Restaurant Lighting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438242 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Restaurant Lighting Market Size

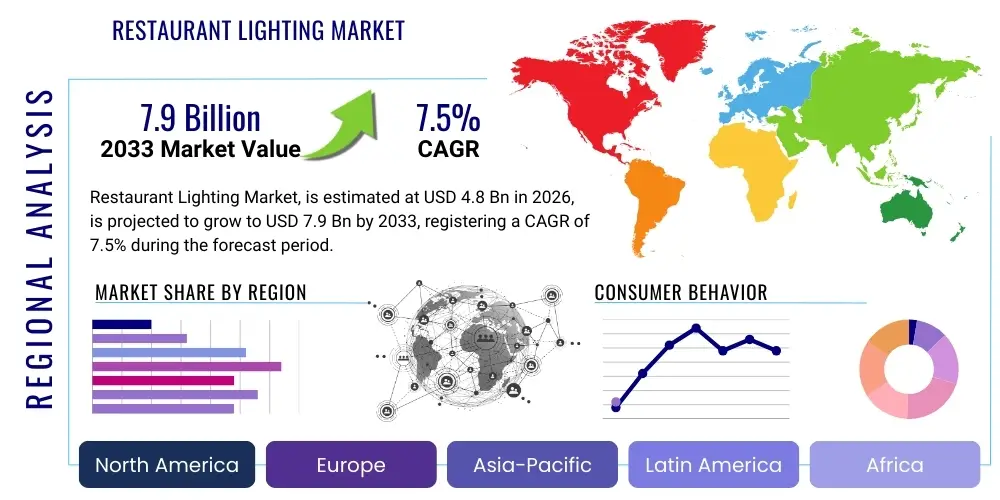

The Restaurant Lighting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Restaurant Lighting Market introduction

The Restaurant Lighting Market encompasses the sale, installation, and maintenance of specialized lighting solutions designed for various commercial food service environments, ranging from quick-service restaurants (QSRs) and casual dining establishments to high-end fine dining venues and bars. These lighting systems are crucial components of the overall dining experience, significantly influencing ambiance, brand identity, energy efficiency, and operational safety. Modern restaurant lighting is moving far beyond simple illumination, incorporating advanced controls, tunable white technology, and aesthetic fixture designs to create dynamic, layered lighting schemes that adapt throughout the day and across different dining zones.

Key products within this sector include LED fixtures, smart lighting controls (DALI, Bluetooth mesh), decorative pendants, track lighting, downlights, and architectural lighting elements. The product description emphasizes durability, low maintenance, high color rendering index (CRI) for accurate food presentation, and integration capability with sophisticated building management systems (BMS). The transition from traditional incandescent and fluorescent sources to energy-efficient LED technology is the primary accelerator for market modernization, driven by stricter energy codes and restaurant operators' desire to reduce long-term operational costs.

Major applications of restaurant lighting solutions are segmented by functional area, including ambient lighting for general illumination, accent lighting to highlight architectural features, task lighting for kitchens and serving stations, and decorative lighting to establish thematic resonance. The benefits derived from optimal restaurant lighting are multifaceted, encompassing enhanced customer satisfaction, increased dwell time, improved visual comfort for both patrons and staff, and significant environmental sustainability advantages through reduced power consumption. Driving factors include the continuous expansion of the global hospitality industry, rising consumer expectations for experiential dining, and technological advancements in solid-state lighting (SSL) and control systems.

Restaurant Lighting Market Executive Summary

The Restaurant Lighting Market exhibits robust business trends characterized by a strong shift towards sustainable and digitally interconnected systems. Key business drivers include the rapid pace of restaurant renovations and new construction projects globally, coupled with governmental mandates prioritizing energy conservation. The market is witnessing increased consolidation among key lighting manufacturers who are integrating smart controls and IoT capabilities directly into their fixtures, offering comprehensive, end-to-end solutions rather than standalone hardware. This integration addresses the growing demand from restaurant groups for standardized, scalable, and centrally managed lighting ecosystems across multiple locations, facilitating brand consistency and remote diagnostics.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by urbanization, massive growth in middle-class disposable income, and the corresponding boom in the quick-service and casual dining sectors, particularly in China and India. North America and Europe, while mature, maintain strong market shares driven by high adoption rates of premium, high-CRI, and Human-Centric Lighting (HCL) systems in fine dining and high-traffic metropolitan areas, often linked to strict adherence to sophisticated architectural design standards. Regulatory frameworks concerning energy efficiency (e.g., EU Ecodesign regulation) continue to shape regional product offerings, favoring low-voltage, long-lifespan LED solutions.

Segment trends highlight the dominance of the LED segment due to its efficiency and longevity. The control systems segment, particularly networked lighting control (NLC) platforms, is experiencing the highest growth trajectory, demonstrating the industry's shift from static lighting to dynamic, scene-based illumination. By installation type, the renovation and retrofit segment often surpasses new construction, especially in established markets, as older facilities upgrade to modern LED and smart technologies to capture energy savings and enhance aesthetic appeal without major structural changes. The fine dining segment demands highly customized, low-glare, high-CRI solutions, while QSRs focus on robust, easily maintainable, and uniform illumination across wide areas.

AI Impact Analysis on Restaurant Lighting Market

User inquiries concerning AI's role in restaurant lighting frequently center on themes of automation, predictive maintenance, personalization, and energy optimization. Key questions revolve around how AI can dynamically adjust lighting scenes based on occupancy and real-time operational data, whether AI can predict fixture failure before it occurs, and how machine learning algorithms can analyze customer behavior patterns (e.g., seating preferences, traffic flow) to automatically enhance the dining ambiance. Users also express interest in AI-driven tools that simplify complex commissioning and maintenance tasks for large restaurant chains, seeking systems that learn optimal operating parameters autonomously.

The core influence of Artificial Intelligence in the restaurant lighting market is its capacity to transform passive illumination systems into active, responsive, and predictive components of the overall building environment. AI algorithms process massive datasets—including time-of-day scheduling, natural light input, HVAC status, occupancy sensors, point-of-sale data, and even customer feedback metrics—to achieve highly granular, adaptive lighting control. This shift moves beyond simple dimming and scheduling; AI optimizes light levels and color temperature in real-time to support staff productivity, reduce energy waste, and tailor the mood exactly to the moment, such as automatically brightening a table just before a server approaches or softening the light in unoccupied zones.

Furthermore, AI is pivotal in the realm of predictive maintenance, utilizing sensor data from networked lighting fixtures (IoT endpoints) to monitor performance degradation, voltage fluctuations, and thermal stress. By applying machine learning models to this historical performance data, AI can forecast the precise remaining useful life of components like LED drivers or power supplies, alerting facility managers weeks or months in advance of failure. This capability minimizes unexpected downtime and ensures continuous, high-quality lighting, which is critical for maintaining the high standards expected in premium dining establishments. This integration of intelligence significantly enhances the value proposition of modern lighting infrastructure.

- AI enables predictive maintenance of lighting systems, minimizing operational downtime.

- Machine learning algorithms optimize energy consumption based on dynamic occupancy and ambient light readings.

- AI facilitates real-time, personalized ambiance adjustment tailored to specific dining scenes and customer flow.

- Intelligent systems analyze point-of-sale and seating data to correlate lighting quality with customer satisfaction metrics.

- Voice and gesture control interfaces, often AI-powered, simplify complex scene management for restaurant staff.

DRO & Impact Forces Of Restaurant Lighting Market

The Restaurant Lighting Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all channeled through significant impact forces. The primary driving force is the relentless pursuit of energy efficiency and sustainability goals across the commercial sector, heavily favoring the adoption of advanced LED technology and networked controls that yield substantial long-term operational savings. A secondary, yet equally powerful, driver is the increasing focus on creating unique and highly differentiated dining experiences; lighting is now recognized as a vital design tool for storytelling, brand enhancement, and mood creation, compelling establishments to invest in premium, high-CRI, dynamic systems. These drivers are bolstered by technological maturation, reducing the cost of high-performance components and simplifying installation.

Restraints primarily involve the high initial capital expenditure associated with sophisticated smart lighting systems, particularly when factoring in complex wiring, advanced sensors, and control software integration. For smaller, independent restaurants or those operating on thin margins, this upfront investment can be prohibitive compared to basic conventional lighting. Additionally, the complexity of commissioning and maintaining integrated IoT lighting networks requires specialized technical expertise, which presents a barrier to entry in regions lacking skilled labor. Market saturation in terms of basic LED replacement also slows growth in certain established markets, shifting the focus only toward high-end, dynamic systems.

Opportunities are abundant in the expansion of Human-Centric Lighting (HCL) within restaurant spaces, focusing on optimizing light quality (color temperature and intensity) to enhance staff well-being in kitchen and service areas while maximizing guest comfort in dining zones. The burgeoning retrofit market, driven by the need to upgrade millions of existing facilities to meet new energy codes and aesthetic standards, offers massive long-term potential. Impact forces, such as rapid innovation in wireless control protocols (e.g., Zigbee, Bluetooth Mesh) and the standardization of open APIs for system integration, significantly amplify market penetration. Furthermore, growing regulatory pressures toward sustainability act as a continuous catalyst, transforming opportunities into necessary investments for long-term viability.

Segmentation Analysis

Segmentation analysis of the Restaurant Lighting Market provides a granular view of demand patterns across different product types, technologies, applications, and end-user categories. The market is broadly segmented by fixture type, ranging from fundamental downlights and track lights used for general illumination to highly aesthetic pendant fixtures, chandeliers, and linear systems that define the architectural appeal of the space. The technological breakdown confirms the overwhelming dominance of Light Emitting Diode (LED) solutions due to their superior lifespan, minimal heat emission, and inherent compatibility with digital control systems, fundamentally displacing traditional fluorescent and halogen technologies.

Further segmentation by installation type distinguishes between new construction projects, which allow for seamless integration of smart infrastructure, and the massive retrofit/renovation market, where compatibility with existing electrical infrastructure and rapid deployment are paramount. The application landscape is categorized by the specific functional needs of different restaurant zones, including ambient lighting (general soft light), accent lighting (highlighting artwork, architecture, or tables), decorative lighting (fixtures as focal points), and task lighting (high-intensity, glare-free light for food preparation and cashier stations). The nuances in requirements necessitate specialized product offerings tailored to each environment.

Crucially, the market is also segmented by end-user type, recognizing that the lighting needs of a Quick Service Restaurant (QSR) chain differ drastically from those of an independent Fine Dining establishment or a Casual Theme Restaurant. QSRs prioritize high lumen output, durability, and cost-effectiveness, favoring standardized modular systems. In contrast, Fine Dining venues demand exceptional color rendering index (CRI > 90), precise beam control, and highly customizable scene settings to achieve an intimate, luxury ambiance. Understanding these specific segments allows manufacturers to tailor marketing strategies and product development to address distinct operational and aesthetic demands efficiently.

- By Technology:

- LED Lighting

- High-Intensity Discharge (HID) Lighting

- Fluorescent Lighting (Declining)

- Halogen and Incandescent (Niche Decorative/Retrofit)

- By Fixture Type:

- Downlights and Troffers

- Track Lighting Systems

- Pendant and Decorative Fixtures

- Linear and Strip Lighting

- Spotlights and Accent Lights

- By Application/Functional Area:

- Ambient Illumination

- Accent and Display Lighting

- Task Lighting (Kitchens and Service Areas)

- Outdoor and Façade Lighting

- By End-User (Restaurant Type):

- Quick Service Restaurants (QSR)

- Casual Dining Restaurants (CDR)

- Fine Dining and Upscale Establishments

- Bars, Cafes, and Specialty Food Service

Value Chain Analysis For Restaurant Lighting Market

The Value Chain for the Restaurant Lighting Market commences with the upstream segment, dominated by raw material suppliers and component manufacturers. This stage involves the procurement and processing of critical materials such as semiconductors (LED chips), metals (aluminum for heat sinks and fixture housings), plastics, and specialized glass or optical diffusers. Key upstream activities include semiconductor fabrication for high-performance LEDs, driver electronics manufacturing, and optical design refinement, which significantly influence the final product's efficiency, color quality (CRI), and lifespan. Cost optimization and sourcing stability at this stage are crucial, particularly regarding rare earth elements and specialized components required for high-CRI applications.

The intermediate stage involves the core manufacturing process, where Original Equipment Manufacturers (OEMs) design, assemble, and test the finished lighting fixtures and control systems. This stage adds substantial value through proprietary thermal management design, fixture aesthetics, integration of smart sensors (occupancy, daylight harvesting), and the development of robust, reliable network control software platforms. Distribution channels form a critical link, segmented primarily into direct sales to large corporate chains, sales through specialized electrical distributors, and sales via lighting design consultants and architectural firms who specify premium products. Effective inventory management and logistical speed are vital given the project-based nature of installations.

The downstream analysis focuses on the installation, integration, and maintenance services provided to the end-user—the restaurant operators. Direct channels involve manufacturers or specialized contractors working directly with national or international restaurant chains to ensure brand standards are met consistently across all locations. Indirect channels often rely on general electrical contractors and third-party facility management companies for standard installations and routine maintenance. The long-term value generated in the downstream segment comes from service contracts for commissioning networked systems, software updates, and predictive maintenance programs, ensuring sustained performance and capturing recurring revenue opportunities that extend the product life cycle far beyond the initial sale.

Restaurant Lighting Market Potential Customers

The primary potential customers and end-users in the Restaurant Lighting Market are diverse and categorized based on operational scale, architectural complexity, and aesthetic requirements. Large, multi-national Quick Service Restaurant (QSR) chains, such as major burger and coffee franchises, represent a substantial volume buyer segment. These customers prioritize standardized, durable, easily replaceable, and highly energy-efficient modular systems across thousands of locations. Their purchasing decisions are heavily centralized and driven by Total Cost of Ownership (TCO), aiming for uniformity in branding and minimal maintenance requirements.

The Casual Dining sector (including theme restaurants, family dining, and brewpubs) forms another major segment. These customers require more aesthetic variety and flexibility than QSRs, often employing layered lighting schemes to segment dining spaces and create specific atmospheres. They are key buyers of decorative pendants, track lighting with adjustable beam angles, and integrated control systems that allow staff to change scenes dynamically between lunch and dinner service. Purchasing decisions here are influenced by design consultants and interior architects who specify systems that enhance the restaurant's thematic appeal and ambiance.

The high-end Fine Dining and Luxury Hospitality sector constitutes the premium segment of the market. These establishments demand bespoke, high-performance fixtures with extremely high Color Rendering Index (CRI > 95), precise optics to minimize glare, and advanced tunable white or color-mixing capabilities. For these buyers, lighting is a strategic investment in the guest experience, often justifying significantly higher capital expenditure for custom-designed luminaires and sophisticated, centralized control platforms integrated seamlessly with other hotel/restaurant systems. Additionally, independent, locally owned restaurants, while individually smaller, collectively represent a dynamic segment driven by unique architectural visions and the need for cost-effective, yet aesthetically pleasing, lighting solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Acuity Brands, Signify (Philips Lighting), Eaton (Cooper Lighting), OSRAM, Panasonic, Hubbell Lighting, Zumtobel Group, LSI Industries, Lutron Electronics, Cree Lighting, General Electric (GE Lighting), Trilux, Fagerhult Group, Dialight, Wipro Lighting, Kenall Manufacturing, Glamox, Thorn Lighting, ERCO, ETC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Restaurant Lighting Market Key Technology Landscape

The technological landscape of the Restaurant Lighting Market is rapidly evolving, moving decisively away from conventional light sources towards sophisticated, digital Solid-State Lighting (SSL) and integrated control platforms. The cornerstone technology is the Light Emitting Diode (LED), which offers unparalleled energy efficiency, extended operational life, and superior controllability essential for dynamic restaurant environments. Crucially, advancements in LED phosphors and chip technology have dramatically improved the Color Rendering Index (CRI) and color quality consistency, allowing modern fixtures to accurately represent food presentation and interior design colors, a vital requirement in high-end dining.

Beyond the LED source itself, networked lighting control (NLC) systems represent the next major technological front. These systems utilize various communication protocols, including DALI (Digital Addressable Lighting Interface), Bluetooth Mesh, Zigbee, and Power over Ethernet (PoE), to create intelligent, addressable networks. PoE technology, in particular, is gaining traction as it simplifies installation by delivering both power and data over standard Ethernet cables, streamlining infrastructure in new construction projects. NLC platforms enable complex scene setting, integration with BMS and scheduling software, and provide granular data on energy usage and occupancy patterns, optimizing operational efficiency.

Emerging technologies like Tunable White (TW) and Human-Centric Lighting (HCL) are becoming standard features, especially in fine dining and service areas. TW technology allows the restaurant operator to precisely adjust the correlated color temperature (CCT) of the light—for example, shifting from a bright, cool white (4000K) for lunchtime activities to a warm, intimate amber glow (2700K) for dinner—to align the lighting environment with the circadian rhythm and desired mood. Further integration of IoT sensors (e.g., thermal, acoustic, and environmental sensors) within lighting fixtures transforms the lighting grid into a comprehensive data collection network, enabling sophisticated analysis and integration with AI-driven building automation.

Regional Highlights

Geographically, the Restaurant Lighting Market is analyzed across five major regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA). North America, encompassing the United States and Canada, remains a leading market characterized by high adoption rates of advanced, energy-efficient LED systems and strict adherence to architectural standards. The U.S. market is highly fragmented but demands premium products, particularly in metropolitan centers known for competitive hospitality sectors. Drivers in this region include significant retrofit activities driven by energy conservation mandates and a consumer base that expects sophisticated, experiential lighting in dining venues.

Europe represents another mature and technologically advanced region. Western European countries, such as Germany, the UK, and France, are prominent adopters of highly specialized lighting solutions, focusing intensely on sustainability (e.g., using low-carbon footprint materials) and DALI-based control systems. Regulatory pressures, specifically the implementation of stringent energy performance directives, propel the continuous replacement of older lighting infrastructure with smart, high-efficiency LED solutions. The Nordic countries, in particular, lead in the deployment of Human-Centric Lighting (HCL) systems in professional kitchen and back-of-house areas to enhance staff well-being and productivity.

Asia Pacific (APAC) is projected to be the fastest-growing market globally due to explosive growth in the hospitality and food service sectors across developing economies like China, India, and Southeast Asian nations. Rapid urbanization, increasing disposable incomes, and the corresponding expansion of international and domestic restaurant chains fuel this growth. While cost-effectiveness remains a key factor, there is a growing trend toward adopting smart lighting controls and high-CRI fixtures in luxury hotel restaurants and upscale malls in major cities. This region benefits from large-scale new construction projects that integrate modern lighting infrastructure from inception.

Latin America (LATAM) and the Middle East and Africa (MEA) offer significant future opportunities. LATAM’s growth is driven by expanding tourism sectors and increasing investment in modern commercial infrastructure. The MEA region, particularly the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), shows high demand for premium, custom, and aesthetic lighting solutions, driven by massive investments in luxury hospitality, mega-projects, and high-profile architectural developments where lighting is a key differentiator in establishing world-class dining destinations. These regions often import high-end technology from North American and European manufacturers.

- North America: High penetration of smart LED controls; focus on energy efficiency standards and customized design in urban areas.

- Europe: Driven by strict environmental regulations (Ecodesign); strong adoption of DALI systems and HCL for enhanced staff welfare.

- Asia Pacific (APAC): Fastest growth due to rapid QSR expansion and new commercial construction across China and India; balancing cost and emerging smart technology adoption.

- Middle East and Africa (MEA): High demand for luxury, aesthetic, and bespoke lighting in hospitality mega-projects, particularly in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Restaurant Lighting Market.- Acuity Brands

- Signify (Philips Lighting)

- Eaton (Cooper Lighting)

- OSRAM

- Panasonic

- Hubbell Lighting

- Zumtobel Group

- LSI Industries

- Lutron Electronics

- Cree Lighting

- General Electric (GE Lighting)

- Trilux

- Fagerhult Group

- Dialight

- Wipro Lighting

- Kenall Manufacturing

- Glamox

- Thorn Lighting

- ERCO

- ETC

- Technilum

- iGuzzini illuminazione

- Nichia Corporation

- Seoul Semiconductor

Frequently Asked Questions

Analyze common user questions about the Restaurant Lighting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Restaurant Lighting Market?

The primary driving force is the global mandate for energy efficiency and sustainability, coupled with the recognized strategic importance of lighting in creating experiential dining environments. The transition to highly efficient, digitally controlled LED systems minimizes operational costs while maximizing aesthetic appeal and brand consistency across diverse restaurant formats.

How does the Color Rendering Index (CRI) affect restaurant operations and customer satisfaction?

CRI is crucial as it measures how accurately lighting reproduces colors compared to natural light. In restaurants, a high CRI (typically > 90) is necessary to ensure food presentation is accurate and appetizing, directly influencing the perceived quality of the meal and enhancing overall customer satisfaction, particularly in fine dining settings.

What role does Networked Lighting Control (NLC) play in modern restaurant design?

NLC systems allow for centralized management, dynamic scene setting, and automation of lighting based on time of day, occupancy, or service requirements. This control capability enhances flexibility, reduces energy consumption through daylight harvesting and dimming, and enables remote diagnostics and maintenance for large restaurant chains.

Which regional market is experiencing the fastest growth in restaurant lighting adoption?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth. This acceleration is attributed to massive infrastructure development, rapid urbanization, and the substantial expansion of both international and local quick-service and casual dining restaurant chains across countries like China and India.

What are the main financial challenges associated with implementing smart restaurant lighting systems?

The chief financial hurdle is the high initial capital expenditure (CapEx) required for advanced smart LED fixtures, complex sensors, networked controls, and integration software, which can be difficult for independent operators to absorb, despite the promise of significant long-term energy savings.

Define Human-Centric Lighting (HCL) and its relevance to the food service industry.

HCL involves adjusting the spectral quality and intensity of light to support human well-being, mood, and circadian rhythms. In restaurants, HCL is primarily relevant in back-of-house areas (kitchens) to boost staff alertness and productivity, and subtly in dining areas to enhance guest comfort and relaxation.

How is Power over Ethernet (PoE) impacting new restaurant lighting installations?

PoE simplifies installation by using standard network cabling to deliver both low-voltage power and data to LED fixtures. This reduces the need for conventional AC wiring, lowers installation complexity and material costs, and provides an easier pathway for integrating lighting fixtures into the restaurant's existing IT network infrastructure.

What specific lighting features are prioritized by Quick Service Restaurants (QSRs) compared to Fine Dining establishments?

QSRs prioritize robust durability, high lumen output, standardized, modular fixtures, and maximum energy efficiency for uniform, bright illumination. Fine Dining establishments prioritize high CRI, precise beam control, low glare, and custom aesthetic designs with advanced scene-setting capabilities to create a high-luxury, intimate ambiance.

What is the expected lifespan advantage of modern LED restaurant lighting over traditional sources?

Modern high-quality LED fixtures generally boast operational lifespans (L70 rating) exceeding 50,000 hours, significantly surpassing the 1,000 to 20,000 hours typical of halogen and fluorescent lamps. This extended lifespan drastically reduces maintenance costs and the frequency of lamp replacement in high-ceiling restaurant environments.

How do governmental regulations influence the Restaurant Lighting Market in Europe?

European market development is heavily influenced by directives such as the Ecodesign requirements, which mandate minimum energy efficiency levels and phasing out less efficient light sources. These regulations compel restaurants to retrofit existing infrastructure with modern, certified LED technology, driving market modernization and compliance.

Explain the concept of zonal lighting in a restaurant setting.

Zonal lighting involves dividing the restaurant space into distinct areas (zones) such as the bar, dining tables, circulation paths, and serving stations, with each zone having independently controllable lighting levels and color temperatures. This technique ensures specific functional and aesthetic needs are met dynamically across the entire facility.

What is the importance of thermal management in LED fixture design for restaurants?

Thermal management, typically achieved through specialized heat sinks (often aluminum), is essential for dissipating the heat generated by the LED chip. Effective heat dissipation directly dictates the fixture's long-term performance, color stability, and overall lifespan. Poor thermal management leads to premature lumen depreciation and color shift.

In the value chain, what role do architectural lighting designers typically play?

Architectural lighting designers act as key specifiers in the value chain, particularly for mid-to-high-end restaurants. They translate the restaurant concept into detailed lighting plans, select specific fixtures and controls based on aesthetic and performance criteria, and often work directly with manufacturers to source customized or premium solutions.

How is the aftermarket/retrofit segment contributing to market growth?

The aftermarket or retrofit segment is a significant growth engine, particularly in mature economies, as millions of existing commercial facilities seek to upgrade outdated, inefficient lighting systems to comply with new energy codes and improve the dining ambiance without undertaking full structural renovations. LED retrofit kits offer a cost-effective path to modernization.

Beyond illumination, what non-lighting functions are integrated into modern restaurant lighting fixtures?

Modern fixtures often integrate numerous non-lighting functions, transforming them into IoT endpoints. These functions include occupancy sensing, daylight harvesting sensors, temperature and humidity monitoring, acoustic detection, and in some advanced systems, indoor positioning services (IPS) for asset tracking and optimizing staff movement.

What is the impact of restaurant design trends, such as open ceilings, on fixture selection?

Open ceiling designs necessitate industrial or aesthetically pleasing track systems, exposed linear suspensions, and decorative pendant fixtures that serve as architectural elements. Fixtures must offer controlled light distribution to avoid glare while accommodating the high mounting heights characteristic of this popular design style.

How does AI contribute to energy savings in restaurant lighting environments?

AI utilizes machine learning to continuously analyze real-time data from occupancy sensors and light meters, identifying optimal operational patterns that human scheduling cannot achieve. AI dynamically dims or turns off lights in non-critical or unoccupied zones, learning and predicting usage fluctuations to maximize instantaneous energy savings autonomously.

What risks are associated with wireless control systems in busy restaurant settings?

Potential risks include signal interference from other high-density wireless devices (e.g., POS terminals, patron Wi-Fi), network security vulnerabilities if not properly segmented, and complexity in ensuring robust, reliable communication across large or structurally challenging restaurant layouts, requiring meticulous commissioning.

Explain the difference between ambient, accent, and task lighting in a restaurant.

Ambient lighting provides uniform general illumination for visibility; accent lighting uses focused beams (e.g., spot lights) to draw attention to specific elements like tables, artwork, or architectural details; and task lighting provides high-intensity, localized light for functional activities, typically found in kitchens or food prep areas.

How important is IP rating when selecting lighting for kitchen and washroom areas?

IP (Ingress Protection) rating is critically important for kitchen and washroom lighting. Kitchens require fixtures with high IP ratings (e.g., IP65 or higher) to withstand moisture, steam, splashing water during cleaning, and high-pressure washing, ensuring safety and longevity under harsh operating conditions.

What competitive advantage do manufacturers gain by offering comprehensive software platforms?

Manufacturers offering robust software platforms gain a competitive edge by providing centralized control, data analytics on energy consumption and space utilization, remote diagnostics capabilities, and seamless integration with other building systems, moving the value proposition from selling hardware to selling intelligent service ecosystems.

How does sustainable material usage (e.g., recycled aluminum) affect purchasing decisions in the restaurant market?

Sustainable material usage is increasingly important, particularly for large chains and high-profile establishments committed to environmental standards (LEED certification). Restaurants prioritize fixtures made from recycled or low-impact materials to align with corporate social responsibility goals and benefit from green building certifications, even if the initial cost is slightly higher.

What is spectral power distribution (SPD) and why is it important in food service?

SPD describes the amount of energy radiated at each wavelength of the visible spectrum. In food service, specific SPD profiles (often those slightly emphasizing red and yellow tones) are engineered to make food items—such as meats, produce, and pastries—appear more vibrant and appealing, directly enhancing the perceived quality and freshness of the menu.

How are portable and battery-powered decorative lighting fixtures utilized in modern restaurants?

Portable, battery-powered fixtures (e.g., tabletop lamps, cordless uplights) are used to provide flexible, localized accent lighting on dining tables and bars without the constraint of fixed wiring. They are essential for creating intimate evening ambiance, easily repositioned for different table configurations, and enhance the high-touch customer experience.

What is the market impact of customization and personalization trends in restaurant lighting?

The increasing trend toward customization demands manufacturers offer bespoke fixture designs, specialized finishes, and tailored control software. This trend drives market value towards premium segments, as restaurants view unique lighting as a critical element of their proprietary brand identity and competitive differentiation against standardized chain formats.

How do stringent health and safety regulations affect lighting product development for kitchen areas?

Health and safety regulations require kitchen fixtures to be sealed against contaminants (high IP rating), provide specific light levels (lux) to prevent accidents, offer minimal glare to reduce eye strain for staff, and utilize materials that are easy to clean and resist corrosion from chemicals and heat, driving specialized product development in this segment.

What is the primary distinction between the demand drivers in North America versus Asia Pacific?

North America's demand is driven primarily by mandatory energy retrofits, sophisticated architectural design, and technology adoption (smart controls). APAC's demand is driven mainly by sheer volume, rapid new construction of commercial spaces, urbanization, and the expanding presence of franchised QSR and casual dining concepts.

How are lighting manufacturers leveraging data collected from networked fixtures?

Manufacturers leverage aggregated data on operational hours, energy consumption, occupancy patterns, and fixture health to refine product design, offer predictive maintenance services, improve warranties, and provide facility managers with actionable insights for optimizing space utilization and further reducing long-term operational costs across entire property portfolios.

What are the typical luminous flux requirements (lux levels) for general dining areas?

General dining areas typically require moderate luminous flux, often ranging between 100 and 300 lux. However, the requirement is highly dependent on the restaurant style; fine dining often favors the lower end (100-150 lux) for intimacy, while casual or quick-service areas use higher levels (250-300 lux) for visibility and energy.

Describe the role of IoT in creating 'smart restaurants' via lighting infrastructure.

IoT enables lighting infrastructure to serve as the backbone of a 'smart restaurant' by integrating various sensors that collect environmental and occupancy data. The lighting network then communicates this data to central Building Management Systems (BMS), allowing for automated adjustment of lighting, HVAC, and security systems based on real-time needs and operational metrics.

How does the rising cost of electricity influence LED adoption rates in restaurants?

The rising global cost of electricity significantly accelerates the adoption of LED lighting. Since lighting can account for a substantial portion of a restaurant's utility bill, the superior efficiency of LEDs (which consume up to 80% less power than traditional sources) provides a strong and rapid Return on Investment (ROI) justification for expensive retrofits.

What kind of service agreements are becoming common for complex lighting control systems?

Subscription-based models for software maintenance, data analytics, and cloud hosting of control platforms are becoming common. These agreements often include remote monitoring, periodic software updates, proactive diagnostics, and technical support, ensuring the continuous, optimal performance of sophisticated networked lighting systems.

What impact does glare reduction technology have on the dining environment?

Glare reduction, achieved through precise optics, deep recessed downlights, and specialized diffusers, is essential for high-quality dining experiences. Reducing glare enhances visual comfort for patrons, preventing harsh spots or reflections that distract from the food or conversation, thereby improving the overall perception of the restaurant's atmosphere.

In the context of the value chain, what is 'upstream analysis' focused on?

Upstream analysis focuses on the raw material sourcing and component manufacturing stage. For restaurant lighting, this includes the production of LED chips (semiconductors), drivers, heat sinks, and optical elements. Efficiency and cost optimization at this stage directly influence the final pricing and quality of the finished lighting fixture.

How are specialty lighting fixtures used to enhance branding in themed restaurants?

Themed restaurants utilize specialty, custom-fabricated fixtures—such as oversized pendants, historically accurate reproductions, or uniquely shaped linear lights—as centerpiece elements. These fixtures are integral to the architectural narrative, reinforcing the restaurant's theme, logo, or brand identity, creating memorable, photo-worthy customer touchpoints.

Why is standardization of fixtures important for national restaurant chains?

Standardization ensures brand consistency across all locations, simplifies procurement, minimizes training required for installation and maintenance staff, and reduces inventory complexity for replacement parts. It allows centralized facility management teams to maintain uniform ambiance and performance regardless of geographic location.

What is DALI and why is it frequently used in European restaurant lighting projects?

DALI (Digital Addressable Lighting Interface) is a dedicated, standardized protocol for controlling and managing lighting fixtures. It is popular in European restaurants because it offers highly reliable, bidirectional communication for precise dimming, addressing individual fixtures, grouping, and fault reporting, meeting the region's high standards for complexity and sustainability reporting.

How does the demand for outdoor dining spaces affect lighting product requirements?

The growth in outdoor dining necessitates highly durable, weather-resistant fixtures (high IP ratings) that can withstand UV exposure, rain, and temperature fluctuations. These products must balance safety (pathway illumination) with aesthetic considerations, often incorporating low-glare, warm-colored light to match the indoor dining experience.

What is the key difference in purchasing decisions between independent restaurants and large corporate chains?

Independent restaurants typically base decisions on localized aesthetic requirements and immediate budget constraints, often sourcing through local distributors. Corporate chains base decisions on centralized purchasing power, standardization, TCO analysis over long periods, and technical specifications tailored for system-wide integration and remote management.

How does technological innovation impact the price point of high-CRI LED fixtures over time?

Technological innovation, particularly in LED chip efficiency and manufacturing scale, consistently drives down the price point of high-CRI fixtures. What was once premium technology reserved for luxury establishments is becoming increasingly accessible, accelerating market adoption across casual and mid-range dining sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager