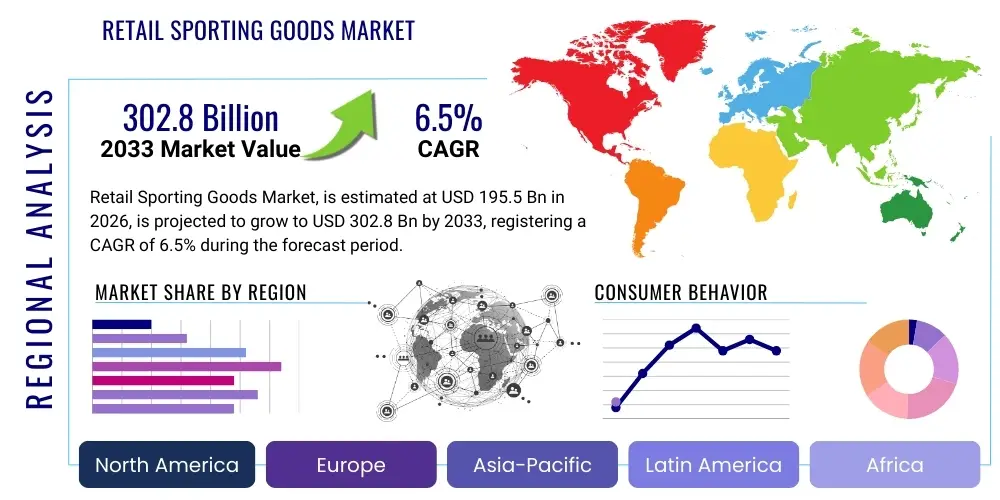

Retail Sporting Goods Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438158 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Retail Sporting Goods Market Size

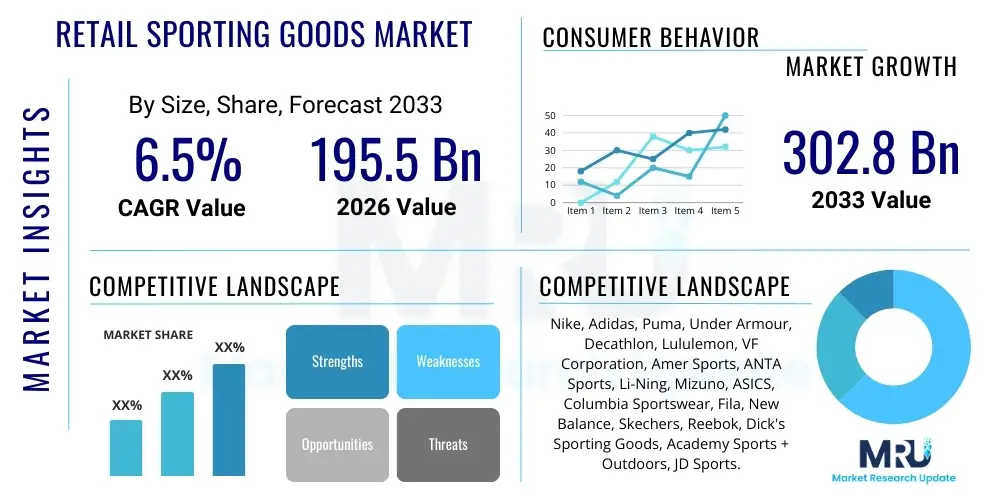

The Retail Sporting Goods Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 195.5 Billion in 2026 and is projected to reach USD 302.8 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by increasing global participation in organized sports and recreational activities, coupled with significant advancements in product technology, materials science, and digital distribution strategies that enhance consumer access and product performance.

Retail Sporting Goods Market introduction

The Retail Sporting Goods Market encompasses the sale of athletic footwear, specialized apparel, and performance-enhancing equipment designed for professional and recreational sports activities. Key product categories range from high-tech running shoes and moisture-wicking jerseys to complex fitness machines and protective gear. Major applications span competitive sports, general fitness, outdoor recreation, and athleisure wear, catering to a diverse global consumer base prioritizing health and active lifestyles. The inherent benefits of these products include improved performance, reduced risk of injury, and enhanced comfort during physical exertion, driving persistent consumer demand for innovation.

Driving factors propelling this market include rising disposable incomes in emerging economies, government initiatives promoting physical education and sports participation, and the pervasive influence of social media and athlete endorsements that elevate the status of branded athletic wear. Furthermore, the convergence of fashion and fitness, often termed the 'athleisure' trend, has significantly expanded the market’s scope beyond traditional sports participation. Technological integrations, such as wearable sensors and smart apparel, are continuously redefining product value, fostering a cycle of innovation and replacement purchases that sustains robust market expansion.

The market landscape is characterized by intense competition, with established global brands continually investing in research and development to create lighter, more durable, and environmentally sustainable products. Distribution channels are undergoing rapid transformation, shifting towards omnichannel strategies where seamless integration between brick-and-mortar stores, brand-specific e-commerce platforms, and third-party retailers is crucial for maximizing reach. This dynamic environment necessitates continuous market analysis, strategic inventory management, and personalized marketing approaches to capture the evolving preferences of modern, digitally-aware consumers.

Retail Sporting Goods Market Executive Summary

The Retail Sporting Goods Market is currently defined by significant business trends centered on sustainability, omnichannel integration, and customization. Major corporations are increasingly integrating recycled materials and ethical sourcing practices into their supply chains, driven by strong consumer demand for eco-friendly products, leading to the establishment of new market standards for transparency and environmental responsibility. Regionally, Asia Pacific is anticipated to exhibit the fastest growth, fueled by massive population bases, increasing urbanization, and the rapid expansion of middle-class consumer segments with greater purchasing power allocated toward health and wellness products. North America and Europe remain foundational markets, characterized by high technological adoption rates and established consumer loyalty to major sports brands, while simultaneously leading the charge in digital transformation within the retail space.

Segment trends indicate that the Footwear segment, particularly performance running and cross-training shoes, holds the largest market share due to consistent innovation in sole technology and material science (e.g., carbon plates, advanced cushioning foams). The Apparel segment is rapidly expanding, propelled by the enduring popularity of athleisure and the development of technical fabrics that offer features like temperature regulation and UV protection. Distribution channels are seeing a marked preference shift towards online sales, forcing traditional specialty retailers to invest heavily in digital infrastructure, personalized inventory recommendations, and enhanced fulfillment capabilities to compete effectively with pure-play e-commerce giants and direct-to-consumer (DTC) brand models.

Investment priorities across the market are focused on supply chain resilience, leveraging AI for demand forecasting, and enhancing the in-store and online customer experience through personalized engagement tools. Companies that successfully navigate geopolitical trade complexities and master logistics optimization while maintaining a strong commitment to brand authenticity and athlete endorsement are positioned for sustained long-term growth. The overall outlook remains highly positive, supported by global demographic trends favoring active and healthy lifestyles and continuous technological disruption across product development and retail operations.

AI Impact Analysis on Retail Sporting Goods Market

Common user questions regarding AI's impact on the Retail Sporting Goods Market frequently revolve around how artificial intelligence can personalize the shopping experience, optimize complex global supply chains, and predict fast-changing consumer fashion trends. Users are concerned about the implementation costs, data privacy implications associated with collecting biometric and purchasing data, and the tangible benefits of AI in reducing waste and improving inventory accuracy. The core themes center on efficiency gains, hyper-personalization, and predictive analytics. Users expect AI to move beyond basic inventory management to truly revolutionize product design, allowing for mass customization and instantaneous feedback loops from wear testing and performance data back into the manufacturing process, ultimately lowering stockouts and markdowns while significantly elevating the consumer experience.

The application of AI and Machine Learning (ML) is fundamentally transforming operational efficiency within the sporting goods sector, extending far beyond the traditional realms of demand forecasting. ML algorithms are now critical in optimizing dynamic pricing strategies in real-time, allowing retailers to adjust prices based on competitive activity, localized demand spikes, and inventory levels, maximizing profit margins and reducing shelf-life risks. Furthermore, AI-powered chatbots and virtual assistants are providing instant, tailored customer service, handling inquiries about product fit, material performance, and warranty details, which significantly improves customer satisfaction and reduces reliance on costly human resources for routine interactions.

Crucially, AI is playing a decisive role in the sustainable development goals of major sporting goods brands. By analyzing vast datasets related to material procurement, manufacturing waste streams, and reverse logistics for returns and recycling programs, AI systems can identify inefficiencies and recommend circular economy solutions. This capability allows brands to design products with minimized environmental footprints from the initial concept phase and accurately forecast the optimal levels of recycled inputs, aligning business objectives with mounting regulatory and consumer pressure for greater ecological responsibility. The data derived from these systems also informs marketing efforts, emphasizing sustainability attributes to environmentally conscious consumer segments.

- AI enhances demand forecasting accuracy, reducing inventory obsolescence and maximizing stock availability during peak seasons.

- Machine learning algorithms enable hyper-personalized marketing and product recommendations based on individual athletic performance data and purchase history.

- AI-driven computer vision and AR applications facilitate virtual try-ons for apparel and footwear, improving online conversion rates and reducing product returns.

- Predictive maintenance analytics applied to manufacturing equipment minimizes downtime, ensuring consistent production of highly specialized sporting goods.

- Optimization of complex global supply chains using AI routing reduces transportation costs and carbon emissions.

- AI processes customer feedback and social listening data instantaneously to inform rapid product iteration and trend analysis.

DRO & Impact Forces Of Retail Sporting Goods Market

The Retail Sporting Goods Market is shaped by a powerful interplay of Driving forces, Restraints, and Opportunities (DRO). A primary driver is the pervasive global trend toward health consciousness and active living, spurring demand for high-performance and technologically integrated products across demographics. Opportunities are largely concentrated in digital transformation—specifically the expansion of direct-to-consumer (DTC) channels and the integration of smart technologies (IoT, wearables) into sporting equipment. Conversely, major restraints include volatile raw material prices, complex global regulatory environments, and the rising counterfeiting issue, which undermines brand integrity and requires substantial investment in protective technologies and legal enforcement.

Impact forces within the market are predominantly driven by competitive rivalry and the bargaining power of consumers. Intense rivalry exists among global giants vying for market share through aggressive sponsorship deals, advanced product innovation cycles, and strategic acquisitions of niche technology companies. The bargaining power of consumers is high, especially in the online sphere, where price transparency and easy access to comparative reviews compel retailers to offer exceptional value, quality, and flexible return policies. This dynamic environment necessitates continuous process optimization and differentiation based on brand values, such as sustainability and social responsibility.

Furthermore, substitution threats remain moderate, primarily coming from general athletic wear or fast fashion alternatives that mimic the style but not the technical performance of specialized sporting goods. However, for serious athletes, specialized equipment remains indispensable, mitigating the overall substitution risk in the high-end segments. The threat of new entrants is relatively low due to the substantial capital required for R&D, establishing global distribution networks, and securing long-term athlete endorsements, creating high barriers to entry for newcomers hoping to compete with established brands like Nike or Adidas in core categories like footwear and performance apparel.

Segmentation Analysis

The Retail Sporting Goods Market is comprehensively segmented based on product type, distribution channel, and end-user, allowing for targeted analysis of market dynamics and consumer preferences within distinct sub-sectors. The segmentation by product type—including Footwear, Apparel, and Equipment—highlights differing growth rates influenced by technological refresh cycles and fashion trends. Footwear typically leads in innovation and market value due to continuous advancements in cushioning and biomechanics. Distribution channel analysis reveals a critical shift from traditional Offline channels (such as specialty stores and department stores) toward Online platforms, which offer greater convenience and a wider selection, necessitating strategic investment in e-commerce infrastructure across the value chain.

Analyzing the market by end-user—Professional Athletes, Hobbyists/Amateurs, and Institutional Buyers (e.g., schools, gyms)—provides insight into pricing sensitivities and performance requirements. Professional segments demand the highest quality and cutting-edge technology, often influencing mainstream consumer adoption. Conversely, the much larger Hobbyist/Amateur segment prioritizes a balance of performance, comfort, and affordability. Institutional purchasing often focuses on durability and bulk pricing, driving specific manufacturing and supply contracts for large volume orders of standardized equipment.

This layered segmentation is crucial for stakeholders to tailor their product development and marketing strategies effectively. For instance, high-margin, performance-driven equipment requires specialized marketing targeting athletes and fitness experts, while the broader athleisure apparel market thrives on digital marketing campaigns emphasizing lifestyle and celebrity endorsement. Understanding these nuances allows retailers and manufacturers to allocate resources optimally and achieve diversified revenue streams across product categories and consumer groups.

- Product Type:

- Apparel (Tops, Bottoms, Outerwear)

- Footwear (Running, Training, Sport-Specific, Casual Athletic)

- Equipment (Balls, Racquets, Protective Gear, Fitness Machinery, Outdoor Gear)

- Distribution Channel:

- Offline (Specialty Stores, Department Stores, Hypermarkets, Discount Stores)

- Online (Brand Websites, Third-Party E-commerce Platforms, Social Commerce)

- End-User:

- Professional Athletes

- Hobbyists/Amateurs (Recreational Users)

- Institutional Buyers (Schools, Clubs, Fitness Centers)

Value Chain Analysis For Retail Sporting Goods Market

The value chain for the Retail Sporting Goods Market begins with intensive upstream activities focused on raw material procurement and advanced R&D. Upstream suppliers provide specialized synthetic fibers, performance plastics, rubber, and smart textiles, often involving complex contractual agreements to ensure consistency and quality. The manufacturing phase is highly automated, utilizing precision engineering, 3D printing, and sustainable production techniques to convert these materials into highly technical products. Effective management of this upstream segment is critical, as volatility in oil prices (impacting synthetic materials) or geopolitical stability (affecting manufacturing hubs in Asia) directly influences the final product cost and market timing.

The crucial midstream element involves distribution channels, which are undergoing continuous modernization. Historically dominated by physical retail (specialty and department stores), the trend has decisively shifted toward omnichannel and direct-to-consumer (DTC) models. Direct distribution allows brands maximum control over pricing, brand experience, and valuable customer data, fostering a deeper connection with end-users. Indirect distribution, leveraging major third-party retailers and e-commerce giants, remains vital for broad market penetration and logistical efficiency, particularly in geographically expansive regions.

Downstream activities focus on consumer engagement, after-sales support, and reverse logistics. Successful brands prioritize experiential retail, integrating digital tools like AR/VR into physical stores or offering robust digital community platforms online. Post-purchase services, including repair, customization, and sustainable end-of-life product management (recycling programs), are increasingly important differentiators. Optimizing this entire chain, from sustainable material sourcing to personalized last-mile delivery, determines profitability and market leadership in this highly competitive retail environment.

Retail Sporting Goods Market Potential Customers

Potential customers in the Retail Sporting Goods Market are highly diversified, ranging from elite professional athletes requiring customized, cutting-edge equipment to casual consumers seeking comfortable, functional apparel for everyday wear (athleisure). The largest customer base consists of hobbyists and amateur fitness enthusiasts who participate regularly in activities like running, yoga, weightlifting, and team sports. This segment is highly price-sensitive but strongly influenced by trends, social media, and local community activities, driving volume sales for mid-range product lines and essential equipment.

A rapidly growing customer segment includes the aging population worldwide, who are increasingly engaging in low-impact activities like walking, hiking, and specialized exercise to maintain health. This demographic requires products tailored for comfort, stability, and injury prevention, representing a significant opportunity for adaptive and ergonomic sporting goods design. Furthermore, institutional buyers, such as public and private schools, university athletic departments, and commercial fitness franchises, constitute a reliable revenue stream, primarily focused on large-volume purchasing of durable, standardized equipment for training facilities and organized sports programs.

Geographically, customers in developed markets (North America, Western Europe) are early adopters of premium, smart sporting goods, valuing brand heritage and sustainable production. Customers in emerging economies (APAC, Latin America) are characterized by rapid entry into fitness culture, leading to explosive demand for accessible, aspirational products and mid-tier performance wear. Understanding the performance expectations, willingness to pay, and preferred shopping channel (online vs. physical) of each segment is vital for developing effective market entry and retention strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 195.5 Billion |

| Market Forecast in 2033 | USD 302.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nike, Adidas, Puma, Under Armour, Decathlon, Lululemon, VF Corporation, Amer Sports, ANTA Sports, Li-Ning, Mizuno, ASICS, Columbia Sportswear, Fila, New Balance, Skechers, Reebok, Dick's Sporting Goods, Academy Sports + Outdoors, JD Sports. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Retail Sporting Goods Market Key Technology Landscape

The technological landscape of the Retail Sporting Goods Market is rapidly evolving, driven primarily by the need for enhanced product performance, personalized consumer experiences, and optimized operational efficiency. Key innovations center around materials science, integrating bio-based and recycled polymers to improve sustainability without compromising durability or function. Advanced manufacturing techniques like selective laser sintering (SLS) and digital knitting allow for hyper-customized shoe components and seamless apparel construction, significantly reducing waste and manufacturing lead times. Furthermore, the integration of micro-sensors and biometric data collection into athletic wear and equipment is transforming how performance is measured and optimized, providing real-time feedback to users and valuable research data to manufacturers.

Digital transformation technologies are equally critical in the retail environment. Augmented Reality (AR) and Virtual Reality (VR) are moving from niche experimentation to mainstream application, allowing consumers to digitally 'try on' apparel and visualize equipment placement in their homes before purchase, drastically improving consumer confidence and reducing returns for online sales. IoT connectivity plays a pivotal role, enabling smart equipment—such as connected treadmills or golf clubs with embedded sensors—that communicates performance metrics directly to user apps and coaching platforms, enhancing the overall training ecosystem and creating lucrative subscription service opportunities tied to the physical product.

E-commerce optimization relies heavily on sophisticated data analytics, predictive modeling, and AI-powered recommendations engines that interpret complex consumer behavior data to personalize the shopping journey. Blockchain technology is also gaining traction, particularly in establishing verifiable supply chain transparency and combating the persistent problem of counterfeit goods. These technologies collectively enable the shift toward a truly seamless, data-driven, and highly adaptive retail model, focusing on speed, customization, and minimizing the environmental footprint of global operations.

Regional Highlights

- North America: This region represents a mature yet highly innovative market, characterized by high consumer spending on sports participation and strong adoption of premium, technologically advanced athletic wear and equipment. The market here is driven by established fitness culture, the dominance of major global brands headquartered in the region, and significant investment in professional sports leagues that fuel massive demand for licensed apparel. Key trends include the robust growth of the outdoor recreation segment (hiking, climbing, camping) and the rapid penetration of DTC channels, allowing brands to bypass traditional retail barriers and engage consumers directly through sophisticated e-commerce platforms and experiential flagship stores. Investment is heavily focused on optimizing logistics and leveraging AI for personalized marketing to maintain market dominance against increasing digital competition.

- Europe: The European market demonstrates robust demand, particularly for running, football (soccer), and winter sports equipment, supported by high participation rates and strong governmental support for amateur sports. This region is a global leader in demanding sustainable and ethically sourced sporting goods; thus, brands prioritizing recycled materials, circular design, and transparent supply chains gain a significant competitive edge. The market is fragmented across national preferences and regulatory standards, requiring localized marketing and distribution strategies. Central to European growth is the proliferation of multisport retailers like Decathlon, emphasizing affordability and accessibility alongside specialized brand offerings, making the competitive landscape highly diverse and challenging.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, underpinned by demographic advantages, including burgeoning middle classes in countries like China, India, and Southeast Asia, coupled with increasing disposable incomes. Major growth drivers include the massive institutional investment in sports infrastructure (e.g., Olympic preparations), rapid urbanization leading to increased access to fitness facilities, and the high aspirational value placed on Western sports brands. China, in particular, is a crucial growth engine, with domestic brands like ANTA and Li-Ning successfully competing against global established players by leveraging strong government support and hyper-localized product strategies focused on digital engagement and speed-to-market. E-commerce penetration is exceptionally high, driving rapid digital transformation in retail.

- Latin America (LATAM): The LATAM market shows promising potential, driven by deep-rooted cultural enthusiasm for sports, particularly football, fitness, and running. Market growth is often challenged by economic volatility, currency fluctuations, and complex import tariffs, leading to higher retail prices compared to other regions. However, increasing awareness of health and wellness, coupled with expanding digital access, is gradually unlocking consumer spending potential. Brands often focus on building strong local partnerships and optimizing accessible pricing strategies to penetrate key markets like Brazil and Mexico, relying heavily on durable, multi-purpose equipment and value-focused apparel offerings.

- Middle East and Africa (MEA): Growth in the MEA region is segmented. The Gulf Cooperation Council (GCC) countries exhibit high spending power, driven by luxury consumption and massive government investments in developing world-class sports facilities and hosting major international sporting events. Demand here focuses on high-end performance gear and specialized niche sports like golf and equestrian activities. In contrast, the African segment is primarily driven by affordability and the widespread popularity of football. The region faces infrastructural challenges in logistics and e-commerce, making traditional wholesale and physical retail channels more dominant, although digital adoption is accelerating in urban centers, creating opportunities for mobile-first retail strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Retail Sporting Goods Market.- Nike Inc.

- Adidas AG

- Puma SE

- Under Armour Inc.

- Decathlon S.A.

- Lululemon Athletica Inc.

- VF Corporation (including The North Face, Vans)

- Amer Sports (acquired by ANTA Sports consortium)

- ANTA Sports Products Limited

- Li-Ning Company Limited

- Mizuno Corporation

- ASICS Corporation

- Columbia Sportswear Company

- Fila Holdings Corp.

- New Balance Athletics, Inc.

- Skechers U.S.A., Inc.

- Reebok (owned by Authentic Brands Group)

- Dick's Sporting Goods, Inc.

- Academy Sports + Outdoors

- JD Sports Fashion plc

Frequently Asked Questions

Analyze common user questions about the Retail Sporting Goods market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Retail Sporting Goods Market?

Market growth is primarily driven by increasing global health consciousness, the sustained popularity of the athleisure fashion trend, rising disposable incomes in emerging economies, and continuous technological innovation leading to superior product performance and functionality.

How is the shift to e-commerce impacting traditional sporting goods retailers?

The shift to e-commerce is forcing traditional retailers to adopt omnichannel strategies, integrating their physical presence with robust online platforms, implementing personalized digital services (like virtual try-ons), and focusing on streamlined logistics to compete with direct-to-consumer (DTC) brands.

Which geographical region holds the greatest future growth potential in the sporting goods market?

The Asia Pacific (APAC) region is projected to hold the greatest future growth potential, fueled by large, rapidly expanding middle-class populations, increased government investment in sports infrastructure, and high rates of digital adoption across major consumer hubs like China and India.

What role does sustainability play in current retail sporting goods strategies?

Sustainability is a core competitive differentiator, with brands prioritizing the use of recycled and bio-based materials, establishing transparent supply chains, and implementing circular economy initiatives to meet strong consumer demand for eco-friendly products and adhere to stricter environmental regulations.

What key product segments are expected to see the fastest market expansion?

The Footwear segment, driven by rapid biomechanical and material science innovations (e.g., advanced cushioning technology), and the Apparel segment, propelled by the blend of performance technology and lifestyle fashion (athleisure), are anticipated to experience the fastest expansion rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager