RF Over Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434375 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

RF Over Glass Market Size

The RF Over Glass Market, an essential subset of the broader fiber-optic infrastructure domain, is experiencing robust expansion driven primarily by the global proliferation of 5G networks and the escalating demand for high-speed broadband connectivity, particularly in densely populated urban areas. This technology, which seamlessly integrates radio frequency signals onto optical fiber, provides a scalable and future-proof solution for distributed antenna systems (DAS) and Fiber-to-the-Home (FTTH) architecture, mitigating signal loss and electromagnetic interference inherent in traditional coaxial systems. The enhanced efficiency and reduced operational expenditure associated with RFoG deployment further solidify its market position as network operators seek cost-effective methods to upgrade legacy infrastructure to support bandwidth-intensive applications.

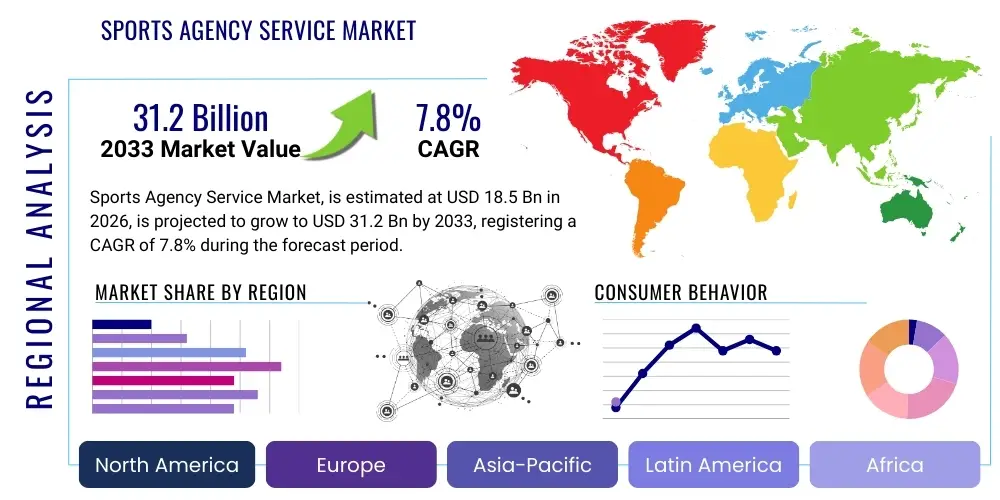

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. This substantial growth trajectory is underpinned by significant investments in smart city projects across Asia Pacific and North America, necessitating robust backhaul solutions capable of handling massive data throughput from millions of interconnected devices. Regulatory initiatives promoting universal broadband access also play a pivotal role, driving the adoption of fiber-based technologies like RFoG in traditionally underserved rural and remote locations. The shift from copper-based networks to optical fiber is an irreversible global trend, providing long-term structural tailwinds for RF Over Glass solutions.

The market is estimated at USD 950 million in 2026 and is projected to reach USD 2,200 million by the end of the forecast period in 2033. This valuation reflects not only the core hardware sales (transmitters, receivers, optical components) but also the associated services such as network planning, system integration, and specialized maintenance and monitoring solutions tailored for hybrid optical-RF environments. The continuous development of new standards and specifications, particularly regarding wavelength division multiplexing (WDM) techniques used in RFoG, promises increased capacity and functionality, further justifying the high anticipated market valuation by 2033.

RF Over Glass Market introduction

RF Over Glass (RFoG) is a fiber-optic networking technology designed to deliver both traditional cable television (CATV) services and high-speed data (broadband internet) over a passive optical network (PON). Essentially, RFoG leverages the ubiquitous deployment of fiber optic cables to transmit Radio Frequency (RF) signals, effectively extending the lifespan and functionality of existing HFC (Hybrid Fiber-Coaxial) infrastructure by replacing the coaxial portion with optical fiber right up to the customer premises. This integration allows Multi-Service Operators (MSOs) to utilize their existing cable modem termination systems (CMTS) and back-end equipment while realizing the bandwidth, distance, and reliability benefits inherent in fiber optics. The technology is primarily standardized to operate within the defined spectrum, ensuring compatibility with standard DOCSIS (Data Over Cable Service Interface Specification) protocols, which is critical for seamless service migration.

The major applications of RFoG span residential broadband delivery, commercial enterprise connectivity, and complex distributed antenna systems (DAS) used in large venues, campuses, and major transportation hubs. In the residential segment, RFoG enables the triple-play service model—voice, video, and data—with unparalleled quality and capacity, directly competing with pure Fiber-to-the-Home (FTTH) solutions. For commercial applications, it provides robust, secure, and high-bandwidth connections necessary for modern cloud computing, large data transfers, and videoconferencing requirements. The benefits derived from adopting RFoG are substantial, including reduced power consumption compared to active network components, extended transmission distances without signal degradation, superior resistance to electromagnetic interference, and significantly simplified network architecture leading to lower long-term maintenance costs and improved service reliability.

Key driving factors fueling the expansion of the RF Over Glass market include the global transition to ultra-high-definition video content (4K and 8K streaming), the exponential growth of internet-connected devices (IoT), and the aggressive global rollout of 5G wireless technology, which requires dense, high-capacity fiber backhaul. Furthermore, the inherent need for cable operators to remain competitive against rival telecommunications providers pushing pure fiber solutions necessitates the adoption of RFoG as an upgrade pathway. The modular nature of RFoG, allowing gradual deployment and utilization of existing assets, makes it an economically attractive choice for operators managing large legacy networks, providing a balance between capitalizing on past investments and future-proofing connectivity capabilities.

RF Over Glass Market Executive Summary

The RF Over Glass market is characterized by dynamic business trends centered on technological convergence, strategic vendor consolidation, and intense competition among fiber infrastructure providers. A dominant trend involves the hybridization of network architectures, where MSOs are increasingly deploying RFoG alongside pure GPON (Gigabit Passive Optical Network) or XGS-PON technologies to optimize capital expenditure based on regional density and existing plant characteristics. Business trends also highlight the increasing importance of system integration capabilities, moving beyond component sales to providing holistic network design, installation, and managed services. Furthermore, sustainability is emerging as a critical factor, driving demand for low-power optical components and energy-efficient headend equipment, aligning with global environmental, social, and governance (ESG) standards.

Regionally, the market exhibits varied maturity levels. North America remains a significant market segment, primarily driven by legacy HFC network upgrades and the sustained demand for high-speed residential internet services, particularly in suburban and metropolitan areas where major cable operators dominate. The Asia Pacific region, however, is projected to display the fastest growth, fueled by massive state-led investments in digital infrastructure, particularly in countries like China, India, and Southeast Asian nations focused on achieving widespread fiber penetration. Europe presents a steady growth environment, propelled by regulatory mandates aiming for high-speed connectivity targets across the European Union, favoring hybrid fiber solutions that bridge existing cable networks with next-generation speeds. This regional variation dictates tailored go-to-market strategies focusing on regulatory compliance and partnership development.

Segment trends underscore the rising demand for higher bandwidth supporting components, specifically advanced optical transmitters and receivers capable of handling higher spectral efficiency and greater split ratios. The application segment sees robust growth in the commercial and industrial sectors, particularly for building robust in-building wireless coverage through DAS utilizing RFoG as the optical transport layer. Moreover, there is a pronounced segment trend towards plug-and-play solutions and simplified deployment tools, reducing the skill level required for field technicians and accelerating time-to-market for network extensions. As technology matures, the integration of smart monitoring features into RFoG equipment, enabling predictive maintenance and remote fault isolation, is becoming a key differentiator among leading vendors, streamlining operations management.

AI Impact Analysis on RF Over Glass Market

Common user questions regarding AI's impact on the RF Over Glass market generally revolve around how intelligent systems can manage the complexity of hybrid optical-RF networks, optimize signal quality, and predict potential network failures before they impact service delivery. Users are keenly interested in leveraging AI for dynamic bandwidth allocation across the PON structure, ensuring optimal Quality of Service (QoS) for various tiered service packages without manual intervention. Key themes emerging from these inquiries include the potential for AI-driven fault detection and isolation in the optical fiber path, optimizing energy consumption within headend and distribution hubs, and using machine learning models to forecast subscriber demand based on historical usage patterns, thereby informing proactive network capacity upgrades. The primary concern is often the integration challenge: deploying sophisticated AI software within existing, often heterogeneous, network management systems already utilized by cable operators.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the operational paradigm of RF Over Glass networks, shifting network management from reactive troubleshooting to proactive optimization. AI algorithms can analyze vast streams of real-time data collected from optical network terminals (ONTs), headend equipment, and operational support systems (OSS) to detect subtle anomalies indicative of performance degradation, such as reflections or noise floor increases in the RF path, significantly ahead of conventional monitoring methods. This capability reduces mean time to repair (MTTR) and minimizes service disruptions, leading to higher customer satisfaction and lower operational expenditure. AI also plays a critical role in network planning, simulating future capacity needs based on population density growth and data consumption trends, guiding strategic fiber deployment decisions.

Furthermore, AI facilitates intelligent spectrum management, crucial in RFoG systems where maintaining signal integrity across varied frequencies is paramount. Machine learning models can dynamically adjust transmission power levels, optimize optical splitting ratios, and fine-tune signal modulation schemes to maximize the usable capacity of the fiber while minimizing cross-talk and interference, especially in heavily utilized network segments. As RFoG systems become more dense, particularly in DAS applications for 5G, AI ensures seamless handoff and load balancing between cells, guaranteeing reliable connectivity for mobile users. This sophisticated level of operational control, previously unattainable through static network rules, positions AI as an indispensable tool for maximizing the economic and technical benefits of RF Over Glass infrastructure.

- AI enhances Predictive Maintenance by analyzing optical performance metrics (e.g., received optical power, BER) to forecast component failures.

- Machine Learning algorithms optimize Dynamic Bandwidth Allocation across the passive optical network, ensuring fair and efficient resource utilization.

- AI-driven automated Fault Detection and Isolation significantly reduces the time required to pinpoint issues in the fiber plant or RF components.

- Intelligent Network Planning uses historical data and demographic analysis to optimize the placement and capacity of RFoG nodes.

- AI aids in Energy Optimization by intelligently powering down or modulating the activity of dormant optical line terminals (OLTs) and ONTs during low usage periods.

DRO & Impact Forces Of RF Over Glass Market

The market dynamics of RF Over Glass are heavily influenced by a complex interplay of drivers, restraints, and opportunities that shape investment decisions and technological adoption trajectories. The primary drivers include the ubiquitous demand for high-speed internet access globally, the imperative for MSOs to upgrade their HFC networks to compete with pure fiber providers, and the increasing reliance on fiber optics for 5G backhaul and dense small cell deployment. Opportunities are vast, particularly in leveraging RFoG for smart city infrastructure, expanding into emerging markets with rapidly growing broadband needs, and integrating new standards like DOCSIS 4.0 that require enhanced optical transport capabilities. These positive forces are countered by significant restraints, primarily the high initial capital expenditure associated with deploying new fiber infrastructure, the complexity of integrating RFoG into existing, multifaceted operational systems, and the persistent technological competition from alternative fiber architectures like XGS-PON and WDM-PON.

The Drivers (D) are predominantly structural and demand-driven. The escalating consumption of data, fueled by video streaming, remote work, and online gaming, necessitates scalable fiber solutions. RFoG provides a highly scalable path that uses established cable infrastructure protocols, mitigating some of the risk associated with entirely new technology adoption. The Restraints (R), conversely, are often financial and logistical. The process of replacing large segments of coaxial cable with glass fiber is labor-intensive and requires significant upfront investment in specialized optical components and civil engineering works. Furthermore, securing permits and rights-of-way for fiber deployment, especially in mature urban environments, can impose significant time delays and raise costs, thereby slowing down market penetration.

Opportunities (O) often arise from technological convergence and expansion into niche applications. The burgeoning market for IoT devices in industrial and municipal settings creates a demand for highly reliable, noise-resistant connectivity, areas where RFoG excels. Moreover, the environmental benefits of fiber (less power consumption) present a strong market opportunity as corporations prioritize green initiatives. The collective Impact Forces (IF) indicate that the strong, sustained drivers, particularly the insatiable demand for bandwidth and the necessary infrastructure upgrade cycles, significantly outweigh the restraints over the long term. While short-term capital constraints may cause deployment delays, the fundamental technical superiority and economic viability of RFoG as a hybrid solution ensure its sustained positive impact on network evolution, particularly for cable operators aiming to maximize return on legacy investments while offering future-proof services.

Segmentation Analysis

The RF Over Glass market is meticulously segmented based on components, application types, end-users, and network architecture, providing a granular view of market dynamics and investment pockets. The segmentation highlights the diverse operational environments and technical requirements that RFoG technology caters to, ranging from massive residential deployments requiring high-density splitters to specialized commercial applications needing enhanced signal security and guaranteed uptime. A comprehensive understanding of these segments is vital for vendors to tailor product offerings and for service providers to strategically plan network rollouts based on cost-efficiency and target market demands. The core components of RFoG—Optical Line Terminals (OLTs), Optical Network Units (ONUs), and specialized RF amplifiers—represent distinct market opportunities influenced by vendor capabilities and integration complexity.

Segmentation by components, for example, reveals a strong growth trend in advanced optical transceiver modules, which are essential for supporting higher modulation schemes and extended operating temperatures required in outdoor plant installations. These components are critical determinants of network performance, affecting both the upstream and downstream data rates and the quality of the transported video signals. Similarly, the end-user segmentation clearly distinguishes between the requirements of MSOs, which prioritize high-volume, cost-effective equipment, and enterprise users, who demand customized, high-reliability solutions for mission-critical applications such as campus connectivity and private networking. This differentiation necessitates parallel product development strategies aimed at optimizing performance for mass deployment versus focusing on robustness for specialized industrial use.

Further analysis of the network architecture segment, distinguishing between centralized and distributed RFoG deployments, provides insights into regional preference and population density impact. Centralized architectures, where OLTs are housed primarily in the headend, are typical in denser areas. In contrast, distributed architectures, utilizing remote OLTs, are increasingly favored for wider geographical coverage and more efficient service delivery in sprawling suburban or rural environments. These segmentation insights are instrumental for accurate forecasting and identifying nascent market segments, such as the emerging potential for RFoG integration into municipal smart grid and utility monitoring systems, requiring specialized, low-latency communication capabilities.

- By Component:

- Optical Line Terminal (OLT)

- Optical Network Unit (ONU/ONT)

- RF Transmitters and Receivers (Optical Transceivers)

- Splitters and Filters

- RF Amplifiers and Equalizers

- By Application:

- Residential Broadband and CATV Services

- Commercial Enterprise Connectivity

- Distributed Antenna Systems (DAS) and Mobile Backhaul

- Industrial Networking and Monitoring

- By End-User:

- Cable Multiple System Operators (MSOs)

- Telecommunication Service Providers

- Private Network Operators

- Utilities and Government Agencies

- By Network Architecture:

- Centralized RFoG

- Distributed RFoG

Value Chain Analysis For RF Over Glass Market

The value chain of the RF Over Glass market is highly structured, beginning with specialized component manufacturing and extending through complex network integration, deployment, and long-term maintenance. Upstream analysis focuses intensely on the production of critical optical components, including high-power lasers (DFB, FP), photodiodes, specialized low-loss optical fiber, and high-performance RF chips capable of precise modulation and demodulation of signals. These manufacturing activities are capital-intensive and concentrated among a few specialized technology providers, often located in Asia, which dictates pricing and supply chain stability for the entire ecosystem. The quality and performance of these upstream components directly determine the overall reliability and capacity limits of the final RFoG network deployment.

Midstream activities involve the design, assembly, and testing of final RFoG systems, such as OLT chassis, ONTs, and integrated headend equipment. System integrators and original equipment manufacturers (OEMs) aggregate the components, develop proprietary software for management and monitoring, and ensure compliance with industry standards (e.g., DOCSIS standards compliance). This stage requires significant intellectual property related to network management software and robust quality control procedures. The efficiency of this midstream process, including inventory management and customized product configuration, heavily influences the total cost of ownership (TCO) for network operators and determines the speed at which new technologies can be introduced to the market.

The downstream segment primarily encompasses distribution and service delivery. Distribution channels are typically a mix of direct sales to large MSOs and indirect channels utilizing specialized telecom distributors and value-added resellers (VARs) who manage sales and logistical support to smaller operators or international markets. Direct channels are preferred for major infrastructure projects, allowing close collaboration between the operator and the vendor for customized solutions. Indirect channels offer broader geographic reach and specialized local installation expertise. The final stage involves extensive deployment services, including fiber installation (trenching, aerial deployment), system integration, activation, and ongoing maintenance contracts, which often constitute a significant and high-margin revenue stream for the downstream service providers, ensuring network longevity and optimal performance.

RF Over Glass Market Potential Customers

The primary potential customers and end-users of RF Over Glass technology are entities responsible for delivering multi-service broadband communication, infrastructure, and high-capacity wireless backhaul solutions. The largest segment comprises Cable Multiple System Operators (MSOs), globally recognized as the core buyers, who utilize RFoG as a strategic tool to cost-effectively upgrade their extensive Hybrid Fiber-Coaxial (HFC) plant to a fiber-deep architecture, offering symmetrical speeds and enhanced reliability that align with competitive FTTH offerings. For MSOs, RFoG offers a crucial transitional path that maximizes the utility of their existing headend infrastructure (CMTS), minimizing immediate capital outlay associated with a full migration to pure optical architectures.

A second major customer group includes Tier 1 and Tier 2 Telecommunication Service Providers (Telcos) who may operate legacy copper or HFC assets in certain regions. While many Telcos prefer GPON or XGS-PON, RFoG presents a specialized solution for integrating video services seamlessly or for targeted deployments where legacy video distribution systems must be preserved. Furthermore, the burgeoning demand for centralized Distributed Antenna Systems (DAS) and small cell backhaul, especially in densely populated urban cores and large internal venues (stadiums, shopping centers), positions mobile network operators (MNOs) as critical potential customers seeking RFoG solutions for efficient optical transport of radio signals.

Finally, municipal governments, public utilities, and large private enterprises requiring robust campus-wide connectivity represent a growing customer segment. Utilities often leverage the fiber backbone inherent in RFoG for smart grid applications, remote metering, and critical infrastructure monitoring due to the technology's resilience and capacity for both data and potentially legacy communication protocols. Private campus networks, such as those found in large universities or industrial complexes, deploy RFoG for integrated voice, video, security, and high-speed data delivery, appreciating the reduced signal attenuation over long distances provided by fiber optics, which is vital for sprawling geographical footprints.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 Million |

| Market Forecast in 2033 | USD 2,200 Million |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arris International (now CommScope), Nokia Corporation, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Corning Incorporated, Adtran, Inc., Calix, Inc., Vecima Networks Inc., PCT International, Inc., Sumitomo Electric Industries, Ltd., OptiCom, ZTE Corporation, Tellabs, ECI Telecom, FiberHome Telecommunication Technologies Co., Ltd., Harmonic Inc., Broadcom Inc., MaxLinear, Inc., Luster Teraband Optical Technology Co., Ltd., and Aurora Networks (a CommScope Company). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

RF Over Glass Market Key Technology Landscape

The technological landscape of the RF Over Glass market is characterized by a high degree of specialization in optoelectronic components and adherence to evolving industry standards, primarily centered around DOCSIS and PON protocols. A critical element is the utilization of wavelength division multiplexing (WDM) techniques, particularly for separating the upstream RF signals (often using a 1310 nm or 1610 nm wavelength) from the downstream optical video (1550 nm) and data signals (1490 nm or 1577 nm). This careful spectral management is essential to ensure that the multiple services carried over a single strand of fiber do not interfere with one another, maintaining signal integrity and facilitating bi-directional communication. The advancement in miniaturization and power efficiency of DFB (Distributed Feedback) lasers and APD (Avalanche Photodiode) receivers is central to deploying high-performance RFoG nodes closer to the customer premises while minimizing power consumption and heat generation in outdoor environments.

Another crucial technological development involves the continuous evolution of the CMTS (Cable Modem Termination System) and OLT (Optical Line Terminal) compatibility and integration. For RFoG to be successful, the OLT must seamlessly emulate the functionality required by the HFC network’s headend equipment, allowing MSOs to transition gradually without replacing their entire back-office infrastructure. Recent technological advancements focus on extending the spectral capacity available, aligning with future DOCSIS iterations such as DOCSIS 4.0 (Full Duplex and Extended Spectrum DOCSIS), which require highly linear optical transmitters capable of handling significantly broader frequency ranges (up to 1.8 GHz). Achieving high linearity in optical transmission is technically challenging but necessary for minimizing distortion and noise when transporting high-density RF signals.

Furthermore, the technology landscape includes sophisticated optical monitoring and management systems. Because RFoG is often deployed in passive networks, troubleshooting requires specialized test equipment and software capable of pinpointing physical fiber faults and diagnosing RF impairment issues remotely. Key technologies here include advanced Optical Time-Domain Reflectometers (OTDRs) optimized for PON architectures and integrated management software that provides real-time performance statistics, such as optical power levels and RF carrier-to-noise ratios. The ongoing trend is towards simplifying these field operations through automated testing and diagnostic tools, reducing the need for highly specialized technicians and accelerating service restoration times, further enhancing the appeal and reliability of RFoG as a robust infrastructure solution.

Regional Highlights

Regional dynamics significantly influence the adoption rate and deployment scale of RF Over Glass technology, primarily reflecting varying levels of broadband maturity, regulatory landscapes, and the operational dominance of cable versus telecommunication operators in each geographic area. Each region exhibits unique drivers and challenges that shape market growth strategies.

- North America: This region holds a leading market share due to the widespread presence of major Multiple System Operators (MSOs) like Comcast, Charter, and Cox, who are deeply invested in upgrading their extensive HFC networks. The primary driver is the intense competitive pressure from rival fiber providers, necessitating fiber-deep solutions. RFoG is particularly strong here because it allows MSOs to utilize existing CMTS equipment while delivering gigabit speeds, maximizing the return on legacy investments. Government subsidies aimed at closing the digital divide further encourage fiber deployment in less densely populated areas, favoring robust and scalable technologies like RFoG.

- Europe: The European market demonstrates steady growth, driven by ambitious European Union mandates (e.g., Digital Agenda) to ensure ultra-fast broadband access for all citizens. While many countries initially favored P2P fiber or GPON, MSOs in countries with historically strong cable penetration (e.g., UK, Germany, Netherlands) increasingly adopt RFoG as a cost-effective and swift pathway to enhance data rates and competitive parity. The challenge in Europe often lies in the fragmented regulatory environment and varying standards across member states, requiring vendors to maintain adaptable product lines.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, characterized by massive investments in new infrastructure, particularly 5G and FTTH rollouts in countries like China, India, and Southeast Asia. While pure GPON dominates new residential builds, the increasing need for high-density mobile backhaul and video distribution in congested urban centers creates a significant opportunity for RFoG, particularly in markets where hybrid infrastructure solutions offer greater operational flexibility and speed of deployment. Economic development and urbanization are key underlying drivers.

- Latin America (LATAM): This region is characterized by high variability in technological maturity. Growth is strong in major economies (Brazil, Mexico) driven by rising consumer affluence and increasing internet penetration rates. RFoG provides a viable solution for local operators looking to offer high-quality multi-play services without the immediate, comprehensive overhaul required by pure FTTH, allowing for incremental investment and faster market entry, especially in areas with moderate population density.

- Middle East and Africa (MEA): The MEA market is nascent but rapidly expanding, particularly in the Gulf Cooperation Council (GCC) states due to large-scale infrastructure projects and smart city initiatives. While fiber deployment is often state-sponsored, the demand for integrated security and video surveillance systems utilizing robust optical transport favors RFoG solutions in specific institutional and corporate environments. The African segment, focused largely on foundational broadband, is starting to see RFoG adoption as mobile operators seek reliable backhaul solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the RF Over Glass Market, encompassing component manufacturers, system integrators, and network equipment providers who drive innovation and market deployment. These companies compete based on technological superiority, integration capabilities, adherence to standards, and global support infrastructure. Strategic mergers and acquisitions are common as companies seek to consolidate intellectual property and expand their geographic footprint in the highly competitive fiber optics sector.- CommScope (formerly Arris International)

- Nokia Corporation

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Corning Incorporated

- Adtran, Inc.

- Calix, Inc.

- Vecima Networks Inc.

- PCT International, Inc.

- Sumitomo Electric Industries, Ltd.

- OptiCom

- ZTE Corporation

- Tellabs

- ECI Telecom

- FiberHome Telecommunication Technologies Co., Ltd.

- Harmonic Inc.

- Broadcom Inc.

- MaxLinear, Inc.

- Luster Teraband Optical Technology Co., Ltd.

- Aurora Networks (now part of CommScope)

Frequently Asked Questions

Analyze common user questions about the RF Over Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between RF Over Glass (RFoG) and traditional Fiber-to-the-Home (FTTH)?

RFoG is a specialized FTTH architecture that specifically maintains compatibility with existing Cable Modem Termination Systems (CMTS) and standard cable infrastructure protocols (DOCSIS). Unlike generic FTTH, RFoG allows cable operators (MSOs) to migrate to a fiber-deep network while preserving their investments in headend equipment, offering a smoother, less disruptive transition path.

How does RFoG support the rollout of 5G infrastructure?

RFoG systems are crucial for 5G backhaul, especially in Distributed Antenna Systems (DAS) and small cell environments. It provides the high-capacity, low-latency optical transport necessary to connect remote radio heads and small cells to the centralized network core, efficiently converting RF signals to optical signals for long-distance, high-speed transmission.

What are the main technical challenges associated with RF Over Glass deployment?

Key technical challenges include managing optical signal reflections and ensuring high linearity in the optical transmitters to avoid distortion of the sensitive RF carriers. Additionally, maintaining system compliance with rapidly evolving DOCSIS standards (like DOCSIS 4.0) while integrating seamlessly with Passive Optical Network (PON) components requires complex engineering and stringent component quality control.

Is RF Over Glass expected to be replaced by next-generation PON technologies like XGS-PON?

While XGS-PON (10 Gig symmetrical PON) offers higher absolute data rates, RFoG is not necessarily replaced; rather, they are often complementary or used in different strategic contexts. RFoG is preferred when maximizing legacy CMTS asset utility is paramount, whereas XGS-PON is favored for brand-new builds or service areas prioritizing symmetrical gigabit speeds over compatibility with existing cable protocols. The market increasingly supports hybrid deployments utilizing both technologies.

Which geographical region exhibits the highest growth potential for RF Over Glass technology?

The Asia Pacific (APAC) region, driven by extensive government investments in universal broadband access and rapid urbanization, is projected to show the highest Compound Annual Growth Rate (CAGR). High population density and the widespread deployment of fiber infrastructure for both telecommunication and cable services create an extensive addressable market for RFoG solutions designed for scalability and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager