Retail IDC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432352 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Retail IDC Market Size

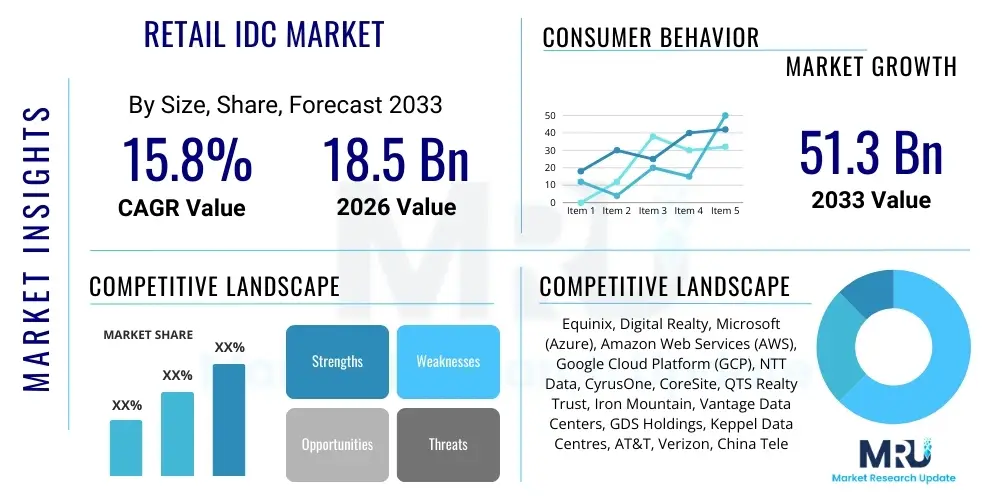

The Retail IDC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 18.5 billion in 2026 and is projected to reach USD 51.3 billion by the end of the forecast period in 2033.

Retail IDC Market introduction

The Retail Infrastructure Data Center (IDC) Market encompasses the specialized data center services and physical infrastructure tailored to meet the demanding, often fluctuating, needs of the global retail industry. This infrastructure is critical for supporting modern retail operations, including high-volume e-commerce transactions, real-time inventory management, point-of-sale (POS) systems across vast geographical footprints, and sophisticated customer relationship management (CRM) tools. The product description of Retail IDC solutions typically includes colocation services, managed hosting, cloud integration (hybrid and multi-cloud environments are dominant), and specialized services like edge computing deployment to enable faster processing near store locations or distribution centers. Major applications revolve around omnichannel fulfillment, advanced analytics for personalized shopping experiences, fraud detection, and robust supply chain synchronization. The core benefit derived by retailers is enhanced operational efficiency, reduced latency for critical applications, and improved data security and compliance, especially concerning payment card industry (PCI) standards and consumer data privacy regulations like GDPR or CCPA.

The Retail IDC market is fundamentally driven by the accelerated pace of digital transformation within the retail sector. Retailers are migrating from legacy, on-premise infrastructure to flexible, scalable, and resilient IDC environments to handle peak shopping seasons (such as Black Friday or holiday sales) and accommodate the complexity introduced by unified commerce strategies. Further driving factors include the proliferation of IoT devices within smart retail environments—ranging from sensors in distribution centers to smart shelves—and the increasing reliance on big data analytics to derive actionable insights from massive volumes of transaction and behavioral data. Furthermore, the necessity for high availability (HA) and disaster recovery (DR) planning, given the 24/7 nature of modern e-commerce, compels retailers to invest in professional, high-tier data center services, fueling consistent market expansion globally.

Retail IDC Market Executive Summary

The Retail IDC Market is undergoing a rapid evolutionary phase, driven primarily by fundamental shifts in consumer behavior and the necessity for omnichannel integration. Current business trends indicate a significant preference among major retail chains for hybrid cloud architectures, blending the scalability of public clouds with the control and security of dedicated data center environments, often facilitated by IDC providers specializing in retail ecosystems. Regionally, North America and Europe currently dominate the market share due to the early adoption of advanced e-commerce technologies and stringent data compliance mandates, though the Asia Pacific region is demonstrating the highest growth trajectory, spurred by massive mobile commerce adoption in emerging economies like China and India. Segment trends reveal a strong emphasis on managed services and customized deployment models, particularly concerning edge data centers. The shift towards decentralization is highly evident, as retailers seek to minimize latency for critical applications like AR/VR shopping experiences and instant payment processing, making location-specific infrastructure optimization a paramount competitive differentiator across all key market segments.

AI Impact Analysis on Retail IDC Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) workloads affect the infrastructure requirements of retail data centers, particularly focusing on the need for high-density computing and specialized cooling systems. Key themes analyzed include the expected increase in demand for graphical processing units (GPUs) and specialized AI accelerators within colocation facilities, the necessity for IDC providers to offer AI-as-a-Service capabilities, and the infrastructure support required for widespread deployment of predictive analytics, computer vision for inventory tracking, and hyper-personalized recommendation engines. Concerns often center around the substantial power consumption associated with AI models and whether existing data center footprints are prepared to handle the thermal load and energy demands. Users generally expect AI to drive significant optimization in retail supply chains and customer experiences, thus demanding highly resilient, scalable, and low-latency infrastructure capable of supporting iterative model training and real-time inference at the edge.

- AI drives demand for high-density racks and advanced liquid cooling solutions within IDCs to support power-intensive GPU clusters required for model training.

- Increased utilization of predictive logistics and supply chain optimization models necessitates greater interconnection bandwidth and low-latency connectivity between corporate IDCs and regional distribution centers.

- Edge AI deployment, supporting real-time computer vision (e.g., shelf monitoring, autonomous checkout), requires micro-data centers integrated directly within retail stores or nearby aggregation points.

- AI algorithms enhance data center operations efficiency through predictive maintenance, optimizing cooling and power distribution, thereby reducing operational expenditure for both IDC operators and retail clients.

- The implementation of AI-driven personalization and chatbot services demands robust, secure, and geographically compliant storage infrastructure capable of handling massive volumes of structured and unstructured customer data.

DRO & Impact Forces Of Retail IDC Market

The dynamics of the Retail IDC Market are complex, characterized by powerful growth drivers offset by substantial restraints, while vast opportunities emerge from technological convergence, all contributing to influential market impact forces. Key drivers include the exponential growth of e-commerce adoption globally, the strategic imperative for omnichannel retail integration, and the increasing volume and complexity of consumer data requiring secure, scalable hosting. Conversely, significant restraints involve the substantial initial capital expenditure required for adopting tier-4 data center solutions, continuous regulatory scrutiny regarding data sovereignty and privacy (e.g., regional data localization laws), and the persistent challenge of ensuring energy efficiency while managing high-density workloads like AI and high-frequency trading related to flash sales. The principal opportunity lies in the rapid expansion of edge computing deployments, enabling retailers to process data closer to the customer interaction point, thereby minimizing latency crucial for modern retail technologies such as augmented reality shopping and rapid delivery tracking systems. These factors combine to create powerful impact forces, primarily centered on competitive pressure to deliver ultra-low latency services and the non-negotiable requirement for zero downtime during peak seasonal retail activity, pushing IDC providers to innovate rapidly in infrastructure resilience and geographical coverage.

Segmentation Analysis

The Retail IDC Market is intricately segmented based on infrastructure type, service model, deployment size, and the specific application focus within the retail ecosystem, reflecting the diverse operational needs of different retail formats—from large multinational chains to specialized local businesses. Understanding these segments is crucial for both vendors and retail CIOs as it dictates procurement strategies and service optimization. The segmentation highlights a clear market distinction between basic colocation needs and highly managed services encompassing security, network, and application layer support, reflecting the retailer’s technical capabilities and desired level of infrastructure outsourcing. Furthermore, the rise of specialized retail applications, particularly those requiring edge integration, has necessitated distinct segmentation based on workload requirements, moving beyond traditional geographical divisions to focus on latency demands.

- By Infrastructure Type:

- Cooling Solutions (Air-based, Liquid/Immersion)

- Power & UPS Systems

- Racks & Cabinets

- Security and Monitoring Systems

- By Service Model:

- Colocation Services

- Managed Services (Managed Hosting, Managed Security)

- Cloud Connectivity Services (Hybrid/Multi-Cloud)

- Professional Services (Consulting, Migration)

- By Deployment Type:

- Hyperscale Data Centers

- Enterprise Data Centers

- Edge Data Centers / Micro Data Centers

- By Retail Application:

- E-commerce and Omnichannel Platforms

- Supply Chain Management and Logistics

- Payment Processing and Fraud Detection

- In-Store Operations (POS, Inventory Management)

- Customer Analytics and Personalization

- By Retail Format:

- Hypermarkets and Supermarkets

- Department Stores and Specialty Retail

- E-commerce Pure Plays

- Convenience Stores and Gas Stations

Value Chain Analysis For Retail IDC Market

The value chain for the Retail IDC Market begins with the upstream suppliers responsible for fundamental infrastructure components. This includes manufacturers of highly sophisticated power infrastructure (e.g., high-efficiency UPS, generator sets), precision cooling systems (e.g., CRAC units, liquid cooling providers), and robust networking equipment (e.g., high-speed switches, fiber optic cabling). The efficiency and reliability of these upstream inputs directly determine the Tier classification and operational capability of the resulting data center. Key relationships at this stage involve long-term procurement contracts and technological collaborations focused on innovation, particularly concerning energy efficiency and density management, which are critical cost drivers for IDC providers. The core transformation stage involves the IDC service providers themselves, who design, construct, operate, and maintain the facility, focusing intensely on security, regulatory compliance, and network interconnection quality. This centralized step adds significant value through economies of scale and expertise in complex infrastructure management, which is often unattainable for individual retailers.

Moving into the downstream segment, the services are delivered directly to retail enterprises. The distribution channel is primarily segmented into direct engagement and indirect channels. Direct engagement involves large IDC providers offering customized colocation or managed hosting agreements directly to Tier 1 and Tier 2 retailers with significant IT footprints. This channel emphasizes relationship management and tailor-made service-level agreements (SLAs). Indirect channels predominantly utilize systems integrators, IT consultants, and value-added resellers (VARs) who bundle IDC services with other enterprise technology solutions, such as ERP systems, security software, or cloud managed services. This approach is highly prevalent among mid-market retailers seeking comprehensive, simplified technology stacks rather than managing individual vendor contracts.

The final layer of the value chain involves the optimization of retail-specific applications running within the IDC environment. IDC providers differentiate themselves downstream by offering services explicitly tuned for retail workloads, such as PCI DSS compliance validation, burst capacity provisioning for seasonal peaks, and direct connectivity to major commerce platforms or payment gateways. The integration of edge computing capabilities is becoming a critical value-added activity in the downstream segment, enabling faster deployment cycles for in-store technologies and reducing data transport costs. Overall, maximizing value requires tight integration between infrastructure providers (upstream), specialized IDC operators (midstream), and retail technology partners (downstream) to ensure the infrastructure aligns perfectly with the retailer's complex and cyclical business demands.

Retail IDC Market Potential Customers

The primary end-users and buyers in the Retail IDC Market are highly diverse, spanning the entire spectrum of the global commerce ecosystem. The most prominent potential customers are large, multinational retail corporations, including hypermarket chains, major department stores, and global apparel brands that require distributed infrastructure to support their vast physical presence and rapidly scaling e-commerce platforms. These Tier 1 retailers often seek customized hybrid solutions, demanding substantial colocation space coupled with dedicated connectivity to major public cloud providers (e.g., AWS, Azure) to handle critical workloads like supply chain optimization and global ERP systems, requiring extremely high SLAs and robust disaster recovery capabilities.

A second significant customer segment comprises pure-play e-commerce companies, ranging from established online giants to rapidly expanding digital marketplaces. These organizations are characterized by extreme elasticity demands—their infrastructure needs can spike dramatically based on promotional cycles and viral marketing success. For these buyers, the key considerations are scalability, rapid deployment capabilities, and access to high-performance networking to ensure low-latency delivery of digital content and seamless checkout experiences. They often prefer flexible managed hosting solutions or robust multi-cloud environments facilitated by IDC providers that specialize in high-transaction volume processing and advanced security against cyber threats targeting consumer data and payment credentials.

Furthermore, specialty retailers and mid-sized regional chains constitute a substantial, growing customer base. While they may not require hyperscale capacity, they seek outsourced infrastructure to mitigate the high costs and complexity of managing their own data centers. These customers typically leverage standardized colocation rack units or managed services focusing specifically on compliance (like GDPR for European retailers) and the seamless integration of in-store technology, such as smart POS terminals and digital signage networks. For this segment, the availability of easily deployable edge computing solutions to support localized operations—such as quick fulfillment from regional distribution centers or advanced inventory management—represents a major purchasing driver, demonstrating the market's focus on granular, location-aware infrastructure services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 billion |

| Market Forecast in 2033 | USD 51.3 billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Equinix, Digital Realty, Microsoft (Azure), Amazon Web Services (AWS), Google Cloud Platform (GCP), NTT Data, CyrusOne, CoreSite, QTS Realty Trust, Iron Mountain, Vantage Data Centers, GDS Holdings, Keppel Data Centres, AT&T, Verizon, China Telecom, ST Telemedia Global Data Centres, Global Switch, Aligned Energy, Switch |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Retail IDC Market Key Technology Landscape

The technological landscape of the Retail IDC Market is defined by the convergence of high-density infrastructure, sophisticated networking, and advanced security protocols necessary to sustain modern retail transactions and data processing. Crucial technological adoptions include the implementation of software-defined networking (SDN) and Network Function Virtualization (NFV), which provide retailers with unparalleled agility in managing network traffic, crucial for dynamically adjusting bandwidth during high-traffic promotional events. Furthermore, the shift towards liquid cooling technologies, particularly direct-to-chip and immersion cooling, is gaining traction. This shift is necessitated by the increasing density of computational resources, especially GPU servers deployed for AI/ML workloads related to personalized marketing and predictive inventory management, where conventional air cooling methods are proving inefficient and uneconomical. The core objective is to deliver power efficiency while maintaining the high performance required for retail's real-time operations.

Hybrid and Multi-Cloud orchestration technologies form another critical component of the retail IDC technology stack. Retailers rarely rely on a single infrastructure environment; instead, they utilize IDC providers as strategic points of interconnection (Interconnection Oriented Architecture - IOA) to seamlessly bridge their private infrastructure with multiple public cloud platforms. This requires IDC solutions capable of offering robust, low-latency cross-connects and unified management portals for managing distributed workloads, ensuring that critical data remains compliant while leveraging the scalability of external clouds for non-sensitive, elastic workloads. This focus on seamless connectivity minimizes vendor lock-in and allows retailers to optimize costs based on workload requirements and geographical location, significantly enhancing supply chain resilience.

Finally, the rapid evolution of Edge Computing represents the most transformative technological trend impacting Retail IDC. Retailers are deploying smaller, modular data centers (Micro Data Centers) closer to store fronts, warehouses, and distribution hubs. These edge deployments leverage hyperconverged infrastructure (HCI) and containerization technologies (like Kubernetes) to facilitate localized processing of time-sensitive data, such as real-time inventory adjustments, security monitoring via computer vision, and instantaneous POS transactions. This technological decentralization reduces reliance on central IDCs for every operation, significantly lowering latency for critical in-store applications and enhancing the resilience of physical retail operations, cementing edge infrastructure as a cornerstone technology for any retailer pursuing a truly unified omnichannel strategy.

Regional Highlights

- North America: This region remains the most mature market for Retail IDC, characterized by high adoption rates of advanced cloud infrastructure and stringent regulatory environments, particularly concerning payment security (PCI DSS). The United States leads innovation in e-commerce fulfillment and advanced retail analytics, driving substantial demand for high-tier (Tier III/IV) colocation and robust interconnection services. Major retailers in the region focus heavily on hybrid IT strategies, prioritizing providers with dense ecosystems that offer direct, high-speed access to all major cloud providers and dedicated dark fiber options for backbone connectivity between corporate offices and primary IDC sites.

- Europe: Growth is primarily fueled by digitalization efforts and mandatory compliance with GDPR, which necessitates localized data storage and robust security measures. Western European nations, notably the UK, Germany, and France, exhibit strong IDC adoption, often focusing on sustainable and environmentally friendly data center operations (Green IDCs). The market trend here involves utilizing regional IDC hubs to manage complex supply chains across multiple national boundaries, requiring providers skilled in navigating fragmented regulatory landscapes and offering highly resilient cross-border connectivity.

- Asia Pacific (APAC): APAC is the fastest-growing region, propelled by massive mobile commerce penetration, particularly in China, India, and Southeast Asia. The retail landscape here demands extreme scalability to handle peak transaction volumes unique to regional shopping holidays (e.g., Single’s Day). Investment is heavily focused on building hyperscale IDCs and enhancing regional network density to support rapidly expanding e-commerce pure plays. The challenge and opportunity lie in deploying infrastructure quickly across highly diverse and geographically dispersed emerging markets, driving demand for modular and quickly deployable data center solutions.

- Latin America (LATAM): While smaller than other regions, LATAM is witnessing significant digital acceleration, with Brazil and Mexico serving as key IDC investment hubs. Localized cloud services and data residency requirements are major drivers. Retailers in this region are rapidly migrating from legacy systems to managed IDC environments to improve system reliability and reduce exposure to regional infrastructure instability, focusing on cost-effective colocation and entry-level managed services tailored to local operational costs.

- Middle East and Africa (MEA): Growth is concentrated in economic hubs such as the UAE, Saudi Arabia, and South Africa, driven by ambitious national digitalization visions (e.g., Saudi Vision 2030). Retail IDC demand is intrinsically linked to luxury retail, rapidly developing e-commerce markets, and logistics modernization projects. Providers must deliver world-class security and resilience, often serving as regional gateways for global retailers entering these lucrative, but highly specific, consumer markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Retail IDC Market.- Equinix

- Digital Realty

- Microsoft (Azure)

- Amazon Web Services (AWS)

- Google Cloud Platform (GCP)

- NTT Data

- CyrusOne

- CoreSite

- QTS Realty Trust

- Iron Mountain

- Vantage Data Centers

- GDS Holdings

- Keppel Data Centres

- AT&T

- Verizon

- China Telecom

- ST Telemedia Global Data Centres

- Global Switch

- Aligned Energy

- Switch

Frequently Asked Questions

What is the primary factor driving retailers to adopt hybrid IDC environments?

The primary factor driving retailers toward hybrid IDC environments is the critical need for operational elasticity combined with stringent data governance requirements. Hybrid models allow retailers to leverage scalable public clouds for high-traffic, non-sensitive applications (e.g., front-end e-commerce) while keeping highly sensitive customer data and core enterprise resource planning (ERP) systems secure and compliant within dedicated private colocation infrastructure, ensuring optimal cost control and regulatory adherence.

How does edge computing specifically benefit modern retail operations?

Edge computing significantly benefits modern retail by drastically reducing latency for time-sensitive, location-dependent applications. By processing data closer to the source—such as in-store security cameras, smart inventory sensors, and POS systems—edge deployments enable real-time inventory updates, immediate personalized customer interactions, and rapid machine learning inference, which is vital for maximizing conversion rates and operational efficiency in physical and fulfillment locations.

What are the major security concerns retailers address by using specialized IDCs?

Retailers using specialized IDCs primarily address security concerns related to Payment Card Industry Data Security Standard (PCI DSS) compliance, protection against distributed denial-of-service (DDoS) attacks during peak shopping events, and safeguarding massive volumes of personally identifiable information (PII). Specialized IDC providers offer advanced physical and cyber security layers, including dedicated security operation centers and certified compliance environments, which are challenging for individual retailers to maintain internally.

Which geographical region is expected to show the highest growth rate in the Retail IDC Market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) in the Retail IDC Market during the forecast period. This rapid expansion is attributed to the unprecedented acceleration of mobile commerce adoption, vast population sizes driving transaction volume growth, and significant government and private sector investment in establishing digital infrastructure across major economic hubs like China, India, and Southeast Asia.

What technological challenge does AI adoption pose for traditional retail data centers?

AI adoption poses a significant technological challenge to traditional retail data centers primarily related to power density and thermal management. AI workloads require high-performance computing clusters utilizing specialized hardware like GPUs, which consume substantially more power per rack than standard servers. This necessitates costly upgrades to power distribution units, advanced heat dissipation mechanisms, and often, the implementation of complex liquid cooling solutions that older data center infrastructure cannot support without massive retrofitting.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager