Restaurant Furniture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432004 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Restaurant Furniture Market Size

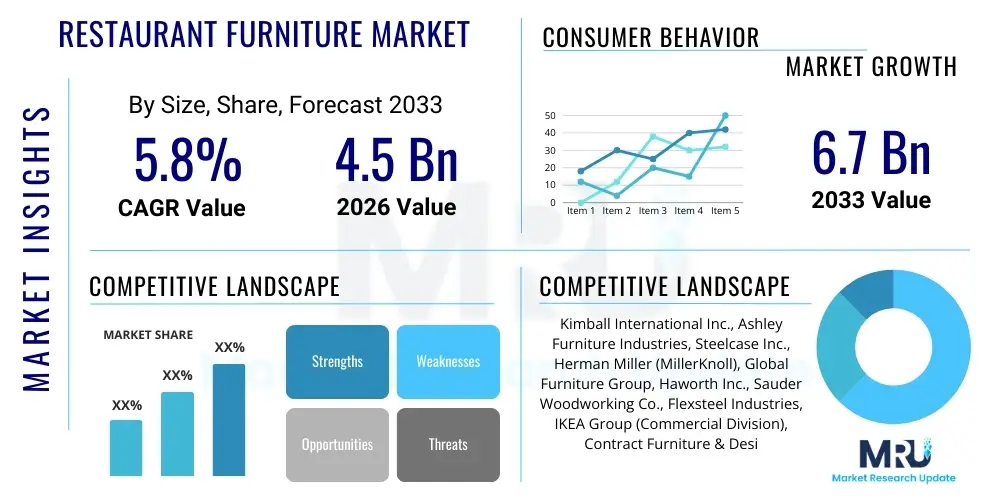

The Restaurant Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the rapid global expansion of the hospitality sector, particularly the proliferation of quick-service restaurants (QSRs), fine dining establishments, and independent cafes, all of which require specialized, durable, and aesthetically appealing furniture solutions tailored to enhance customer experience and operational efficiency. Furthermore, the increasing consumer preference for dining out, coupled with continuous refurbishment cycles mandated by evolving interior design trends and strict hygiene standards, ensures consistent demand across mature and emerging economies.

Restaurant Furniture Market introduction

The Restaurant Furniture Market encompasses the design, manufacture, and distribution of tables, chairs, booths, bar stools, outdoor seating, and custom fixtures specifically engineered for use in commercial food service environments. These products are crucial components of the hospitality infrastructure, serving not only functional purposes—providing comfortable seating and dining surfaces—but also playing a vital role in establishing the venue’s brand identity, ambiance, and overall customer flow. Product descriptions range from highly durable, stackable polymer seating suitable for fast-casual settings to bespoke, artisanal wooden pieces utilized in luxury fine dining establishments, reflecting a diverse material and design landscape intended to meet stringent commercial durability requirements and aesthetic demands.

Major applications for restaurant furniture span the entire Food Service (FoSe) ecosystem, including full-service restaurants (FSRs), cafes and coffee shops, bars and pubs, institutional cafeterias (such as those in corporate offices or educational settings), and specialized entertainment venues. The inherent benefits of specialized restaurant furniture include enhanced structural integrity compared to residential alternatives, fire resistance compliance, ease of cleaning, and designs optimized for efficient spatial utilization and high turnover rates. Driving factors propelling this market expansion include robust growth in global tourism and travel, rising disposable incomes in developing nations leading to increased discretionary spending on dining experiences, and the persistent trend of interior redesign and renovation to stay competitive in hyper-local markets.

The operational landscape is further shaped by the need for quick-turnaround installations and the increasing complexity of supply chains, balancing demands for sustainable sourcing and custom manufacturing capabilities. Market participants are constantly innovating in material science, focusing on lightweight, ergonomic designs that minimize maintenance requirements while maximizing longevity. This dedication to commercial-grade quality, combined with the psychological impact furniture has on diner satisfaction and willingness to linger, positions restaurant furniture as a high-value investment for hospitality operators seeking long-term operational success and market differentiation in an intensely competitive global industry.

Restaurant Furniture Market Executive Summary

The Restaurant Furniture Market is characterized by vigorous growth, driven primarily by favorable macroeconomic business trends, specifically the resurgence of global travel and the expansion of multi-unit restaurant chains emphasizing standardized aesthetics and rapid scalability. Current business trends indicate a strong move toward resilient, multi-functional furniture, often incorporating integrated power solutions or modular designs that can adapt to varying seating arrangements for different dining times or private events. Furthermore, supply chain diversification and optimization are critical focuses for manufacturers, who are leveraging advanced logistics and localized production to mitigate geopolitical risks and reduce lead times, a vital factor for time-sensitive restaurant renovations and new builds.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, propelled by accelerating urbanization, the proliferation of international dining concepts, and immense infrastructure development in countries like China and India. Conversely, North America and Europe maintain dominant market shares, characterized by a higher propensity for premium, designer furniture and a strong focus on sustainability and ergonomic compliance, often driven by stricter consumer protection and environmental regulations. The mature markets exhibit higher replacement cycles, focused less on initial expansion and more on maintaining modern, updated environments compliant with current hospitality design paradigms.

Segment trends underscore the dominance of the seating segment (chairs, booths, and barstools) due to its high volume and frequency of replacement, although the tables segment is also seeing innovation related to material durability and integrated technology. Material-wise, wood remains highly popular for its aesthetic appeal, especially in fine dining, while metal and synthetic polymers are gaining traction in outdoor and fast-casual settings due to their resilience to wear and weather. The increasing consumer demand for experiential dining is significantly driving the growth of custom and designer furniture, allowing establishments to cultivate highly unique and Instagrammable interiors, thus making differentiation based on specialized furniture a key competitive strategy across all market segments.

AI Impact Analysis on Restaurant Furniture Market

Analysis of common user questions regarding AI's impact on the Restaurant Furniture Market reveals key themes centered around operational efficiency, personalized design, and enhanced supply chain predictive capabilities. Users are frequently asking: "How can AI optimize furniture design based on restaurant foot traffic patterns?" "Will AI streamline custom manufacturing processes and reduce errors?" and "What role does predictive maintenance through AI play in maximizing furniture lifespan?" The general expectation is that AI will move beyond simple automation, fundamentally transforming how commercial furniture is designed, purchased, maintained, and how interior layouts are configured to maximize customer comfort and profitability. Concerns often revolve around the initial capital investment required for adopting advanced AI platforms and ensuring that AI-generated designs do not compromise the unique artistic flair required by high-end interior designers.

The application of Artificial Intelligence is poised to revolutionize several critical facets of the restaurant furniture value chain, starting with demand forecasting and inventory management. By utilizing machine learning algorithms to analyze real-time sales data, seasonality trends, and local economic indicators, manufacturers can achieve significantly more accurate production scheduling, minimizing waste from overstocking and reducing delays associated with material shortages. This predictive capability translates directly into faster turnaround times for restaurant operators, a crucial competitive advantage when renovating or launching new venues.

Furthermore, AI is increasingly being integrated into the design phase through Generative Design platforms. These tools allow designers to input constraints—such as structural load requirements, required aesthetic styles, spatial dimensions of the dining area, and ergonomic standards—and quickly generate thousands of optimized furniture designs. This rapid prototyping accelerates the bespoke furniture process, ensuring compliance with commercial safety standards while maximizing material efficiency and visual appeal. AI also assists in sophisticated layout planning, using spatial analytics to determine the optimal placement of tables and chairs to maximize seating capacity, comply with accessibility standards, and enhance the overall flow of service staff, thereby directly influencing the restaurant's operational effectiveness and profitability.

- AI-driven Predictive Maintenance: Monitoring furniture wear and tear using sensor data to recommend timely repairs or replacements, extending asset lifespan.

- Generative Design Optimization: Creating commercially viable, aesthetically pleasing, and material-efficient furniture models based on specified parameters.

- Automated Quality Control: Utilizing computer vision systems in manufacturing to detect structural flaws or cosmetic imperfections with high precision.

- Supply Chain Demand Forecasting: Machine learning algorithms optimizing raw material purchasing and inventory levels based on anticipated hospitality sector expansion.

- Dynamic Pricing Models: AI influencing the pricing of furniture components based on real-time market material costs and competitor analysis.

- Personalized Layout Simulation: Using virtual reality and AI to test various restaurant layouts for optimal customer flow and capacity utilization before installation.

DRO & Impact Forces Of Restaurant Furniture Market

The market dynamics of the Restaurant Furniture sector are governed by a complex interplay of driving forces (D), restrictive factors (R), and compelling opportunities (O), creating a nuanced environment subject to significant impact forces. A primary driver is the accelerating pace of global hospitality sector investment, fueled by economic recovery and increased consumer expenditure on leisure and dining experiences, which necessitates constant procurement of new and replacement furniture. However, this growth is restrained by extreme volatility in raw material costs, particularly timber and metals, coupled with increasing environmental regulations mandating sustainable sourcing and waste reduction, which subsequently drive up manufacturing complexity and operational expenses for furniture producers.

Opportunities abound in the transition towards sustainable and smart furniture solutions; there is a significant market opening for manufacturers specializing in recycled materials, non-toxic finishes, and furniture embedded with smart technology like wireless charging stations or integrated lighting. The shift towards experiential dining, requiring unique, custom, and highly thematic furniture, also presents a lucrative niche opportunity for specialized design firms. Nevertheless, the entire dynamic system is subject to high impact forces from external factors, including trade disputes affecting global shipping and tariff structures, rapid shifts in consumer dining habits (e.g., preference for outdoor dining post-pandemic), and the pervasive threat of counterfeiting or low-quality imports which place downward pressure on pricing and perceived value across specific segments.

These opposing forces create a scenario where successful market players must demonstrate agility, not only in design innovation but also in sophisticated supply chain management capable of buffering against external shocks. The impact forces are particularly acute in the competitive landscape, where differentiation based solely on price is increasingly unsustainable; success hinges on the ability to offer a compelling value proposition that balances durability, aesthetic appeal, regulatory compliance, and timely delivery. Consequently, firms investing heavily in localized manufacturing capabilities and digital technologies for direct customer engagement are better positioned to navigate the market complexities and capitalize on emerging regional growth pockets.

Segmentation Analysis

The Restaurant Furniture Market is analyzed based on product type, material, end-user application, and distribution channel, providing a granular view of market dynamics and consumer preferences across various hospitality settings. Understanding these segments is critical for manufacturers to tailor their product offerings, sales strategies, and marketing efforts efficiently. The market heterogeneity means that furniture requirements differ vastly between a high-traffic quick-service restaurant (QSR) demanding extreme durability and easy maintenance, and a boutique hotel restaurant prioritizing luxury aesthetics and custom design.

Segmentation by product type reveals that the seating segment, encompassing chairs, booths, and barstools, consistently holds the largest market share due to the high volume required in any dining setting and the necessity for frequent replacement driven by daily wear and tear. Material segmentation highlights the tension between traditional choices like wood, valued for its classic appeal, and modern materials such as metal and high-density polymers, favored for their robustness, weather resistance, and contemporary industrial aesthetic, particularly in fast-casual and outdoor dining areas. Furthermore, the segmentation by end-user, differentiating between full-service, quick-service, and institutional venues, dictates the specific functional and design requirements, profoundly influencing purchasing decisions and procurement volumes across the globe.

- By Product Type:

- Chairs and Seating (Dining Chairs, Lounge Chairs, Booth Seating, Bar Stools)

- Tables (Dining Tables, Cocktail Tables, Communal Tables, Outdoor Tables)

- Storage and Display Units (Wait Stations, Shelving, Cabinets)

- Outdoor Furniture (Patio Sets, Benches, Umbrellas)

- By Material:

- Wood (Hardwood, Plywood, Bamboo)

- Metal (Aluminum, Steel, Wrought Iron)

- Plastics and Composites (Polypropylene, Fiberglass, Resin)

- Upholstery and Fabric (Leather, Vinyl, Commercial Grade Textiles)

- By End-User:

- Full-Service Restaurants (FSRs)

- Quick-Service Restaurants (QSRs) and Fast Casual

- Cafes and Bistros

- Bars, Pubs, and Nightclubs

- Institutional Foodservice (Hotels, Corporate Cafeterias, Educational Institutions)

- By Distribution Channel:

- Offline Channels (Direct Sales, Distributors, Furniture Dealers)

- Online Channels (E-commerce Platforms, Company Websites)

Value Chain Analysis For Restaurant Furniture Market

The value chain of the Restaurant Furniture Market begins with upstream activities focused on sourcing and processing raw materials, primarily timber, metals (steel and aluminum), and petrochemicals for plastics and upholstery. This stage is highly critical as fluctuations in global commodity prices directly impact manufacturing costs and, consequently, final retail pricing. Efficiency and ethical sourcing in the upstream segment are becoming increasingly important due to regulatory pressures and consumer demand for sustainable products, prompting many large furniture manufacturers to vertically integrate or secure long-term contracts with certified material suppliers, thereby stabilizing costs and ensuring quality control before the manufacturing process commences.

The core manufacturing and assembly stage involves specialized craftsmanship, precision engineering, and adherence to stringent commercial durability and fire safety codes. This midstream process often includes custom design work, upholstery, welding, finishing, and quality assurance checks tailored for high-use commercial environments. Downstream analysis focuses on the efficient movement of finished goods to end-users. The distribution channel is predominantly hybrid, utilizing specialized commercial furniture dealers, interior design firms who specify products, and, increasingly, dedicated e-commerce platforms that cater to smaller independent operators or high-volume QSR chains seeking standardized pieces.

Direct sales channels, where manufacturers interface directly with large hospitality groups for custom orders, account for a substantial portion of high-value transactions, ensuring personalized service and strict adherence to specific brand standards. Conversely, indirect channels, relying on distributors and regional dealers, are essential for penetrating geographically diverse markets and servicing smaller, non-chain operations, allowing for localized installation and after-sales support. The optimal channel strategy balances direct control over high-profile projects with the extensive market reach provided by a robust network of trusted indirect partners who understand local regulatory requirements and installation complexities.

Restaurant Furniture Market Potential Customers

Potential customers, or end-users/buyers, in the Restaurant Furniture Market represent a broad and diverse spectrum within the commercial hospitality sector, all requiring durable, aesthetically congruent, and commercially compliant furnishings. The primary customer segment comprises large, multi-unit restaurant chains, including major quick-service operators and global full-service brands. These buyers typically engage in large-volume, contractual procurement, prioritizing standardization, ease of maintenance, global warranty coverage, and the ability to roll out consistent furniture packages across numerous locations simultaneously, often necessitating custom colors and branding elements.

A secondary, yet rapidly expanding customer base includes independent restaurants, cafes, and specialized bistros, which place a high premium on bespoke design, unique artisanal pieces, and furniture that contributes distinctively to the local identity and thematic atmosphere of the venue. Unlike large chains, these buyers often rely heavily on interior designers and specialized furniture showrooms for product discovery and selection, focusing on quality over bulk volume discounts, and often seeking furniture that is perceived as being "Instagrammable" to enhance their digital marketing presence and attract modern consumers.

Furthermore, the institutional foodservice sector constitutes a significant customer segment. This includes major hotel groups, corporate dining facilities, university cafeterias, and healthcare establishment dining rooms. These buyers prioritize furniture compliance with rigorous fire codes (e.g., Cal 133 standards in the US), extreme durability suitable for 24/7 operations, and designs that facilitate hygiene and cleaning protocols. Purchasing decisions in this segment are often driven by facility management teams and procurement specialists who mandate long-term value, rigorous safety certification, and proven longevity under stressful operational conditions, distinctly differing from the design-first considerations of independent boutique establishments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kimball International Inc., Ashley Furniture Industries, Steelcase Inc., Herman Miller (MillerKnoll), Global Furniture Group, Haworth Inc., Sauder Woodworking Co., Flexsteel Industries, IKEA Group (Commercial Division), Contract Furniture & Design (CF&D), JIJI Restaurant Furniture, Gasser Chair Company, Shelby Williams, Kian, MTS Seating, BEAUDRY, Vitra, Maglin Site Furniture, Furniture Concepts, and Sandler Seating. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Restaurant Furniture Market Key Technology Landscape

The Restaurant Furniture Market is increasingly leveraging advanced manufacturing and digital technologies to enhance product quality, accelerate design cycles, and improve operational efficiency across the supply chain. A cornerstone of this technological evolution is the widespread adoption of Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) systems, which allow for precision engineering of complex commercial furniture pieces, ensuring dimensional accuracy and structural integrity vital for passing rigorous commercial safety testing. Furthermore, sophisticated CNC (Computer Numerical Control) machining centers are integral to producing large volumes of standardized components with minimal human error, optimizing material yield, particularly in wood and metal fabrication processes.

In addition to manufacturing automation, the industry is embracing digital visualization and customer engagement technologies. Virtual Reality (VR) and Augmented Reality (AR) tools are becoming essential sales aids, allowing restaurant owners and interior designers to virtually place and visualize furniture pieces within their planned spaces before committing to an order. This technology significantly reduces the risk of spatial planning errors, enhances the customization experience, and accelerates the procurement timeline. On the material science front, continuous R&D is focused on developing high-performance, durable surface finishes, such as scratch-resistant laminates, antimicrobial coatings, and fire-retardant commercial-grade textiles, all aimed at extending the lifespan of the furniture in high-wear environments and adhering to evolving public health standards.

The rise of Industry 4.0 principles, including the Internet of Things (IoT), is beginning to permeate the sector, particularly in smart dining installations. While nascent, this includes embedding furniture with passive sensors for tracking utilization rates or active components like integrated charging hubs and touch-sensitive surfaces. Furthermore, the push towards sustainability is driving technological innovation in material recycling and waste reduction techniques. Manufacturers are implementing sophisticated material tracking systems using blockchain or similar distributed ledger technologies to provide provenance data, assuring customers of the ethical sourcing and environmental compliance of the raw materials used in their final furniture products.

Regional Highlights

Regional dynamics significantly influence the demand and style preferences within the Restaurant Furniture Market, reflecting localized dining cultures, economic development, and regulatory environments. North America remains a dominant and highly lucrative market, characterized by large, often standardized orders from major national chains and a consistent demand for premium, ergonomic, and locally manufactured furniture. The region exhibits high spending on hospitality upgrades, driven by fiercely competitive metropolitan dining scenes and strict adherence to ADA (Americans with Disabilities Act) and local fire codes, necessitating specific furniture designs and clearances.

Europe, a mature market, shows robust demand for high-end, contemporary, and vintage-inspired designs, often prioritizing sustainability certifications and handcrafted quality. Countries such as Italy, Germany, and the Scandinavian nations are global hubs for furniture design innovation, focusing on minimalist aesthetics and durable, long-lasting products. The regulatory landscape, particularly REACH compliance concerning chemical use, strongly influences material choices. Replacement cycles tend to be long, emphasizing investment in furniture pieces perceived as long-term assets rather than disposable commodities, driving demand for premium wood and metal fabrication.

Asia Pacific (APAC) stands out as the fastest-growing region, fueled by rapid economic expansion, massive urbanization, and the aggressive penetration of international restaurant brands alongside the explosive growth of indigenous quick-service chains. The sheer volume of new restaurant openings in countries like China, India, and Southeast Asia ensures immense market potential, largely characterized by price sensitivity but also an increasing demand for sophisticated, modern, space-efficient, and easily maintainable furniture solutions tailored for densely populated urban environments. Latin America and the Middle East & Africa (MEA) present emerging market opportunities, driven by increasing tourism infrastructure development and rising middle-class disposable income, prompting localized customization of global furniture trends to suit regional aesthetic preferences and climate challenges.

- North America: High demand for commercial-grade, ADA-compliant seating; strong market presence of large QSR chains requiring standardized designs and logistics support.

- Europe: Focus on sustainable, design-led furniture; strong preference for hardwood and minimalist styles; market heavily influenced by Italian and German design houses.

- Asia Pacific (APAC): Highest volume growth potential driven by new restaurant construction; emphasis on space-saving, stackable designs, and cost-effective material choices.

- Latin America: Growing tourism sector driving demand for stylish outdoor and resort-style furniture; market sensitivity toward localized material sourcing to mitigate import costs.

- Middle East & Africa (MEA): Luxury hotel sector fueling demand for bespoke, high-end, upholstered furniture; need for materials resilient to high heat and humidity, particularly in Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Restaurant Furniture Market.- Kimball International Inc.

- Ashley Furniture Industries

- Steelcase Inc.

- Herman Miller (MillerKnoll)

- Global Furniture Group

- Haworth Inc.

- Sauder Woodworking Co.

- Flexsteel Industries

- IKEA Group (Commercial Division)

- Contract Furniture & Design (CF&D)

- JIJI Restaurant Furniture

- Gasser Chair Company

- Shelby Williams

- Kian

- MTS Seating

- BEAUDRY

- Vitra

- Maglin Site Furniture

- Furniture Concepts

- Sandler Seating

Frequently Asked Questions

Analyze common user questions about the Restaurant Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Restaurant Furniture Market?

The Restaurant Furniture Market is projected to exhibit a CAGR of 5.8% during the forecast period spanning 2026 to 2033, driven by continuous expansion and refurbishment cycles in the global hospitality industry.

Which material segment currently dominates the market, and why is this segment preferred?

The metal segment, encompassing steel and aluminum, maintains significant dominance due to its exceptional durability, ease of maintenance, and suitability for high-traffic and outdoor commercial environments, making it cost-effective over the long term for restaurant operators.

How do sustainability trends influence procurement decisions in the restaurant furniture sector?

Sustainability significantly influences purchasing, with large chains increasingly demanding furniture made from recycled materials, sustainably sourced timber (FSC certified), and low Volatile Organic Compound (VOC) finishes, aligning with corporate social responsibility goals and consumer preference for eco-friendly businesses.

What are the primary challenges faced by manufacturers in the Restaurant Furniture value chain?

Manufacturers primarily contend with fluctuating global commodity prices for essential raw materials like steel and timber, coupled with complex international trade tariffs and the necessity to comply with varied and stringent fire safety and commercial durability standards across different regions.

Which geographical region is expected to demonstrate the highest growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, propelled by rapid urbanization, significant infrastructure investment, and the booming expansion of quick-service and full-service restaurant chains across key economies such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager