growth areas and technological preferences across different sectors. Machine type analysis differentiates between various welding methodologies, which directly influences application scope and machine design complexity. Technology segmentation highlights the ongoing evolution toward greater energy efficiency and precise control. Finally, end-user segmentation clearly indicates where the dominant demand originates and which emerging sectors are driving future innovations in equipment design and software features.

- By Machine Type:

- Spot Welding Machines

- Seam Welding Machines

- Projection Welding Machines

- Flash/Butt Welding Machines

- Micro-Resistance Welding Machines (e.g., Battery Tab Welders)

- By Technology:

- AC Resistance Welding

- DC Resistance Welding (e.g., Three-Phase DC)

- Medium Frequency Direct Current (MFDC) Resistance Welding

- Capacitor Discharge (CD) Resistance Welding

- By End-Use Industry:

- Automotive (Body in White, Components, EV Battery Manufacturing)

- Aerospace & Defense

- Electronics & Electrical

- Medical Devices

- Metal Fabrication (General Industrial)

- Others (Appliances, Renewable Energy Components)

Value Chain Analysis For Resistance Welding Machinery Market

The value chain for Resistance Welding Machinery begins with the upstream suppliers responsible for crucial raw materials and high-value components. This upstream segment involves specialized manufacturers of copper alloys for electrodes, high-performance steel for machine frames, and sophisticated electronic components such as IGBTs (Insulated Gate Bipolar Transistors) and proprietary microprocessors essential for inverter-based power supplies and precise control units. The quality and reliability of these specialized components directly dictate the performance, efficiency, and longevity of the final welding machine, making supplier management and strategic component sourcing critical for profitability and technical superiority.

The core manufacturing stage involves the design, assembly, and testing of the welding equipment, often requiring deep expertise in electrical engineering, mechanical precision, and advanced software integration. Companies in this stage focus on producing highly reliable welding heads, robust mechanical frames, and, increasingly, integrating sophisticated sensor technology for real-time monitoring. Direct distribution typically involves the manufacturer selling specialized, high-cost, automated robotic welding cells directly to large Tier 1 automotive suppliers or OEMs who require customized installation and extensive post-sale technical support. This direct channel facilitates closer communication and tailored solutions.

Indirect distribution relies on a network of specialized technical distributors, integrators, and system houses, particularly for standard machines, replacement parts, and accessories. These indirect channels are vital for reaching smaller fabrication shops and diverse regional markets, often providing local service, training, and integration services for robotic systems. The downstream element involves the integration of the machinery into the end-user's production line, which often requires significant system integration expertise, especially when incorporating automation and data analytics platforms (IIoT). Post-sale support, including electrode maintenance, calibration services, and software updates, remains a crucial revenue stream and a determinant of customer satisfaction and machine uptime.

Resistance Welding Machinery Market Potential Customers

Potential customers for Resistance Welding Machinery are primarily concentrated in high-volume manufacturing sectors that demand superior joint integrity, precise process control, and rapid production cycles. The automotive industry represents the largest and most critical customer segment, specifically global Original Equipment Manufacturers (OEMs) and their network of Tier 1 and Tier 2 suppliers. This group utilizes resistance welding for nearly every aspect of vehicle construction, from 'Body in White' assembly using spot welding to the complex and precise connections required in modern electric vehicle battery packs, demanding advanced MFDC and micro-resistance welding equipment capable of handling sensitive cell materials with minimal thermal impact.

Another high-value customer group includes manufacturers in the electronics and electrical components sector. These buyers require micro-resistance welding machinery for applications such as battery tab welding in consumer electronics, connecting delicate wires, and assembling sensor components. Their key requirements revolve around microscopic precision, repeatability at high speeds, and extremely low heat input to prevent damage to sensitive internal circuitry. The demand for these highly specialized machines is growing rapidly, driven by the proliferation of portable devices, medical instruments, and high-density electronics where miniaturization and reliability are paramount.

Furthermore, the general metal fabrication industry, appliance manufacturers, and the HVAC (Heating, Ventilation, and Air Conditioning) sector represent steady customers, procuring standard spot and seam welding machines for chassis construction, cabinet assembly, and joining sheet metal parts. Procurement decisions across all customer segments are increasingly influenced not just by the initial cost and speed of the machine, but by the sophistication of the process control software, energy efficiency ratings, ease of integration into robotic cells, and the availability of reliable localized technical service and specialized consumable supplies, such as high-conductivity electrodes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Thompson Co. Ltd. (IKO), T. J. Snow Co., Inc., AMADA WELD TECH INC., TUNKERS Maschinenbau GmbH, CenterLine (Windsor) Limited, Daihen Corporation (OTC:DAHNF), Dengensha Manufacturing Co., Ltd., Fronius International GmbH, KOCO Industry GMBH, Lors Machinery, Inc., Matuschek Welding Technology GmbH, Milco Manufacturing, Inc., Nippon Pillar Packing Co., Ltd., RoMan Manufacturing Inc., Taylor-Winfield Corporation, T. J. Snow Co., Inc., WPI Inc., TECNA S.p.A., ARO Technologies S.A.S, SCHLATTER Industries AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Resistance Welding Machinery Market Key Technology Landscape

The technology landscape of the Resistance Welding Machinery market is defined by a continuous push for enhanced energy efficiency, greater process control, and deeper integration with factory automation systems. The single most impactful technological advancement has been the widespread adoption of Medium Frequency Direct Current (MFDC) technology, which utilizes inverters to convert standard three-phase AC power into a regulated DC current at a much higher frequency (typically 1kHz to 4kHz). This transition allows for faster current rise times, reduced thermal impact on the workpiece, and a significantly improved power factor compared to older, bulky AC transformer-based systems. MFDC technology is now the standard for high-quality, precision welding, especially critical in the automotive sector for welding advanced high-strength steels (AHSS) and aluminum alloys, materials notoriously difficult to join reliably with traditional AC methods.

Another crucial technological area involves the implementation of advanced monitoring and control systems, often leveraging proprietary algorithms and servo control mechanisms. Modern resistance welding machines integrate displacement monitoring, real-time voltage and current feedback, and force control via servo actuators to ensure that the electrode force and the subsequent thermal profile are precisely managed throughout the entire weld cycle. This level of control is essential for ensuring consistent nugget size and metallurgical integrity, which is particularly vital in regulated industries like aerospace and medical devices. Furthermore, the development of sophisticated weld schedules incorporating pre-heating, post-heating, and pulsation techniques allows manufacturers to weld challenging material combinations, expanding the versatility of resistance welding.

The third major trend is the development of robust, specialized electrodes and materials science innovation. As manufacturers transition to non-ferrous materials and dissimilar metal joints, standard copper electrodes exhibit rapid wear. The industry is responding with advanced electrode materials, often incorporating dispersion-strengthened copper (DSC) or exotic alloys, designed to withstand higher pressures and temperatures while minimizing sticking and contamination. Finally, the seamless integration of welding machinery into robotic arms and collaborative robot cells, facilitated by standardized communication protocols (like Ethernet/IP or Profinet), is transforming the factory floor, making resistance welding a fully automated, data-rich segment of the manufacturing process, further solidifying the market’s technological maturity and competitive intensity.

Regional Highlights

The Resistance Welding Machinery Market exhibits distinct growth profiles and maturity levels across key geographical regions, driven by local manufacturing strength and specific industrial investment priorities.

- Asia Pacific (APAC): APAC is the dominant market, propelled by the unparalleled scale of manufacturing activities, particularly in China, South Korea, and Japan. These countries host massive automotive production hubs and dominate the global consumer electronics and semiconductor supply chains. The region is seeing explosive growth driven by immense governmental and private investment in EV battery gigafactories, creating massive demand for highly automated MFDC spot and projection welding systems. Lower labor costs in some areas combined with a rapid adoption of sophisticated automation in major factories drive both volume and technological demand.

- North America: North America represents a mature market characterized by high technology adoption and a focus on operational efficiency and quality assurance. Growth is primarily driven by the "reshoring" or "nearshoring" of manufacturing activities and heavy investment in localized EV production infrastructure, particularly in the United States and Mexico. Customers prioritize advanced, highly integrated robotic welding cells featuring AI-enabled process monitoring and predictive maintenance capabilities to justify higher capital expenditure and meet stringent regional safety standards.

- Europe: The European market is highly innovation-driven, heavily influenced by Germany, Italy, and Scandinavia. The region leads in adopting Industry 4.0 standards and is focused on sustainable manufacturing practices. Demand is concentrated on energy-efficient MFDC systems and machinery capable of welding lightweight materials like aluminum alloys to comply with strict European Union emissions and vehicle safety regulations. The presence of major European automotive OEMs dictates a high standard for automation, process traceability, and sophisticated welding control software.

- Latin America (LATAM): LATAM is an emerging market with growth concentrated in Brazil and Mexico, linked primarily to the regional automotive assembly and general metal fabrication industries. The market often seeks cost-effective, durable equipment, though there is a gradual transition toward adopting more modern inverter-based technologies, particularly among international companies expanding their production footprints in the region.

- Middle East and Africa (MEA): The MEA region remains a smaller market, characterized by localized demand primarily driven by infrastructure projects, oil and gas sector fabrication, and nascent automotive manufacturing activities. Adoption rates for advanced welding machinery are steadily increasing, particularly in the Gulf Cooperation Council (GCC) countries, focusing on imported, high-reliability equipment to support diverse industrial diversification strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Resistance Welding Machinery Market.- Nippon Thompson Co. Ltd. (IKO)

- T. J. Snow Co., Inc.

- AMADA WELD TECH INC.

- TUNKERS Maschinenbau GmbH

- CenterLine (Windsor) Limited

- Daihen Corporation (OTC:DAHNF)

- Dengensha Manufacturing Co., Ltd.

- Fronius International GmbH

- KOCO Industry GMBH

- Lors Machinery, Inc.

- Matuschek Welding Technology GmbH

- Milco Manufacturing, Inc.

- Nippon Pillar Packing Co., Ltd.

- RoMan Manufacturing Inc.

- Taylor-Winfield Corporation

- WPI Inc.

- TECNA S.p.A.

- ARO Technologies S.A.S

- SCHLATTER Industries AG

- Groschopp AG

- Cejn AB

Frequently Asked Questions

Analyze common user questions about the Resistance Welding Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for advanced resistance welding machinery?

The overwhelming global shift towards Electric Vehicle (EV) manufacturing is the primary driver. EV production requires precise, high-speed resistance welding, specifically for assembling complex lithium-ion battery modules and joining dissimilar lightweight structural materials, necessitating the adoption of advanced MFDC and micro-resistance welding systems.

How does Medium Frequency Direct Current (MFDC) technology improve resistance welding?

MFDC technology utilizes high-frequency inverters to deliver stable DC current, offering superior process control, better energy efficiency (higher power factor), and reduced thermal input. This capability allows for reliable welding of challenging materials like aluminum and high-strength steels, crucial for modern vehicle lightweighting efforts.

Which industry segment holds the largest share in the Resistance Welding Machinery Market?

The Automotive industry segment maintains the largest market share due to its consistent, high-volume demand for spot and projection welding machinery used in 'Body in White' construction, component assembly, and the rapidly growing requirement for highly precise battery pack welding systems.

What role does Artificial Intelligence (AI) play in modern resistance welding systems?

AI is integrated for real-time process optimization and predictive maintenance. AI algorithms analyze welding data to automatically adjust parameters to ensure consistent weld quality despite material variations and predict electrode wear, thereby minimizing defects and maximizing machine uptime in automated robotic cells.

What are the main regional growth opportunities for manufacturers in this market?

Asia Pacific, specifically due to its massive EV battery manufacturing capacity, remains the largest volume opportunity. However, significant high-value growth opportunities exist in North America and Europe, driven by substantial investment in localized, fully automated, and high-specification manufacturing lines adhering to stringent quality and sustainability standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager