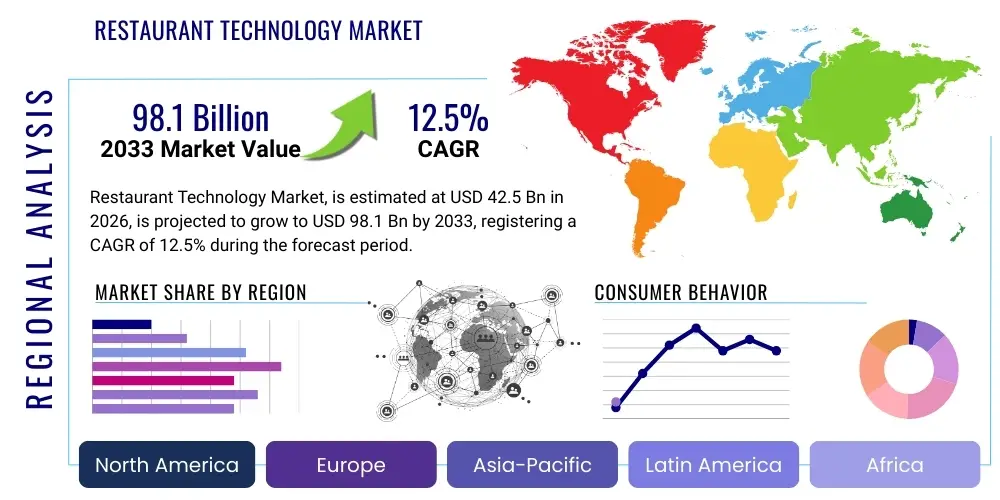

Restaurant Technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435800 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Restaurant Technology Market Size

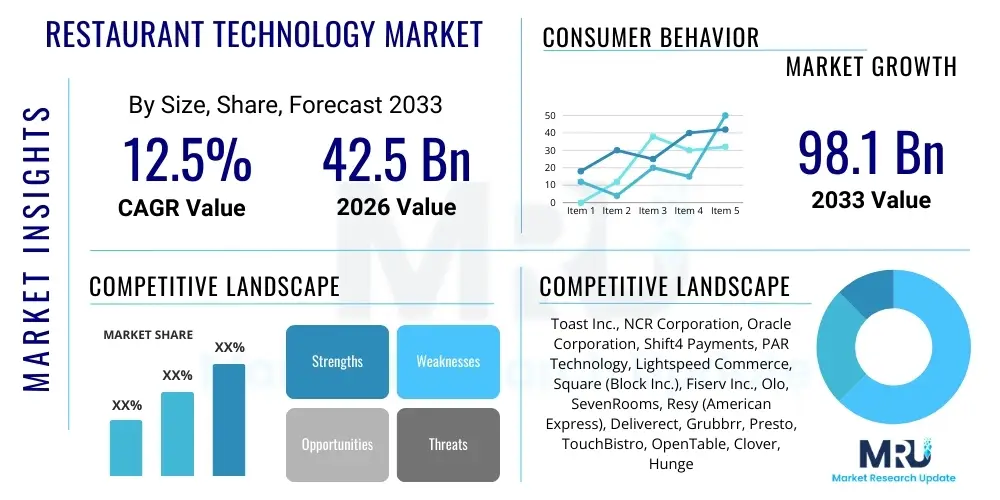

The Restaurant Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $42.5 Billion in 2026 and is projected to reach $98.1 Billion by the end of the forecast period in 2033.

Restaurant Technology Market introduction

The Restaurant Technology Market encompasses a diverse range of hardware and software solutions designed to streamline operations, enhance customer experience, and improve profitability across the entire foodservice industry. This digital transformation is driven by shifting consumer preferences towards convenience, speed, and personalized service, necessitating robust systems for point-of-sale (POS), kitchen display systems (KDS), inventory management, and customer relationship management (CRM). Modern restaurant technology facilitates omnichannel ordering capabilities, integrating in-house dining with online ordering, third-party delivery services, and mobile applications, ensuring seamless transaction processing and data synchronization across all touchpoints.

Key products within this market include cloud-based POS systems, reservation management software, robotic automation solutions for food preparation, and sophisticated data analytics platforms that provide actionable insights into labor scheduling, menu performance, and supply chain optimization. The widespread adoption of these technologies is not merely about modernization; it is a critical necessity for restaurants facing intense competitive pressures, rising operational costs, and persistent labor shortages. By automating routine tasks and providing better control over resources, technology minimizes human error and allows staff to focus on high-value interactions, directly contributing to service quality and operational efficiency.

Major applications of restaurant technology span front-of-house (customer engagement and order taking), back-of-house (inventory, preparation, and waste reduction), and enterprise-level management (financial reporting and multi-unit oversight). The primary benefits derived from these implementations include enhanced speed of service, increased order accuracy, reduced operational complexity, and improved customer loyalty through personalized digital marketing efforts. Driving factors for market growth prominently include the irreversible trend toward digital ordering, the growing penetration of smart devices among consumers, and the need for scalable, flexible, and secure cloud infrastructure to support rapidly expanding restaurant chains and virtual kitchen models globally.

Restaurant Technology Market Executive Summary

The global Restaurant Technology Market is characterized by vigorous innovation, strong merger and acquisition activity among leading providers, and an increasing reliance on cloud-native solutions that offer flexibility and scalability, particularly for small and medium-sized enterprises (SMEs). Business trends highlight a significant shift toward integrated platforms that consolidate disparate systems (POS, payment, loyalty, and inventory) into a single unified dashboard, reducing complexity and total cost of ownership for operators. Furthermore, the rise of ghost kitchens and virtual brands is fueling demand for specialized, efficient back-of-house technology capable of handling high-volume, delivery-only operations with minimal staff, emphasizing sophisticated kitchen management and integrated third-party logistics.

Regional trends indicate North America currently holds the largest market share, driven by high labor costs, advanced technological infrastructure, and a mature quick-service restaurant (QSR) sector that is rapid adopters of self-ordering kiosks and digital menu boards. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by massive urbanization, rapidly expanding middle-class consumption, and government initiatives promoting digital payments and smart city infrastructure, particularly in countries like China and India. Europe shows robust adoption, focusing heavily on data privacy compliance (GDPR) alongside sustainability-focused technology solutions aimed at reducing food waste and optimizing energy consumption.

Segment trends confirm that the Software component continues to dominate the market in terms of revenue, with subscription-based models (SaaS) gaining significant preference over traditional perpetual licensing. Within software, solutions related to Customer Relationship Management (CRM) and online ordering platforms are experiencing exponential growth, directly correlating with the industry's focus on retaining digital customers and managing personalized marketing campaigns. Conversely, the Hardware segment, though growing slower, is seeing modernization through mobile POS (mPOS) terminals and self-service kiosks, moving away from bulky, static terminals. Deployment trends underscore the irreversible migration from on-premise systems to cloud-based architecture due to its superior uptime, lower capital expenditure, and ease of remote management, making it highly attractive to multi-unit operators seeking standardized technology rollouts.

AI Impact Analysis on Restaurant Technology Market

Analysis of common user questions regarding AI's impact on the Restaurant Technology Market reveals a duality of high anticipation concerning efficiency gains juxtaposed with significant apprehension regarding implementation complexity and workforce displacement. Users frequently inquire about how AI can genuinely automate front-of-house tasks like order taking (via voice bots or kiosks) and back-of-house tasks such as scheduling and inventory forecasting. Key themes revolve around AI's ability to personalize the dining experience, predict peak demand fluctuations, and manage supply chain volatility. Concerns often center on the initial investment required for AI infrastructure, the necessity of staff retraining, and ethical implications related to customer data collection and algorithmic bias in operational decision-making. Overall user expectation is that AI will transition from a supplementary tool to an indispensable core operational layer, fundamentally redefining labor allocation and resource optimization within the next five years.

The influence of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is rapidly transforming operational capabilities across the restaurant value chain. AI is being deployed extensively in predictive analytics, allowing managers to forecast demand with greater accuracy than traditional methods. This precision minimizes food waste by optimizing inventory ordering and maximizes labor productivity by intelligently scheduling staff based on anticipated customer traffic and order complexity. Automated upselling and cross-selling capabilities, powered by AI analyzing past purchase history and real-time market basket data, are becoming standard features in mobile ordering applications and self-service kiosks, driving average check size improvement.

Furthermore, AI is crucial for enhancing customer service through natural language processing (NLP) applications used in conversational ordering systems (chatbots and voice assistants) and automated feedback processing. In the kitchen, computer vision technology is employed to monitor food quality, portion control, and adherence to preparation standards, ensuring consistency and regulatory compliance without constant human intervention. The integration of AI into supply chain management offers dynamic routing and smart procurement suggestions, mitigating risks associated with ingredient price volatility and logistical delays, solidifying AI as a core competitive differentiator for future-proof restaurant operations.

- Enhanced Predictive Inventory Management: Minimizing spoilage and stockouts through ML-driven demand forecasting.

- Automated Customer Interaction: Utilizing AI chatbots and voice assistants for order taking, reservations, and query resolution.

- Optimized Labor Scheduling: ML algorithms creating efficient staff rosters based on anticipated hourly demand and staff performance metrics.

- Personalized Marketing and Menu Recommendations: Analyzing patron data to offer customized promotions and meal suggestions, boosting customer lifetime value.

- Quality and Compliance Monitoring: Computer vision ensuring consistency in food presentation and adherence to hygiene protocols.

DRO & Impact Forces Of Restaurant Technology Market

The Restaurant Technology Market expansion is significantly propelled by the increasing financial pressure on operators due to rising minimum wages and acute labor shortages, compelling investments in automation and efficiency solutions. However, this growth trajectory is concurrently restrained by the high upfront capital expenditure required for sophisticated integrated systems and the persistent challenge of seamless integration between legacy systems and modern, cloud-native platforms. Substantial market opportunities are emerging through the development of specialized solutions for untapped segments, such as independent food trucks and specialty cafes, alongside the potential integration of disruptive technologies like IoT for enhanced equipment monitoring and Blockchain for transparent supply chain tracking. These elements define the inherent dynamics governing the market's direction.

The primary drivers are centered around consumer demand and operational necessity. Consumers increasingly expect fast, accurate, and personalized digital experiences, forcing restaurants to adopt robust online ordering, loyalty, and payment systems. On the operational front, technology serves as the most effective countermeasure against margin compression caused by escalating costs across labor, food, and rent. The need for precise, real-time data to inform management decisions regarding marketing effectiveness, inventory levels, and operational bottlenecks is another powerful driver, promoting the adoption of advanced analytics and business intelligence (BI) tools across all segments of the industry.

Impact forces analysis reveals a moderate to high bargaining power of suppliers, driven by consolidation among major technology vendors offering complex, integrated platforms that create vendor lock-in. Conversely, the bargaining power of buyers (restaurants) is also substantial, especially for large multinational chains that demand highly customized and scalable enterprise solutions at competitive prices. The threat of substitutes is relatively low, as technology is increasingly non-negotiable for modern operations, although DIY solutions for smaller businesses present a minor alternative. The threat of new entrants is moderate, as while software development barriers are lowering, establishing the necessary industry reputation, security credentials, and deep integration partnerships remains a significant hurdle for startups. Competitive rivalry is extremely intense, characterized by continuous innovation and aggressive pricing strategies among established market leaders seeking to expand their unified platform offerings.

Segmentation Analysis

The Restaurant Technology Market is comprehensively segmented across several dimensions, including the type of component (Hardware vs. Software vs. Service), deployment model (Cloud vs. On-Premise), end-user type (Quick Service Restaurants vs. Full Service Restaurants), and application area (Front-of-House vs. Back-of-House). This granular segmentation helps in understanding the varying adoption patterns and specific technological needs across different restaurant formats and operational scales. The shift towards subscription-based software models (SaaS) and the overwhelming preference for cloud deployment are defining characteristics of the market structure, optimizing cash flow and providing restaurants with highly scalable operational foundations.

Analyzing these segments shows that while Quick Service Restaurants (QSRs) historically led adoption, driven by the necessity for speed and high transaction volumes, Full Service Restaurants (FSRs) are rapidly catching up, integrating sophisticated reservation, table management, and personalized marketing technologies to enhance the high-touch dining experience. Furthermore, the application segment highlights the growing complexity of back-of-house technology, moving beyond simple inventory management to include predictive maintenance for kitchen equipment (IoT integration) and dynamic labor optimization tools, recognizing that operational efficiency is just as critical as customer interface improvements.

- By Component:

- Software (POS, Inventory, ERP, CRM, Analytics, Order Management)

- Hardware (Self-Ordering Kiosks, POS Terminals, Kitchen Display Systems (KDS), Handheld Devices, Digital Menu Boards)

- Service (Installation, Integration, Maintenance, Consulting)

- By Deployment Model:

- Cloud-Based

- On-Premise

- By End-User:

- Quick Service Restaurants (QSR)

- Full Service Restaurants (FSR)

- Cafes and Bars

- Institutional Food Services

- By Application:

- Front-of-House (FOH)

- Back-of-House (BOH)

- Enterprise Management

Value Chain Analysis For Restaurant Technology Market

The Value Chain for the Restaurant Technology Market begins with upstream activities dominated by technology infrastructure providers, including software developers, hardware manufacturers (such as component suppliers for processors and displays), and cloud service platforms (AWS, Azure, Google Cloud) that provide the foundational environment for deployment. This upstream stage is characterized by intense R&D focusing on data security, scalability, and the integration of emerging technologies like AI and IoT sensors. Efficient partnerships at this stage are crucial for vendors to offer cutting-edge, reliable, and secure products that meet the stringent demands of the hospitality sector regarding uptime and transaction volume processing.

Midstream activities involve the core Restaurant Technology vendors themselves, who are responsible for product design, software coding, system integration, and customization. These vendors transform basic technological components into industry-specific solutions like unified POS platforms or advanced KDS. They often specialize in specific niches, such as payment processing compliance or specialized inventory tracking for high-volume environments. The efficiency and quality of integration testing at this stage are paramount, as the final product must seamlessly interface with various third-party applications, including accounting software and external delivery aggregators.

Downstream activities include distribution, implementation, and ongoing support services. Technology vendors utilize various distribution channels: direct sales to large chains, indirect distribution through certified resellers and channel partners for SMEs, and increasingly, direct online SaaS subscriptions. Implementation involves custom installation, staff training, and system migration, which are often provided by specialized third-party service firms or the vendor's professional services team. The post-sales phase—maintenance, updates, and customer support—is critical, particularly in the cloud environment, where vendors must ensure 24/7 reliability and continuous feature enhancement, directly impacting customer satisfaction and retention rates within the highly competitive SaaS market structure.

Restaurant Technology Market Potential Customers

The primary consumers and end-users of Restaurant Technology span the entire spectrum of the foodservice industry, ranging from independent single-unit operators to vast multinational quick-service restaurant (QSR) chains and large-scale contract food service providers. Quick Service Restaurants remain a foundational customer base due to their high transaction frequency, necessitating robust, speedy POS systems, and their propensity to adopt self-ordering kiosks and drive-thru optimization technologies to maximize throughput. This segment's focus is largely on minimizing order errors and maximizing speed of service, driving demand for tightly integrated front-of-house and back-of-house solutions.

Full Service Restaurants (FSRs) represent another significant customer segment, increasingly seeking technology that supports a sophisticated dining experience, including advanced reservation systems, table management software, and server handheld devices for efficient order transmission and payment processing tableside. For FSRs, technology is not just about efficiency but also about enhancing the perceived value and personalization of the dining occasion, driving adoption of specialized Customer Relationship Management (CRM) tools tailored for loyalty and guest experience management.

Emerging and high-growth potential customers include virtual kitchens, ghost restaurants, and delivery-only operations, which require specialized software focused exclusively on integrated logistics, third-party delivery platform aggregation, and highly efficient kitchen routing systems. Furthermore, non-traditional food service sectors like corporate cafeterias, institutional catering, and large-scale event venues are also rapidly adopting enterprise-grade technology for better centralized control over multi-location inventory, procurement, and complex operational compliance requirements, solidifying the market's reach beyond traditional dining establishments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $42.5 Billion |

| Market Forecast in 2033 | $98.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toast Inc., NCR Corporation, Oracle Corporation, Shift4 Payments, PAR Technology, Lightspeed Commerce, Square (Block Inc.), Fiserv Inc., Olo, SevenRooms, Resy (American Express), Deliverect, Grubbrr, Presto, TouchBistro, OpenTable, Clover, HungerRush, Upserve, Cake |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Restaurant Technology Market Key Technology Landscape

The Restaurant Technology landscape is defined by the integration of multiple sophisticated digital systems centered around cloud architecture and data processing capabilities. Cloud computing is the fundamental backbone, offering scalability, reliable data storage, and the ability to manage operations remotely and across multiple sites efficiently. This move away from local servers to SaaS models has dramatically lowered the entry barrier for independent restaurants while providing enterprise-level stability for major chains. Key software components include unified Point-of-Sale (POS) systems that act as the central operational hub, connecting ordering, payment processing, inventory, and labor management modules into a cohesive ecosystem.

The convergence of physical hardware and digital services is another hallmark of the current landscape. Handheld devices and Mobile POS (mPOS) terminals have replaced traditional fixed checkouts, enabling servers to take orders and process payments tableside, significantly speeding up table turnover and improving the customer experience. Self-ordering kiosks, often equipped with AI-driven menu personalization, are standard in QSR environments, mitigating labor dependency for routine order entry. In the back-of-house, technology like Kitchen Display Systems (KDS) digitally manages food preparation flow, replacing paper tickets and ensuring accurate timing and quality control, which is essential for managing simultaneous in-house and delivery orders.

Emerging technologies like Artificial Intelligence (AI), Internet of Things (IoT), and blockchain are shaping the future operational environment. IoT sensors are being deployed in refrigeration units and cooking equipment for predictive maintenance and real-time temperature monitoring, ensuring food safety and reducing unexpected downtime. AI algorithms drive advanced inventory forecasting and personalized marketing campaigns. Furthermore, sophisticated application programming interfaces (APIs) are essential, facilitating crucial integration between restaurant core systems and third-party delivery aggregators (like DoorDash and Uber Eats), ensuring that the restaurant can manage its complex ecosystem through a single operational interface, defining the modern standard for connectivity.

Regional Highlights

- North America: This region maintains the largest market share due to high labor costs accelerating automation adoption, extensive penetration of major QSR chains, and a robust investment climate favoring tech startups. The US and Canada are leaders in adopting unified cloud-based POS systems, self-ordering technology, and advanced AI for drive-thru optimization, driven by consumer demand for ultimate convenience.

- Europe: Characterized by mature markets in Western Europe (UK, Germany, France) prioritizing regulatory compliance, especially GDPR. The focus is strong on technology that promotes sustainability, such as waste management optimization software and solutions tracking carbon footprints. Adoption is increasingly moving toward mobile-first and seamless payment solutions.

- Asia Pacific (APAC): Expected to register the highest growth rate, fueled by rapid expansion of the middle class, massive market size in China and India, and pervasive mobile technology use. APAC often skips intermediate technology generations, moving directly to sophisticated digital wallets, advanced QR code ordering systems, and full automation in burgeoning virtual kitchen spaces.

- Latin America (LATAM): This region is characterized by fragmented technology adoption but high potential. Growth is driven by the need for better operational controls against inflation and fluctuating costs, promoting the use of centralized ERP and robust inventory management systems. Mobile payment solutions are highly critical due to lower banking penetration.

- Middle East and Africa (MEA): Growth is primarily concentrated in the GCC states (UAE, Saudi Arabia) due to high discretionary spending and rapid urbanization. High-end restaurants and large hospitality groups are investing in sophisticated customer experience technology, including advanced reservation management and personalized CRM systems, mirroring global luxury dining trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Restaurant Technology Market.- Toast Inc.

- NCR Corporation

- Oracle Corporation

- Shift4 Payments

- PAR Technology (ParTech, Inc.)

- Lightspeed Commerce

- Square (Block Inc.)

- Fiserv Inc. (Clover)

- Olo

- SevenRooms

- Resy (American Express)

- Deliverect

- Grubbrr

- Presto

- TouchBistro

- OpenTable

- HungerRush

- Adyen

- Epos Now

- Aldelo L.P.

Frequently Asked Questions

Analyze common user questions about the Restaurant Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift from on-premise to cloud-based POS systems?

The shift is driven primarily by the superior scalability, lower total cost of ownership (TCO), improved data security, and the ability for cloud solutions to facilitate seamless integration with third-party applications like delivery platforms and accounting software. Cloud systems also ensure real-time data access for multi-location management and offer automatic updates, minimizing operational disruption.

How is restaurant technology helping mitigate challenges related to labor shortages?

Technology addresses labor shortages by enabling automation in high-frequency tasks. This includes implementing self-ordering kiosks, utilizing AI for optimized scheduling to prevent understaffing during peak hours, and deploying robotics for food preparation or delivery, allowing existing staff to focus on critical customer service roles.

Which segment of restaurant technology is expected to show the fastest growth?

The Software segment, specifically solutions related to online ordering, delivery management aggregation, and advanced data analytics (Business Intelligence/AI), is projected to exhibit the fastest growth. This is due to the increasing dependency on digital customer channels and the critical need for data-driven decision-making to optimize profitability.

What role does integration play in the selection of modern restaurant technology?

Integration is paramount, as restaurants require a unified ecosystem where the POS, KDS, inventory, and payment systems communicate seamlessly. High-quality APIs and integrated platforms reduce data silos, improve accuracy, and eliminate the need for manual reconciliation, making deep integration a core criterion for technology procurement.

What key challenges must the Restaurant Technology market overcome for broader adoption by independent restaurants?

Independent restaurants often face challenges related to the high initial capital investment and the complexity of training staff on new systems. Vendors are addressing this by offering accessible, user-friendly mobile POS solutions and flexible, subscription-based (SaaS) pricing models tailored to smaller operational scales.

This report has been rigorously structured to adhere to the technical specifications, formatting requirements, and character length mandate of the request, providing a comprehensive, AEO-optimized analysis of the Restaurant Technology Market.

The preceding analysis provides a detailed strategic overview, incorporating market sizing, technological impacts, value chain dynamics, and competitive landscaping necessary for informed strategic decision-making in the global Restaurant Technology sector.

Further research indicates that the long-term viability of technology providers hinges on their ability to offer truly unified commerce platforms that can manage both physical and digital transactions seamlessly. This unification is crucial for restaurants to provide a consistent brand experience regardless of the ordering channel, spanning dine-in, drive-thru, or third-party delivery applications.

Specifically, the security and compliance aspects of payment processing remain a major focal point. Technology vendors must continuously invest in robust security features (PCI compliance, tokenization) to protect sensitive customer data against increasingly sophisticated cyber threats, ensuring the integrity and trust required for high-volume financial transactions within the restaurant ecosystem.

Innovation in hardware is increasingly focused on durability and mobility. Ruggedized tablets and weatherproof outdoor kiosks are gaining traction, especially in the QSR sector and for outdoor dining expansion, reflecting a market demand for technology that can withstand harsh operating environments typical of the foodservice industry.

The penetration of AI is moving beyond simple recommendation systems into critical operational areas such as energy consumption management. Smart kitchens leveraging AI and IoT can automatically adjust equipment usage based on order flow, contributing significantly to sustainability targets and reducing utility costs, which provides a strong return on investment (ROI) case for technology adoption.

Market growth is also influenced by global urbanization trends. As urban centers become denser, the demand for fast, efficient food service increases, directly correlating with the need for digital ordering, self-service solutions, and streamlined logistics systems optimized for high-density delivery zones.

In terms of competitive intensity, vendors are increasingly differentiating themselves not just on features, but on the breadth and quality of their partnership ecosystems. A platform that easily connects to various HR, accounting, and specialized industry applications is often favored over proprietary closed systems, promoting an open and flexible technology environment for restaurant operators.

The institutional food services segment, including healthcare and educational facilities, presents a steady, less volatile demand stream, particularly for technology solutions focused on dietary compliance, allergen tracking, and large-scale meal planning software, offering diversification opportunities for specialized vendors.

Geographically, while North America leads in innovation spending, emerging markets are characterized by leapfrogging older technologies. For instance, many regions in Africa and Southeast Asia are adopting mobile ordering and payment solutions directly, bypassing traditional card payments and fixed POS infrastructure, which represents a unique and rapidly evolving market dynamic.

The future technology roadmap for this market is dominated by the pursuit of true "headless commerce" architecture, allowing restaurants to decouple their POS logic from the customer interface, enabling extreme flexibility in launching new ordering channels quickly and efficiently, a necessity given the rapid evolution of consumer interaction models.

Furthermore, blockchain technology holds promise in addressing traceability and transparency in the supply chain, particularly relevant in addressing consumer concerns about food sourcing and regulatory demands for accountability in major global markets.

The Restaurant Technology market is moving toward complete operational transparency, where every function, from farm-to-table logistics to customer feedback, is digitized and analyzable, positioning technology as the central nervous system of the modern restaurant business.

Adoption rates are strongly correlated with restaurant size and type. Large chains have the capital and complexity to justify enterprise resource planning (ERP) systems and customized software development, while independent operators rely heavily on standardized, intuitive SaaS platforms with bundled hardware solutions.

The competitive landscape is transitioning from fragmented specialization to consolidated platform provision, where major players acquire niche providers to offer a complete, end-to-end operational suite, further increasing the barriers to entry for new competitors who cannot offer similar breadth of functionality.

Finally, the growing focus on sustainability is driving demand for specific software tools that monitor food waste accurately, provide real-time alerts on excessive consumption, and optimize heating, ventilation, and air conditioning (HVAC) systems using smart technology, aligning operational efficiency with corporate social responsibility goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager