Retail Self Service Kiosk Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438489 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Retail Self Service Kiosk Market Size

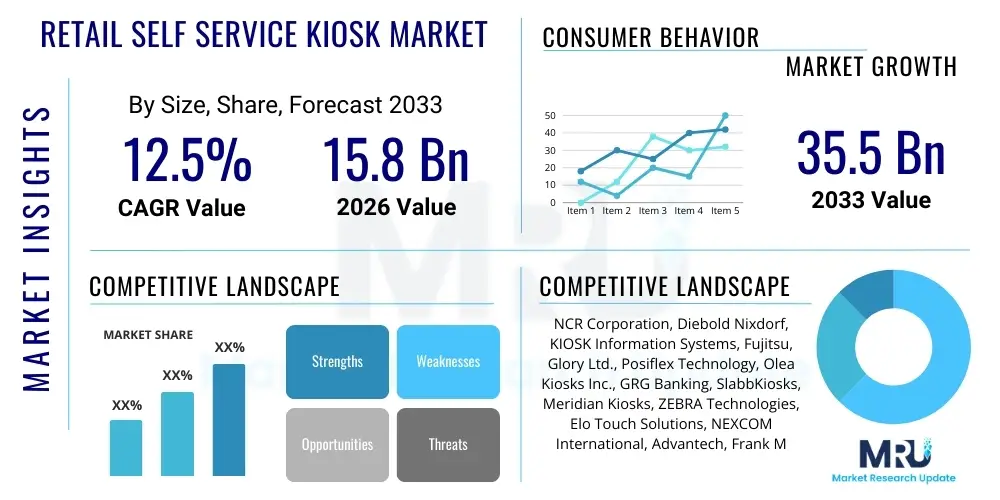

The Retail Self Service Kiosk Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 35.5 Billion by the end of the forecast period in 2033.

Retail Self Service Kiosk Market introduction

The Retail Self Service Kiosk Market encompasses automated terminals designed to facilitate transactions, information access, and customer interactions without requiring direct staff intervention. These systems integrate various technologies, including touchscreens, payment processing hardware, scanners, and specialized software, to enhance operational efficiency and improve the customer experience within retail environments. Initially utilized predominantly for basic functions like price checking and information lookup, modern self-service kiosks have evolved into sophisticated platforms capable of managing complex tasks such as order placement, personalized recommendations, loyalty program sign-ups, and secure payment processing. This evolution is driven primarily by consumer demand for faster service, reduced wait times, and a higher degree of control over the purchasing journey, especially in high-traffic settings like Quick Service Restaurants (QSRs) and large format grocery stores.

Major applications of retail self-service kiosks span across checkout processes (self-checkout systems), interactive ordering (food service and specialty retail), wayfinding in expansive shopping centers, and streamlined returns management. The deployment of these kiosks directly addresses prevailing retail challenges, particularly concerning labor costs and staffing volatility. By automating routine tasks, retailers can reallocate personnel to higher-value activities such as personalized sales assistance or inventory management, thereby maximizing workforce productivity. Furthermore, the inherent modularity and customization potential of kiosk hardware allow retailers to integrate them seamlessly into diverse store designs, optimizing space utilization and maintaining brand consistency.

Key benefits driving market adoption include enhanced operational efficiency, reduced transaction errors, improved customer satisfaction resulting from faster service, and the capability to collect valuable transactional data for business intelligence. The COVID-19 pandemic significantly accelerated the acceptance of self-service technologies, emphasizing contactless interactions and reduced physical touchpoints, solidifying the kiosk's role as a critical component of modern retail infrastructure. Factors driving the market expansion include continuous technological advancements in user interface design, the integration of advanced sensors and biometric security features, and the global imperative among retailers to create unified, omnichannel shopping experiences that blend digital and physical interactions.

Retail Self Service Kiosk Market Executive Summary

The Retail Self Service Kiosk Market is witnessing substantial growth underpinned by converging business and technological trends centered around experiential retail and operational optimization. Business trends indicate a strong move toward omnichannel integration, where kiosks act as essential physical touchpoints bridging online ordering capabilities with in-store pickup and service. Retailers are increasingly viewing kiosk deployment not merely as a cost-saving measure but as a strategic investment in data acquisition, personalization, and customer loyalty enhancement. The proliferation of digital payments, including mobile wallets and tap-to-pay technologies, is intrinsically linked to kiosk functionality, making streamlined, secure payment acceptance a foundational requirement for new deployments. Moreover, the trend toward smaller, more versatile kiosk form factors is enabling specialized retailers and smaller-footprint stores to adopt self-service solutions previously restricted to large enterprises.

Regionally, North America and Europe currently dominate the market, primarily due to high labor costs, mature retail infrastructure, and early adoption of advanced payment systems. However, the Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period, driven by rapid urbanization, increasing disposable income leading to higher demand for efficient QSR services, and significant investments in smart city and digital retail initiatives, particularly in China and India. Regulatory environments encouraging digital transformation in retail banking and government services also indirectly contribute to kiosk acceptance, establishing familiarity with self-service interfaces among the general population across APAC nations. This regional shift highlights the globalization of self-service technology deployment.

Segmentation trends reveal significant traction in interactive ordering kiosks (IOKs), particularly within the food and beverage sector (QSRs), driven by menu customization features and improved order accuracy. Self-checkout systems (SCOs) remain the largest segment by installed base, continually improving through advanced sensor fusion and weight verification technologies to combat shrinkage. From a component perspective, the software segment, including sophisticated middleware and cloud-based management platforms, is growing fastest, emphasizing the transition from purely transactional hardware installations to intelligent, network-enabled service platforms that integrate Artificial Intelligence (AI) and machine learning for predictive maintenance and personalized customer engagement. The market is consolidating around providers that offer end-to-end solutions combining robust hardware manufacturing with scalable software ecosystems.

AI Impact Analysis on Retail Self Service Kiosk Market

Common user questions regarding AI's influence on the Retail Self Service Kiosk Market frequently center on how AI can enhance customer experience, improve security, and drive operational efficiency beyond basic automation. Users often inquire about the feasibility and effectiveness of AI-driven personalization, asking if kiosks can truly offer recommendations comparable to human associates, and what the return on investment (ROI) is for integrating complex AI algorithms like natural language processing (NLP) for voice-activated ordering. Furthermore, significant concerns revolve around security, specifically how AI-powered surveillance or biometric identification impacts consumer privacy and compliance with regulations like GDPR. The overarching expectation is that AI will transform kiosks from passive transaction points into active, intelligent sales and service agents capable of understanding context and adapting to dynamic retail environments.

The integration of AI and Machine Learning (ML) is fundamentally reshaping the capabilities and value proposition of retail self-service kiosks. AI algorithms are now critical in enhancing inventory visibility by tracking item-level sales velocity at the point of interaction, providing real-time demand forecasting that minimizes out-of-stock situations. For instance, in QSR environments, ML models analyze peak ordering times and product combinations to dynamically adjust menu displays, suggesting high-margin items or complementary products based on current sales patterns and historical data, far exceeding the capability of static interfaces. This predictive intelligence drastically improves the average transaction value (ATV) and maximizes throughput during high-volume periods, moving kiosks beyond simple transactional roles toward being highly optimized revenue generators.

Furthermore, AI significantly elevates the security and maintenance protocols associated with kiosk networks. Computer vision systems integrated into kiosks use AI to detect potential fraud attempts during self-checkout (e.g., mis-scanning, item substitution), drastically reducing shrinkage—a primary concern for retailers. On the operational side, ML-powered predictive maintenance models analyze sensor data from internal components (printers, card readers, displays) to anticipate hardware failures before they occur, allowing for proactive servicing. This reduction in unexpected downtime ensures maximum availability of the service and minimizes revenue loss, positioning AI as an essential component for ensuring high uptime and reliable performance across geographically dispersed kiosk fleets.

- AI-driven Personalization: Leveraging ML to offer dynamic, context-aware product recommendations, optimizing upselling and cross-selling at the point of service.

- Natural Language Processing (NLP): Enabling voice-activated ordering and conversational interfaces, improving accessibility and speed, particularly in food service.

- Computer Vision for Security: Implementing real-time monitoring and anomaly detection to prevent shrinkage, verifying items, and ensuring adherence to age restrictions (e.g., alcohol sales).

- Predictive Maintenance: Using machine learning on sensor data to forecast hardware malfunctions, maximizing system uptime and reducing operational expenditures.

- Biometric Authentication: Enhancing loyalty program login and secure payment verification through facial recognition or fingerprint scanning, subject to privacy compliance.

- Dynamic Pricing and Inventory Management: Adjusting displayed prices and promotions in real-time based on current store inventory levels and local demand signals.

DRO & Impact Forces Of Retail Self Service Kiosk Market

The Retail Self Service Kiosk Market is propelled by powerful drivers centered on optimizing the customer journey and streamlining operational expenditure, yet its growth faces constraints related to high initial deployment costs and persistent security vulnerabilities. The primary market driver is the continuous pressure on retailers, especially those operating large-scale chains, to mitigate rising labor expenses through automation, coupled with the consumer preference for rapid, contactless transaction methods accelerated by recent global health concerns. Opportunities abound in emerging markets and through niche applications, such as specialized inventory look-up and personalized digital signage integration. The overall impact of these forces is overwhelmingly positive, driving sustained double-digit growth, though technological readiness and data privacy compliance remain critical variables influencing adoption rates across different regions and retail verticals.

The key drivers sustaining market expansion include the documented success in reducing queue times, which directly correlates with improved customer satisfaction and retention. Furthermore, kiosks consistently generate higher average order values (AOV) in QSR settings compared to traditional cashier interactions, attributed to the system’s ability to relentlessly prompt customers with add-ons and modifiers without human fatigue. Technological advancements, particularly the miniaturization of hardware and the development of robust, flexible cloud-based software management platforms, also reduce the total cost of ownership (TCO) over the long term, making kiosk deployment more economically feasible for small to medium-sized enterprises (SMEs). The governmental support for digital payment infrastructure globally further solidifies the foundational necessity of kiosks as primary transaction points.

However, significant restraints impede faster adoption. The substantial initial capital expenditure required for sophisticated, commercial-grade kiosks, including specialized installation and complex software integration with legacy Point of Sale (POS) systems, remains a formidable barrier, particularly for independent retailers. Additionally, challenges related to maintenance complexity and the requirement for highly specialized technical support to manage large, distributed kiosk fleets often translate into unexpected operational costs. Public perception issues, specifically resistance from certain customer demographics less comfortable with technology, and ongoing concerns about potential job displacement due to automation, also act as soft restraints the industry must navigate. Opportunities for market expansion are concentrated in leveraging kiosks as intelligent data collection hubs, utilizing collected consumer interaction data to refine marketing strategies and merchandising, and expanding into non-traditional retail spaces such as pop-up shops and transit hubs.

Segmentation Analysis

The Retail Self Service Kiosk Market is segmented across several critical dimensions, including component (hardware, software, services), type (self-checkout, interactive ordering, ticketing, information/wayfinding), and end-use vertical (retail, QSR/F&B, entertainment, healthcare). This segmentation reveals a dynamic market structure where the growth rates vary significantly depending on the maturity of automation within specific retail sub-sectors. The hardware segment, while dominant in terms of market value, is characterized by incremental innovation focused on durability and payment security, whereas the software and service components are experiencing exponential growth, driven by the shift towards cloud-managed, subscription-based service models (Kiosk-as-a-Service or KaaS). This move towards software intelligence is the primary differentiator in competitive strategies.

The interactive ordering kiosks (IOKs) segment demonstrates the highest adoption momentum, propelled by global fast-food chains seeking to standardize service delivery, minimize errors, and maximize customization options without relying on verbal communication. Self-checkout systems (SCOs) continue their pervasive penetration across grocery and hypermarket formats, although the focus is shifting from simple transaction processing to complex loss prevention systems integrated with advanced cameras and AI validation. Geographically, segmentation highlights the dominance of established retail markets, yet the strategic focus is increasingly directed toward tailoring solutions for high-growth emerging economies where smaller footprints and lower-cost, more ruggedized hardware solutions are required to address specific logistical and environmental challenges.

From an end-use perspective, the retail sector, encompassing general merchandise and grocery, holds the largest share, constantly innovating to reduce checkout bottlenecks. However, the QSR/F&B sector is the most technologically aggressive segment, driving demand for innovations such as outdoor-rated drive-thru kiosks and seamless integration with kitchen display systems (KDS). The professionalization of maintenance and support services—moving away from reactive repairs to predictive, remote diagnostics—is a crucial segmentation trend, indicating retailers' willingness to invest in specialized service contracts to ensure high operational reliability for these mission-critical transaction platforms.

- By Component:

- Hardware (Display Screens, Payment Terminals, Scanners, Printers, Housings)

- Software (Operating Systems, Application Software, Management Platforms, Cloud Services)

- Services (Installation, Maintenance, Support, Consulting)

- By Type:

- Self-Checkout Kiosks (SCO)

- Interactive Ordering Kiosks (IOK)

- Information and Wayfinding Kiosks

- Ticketing and Vending Kiosks

- By End-Use Vertical:

- Retail (Grocery, Apparel, General Merchandise)

- Quick Service Restaurants (QSR) and Food & Beverage (F&B)

- Entertainment (Cinemas, Theaters, Theme Parks)

- Banking and Financial Services (ATMs, VTMs)

- Healthcare and Hospitality

- By Deployment Model:

- Indoor Kiosks

- Outdoor Kiosks

Value Chain Analysis For Retail Self Service Kiosk Market

The value chain of the Retail Self Service Kiosk Market is complex, spanning from upstream component manufacturing to highly specialized downstream deployment and support services. The upstream segment involves the production and sourcing of critical hardware components such as high-definition touch displays, integrated processors (often custom-designed for commercial use), secure payment modules certified by PCI standards, and specialized peripherals like industrial-grade printers and biometric sensors. Success in the upstream relies heavily on global supply chain efficiency, standardization of component interfaces, and managing geopolitical risks associated with semiconductor and rare earth material sourcing. Key suppliers often specialize in one or two component types, such as touch screen technology or robust printer mechanisms, supplying multiple kiosk manufacturers globally.

The middle stage of the value chain is dominated by Kiosk Original Equipment Manufacturers (OEMs) and system integrators. These entities focus on industrial design, physical chassis fabrication, final assembly, and the integration of operating systems and core application software. This stage is highly critical as it involves customizing the hardware and software stack to meet specific vertical requirements—for example, designing vandal-resistant, weather-proof outdoor units for drive-thru applications, versus sleek, aesthetically pleasing indoor units for luxury retail. Differentiation at this stage is achieved through modular design, ease of maintenance access, and the proprietary software framework used to manage the kiosk lifecycle.

Downstream activities include distribution, deployment, and ongoing support. Distribution often involves both direct sales channels for major retail accounts and indirect channels utilizing Value-Added Resellers (VARs) and regional distributors who specialize in localized installation and maintenance services. The final and increasingly critical part of the value chain is the long-term service and support provided directly to the end-user (retailers). Given that kiosks are mission-critical transaction points, direct and indirect channels must ensure rapid response times, predictive maintenance capabilities, and secure software updates. The shift to cloud-based management platforms facilitates this downstream efficiency, allowing vendors to remotely monitor and diagnose issues, thereby cementing long-term relationships through service level agreements (SLAs).

Retail Self Service Kiosk Market Potential Customers

The primary end-users and buyers of retail self-service kiosks are entities operating large consumer-facing infrastructure with high transaction volumes, necessitating automated processes to handle peak demand efficiently. The most significant customer segment is Quick Service Restaurants (QSRs) and Fast Casual dining establishments, which utilize IOKs to dramatically improve order accuracy, speed, and customization options, directly correlating kiosk deployment with increased profitability. Major grocery chains and hypermarkets constitute another core customer base, heavily investing in Self-Checkout (SCO) systems to manage labor costs and accelerate the throughput of smaller shopping baskets, requiring systems designed for reliability and seamless integration with complex inventory databases.

Beyond traditional retail, the transportation and entertainment sectors represent rapidly expanding customer segments. Airports, railway stations, and metropolitan transit authorities deploy ticketing and information kiosks for passenger services and wayfinding, demanding highly durable, 24/7 operational outdoor and semi-outdoor units. Similarly, venues such as cinemas, concert halls, and theme parks rely on kiosks for high-volume ticket sales and entry validation, prioritizing speed and robust network connectivity. These customers seek customizable software solutions that integrate loyalty programs and dynamic pricing structures seamlessly.

Emerging potential customers include specialized retailers like apparel stores, which utilize interactive digital signage kiosks for virtual try-ons and expanded digital aisle offerings, and institutional environments like universities and healthcare facilities, where kiosks streamline patient check-in processes or provide campus navigation. Across all segments, the modern potential customer is shifting from purchasing basic hardware to procuring comprehensive, managed Kiosk-as-a-Service solutions, valuing long-term partnership with providers who can deliver system security, software updates, and predictive maintenance under a single operational contract.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 35.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NCR Corporation, Diebold Nixdorf, KIOSK Information Systems, Fujitsu, Glory Ltd., Posiflex Technology, Olea Kiosks Inc., GRG Banking, SlabbKiosks, Meridian Kiosks, ZEBRA Technologies, Elo Touch Solutions, NEXCOM International, Advantech, Frank Mayer and Associates, Lilitab Kiosk Solutions, Unmanned Life, REDYREF, Source Technologies, Touch Dynamic |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Retail Self Service Kiosk Market Key Technology Landscape

The technological landscape of the Retail Self Service Kiosk Market is defined by a continuous drive toward enhanced interactivity, security, and connectivity, moving away from closed, proprietary systems toward open, API-driven architectures. Central to this evolution are high-resolution, multi-touch interactive displays, often featuring specialized surface treatments for anti-glare and vandal resistance, critical for maintaining usability in varied retail lighting conditions. Crucially, the integration of certified, multi-modal payment solutions—supporting EMV chip cards, NFC mobile payments, and increasingly, cryptocurrencies—is non-negotiable, requiring hardware manufacturers to adhere to stringent global financial security standards like PCI DSS. The computational backbone is transitioning towards powerful, low-power system-on-chips (SoCs) and embedded industrial PCs capable of running complex AI algorithms locally (edge computing) for real-time decision-making without constant reliance on cloud connectivity.

Connectivity is another fundamental technological pillar, with modern kiosks relying on robust, fail-safe communication protocols, encompassing both high-speed wired Ethernet and redundant cellular (4G/5G) connectivity, ensuring constant uptime even during network fluctuations—a necessity for transaction processing. Software architecture is rapidly standardizing on cloud-native platforms, enabling remote device management, over-the-air (OTA) software updates, and centralized monitoring of dispersed kiosk fleets. This shift facilitates the KaaS model, allowing retailers to scale their deployments quickly and rely on vendors for comprehensive maintenance and security patching, utilizing sophisticated telemetry data gathered from the kiosk's operational sensors and transactional logs.

Emerging technologies like advanced sensor fusion and biometric identification are redefining security and personalization. Kiosks are increasingly equipped with 3D depth-sensing cameras and weight sensors (in SCOs) to accurately verify products and prevent fraud, significantly mitigating the shrinkage inherent to self-checkout. Furthermore, the incorporation of advanced AI/ML toolkits allows for dynamic content rendering and voice interaction capabilities (NLP), transforming the static interface into a personalized, responsive assistant. Haptic feedback and ergonomic design principles are also being integrated to improve accessibility and ensure an inclusive user experience across diverse customer demographics, cementing technology's role in enhancing both operational metrics and user satisfaction.

Regional Highlights

Geographically, the Retail Self Service Kiosk market exhibits varying levels of maturity and growth drivers across major global regions. North America holds the largest market share, predominantly driven by high labor costs, the mature penetration of QSR chains, and the widespread consumer adoption of self-service technologies, particularly self-checkout in grocery and department stores. This region acts as a primary testbed for cutting-edge kiosk technologies, including advanced AI-driven personalization and sophisticated anti-fraud systems. The market here is characterized by highly consolidated vendors offering comprehensive, end-to-end solutions, and future growth is expected to stem from replacing aging kiosk hardware with smart, connected units and expanding deployment into non-traditional retail sectors like cannabis dispensaries and micro-fulfillment centers. Robust investment in digital transformation initiatives further secures the region’s dominance in market value.

Europe represents a highly mature market, characterized by strong regulatory compliance standards (such as GDPR for data privacy) which necessitate advanced security features in kiosk design. Western European countries, particularly the UK, Germany, and France, have high SCO penetration, while the market in Eastern Europe is rapidly accelerating, stimulated by EU-funded digitalization projects and increasing disposable incomes supporting faster QSR expansion. European growth is differentiated by a high demand for aesthetically designed, customized hardware that seamlessly integrates into premium retail environments. Furthermore, the region is a leader in implementing specialized ticketing and information kiosks across complex, multi-lingual public transportation networks, requiring high reliability and standardized interfaces across borders.

Asia Pacific (APAC) is forecast to be the fastest-growing region during the projection period, fueled by rapid urbanization, massive infrastructure development, and the explosive growth of middle-class consumerism, particularly in China and India. While initial deployments focus on high-volume QSRs and basic banking services, the sheer scale of retail expansion and the government push toward cashless societies are creating unprecedented demand. Although the initial average selling price (ASP) of kiosks in APAC might be lower than in Western markets, the volume of units deployed compensates for this. Key drivers include the region's cultural acceptance of digital technologies (like QR code payments) and the need for localized, ruggedized solutions capable of operating reliably in diverse and often challenging environmental conditions, indicating significant untapped market potential for both hardware and localized software solutions.

- North America: Market leader by value; driven by high labor costs, QSR saturation, and early adoption of AI security features. Focus on replacing legacy systems.

- Europe: Mature market with strong regulatory standards (GDPR); high demand for aesthetically integrated and specialized public transport ticketing kiosks.

- Asia Pacific (APAC): Fastest-growing region; driven by mass urbanization, rapid retail expansion, government push for cashless transactions, and strong QSR growth in China and India.

- Latin America (LATAM): Emerging growth area, focused on banking services (VTMs) and initial QSR deployments; faces challenges related to infrastructure and currency volatility.

- Middle East and Africa (MEA): Growth concentrated in GCC nations due to luxury retail and large-scale tourism infrastructure projects; demand for high-end, customized, and outdoor-rated kiosks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Retail Self Service Kiosk Market.- NCR Corporation

- Diebold Nixdorf

- KIOSK Information Systems (a subsidiary of Posiflex)

- Fujitsu

- Glory Ltd.

- Posiflex Technology, Inc.

- Olea Kiosks Inc.

- GRG Banking

- SlabbKiosks

- Meridian Kiosks

- ZEBRA Technologies

- Elo Touch Solutions

- NEXCOM International

- Advantech

- Frank Mayer and Associates

- Lilitab Kiosk Solutions

- Unmanned Life

- REDYREF

- Source Technologies

- Touch Dynamic

Frequently Asked Questions

Analyze common user questions about the Retail Self Service Kiosk market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Retail Self Service Kiosk Market?

The Retail Self Service Kiosk Market is projected to experience robust growth, anticipating a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period from 2026 to 2033, driven by automation demands and contactless payment adoption.

Which segment of the kiosk market is exhibiting the fastest technological adoption and deployment?

The Interactive Ordering Kiosks (IOKs) segment, particularly within the Quick Service Restaurant (QSR) and Fast Casual dining sectors, shows the fastest technological adoption, integrating AI for personalization and advanced payment modalities to increase average order value (AOV).

How is Artificial Intelligence (AI) specifically impacting the functionality of self-service kiosks?

AI integration is transforming kiosks into intelligent assets through features like real-time security monitoring (reducing shrinkage), predictive maintenance, dynamic pricing adjustments, and hyper-personalized product recommendations based on customer loyalty data and inventory levels.

What are the primary factors restraining the widespread adoption of retail self-service kiosks?

The most significant restraints include the high initial capital expenditure required for commercial-grade hardware and sophisticated software integration, along with ongoing operational complexities related to maintenance, technical support, and the necessity for robust fraud prevention systems.

Which geographical region is expected to lead market growth in the near future?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, fueled by rapid expansion of the organized retail sector, extensive urbanization, and governmental initiatives promoting digital and cashless transactions across large consumer bases in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager