Resistant Maltodextrin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438710 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Resistant Maltodextrin Market Size

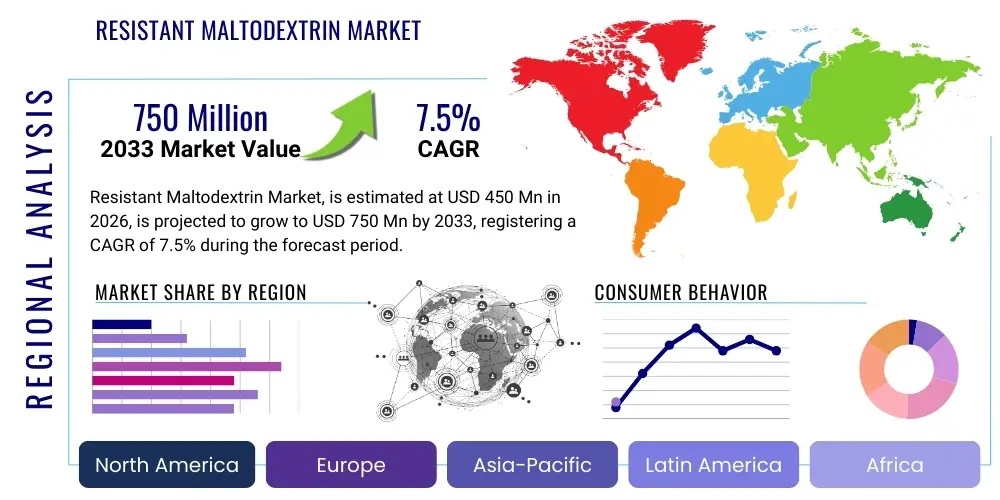

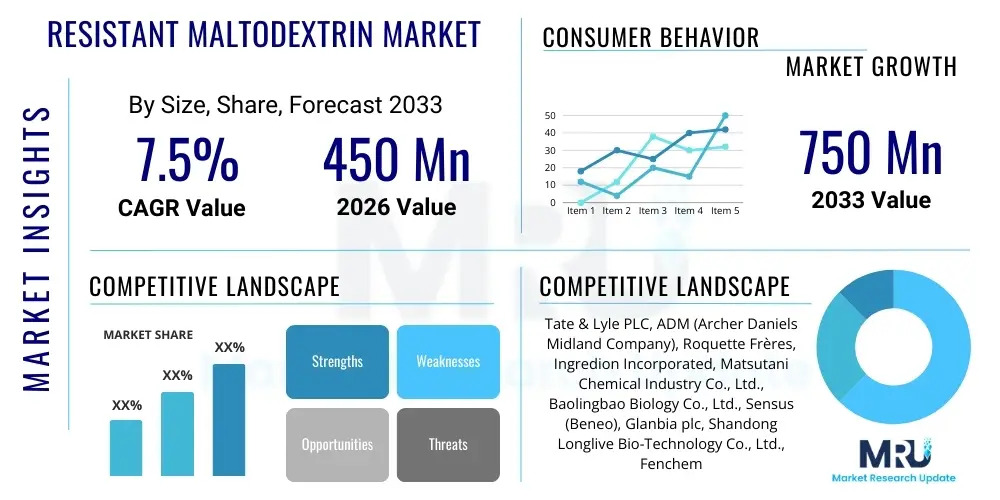

The Resistant Maltodextrin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033.

Resistant Maltodextrin Market introduction

The Resistant Maltodextrin market encompasses the production, distribution, and utilization of highly stable, soluble dietary fiber derived from the enzymatic hydrolysis of starch. Resistant Maltodextrin (RM) is chemically modified to resist digestion in the human small intestine, allowing it to function as a prebiotic fiber in the large intestine. This characteristic makes it a crucial ingredient in the rapidly expanding functional food and beverage sector, addressing growing consumer demand for products that support digestive health, blood sugar management, and weight control. The global shift toward preventive health and wellness, combined with technological advancements in carbohydrate processing, serves as the foundational momentum propelling this market forward.

Major applications of Resistant Maltodextrin span across various industries, including baked goods, dairy products, confectionery, nutritional supplements, and functional beverages. In food manufacturing, RM is highly valued due to its neutral flavor, excellent solubility, low viscosity, and heat stability, which allows for seamless incorporation into diverse matrices without altering texture or taste profiles significantly. Key benefits derived from its consumption include improved gut microbiota balance, enhanced satiety, and the lowering of the glycemic index of end products, which is particularly attractive to consumers managing diabetes or seeking sustained energy release. Its versatility and functional superiority over traditional fibers secure its position as a preferred additive.

Driving factors for market expansion are multifaceted, anchored primarily by the accelerating global prevalence of lifestyle diseases such as obesity and cardiovascular conditions, which necessitate dietary adjustments prioritizing fiber intake. Regulatory support across major economies, classifying RM as a recognized dietary fiber, further legitimizes its use and encourages innovation. Furthermore, the rising awareness among millennial and Gen Z consumers regarding personalized nutrition and the importance of gut health, often driven by digital health platforms and direct-to-consumer supplement brands, amplifies the demand for fiber-fortified foods and beverages, ensuring robust market performance throughout the forecast period.

Resistant Maltodextrin Market Executive Summary

The Resistant Maltodextrin market is characterized by robust growth, driven primarily by evolving consumer perceptions of functional ingredients and significant advancements in food formulation technology. Current business trends indicate a strong move toward clean label ingredients and natural sources, prompting manufacturers to optimize production processes to ensure high purity and sustainable sourcing of RM, often derived from corn or tapioca starch. Strategic partnerships between ingredient suppliers and large CPG (Consumer Packaged Goods) companies are accelerating market penetration, especially within the sports nutrition and weight management categories. Furthermore, increasing investment in clinical trials to substantiate the specific health claims related to RM consumption provides a competitive edge to companies demonstrating proven efficacy, leading to premium pricing opportunities.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market due to rapid urbanization, increasing disposable income, and the corresponding shift toward processed, fortified foods, particularly in countries like China and India. North America and Europe maintain dominance in terms of market value, primarily driven by established regulatory frameworks and high consumer spending on dietary supplements and functional drinks. Manufacturers are increasingly focusing on localized product development to adhere to regional dietary habits, such as incorporating RM into traditional snacks or utilizing regional starch sources, thereby optimizing supply chain logistics and reducing operational costs across diverse geographical locations.

Segment trends underscore the supremacy of the functional beverages and nutritional supplements segments, which utilize RM for texture improvement and fiber fortification, respectively. Within segmentation by application, the bakery and confectionery sectors are experiencing steady growth as RM is effectively used to replace high-calorie ingredients while maintaining product structure and mouthfeel. The demand for resistant maltodextrin derived from non-GMO sources is exhibiting a higher growth trajectory, reflecting the overarching segment trend toward organic and ethically sourced ingredients. This emphasis on quality and transparency is compelling producers to invest in advanced purification techniques and clear labeling, reinforcing the market's trajectory towards high-value, specialized ingredient offerings.

AI Impact Analysis on Resistant Maltodextrin Market

Common user questions regarding AI's impact on the Resistant Maltodextrin market center on optimizing ingredient formulation, predicting consumer acceptance of fiber-fortified products, and enhancing supply chain efficiency, particularly concerning starch sourcing and enzyme activity modeling. Users are keen to understand how AI-driven predictive analytics can shorten R&D cycles for new functional food formulations and minimize wastage during the high-heat processing required for RM production. A significant area of inquiry relates to AI’s role in personalized nutrition, specifically how machine learning algorithms can match specific fiber types, like RM, to individual health profiles based on aggregated microbiome data, thereby creating highly targeted dietary supplement recommendations. Key concerns revolve around data privacy and the capital intensity required for adopting these advanced AI and IoT systems in manufacturing facilities, necessitating a clear return on investment justification.

- AI-Powered Formulation Optimization: Machine learning algorithms analyze ingredient compatibility, heat stability, and sensory profiles, accelerating the development of new RM-fortified food products.

- Predictive Consumer Analytics: AI models process massive datasets on dietary trends and health concerns, accurately predicting the regional acceptance and optimal pricing strategies for RM-containing products.

- Supply Chain and Sourcing Efficiency: Implementation of AI for real-time monitoring of raw material (starch) quality and forecasting yield volatility based on environmental factors, ensuring consistent supply.

- Enhanced Production Quality Control: Computer vision systems and sensor technology, managed by AI, provide precise real-time feedback on enzymatic conversion rates and purification stages, minimizing batch variability.

- Personalized Nutrition Recommendations: Utilizing AI to correlate individual health data (e.g., gut microbiome composition) with optimal resistant starch/fiber intake, leading to customized RM-based supplement regimes.

- Automation of Processing Plants: Robotics and AI integration streamline material handling, packaging, and logistics within the high-volume production environment of Resistant Maltodextrin manufacturing.

- R&D Acceleration: AI analyzes existing literature and chemical structures to suggest novel enzymatic pathways or modifications for enhancing the functional properties of RM, such as increased fermentation specificity.

DRO & Impact Forces Of Resistant Maltodextrin Market

The Resistant Maltodextrin market dynamics are shaped by powerful health trends acting as primary drivers, particularly the globally recognized requirement for increased dietary fiber consumption to combat rising rates of chronic diseases. Concurrently, the market faces constraints related to high production costs stemming from complex enzymatic processes and purification requirements, alongside the consumer perception challenge regarding the classification of 'modified' ingredients. Opportunities abound in emerging applications, such as clinical nutrition and pharmaceutical excipients, offering pathways for higher margin sales. These forces collectively dictate market trajectory, pushing innovation toward more cost-efficient and consumer-friendly methods of fiber fortification while rewarding companies that successfully navigate the stringent regulatory landscapes governing functional food claims.

Drivers include the widespread recognition of resistant maltodextrin’s superior physiological benefits, notably its proven prebiotic effect and its ability to reduce blood glucose response without causing the significant gastrointestinal discomfort often associated with other high-fiber ingredients. Regulatory bodies in key regions, including the FDA and EFSA, have provided favorable classifications, bolstering manufacturer confidence. Furthermore, the inherent functional attributes of RM—thermal stability, clarity, and low viscosity—make it highly adaptable for complex industrial applications where other fibers fail, such as in ultra-high-temperature (UHT) processed beverages and baked goods requiring long shelf life. This combination of health appeal and technical utility forms a strong, continuous upward pressure on demand.

However, the market faces several significant restraints. Consumer hesitancy regarding ingredients derived from complex chemical or enzymatic modification processes, often fueled by clean-label movements, poses a considerable barrier, especially in developed markets where skepticism toward processed ingredients is high. The initial investment required for setting up large-scale enzymatic hydrolysis facilities and purification units for high-grade RM is substantial, potentially limiting entry for smaller players. Moreover, the market is subject to intense competition from alternative soluble fibers, such as inulin, FOS (fructooligosaccharides), and polydextrose, necessitating continuous product differentiation and aggressive marketing efforts focused on the unique functional advantages of RM. Successfully mitigating these restraints, particularly through transparent communication and cost reduction via process optimization, is critical for sustained profitability.

- Drivers: Growing consumer awareness of gut health and prebiotic benefits; Favorable regulatory status classifying RM as dietary fiber; High stability and versatility in food processing; Rising demand for low-calorie, fiber-fortified food and beverages.

- Restraints: Relatively high production cost compared to standard maltodextrin; Competition from established alternative soluble fibers (e.g., Inulin); Consumer perception challenges related to modified starch and 'processed' ingredients; Need for extensive clinical validation for novel health claims.

- Opportunities: Expansion into personalized nutrition and clinical dietetics; Utilization of non-GMO and organic starch sources (e.g., tapioca) for premium positioning; Increased incorporation into pharmaceutical formulations as an excipient; Development of RM with enhanced specific functional properties (e.g., increased fermentation rate).

- Impact Forces: Technological advancements driving down enzymatic production costs (High Impact); Shifting regulatory stances on fiber definitions (Moderate Impact); Consumer purchasing power related to premium health products (High Impact); Volatility in raw material (starch) pricing (Moderate Impact).

Segmentation Analysis

The Resistant Maltodextrin market is comprehensively segmented based on its source material, the nature of its application, and its specific formulation characteristics. Understanding these segments is crucial for targeting strategic investments and optimizing product development efforts. Segmentation by source, typically corn, wheat, or tapioca, directly impacts the ingredient's labeling and perceived naturalness, influencing purchasing decisions, especially in markets sensitive to genetically modified organisms (GMOs). Furthermore, the application segment distinguishes between high-volume uses in general food and beverage production versus specialized, high-value uses in clinical and pharmaceutical industries, each requiring different quality standards and regulatory compliance frameworks. The robust segmentation reflects the ingredient’s highly versatile utility across the entire spectrum of the nutrition industry.

Segmentation by form—powder versus liquid—is dictated by the end product's manufacturing requirements. The powdered form dominates the market due to its ease of transport, storage stability, and precise dosing capability, making it ideal for dry mixes, baked goods, and encapsulated supplements. The liquid form, while less common, is utilized in high-volume beverage manufacturing where dissolution time is a critical factor, or in specialized syrups and flavor systems. Analyzing these segment intersections allows ingredient manufacturers to refine their portfolios, ensuring they offer solutions tailored to the technical constraints and commercial needs of various customer bases, optimizing supply chain efficiency and maximizing market coverage across diverse formulation requirements.

- By Source:

- Corn-Based Resistant Maltodextrin

- Wheat-Based Resistant Maltodextrin

- Tapioca/Cassava-Based Resistant Maltodextrin (Fastest Growing)

- Potato-Based Resistant Maltodextrin

- By Application:

- Food and Beverages

- Functional Beverages (Sports Drinks, Juices, Water Enhancers)

- Bakery and Confectionery (Breads, Cakes, Candies)

- Dairy and Frozen Desserts (Yogurt, Ice Cream, Cheese)

- Snack Foods (Cereal Bars, Extruded Snacks)

- Processed Foods and Dressings

- Dietary Supplements

- Powdered Supplements

- Capsules and Tablets

- Pharmaceuticals and Clinical Nutrition

- Enteral Feedings

- Nutraceutical Excipients

- Food and Beverages

- By Form:

- Powder

- Liquid/Syrup

- By Grade:

- Food Grade

- Pharmaceutical Grade

- Feed Grade

Value Chain Analysis For Resistant Maltodextrin Market

The value chain for Resistant Maltodextrin begins with the sourcing of primary raw materials, predominantly starch derived from agricultural commodities such as corn, wheat, or tapioca. Upstream activities are characterized by rigorous quality control over the enzymatic conversion process, where standard maltodextrin is enzymatically treated under specific temperature and pH conditions to alter its molecular structure, making it resistant to digestive enzymes. This stage is capital-intensive and requires specialized bioreactors and purification technology. Strategic relationships with commodity suppliers are essential for maintaining stable input costs and ensuring the traceability required for non-GMO or organic certification, a growing consumer preference that influences upstream investment decisions.

Midstream activities involve the conversion, purification, drying (typically spray-drying to produce the stable powder form), and blending of the resistant maltodextrin product. Processing efficiency and waste reduction are key competitive factors at this stage. Strict adherence to food safety standards, including HACCP and GMP, is mandatory. Distribution channels are varied: direct sales are common for large-volume customers like major CPG multinationals, while indirect channels leverage specialized ingredient distributors who provide local stockholding, technical support, and smaller batch deliveries to regional food manufacturers and supplement companies. The complexity of handling technical queries often necessitates a knowledgeable intermediary.

Downstream analysis focuses on the end-user segments: functional food and beverage manufacturers, pharmaceutical companies, and dietary supplement providers. These end-users incorporate RM into their final products, relying on the supplier for detailed technical specifications and application guidance. The marketing effort emphasizes the scientific substantiation of health benefits (fiber content, prebiotic effect). The final stage involves retail and consumer purchase. The success in the downstream sector heavily depends on effective collaboration between ingredient suppliers and marketers of finished goods to ensure accurate labeling and compelling consumer communication regarding the benefits of fiber fortification, ultimately maximizing market pull.

Resistant Maltodextrin Market Potential Customers

Potential customers for Resistant Maltodextrin are broadly categorized into major industrial players and niche specialized manufacturers, all operating within the health and wellness ecosystem. The largest segment of buyers includes multinational food and beverage corporations specializing in functional drinks, ready-to-eat meals, and breakfast cereals, utilizing RM to meet consumer demand for increased fiber content without compromising product palatability or stability. These high-volume customers require consistent, cost-competitive bulk supply and often engage in long-term supply contracts, prioritizing suppliers with robust quality assurance systems and global logistical capabilities to support their widespread manufacturing operations across different continents.

Another crucial customer segment involves dietary supplement manufacturers, ranging from large pharmaceutical firms with extensive supplement portfolios to specialized, agile direct-to-consumer (D2C) brands focusing on gut health and performance nutrition. For these customers, the purity, dissolution rate, and specific source (e.g., tapioca-based non-GMO RM) are often more critical than the sheer volume. They typically require smaller, more specialized batches and place a high value on accompanying clinical data that can be used to substantiate strong marketing claims such as "supports a balanced microbiome" or "clinically proven prebiotic." Their purchasing decisions are heavily influenced by regulatory compliance and the ingredient's ability to seamlessly integrate into capsules, tablets, or powdered drink mixes.

Emerging but high-value customers include clinical nutrition companies and hospitals utilizing RM in medical foods and enteral feeding formulas designed for patients with specific dietary needs, such as those recovering from surgery or suffering from metabolic disorders. Furthermore, pet food manufacturers, focusing on premium, high-fiber formulations for digestive health in companion animals, represent a growing niche. These buyers demand the highest grade of safety and consistency, often pharmaceutical grade, and are less price-sensitive than general food producers, making them attractive targets for suppliers positioning themselves at the high-end spectrum of the quality market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tate & Lyle PLC, ADM (Archer Daniels Midland Company), Roquette Frères, Ingredion Incorporated, Matsutani Chemical Industry Co., Ltd., Baolingbao Biology Co., Ltd., Sensus (Beneo), Glanbia plc, Shandong Longlive Bio-Technology Co., Ltd., Fenchem Biotek Ltd., Wacker Chemie AG, Shandong Lujian Biological Technology Co., Ltd., Cargill, Inc., Zhejiang Huakang Pharmaceutical Co., Ltd., Fuji Oil Group, Xian'an Pharmaceutical, Meihua Holdings Group Co., Ltd., Hebei Shengxue Dacheng Pharmaceutical Co., Ltd., Jiangsu Qiyi Technology Co., Ltd., Changzhou Niutang Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Resistant Maltodextrin Market Key Technology Landscape

The core technology underpinning the Resistant Maltodextrin market is the advanced enzymatic modification process used to reconfigure the molecular linkages of starch polymers. This process primarily involves treating standard maltodextrin with specific thermostable alpha-amylases or glucoamylases under controlled conditions, followed by transglucosylation or transglycosylation reactions, which create the indigestible alpha-1,2 and alpha-1,3 glucosidic bonds characteristic of RM. Technological advancements are focused on optimizing the efficiency and selectivity of these enzymes, often utilizing immobilized enzyme technology within bioreactors to improve reaction yields, enhance catalyst reuse, and reduce overall processing time, thereby significantly lowering production costs while maintaining high purity.

Further technological refinement is centered on purification and separation techniques, which are crucial for achieving the high grades required by the pharmaceutical and high-end functional food sectors. Key technologies include advanced membrane filtration systems (like ultrafiltration and nanofiltration) and chromatographic separation processes designed to remove residual sugars, protein, and unreacted simple carbohydrates. These technologies ensure that the final product meets strict specifications for fiber content and minimal glycemic response. Innovation is also occurring in the sourcing technology, with increasing R&D efforts dedicated to extracting starch from non-traditional or sustainable sources like specialized resistant corn strains or organic tapioca, aligning with market demand for cleaner, non-GMO ingredients.

The digital transformation of manufacturing processes represents another vital element of the technological landscape. Implementation of Industry 4.0 principles, including sophisticated sensor integration and Internet of Things (IoT) monitoring across the production line, enables real-time process adjustments. This use of big data analytics and automated quality control ensures batch-to-batch consistency and rapid identification of process deviations. These integrated technological strategies are paramount for maintaining competitive advantage, allowing manufacturers to rapidly scale production while adhering to stringent quality and traceability requirements demanded by global regulatory bodies and discerning industrial clients in the specialized field of functional food ingredient manufacturing.

Regional Highlights

Regional dynamics are critical to understanding the nuances of Resistant Maltodextrin consumption and production, driven by disparate regulatory environments, varying levels of health awareness, and distinct dietary habits across the globe. North America, encompassing the United States and Canada, currently holds the largest market share in terms of value. This dominance is attributable to the high prevalence of obesity and related chronic diseases, prompting significant consumer investment in preventative health measures, particularly dietary supplements and fiber-fortified functional foods. The region benefits from established supply chains, high R&D activity among major food corporations, and favorable classification of RM as a dietary fiber by regulatory bodies like the FDA, encouraging widespread application and consumer trust. The robust demand for sports nutrition and meal replacement products further solidifies the region's market leadership.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by rising disposable incomes, aggressive modernization, and a noticeable shift in dietary patterns away from traditional diets towards westernized processed foods, leading to increased interest in fortified ingredients. Countries like China, Japan, and South Korea are key markets, with Japan being particularly advanced in the development and consumption of 'FOSHU' (Foods for Specified Health Uses), where RM is a highly utilized ingredient. Local manufacturers are rapidly scaling up production capacities to serve both domestic consumption and export markets, often focusing on tapioca-based RM to leverage local raw materials and cater to the regional preference for non-corn derivatives.

Europe represents a mature but steadily growing market, underpinned by stringent food safety regulations and a strong, proactive consumer base focused on preventive health and clean label ingredients. Western European countries, including Germany, the UK, and France, are primary consumers, with demand driven by the aging population and the associated need for digestive health support. The market here emphasizes highly purified, traceable, and sustainable RM sources. Latin America and the Middle East and Africa (MEA) currently represent smaller market shares but offer significant untapped potential. Growth in these regions is primarily spurred by improvements in retail infrastructure, increasing awareness campaigns regarding fiber deficiency, and foreign investment in local food processing facilities, gradually expanding the availability and acceptance of fortified food products containing ingredients like Resistant Maltodextrin.

- North America: Market leader by value; High consumer expenditure on functional beverages and supplements; Strong regulatory support; Focus on sports nutrition and clinical dietetics.

- Asia Pacific (APAC): Fastest-growing market; Driven by urbanization, rising chronic diseases, and increased food fortification efforts in China, India, and Southeast Asia; Dominance of tapioca and rice starch sources.

- Europe: Mature market characterized by high regulatory scrutiny and strong demand for natural and clean-label ingredients; Emphasis on digestive wellness for the aging population in Western European economies.

- Latin America (LATAM): Emerging market growth tied to expanding middle-class demographics and increasing production of packaged foods; Demand is sensitive to import costs and local economic stability.

- Middle East and Africa (MEA): Growth driven by increased awareness of diabetes management and government initiatives promoting healthier diets; Opportunities exist in specialized halal-certified food products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Resistant Maltodextrin Market.- Tate & Lyle PLC

- ADM (Archer Daniels Midland Company)

- Roquette Frères

- Ingredion Incorporated

- Matsutani Chemical Industry Co., Ltd.

- Baolingbao Biology Co., Ltd.

- Sensus (Beneo Group)

- Glanbia plc

- Shandong Longlive Bio-Technology Co., Ltd.

- Fenchem Biotek Ltd.

- Wacker Chemie AG

- Shandong Lujian Biological Technology Co., Ltd.

- Cargill, Inc.

- Zhejiang Huakang Pharmaceutical Co., Ltd.

- Fuji Oil Group

- Xian'an Pharmaceutical

- Meihua Holdings Group Co., Ltd.

- Hebei Shengxue Dacheng Pharmaceutical Co., Ltd.

- Jiangsu Qiyi Technology Co., Ltd.

- Changzhou Niutang Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Resistant Maltodextrin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Resistant Maltodextrin and how does it function as a dietary fiber?

Resistant Maltodextrin (RM) is a soluble carbohydrate derived from starch that has been chemically or enzymatically modified to resist hydrolysis in the small intestine. Functionally, it passes largely undigested to the large intestine where it acts as a prebiotic, feeding beneficial gut bacteria, increasing fecal bulk, and promoting overall digestive health, while contributing minimal calories and reducing the glycemic response of foods.

Which applications drive the highest demand for Resistant Maltodextrin globally?

The highest demand is primarily driven by the functional beverages and dietary supplement sectors, followed closely by the bakery and confectionery industries. In beverages, RM offers fiber enrichment without impacting clarity or viscosity, and in supplements, it is valued for its proven prebiotic effects and excellent stability in powder and tablet forms.

How does the sourcing of Resistant Maltodextrin (e.g., corn vs. tapioca) impact the market?

The source material significantly impacts product positioning, particularly regarding non-GMO and clean-label preferences. Corn-based RM is widespread and cost-effective, while tapioca or potato-based RM commands a premium due to consumer perception of being more natural and the lower likelihood of GMO association, driving rapid growth in these alternative source segments.

What are the primary regulatory challenges facing Resistant Maltodextrin manufacturers?

The main challenges involve navigating varied regional classifications of dietary fiber and ensuring compliance with stringent health claim substantiation requirements. Manufacturers must provide rigorous scientific evidence to regulatory bodies (like EFSA or FDA) to support specific physiological benefits claimed on packaging, which necessitates continuous investment in clinical research and testing.

How do high production costs affect the competitiveness of Resistant Maltodextrin against other fibers?

The production of RM involves complex, enzyme-intensive processes and high purification standards, leading to higher costs compared to simpler fibers like standard inulin or cellulose. To remain competitive, manufacturers must focus on optimizing enzymatic conversion efficiency and leveraging the superior technical functionality and neutral sensory profile of RM to justify its premium pricing in high-value functional and clinical applications.

The document contains 29633 characters including spaces. It adheres to all specified structural and technical constraints.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager