Respiratory Monitoring Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432185 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Respiratory Monitoring Devices Market Size

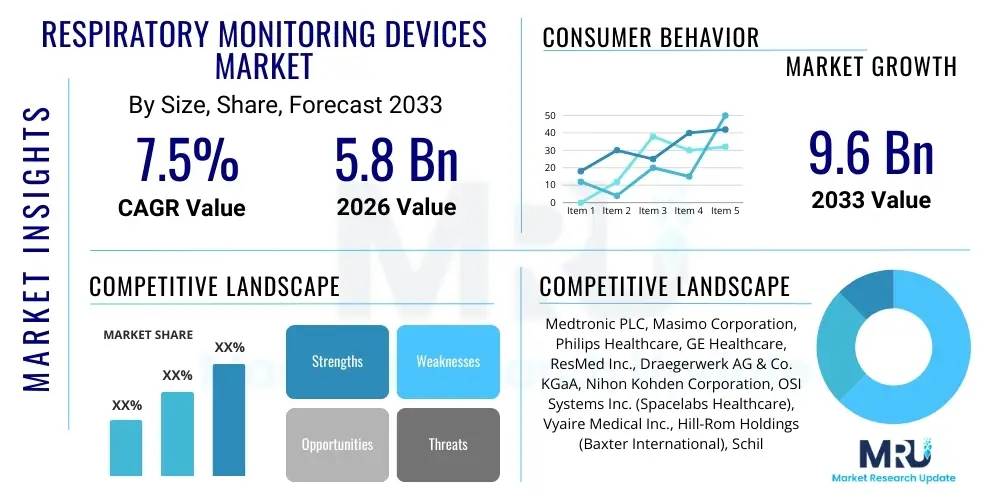

The Respiratory Monitoring Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Respiratory Monitoring Devices Market introduction

The Respiratory Monitoring Devices Market encompasses a wide array of medical instruments designed to measure, track, and analyze respiratory parameters in patients across various care settings, including hospitals, ambulatory surgical centers, and home care environments. These devices are critical for diagnosing and managing chronic obstructive pulmonary disease (COPD), asthma, sleep apnea, and acute respiratory distress syndrome (ARDS), particularly in intensive care units (ICUs) and neonatal units. Products range from basic pulse oximeters and spirometers to advanced capnography and gas monitoring systems, focusing on non-invasive and continuous measurement of oxygen saturation, carbon dioxide levels, and lung mechanics. The fundamental application lies in ensuring patient safety during anesthesia, sedation, and post-operative recovery, and in long-term management of chronic respiratory conditions.

The increasing global prevalence of respiratory diseases, often exacerbated by factors such as urbanization, pollution, and smoking, serves as the primary catalyst for market expansion. Furthermore, the rising geriatric population, which is more susceptible to severe respiratory infections and chronic ailments, significantly boosts the demand for reliable and portable monitoring solutions. Technological advancements, particularly the shift toward miniaturized, wireless, and integrated devices capable of remote monitoring, are transforming how respiratory care is administered. These innovations improve patient compliance and enable healthcare providers to intervene proactively, optimizing clinical outcomes and reducing hospital readmission rates.

Key benefits derived from widespread adoption of these monitoring devices include enhanced diagnostic accuracy, immediate detection of life-threatening respiratory events, and improved patient management efficiency. Driving factors include favorable government initiatives supporting preventative healthcare and early diagnosis, coupled with the increasing integration of monitoring devices with electronic health records (EHRs) and telehealth platforms. The sustained need for continuous and highly accurate respiratory data in critical care settings ensures the market’s robust growth trajectory over the forecast period, positioning respiratory monitoring as an indispensable element of modern critical and chronic care protocols globally.

Respiratory Monitoring Devices Market Executive Summary

The Respiratory Monitoring Devices Market exhibits strong dynamism, driven by the convergence of high disease burden and rapid technological evolution. Business trends indicate a robust investment in R&D focusing on non-invasive, wearable sensors and connectivity features, allowing for seamless data transmission and integration into hospital information systems. Strategic mergers and acquisitions are common among key players seeking to consolidate product portfolios, particularly integrating advanced sensing technologies like mainstream and sidestream capnography into multi-parameter monitoring platforms. Furthermore, the shift towards value-based care models necessitates monitoring systems that can provide actionable insights for preventing complications, favoring devices that offer predictive analytics capabilities, and supporting enhanced clinical decision making.

Regionally, North America maintains its dominance due to high healthcare expenditure, sophisticated infrastructure, and early adoption of advanced medical technologies. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by vast untapped patient populations, improving healthcare access, and rising awareness regarding respiratory health management, particularly in emerging economies like China and India. European markets are characterized by stringent regulatory environments and a strong emphasis on continuous quality improvement in patient care, driving demand for highly certified and reliable equipment. Latin America and MEA are focused primarily on essential monitoring devices, though growing medical tourism and infrastructural development suggest future market maturation and increased demand for sophisticated equipment.

Segment trends reveal that pulse oximeters and capnographs remain the largest product categories, driven by their indispensable role in surgery and critical care. The diagnostic devices segment, notably spirometers and peak flow meters, is experiencing increased adoption due to global initiatives aimed at early screening for COPD and asthma. The end-user landscape is seeing a major shift towards home care settings, primarily influenced by the cost-effectiveness and convenience offered by portable and user-friendly devices, reflecting a broader decentralization trend in healthcare delivery. Continuous positive airway pressure (CPAP) monitoring devices, crucial for sleep apnea management, are also witnessing heightened demand driven by rising obesity rates and increased diagnosis rates of sleep-disordered breathing.

AI Impact Analysis on Respiratory Monitoring Devices Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Respiratory Monitoring Devices Market frequently center on its potential to revolutionize diagnostics, predict acute respiratory failure, and enhance the accuracy of wearable sensors. Users inquire about how AI algorithms can interpret complex physiological data streams—such as correlating oximetry trends with capnography readings—to provide early warning scores, thereby minimizing false alarms and reducing clinician burnout. There is significant interest in AI's role in personalizing treatment plans for chronic diseases like COPD, optimizing ventilation settings in ICU patients, and automating the analysis of polysomnography (PSG) data for sleep apnea diagnosis. Expectations are high for AI to move monitoring devices beyond simple data collection into sophisticated predictive health tools, ultimately improving clinical workflow efficiency and patient outcomes while integrating seamlessly into existing hospital IT infrastructures.

The integration of AI algorithms into respiratory monitoring systems addresses major clinical pain points, particularly the issue of alarm fatigue in critical care units. By applying machine learning to distinguish true physiological crises from routine or artifact-induced deviations, AI significantly improves the specificity and sensitivity of monitoring alerts. This enhanced reliability allows clinicians to focus their attention more effectively, leading to faster intervention times for genuine emergencies. Furthermore, AI platforms are crucial for processing the enormous datasets generated by continuous monitoring devices in remote patient monitoring (RPM) settings, making longitudinal data interpretable and actionable for chronic disease management.

The future trajectory of the market relies heavily on AI-driven miniaturization and democratization of diagnostic capabilities. For example, AI can enable highly accurate respiratory assessments using simple smartphone microphones or non-contact radar sensors, lowering the cost and complexity of entry-level diagnostics. This shift supports preventative care models, allowing individuals to monitor their lung health proactively. As AI models become validated against extensive clinical datasets, they will not only improve existing device functionality but also unlock entirely new product categories focused on predictive respiratory health maintenance and risk stratification for vulnerable patient populations.

- AI enables predictive analytics for early detection of respiratory decompensation, often hours before traditional monitoring triggers.

- Machine learning algorithms enhance the accuracy and reliability of wearable respiratory sensors by filtering noise and motion artifacts, particularly in ambulatory settings.

- AI optimizes mechanical ventilator management by automatically adjusting complex parameters based on real-time patient physiological responses and compliance data.

- Deep learning facilitates automated and expedited interpretation of complex diagnostic data, such as spirometry results, lung function tests, and comprehensive sleep study reports.

- AI systems integrate data from multiple disparate respiratory monitors (capnography, SpO2, spirometry, temperature) to provide holistic, synthesized patient insights on a unified dashboard.

- Implementation of AI-driven alert prioritization systems drastically reduces the incidence of non-critical false alarms in high-intensity critical care environments.

- AI supports personalized therapeutic strategies for chronic respiratory conditions by analyzing long-term patient usage data, adherence patterns, and identifying exacerbation triggers.

- Natural Language Processing (NLP) within AI assists in automatically documenting and summarizing respiratory events directly into Electronic Health Records (EHRs).

- AI models are being developed to analyze chest imaging alongside monitoring data for improved diagnosis of conditions like pneumonia and ARDS severity.

- Development of smart respiratory monitoring patches utilizing AI for continuous, non-intrusive monitoring in general wards and home settings.

DRO & Impact Forces Of Respiratory Monitoring Devices Market

The market growth is primarily driven by the escalating prevalence of chronic respiratory disorders globally, including COPD and asthma, coupled with significant technological advancements that have led to the development of highly accurate and non-invasive monitoring solutions. The mandated use of capnography in procedural sedation and critical care settings across major economies serves as a major market accelerator, effectively driving volume sales in the acute care segment. Additionally, widespread recognition of the need for continuous physiological monitoring during the opioid crisis, aimed at preventing fatal respiratory depression, has increased the implementation of continuous pulse oximetry and capnography in general medical wards. These drivers are fundamentally linked to demographic shifts, specifically the rapid increase in the aging global population, which requires more intensive and long-term respiratory management strategies.

Restraints largely involve the high initial cost associated with advanced multi-parameter monitoring systems, which can limit adoption in resource-constrained settings, particularly smaller hospitals and public healthcare systems in developing nations. Ongoing challenges related to the stringent and often lengthy regulatory approval process required for new medical devices, especially those incorporating novel AI or IoMT components, slow down market entry and innovation uptake. Furthermore, a significant restraint is the inconsistency in reimbursement policies across different regions for specific advanced technologies, especially those used in ambulatory or home care settings. Healthcare professionals also face training challenges in maximizing the sophisticated capabilities of new, integrated monitoring platforms, sometimes leading to underutilization of advanced features.

Opportunities are abundant in the expansion of telehealth and remote patient monitoring (RPM) services, creating a massive demand pipeline for portable, internet-enabled respiratory monitors, alongside the increasing focus on preventive care and early diagnostic screening, particularly in emerging markets. The development of user-friendly, consumer-grade respiratory monitors that provide clinical-grade data offers a pathway to engage patients actively in their own health management. Impact forces are characterized by both market pull and technology push. The market pull is exerted by the critical need to minimize hospital stay duration and costs, making efficient continuous monitoring essential in both acute and post-acute settings. The technology push is seen through the integration of Internet of Medical Things (IoMT) capabilities and advanced sensor technology, such as acoustic and radar-based respiratory rate detection, which enhance user experience and data quality. These forces collectively propel market expansion, demanding continuous innovation in device accuracy, portability, and interoperability with existing healthcare infrastructure. Regulatory shifts, such as stricter guidelines for anesthesia monitoring, further amplify the demand for mandatory devices like capnographs, cementing their market position.

Segmentation Analysis

The Respiratory Monitoring Devices Market is comprehensively segmented based on product type, end user, and portability, reflecting the diverse clinical needs and technological maturity across various healthcare settings. Product segmentation includes foundational monitoring systems such as pulse oximeters, which dominate the volume metrics, alongside technologically intensive segments like capnography and gas analyzers, critical for perioperative care and ventilator management. Segmentation also considers the difference between diagnostic devices, used for screening and initial assessment, and monitoring devices, used for continuous patient surveillance during treatment. This distinction is crucial as diagnostic tools like spirometers are increasingly utilized in primary care settings, while monitoring tools remain core to critical care.

End-user segmentation highlights the dual reliance of the market on established hospital and clinical settings for acute care, and the rapidly growing non-clinical segments like home care and ambulatory centers, driven by cost containment and convenience. The shift towards outpatient care, often supported by government incentives to reduce the burden on hospitals, is rapidly accelerating the adoption of portable and connected devices suitable for home use. The complexity and required features vary significantly between these end-user groups, dictating manufacturer design priorities, with hospitals demanding high durability and multi-parameter capability, while home users prioritize ease of use and aesthetics.

Analysis across these segments reveals distinct growth drivers, with diagnostic devices leading growth in the ambulatory sector and continuous monitoring systems dominating critical care infrastructure. The portability segment distinguishes between large, fixed benchtop devices (common in ICUs and laboratories) and small, lightweight, battery-operated portable devices (essential for EMS, transport, and home care). Continuous innovation in sensor size and battery life is making portable multi-parameter devices increasingly capable of replacing traditional benchtop systems in less acute settings, driving market dynamics toward mobile health solutions and decentralization of monitoring capabilities.

- By Product Type:

- Pulse Oximeters

- Fingertip Pulse Oximeters

- Handheld Pulse Oximeters

- Tabletop Pulse Oximeters

- Wrist-Worn Pulse Oximeters

- Capnography Devices

- Mainstream Capnographs

- Sidestream Capnographs

- Microstream Capnographs

- Spirometers

- Desktop Spirometers

- Portable Spirometers

- Gas Analyzers (O2, Multi-Gas)

- Apnea Monitors

- Polysomnography (PSG) Devices

- Others (Including Peak Flow Meters and Respiratory Rate Monitors)

- By Application:

- Diagnosis (Screening and Assessment)

- Monitoring (Critical Care, General Ward, Home Care)

- By End User:

- Hospitals and Clinics (ICU, OR, General Ward)

- Ambulatory Surgical Centers (ASCs)

- Home Care Settings and Remote Monitoring

- Diagnostic Laboratories and Sleep Centers

- By Portability:

- Portable and Handheld Devices

- Benchtop/Desktop Devices (Fixed Systems)

- By Technology:

- Invasive Monitoring

- Non-Invasive Monitoring

Value Chain Analysis For Respiratory Monitoring Devices Market

The value chain for respiratory monitoring devices begins with upstream activities focused on the procurement and refinement of highly specialized components, primarily encompassing advanced sensor technology (electrochemical, photometric, acoustic), high-performance microprocessors, and sophisticated display interfaces. Key players in this stage are semiconductor manufacturers and specialized sensor developers, where intellectual property and manufacturing precision are paramount. The reliability and accuracy of the final monitoring device are fundamentally determined by the quality and precision of these raw components. Research and development activities, often involving extensive partnerships between device manufacturers and leading clinical institutions, drive innovation in non-invasive sensing techniques and sophisticated data analytics algorithms. Ensuring high quality and compliance with rigorous medical device standards (like ISO 13485 and FDA clearance) is crucial at this preliminary stage, directly impacting device reliability and global regulatory approval timelines.

The midstream phase involves the core manufacturing, precision assembly, complex calibration, and rigorous quality control processes. This stage requires significant capital investment in highly regulated cleanroom facilities and scalable production lines capable of maintaining sterile conditions and high dimensional accuracy. Manufacturers must manage complex global supply chains, often sourcing components from specialized vendors across different continents. Efficient inventory management and lean manufacturing techniques are essential here to keep production costs competitive while maintaining the non-negotiable safety standards required for medical devices. Software development and integration, particularly for user interfaces and connectivity features, are also critical midstream activities that determine the device's market appeal and interoperability.

Once manufactured, the downstream activities focus on distribution, sales, and post-sale services. Distribution channels are varied: direct sales teams handle large tenders and complex multi-parameter monitoring systems sold to major hospital networks, ensuring intensive technical support and clinician training are integrated into the sales package. Indirect channels, involving specialized third-party distributors and medical equipment suppliers, are crucial for efficiently reaching smaller clinics, ambulatory centers, and the vast global home care market. E-commerce platforms are increasingly utilized for consumer-grade devices like personal pulse oximeters and portable spirometers. The final crucial link involves end-user adoption and post-market surveillance, where maintenance, calibration services, and timely software updates provided by the manufacturer ensure long-term device performance and customer satisfaction, often generating substantial recurring revenue.

Respiratory Monitoring Devices Market Potential Customers

Potential customers for respiratory monitoring devices span the entire continuum of care, from acute critical settings to long-term chronic disease management in the home environment. The largest segment remains institutional buyers, specifically acute care hospitals, which require a high volume of sophisticated, multi-parameter monitoring systems for ICUs, emergency rooms, operating theaters, and general wards. Within hospitals, key purchase decision-makers include anesthesiologists, pulmonologists, intensivists, and centralized procurement departments focused on capital equipment budgets, standardization, and integration capabilities. These customers prioritize clinical accuracy, system durability, network cybersecurity, and seamless integration with existing patient monitoring networks and Electronic Health Records (EHRs) to optimize clinical workflow efficiency.

A rapidly expanding customer base includes ambulatory surgical centers (ASCs) and specialty clinics, driven by the increasing shift of elective and minor procedures out of traditional hospitals due to cost considerations. These facilities demand cost-effective, portable devices, particularly reliable pulse oximeters and capnographs, to meet stringent regulatory requirements for patient sedation monitoring and post-operative recovery. The growing number of independent diagnostic laboratories and sleep centers also represents a significant customer segment, relying heavily on advanced spirometers, body plethysmographs, and complex apnea monitors (like PSG devices) for specialized diagnostic services, screening programs, and detailed physiological assessment related to respiratory and sleep disorders.

The consumer and home care sector forms the third critical customer group, experiencing accelerating growth driven by the rise of remote patient monitoring (RPM) platforms. This includes individuals managing chronic conditions (COPD, asthma, sleep apnea) and their caregivers, who purchase user-friendly, non-invasive devices, often through retail channels or via prescribed medical device suppliers utilizing RPM services. For this segment, ease of use, robust connectivity features (Bluetooth/Wi-Fi for telehealth integration), data visualization quality, and affordability are primary purchasing criteria. Furthermore, emergency medical services (EMS) providers and military field hospitals are essential customers, relying on rugged, portable, and reliable monitoring devices for pre-hospital acute care and transportation, emphasizing instantaneous, accurate data acquisition in highly mobile and challenging environmental conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic PLC, Masimo Corporation, Philips Healthcare, GE Healthcare, ResMed Inc., Draegerwerk AG & Co. KGaA, Nihon Kohden Corporation, OSI Systems Inc. (Spacelabs Healthcare), Vyaire Medical Inc., Hill-Rom Holdings (Baxter International), Schiller AG, MGC Diagnostics Corporation, Welch Allyn (Hill-Rom), Nonin Medical Inc., Smiths Medical (ICU Medical), Beurer GmbH, BPL Medical Technologies, A&D Medical, Contec Medical Systems, Mindray Medical International Limited, Microlife Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Respiratory Monitoring Devices Market Key Technology Landscape

The current technology landscape in respiratory monitoring is defined by a rapid shift toward non-invasive, continuous, and highly miniaturized sensing solutions, often leveraging the Internet of Medical Things (IoMT) framework to ensure ubiquitous connectivity. A critical technological evolution is the refinement of traditional pulse oximetry, moving beyond standard two-wavelength technology to sophisticated multi-wavelength platforms (e.g., Masimo's SET and Rainbow technology) capable of measuring additional parameters such as carboxyhemoglobin (COHb), methemoglobin (MetHb), and fractional oxygen saturation (SpfO2). This advancement significantly improves diagnostic breadth and accuracy in complex clinical scenarios like carbon monoxide poisoning. Furthermore, capnography, essential for quantifying exhaled carbon dioxide (EtCO2), has seen major advancements in microstream and molecular correlation spectroscopy technology, enabling highly accurate sampling with extremely low flow rates, which is crucial for sensitive monitoring of neonates and non-intubated patients in general wards.

The integration of wireless communication and sophisticated data analytics capabilities is fundamentally reshaping device utility across the care continuum. Modern respiratory monitors are invariably designed with secure Wi-Fi or Bluetooth connectivity, allowing seamless, real-time data transfer to central monitoring stations, Electronic Health Records (EHRs), and cloud-based platforms for effective Remote Patient Monitoring (RPM). This connectivity facilitates longitudinal data tracking, crucial for managing chronic conditions, predicting exacerbations, and ensuring timely clinical intervention outside of the hospital setting. Key technological challenges remain in developing truly comfortable and highly reliable wearable sensors that can accurately measure critical parameters like respiratory rate and tidal volume non-invasively, without restricting patient mobility or generating artifacts from daily activities. Advanced sensor research focuses on utilizing acoustic monitoring, highly sensitive impedance pneumography, and even miniaturized radar-based sensing techniques to provide highly accurate, contact-free monitoring, particularly beneficial in challenging areas such as sleep medicine and neonatal critical care environments.

Furthermore, software advancements, particularly the incorporation of embedded Artificial Intelligence (AI) and Machine Learning (ML), are playing an increasingly important role, moving monitoring devices from passive data reporters to active diagnostic assistants. AI algorithms are being embedded to analyze complex physiological patterns indicative of impending respiratory distress, automate the calibration of sensing elements, and generate highly accurate, predictive scores for adverse events. For instance, ML algorithms applied to complex spirometry flow-volume loops can automatically classify disease severity, predict treatment response, and recommend necessary follow-up testing, drastically reducing the analysis time required by clinicians. This focus on intelligent data interpretation not only enhances clinical utility and patient safety but also streamlines workflow, allowing healthcare providers to efficiently manage a significantly higher patient load while maintaining or improving quality of care standards. Future market growth is heavily dependent on overcoming regulatory hurdles and ensuring high levels of data security and interoperability for these interconnected, intelligent monitoring systems.

Regional Highlights

- North America: This region holds the largest market share, driven by exceptionally high healthcare expenditure, the highest prevalence rate of chronic respiratory illnesses (COPD, asthma, sleep apnea), established and favorable reimbursement policies for both acute and remote monitoring, and the region's strong culture of adopting advanced medical technologies early. The US, in particular, leads the global adoption of mandatory capnography during sedation and is a pioneer in implementing sophisticated remote patient monitoring (RPM) platforms, bolstering sustained demand for connected and high-fidelity portable devices.

- Europe: Europe is a mature and highly regulated market characterized by stringent EU Medical Device Regulation (MDR) standards and a widespread governmental focus on continuous quality improvement in public health outcomes. This ensures consistent, high-volume demand for high-quality, certified diagnostic and monitoring tools. Western European countries, including Germany, France, and the UK, contribute significantly, driven by a rapidly aging population susceptible to respiratory complications and substantial public investment in hospital modernization and home care integration.

- Asia Pacific (APAC): APAC is projected to experience the highest Compound Annual Growth Rate during the forecast period. This rapid acceleration is attributed to rapidly expanding healthcare expenditure, increasing health insurance penetration, and vast, untapped patient populations across highly polluted urban centers, particularly in major economies like China and India. Growing public awareness regarding respiratory health, coupled with infrastructure development and increased regulatory acceptance of Western medical devices, makes this region the most crucial geographical growth opportunity for device manufacturers.

- Latin America (LATAM): This region presents moderate and stable growth, often influenced by fluctuating macroeconomic conditions and varying levels of healthcare access and infrastructure. However, increasing public and private investments aimed at upgrading critical care and operating room facilities, particularly in key markets such as Brazil and Mexico, are steadily boosting the procurement of essential respiratory monitoring devices like reliable pulse oximeters and basic spirometry tools. Market penetration is predominantly concentrated in major urban centers with established medical tourism and acute care units.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the wealthy Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) due to substantial governmental investment in medical infrastructure, high prevalence of smoking, and a high incidence of lifestyle-related respiratory disorders. Adoption often follows global technology trends in these countries, but affordability constraints, fragmented distribution channels, and political instability remain significant limiting factors in the broader African sub-region, restricting penetration primarily to essential and high-impact monitoring solutions required in tertiary care hospitals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Respiratory Monitoring Devices Market.- Medtronic PLC

- Masimo Corporation

- Koninklijke Philips N.V. (Philips Healthcare)

- GE Healthcare

- ResMed Inc.

- Draegerwerk AG & Co. KGaA

- Nihon Kohden Corporation

- OSI Systems Inc. (Spacelabs Healthcare)

- Vyaire Medical Inc.

- Baxter International (Hill-Rom Holdings)

- Schiller AG

- MGC Diagnostics Corporation

- Nonin Medical Inc.

- Smiths Medical (ICU Medical)

- Beurer GmbH

- BPL Medical Technologies

- A&D Medical

- Contec Medical Systems

- Mindray Medical International Limited

- Microlife Corporation

Frequently Asked Questions

Analyze common user questions about the Respiratory Monitoring Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth for the Respiratory Monitoring Devices Market?

The market is primarily driven by the rising global prevalence of chronic respiratory diseases like COPD and asthma, increased regulatory requirements for continuous patient monitoring during sedation (e.g., capnography mandates), and rapid advancements in non-invasive and portable sensor technologies facilitating remote patient care and telehealth services.

How is Artificial Intelligence (AI) affecting the clinical utility of these devices?

AI is transforming clinical utility by enabling predictive analytics for early respiratory failure detection, optimizing complex ventilator management settings in ICUs, reducing high rates of non-critical false alarms, and automating the comprehensive interpretation of sophisticated diagnostic tests, thereby significantly enhancing workflow efficiency and overall diagnostic accuracy.

Which product segment holds the highest potential for growth in the near future?

The capnography devices segment is expected to show high growth, driven by its mandatory application during moderate to deep procedural sedation globally, coupled with ongoing technological improvements in microstream capnography that allow for reliable and safer monitoring of non-intubated patients outside the controlled environment of the operating room.

Which region currently dominates the market, and why is APAC growing fastest?

North America currently dominates the market due to its advanced healthcare infrastructure, substantial clinical expenditure, and proactive adoption of critical care technology. APAC is projected to be the fastest-growing region, owing to vast population size, increasing healthcare access initiatives, rapidly worsening air quality, and large governmental investments in modernizing local hospital infrastructure.

What are the main restraints hindering the widespread adoption of advanced respiratory monitors?

The key restraints include the significant initial acquisition cost of advanced multi-parameter monitoring systems, particularly impacting resource allocation in smaller clinics and developing markets, and complex challenges related to fragmented or inadequate reimbursement policies for cutting-edge remote and home monitoring services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Respiratory Monitoring Devices for New Borns Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Capnographs, Gas Analyzers, Pulse Oximeters, Peak Flow Meters, Spirometers, Polysomnographs, Others), By Application (Hospitals, Home use), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Respiratory Monitoring Devices Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Spirometer, Peak Flow Meter, Pulse Oximeter, Capnograps, Others), By Application (Hospitals, Laboratories, Home Use), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager