RFID In Retail Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432594 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

RFID In Retail Market Size

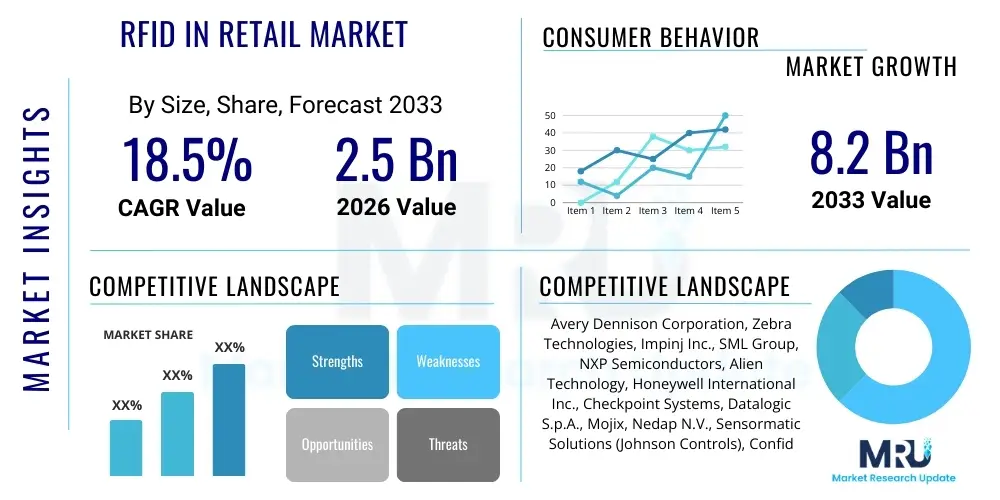

The RFID In Retail Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 2.5 billion in 2026 and is projected to reach USD 8.2 billion by the end of the forecast period in 2033.

The substantial growth trajectory of the RFID in Retail market is fundamentally driven by the escalating demand for accurate inventory management and enhanced supply chain visibility across the global retail landscape. Retailers, facing increasing pressure from e-commerce competition and evolving customer expectations, are adopting RFID solutions—specifically UHF RFID tags and readers—to achieve item-level tracking reliability that was previously unattainable with traditional barcode systems. This technological shift enables stores to maintain high stock accuracy, minimize out-of-stock situations (OOS), and drastically reduce shrinkage, directly impacting profitability and operational efficiency. Furthermore, the declining cost of RFID tags and the development of integrated reader infrastructure are making these solutions economically viable for large-scale deployment across various retail formats, including apparel, groceries, and electronics.

Market expansion is also significantly supported by the growing realization among major retail chains that omnichannel fulfillment strategies require real-time, precise inventory data across all channels—physical stores, distribution centers, and fulfillment hubs. RFID systems provide this unified view, allowing retailers to implement services like Buy Online, Pick Up In Store (BOPIS) and Ship From Store (SFS) efficiently. The adoption extends beyond just inventory control; it encompasses loss prevention, streamlined point-of-sale (POS) processes, and enhanced customer engagement through smart fitting rooms and personalized promotions. These comprehensive application expansions solidify the technology's role as a cornerstone of modern retail infrastructure, ensuring sustained market momentum throughout the forecast period.

RFID In Retail Market introduction

The RFID in Retail Market involves the utilization of Radio Frequency Identification technology to enhance operational efficiency, security, and customer experience within the retail sector. This technology encompasses passive and active tags (transponders), fixed and handheld readers, and supporting software middleware necessary for data processing and integration with existing retail management systems (such as ERP and WMS). Major applications center around item-level inventory visibility, supply chain management, asset tracking, and point-of-sale efficiency, primarily using Ultra-High Frequency (UHF) protocols for long read ranges and fast processing speeds. The core product offering includes various types of tags (inlays, labels, hard tags), readers (fixed, portal, mobile), antennas, and sophisticated software platforms designed specifically for retail analytics and data interpretation.

A principal benefit of adopting RFID in retail is the near-perfect accuracy achieved in inventory counts, often exceeding 98%. This accuracy directly translates into reduced missed sales opportunities due to OOS errors, improved labor productivity by eliminating manual counting processes, and enhanced deterrence against theft (shrinkage). Key driving factors include the global shift towards omnichannel retail requiring unified stock visibility, the increasing complexity of modern supply chains, and the falling unit cost of passive UHF tags, making large-volume deployment financially feasible. Furthermore, the successful integration of RFID data feeds with advanced analytics platforms allows retailers to gain deeper business intelligence regarding product movement, optimizing merchandising and planning strategies across diverse product categories.

The market environment is characterized by continuous innovation in tag design, focusing on solutions for challenging materials like metal and liquid, and the increasing capability of software to process massive volumes of real-time data efficiently. Retailers initially focused deployment on high-value items and apparel, but expansion into grocery and general merchandise is accelerating due to improved technology performance and robust return on investment (ROI) metrics. The technological maturity and proven effectiveness of RFID systems are positioning them as essential tools for retailers seeking competitive advantages in a rapidly digitalizing marketplace, underpinning the strong growth projections detailed in this report.

RFID In Retail Market Executive Summary

The RFID in Retail Market is experiencing transformative business trends driven by the necessity for digital transformation and operational resilience post-pandemic. Key trends include the widespread shift from pilot projects to full-scale enterprise deployments, particularly within large multinational apparel and footwear corporations that have successfully demonstrated compelling ROI. There is a marked increase in demand for integrated solutions that combine RFID technology with other retail technologies, such as Computer Vision and IoT sensors, creating 'Smart Stores' capable of automated inventory audit and dynamic pricing. Furthermore, sustainability is becoming a key business trend, with retailers seeking reusable or easily recyclable RFID tags, influencing vendor selection and material science innovation within the supply chain.

Regionally, North America and Europe maintain dominance, characterized by early adoption, sophisticated retail infrastructures, and high labor costs that accelerate the investment in automation technologies like RFID. However, the Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period, fueled by the rapid expansion of organized retail, substantial government investments in digital infrastructure, and the immense potential for market penetration in countries like China and India. Emerging markets in Latin America and the Middle East and Africa (MEA) are also showing promising growth, primarily focusing on high-value asset tracking and loss prevention in luxury goods and electronics sectors, often leveraging partnerships between local system integrators and global hardware suppliers.

In terms of segmentation, the Hardware segment (especially tags and readers) holds the largest market share, driven by the massive volume of tags required for item-level applications. However, the Software and Services segment is projected to grow at the fastest CAGR, reflecting the increasing complexity of data management and the growing retailer reliance on advanced analytics, cloud platforms, and professional integration services. Apparel and accessories remain the leading application segment, yet groceries and general merchandise are quickly gaining momentum as system costs decrease and retailers prioritize cold chain monitoring and shelf integrity management. These segment trends emphasize a market transition from hardware-centric sales to integrated, data-driven solutions and services.

AI Impact Analysis on RFID In Retail Market

User queries regarding the impact of Artificial Intelligence (AI) on the RFID in Retail Market frequently revolve around how AI enhances the efficiency of data generated by RFID systems. Common questions address the role of AI in predictive inventory forecasting, automating decision-making based on real-time tag reads, and mitigating reading errors. Users are particularly interested in AI's capacity to transform vast, raw RFID data streams into actionable intelligence—such as identifying optimal restocking points, predicting future shrinkage patterns based on behavioral trends captured by integrated sensors, and optimizing store layouts. The overarching theme is the expectation that AI will move RFID beyond simple data collection into true retail process automation and strategic planning, thereby maximizing the ROI derived from the deployed infrastructure.

AI’s influence is shifting the value proposition of RFID from merely knowing where an item is located to understanding the optimal commercial action to take based on that location data. For instance, AI algorithms can analyze reader data across multiple points—entry/exit, shelf, fitting room, POS—to identify unusual patterns that suggest theft or process anomalies more effectively than rule-based software. This integration fundamentally changes how loss prevention is executed. Moreover, when combined with machine learning models, the continuous data flow from RFID tags allows for highly granular sales velocity predictions and dynamic adjustments to safety stock levels, greatly reducing the capital tied up in excess inventory while ensuring high service levels during peak demand periods. This strategic enhancement is key to maximizing the perceived long-term value of RFID systems.

The integration of AI also addresses one of the historical challenges of RFID deployment: data reliability in complex electromagnetic environments. AI-driven algorithms can filter out noise, compensate for missed reads using contextual data, and perform real-time diagnostics on reader infrastructure performance. This capability ensures that the data fed into ERP and merchandising systems is cleaner and more reliable, leading to higher confidence in the automated decisions based on that data. This convergence of RFID’s accurate item tracking with AI’s analytical and predictive power is essential for realizing the vision of fully automated, 'self-aware' retail environments, promising significant improvements in gross margins and operational expenditure management.

- AI optimizes inventory forecasting by analyzing real-time RFID data streams, predicting demand fluctuations and required stock levels with greater precision than traditional models.

- Machine learning algorithms enhance shrinkage detection by identifying anomalous movement patterns of tagged items, automating alerting systems for loss prevention teams.

- AI-powered middleware improves data reliability by filtering environmental noise and compensating for partial or dropped tag reads, ensuring clean data input for WMS and ERP systems.

- Generative AI tools can assist in optimizing reader placement and system tuning during deployment, simulating radio frequency coverage in complex store environments.

- AI enables dynamic pricing and personalized recommendations by correlating real-time physical interactions (e.g., items entering a smart fitting room) with customer profiles and inventory status.

DRO & Impact Forces Of RFID In Retail Market

The RFID in Retail Market is strongly influenced by a robust set of Drivers, Restraints, and Opportunities, collectively determining its impact forces and growth trajectory. Key drivers include the overwhelming industry pressure to establish seamless omnichannel retail experiences, where real-time inventory visibility is non-negotiable, and the proven ability of RFID to significantly reduce inventory discrepancies and operational expenditure. These powerful drivers accelerate investment, especially in high-labor-cost regions where automation provides substantial savings. Conversely, the market faces restraints such as the perceived high initial investment in infrastructure (readers and software integration), data privacy concerns related to tracking consumer behavior using smart tags, and technical challenges associated with read accuracy when dealing with liquids and metallic packaging, which are prevalent in grocery retail. Despite these challenges, the continuous decrease in tag costs and increasing awareness of the strong ROI mitigate some of the financial barriers, supporting the overall market uptake.

Opportunities within the market are vast, centered on expansion into new retail verticals beyond apparel, specifically food and beverage traceability, pharmaceutical inventory management in pharmacy retail, and logistics optimization for last-mile delivery. The convergence of RFID with Internet of Things (IoT) sensors and Artificial Intelligence (AI) platforms represents a major opportunity, allowing for the creation of 'Smart Shelf' systems that automatically monitor stock levels and temperature, triggering autonomous replenishment actions. Furthermore, the growth of circular economy initiatives presents an opportunity for RFID to facilitate product authentication and tracking throughout its entire lifecycle, supporting resale and recycling programs, thereby expanding the application scope far beyond traditional loss prevention and inventory counting.

The core impact forces driving this market are economic efficiency and consumer expectation. The force of economic efficiency compels retailers to adopt solutions that minimize shrinkage (inventory loss), which often accounts for 1.5% to 2% of annual sales, and reduce labor costs associated with manual inventory processes. The force of consumer expectation mandates fast, accurate fulfillment—whether through in-store pickup or online delivery—placing immense pressure on retailers to maintain perfect stock accuracy. These two intertwined forces ensure that investments in RFID technology, which simultaneously address both concerns, remain prioritized. The continuous reduction in implementation complexity and ongoing industry standardization efforts further amplify these positive impact forces, overcoming initial deployment inertia and solidifying RFID's position as a critical enabling technology for modern retail.

Segmentation Analysis

The RFID In Retail market is extensively segmented based on the component type, the specific frequency used for communication, the primary application, and the end-user industry, providing a granular view of market dynamics. Component segmentation distinguishes between hardware (tags, readers, antennas), software (middleware, analytical platforms), and services (installation, integration, maintenance). Application segmentation highlights the diverse functional areas where RFID is deployed, ranging from critical inventory management and asset tracking to advanced point-of-sale efficiency and enhanced customer experience tools. Understanding these segmentations is vital for stakeholders to identify high-growth areas and tailor product offerings to specific operational needs within the retail ecosystem.

- By Product Type:

- Hardware (RFID Tags/Labels/Inlays, RFID Readers/Interrogators, Antennas, Printers)

- Software (Middleware, Inventory Management Software, Data Analytics Platforms)

- Services (Consulting, Integration, Maintenance and Support)

- By Frequency:

- Low Frequency (LF)

- High Frequency (HF)

- Ultra-High Frequency (UHF)

- By Application:

- Inventory Management and Tracking (Item-level, Case-level)

- Supply Chain Management and Logistics

- Loss Prevention (Electronic Article Surveillance - EAS)

- Point-of-Sale (POS) Systems

- Smart Shelf Applications

- Customer Experience and Engagement (Smart Fitting Rooms)

- By End User:

- Apparel and Accessories (Dominant Segment)

- Supermarkets and Groceries

- Department Stores and Mass Merchandisers

- Beauty and Cosmetics

- Electronics and High-Tech

- Jewelry and Luxury Goods

Value Chain Analysis For RFID In Retail Market

The RFID In Retail value chain begins upstream with raw material suppliers and component manufacturers, covering silicon chip fabrication, antenna production, and adhesive material sourcing. This stage is crucial as the cost and performance of the final RFID tag are heavily dependent on the efficiency and miniaturization capabilities of the chip manufacturers. Following component fabrication, tag and label converters transform these components into finished, customized RFID tags, often embedding them into apparel labels, security hard tags, or adhesive stickers specific to retailer needs. Reader and infrastructure manufacturers form the parallel component pillar, developing specialized hardware capable of reliable data capture across diverse retail environments, emphasizing integration capabilities and robust performance in high-traffic areas.

The midstream segment involves system integrators and software providers who act as critical links between the hardware and the end-user’s operational requirements. System integrators specialize in deploying the infrastructure, fine-tuning antenna placement, and ensuring seamless communication between tags, readers, and the retailer's IT backend systems (WMS, ERP, POS). Software providers deliver the necessary middleware to process the massive influx of raw data and transform it into actionable business intelligence, often offering cloud-based solutions for scalability and accessibility. This integration step is complex and high-value, determining the overall success and ROI of the RFID deployment, thus occupying a significant portion of the value chain margin.

Downstream activities involve the distribution channel, which includes both direct sales from major global technology providers to large enterprise retailers and indirect channels utilizing third-party distributors and specialized Value Added Resellers (VARs). VARs often provide localized expertise, crucial for smaller retail chains or regional deployments. Direct channels are generally preferred by Tier 1 retailers who require close collaboration on customized solutions and enterprise-wide deployment strategies. The final consumer in the value chain is the retailer (the end-user/buyer), who utilizes the deployed system to improve inventory accuracy, enhance loss prevention, and optimize omnichannel fulfillment. The quality of ongoing maintenance and support services, delivered either directly or indirectly, closes the loop, ensuring long-term system performance and continuous value generation.

RFID In Retail Market Potential Customers

Potential customers for the RFID in Retail Market primarily consist of large multinational retail corporations across various sectors, followed by mid-sized regional chains seeking a competitive edge through technology adoption. The dominant end-users are apparel and footwear retailers, as item-level tagging provides immediate, measurable benefits in inventory accuracy for SKUs that frequently turnover and require precise size/color tracking. These companies—such as global fashion brands and department stores—are heavily investing in RFID to support their transition to unified commerce models, treating store stock as part of the overall fulfillment network. Their primary buying criteria include proven ROI metrics, system scalability, and compatibility with global sourcing and logistics operations.

Another significant segment of potential customers includes large grocery chains and supermarkets, although their adoption rate has historically been slower due to concerns regarding tag cost for low-margin items and the technical challenges of tagging liquids and metal containers. However, the increasing regulatory pressure for food safety and traceability, coupled with the necessity for highly accurate cold chain monitoring, is rapidly accelerating deployment in this sector. These customers prioritize solutions that can be integrated seamlessly into existing supply chain logistics and provide critical data for expiration management and waste reduction, requiring ruggedized and specialized tag designs suitable for perishable goods environments. The focus here is on improving operational efficiency and compliance rather than solely addressing shrinkage.

Furthermore, specialty retailers dealing with high-value items, such as luxury goods, jewelry, cosmetics, and electronics, represent a distinct customer segment. For these retailers, RFID serves a dual purpose: rapid inventory auditing and robust anti-counterfeiting and theft deterrence. In luxury retail, customers often look for high-security hard tags and seamless integration that enhances the in-store experience without detracting from the aesthetic of the product display. These buyers are less sensitive to tag cost and more focused on the security features, data encryption capabilities, and the potential for leveraging RFID data to offer exclusive post-sale services like authenticated ownership tracking. The breadth of these potential customer needs necessitates a highly customizable and flexible vendor marketplace.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 billion |

| Market Forecast in 2033 | USD 8.2 billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Avery Dennison Corporation, Zebra Technologies, Impinj Inc., SML Group, NXP Semiconductors, Alien Technology, Honeywell International Inc., Checkpoint Systems, Datalogic S.p.A., Mojix, Nedap N.V., Sensormatic Solutions (Johnson Controls), Confidex, Invengo Technology, Identiv, CAEN RFID, Vulcan RFID, GAO RFID, Smartrac (Ariel by Avery Dennison), RF Code |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

RFID In Retail Market Key Technology Landscape

The predominant technology powering the retail RFID market is Ultra-High Frequency (UHF) passive RFID, operating typically in the 860 MHz to 960 MHz range. UHF technology is favored because it offers long read ranges (up to several meters) and high-speed multi-tag reading capabilities, which are essential for quickly scanning large volumes of items in a retail environment—such as during receiving, shelf auditing, or cycle counting. The technological landscape is focused on continuous innovation in IC design (integrated circuits or chips) to increase sensitivity, enabling smaller tags to be read reliably over longer distances, and improve performance in dense reader environments. Furthermore, advancements in specialized tags, such as near-field communication (NFC) enabled UHF tags, are emerging to bridge the gap between back-end inventory management and consumer interaction via smartphones.

Software and middleware form the crucial layer of the technology landscape, translating raw radio frequency data into usable business information. Modern RFID middleware solutions are increasingly cloud-native, offering scalability, real-time data processing, and seamless integration via APIs into complex Enterprise Resource Planning (ERP) and Warehouse Management Systems (WMS). Key technological advancements include the deployment of edge computing capabilities within the reader network to preprocess data locally, reducing network latency and improving system responsiveness. This sophisticated software layer is now often coupled with advanced analytics and reporting dashboards that provide detailed insights into inventory movement, loss events, and employee productivity metrics, moving the technological focus beyond simple connectivity to high-level strategic intelligence.

The hardware infrastructure continues to evolve, emphasizing aesthetic integration and versatility. This includes the development of unobtrusive overhead fixed readers that provide continuous, zone-based monitoring throughout the store, replacing traditional, bulky portal readers. Mobile handheld readers are becoming lighter, more robust, and integrated with augmented reality (AR) features to guide store associates directly to specific items, maximizing picking efficiency for BOPIS orders. The convergence of Electronic Article Surveillance (EAS) and RFID functionalities (often termed "EAS-plus") is a key technological trend, allowing retailers to use a single tag for both inventory counting and theft deterrence, simplifying tagging processes and reducing overall cost of ownership. This integrated approach signifies a maturing technological landscape where efficiency and multipurpose application are prioritized.

Regional Highlights

Regional dynamics within the RFID in Retail market demonstrate varied levels of maturity and growth drivers. North America, particularly the United States, represents a highly mature and dominant market, driven by the presence of large, technologically aggressive retail chains and high consumer expectations for rapid, accurate fulfillment. The early and comprehensive adoption of item-level tagging by major apparel retailers established a strong foundation. Market growth in this region is now fueled by the expansion of RFID use cases into grocery, home improvement, and logistics sectors, coupled with significant investment in advanced software integration and cloud-based analytical tools. High labor costs also continuously incentivize automation through RFID.

Europe closely follows North America in terms of market maturity, with particularly strong adoption rates in Western European countries like the UK, Germany, and Spain. The European market benefits from strong regulatory support for product traceability, especially in food and pharmaceuticals, and a general retail environment characterized by significant omnichannel investment. Furthermore, European retailers have been keen pioneers in sustainable retail practices, driving demand for eco-friendly and reusable RFID tag solutions. However, the market structure in Europe, being somewhat fragmented across national borders, necessitates vendors to offer localized frequency compliance and multilingual software support.

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR due to explosive growth in organized retail, rapid urbanization, and massive e-commerce penetration. Countries like China and India are experiencing a massive build-out of modern retail infrastructure, creating greenfield opportunities for large-scale RFID deployment from the outset. While initial adoption may focus heavily on basic inventory management and loss prevention, the scale of manufacturing and logistics in APAC ensures high demand for tags and infrastructure. Government initiatives supporting smart supply chains and logistics digitalization further solidify APAC's position as the primary engine for future volume growth in the global RFID retail market.

- North America: Market leader; characterized by enterprise-wide deployment, high operational integration complexity, and strong demand for advanced data analytics. Key focus on labor cost reduction and sophisticated omnichannel execution.

- Europe: High maturity; driven by traceability requirements, strong apparel sector adoption, and a rising trend towards sustainable RFID materials and reusable tags. Focus on loss prevention and pan-European inventory visibility.

- Asia Pacific (APAC): Fastest growing region; propelled by the expansion of organized retail, rapid e-commerce infrastructure development, and significant volume production potential in China and Southeast Asia. Initial focus on logistics and supply chain optimization.

- Latin America (LATAM): Emerging market; growth concentrated in high-value retail (luxury, pharmaceuticals) and increasing investment in supply chain transparency to combat counterfeiting and theft.

- Middle East and Africa (MEA): Growth driven by large-scale hypermarket chains and duty-free retail, emphasizing security and asset tracking within rapidly developing retail hubs like the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the RFID In Retail Market.- Avery Dennison Corporation

- Zebra Technologies

- Impinj Inc.

- SML Group

- NXP Semiconductors

- Alien Technology

- Honeywell International Inc.

- Checkpoint Systems

- Datalogic S.p.A.

- Mojix

- Nedap N.V.

- Sensormatic Solutions (Johnson Controls)

- Confidex

- Invengo Technology

- Identiv

- CAEN RFID

- Vulcan RFID

- GAO RFID

- Smartrac (Ariel by Avery Dennison)

- RF Code

Frequently Asked Questions

Analyze common user questions about the RFID In Retail market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical Return on Investment (ROI) period for item-level RFID implementation in retail?

The typical ROI period for item-level RFID implementation in the apparel sector ranges from 12 to 18 months. This rapid return is primarily achieved through direct increases in sales revenue due to near-perfect inventory accuracy, minimizing out-of-stock situations, and substantial reductions in labor hours dedicated to manual counting and cycle checks.

How does Ultra-High Frequency (UHF) RFID compare to traditional barcode scanning in modern retail operations?

UHF RFID offers significant advantages over barcodes, primarily in speed and efficiency. RFID readers can simultaneously scan hundreds of items per second without requiring a direct line of sight, drastically reducing the time needed for tasks like receiving shipments and conducting store-wide inventory audits, which are typically time-intensive and error-prone with barcodes.

What is the primary technical challenge hindering broader RFID adoption in the grocery and food retail sector?

The primary technical challenge in grocery retail is the difficulty in reliably reading RFID tags placed near or on products containing significant amounts of liquid or metal, which interfere with the radio frequency signals. Overcoming this requires specialized tags, advanced reader algorithms, and careful positioning, contributing to a higher complexity and cost profile compared to tagging apparel.

Can RFID technology effectively replace Electronic Article Surveillance (EAS) systems for loss prevention?

Yes, modern RFID solutions are increasingly replacing traditional EAS systems through 'EAS-plus' tags. These dual-function tags handle both item tracking and loss prevention. The benefit is that the RFID system offers granular item identity upon exit attempts, providing more intelligence than basic EAS and allowing for data-driven decisions regarding security threats.

How is cloud computing impacting the deployment and scalability of RFID solutions for large retail enterprises?

Cloud computing is critical for scaling RFID globally by providing centralized data processing and accessible analytics. Cloud platforms handle the massive data volumes generated by millions of tag reads, enabling real-time inventory visibility across global store networks and facilitating seamless integration with existing enterprise software without requiring extensive on-premise IT infrastructure investment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager