Retractor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434006 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Retractor Market Size

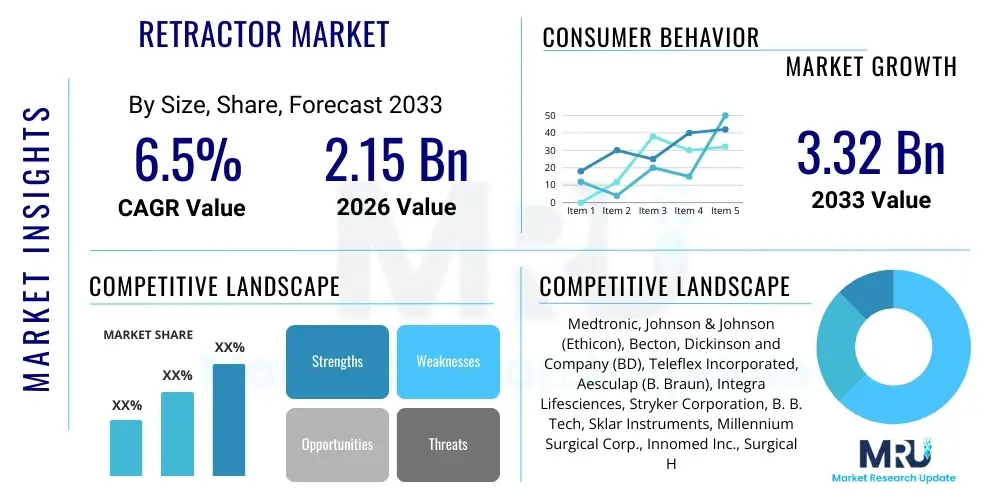

The Retractor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 3.32 Billion by the end of the forecast period in 2033.

Retractor Market introduction

The Retractor Market encompasses the production, distribution, and sale of specialized surgical instruments designed to hold incision edges or tissues away from the surgical field, providing surgeons with necessary access and visualization. These devices are critical components in almost every surgical procedure, ranging from minimally invasive surgeries (MIS) to complex open-heart operations. Retractors vary widely in design, including manual retractors, self-retaining retractors, and table-mounted systems, catering to diverse anatomical locations and procedural requirements. Technological advancements, particularly the shift towards specialized retraction systems optimized for specific surgical specialties like orthopedic, neurological, and gynecological procedures, are key market dynamics driving product innovation and adoption across global healthcare settings.

The primary applications of retractors span the entire surgical spectrum, including general surgery, abdominal surgery, neurosurgery, cardiovascular surgery, and plastic surgery. The devices ensure optimal exposure of the target tissue, minimize collateral damage, and improve surgical efficiency. Key benefits driving the market include enhanced surgical precision, reduced operating time, improved patient safety due to stable tissue management, and the enabling of advanced minimally invasive techniques. Furthermore, the development of disposable and single-use retractors addresses stringent sterility requirements and reduces the risk of cross-contamination, contributing significantly to their increased adoption, especially in high-volume surgery centers.

Major factors propelling the growth of the Retractor Market include the global increase in the volume of surgical procedures, driven by the rising prevalence of chronic diseases (such as cardiovascular disorders and cancer) and an aging global population requiring orthopedic and general surgeries. Furthermore, sustained investments in healthcare infrastructure in emerging economies, coupled with continuous innovation leading to the creation of procedure-specific, ergonomic, and automated retraction systems, significantly contribute to market expansion. The increasing preference for self-retaining retractors, which free up surgical staff and offer consistent retraction force, is another crucial growth stimulant, reshaping traditional surgical practices.

Retractor Market Executive Summary

The Retractor Market exhibits robust growth, primarily fueled by the accelerating adoption of minimally invasive surgery (MIS) techniques globally, which necessitate specialized, small-profile retraction devices. Business trends indicate a strong move toward consolidated product offerings, focusing on customizable and ergonomic surgical kits that include specialized retractors, thereby enhancing efficiency in operating rooms. Manufacturers are prioritizing the integration of high-strength, lightweight materials like medical-grade polymers and specialized alloys to improve product handling and durability. Furthermore, partnerships between medical device manufacturers and specialized surgical centers are becoming prevalent to drive procedure-specific training and product development, ensuring market offerings align closely with clinical needs and optimizing the supply chain for high-demand consumables.

Regionally, North America maintains the dominant market share due to advanced healthcare infrastructure, high surgical procedure volume, and favorable reimbursement policies for complex surgeries. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by improving healthcare expenditure, increasing medical tourism, and the rapid establishment of advanced surgical facilities in populous countries like China and India. European countries continue to focus on stringent quality standards and the adoption of single-use retractors to enhance surgical safety, while Latin America and the Middle East and Africa (MEA) offer nascent growth opportunities driven by healthcare system modernization and increasing access to specialized medical technologies, particularly in urban centers.

Segment trends highlight the dominance of the self-retaining retractor segment, valued for its ability to maintain consistent tension without dedicated human assistance, significantly optimizing OR workflow. By application, orthopedic surgery and abdominal/general surgery remain the largest segments, supported by the high incidence of musculoskeletal injuries and gastrointestinal conditions. Moreover, the disposable retractor segment is experiencing rapid growth due to heightened concerns regarding infection control and the simplification of reprocessing protocols in busy hospitals. The competitive landscape is characterized by established global leaders focusing on portfolio diversification and smaller, innovative companies specializing in niche retraction technologies tailored for robotic and endoscopic procedures, signaling a dynamic environment focused on precision and procedural efficacy.

AI Impact Analysis on Retractor Market

User queries regarding AI's impact on the Retractor Market predominantly revolve around how robotic surgery platforms, often powered by AI algorithms for enhanced control and visualization, will influence the demand for traditional manual and self-retaining instruments. Common themes include the potential for AI-driven surgical planning to necessitate more precise, less invasive retraction solutions, the role of machine learning in optimizing retractor placement and minimizing tissue stress during prolonged surgeries, and the development of 'smart' retractors capable of real-time monitoring of tissue tension or physiological parameters. Users are concerned about whether automation will completely phase out conventional retraction tools or if specialized AI-optimized devices will emerge as a distinct premium category, focusing on the seamless integration of retraction functionality into complex robotic arms to achieve unprecedented stability and tissue protection in confined anatomical spaces.

While AI does not directly manufacture retractors, its integration into the surgical workflow—specifically through robotics, surgical planning software, and augmented reality (AR) guidance—significantly influences the design requirements and functional expectations for next-generation retraction devices. AI-powered planning models can pre-determine the optimal incision size and necessary retraction force, driving demand for customizable, low-profile retractors that fit the predetermined surgical corridor precisely. This shift emphasizes smaller, lighter, and more specialized instruments that integrate smoothly with robotic interfaces, requiring manufacturers to adapt material science and engineering to meet new standards of precision, rather than mass-market versatility.

Furthermore, AI algorithms are instrumental in training simulations and predictive analytics for surgical outcomes. By simulating complex retraction scenarios, AI helps refine the specifications for retractors used in high-risk procedures, ensuring they can withstand necessary forces without causing tissue damage. This translates to an increased focus on ergonomic design and the development of instruments with integrated sensors (Smart Retractors), potentially monitored and adjusted by AI systems, to prevent excessive tissue compression or nerve impingement during lengthy operations, thereby elevating patient safety standards and procedural effectiveness across the market.

- AI enhances robotic surgery platforms, driving demand for specialized, smaller-footprint retractors compatible with robotic arms.

- Machine learning optimizes pre-operative surgical planning, dictating precise retractor dimensions and placement, reducing dependency on general-purpose tools.

- Development of 'Smart Retractors' with embedded sensors allows for real-time monitoring of tissue tension, governed by AI algorithms to prevent surgical complications.

- AI-driven simulation and training improve the design specification for procedure-specific retraction devices, enhancing surgical efficacy and safety.

- Automated tissue navigation powered by AI may lead to the eventual integration of retraction capabilities directly into advanced robotic tools, reducing the need for separate manual devices in certain high-tech procedures.

DRO & Impact Forces Of Retractor Market

The Retractor Market is fundamentally shaped by several powerful drivers, chief among them being the global demographic trend of an aging population, which necessitates higher volumes of age-related surgeries, including orthopedic, cardiovascular, and general abdominal procedures. This is strongly supported by continuous technological advancements in surgical techniques, particularly the widespread shift toward Minimally Invasive Surgery (MIS), which mandates the use of highly specialized, compact, and often single-use retractors designed for smaller operative fields. These drivers collectively push the market forward, compelling manufacturers to invest heavily in R&D to deliver instruments that enhance visualization, reduce trauma, and improve recovery times, positioning innovation as a core market stimulant.

However, significant restraints temper this expansion. The primary constraint is the high cost associated with advanced self-retaining and robotic-compatible retractor systems, which limits their adoption in price-sensitive emerging markets and smaller hospitals. Furthermore, the stringent regulatory environment governing medical devices, particularly in developed regions like North America and Europe, often results in lengthy and expensive approval processes, hindering rapid product introduction. Another critical restraint involves the ongoing risks associated with surgical site infections (SSIs) and the necessary efforts and costs related to the proper sterilization and reprocessing of reusable retractors, occasionally encouraging a shift toward disposable, albeit costlier, alternatives.

Opportunities for growth are vast, particularly in the realm of specialized and niche applications, such as retractors designed specifically for complex neurological, spinal fusion, and reconstructive plastic surgery procedures, where conventional tools often fall short. The untapped potential in emerging economies, driven by government initiatives to improve public health infrastructure and rising disposable incomes allowing access to private healthcare, offers significant geographical expansion opportunities. Crucially, the development of eco-friendly, bio-degradable disposable retractors represents a compelling avenue, addressing growing environmental concerns and streamlining disposal processes, thereby providing a competitive advantage to early movers in sustainable medical device manufacturing.

The impact forces within the Retractor Market are characterized by intense competition leading to aggressive pricing strategies, especially in the general surgery segment. The rising influence of Group Purchasing Organizations (GPOs) and large hospital networks dictates purchasing decisions, favoring suppliers capable of providing bulk discounts and comprehensive product portfolios. Regulatory shifts, such as stricter reprocessing guidelines or mandates for single-use instruments, can rapidly disrupt existing supply chains and product lines. Finally, evolving clinical best practices, particularly the focus on enhanced recovery protocols, directly impact instrument design, favoring less traumatic and more predictable retraction tools, ultimately accelerating the obsolescence of older, less precise technologies.

Segmentation Analysis

The Retractor Market is extensively segmented based on several key parameters: Product Type, Application, Design, Usage, and End-User. Analyzing these segments provides a nuanced understanding of market dynamics, revealing areas of high growth and technological focus. The complexity of modern surgery drives diversification in product design, necessitating specialized instruments for varying anatomical depths and tissue characteristics. Product segmentation, covering handheld, self-retaining, and table-mounted systems, reflects the spectrum of required stability and manual input across different surgical scenarios, with self-retaining systems seeing accelerated demand due to their operational efficiency benefits.

Application-based segmentation is critical, as surgical procedures dictate the specific geometry and material requirements of the retractors. Orthopedic procedures, requiring robust systems for deep tissue access and bone manipulation, contrast sharply with minimally invasive procedures that demand slender, flexible, and high-visibility instruments. Furthermore, end-user categorization, primarily spanning hospitals and ambulatory surgical centers (ASCs), reflects distinct purchasing behaviors; hospitals often require large volume, versatile instruments, while ASCs typically prioritize cost-effective, procedure-specific, and often single-use solutions to streamline fast-turnaround procedures and minimize overhead costs associated with sterilization.

The segmentation by Usage (reusable vs. disposable) is particularly dynamic, influenced heavily by global infection control mandates and hospital budget constraints. While reusable retractors remain dominant in high-volume, cost-sensitive segments, the disposable segment is rapidly gaining traction due to guaranteed sterility and reduced operational complexity (eliminating cleaning and inspection protocols). This ongoing shift reflects a compromise between long-term capital expenditure savings (reusable) and immediate operational ease and safety assurance (disposable), creating a competitive battleground where sustainability and cost-effectiveness are increasingly intertwined in product development strategies across all major market segments.

- By Product Type: Handheld Retractors, Self-Retaining Retractors, Table-Mounted Retractors.

- By Application: Abdominal/General Surgery, Orthopedic Surgery, Neurosurgery, Cardiovascular Surgery, Plastic Surgery, Obstetrics & Gynecology (OB/GYN), Urological Surgery.

- By Design: Blade Retractors, Hook Retractors, Wire Retractors, Ring Retractors.

- By Usage: Reusable Retractors, Disposable Retractors.

- By End User: Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics.

Value Chain Analysis For Retractor Market

The value chain for the Retractor Market begins with upstream activities focused on raw material sourcing, predominantly medical-grade stainless steel alloys, titanium, and advanced engineering polymers. Suppliers must adhere to strict quality and biocompatibility standards, as materials directly influence the instrument's strength, sterilizability, and patient safety profile. Key upstream challenges involve managing fluctuating material costs and ensuring the traceability of components. Following material acquisition, the manufacturing phase involves complex processes such as precision machining, forging, laser cutting, and surface finishing to create the intricate geometries required for retraction devices. This stage is capital-intensive and requires high levels of regulatory compliance (e.g., ISO 13485 certification) to ensure product quality and reliability before packaging and sterilization.

The downstream component of the value chain is focused on distribution and sales. Distribution channels are varied, involving both direct sales forces, particularly for high-end, table-mounted, or specialized robotic-compatible systems, and indirect channels relying on extensive networks of authorized distributors and medical equipment suppliers. Distributors play a crucial role in managing inventory, logistics, and localized regulatory compliance, ensuring timely delivery to end-users such as hospitals and ASCs. The choice between direct and indirect channels is often strategic, driven by the size of the target market and the complexity of the product; highly technical or expensive systems usually benefit from direct engagement for tailored support and training.

Direct distribution maximizes manufacturer control over pricing and customer relationships, which is essential for capturing high-value contracts with large hospital networks or Group Purchasing Organizations (GPOs). This channel often includes specialized surgical representatives who provide clinical training and technical support on complex retraction systems. Conversely, the indirect distribution model, utilizing third-party wholesalers and regional distributors, is effective for broad market reach, especially for commodity items like basic handheld retractors and high-volume disposable products, offering cost efficiencies in logistics. Success throughout the value chain hinges on maintaining transparency, ensuring consistent quality, and providing robust post-sale support and servicing, particularly for reusable, specialized retraction instruments requiring ongoing maintenance and calibration.

Retractor Market Potential Customers

The primary consumers and end-users of retraction devices are institutions that perform surgical procedures, led predominantly by hospitals, which account for the largest volume of purchases due to the wide array of surgical specialties they house and the high throughput of both elective and emergency operations. Within hospitals, the purchasing decision involves surgical procurement departments, overseen by surgical heads and value analysis committees, who balance clinical need, cost-effectiveness, and infection control requirements. Hospitals demand versatile retractors capable of handling diverse procedures, often focusing on reusable instruments for cost management, but are increasingly adopting disposable options for critical or high-risk surgeries to ensure maximum patient safety and procedural efficiency.

Ambulatory Surgical Centers (ASCs) represent the fastest-growing segment of potential customers, driven by the shift of low-complexity and elective outpatient procedures away from traditional hospitals. ASCs prioritize efficiency, quick turnaround times, and minimizing capital expenditure, making them ideal buyers for procedure-specific kits and single-use, disposable retractors. Their focus on specific surgical domains (e.g., ophthalmology, orthopedics, gastroenterology) means their purchasing is highly targeted, favoring suppliers who can offer tailored, economically viable solutions that reduce the need for complex sterilization infrastructure and staffing overheads. The decision-making process in ASCs is typically faster and more decentralized than in large hospitals, allowing for quicker adoption of innovative, cost-saving retraction technologies.

Specialty Clinics, particularly those focused on plastic surgery, dermatology, and pain management, also constitute a significant customer base, albeit requiring specialized and minimally invasive retraction tools. These smaller facilities often prioritize aesthetic outcomes and precision, driving demand for fine, ergonomic handheld retractors. Furthermore, military and disaster relief medical units represent a niche but crucial customer group, requiring rugged, portable, and easily sterilizable or disposable retraction systems suitable for field operations. For all potential customers, the long-term reliability of the instrument, compliance with global safety standards, and the manufacturer's ability to provide continuous clinical training are paramount selection criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.32 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Johnson & Johnson (Ethicon), Becton, Dickinson and Company (BD), Teleflex Incorporated, Aesculap (B. Braun), Integra Lifesciences, Stryker Corporation, B. B. Tech, Sklar Instruments, Millennium Surgical Corp., Innomed Inc., Surgical Holdings, Thompson Surgical, Applied Medical, CooperSurgical, Inc., TeDan Surgical Innovations, Changzhou Haida Medical Equipment Co., Ltd., Ruhof Corporation, Surgical Instruments Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Retractor Market Key Technology Landscape

The technological evolution within the Retractor Market is centered on enhancing surgical precision, reducing patient trauma, and improving workflow efficiency within the operating theatre. A major technological focus is the continuous refinement of materials, moving beyond traditional stainless steel to incorporate advanced, radiolucent materials like carbon fiber and specialized polymers, particularly in table-mounted and neurological retraction systems. These materials not only reduce the weight of the instruments, enhancing surgeon comfort and maneuverability, but also minimize interference with intraoperative imaging technologies such as fluoroscopy and CT scans, which is critical for complex orthopedic and spinal procedures, thereby enabling superior real-time guidance during surgery and improving clinical outcomes.

Another crucial area of innovation lies in the development of modular and versatile retraction systems. These systems allow surgeons to customize the retraction setup based on the patient’s anatomy and the specific surgical approach required, offering unparalleled flexibility. Advanced self-retaining retractors now incorporate ratchet mechanisms and locking features that provide highly consistent and adjustable tension control, minimizing slippage and reducing the risk of accidental tissue damage compared to older friction-based systems. Furthermore, the integration of fiber optic illumination directly into the retractor blades has become standard for deep-cavity surgery, providing brilliant, shadow-free lighting precisely where it is needed, which significantly enhances visualization and contributes to the success of technically challenging operations.

The integration of retraction technology with robotic surgical systems represents the forefront of market innovation. Specialized robotic retractors are designed to interface directly with robotic arms, offering micro-level adjustments and stable retraction forces that manual systems cannot replicate. Future developments are focused on 'smart' retractors that incorporate embedded biosensors to monitor pressure, temperature, or tissue perfusion, providing the surgical team with real-time feedback. This data-driven approach, supported by ongoing material science research into antimicrobial coatings and disposable mechanisms, promises to further refine surgical safety protocols, minimize cross-contamination risks, and solidify the market's trajectory towards highly specialized, integrated surgical tools that maximize both efficiency and patient outcome quality.

Regional Highlights

North America currently dominates the Retractor Market, primarily driven by the robust presence of leading medical device manufacturers, high healthcare expenditure, and the widespread adoption of advanced surgical technologies, including robotic systems and complex neurosurgical procedures. The region benefits from a well-established infrastructure of hospitals and specialized Ambulatory Surgical Centers (ASCs) that readily incorporate innovative, premium-priced retraction instruments. Furthermore, favorable reimbursement policies for surgical interventions and a high awareness among surgeons regarding the benefits of specialized retraction systems contribute significantly to the high market penetration rates and continued dominance of the United States and Canada in this market segment.

Europe holds the second-largest share, characterized by stringent quality control standards (CE Mark) and a strong emphasis on patient safety, which fuels the demand for high-quality, reusable, and single-use disposable retractors to mitigate infection risks. Countries like Germany, France, and the UK are major contributors, driven by an aging population and high prevalence of chronic diseases requiring surgical treatment. The European market shows a strong preference for ergonomic and specialized instrument designs tailored for various MIS procedures. Economic restraints in certain peripheral European markets, however, occasionally favor reusable over disposable products, creating a varied demand landscape across the continent.

The Asia Pacific (APAC) region is projected to be the fastest-growing market over the forecast period. This rapid expansion is attributable to dramatic improvements in healthcare infrastructure, increasing government and private investments in medical facilities, and the rising middle class's ability to afford advanced surgical care. Countries such as China, India, and Japan are pivotal, witnessing rising surgical volumes, particularly in general and orthopedic surgeries. While price sensitivity remains a factor, driving demand for cost-effective local manufacturing, the increasing prevalence of medical tourism and the adoption of Western surgical standards are accelerating the acceptance of sophisticated self-retaining and single-use retraction systems, positioning APAC as a crucial future revenue hub.

- North America: Market leader due to high surgical volume, advanced robotic surgery adoption, and robust reimbursement frameworks. Focus on premium, specialized, and disposable systems, particularly in the US.

- Europe: Second largest market, driven by stringent safety regulations and an aging population. High demand for reusable, high-quality instruments and increasing uptake of specialized MIS retraction tools.

- Asia Pacific (APAC): Highest projected CAGR due to healthcare modernization, rising surgical capacity, and increasing disposable income across major economies like China and India.

- Latin America (LAMEA): Emerging market characterized by infrastructural growth and increasing access to specialized care, particularly in Brazil and Mexico, focusing on cost-effective yet reliable reusable instruments.

- Middle East and Africa (MEA): Growth stimulated by burgeoning medical tourism in Gulf nations and expanding public health investments, leading to selective adoption of advanced retraction technologies in key urban medical centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Retractor Market.- Medtronic plc

- Johnson & Johnson (Ethicon)

- Becton, Dickinson and Company (BD)

- Teleflex Incorporated

- Aesculap (B. Braun Melsungen AG)

- Integra Lifesciences

- Stryker Corporation

- Thompson Surgical Instruments

- Applied Medical Resources Corporation

- CooperSurgical, Inc.

- TeDan Surgical Innovations

- Innomed Inc.

- Sklar Instruments

- Millennium Surgical Corp.

- Changzhou Haida Medical Equipment Co., Ltd.

- Richard Wolf GmbH

- Zimmer Biomet Holdings, Inc.

- V. Mueller (A part of Cardinal Health)

- Ruhof Corporation

- Surgical Holdings

Frequently Asked Questions

Analyze common user questions about the Retractor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards disposable retractors in surgical settings?

The shift towards disposable retractors is primarily driven by heightened global focus on infection control and minimizing the risk of Surgical Site Infections (SSIs). Disposable instruments guarantee sterility, eliminate the high costs and labor associated with sterilization, and prevent cross-contamination risks inherent in reprocessing reusable devices, thereby enhancing patient safety and streamlining operating room turnover.

Which product segment holds the largest market share in the Retractor Market?

The Self-Retaining Retractors segment typically holds the largest market share. These devices offer mechanical stability, free up surgical assistants, and maintain consistent tension over prolonged periods, significantly improving workflow efficiency and surgical visualization, making them essential tools for complex and lengthy procedures across various surgical specialties.

How does the increasing adoption of Minimally Invasive Surgery (MIS) impact retractor design?

MIS adoption necessitates the development of specialized retractors that are smaller, lighter, and possess flexible or articulating designs, allowing them to be inserted through small incisions or cannulas. This drives innovation toward high-visibility materials, modular components, and instruments compatible with endoscopic and robotic systems to achieve precise retraction with minimal tissue trauma.

What are the primary restraints affecting market growth in emerging economies?

The primary restraints in emerging economies include the high initial capital investment required for purchasing advanced self-retaining and robotic-compatible retractor systems. Additionally, budget constraints within public healthcare systems and less standardized regulatory approval processes often favor basic, locally manufactured, or reused instrumentation over premium international alternatives, slowing advanced product adoption.

What role do technological innovations like 'smart retractors' play in future market growth?

'Smart retractors' equipped with embedded sensors (e.g., pressure or temperature monitoring) will play a crucial role by providing surgeons with real-time quantitative data on tissue interaction. This technology enhances surgical precision, minimizes the risk of nerve damage or excessive compression, and improves patient outcomes, positioning these data-driven instruments as a key differentiator and high-growth segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Lighted Surgical Retractor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Retractor Market Size Report By Type (Hand Held Retractors, Self-Retaining Retractors), By Application (Abdomen Surgery, Brain Surgery, Vascular Surgery, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Retractor Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Hand Held Retractors, Self-Retaining Retractors), By Application (Abdomen Surgery, Brain Surgery, Vascular Surgery, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager