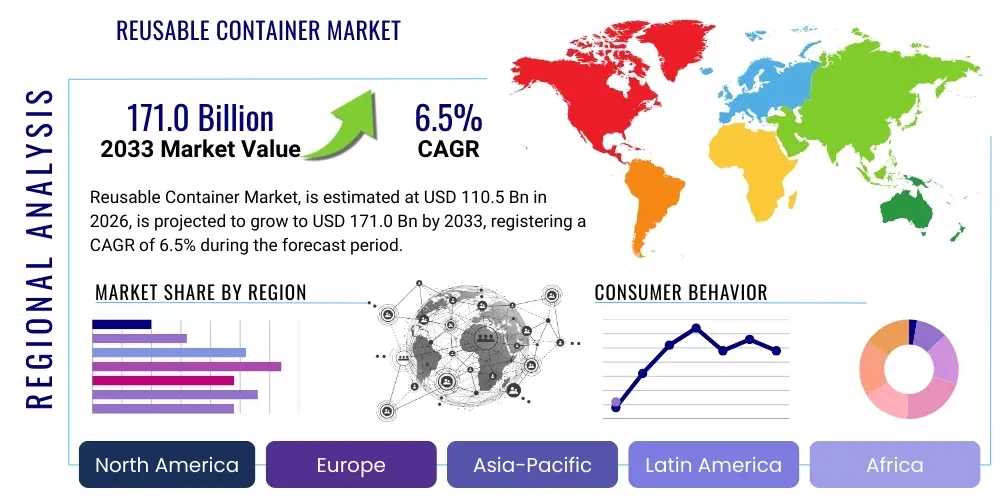

Reusable Container Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438786 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Reusable Container Market Size

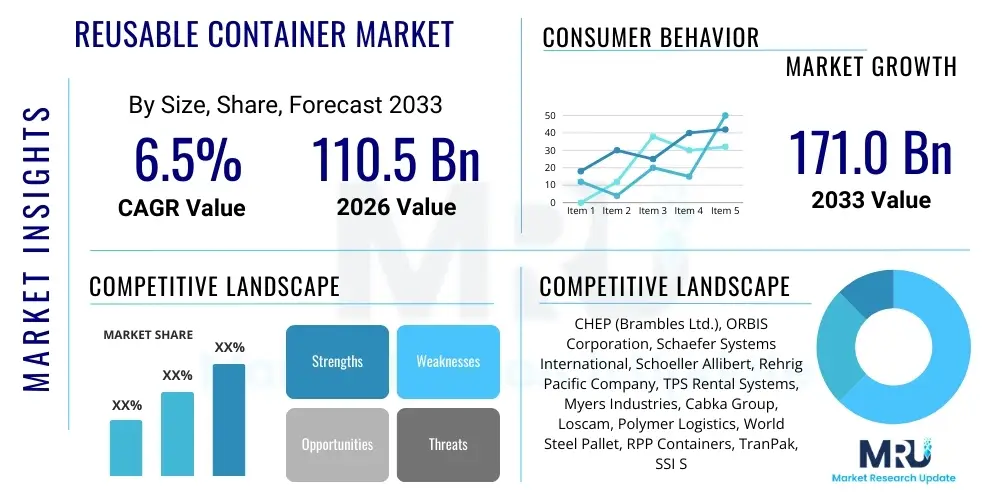

The Reusable Container Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 110.5 Billion in 2026 and is projected to reach USD 171.0 Billion by the end of the forecast period in 2033.

Reusable Container Market introduction

The Reusable Container Market encompasses products designed for multiple trips or extended lifecycles across supply chains, serving as a sustainable alternative to single-use packaging. These containers, including pallets, crates, intermediate bulk containers (IBCs), drums, and specialized totes, are primarily utilized in closed-loop logistics systems, minimizing waste generation and optimizing product protection during transit and storage. The fundamental shift driving this market is the global imperative toward circular economy practices, coupled with increasing regulatory pressures on plastic waste and packaging efficiency across various industrial sectors. Key benefits derived from adopting reusable containers include significant reductions in packaging material costs over time, improved efficiency in material handling, and enhanced brand image associated with environmental responsibility.

Major applications of reusable containers span the automotive, food and beverage, pharmaceutical, and retail sectors. In automotive manufacturing, standardized reusable bins and racks facilitate precise component delivery via just-in-time systems. Within the food industry, durable crates and insulated totes ensure cold chain integrity and hygiene for fresh produce and prepared meals. The primary driving factors are the rising cost volatility of raw materials used in disposable packaging, stringent corporate sustainability goals focused on achieving zero waste, and continuous advancements in container materials (such as high-density polyethylene or metal alloys) that enhance durability and longevity, thereby improving the return on investment for end-users.

Reusable Container Market Executive Summary

The Reusable Container Market is experiencing robust expansion, fundamentally driven by shifts in global logistics toward sustainable and efficient supply chain management. Current business trends indicate a strong move toward digitalization, integrating reusable asset management systems using IoT and RFID technologies to track containers, minimize loss rates, and optimize replenishment cycles. This focus on technology is crucial for justifying the high initial capital investment required for reusable systems. Regionally, Europe and North America currently lead the market due to established infrastructure, early adoption of stringent environmental policies (such as the EU’s Packaging and Packaging Waste Regulation), and high consumer awareness regarding sustainability. However, the Asia Pacific region is anticipated to demonstrate the fastest growth rate, fueled by rapid industrialization, burgeoning e-commerce penetration, and increasing investment in modern logistics networks, particularly in China and India.

Regarding segment trends, the pallets and crates segment dominates the market volume, primarily due to their extensive use in standardized warehouse operations and inter-company logistics. However, the intermediate bulk containers (IBCs) and specialized containers segment is projected to show accelerated value growth, owing to their critical application in handling high-value or sensitive materials in the chemical and pharmaceutical industries where contamination control and robust structural integrity are paramount. Furthermore, the rental and pooling services segment is gaining substantial traction, offering flexibility and reducing the financial burden of large upfront purchases for small and medium-sized enterprises (SMEs), thereby democratizing access to high-quality reusable packaging solutions across multiple industries.

AI Impact Analysis on Reusable Container Market

User inquiries regarding AI's influence on the Reusable Container Market center predominantly on themes of logistical optimization, predictive maintenance, and enhancing the efficiency of asset pooling and recovery systems. Users are keen to understand how AI can move beyond simple tracking (RFID/IoT) to predictive analytics—specifically, optimizing container routing, forecasting demand fluctuations to prevent inventory shortages or excesses, and utilizing computer vision systems for automated damage detection during sorting and washing processes. Key concerns revolve around data privacy, the cost of implementing complex AI infrastructure, and the need for standardized data protocols to ensure interoperability among different stakeholders in a shared logistics ecosystem.

The application of Artificial Intelligence is revolutionizing the management and utilization of reusable assets, significantly enhancing efficiency throughout the supply chain. AI-driven predictive logistics models analyze vast datasets, including historic utilization rates, seasonal demand patterns, and real-time sensor data (IoT/telematics), to determine the optimal location and quantity of containers required at any given node. This advanced forecasting minimizes 'dead-heading' (empty container transport) and ensures that assets are repositioned proactively rather than reactively. Furthermore, AI algorithms are instrumental in optimizing container pooling systems, dynamically matching supply (available containers) with demand (user needs) across large geographical networks, which is essential for maximizing the operational lifespan and economic viability of these assets.

In addition to logistics, AI plays a crucial role in asset health management. Machine learning models analyze visual data captured during automated inspection processes to identify micro-fractures, structural weaknesses, or contamination levels that might be missed by manual checks. This predictive maintenance capability allows companies to schedule repairs or replacements precisely when needed, preventing catastrophic failures, extending the container's service life, and maintaining stringent safety and hygiene standards, particularly vital in the pharmaceutical and food sectors. The integration of AI thus transforms reusable container management from a reactive tracking function into a proactive, optimized, and predictive logistical strategy.

- AI-Powered Predictive Logistics: Optimizing routing and minimizing empty miles by forecasting future demand and optimizing repositioning based on real-time network conditions.

- Automated Damage Detection: Utilizing computer vision and machine learning for rapid, precise identification of wear, tear, and structural integrity issues during the cleaning and sorting phase.

- Inventory Optimization: Dynamic forecasting of container stock levels required at distribution centers, reducing capital tied up in excess inventory and preventing stockouts.

- Demand-Supply Matching in Pooling: Algorithmic management of shared asset pools to efficiently match container availability with end-user requirements across multi-client networks.

- Sustainability Reporting Enhancement: AI models process usage data to generate precise, auditable environmental impact reports, calculating CO2 savings and waste reduction metrics for compliance.

DRO & Impact Forces Of Reusable Container Market

The Reusable Container Market is shaped by a strong combination of economic drivers and environmental pressures, counterbalanced by significant logistical restraints. The primary drivers include global sustainability mandates (especially plastic reduction targets), the proven long-term cost savings associated with eliminating recurring packaging procurement costs, and the superior protection reusable containers offer to sensitive goods compared to single-use options. Conversely, the market faces restraints such as the high initial capital expenditure required for system implementation, the logistical complexity of managing container return and cleaning loops (reverse logistics), and the lack of universally standardized container sizes across all regional supply chains, which hinders seamless cross-border utilization. These forces, acting concurrently, determine the overall rate and geographical scope of market adoption.

Opportunities for growth are concentrated in the expansion of pooling services, allowing SMEs to participate without large capital outlay, and the increasing demand from emerging markets, particularly for food and beverage logistics where improved hygiene and durability are critical. Technological advancement represents another major opportunity, specifically the integration of inexpensive IoT sensors and robust software platforms that enhance traceability and reduce asset loss, thereby improving the economic feasibility of reusable systems. The key impact forces dictating market behavior include regulatory shifts (governments imposing extended producer responsibility schemes), shifting consumer preference toward eco-friendly products, and technological breakthroughs in material science that further enhance the strength-to-weight ratio of reusable containers, making them lighter and more efficient to transport.

Segmentation Analysis

The Reusable Container Market is highly fragmented and segmented based on material type, product category, end-use industry, and handling capacity. Analyzing these segments provides a clear map of investment priorities and growth pockets within the sector. Material segmentation, covering plastics (HDPE, PP), metals (steel, aluminum), and wood, is crucial as material choice dictates durability, cleanability, and cost structure. Product categories, such as pallets, crates, IBCs, and drums, are defined by their functional application in material handling. End-use segmentation highlights sector-specific needs, with automotive and food and beverage being historically dominant, while pharmaceuticals and e-commerce show rapid penetration rates due to their specific logistical requirements for asset protection and temperature control.

- By Material:

- Plastic (HDPE, PP, PET)

- Metal (Steel, Aluminum)

- Wood

- Others (Composite Materials)

- By Product:

- Pallets

- Crates and Totes (Handheld and Bulk)

- Intermediate Bulk Containers (IBCs)

- Drums and Barrels

- Racks and Dairies

- By End-Use Industry:

- Food and Beverage

- Automotive

- Pharmaceuticals and Healthcare

- Chemical and Petroleum

- Retail and Consumer Goods

- E-commerce Logistics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Reusable Container Market

The value chain for the Reusable Container Market begins with upstream activities involving raw material procurement, dominated by plastics manufacturers and metal fabricators. Key competitive advantages at this stage are derived from sourcing high-quality, durable materials (e.g., virgin or recycled HDPE/PP) and implementing efficient, high-volume molding or stamping processes. This segment is highly reliant on energy efficiency and material science innovation to produce containers with optimal strength-to-weight ratios and extended life expectancy, which directly impacts the total cost of ownership for end-users. Certification and compliance with international standards (like ISO or specific food safety requirements) are non-negotiable upstream prerequisites.

Midstream activities primarily encompass manufacturing, assembly, and system integration. Manufacturers often specialize by product type (e.g., focusing solely on collapsible bulk containers or standardized pallets). Crucially, the growth of pooling services introduces an additional layer of value, where companies lease containers and manage the entire lifecycle, including tracking, retrieval, maintenance, and cleaning. The distribution channel is bifurcated into direct sales (large industrial buyers purchasing their own fleet) and indirect channels facilitated by third-party logistics (3PL) providers and dedicated pooling service operators, who manage the complex logistics of the closed-loop system.

Downstream activities involve the end-users—the various industrial sectors utilizing the containers for internal logistics, supplier management, and distribution to retail points. Success downstream relies heavily on seamless integration of reusable containers into existing Material Handling Equipment (MHE) and Warehouse Management Systems (WMS). Post-use management, including collection, cleaning, and repair (reverse logistics), constitutes a specialized and critical part of the value chain. Ultimately, the end-of-life process involves advanced recycling or grinding of materials, ensuring the circularity promise of the product, although this remains challenging for complex composite containers.

Reusable Container Market Potential Customers

Potential customers for reusable containers are diverse, spanning virtually every sector that handles physical goods, but are particularly concentrated in industries characterized by high volume, repetitive shipping cycles, and stringent hygiene or safety requirements. The primary buyers are large-scale manufacturing enterprises, particularly in the automotive sector for supplying components to assembly lines (Tier 1 suppliers and OEMs), and major food processors and distributors (grocery chains, centralized kitchens, and agricultural cooperatives). These customers prioritize reliability, standardization (to fit automated systems), and the long-term total cost savings associated with eliminating single-use packaging waste.

The pharmaceutical and chemical industries represent high-value potential customers. For pharmaceuticals, buyers require highly specialized, verifiable, and often temperature-controlled containers (like insulated IBCs) to maintain product integrity and comply with strict regulatory mandates, such as Good Distribution Practices (GDP). Chemical manufacturers require durable, corrosion-resistant drums and IBCs that meet dangerous goods transportation regulations. Furthermore, the burgeoning e-commerce and retail sectors are rapidly becoming key buyers, particularly for utilizing foldable crates and totes that optimize warehouse space and expedite last-mile delivery operations, driving demand for light-weight, traceable solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 110.5 Billion |

| Market Forecast in 2033 | USD 171.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CHEP (Brambles Ltd.), ORBIS Corporation, Schaefer Systems International, Schoeller Allibert, Rehrig Pacific Company, TPS Rental Systems, Myers Industries, Cabka Group, Loscam, Polymer Logistics, World Steel Pallet, RPP Containers, TranPak, SSI SCHAEFER, DS Smith, Tri-Wall, GEFCO, IFCO Systems, Menasha Corporation, RM2 International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reusable Container Market Key Technology Landscape

The technological landscape of the Reusable Container Market is rapidly evolving, moving beyond simple physical products to sophisticated, integrated asset management systems. A foundational technology driving efficiency is the adoption of IoT (Internet of Things) devices, including inexpensive sensors embedded directly into containers. These sensors transmit real-time data regarding location, temperature, humidity, and shock events, crucial for maintaining product quality in sensitive supply chains like pharmaceuticals. Complementing IoT is the widespread use of Radio Frequency Identification (RFID) and barcode technologies, which automate check-in/check-out processes at distribution points, dramatically improving inventory accuracy and reducing manual tracking errors, essential for managing high circulation volumes.

Beyond hardware, sophisticated software platforms and enterprise resource planning (ERP) integrations are transforming how reusable assets are managed. These platforms utilize cloud computing to aggregate data from thousands of containers, applying machine learning algorithms (as detailed in the AI analysis) to predict maintenance needs and optimize logistical routes for container recovery. Blockchain technology is emerging as a critical tool, particularly for creating immutable records of container ownership, usage history, and cleaning cycles across multi-party supply chains. This transparency enhances trust, verifies compliance with hygiene standards, and facilitates easier auditing, crucial for cross-industry pooling operations.

Furthermore, advancements in material science contribute significantly to technological innovation. Research focuses on developing lighter, yet stronger, composite materials and high-performance polymers (like specialized HDPE blends) that resist chemical corrosion and provide better impact resistance, thereby extending the life cycle of the containers and reducing overall transport weight. The trend towards standardization, aided by digital modeling and 3D printing for prototyping specialized designs, also ensures that new containers are optimized for automated handling equipment, driving greater operational efficiency across highly automated warehouses and distribution centers globally.

Regional Highlights

- North America: This region is characterized by high operational maturity and substantial capital investment in logistics automation. Key drivers include the large presence of the automotive and manufacturing sectors requiring closed-loop systems, and strong regulatory frameworks promoting sustainable logistics. The U.S. leads the adoption, primarily driven by major grocery retailers and e-commerce giants implementing extensive reusable tote and pallet programs to optimize their vast distribution networks.

- Europe: Europe is a global leader in reusable container adoption, largely due to stringent environmental legislation, notably ambitious targets for plastic reduction and high landfill taxes that make single-use packaging economically unfavorable. Pooling services are extremely dominant here, facilitated by companies like CHEP and IFCO, which manage shared systems across multiple countries, particularly for standardized plastic crates used in fresh food supply chains across the European Union.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid expansion of the manufacturing base, infrastructural development, and increasing urbanization leading to complex supply chains. Countries like China and India are investing heavily in modernizing their logistics infrastructure. While initial adoption was slow, driven mainly by food safety concerns and export requirements, recent government initiatives promoting circular economy principles are accelerating the transition from traditional wood pallets and cardboard packaging to durable plastic and metal reusable assets.

- Latin America: Market growth here is moderate but steady, focused primarily on the Food and Beverage sector and specific large-scale export industries (e.g., agriculture and mining). The challenge lies in fragmented infrastructure and geopolitical stability issues, making asset recovery and reverse logistics challenging. However, multinational companies operating within the region are instrumental in transferring best practices and driving demand for reliable reusable solutions.

- Middle East and Africa (MEA): This region is emerging, with adoption concentrated in GCC countries due to oil and gas, and pharmaceutical investments. Logistics efficiency is a high priority, especially given the challenging climatic conditions that demand robust, protective containers. The adoption is currently focused on high-value segments like specialized chemical IBCs and temperature-controlled containers for healthcare supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reusable Container Market.- CHEP (Brambles Ltd.)

- ORBIS Corporation

- Schoeller Allibert

- Schaefer Systems International (SSI SCHAEFER)

- Rehrig Pacific Company

- IFCO Systems

- Loscam

- Cabka Group

- Polymer Logistics

- Myers Industries, Inc.

- Buckhorn, Inc.

- TPS Rental Systems

- TranPak, Inc.

- Menasha Corporation

- DS Smith

- World Steel Pallet Co., Ltd.

- RM2 International S.A.

- Greif, Inc.

- GEFCO

- Tri-Wall Group

Frequently Asked Questions

Analyze common user questions about the Reusable Container market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Reusable Container Market?

The primary driver is the accelerating global focus on circular economy principles and mandated corporate sustainability targets. Regulations enforcing plastic reduction and taxation on single-use packaging significantly enhance the economic viability of long-term reusable container systems, particularly in established markets like Europe and North America.

How does the total cost of ownership (TCO) compare between reusable and single-use packaging?

While reusable containers require a higher initial capital investment, their superior durability and extended lifespan (often lasting 5 to 10 years or more) result in a significantly lower TCO over the long term compared to the recurring procurement costs of single-use options, coupled with reduced waste disposal fees.

Which segment is expected to show the highest adoption rate by end-use industry?

The Food and Beverage (F&B) industry is expected to maintain the highest volume adoption rate, driven by stringent hygiene requirements, the need for robust cold chain logistics, and the widespread use of standardized reusable plastic containers (RPCs) for fresh produce and prepared foods across global retail supply chains.

What are the main logistical challenges associated with implementing reusable container systems?

The main logistical challenge is managing efficient and cost-effective reverse logistics. This includes the complexities of retrieving, tracking, cleaning, maintaining, and repositioning empty containers back to their point of origin, requiring robust IT infrastructure and network coordination.

How are new technologies like IoT and AI integrated into reusable container management?

IoT sensors provide real-time location and environmental data for asset tracking and monitoring product integrity. AI/Machine Learning models utilize this data to optimize container routing, predict necessary maintenance, and enhance the efficiency of shared pooling services, transforming management from reactive to predictive.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager