Reverse Vending Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437285 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Reverse Vending Machine Market Size

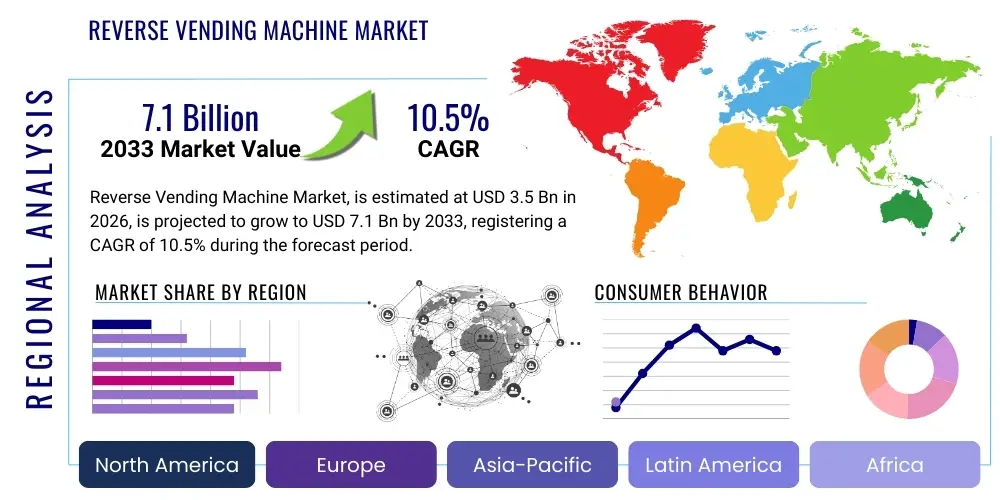

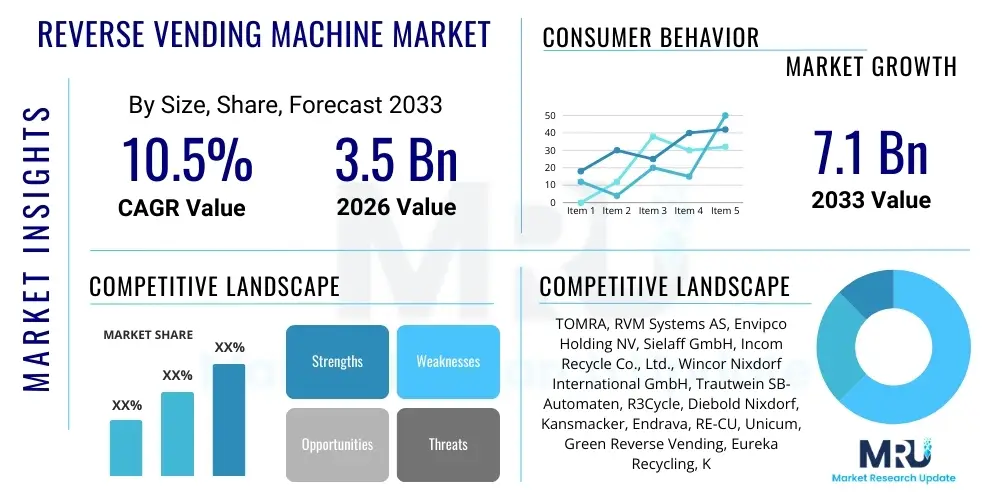

The Reverse Vending Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033.

Reverse Vending Machine Market introduction

The Reverse Vending Machine (RVM) Market encompasses the design, manufacture, distribution, and utilization of automated machines that accept used beverage containers (such as plastic bottles, aluminum cans, and glass) and refund deposits or issue coupons to the user. These machines serve as crucial infrastructure within Deposit Return Schemes (DRS), functioning as the primary collection point for recycling efforts in high-volume retail environments and dedicated recycling centers. The core benefit of RVMs lies in their ability to automate the collection process, verify the material type, crush or compact the containers for efficient logistics, and ensure accurate tracking of returned materials, thereby enhancing the overall efficiency and transparency of recycling programs globally. This technology directly supports the transition towards a circular economy by increasing recycling rates and reducing litter.

Product descriptions within this market vary based on capacity, material handling capabilities, and technological sophistication. Basic RVMs focus solely on container recognition and deposit return, while advanced models incorporate features like touchscreen interfaces, network connectivity (IoT), remote diagnostics, and AI-powered sorting mechanisms. Major applications are predominantly found in high-traffic commercial areas where consumers frequently purchase beverages, including supermarkets, hypermarkets, convenience stores, and dedicated public recycling kiosks. The effectiveness of RVMs is directly tied to governmental policy implementation, particularly mandatory Deposit Return Schemes, which incentivize consumer participation by attaching a redeemable monetary value to the packaging.

Key driving factors propelling the market expansion include the escalating global pressure to meet stringent environmental regulations concerning plastic waste reduction and single-use packaging. Consumers are increasingly aware of their environmental footprint, demanding convenient and reliable recycling options. Furthermore, retailers benefit from RVMs by optimizing in-store labor requirements associated with manual returns, improving hygiene standards, and attracting environmentally conscious customers. The continuous innovation in sensor technology and data analytics integration allows RVM operators to gain valuable insights into consumer recycling behavior and material flow, further optimizing logistics and resource management across the recycling value chain.

Reverse Vending Machine Market Executive Summary

The Reverse Vending Machine market is experiencing robust growth, driven primarily by the global proliferation and expansion of mandatory Deposit Return Schemes (DRS), particularly across Europe and parts of Asia Pacific. Business trends indicate a strong shift toward interconnected RVM solutions, utilizing IoT to facilitate real-time monitoring, predictive maintenance, and seamless data integration with retailer inventory and financial systems. Manufacturers are focusing on developing multi-feed systems capable of handling large volumes rapidly, reducing consumer wait times, and enhancing the overall user experience. Furthermore, strategic partnerships between RVM vendors and waste management companies are becoming common, aiming to create end-to-end material recovery solutions that simplify the recycling logistics pipeline from collection point to reprocessing facility, aligning business interests with sustainability mandates.

Regionally, Europe maintains market leadership due to established and long-standing DRS policies in countries like Germany, Norway, and Finland, coupled with recent major expansions in Eastern and Southern European nations adopting new legislation. Asia Pacific is poised for the fastest growth, fueled by densely populated nations like China, South Korea, and emerging economies implementing pilot programs or full-scale DRS initiatives to combat severe municipal waste challenges. North America, specifically the US states and Canadian provinces with existing bottle bills, presents steady replacement and upgrade demand, while emerging policy discussions in non-deposit states signal significant future market potential. The regional trends highlight a clear correlation between governmental regulatory commitment and market penetration rates for RVM technology.

Segmentation trends show that the Multi-Feed segment is gaining dominance, largely favored by high-volume retailers seeking efficiency and speed. In terms of material type, RVMs designed for PET/Plastic containers constitute the largest share due to the ubiquitous use of plastic in beverage packaging and high recycling recovery goals for plastics globally. The application segment remains heavily concentrated in Supermarkets and Hypermarkets, as these locations offer the required consumer traffic and infrastructure for large RVM deployment. Future segment growth is expected in public domain applications (transport hubs, universities) utilizing compact, standalone units, and the integration of advanced recognition technologies to handle increasingly complex container materials and shapes effectively.

AI Impact Analysis on Reverse Vending Machine Market

Users frequently inquire about how Artificial Intelligence (AI) will fundamentally change the operational efficiency, material sorting accuracy, and consumer interaction capabilities of Reverse Vending Machines. Common questions center on the ability of AI to differentiate between similar-looking but structurally different materials (e.g., food-grade versus non-food-grade PET), how machine learning algorithms improve fraud detection rates against non-eligible containers, and the role of predictive analytics in optimizing RVM maintenance schedules. Users also express interest in AI-driven personalization of the user experience, such as tailored couponing or gamification based on individual recycling history. The consensus expectation is that AI integration will shift RVMs from simple mechanical collection points into smart, connected data nodes essential for advanced material recovery systems, thereby increasing both profitability and environmental performance metrics significantly.

The integration of AI, specifically through computer vision and machine learning (ML), addresses several historical constraints of RVM technology. Traditional RVMs rely on barcode recognition and basic shape/weight sensors, which are vulnerable to label damage or subtle fraudulent attempts. AI-powered image recognition algorithms can identify container integrity, brand, size, and material composition even when visual identification markers are obscured, dramatically improving sorting precision and reducing ineligible returns. Furthermore, ML models analyze operational data—such as peak usage times, component wear rates, and common fault types—to predict failures before they occur, scheduling preventative maintenance automatically and boosting machine uptime, which is a critical performance indicator for retailers.

Beyond internal operations, AI enhances the strategic value of the RVM data collected. Retailers and producers can utilize AI-processed data to gain granular insights into package consumption patterns, regional recycling disparities, and the effectiveness of specific container designs in the circular economy loop. This feedback loop allows beverage companies to optimize packaging for better recyclability. The deployment of AI-enabled chatbot interfaces or voice command features also streamlines the user experience, making recycling more intuitive for all demographics, thereby supporting broader participation in DRS programs, which is crucial for achieving high recovery targets set by regulatory bodies.

- Enhanced container recognition and sorting accuracy using Computer Vision and Machine Learning.

- Improved fraud detection through pattern analysis of ineligible returns and altered containers.

- Predictive maintenance scheduling, maximizing RVM uptime and operational efficiency.

- Personalized user interaction and tailored reward systems (couponing) driven by user history analysis.

- Optimization of logistics and material routing based on real-time collection data and AI forecasting.

DRO & Impact Forces Of Reverse Vending Machine Market

The Reverse Vending Machine Market is highly dynamic, being driven by stringent regulatory frameworks, constrained by significant upfront investment hurdles, and simultaneously presented with vast opportunities arising from technological integration. The primary driver is the accelerating global adoption of mandatory Deposit Return Schemes (DRS), which instantly creates demand for the collection infrastructure. However, the high initial capital expenditure required for sophisticated RVM units, coupled with the logistical complexities of deploying and maintaining a large fleet across diverse retail environments, acts as a primary restraint, especially in markets with nascent recycling cultures. The major opportunity lies in leveraging IoT, AI, and Big Data analytics to transform RVMs into smarter, multi-functional collection points that reduce operational expenditure over time and enhance data monetization potential. These forces collectively define the market trajectory, strongly favoring regions and companies that can navigate high regulatory compliance costs while capitalizing on technological advancements to drive operational efficiencies.

The impact forces within the market are predominantly regulatory and technological. Regulatory forces dictate market expansion, as the establishment or expansion of a DRS guarantees a baseline level of investment and sustained demand. Conversely, the absence of such schemes renders RVM deployment economically unviable. Technological impact forces, particularly the push towards smarter machines, are essential for overcoming the restraint of high operational costs. For instance, the transition to sensor-based sorting and network connectivity reduces labor dependence and lowers the total cost of ownership (TCO) for retailers. Furthermore, the strong societal pressure regarding Environmental, Social, and Governance (ESG) criteria compels major beverage producers and retailers to invest in visible, public recycling solutions like RVMs, irrespective of immediate profitability, viewing it as a critical component of corporate responsibility and brand image protection.

The delicate balance between legislative requirements (Drivers) and the financial viability of deployment (Restraints) is moderated by technological innovation (Opportunities). Successful market participants will be those who develop modular and scalable RVM solutions that can be affordably implemented in various retail formats—from large hypermarkets requiring high-throughput bulk-feed systems to smaller convenience stores needing compact, standalone units. The integration of advanced diagnostics and remote management is not just an opportunity but becoming a necessity to manage maintenance costs effectively across geographically dispersed networks. These integrated solutions are essential for realizing the full potential of DRS programs, ensuring maximum container recovery rates, and providing high quality, clean feedstock for the recycling industry.

Segmentation Analysis

The Reverse Vending Machine market segmentation provides a granular view of product diversity and application relevance across various end-user environments. The market is primarily segmented based on Product Type (defining capacity and operational mechanism), Material Type (identifying the containers accepted), and Application (identifying the deployment location). This structural breakdown is essential for stakeholders to understand where investment is concentrated and where niche market opportunities exist. The dominant trend across all segments is the preference for high-throughput, integrated systems that minimize human intervention, especially in countries with well-established and highly utilized DRS programs, where efficiency and speed are paramount to handling millions of returns daily. Furthermore, the move towards multi-material capability addresses the complex reality of modern beverage consumption patterns.

The segmentation by Product Type distinguishes between basic machines, which handle single items (Standalone), and advanced machines designed for continuous, high-speed returns (Bulk Feed and Multi-Feed). The Bulk Feed segment is gaining traction due to its ability to process a large quantity of containers dropped simultaneously, dramatically reducing consumer queuing time, making it ideal for massive retail outlets. Conversely, the Material Type segmentation confirms that PET/Plastic bottles hold the largest market share, reflecting global beverage packaging trends, although the ability to process glass remains critical in markets like Germany where glass deposit schemes are prevalent. Application analysis clearly identifies retail environments (Supermarkets and Hypermarkets) as the primary revenue generators due to the mandatory nature of collection points under most DRS legislation.

Future growth analysis within these segments suggests intensified competition in the development of modular RVMs that can adjust capacity based on location and seasonality. There will also be increased emphasis on RVMs capable of distinguishing newer, complex bioplastics and compostable materials if these enter mainstream DRS programs, necessitating continuous technological upgrades in sensor and recognition systems. The integration of payment processing options beyond standard deposit refunds (e.g., charity donations, direct mobile payments) is also driving innovation within the application segment, transforming RVMs into community engagement hubs rather than just simple recycling machines. This layered segmentation insight allows vendors to tailor product development to specific regulatory and consumer requirements globally.

- Product Type:

- Bulk Feed RVMs

- Multi-Feed RVMs

- Standalone/Semi-Automatic RVMs

- Material Type:

- PET/Plastic Containers

- Glass Containers

- Metal Cans (Aluminum/Steel)

- Application:

- Supermarkets and Hypermarkets

- Retail Stores and Convenience Stores

- Recycling Centers and Kiosks

- Others (Universities, Transport Hubs, Public Venues)

Value Chain Analysis For Reverse Vending Machine Market

The Value Chain for the Reverse Vending Machine market is structurally complex, commencing with upstream activities related to component sourcing and sophisticated manufacturing, extending through distribution, deployment, and concluding with critical downstream operations involving logistics and data management. Upstream analysis focuses on the procurement of specialized components, including advanced sensor technology (barcode readers, material recognition sensors, weight scales), robust crushing/compaction mechanisms, and sophisticated software and networking modules. Key strategic partnerships at this stage involve suppliers of durable industrial-grade plastics and metals, as well as high-tech sensor manufacturers. Efficiency and quality control at the manufacturing stage are paramount, as RVMs are required to operate reliably under high usage conditions in diverse retail environments, necessitating substantial R&D investment in modular design and robust engineering.

The midstream component involves the distribution and sales channels. Due to the high-value nature and customization requirements of RVMs, direct sales models, where manufacturers engage directly with large retail chains, container deposit operators, and governmental bodies, are dominant. Indirect distribution is utilized through authorized system integrators and distributors, particularly in emerging markets where local support and regulatory navigation are crucial. The installation and commissioning phases are highly specialized, often requiring dedicated technical teams to integrate the RVM into the retailer’s existing infrastructure, including power, network, and security systems. The distribution channel must also support the long lifecycle of the product, necessitating comprehensive training and spare parts logistics.

Downstream activities are defined by the operational life of the RVM and include maintenance, material logistics, and data utilization. Effective downstream management involves remote diagnostics and preventative maintenance services (often subscription-based) to ensure maximum uptime. The logistics network—the process of emptying the collected, often compacted, materials and transporting them to recycling facilities—is critical and requires tight coordination between the RVM operator, the retailer, and the recycling reprocessing industry. Data generated by the RVMs (volumes, types, usage patterns) is the final, high-value element of the chain, utilized for strategic planning, fraud monitoring, and compliance reporting to regulatory bodies, providing a basis for potential data monetization services.

Reverse Vending Machine Market Potential Customers

The primary customer base for the Reverse Vending Machine Market consists of entities mandated or incentivized to operate collection points under Deposit Return Schemes (DRS). End-users, or buyers, are dominated by large retail enterprises, including major supermarket chains and hypermarkets, who utilize RVMs to fulfill their legal obligations for container returns and to maintain customer convenience. These retailers often require high-capacity, integrated RVM systems capable of handling peak volumes and integrating seamlessly with their existing point-of-sale and back-office systems. The decision-making process for these buyers is heavily influenced by total cost of ownership (TCO), machine reliability, and the efficiency of material handling within a constrained retail space.

A secondary, yet rapidly growing, customer segment includes specialized waste management and recycling companies, particularly those acting as Central System Administrators (CSAs) or Program Operators for DRS programs. These organizations purchase RVMs for deployment in dedicated community recycling centers or as public access kiosks (often located in transport hubs, municipal areas, or educational campuses). Their purchasing decisions prioritize robustness, vandalism resistance, and network compatibility, as they often manage vast, geographically dispersed fleets of machines. Furthermore, governmental and municipal bodies sometimes procure RVMs directly for deployment in public areas as part of broader environmental initiatives, seeking highly accessible and user-friendly units to encourage citizen participation.

Beyond traditional buyers, the tertiary customer base includes beverage producers and brand owners, who, while not directly operating the machines, often invest in RVM technology through sponsorship or shared responsibility schemes to meet Extended Producer Responsibility (EPR) targets. Their interest lies in ensuring high-quality material recovery and promoting their commitment to sustainability. Overall, the market centers on organizations that value automated efficiency, regulatory compliance, and the ability to integrate recycling efforts directly into the consumer shopping experience, making high-volume retail environments the sustained core of demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TOMRA, RVM Systems AS, Envipco Holding NV, Sielaff GmbH, Incom Recycle Co., Ltd., Wincor Nixdorf International GmbH, Trautwein SB-Automaten, R3Cycle, Diebold Nixdorf, Kansmacker, Endrava, RE-CU, Unicum, Green Reverse Vending, Eureka Recycling, KIS-France, Aco Recycling, Star Vending, TerraCycle, New Vision RVM |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reverse Vending Machine Market Key Technology Landscape

The technological evolution of the Reverse Vending Machine market is moving rapidly beyond simple mechanical collection toward integrated smart systems, defined primarily by advancements in sensor technology, material recognition software, and Internet of Things (IoT) connectivity. A critical technology is the utilization of advanced optical sensors and multi-spectral imaging systems combined with machine learning algorithms. These systems allow RVMs to accurately determine the material type, integrity, and brand identity of a container, even when barcodes are damaged or labels are removed. This precise recognition capability is vital for compliance with strict DRS regulations which often require differentiation between recyclable materials and non-eligible containers, significantly boosting system trustworthiness and minimizing instances of fraud.

Another major technological pillar is the widespread adoption of IoT platforms for fleet management. Modern RVMs are equipped with integrated modems and cloud connectivity, enabling real-time transmission of operational data, including container count, fill levels, system diagnostics, and financial transaction data. This connectivity facilitates critical functions such as remote software updates, immediate alerts for mechanical failures, and dynamic route optimization for logistics partners responsible for material collection. This shift from physical monitoring to remote digital management drastically reduces operational expenditure for retailers and system operators, ensuring higher machine uptime—a key metric for consumer satisfaction and regulatory performance.

Furthermore, innovations are focused on enhancing user interface and power efficiency. High-resolution touchscreens and intuitive software are standard, often integrating features like customized coupon dispensing, mobile payment options, and personalized user profiles that track recycling achievements. Energy optimization technologies, particularly the development of high-efficiency crushing mechanisms and sleep modes, ensure that the large-scale RVM deployment remains sustainable from an energy consumption perspective. The integration of advanced compaction technology, such as shredding mechanisms for PET, also maximizes the storage capacity within the RVM, reducing the frequency of necessary material collection runs, thus contributing to overall logistical efficiency and sustainability goals.

Regional Highlights

Regional dynamics play a paramount role in shaping the Reverse Vending Machine market, with market size and growth dictated primarily by regulatory mandate. Europe currently dominates the global market, benefiting from mature, high-participation Deposit Return Schemes (DRS) that have been operational for decades in nations like Germany, Norway, and Sweden. Germany, in particular, showcases the highest RVM penetration due to its highly successful Pfand system, driving continuous demand for replacement units and capacity upgrades. Recent adoption of new DRS legislation in the UK, Scotland, and various Central European countries is creating massive greenfield opportunities, ensuring Europe’s continued leadership.

Asia Pacific (APAC) is projected to be the fastest-growing regional market, catalyzed by rapidly increasing urbanization, severe plastic waste crises, and governmental responses to improve recycling infrastructure. Countries like South Korea and potentially India and China are exploring or piloting large-scale DRS programs, creating explosive demand for RVM technology. The challenge in APAC lies in adapting RVM units to handle diverse packaging standards and integrating systems within fragmented retail and waste management landscapes, requiring customizable and robust solutions tailored for high population density.

North America remains a crucial market, driven by existing state-level bottle bills (e.g., California, Michigan, New York). While growth is steady, future expansion is contingent on the political adoption of DRS in non-deposit states. The US market emphasizes high-capacity machines and robust integration with retail loyalty programs. Latin America and the Middle East & Africa (MEA) are emerging markets, currently characterized by smaller pilot programs and localized initiatives, primarily focusing on addressing tourism-related litter and demonstrating corporate ESG commitments, signaling nascent but strong potential linked to future policy development.

- Europe: Market leader due to mature DRS programs (Germany, Scandinavia) and recent major legislative rollouts (UK, Eastern Europe), focusing on high-volume, integrated RVM systems.

- Asia Pacific (APAC): Fastest-growing region, driven by governmental mandates to combat plastic pollution (South Korea, potential large-scale adoption in high-density economies), requiring flexible, scalable RVM solutions.

- North America: Steady market relying on established bottle bills in select states and provinces; high demand for technologically advanced, integrated retail solutions and lobbying for expanded DRS coverage.

- Latin America & MEA: Emerging markets with localized pilot programs and increasing focus on public-access kiosks to manage specific urban waste challenges and meet sustainability goals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reverse Vending Machine Market.- TOMRA

- RVM Systems AS

- Envipco Holding NV

- Sielaff GmbH

- Incom Recycle Co., Ltd.

- Wincor Nixdorf International GmbH

- Trautwein SB-Automaten

- R3Cycle

- Diebold Nixdorf

- Kansmacker

- Endrava

- RE-CU

- Unicum

- Green Reverse Vending

- Eureka Recycling

- KIS-France

- Aco Recycling

- Star Vending

- TerraCycle

- New Vision RVM

Frequently Asked Questions

Analyze common user questions about the Reverse Vending Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Reverse Vending Machine (RVM) and how does it work?

An RVM is an automated device that accepts used beverage containers (plastic, glass, aluminum) and issues a cash deposit refund or coupon to the user. It works by scanning the container's barcode and using advanced sensors to verify material type and eligibility before sorting and compacting the item internally for efficient recycling logistics.

How significant is the role of Deposit Return Schemes (DRS) in driving RVM market growth?

DRS is the single most critical driver. Mandatory DRS legislation, which assigns a refundable deposit value to packaging, directly compels retailers and operators to install RVMs to manage container returns, instantly creating and sustaining massive market demand for the necessary collection infrastructure.

What are the key technological advancements expected to impact RVMs?

Key advancements include the integration of Artificial Intelligence (AI) for enhanced material recognition and fraud detection, the deployment of IoT for real-time remote monitoring and predictive maintenance, and improved compaction technologies to maximize internal storage capacity and reduce collection frequency.

Which region currently leads the global Reverse Vending Machine market?

Europe currently leads the global market due to the maturity and high penetration rates of long-established DRS programs in countries like Germany and Scandinavia, coupled with significant recent expansion driven by new legislative mandates across the continent.

What is the primary restraint facing RVM market expansion?

The primary restraint is the high initial capital investment required for purchasing, installing, and integrating sophisticated RVM hardware, coupled with the ongoing operational costs associated with maintenance and logistical management of the collected materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager