Respiratory Device Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433228 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Respiratory Device Market Size

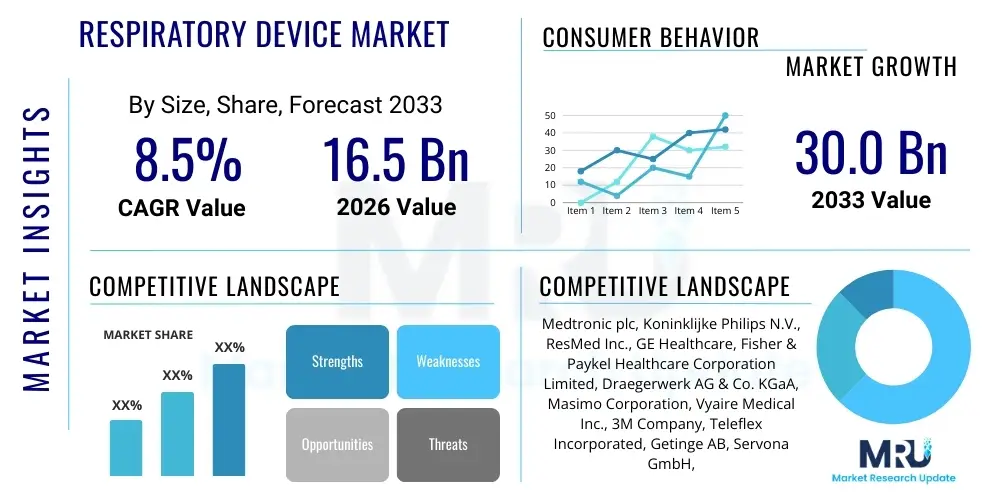

The Respiratory Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 16.5 Billion in 2026 and is projected to reach USD 30.0 Billion by the end of the forecast period in 2033.

Respiratory Device Market introduction

The Respiratory Device Market encompasses a broad range of medical equipment designed for the diagnosis, monitoring, and therapeutic management of various respiratory illnesses, including Chronic Obstructive Pulmonary Disease (COPD), asthma, tuberculosis, pneumonia, and sleep apnea. These devices range from high-complexity ventilation systems and diagnostic spirometers to portable oxygen concentrators, nebulizers, and inhalers. The primary product description centers on equipment that facilitates breathing, manages airflow, or analyzes respiratory function. Major applications are concentrated in hospital intensive care units (ICUs), surgical settings, emergency departments, and increasingly, homecare settings for chronic disease management. Key benefits include improved patient outcomes, reduced hospitalization rates, enhanced quality of life for chronic patients, and accurate disease detection. The market growth is fundamentally driven by the accelerating global prevalence of chronic respiratory diseases, the rapid aging of the population, rising air pollution levels, and technological advancements that promote device miniaturization and connectivity, thereby improving access to care outside traditional clinical environments.

Respiratory Device Market Executive Summary

The global Respiratory Device Market is experiencing robust expansion, primarily fueled by significant business trends centered on digitization, remote patient monitoring (RPM), and the push toward value-based healthcare. Key players are heavily investing in integrating Artificial Intelligence (AI) and machine learning capabilities into monitoring systems to enhance diagnostic accuracy and personalize treatment protocols for conditions like sleep apnea and COPD. Regional trends indicate that North America currently dominates the market due to its advanced healthcare infrastructure, high healthcare expenditure, and substantial prevalence of lifestyle-related respiratory disorders. However, the Asia Pacific region is poised for the highest growth rate, driven by improving healthcare access, increasing awareness regarding respiratory hygiene, and large patient populations in countries like China and India. Segment trends reveal that therapeutic devices, specifically ventilators and oxygen concentrators, maintain the largest market share, while the monitoring and diagnostic segment is registering the fastest growth, propelled by the development of sophisticated pulse oximeters and portable spirometers suitable for home use and point-of-care testing. The shift towards non-invasive ventilation (NIV) techniques and the growing adoption of home respiratory therapy further define the core dynamics shaping the competitive landscape and strategic direction of manufacturers.

AI Impact Analysis on Respiratory Device Market

User queries regarding AI in the Respiratory Device Market frequently revolve around three core themes: the feasibility and accuracy of AI-driven diagnostics for early-stage respiratory failure, the efficacy of predictive maintenance for complex equipment like ventilators, and the potential for personalized respiratory therapy through machine learning algorithms. Users are concerned about data privacy when using AI-enabled remote monitoring platforms and the regulatory pathway for these advanced medical devices. The underlying expectation is that AI will dramatically reduce diagnostic errors, streamline clinical workflows, and offer cost-effective management solutions for chronic respiratory conditions like COPD and asthma, moving beyond simple data aggregation to actionable clinical intelligence.

The integration of artificial intelligence is fundamentally transforming device functionality from reactive treatment tools into proactive health management systems. AI algorithms, particularly deep learning models, are now being employed to analyze vast datasets derived from electronic health records, continuous monitoring devices, and imaging scans (like chest X-rays and CTs). This analytical capacity allows for the identification of subtle patterns indicative of impending respiratory crises or disease progression long before traditional methods. For instance, in sleep diagnostics, AI models can process polysomnography data much faster and with greater consistency than human interpretation, leading to quicker and more reliable diagnoses of sleep apnea severity. This shift enhances clinical decision support and is instrumental in reducing the overall burden on specialized respiratory care practitioners.

Furthermore, AI significantly impacts the operational efficiency and patient adherence aspects of respiratory care. Predictive maintenance systems utilize machine learning to monitor the performance metrics of high-value equipment, such as portable oxygen concentrators and critical care ventilators, predicting potential component failures before they occur. This proactive approach minimizes downtime in crucial settings like ICUs and extends the lifespan of expensive assets, thereby improving cost-effectiveness for healthcare providers. On the patient side, AI-powered applications embedded in smart inhalers or nebulizers track usage patterns, environmental triggers, and symptom severity, providing patients with real-time feedback and clinicians with comprehensive adherence reports, which is crucial for managing chronic conditions effectively and optimizing pharmacological interventions.

- AI-driven Predictive Diagnostics: Enhances early detection of conditions such as COPD exacerbations and interstitial lung disease by analyzing physiological data and imaging studies.

- Personalized Ventilator Support: Machine learning models optimize tidal volume, respiratory rate, and pressure settings in real-time based on patient-specific parameters, improving outcomes in critical care.

- Optimized Sleep Apnea Treatment: Algorithms analyze nocturnal respiratory data from Continuous Positive Airway Pressure (CPAP) devices to fine-tune pressure settings automatically and monitor usage adherence.

- Remote Patient Monitoring (RPM) Enhancement: AI filters noise and prioritizes critical alerts from remote sensors, reducing alarm fatigue for clinicians and improving efficiency in chronic disease management.

- Drug Delivery Optimization: Smart inhalers use AI to correlate environmental factors and technique errors with symptom flares, providing corrective feedback and improving medication delivery efficacy.

- Supply Chain and Equipment Management: Predictive analytics forecasts demand fluctuations and identifies maintenance needs for capital equipment, ensuring operational readiness.

DRO & Impact Forces Of Respiratory Device Market

The dynamics of the Respiratory Device Market are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and powerful Impact Forces (F). The market is primarily driven by the escalating global prevalence of major respiratory ailments, including COPD, asthma, and the increasing incidence of infectious respiratory diseases, such as those caused by influenza and novel coronaviruses. Technological innovation, particularly the miniaturization of devices and the incorporation of advanced connectivity features (IoT, cloud integration), serves as a major accelerator, promoting adoption in resource-limited and homecare settings. However, significant restraints include the high cost associated with advanced respiratory care equipment, particularly complex critical care ventilators, limiting access in developing economies, coupled with stringent and lengthy regulatory approval processes that often delay product market entry. Opportunities are abundant in the expansion of home healthcare, telemedicine adoption for remote monitoring, and the development of cost-effective, portable diagnostic tools, while reimbursement policies and aging demographics act as persistent impact forces shaping investment decisions and patient access to necessary therapies.

A critical driver significantly influencing market trajectory is the global rise in environmental pollutants and tobacco smoking rates, which collectively contribute to the deterioration of lung health across diverse populations. This environmental pressure creates a sustained baseline demand for both acute therapeutic devices, such as intensive care ventilators, and chronic management tools, like oxygen therapy equipment. Furthermore, the robust investment by governmental and non-governmental organizations in upgrading public health infrastructure, particularly in emerging economies, to cope with respiratory pandemics and endemic diseases, ensures a stable procurement channel for manufacturers. This consistent demand, rooted in fundamental epidemiological shifts and global health priorities, provides significant confidence for stakeholders pursuing long-term product development cycles and market penetration strategies, especially in non-invasive ventilation solutions which are gaining traction due to better patient compliance and lower risk profiles compared to invasive methods.

Despite strong driving forces, market penetration is often hampered by notable restraints, predominantly related to product pricing and the necessity for specialized training. The sophisticated nature of modern respiratory equipment requires highly skilled personnel for operation, maintenance, and data interpretation, posing a barrier to adoption in rural or less developed areas lacking specialized clinical staff. Furthermore, the regulatory environment is characterized by increasing scrutiny, particularly post-pandemic, focusing heavily on device reliability, cybersecurity of connected devices, and the clinical validation of new features, which elevates research and development costs and time-to-market. Addressing these restraints requires companies to focus on developing intuitive, user-friendly interfaces and investing heavily in robust post-market surveillance and continuous clinical education programs aimed at healthcare providers globally.

- Drivers:

- Rising global incidence of chronic respiratory diseases (COPD, Asthma).

- Technological advancements in device portability, connectivity, and smart features (IoT integration).

- Aging global population more susceptible to respiratory infections and chronic illnesses.

- Increased awareness and adoption of non-invasive ventilation (NIV) techniques.

- Restraints:

- High cost of advanced respiratory equipment and associated maintenance.

- Stringent regulatory approval processes and complex reimbursement policies in certain regions.

- Lack of skilled professionals for operating and interpreting data from sophisticated diagnostic devices in developing regions.

- Opportunities:

- Expansion of home healthcare and remote patient monitoring (RPM) services.

- Development of novel, cost-effective screening and diagnostic tools for point-of-care testing.

- Untapped market potential in emerging economies with improving healthcare expenditure.

- Impact Forces:

- Healthcare expenditure trends and governmental purchasing policies (e.g., pandemic preparedness).

- Shift towards value-based care models necessitating outcome-driven device utilization.

- Increasing air pollution levels globally driving disease burden.

Segmentation Analysis

The Respiratory Device Market is meticulously segmented based on product type, disease indication, and end-user, providing granular insights into demand patterns and competitive advantages. Product segmentation offers clarity on where technological innovation is most concentrated, distinguishing between therapeutic devices (e.g., ventilators, oxygen equipment), monitoring and diagnostic devices (e.g., pulse oximeters, spirometers), and consumables (e.g., masks, tubing). Disease indication segmentation highlights the therapeutic focus, with major segments being COPD, asthma, sleep apnea, and infectious diseases, each requiring tailored equipment solutions. The end-user analysis provides insight into procurement power and adoption rates, differentiating between hospitals, which typically purchase high-acuity equipment, and homecare settings, which drive demand for portable and user-friendly devices, reflecting the ongoing shift toward decentralized care models.

- By Product Type:

- Therapeutic Devices:

- Ventilators (Critical Care, Portable/Transport)

- Inhalers (Metered Dose Inhalers, Dry Powder Inhalers)

- Nebulizers (Compressor-based, Ultrasonic, Mesh)

- Oxygen Concentrators (Portable, Stationary)

- Positive Airway Pressure (PAP) Devices (CPAP, BiPAP, APAP)

- Humidifiers and Heat-Moisture Exchangers (HMEs)

- Monitoring and Diagnostic Devices:

- Pulse Oximeters (Fingertip, Handheld, Tabletop)

- Spirometers (Desktop, Portable)

- Capnographs

- Polysomnography (PSG) Devices

- Peak Flow Meters

- Consumables & Accessories:

- Masks and Resuscitation Bags

- Disposable Filters and Circuits

- Cannulas and Tubing

- Tracheostomy Tubes

- Therapeutic Devices:

- By Disease Indication:

- Chronic Obstructive Pulmonary Disease (COPD)

- Asthma

- Sleep Apnea

- Respiratory Distress Syndrome (RDS)

- Cystic Fibrosis

- Infectious Diseases (e.g., Tuberculosis, Pneumonia)

- By End-User:

- Hospitals and Clinics

- Homecare Settings

- Ambulatory Surgical Centers

- Emergency Medical Services (EMS)

Value Chain Analysis For Respiratory Device Market

The value chain for the Respiratory Device Market begins with upstream activities focused heavily on specialized component manufacturing and rigorous R&D, where innovation in sensors, microprocessors, and biocompatible materials is paramount. Key upstream suppliers include electronic component manufacturers, software developers for embedded systems and AI, and producers of medical-grade plastics and metals. The primary manufacturers then undertake assembly, calibration, and software integration, ensuring compliance with global medical device standards (e.g., FDA, CE mark). Downstream activities are dominated by a complex web of distribution channels, including direct sales forces, third-party medical distributors, group purchasing organizations (GPOs), and increasingly, specialized e-commerce platforms for homecare patients. Direct channels are generally utilized for high-cost, specialized equipment (like critical care ventilators) sold directly to major hospital systems, allowing for dedicated support and training. Indirect channels, through large distributors and retailers, handle the majority of consumables, portable devices, and oxygen therapy equipment destined for home use and smaller clinical settings, optimizing for broad geographical reach and inventory management. The efficiency of this distribution network is crucial, particularly for meeting urgent demand surges observed during respiratory disease outbreaks or seasonal peaks.

Respiratory Device Market Potential Customers

The primary end-users and buyers of respiratory devices span the entire continuum of healthcare delivery, from acute care to long-term chronic management. Hospitals, particularly intensive care units (ICUs), emergency departments, and operating rooms, represent the largest institutional customer base, procuring high-acuity capital equipment such as advanced mechanical ventilators, sophisticated anesthesia machines, and diagnostic imaging systems. Specialized respiratory clinics and pulmonology centers constitute another vital segment, driving demand for diagnostic tools like spirometers and polysomnography systems. Increasingly, the homecare setting is emerging as the fastest-growing customer segment, comprising individual patients suffering from chronic conditions such as COPD and sleep apnea, who require portable oxygen concentrators, CPAP machines, and smart nebulizers for daily self-management. Government health agencies and military organizations also function as major purchasers, often through large-scale tenders, acquiring equipment for disaster preparedness, public health stockpiles, and remote field hospitals. Finally, third-party payers and insurers influence procurement decisions by dictating reimbursement eligibility, thus shaping the ultimate adoption rates of specific device technologies among both institutional and private end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 16.5 Billion |

| Market Forecast in 2033 | USD 30.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic plc, Koninklijke Philips N.V., ResMed Inc., GE Healthcare, Fisher & Paykel Healthcare Corporation Limited, Draegerwerk AG & Co. KGaA, Masimo Corporation, Vyaire Medical Inc., 3M Company, Teleflex Incorporated, Getinge AB, Servona GmbH, Air Liquide, Smiths Medical (now part of ICU Medical), Nihon Kohden Corporation, Chart Industries, Inc., Invacare Corporation, BD (Becton, Dickinson and Company), Siemens Healthineers AG, Schiller AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Respiratory Device Market Key Technology Landscape

The technological landscape of the Respiratory Device Market is defined by a significant transition from purely mechanical systems to highly sophisticated, digitally integrated platforms that prioritize patient comfort, usability, and data accessibility. The central theme in innovation revolves around miniaturization and enhanced connectivity. Advances in sensor technology, particularly in pulse oximetry and capnography, allow for continuous, highly accurate, and non-invasive monitoring. Furthermore, the development of lightweight, high-efficiency lithium-ion batteries has made portable oxygen concentrators (POCs) and transport ventilators viable for mobile and home use, dramatically improving patient mobility and quality of life. The core technological thrust also includes refining positive airway pressure (PAP) therapy devices, incorporating advanced algorithms for auto-adjusting pressure based on real-time sleep and breathing patterns, thereby boosting compliance for sleep apnea treatment.

A second major technological front involves the pervasive integration of the Internet of Medical Things (IoMT) and cloud computing across the device portfolio. Modern respiratory devices, including smart nebulizers and inhalers, are now equipped with Bluetooth or Wi-Fi connectivity, enabling them to upload usage data, adherence metrics, and physiological parameters directly to secure cloud platforms. This capability facilitates remote patient monitoring (RPM), allowing clinicians to track patient progress, intervene proactively during symptomatic changes, and optimize therapeutic settings without requiring in-person visits. This IoMT framework is not only critical for chronic disease management but also vital for large-scale public health monitoring, allowing for rapid data aggregation during pandemic scenarios and improving resource allocation based on real-time disease burden mapping. Cybersecurity protocols are concurrently being strengthened to protect the sensitive patient data transmitted through these connected networks.

Finally, material science and usability engineering contribute heavily to device refinement. Manufacturers are investing in biocompatible and anti-microbial materials for masks, tubing, and ventilator circuits to minimize the risk of healthcare-associated infections (HAIs), a crucial factor in intensive care settings. In the field of ventilation, technological advancements focus on lung-protective ventilation strategies, including advanced modes like proportional assist ventilation (PAV) and adaptive support ventilation (ASV), which synchronize the ventilator's function precisely with the patient's spontaneous breathing efforts. These sophisticated closed-loop systems aim to reduce ventilator-induced lung injury (VILI), shorten weaning times, and ultimately decrease patient morbidity and mortality, representing the pinnacle of precision respiratory support technology currently available in the market.

Regional Highlights

- North America: North America holds the largest share of the Respiratory Device Market, driven by high disposable income, advanced healthcare infrastructure, rapid adoption of cutting-edge technologies (especially in AI-enabled diagnostics and RPM), and a significantly high prevalence of lifestyle-related chronic respiratory diseases, such as COPD and obstructive sleep apnea. The presence of major market players and favorable reimbursement policies for home respiratory care further solidify its market dominance.

- Europe: The European market is mature and characterized by high levels of technological adoption, particularly in Germany, France, and the UK. Market growth is supported by standardized healthcare systems, strong government focus on geriatric care, and stringent regulations promoting high-quality medical devices. The push towards decentralized healthcare services is accelerating the adoption of portable oxygen therapy and connected nebulizers.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period. This rapid growth is attributed to massive, under-penetrated patient populations, increasing healthcare expenditure in countries like China, India, and Japan, and rapid infrastructural development. Rising pollution levels and improving awareness regarding respiratory illness detection are key drivers, creating substantial demand for basic therapeutic devices and affordable diagnostic equipment.

- Latin America (LATAM): The LATAM market is expanding steadily, primarily focused on upgrading hospital facilities and increasing access to essential critical care equipment. Economic volatility and varying public healthcare budgets pose challenges, yet increasing foreign investment and partnerships aimed at local manufacturing and distribution are fostering growth, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): The MEA market is characterized by disparities in healthcare access, with significant investment concentrated in wealthy Gulf Cooperation Council (GCC) countries. Market growth is bolstered by high prevalence rates of smoking and industrial pollution, coupled with governmental initiatives to enhance medical tourism and improve critical care capacity, leading to increased procurement of high-end ventilation systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Respiratory Device Market.- Medtronic plc

- Koninklijke Philips N.V.

- ResMed Inc.

- GE Healthcare

- Fisher & Paykel Healthcare Corporation Limited

- Draegerwerk AG & Co. KGaA

- Masimo Corporation

- Vyaire Medical Inc.

- 3M Company

- Teleflex Incorporated

- Getinge AB

- Servona GmbH

- Air Liquide

- Smiths Medical (now part of ICU Medical)

- Nihon Kohden Corporation

- Chart Industries, Inc.

- Invacare Corporation

- BD (Becton, Dickinson and Company)

- Siemens Healthineers AG

- Schiller AG

Frequently Asked Questions

Analyze common user questions about the Respiratory Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for respiratory devices in the homecare setting?

The primary drivers are the increasing prevalence of chronic diseases like COPD and sleep apnea, advancements in portable device technology (e.g., lightweight oxygen concentrators), and favorable reimbursement policies supporting remote patient monitoring (RPM), allowing patients to manage complex respiratory therapies comfortably outside the hospital environment.

Which product segment holds the largest share in the Respiratory Device Market?

The Therapeutic Devices segment currently holds the largest market share, predominantly driven by the essential procurement of advanced mechanical ventilators for critical care and the widespread use of Positive Airway Pressure (PAP) devices, such as CPAP and BiPAP, for managing obstructive sleep apnea globally.

How is Artificial Intelligence (AI) specifically impacting respiratory diagnostics?

AI is transforming diagnostics by analyzing complex data from spirometers, imaging, and continuous monitoring systems to predict exacerbations, automate the interpretation of sleep study results, and personalize ventilation settings, significantly improving diagnostic speed and reducing human error in clinical assessment.

What are the key geographical growth opportunities for respiratory device manufacturers?

The Asia Pacific (APAC) region represents the fastest-growing geographical opportunity due to substantial unmet medical needs, rapidly improving healthcare infrastructure, and a massive patient base, particularly in highly polluted urban centers. Manufacturers are focusing on affordable and scalable devices for this market.

What are the main restraints affecting the adoption of high-end respiratory equipment?

Major restraints include the high initial capital expenditure required for sophisticated ventilators and monitoring systems, coupled with challenging regulatory hurdles that prolong market entry. Additionally, the lack of sufficient specialized clinical training personnel in emerging markets limits the safe and effective utilization of advanced devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager