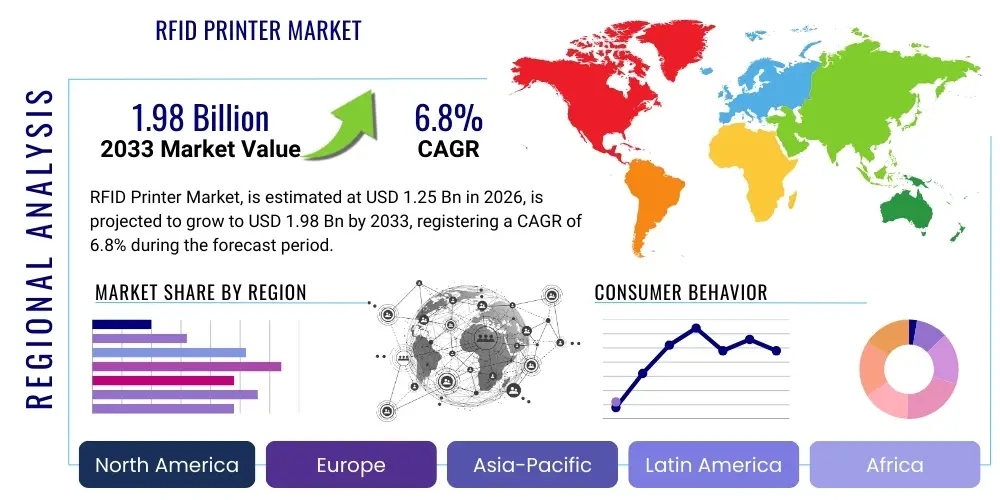

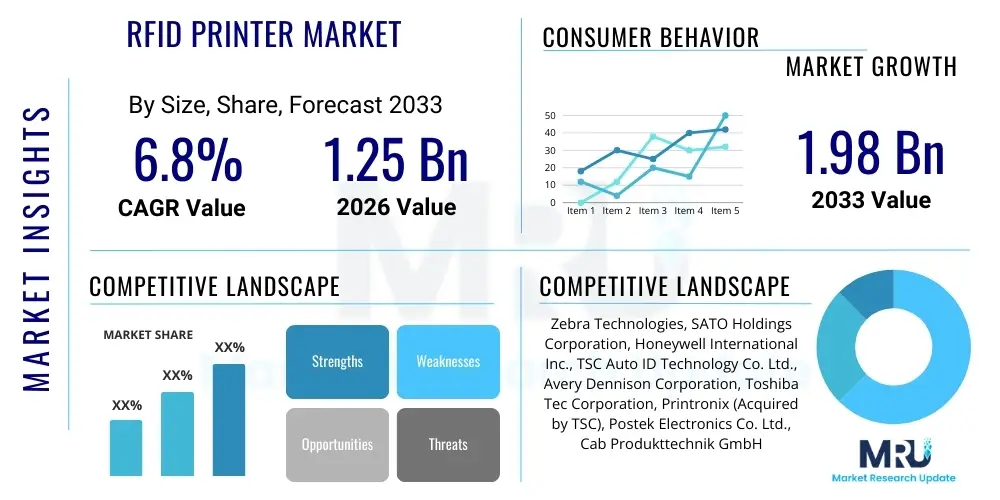

RFID Printer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436205 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

RFID Printer Market Size

The RFID Printer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.98 Billion by the end of the forecast period in 2033. This growth trajectory is fueled by the increasing adoption of automated data capture technologies across logistics, retail, and healthcare sectors, driven by the necessity for enhanced inventory accuracy and supply chain visibility.

RFID Printer Market introduction

The RFID Printer Market encompasses devices designed to encode and print smart labels containing embedded Radio-Frequency Identification (RFID) inlays. These printers combine standard thermal printing technology, used for human-readable text and barcodes, with advanced RFID encoding modules that write data onto the chip within the label before printing. The primary function of these specialized printers is to streamline the labeling process for assets, inventory, and shipments, ensuring that items are trackable through the entire supply chain lifecycle using RFID readers.

Major applications of RFID printers span diverse industries, including retail for inventory management and loss prevention, manufacturing for work-in-progress tracking and asset identification, and logistics for enhanced parcel tracking and automated sorting systems. Key benefits driving the market include superior accuracy compared to traditional barcode systems, high-speed data capture without requiring line-of-sight, and the ability to read hundreds of tags simultaneously, drastically reducing labor costs and improving operational efficiency. Furthermore, the printers support both high-frequency (HF) and ultra-high frequency (UHF) tags, catering to specific application requirements globally.

The market's expansion is significantly driven by the proliferation of Internet of Things (IoT) platforms in industrial environments, mandating the digital identification of physical assets. Regulatory compliance, particularly in pharmaceuticals and food safety, also pushes companies toward secure, trackable labeling solutions like RFID. Additionally, the continuous decline in the cost of RFID inlays and the development of more compact, versatile mobile RFID printers are broadening accessibility for small and medium-sized enterprises (SMEs), further solidifying the printer market's upward trend.

RFID Printer Market Executive Summary

The RFID Printer Market is characterized by intense technological innovation focused on improving encoding speed, ensuring print quality fidelity across diverse tag materials, and integrating seamlessly with Enterprise Resource Planning (ERP) and Warehouse Management Systems (WMS). Current business trends indicate a strong shift towards industrial and ruggedized printers capable of handling high-volume, continuous printing in harsh environments, particularly within large-scale logistics and manufacturing hubs. Key market players are prioritizing the development of intuitive software interfaces and remote management capabilities to simplify deployment and maintenance for global enterprises.

Regional trends reveal that North America and Europe currently dominate the market due to early adoption of advanced inventory technologies and the presence of established large retailers and logistics giants. However, the Asia Pacific region is poised for the fastest growth, fueled by rapid industrialization, massive e-commerce expansion in countries like China and India, and significant government investments in smart city infrastructure requiring advanced asset tagging. Segmentation trends show the UHF segment holding the largest market share owing to its superior read range, making it ideal for pallet and container tracking, while the Desktop printer segment maintains steady demand for lighter, smaller-scale retail and office applications.

Overall, the market remains moderately consolidated, with major players leveraging strategic partnerships and mergers to enhance their solution portfolios, specifically integrating RFID printing solutions with broader supply chain visibility platforms. The primary challenges revolve around the standardization of global frequency regulations and the need for comprehensive user training to maximize the benefit of complex encoding settings. Despite these hurdles, the foundational demand driven by automation and traceability requirements ensures robust, sustainable growth across all geographical and end-user segments throughout the forecast period.

AI Impact Analysis on RFID Printer Market

Common user questions regarding AI's influence on the RFID Printer Market frequently center on how machine learning can optimize printer operational parameters, predict maintenance needs, and enhance the quality control of encoded tags. Users are keenly interested in predictive analytics capabilities—specifically, whether AI algorithms can analyze print job data (such as throughput, encoding errors, and ribbon usage) in real-time to schedule preventative maintenance before failure occurs. Another critical concern relates to intelligent label design; users want to know if AI can automatically adjust printing and encoding power settings based on the specific tag type, material composition, and environmental conditions to ensure optimal readability and minimize wastage, a persistent challenge in complex RFID deployments. The overarching expectation is that AI integration will shift RFID printing from a reactive operational task to a proactive, highly optimized component of the smart factory or warehouse.

The initial integration of Artificial Intelligence focuses heavily on streamlining the encoding process and improving overall equipment effectiveness (OEE). AI-powered diagnostic tools embedded within high-end industrial RFID printers are now capable of self-calibrating the antennae and printhead pressure dynamically, compensating for slight variations in tag placement or material thickness, which drastically reduces the occurrence of "bad tags" that are encoded incorrectly or cannot be read efficiently downstream. Furthermore, AI contributes significantly to cybersecurity, analyzing abnormal print job patterns or unusual data requests to detect and flag potential security breaches or unauthorized attempts to encode sensitive data onto tags, thereby protecting the integrity of the supply chain data.

The long-term impact of AI suggests a move toward fully autonomous printing systems. Imagine a future where the inventory management system, powered by AI, automatically dictates the exact number, type, frequency, and data structure of RFID tags needed for an upcoming shipment, sending the job directly to the optimal printer in the warehouse, minimizing human intervention and potential configuration errors. This level of automation, coupled with predictive modeling for supply replenishment of ribbons and tags, promises not just efficiency gains but a fundamental change in how labeling operations are integrated into the wider, interconnected digital enterprise ecosystem.

- Enhanced Predictive Maintenance: AI monitors printhead wear, ribbon consumption, and encoding module health to forecast necessary servicing, maximizing printer uptime.

- Optimized Encoding Parameters: Machine learning algorithms dynamically adjust power levels and timing based on real-time tag input and environmental factors, reducing tag failure rates.

- Automated Quality Control: Vision systems integrated with AI algorithms inspect printed barcodes and verify tag encoding success instantaneously, rejecting faulty labels immediately.

- Improved Workflow Integration: AI facilitates seamless communication between the printer operating system and WMS/ERP platforms, automating job scheduling and prioritization.

- Intelligent Supply Management: Algorithms predict optimal timing for ordering replacement media (ribbons, tags), minimizing stockouts and inventory overhead.

- Cybersecurity Enhancement: AI detects anomalous encoding behavior or access patterns, providing real-time alerts against data manipulation or unauthorized tag creation.

DRO & Impact Forces Of RFID Printer Market

The dynamics of the RFID Printer Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces determining market direction and velocity. The primary driver is the accelerating global adoption of digital transformation initiatives, necessitating superior asset visibility and traceability across diverse supply chains. Simultaneously, stringent regulatory mandates, particularly in pharmaceuticals (anti-counterfeiting) and perishables (cold chain monitoring), compel organizations to invest in high-fidelity tracking systems that RFID printers facilitate. Furthermore, the economic advantage derived from reducing manual counting errors and improving inventory reconciliation heavily incentivizes implementation, acting as a crucial underlying economic driver.

However, the market faces significant restraints. The high initial investment cost associated with both the specialized printers and the necessary RFID infrastructure (readers, software integration) acts as a barrier, particularly for smaller organizations or those operating on tight capital expenditure budgets. Technical complexities related to tag reliability, such as signal interference in dense metallic environments or the need for precise calibration for varied media, present operational hurdles that require specialized expertise. Furthermore, the lack of standardized frequency regulations across all international borders complicates global deployments for large multinational corporations, demanding customized printer configurations or media sourcing for different regions, slowing down mass adoption.

Opportunities for growth are abundant, particularly in emerging sectors and technological advancements. The expansion of smart packaging solutions, where RFID tags are embedded directly into consumer product packaging during the manufacturing process, opens vast new opportunities for high-volume industrial printing. The growing demand for mobile RFID printers, driven by field service and last-mile delivery applications, offers vendors a specialized niche for ruggedized, battery-powered devices. The technological convergence with IoT and cloud platforms also presents opportunities for vendors to offer ‘Printer-as-a-Service’ models, integrating hardware, software, and consumables into subscription-based offerings, lowering the entry barrier for potential customers and ensuring recurring revenue streams.

The impact forces are currently tilted towards acceleration, with drivers strongly overpowering restraints. The fundamental shift towards automated logistics (e.g., automated warehouses, drone inventory counting) is non-negotiable for modern competitiveness. While costs remain a restraint, the return on investment (ROI) derived from loss reduction and efficiency gains, often measured in months, makes the business case compelling. The development of specialized, affordable printers tailored for niche applications (e.g., healthcare wristbands, laundry tagging) continues to fragment the market positively, ensuring that RFID printing technology permeates traditionally underserved industries. This robust demand, coupled with technological refinements mitigating technical complexity, ensures a positive net impact force propelling the market forward.

Segmentation Analysis

The RFID Printer market is highly diversified and segmented based on key criteria including the type of printer (defining throughput and durability), the underlying printing and encoding technology used, the frequency band supported by the encoder (affecting read range), and the specific industry application. Understanding these segments is crucial for manufacturers to tailor their product offerings and for end-users to select the appropriate equipment that meets their operational scale and environmental demands. The market structure reflects a clear bifurcation between high-volume, industrial-grade equipment designed for continuous 24/7 operation in harsh factory settings, and lighter, desktop/mobile units optimized for retail backrooms or on-demand field use.

The technology segmentation highlights the dominance of thermal transfer methods, which provide highly durable and archival-quality printing essential for labels that must withstand extreme temperatures, chemicals, or prolonged external exposure, such as asset tags or outdoor logistics labels. Conversely, direct thermal technology, while less durable, is often preferred for short-term retail receipts or shipping labels where cost-efficiency and quick throughput are paramount. Furthermore, the critical segmentation by frequency (UHF vs. HF) determines the functional capability of the printer; UHF printers, offering multi-read capabilities and long-range tracking, command premium pricing and dominate warehousing and supply chain applications, while HF printers are prevalent in access control, payment systems, and document management due to their shorter, secure read characteristics.

Application-wise, the logistics and retail sectors remain the largest consumers, rapidly adopting RFID printing for real-time inventory visibility and reducing out-of-stock scenarios. However, the healthcare sector is emerging as a high-growth segment, leveraging RFID for tracking patient records, surgical tools, and high-value medications, emphasizing the need for precision encoding and error-free printing crucial for patient safety. This nuanced segmentation allows market participants to focus on specialized requirements, such as printers certified for medical environments or those designed to handle small, complex jewelry tags in high-end retail, ensuring continuous innovation tailored to specific vertical needs.

- By Printer Type:

- Desktop RFID Printers

- Industrial RFID Printers

- Mobile RFID Printers

- By Technology:

- Thermal Transfer

- Direct Thermal

- By Frequency:

- Ultra-High Frequency (UHF)

- High Frequency (HF)

- Low Frequency (LF)

- By Application/End-Use Industry:

- Retail and E-commerce

- Logistics and Transportation

- Manufacturing (WIP and Asset Tracking)

- Healthcare and Pharmaceuticals

- Government and Defense

- Others (Hospitality, Libraries)

Value Chain Analysis For RFID Printer Market

The value chain for the RFID Printer Market starts with the upstream suppliers responsible for core components and raw materials. This includes manufacturers of high-precision printheads (which are vital for print quality), sophisticated thermal ribbon and specialized RFID label media (inlays and face stock), and the electronic components, particularly the specialized RFID encoder chips and antennae. These upstream suppliers dictate material costs and technological limits. Reliability and quality control at this stage are paramount, as faulty inlays or poor printhead quality directly impact the printer's performance and the subsequent readability of the encoded tag in the field.

The midstream focuses on the Original Equipment Manufacturers (OEMs)—the core printer companies—who design, assemble, and integrate the mechanical and electronic components. Key activities here involve R&D in encoding technology, developing proprietary firmware to manage tag calibration, and ensuring software compatibility with major ERP/WMS systems. Integration complexity is high, requiring close collaboration between the hardware manufacturer and software developers. The ability to offer robust, easy-to-use configuration software is a significant differentiator for OEMs in this stage, determining the total cost of ownership (TCO) for the end-user.

The downstream segment encompasses the distribution and end-user deployment. Distribution channels are typically a mix of direct sales for large, customized industrial orders and indirect distribution through value-added resellers (VARs), system integrators, and specialized technology distributors. VARs play a crucial role as they often bundle the RFID printer with complementary hardware (readers, antennae) and software solutions, offering tailored deployment services and post-sales support specific to the end-user's industry (e.g., retail inventory management setup). Direct sales are generally reserved for major governmental or defense contracts requiring stringent security and compliance, bypassing the third-party intermediary.

The structure is highly dependent on system integrators (indirect channel) because a printer is rarely sold in isolation; it is part of a holistic RFID solution. These integrators provide the essential link between the printer hardware and the user's existing enterprise infrastructure. Therefore, the strategic focus for OEMs is building strong relationships with these integrators, providing them with training and certification. The end-user (the final segment) is ultimately responsible for maintenance and consumable replenishment, making the recurring revenue generated from high-margin media (labels and ribbons) a critical component of the overall value capture for the entire chain.

RFID Printer Market Potential Customers

The primary buyers and end-users of RFID printers are organizations that require high-volume, reliable identification and tracking capabilities for physical assets or inventory moving through complex supply chains. This includes large multinational retailers, specifically those managing extensive apparel, electronics, or general merchandise inventories, who use these printers to comply with mandates for item-level tagging designed to improve shelf visibility and reduce shrinkage. E-commerce fulfillment centers and major third-party logistics (3PL) providers are also significant customers, leveraging industrial printers to tag packages, pallets, and returnable transport items (RTIs) for enhanced automated sorting and tracking efficiency across wide operational areas.

The manufacturing sector, encompassing automotive, aerospace, and high-tech electronics, utilizes RFID printers extensively for Work-In-Progress (WIP) tracking, where tags attached to components or assemblies provide real-time updates on manufacturing status and location, facilitating lean production strategies. Within the healthcare domain, hospitals and pharmaceutical companies are rapidly increasing adoption, driven by the need for secure drug pedigree tracking, efficient management of high-value surgical equipment, and patient identification via encoded wristbands. Government agencies, particularly defense and public infrastructure organizations, represent another substantial customer segment, utilizing RFID for secure asset management, inventory control of specialized equipment, and maintaining chain of custody for sensitive items, valuing the durability and security provided by thermal transfer RFID labeling.

Emerging customers include smaller, specialized businesses that require unique tracking solutions, such as high-end jewelry retailers needing discreet but secure tags, laundries tracking uniforms and linens through wash cycles, and libraries managing large collections. These diverse end-users require a range of printer types, from small desktop units for front-office operations to robust industrial units capable of printing and encoding thousands of tags per day, underscoring the market's reliance on tailored solutions addressing specific industry needs for automation and regulatory compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zebra Technologies, SATO Holdings Corporation, Honeywell International Inc., TSC Auto ID Technology Co. Ltd., Avery Dennison Corporation, Toshiba Tec Corporation, Printronix (Acquired by TSC), Postek Electronics Co. Ltd., Cab Produkttechnik GmbH & Co KG, Datamax-O'Neil (Acquired by Honeywell), CITIZEN SYSTEMS EUROPE GmbH, BIXOLON Co. Ltd., Wasp Barcode Technologies, Godex International, Dascom Americas. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

RFID Printer Market Key Technology Landscape

The core technology driving the RFID Printer market centers around the precise integration of thermal printing mechanisms with sophisticated radio frequency encoding modules. The predominant printing methods are Thermal Transfer (TT) and Direct Thermal (DT). TT printers utilize a heat-sensitive ribbon to transfer ink onto the label substrate, creating highly durable, long-lasting printouts suitable for permanent asset tracking and outdoor use, demanding specialized ribbon formulations optimized for specific label materials. DT printers, conversely, use chemically treated paper that darkens when heated, offering a lower cost and faster printing speed, though the resulting label is susceptible to heat and light exposure, limiting its use to short-term applications like shipping labels or receipts.

The crucial technology lies in the RFID encoding module, which must accurately write data onto the microscopic integrated circuit (IC) embedded within the inlay before the label passes under the printhead. Advanced printers utilize "smart calibration" technology, where the encoder automatically detects the position and type of the RFID inlay in the label stock and adjusts the transmission power and antenna tuning accordingly. This real-time calibration is essential for maintaining a high yield of readable, correctly encoded tags, especially given the variability in antenna designs and IC sensitivity across different media vendors. Vendors are increasingly integrating tools that verify the encoding process immediately after writing, often utilizing a built-in reader to confirm successful data writing, thereby preventing the deployment of "dead" tags into the supply chain.

Furthermore, connectivity and software integration define the modern technology landscape. Contemporary RFID printers are designed to operate seamlessly within networked environments, supporting Wi-Fi, Ethernet, and increasingly, cloud-based interfaces for remote management and diagnostic monitoring. This facilitates centralized control over vast fleets of printers deployed globally. The integration of specialized printer command languages (like ZPL or DPL) alongside comprehensive SDKs allows enterprises to directly embed RFID printing functionality into their existing WMS, MES (Manufacturing Execution Systems), or custom enterprise applications, making the printer not just a peripheral device but an integral, intelligent node in the larger enterprise IoT ecosystem.

Regional Highlights

The global RFID Printer market exhibits varied growth patterns and technology adoption rates across major geographies, largely influenced by local regulatory environments, industrial maturity, and e-commerce penetration. North America currently holds the largest market share, driven primarily by the strong presence of major retail corporations that have mandated item-level RFID tagging for inventory accuracy, coupled with advanced automation efforts within the logistics and defense sectors. The region benefits from a mature technological infrastructure and high IT spending capabilities, leading to early and widespread adoption of high-end industrial RFID printing solutions and associated professional services. The focus here is on maximizing operational efficiency and leveraging RFID data for complex supply chain analytics.

Europe, particularly Western Europe (Germany, UK, France), represents another significant market, characterized by stringent traceability requirements in the food and pharmaceutical industries. European manufacturers are strong proponents of Industry 4.0, integrating RFID printers directly into production lines for automated quality control and asset identification within smart factories. The market growth in Europe is steady, supported by investment in cold chain monitoring applications and governmental interest in digital identity solutions, which sometimes utilize HF or UHF printing capabilities. However, regulatory diversity across the EU nations regarding frequency allocation occasionally poses integration challenges compared to the more unified approach in the U.S.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This exponential growth is underpinned by massive infrastructural investments in logistics, the explosive growth of e-commerce (especially in China, India, and Southeast Asia), and rapid industrial automation across the manufacturing base. While initial deployments focus on high-volume, low-cost logistics labeling, there is increasing demand for advanced RFID solutions in pharmaceuticals and luxury goods to combat rampant counterfeiting. The lower initial cost sensitivity in some APAC markets also drives demand for more entry-level, cost-effective desktop and light industrial RFID printers, although increasing quality standards are steadily pushing demand towards reliable, internationally certified brands.

- North America: Market leader; driven by retail item-level tagging mandates, high e-commerce volume, and mature supply chain infrastructure. High demand for industrial and high-throughput printers.

- Europe: Strong adoption in pharmaceuticals and automotive sectors due to strict traceability regulations; high growth in smart factory and Industry 4.0 integration.

- Asia Pacific (APAC): Highest CAGR; propelled by massive e-commerce growth, rapid manufacturing automation, and increasing need for anti-counterfeiting measures in fast-developing economies.

- Latin America: Emerging market; characterized by increasing investments in modernizing ports and customs procedures, leading to gradual adoption in logistics and agriculture.

- Middle East and Africa (MEA): Growth driven by large-scale government projects (smart cities) and significant investment in oil and gas asset tracking, requiring ruggedized and mobile solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the RFID Printer Market.- Zebra Technologies Corporation

- SATO Holdings Corporation

- Honeywell International Inc.

- TSC Auto ID Technology Co. Ltd.

- Avery Dennison Corporation

- Toshiba Tec Corporation

- Printronix (Acquired by TSC)

- Postek Electronics Co. Ltd.

- Cab Produkttechnik GmbH & Co KG

- Datamax-O'Neil (Acquired by Honeywell)

- CITIZEN SYSTEMS EUROPE GmbH

- BIXOLON Co. Ltd.

- Wasp Barcode Technologies

- Godex International

- Dascom Americas

- Brother Industries, Ltd.

- Seiko Epson Corporation

- Datalogic S.p.A.

- RG-Group

- Newland Auto-ID Tech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the RFID Printer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a standard thermal printer and an RFID printer?

An RFID printer incorporates an internal RFID encoder and antenna, allowing it to write digital data onto the embedded chip within the tag before printing the human-readable text and barcode. A standard thermal printer only handles the visual printing aspect.

Which frequency (UHF vs. HF) is most common for supply chain logistics applications?

Ultra-High Frequency (UHF) is predominantly used in supply chain logistics and warehousing because it provides a longer read range (up to 30 feet) and enables simultaneous reading of multiple tags, essential for pallet and container tracking.

Are mobile RFID printers suitable for industrial environments?

Yes, modern mobile RFID printers are designed with ruggedized casings and high battery capacity to withstand the operational demands of field services, inventory audits, and occasional use in industrial settings, offering on-demand printing capability.

What is the most critical factor affecting the total cost of ownership (TCO) for RFID printers?

The most critical factor is the recurring cost of consumables, specifically the specialized RFID labels/tags and thermal ribbons, which are generally priced higher than standard barcode media due to the embedded electronic components and specialized material requirements.

How does AI contribute to the efficiency of RFID printing operations?

AI primarily enhances efficiency through predictive maintenance, optimizing encoding power settings based on tag material to minimize read/write errors, and providing real-time diagnostics, thereby maximizing printer uptime and reducing media waste.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- RFID Printer Market Size Report By Type (Desktop RFID Printers, Industrial RFID Printers, Mobile RFID Printers), By Application (Industrial Application, Transportation & Logistics, Retail, Healthcare, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- RFID Printer Market Statistics 2025 Analysis By Application (Industrial Application, Transportation & Logistics, Retail, Healthcare), By Type (Desktop RFID Printers, Industrial RFID Printers, Mobile RFID Printers), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager