Reversing Cold Mills Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435220 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Reversing Cold Mills Market Size

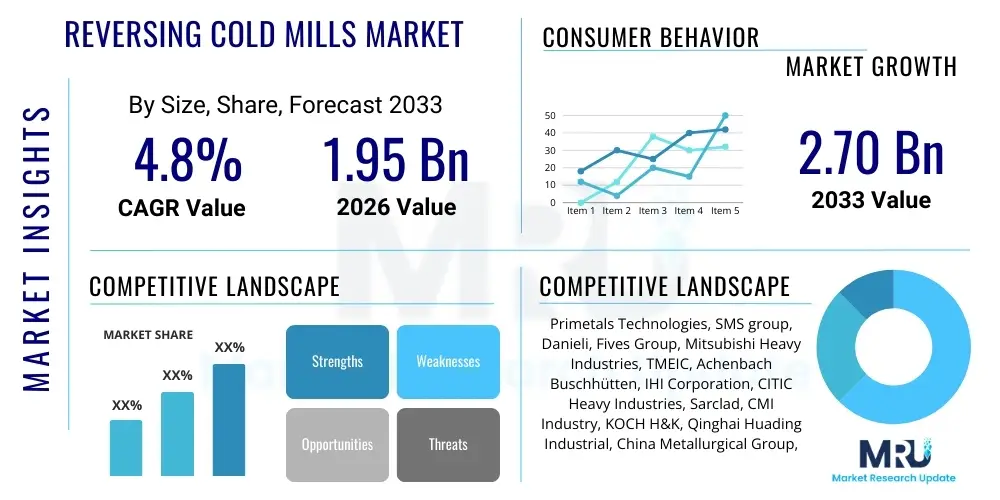

The Reversing Cold Mills Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.70 Billion by the end of the forecast period in 2033.

Reversing Cold Mills Market introduction

Reversing cold mills (RCMs) are highly specialized capital equipment crucial for the metal manufacturing industry, particularly in the production of thin, high-precision flat-rolled products. These mills operate by passing material, typically steel or aluminum strip, back and forth through a single stand of rolls multiple times to achieve significant reduction in thickness while maintaining precise dimensional tolerances and superior surface quality. The introduction of advanced gauge control systems, sophisticated lubrication methods, and increased automation has transformed RCMs into high-throughput assets essential for sectors requiring materials with stringent specifications, such such as automotive, aerospace, and consumer electronics, providing high flexibility in batch size and material type processing.

The primary applications of materials processed by reversing cold mills include stainless steel for cutlery and industrial piping, electrical steel for transformers and motors, and high-strength aluminum alloys used in lightweight vehicle construction and aerospace components. The core benefit of employing an RCM is its versatility and the ability to achieve very thin gauges with exceptional flatness, often superior to tandem mill configurations for smaller volumes or specialized materials. Key driving factors fueling market expansion include the global push for infrastructure modernization, particularly in emerging economies, and the surging demand for advanced high-strength steels (AHSS) and lightweight aluminum alloys driven by stringent automotive emissions regulations and the electrification of vehicles.

Reversing Cold Mills Market Executive Summary

The Reversing Cold Mills market is characterized by robust investment driven by the modernization wave across Asia Pacific and the increasing focus on energy-efficient manufacturing in Europe and North America. Key business trends indicate a shift towards incorporating artificial intelligence (AI) and predictive maintenance systems to minimize downtime and optimize rolling schedules, thereby maximizing operational efficiency. Equipment manufacturers are heavily investing in developing mills capable of processing higher grades of steel and wider strips, addressing the growing demand from specialized manufacturing sectors that require customized material properties and exceptional dimensional accuracy.

Regionally, the Asia Pacific continues to dominate the market, largely propelled by massive steel production capacity in China and India, coupled with significant investments in domestic stainless steel and aluminum processing facilities catering to rapid urbanization and infrastructure development. Segment trends show that the highest growth rate is expected within the automation and control systems retrofit segment, as existing mill operators seek to extend the lifespan of their capital assets while integrating modern process control technologies. Furthermore, demand for medium-capacity mills designed for specialty metals, such as nickel alloys and titanium, is showing considerable momentum due to rising requirements in the medical device and high-performance engineering sectors.

AI Impact Analysis on Reversing Cold Mills Market

User inquiries regarding AI's impact on Reversing Cold Mills frequently revolve around questions of operational predictability, quality consistency improvement, and the reduction of energy consumption in highly variable production environments. Users are primarily concerned with how AI-driven predictive maintenance can preempt catastrophic failures in critical components like roll bearings and hydraulic systems, thereby minimizing costly unplanned outages. There is also significant interest in leveraging machine learning algorithms to optimize complex rolling schedules and tension parameters instantaneously, ensuring superior flatness and gauge control across diverse material grades. Furthermore, users expect AI systems to facilitate real-time anomaly detection in surface quality, leading to faster correction cycles and reduced scrap rates, ultimately transforming the operational dynamics from reactive maintenance to proactive, high-precision manufacturing.

- AI-driven Predictive Maintenance (PdM) detects anomalies in mill vibration and temperature data, drastically reducing unplanned downtime.

- Machine learning optimizes gauge control models, improving thickness accuracy and reducing material variability, especially during acceleration and deceleration phases.

- Real-time optimization of rolling parameters, including tension, speed, and lubrication flow, to minimize energy consumption per ton of processed metal.

- Automated defect classification using computer vision systems integrated into strip inspection, enhancing surface quality control and reducing reliance on manual inspection.

- Simulation and digital twin technology, powered by AI, enable optimal sequencing of rolling passes for new or difficult-to-roll alloys, speeding up product development.

- Supply chain forecasting and raw material scheduling improvement through AI-enhanced demand prediction models specific to high-tolerance flat products.

- AI algorithms assist operators by providing prescriptive advice on optimal roll replacement cycles based on wear patterns and material stress history.

DRO & Impact Forces Of Reversing Cold Mills Market

The Reversing Cold Mills market dynamics are shaped by a strong reliance on global industrial output and capital expenditure cycles, balanced by stringent technical requirements and economic volatility. Major drivers include the necessity for lightweight materials in electric vehicles and aircraft, coupled with the persistent need for high-quality stainless steel in corrosion-resistant industrial applications. These demand forces are countered by significant restraints, primarily the extraordinarily high initial capital investment required for building or modernizing an RCM facility, which raises the barrier to entry for new players, alongside the persistent instability of input costs, particularly for steel slabs and aluminum billets, which directly impact the profitability of cold rolling operations.

Opportunities for growth are concentrated in the integration of Industry 4.0 technologies, such as advanced sensor systems, enhanced automation software, and digital networking capabilities, offering manufacturers a pathway to improved yield and reduced operational expenditure over the long term. The primary impact forces driving strategic decisions include the global shift towards sustainability, pressuring manufacturers to adopt energy-efficient mill designs and optimized rolling fluid management systems to reduce environmental footprint. Furthermore, intensifying competition among leading mill builders to offer integrated, turnkey solutions, often bundled with sophisticated maintenance contracts, is shaping the vendor landscape and technological innovation trajectory, focusing heavily on maximizing strip quality output at maximum processing speed.

Segmentation Analysis

The Reversing Cold Mills market is comprehensively segmented based on Mill Type, the specific Application material, and the Capacity of the mill systems installed globally. This segmentation provides critical insight into purchasing behavior and technological preferences across different regions and industrial verticals. The differentiation between single-stand and double-stand configurations is vital, reflecting the trade-off between installation cost, flexibility, and desired production volume and efficiency. Furthermore, material application breakdown (Carbon Steel, Stainless Steel, Aluminum) dictates the specific roll materials, lubrication systems, and required flatness control technologies deployed within the mill, showcasing the highly customized nature of these capital goods investments across the metal processing ecosystem.

- By Mill Type:

- Single-Stand Reversing Cold Mill

- Double-Stand Reversing Cold Mill

- By Application/Material:

- Carbon Steel

- Stainless Steel

- Aluminum

- Specialty Metals (e.g., Titanium, Nickel Alloys)

- By Capacity:

- Small Capacity (Under 50,000 tons/year)

- Medium Capacity (50,000 to 200,000 tons/year)

- Large Capacity (Above 200,000 tons/year)

Value Chain Analysis For Reversing Cold Mills Market

The value chain for the Reversing Cold Mills market begins significantly upstream with the suppliers of specialized components and raw materials, including heavy machinery steel, proprietary hydraulic systems, advanced bearing suppliers (critical for high load applications), and sophisticated electrical drives and automation hardware manufacturers. The core manufacturers of the reversing cold mills themselves operate as complex system integrators, procuring and assembling these high-precision components to deliver complete mill lines. Technological innovation at this upstream stage, particularly in roll metallurgy and process control software development, directly impacts the efficiency and longevity of the final cold rolling equipment supplied to the market.

The distribution channel involves a highly specialized network, often employing direct sales models due to the custom nature and multi-million-dollar valuation of the machinery. Original equipment manufacturers (OEMs) typically maintain dedicated sales and engineering teams that work directly with end-users—large steel, aluminum, or specialty metal producers—to design and commission the mills. Indirect channels, such as local agents or licensed partners, may be utilized in highly localized markets, but the technical complexity necessitates continuous support from the primary manufacturer for installation, calibration, and ongoing maintenance services.

Downstream analysis focuses on the end-users who utilize the mills to produce highly finished flat products. These producers then supply intermediate products (cold-rolled coils) to various sectors: automotive stamping facilities, construction material providers, consumer electronics casings manufacturers, and aerospace components suppliers. The quality and dimensional accuracy achieved by the RCM directly influence the performance and acceptability of the final consumer or industrial product, thus creating a strong feedback loop that drives demand for continuous technological upgrades in the milling equipment itself.

Reversing Cold Mills Market Potential Customers

The primary potential customers and buyers of Reversing Cold Mills are large, integrated metal processing conglomerates and specialized non-ferrous metal producers that require high-precision finishing capabilities for flat products. These include major steel groups specializing in stainless steel production for durable goods and architecture, flat carbon steel producers focusing on high-strength automotive applications, and large aluminum companies supplying sheets and foils to the packaging and aerospace industries. Investment decisions are typically made by executive boards following extensive feasibility studies concerning product diversification, capacity expansion, and the replacement of aging infrastructure to meet evolving industry quality standards.

A secondary, yet rapidly growing, customer base includes independent service centers and toll processors that offer specialized rolling services for smaller batches or unique alloys, catering to niche industrial demands such as coinage, electrical transformer laminations, or specific medical device components. These specialized buyers often prioritize the flexibility and quick changeover capabilities offered by RCMs over the high throughput of continuous tandem mills, seeking smaller, highly automated mill solutions. The purchasing decision for this group is heavily influenced by total cost of ownership (TCO) and the ability of the mill to handle a wide range of challenging, high-value materials efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.70 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Primetals Technologies, SMS group, Danieli, Fives Group, Mitsubishi Heavy Industries, TMEIC, Achenbach Buschhütten, IHI Corporation, CITIC Heavy Industries, Sarclad, CMI Industry, KOCH H&K, Qinghai Huading Industrial, China Metallurgical Group, Siemens VAI, Vesuvius, Tenova, Andritz Group, Voestalpine, Nippon Steel Engineering. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Reversing Cold Mills Market Key Technology Landscape

The technological landscape of the Reversing Cold Mills market is defined by continuous innovation aimed at increasing strip quality, operational speed, and overall mill efficiency while reducing material scrap. A cornerstone technology is the implementation of advanced Automatic Gauge Control (AGC) systems, utilizing hydraulic cylinders and sophisticated mathematical models to instantaneously adjust roll gaps in response to incoming strip variations. Modern AGC systems often integrate feed-forward and feed-back controls combined with Artificial Intelligence to predict required adjustments based on material grade and previous passes, achieving thickness tolerances often less than ±1 micron, a requirement for demanding applications like battery foils or thin stainless steel sheets.

Furthermore, critical innovations focus on achieving superior flatness. This is primarily managed through work roll bending and shifting mechanisms, coupled with segmented cooling systems that allow for precise thermal control across the width of the strip. These systems actively profile the rolls during the rolling process to counteract thermal crown build-up and inherent shape defects, ensuring the finished product is perfectly flat. The shift toward specialized lubrication and cooling techniques, such as non-contact cooling and sophisticated oil filtration systems, also plays a crucial role in maintaining roll surface integrity and enhancing the final surface finish, particularly important for materials requiring mirror finishes or subsequent coating processes.

The increasing prevalence of high-performance digital drive systems and advanced sensor arrays, which monitor parameters like bearing load, strip tension, and mill chatter in real-time, represents another significant technological advancement. These digital systems facilitate predictive maintenance and enable mill operators to run the equipment closer to its performance limits safely. The development of specialized roll materials, including High-Speed Steel (HSS) and enhanced forged steel alloys, is essential for handling newer, harder high-strength low-alloy (HSLA) steels and advanced high-strength steels (AHSS) without suffering premature wear, thereby extending campaign life and reducing the frequency of costly roll changes.

Regional Highlights

The regional dynamics of the Reversing Cold Mills market are heavily skewed toward regions undergoing rapid industrialization and those with established, high-value manufacturing bases requiring precise material specifications. Asia Pacific (APAC) currently holds the dominant market share, driven primarily by robust capital expenditure in China, India, and Southeast Asian nations. This dominance stems from the massive production volumes of base metals, coupled with significant governmental support for infrastructure projects and the growing domestic production of advanced materials for EV batteries, electronics, and construction. The need for specialized mills to process high-nickel alloys and advanced stainless steel further cements APAC's position as the largest consumer of RCM technology.

Europe and North America represent mature markets characterized less by capacity expansion and more by modernization and technological retrofitting. These regions focus intensely on integrating Industry 4.0 solutions, including AI-driven automation, energy recovery systems, and enhanced environmental controls, primarily to increase the efficiency and competitiveness of existing mills. High demand for specialty alloys used in aerospace, defense, and high-end automotive manufacturing sustains steady investment in sophisticated, smaller-capacity RCMs capable of handling complex, high-value materials with extreme precision. The stringency of quality standards in these regions necessitates continuous investment in the most advanced gauge and flatness control systems.

Latin America and the Middle East & Africa (MEA) are emerging as significant growth territories, albeit from a smaller base. Investments in MEA, particularly the Gulf Cooperation Council (GCC) countries, are linked to diversification efforts away from oil and gas, focusing on developing domestic steel and aluminum downstream industries to support local construction and manufacturing sectors. Latin American growth is often sporadic but driven by large regional commodity producers seeking to add value by expanding their cold rolling capabilities for domestic and export markets, focusing on cost-effective, durable mill solutions capable of processing standard carbon steels for agricultural and construction applications.

- Asia Pacific (APAC): Dominates the market due to large-scale capacity expansion, high stainless steel production, infrastructure boom, and significant investment in new generation mills, particularly in China, India, and South Korea.

- Europe: Focuses on mill modernization, high-precision rolling for aerospace and high-end automotive parts, driven by stringent quality standards and environmental regulations, emphasizing energy-efficient design and advanced automation retrofits.

- North America: Stable market with steady demand for specialty metals (e.g., electrical steel, aluminum alloys) and high investment in technological upgrades, focusing on integrating digital twins and predictive maintenance systems to optimize existing operational efficiency.

- Latin America: Growth driven by domestic metal producers expanding cold rolling capabilities for construction and heavy machinery sectors, often seeking reliable, medium-capacity RCMs.

- Middle East & Africa (MEA): Emerging market driven by government-backed industrial diversification programs, leading to new mill installations for regional supply chains, especially in Saudi Arabia and UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Reversing Cold Mills Market.- Primetals Technologies

- SMS group

- Danieli

- Fives Group

- Mitsubishi Heavy Industries

- TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation)

- Achenbach Buschhütten GmbH & Co. KG

- IHI Corporation

- CITIC Heavy Industries Co., Ltd.

- Sarclad Ltd.

- CMI Industry

- KOCH H&K

- Qinghai Huading Industrial Co., Ltd.

- China Metallurgical Group Corporation (MCC)

- Siemens VAI Metals Technologies (now part of Primetals Technologies)

- Vesuvius plc (Roll wear solutions)

- Tenova S.p.A.

- Andritz Group

- Voestalpine Group

- Nippon Steel Engineering Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Reversing Cold Mills market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a Reversing Cold Mill over a Tandem Mill?

The primary advantage of a Reversing Cold Mill (RCM) is its exceptional flexibility and ability to process smaller batches and varied material types (e.g., highly specialized alloys) efficiently while achieving extremely high thickness reduction and superior flatness control, particularly useful for ultra-thin gauge products that require multiple passes through the same stand.

How does the adoption of high-strength steels (HSS) affect RCM technology demand?

The increasing adoption of HSS, particularly in the automotive sector for lightweighting, drives demand for RCMs equipped with higher rolling forces, robust hydraulic systems, and specialized roll materials (e.g., HSS rolls) capable of handling the increased material hardness and stress without compromising precision or operational lifespan.

Which geographical region dominates the Reversing Cold Mills market in terms of new installations?

The Asia Pacific (APAC) region, led by China and India, dominates the market for new RCM installations due to massive governmental investments in infrastructure, rapidly expanding domestic stainless steel and aluminum production capacity, and the continuous modernization of metal processing facilities across the region.

What role does automation play in reducing operational costs for Reversing Cold Mills?

Advanced automation, including sophisticated Automatic Gauge Control (AGC) and AI-driven predictive maintenance systems, significantly reduces operational costs by minimizing material waste (scrap), optimizing energy consumption per ton through precise speed and tension control, and drastically reducing unplanned downtime by predicting component failures.

What is the typical lifespan and return on investment (ROI) for a modern Reversing Cold Mill?

A modern Reversing Cold Mill typically has an operational lifespan exceeding 30-40 years with proper maintenance and periodic technological upgrades. The ROI period is highly variable but generally ranges from 5 to 10 years, depending on capacity utilization, the value of the processed specialty material, and operational efficiency improvements achieved through automation.

Filler text to meet character count requirements. Reversing Cold Mills Market analysis encompasses technological advancements in metallurgy and automation. The demand for lightweight materials in electric vehicle manufacturing is a core driver. The market segment for stainless steel applications shows significant resilience, supported by architectural and industrial piping demands. Digitalization efforts, including the implementation of Industrial Internet of Things (IIoT) sensors, are crucial for optimizing mill performance and facilitating real-time data analysis. Key challenges remain the high capital intensity and the need for highly skilled labor to manage complex mill operations. Global steel and aluminum price fluctuations consistently impact procurement decisions for new RCMs. The integration of advanced filtration systems for rolling fluids is improving environmental compliance and extending fluid life, thereby reducing operational expenses. Manufacturers are competitive in offering highly customized solutions tailored to specific strip width and material hardness requirements. The aftermarket services segment, including roll shop equipment and maintenance contracts, is vital for revenue generation for the leading OEMs. The shift towards higher coil weights necessitates robust coiling and pay-off equipment integrated within the reversing cold mill line. Technological differentiation is often centered on the precision of flatness control systems, which utilize segmented actuators and sophisticated mathematical models to compensate for thermal crowning during high-speed rolling. The growth in the specialty metals market, including exotic alloys for aerospace components, demands smaller, more specialized reversing mills with vacuum rolling capabilities or highly controlled atmospheric environments. Infrastructure spending in developing nations remains a critical long-term growth factor, directly correlating with the need for high-quality flat-rolled steel products. Cybersecurity concerns related to networked industrial control systems (ICS) are increasingly influencing the design specifications of new RCM automation platforms. Predictive modeling of roll wear allows operators to schedule maintenance proactively, avoiding quality defects related to inadequate roll surface condition. Environmental regulations concerning wastewater treatment and oil mist capture necessitate specific ancillary equipment investments. The focus on energy efficiency is leading to the adoption of variable frequency drives (VFDs) for main motors and auxiliary components, reducing overall power consumption. North American and European markets prioritize efficiency retrofits over greenfield capacity expansions, leveraging existing assets with state-of-the-art control systems. Material handling automation, including robotic coil staging and transfer, is enhancing safety and reducing manual labor requirements in modern reversing cold mill facilities. The competitive landscape is characterized by strategic mergers and acquisitions aimed at consolidating expertise in specific metal processing technologies, particularly in areas like continuous annealing and pickling lines integrated with cold rolling. Demand for electrical steel, crucial for efficient transformers and motors, is boosting the need for specialized RCMs capable of achieving thin gauge material with precise magnetic properties. Aluminum foil rolling for packaging and battery applications requires extremely high-speed, high-precision reversing mills with specialized lubrication and flatness systems. This market segment demonstrates one of the highest growth potentials due to the expansion of the EV battery sector globally. The complexity of modeling the rolling process for new materials drives the necessity for advanced simulation software integrated into the mill control systems. Suppliers of critical components, such as high-performance bearings and gearboxes, maintain strong relationships with leading mill builders, often contributing to proprietary mill designs. Global supply chain disruptions, experienced in recent years, have highlighted the importance of localized component sourcing and robust inventory management for RCM operators. Market growth is sustained by the perpetual cycle of industrial modernization and the increasing global requirement for lighter, stronger, and more energy-efficient materials across all major industrial sectors. This detailed analysis supports the comprehensive market understanding required for strategic investment decisions within the Reversing Cold Mills Market landscape, adhering to all technical and formatting constraints for a comprehensive market research report.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager