Restaurant Online Ordering System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434480 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Restaurant Online Ordering System Market Size

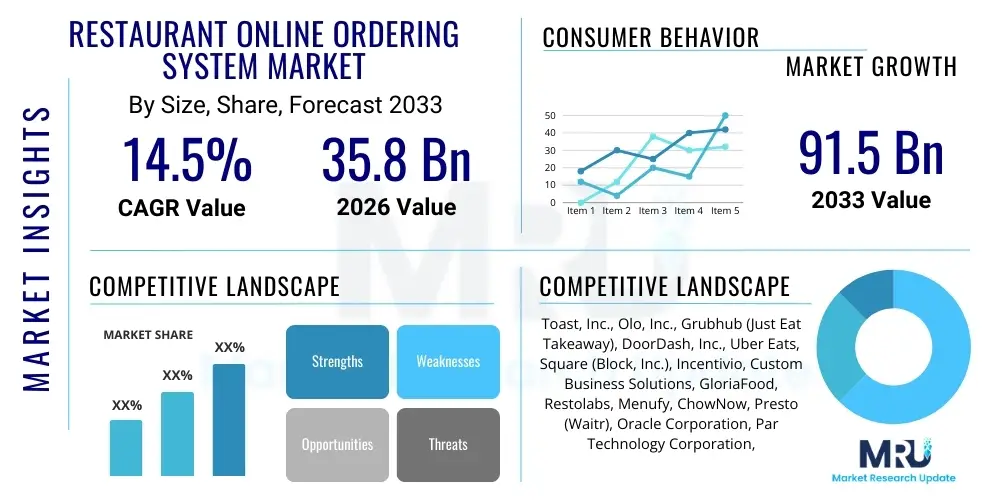

The Restaurant Online Ordering System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 35.8 Billion in 2026 and is projected to reach USD 91.5 Billion by the end of the forecast period in 2033.

Restaurant Online Ordering System Market introduction

The Restaurant Online Ordering System Market encompasses sophisticated digital platforms enabling customers to place and pay for food orders directly from restaurants via proprietary websites, dedicated mobile applications, or third-party aggregators. This technology suite includes front-end user interfaces, secure payment gateways, integrated kitchen display systems (KDS), and customer relationship management (CRM) tools, streamlining the entire order fulfillment process from initial input to final delivery or pickup. The primary objective of these systems is to enhance operational efficiency, minimize order errors, and significantly improve customer convenience and experience, driving substantial growth in digital revenue streams for the foodservice industry.

Key applications span the entire spectrum of the culinary landscape, ranging from Quick Service Restaurants (QSRs) and Fast Casual establishments, which rely heavily on volume and speed, to Full-Service Restaurants (FSRs) and fine dining venues that utilize online ordering for curated takeout and specialized catering services. The rapid acceleration of digital transformation, catalyzed profoundly by global health events and subsequent shifts in consumer behavior toward convenience and contactless transactions, remains the central driving force. These platforms offer benefits such as enhanced data collection for personalized marketing, reduced reliance on traditional phone orders, and expanded geographical reach.

Furthermore, the continuous integration of advanced technological features, including artificial intelligence (AI) for predictive ordering, enhanced data analytics for menu optimization, and seamless integration with point-of-sale (POS) systems, is pushing the market forward. Driving factors include increasing smartphone penetration globally, the imperative for restaurants to manage rising labor costs through automation, and the competitive necessity of providing a seamless, multi-channel customer experience (omnichannel). The systems are evolving from simple ordering portals into complex digital ecosystems managing loyalty programs, dynamic pricing, and sophisticated logistics management, positioning them as essential investments for modern restaurant operations seeking sustainable expansion and competitive advantage.

Restaurant Online Ordering System Market Executive Summary

The Restaurant Online Ordering System Market is characterized by robust commercial activity driven primarily by the shift towards Software as a Service (SaaS) deployment models, offering scalability and reduced initial capital expenditure for operators globally. Current business trends indicate a strong move toward platform consolidation, where independent restaurants increasingly favor integrated solutions that combine ordering, POS, marketing, and loyalty functionalities under a single vendor umbrella, thereby minimizing complexity and integration friction. Furthermore, the burgeoning demand for white-label solutions, which allow restaurants to maintain complete control over customer data and branding while utilizing advanced third-party technology, represents a significant market dynamic, challenging the traditional dominance of third-party delivery aggregators.

Regionally, North America and Asia Pacific exhibit the highest market penetration and growth potential, respectively. North America, driven by high consumer spending power and advanced infrastructure, leads in adoption of sophisticated AI-powered personalization tools. Conversely, Asia Pacific's growth is fueled by massive mobile-first consumer bases, particularly in emerging economies, and the rapid expansion of QSR chains utilizing localized mobile payment systems. European markets are characterized by stringent data privacy regulations (like GDPR), compelling vendors to focus on highly secure and compliant platforms, emphasizing data protection and consumer trust as competitive differentiators.

Segmentation trends highlight the increasing importance of mobile applications over web-based ordering due to superior user experience, push notification capabilities, and geolocation services that enable efficient delivery logistics. Within end-users, the Quick Service Restaurant (QSR) segment maintains the largest market share due to high transaction volume and standardization, while the Fast Casual and Full-Service Restaurant (FSR) segments are witnessing the highest growth rate, adopting these systems to manage complex menus and premium customer expectations. The integration capability with ghost kitchens and virtual brands further accelerates market evolution, demanding flexible and scalable ordering interfaces capable of managing multiple brand identities from a single operational hub.

AI Impact Analysis on Restaurant Online Ordering System Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Restaurant Online Ordering System Market typically revolve around operational efficiency gains, personalization capabilities, potential effects on labor requirements, and the accuracy of predictive inventory management. Users frequently inquire: "How accurately can AI predict future order volume and optimize staffing?", "Can AI recommendation engines truly increase average order value (AOV)?", and "What are the data privacy implications of using AI to analyze customer preferences?" The consensus theme emerging from these inquiries focuses on AI's potential to transcend basic order taking, moving toward intelligent, autonomous, and hyper-personalized digital experiences that maximize revenue while minimizing food waste and operational overhead.

AI's core influence lies in transforming raw transactional data into actionable strategic insights, fundamentally changing how restaurants interact with their customer base and manage their supply chain. AI-driven systems leverage machine learning algorithms to analyze historical purchasing patterns, time of day, weather, and localized events to generate highly accurate demand forecasts, significantly improving inventory management and reducing spoilage. On the customer-facing side, advanced recommendation engines utilize collaborative filtering and real-time behavioral tracking to suggest personalized upselling and cross-selling opportunities, dynamically altering menu displays to maximize profitability, thereby optimizing the consumer journey for higher conversion rates and Average Order Value (AOV).

Beyond customer interaction, AI facilitates sophisticated back-of-house automation. AI-powered chatbots and voice assistants handle routine customer support inquiries regarding orders, modifications, and delivery status, reducing the workload on human staff. Furthermore, integration of AI with Kitchen Display Systems (KDS) optimizes cooking and prep times by dynamically prioritizing orders based on complexity, delivery time estimates, and kitchen load, ensuring timely fulfillment and consistent service quality, which are crucial differentiators in a saturated digital market. This analytical and automation capability solidifies AI as an indispensable tool for scalability and profitability in the competitive online ordering ecosystem.

- List AI impacts in concise points

- Enhanced personalized menu recommendations leading to increased Average Order Value (AOV).

- Predictive demand forecasting for optimized inventory management and waste reduction.

- Automated customer service via AI-powered chatbots for routine order inquiries and support.

- Dynamic pricing strategies based on real-time demand and competitive analysis.

- Optimized kitchen workflow and throughput management via intelligent KDS synchronization.

- Advanced fraud detection and secure transaction processing through machine learning models.

- Improved customer segmentation and targeted marketing campaign execution.

DRO & Impact Forces Of Restaurant Online Ordering System Market

The Restaurant Online Ordering System Market is powerfully influenced by a confluence of driving factors (D), inherent restraints (R), and compelling opportunities (O), which collectively determine the market trajectory and competitive landscape, forming the critical impact forces. The dominant drivers include the sustained increase in consumer preference for convenient, on-demand digital services, the widespread adoption of smartphones and high-speed internet, and the operational efficiencies mandated by rising labor costs, pushing restaurants toward automation. These factors create strong upward pressure on market demand, making an integrated online presence a matter of survival rather than mere innovation for most foodservice businesses globally. The legacy effect of the pandemic, which dramatically accelerated digital infrastructure investment, continues to sustain high growth momentum.

However, the market faces significant restraints that necessitate sophisticated vendor solutions. Foremost among these are cybersecurity risks and data breaches, given the large volume of sensitive customer payment information processed by these platforms. High commission rates charged by major third-party aggregators often strain restaurant profitability, leading to increased interest in proprietary, direct-to-consumer platforms but demanding substantial initial investment and marketing efforts. Furthermore, the complexities associated with integrating ordering systems with diverse existing legacy Point-of-Sale (POS) systems, kitchen hardware, and external delivery logistics providers present technical barriers, particularly for smaller, independent operators who lack dedicated IT infrastructure or expertise.

Opportunities for exponential growth are concentrated in untapped Small and Medium-sized Business (SMB) markets, particularly in emerging economies, where digital adoption is accelerating rapidly, often skipping desktop stages entirely in favor of mobile applications. There is a substantial opportunity in offering highly specialized, niche ordering systems tailored for specific segments like catering, ghost kitchens, or institutional food services (e.g., hospitals, universities). The most significant impact force driving long-term value creation is the development of fully unified commerce platforms that seamlessly integrate in-store, online, and delivery operations, powered by advanced cloud architecture and AI, offering restaurants a single, cohesive view of their entire customer base and operational performance, moving beyond transactional platforms into true digital business management ecosystems.

Segmentation Analysis

The Restaurant Online Ordering System Market is comprehensively segmented based on critical operational and technical characteristics, providing detailed insights into market dynamics and growth pockets. Key segmentation axes include the deployment model, the platform type, and the end-user application. Understanding these segments is crucial for both vendors tailoring their product offerings and restaurants evaluating the most suitable technological investment for their specific operational needs and scale. The shift towards cloud-based solutions across all segments is the most defining trend, driven by the need for scalability, remote access, and lower maintenance costs compared to traditional on-premise installations.

Within the deployment model segment, Software as a Service (SaaS) dominates the landscape due to its subscription-based pricing, reduced upfront investment, and continuous automated updates, making sophisticated technology accessible even to small independent restaurants. Conversely, platform type segmentation reveals that mobile applications are rapidly gaining market share over traditional web-based portals, primarily because mobile interfaces offer superior user experience, integrate easily with device-specific features (e.g., Apple Pay, Google Wallet), and leverage personalized push notifications for marketing and status updates. This mobile-first approach is reshaping consumer expectations for order tracking and communication.

The end-user application segmentation underscores the vital role of these systems across the entire foodservice industry. While Quick Service Restaurants (QSRs) are volume drivers, leveraging ordering systems for speed and efficiency, the Full-Service Restaurant (FSR) segment is increasingly adopting these solutions to manage complex order customizations, reservations, and upscale takeout services, driving growth in higher-value transactions. This intricate segmentation confirms that the market is fragmenting, requiring highly adaptable software solutions capable of meeting the varied demands of different restaurant formats, ranging from simple menu interfaces to sophisticated enterprise resource planning (ERP) integrations.

- Deployment Type

- Software as a Service (SaaS)

- On-Premise

- Platform Type

- Web-Based

- Mobile Application

- End User

- Quick Service Restaurants (QSR)

- Full Service Restaurants (FSR)

- Fast Casual Restaurants

- Cafes and Bars

- System Integration

- Proprietary Systems (White-Label)

- Third-Party Aggregators

- Payment Integration

- In-App Payment

- Cash on Delivery (CoD)

Value Chain Analysis For Restaurant Online Ordering System Market

The Value Chain for the Restaurant Online Ordering System Market is fundamentally anchored by the interplay between upstream technology providers and downstream end-users, managed through diverse and evolving distribution channels. Upstream activities involve key technology development centered around core software architects, cloud infrastructure providers (like AWS or Azure), and specialized fintech firms providing secure payment gateway solutions. These upstream participants are responsible for innovation in areas such as API connectivity, data analytics engines, and robust cybersecurity protocols. The efficiency of the upstream segment dictates the scalability and reliability of the ordering systems deployed downstream.

The core midstream activities include the actual development, customization, deployment, and ongoing maintenance of the ordering platforms. Distribution channels are bifurcated into direct sales models, where proprietary system vendors sell directly to large restaurant chains (often resulting in white-label solutions), and indirect models, dominated by third-party delivery platforms and value-added resellers (VARs) who integrate the ordering software into a broader ecosystem of services. The indirect channel, particularly through major aggregators, provides vast reach but often introduces high commission costs and less control over customer data for the restaurant operator.

Downstream value is realized at the restaurant level (B2B end-user) and ultimately delivered to the consumer (B2C end-user). Restaurants utilize these systems to enhance customer experience, manage kitchen operations, and optimize delivery logistics, creating value through increased order volume and streamlined processes. Direct channels—where the customer orders through the restaurant’s own website or app—maximize restaurant profitability and provide invaluable direct customer data for loyalty building. Conversely, indirect channels prioritize convenience for the consumer through aggregation, offering choice but diluting the restaurant’s brand connection. Optimization across the entire chain demands seamless data flow from payment processing through to kitchen fulfillment and final delivery tracking, necessitating robust integration standards.

Restaurant Online Ordering System Market Potential Customers

The primary potential customers and end-users of Restaurant Online Ordering Systems span the entire spectrum of the food service and hospitality industry, ranging from large multinational enterprise chains to small, independent, and micro-scale food vendors. The largest market segments by volume are global Quick Service Restaurants (QSRs) and major Fast Casual chains, which require high-throughput, highly standardized, and enterprise-grade systems capable of scaling across thousands of locations and integrating complex loyalty programs and global payment methods. These enterprise customers prioritize reliability, centralized management, and deep integration with existing ERP and legacy POS infrastructures.

A significant, high-growth segment comprises independent and local Full-Service Restaurants (FSRs), cafes, and specialty food providers (bakeries, pizzerias). For this cohort, accessibility and ease of use are paramount. They predominantly seek flexible, affordable, SaaS-based solutions that require minimal upfront investment and technical skill to operate. These buyers are increasingly moving away from restrictive third-party aggregators toward white-label solutions that allow them to establish a direct digital connection with their clientele, essential for brand building and avoiding high commission fees, representing a critical target demographic for new market entrants.

Emerging potential customer segments also include institutional kitchens such as those in corporate campuses, universities, hospitals, and dark/ghost kitchens. Ghost kitchens, in particular, rely exclusively on online ordering systems as their sole channel to market, demanding hyper-efficient platforms optimized purely for off-premise fulfillment and capable of managing multiple virtual brands simultaneously from a single physical location. Additionally, non-traditional food vendors utilizing temporary or mobile setups (food trucks, pop-up events) represent a niche but growing customer base requiring mobile-friendly, flexible, and short-term contractual ordering solutions integrated with secure payment systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.8 Billion |

| Market Forecast in 2033 | USD 91.5 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toast, Inc., Olo, Inc., Grubhub (Just Eat Takeaway), DoorDash, Inc., Uber Eats, Square (Block, Inc.), Incentivio, Custom Business Solutions, GloriaFood, Restolabs, Menufy, ChowNow, Presto (Waitr), Oracle Corporation, Par Technology Corporation, Lightspeed Commerce Inc., Deliverect, Resy (American Express), BentoBox, Fiserv. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Restaurant Online Ordering System Market Key Technology Landscape

The technology landscape of the Restaurant Online Ordering System Market is rapidly evolving, driven by the shift towards microservices architecture, advanced API connectivity, and the integration of edge computing. The core technological foundation is rooted in cloud-native platforms, primarily utilizing Software as a Service (SaaS) models hosted on major public cloud infrastructures. This cloud dependency is essential for offering the scalability required to handle massive, fluctuating transaction volumes, particularly during peak mealtimes and seasonal demand spikes. Key vendors are investing heavily in developing robust, open APIs that facilitate seamless two-way communication between the ordering system and disparate technologies, including third-party logistics providers (LSPs), loyalty platforms, and next-generation smart kitchen equipment.

A major disruptive technological trend is the adoption of "headless commerce" principles. Traditional ordering systems link the front-end user interface (the "head") directly to the back-end commerce logic. Headless architecture decouples these layers, allowing restaurants to use highly customized front-end customer experiences (e.g., voice ordering, kiosk interfaces, augmented reality menus) while maintaining a centralized, unified back-end system for order processing and inventory management. This flexibility is vital for large chains seeking to deploy varied, brand-specific digital experiences without requiring a complete overhaul of their core infrastructure. Furthermore, advanced payment processing technologies, including tokenization and embedded finance options (like Buy Now, Pay Later), are being integrated to enhance checkout speed and security, reducing cart abandonment rates.

The role of data technologies, specifically advanced analytics and Machine Learning (ML), is critical in shaping the future technology landscape. Real-time data processing capabilities are being implemented to support dynamic menu engineering and instantaneous A/B testing of pricing or promotional strategies. Beyond customer data, there is a growing focus on utilizing IoT sensors within kitchens and delivery mechanisms to feed operational data (temperature, speed, preparation time) back into the ordering system. This integration ensures highly accurate preparation and delivery time estimates, fundamentally improving customer transparency and satisfaction. Blockchain technology is also being explored for secure, tamper-proof record-keeping of transactions and supply chain provenance, building trust and regulatory compliance within the digital ordering ecosystem.

Regional Highlights

- Highlight key countries or regions and their market relevance

- North America (NA): Dominates the market share due to high consumer spending, early adoption of mobile technology, and the presence of major technological innovation hubs and key market players. The US market is characterized by fierce competition between proprietary platforms (Olo, Toast) and major aggregators (DoorDash, Uber Eats). Canada also exhibits strong growth, mirroring US trends but with higher regulatory focus on commission caps in certain provinces. NA leads in the deployment of AI-powered personalization and integrated POS-ordering solutions.

- Europe: Exhibits steady growth, primarily driven by the UK, Germany, and France. The region is highly fragmented, with strong reliance on local and regional third-party aggregators. Growth is tempered by stringent regulatory environments, particularly GDPR, which mandates careful handling of customer data, necessitating significant investment in secure and compliant ordering platforms. Scandinavia shows high per capita adoption of advanced digital payment and ordering systems.

- Asia Pacific (APAC): Positioned as the fastest-growing region globally, fueled by massive, mobile-first populations in China, India, and Southeast Asia. Market dynamics here are driven by high density, rapid urbanization, and a diverse competitive landscape featuring strong local players (e.g., Meituan in China) alongside global giants. APAC excels in adopting super-app models that bundle ordering, payment, and delivery services, often leveraging localized digital wallets and high engagement rates.

- Latin America (LATAM): Showing accelerated growth, particularly in Brazil and Mexico, driven by increasing internet penetration and consumer demand for convenience in urban centers. The market is highly sensitive to payment infrastructure development and macroeconomic volatility. Vendors focus on solutions optimized for mobile usage and multiple, localized payment options, including installment plans and cash-on-delivery, reflecting regional financial specificities.

- Middle East and Africa (MEA): Emerging market with high potential, concentrated mainly in the UAE, Saudi Arabia, and South Africa. Growth is rapid, spurred by high disposable incomes in Gulf Cooperation Council (GCC) countries and significant investments in logistics and smart city infrastructure. The high utilization of digital services in the Gulf region creates a fertile ground for premium, bespoke online ordering systems tailored for upscale dining and catering services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Restaurant Online Ordering System Market.- Toast, Inc.

- Olo, Inc.

- DoorDash, Inc.

- Uber Eats

- Grubhub (Just Eat Takeaway)

- Square (Block, Inc.)

- ChowNow

- Menufy

- GloriaFood

- Custom Business Solutions

- Presto (Waitr)

- Par Technology Corporation

- Oracle Corporation (MICROS)

- Lightspeed Commerce Inc.

- Incentivio

- Deliverect

- BentoBox

- Resy (American Express)

- Fishbowl Marketing

- Fiserv

Frequently Asked Questions

Analyze common user questions about the Restaurant Online Ordering System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Restaurant Online Ordering System Market?

The market is projected to grow at a robust CAGR of 14.5% during the forecast period spanning from 2026 to 2033, driven by digitalization and consumer demand for seamless food ordering experiences.

Which deployment model is dominating the market, SaaS or On-Premise?

Software as a Service (SaaS) deployment models currently dominate the market. SaaS offers restaurants greater scalability, lower initial investment costs, and continuous automated software updates, aligning with operational needs for modern, flexible IT infrastructure.

How does AI technology primarily impact the profitability of online ordering systems?

AI significantly enhances profitability by optimizing demand forecasting, reducing food waste, and implementing hyper-personalized recommendations to increase the average order value (AOV) through highly effective cross-selling and upselling techniques.

What are the primary restraints hindering rapid market growth in developed regions?

Primary restraints include persistent high commission fees charged by third-party aggregators, significant cybersecurity and data privacy concerns, and the technical complexities associated with integrating modern ordering systems with legacy Point-of-Sale (POS) infrastructure.

Which geographical region is expected to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid urbanization, high mobile penetration rates, and the substantial expansion of both Quick Service Restaurants and local third-party delivery services across emerging economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager