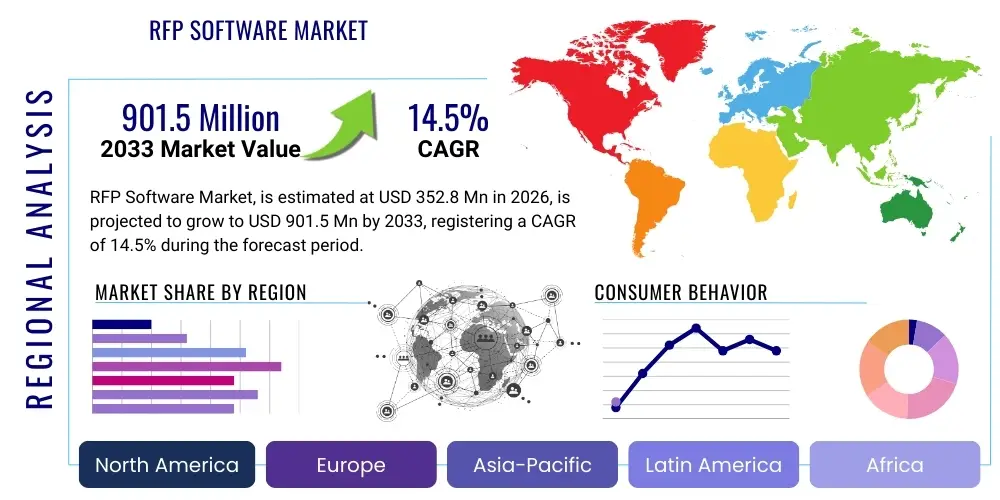

RFP Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434996 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

RFP Software Market Size

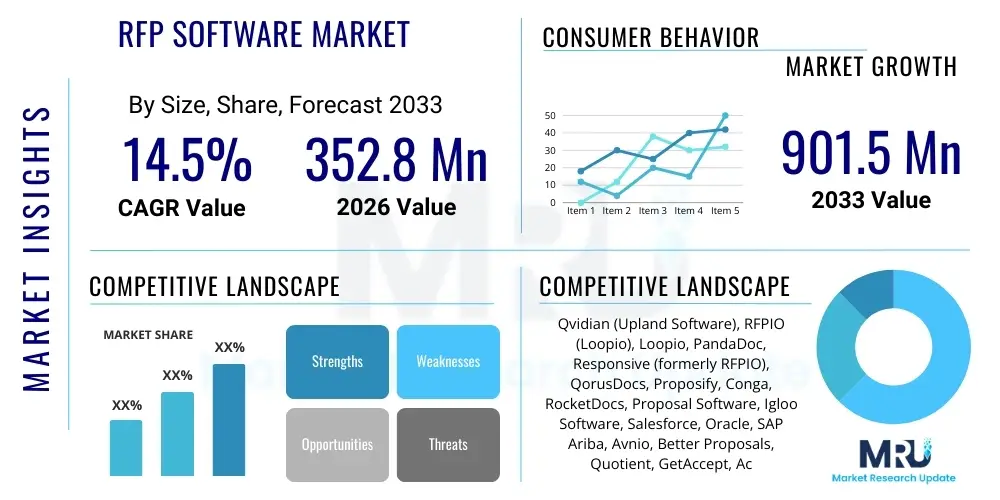

The RFP Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 352.8 million in 2026 and is projected to reach USD 901.5 million by the end of the forecast period in 2033.

RFP Software Market introduction

The Request for Proposal (RFP) Software Market encompasses specialized digital solutions designed to streamline and automate the entire lifecycle of the RFP process, encompassing both response generation (RFP response software) and procurement initiation (RFP issuance software). These platforms utilize advanced features such as centralized content libraries, collaboration tools, automated document generation, and project tracking to improve efficiency, accuracy, and compliance in high-stakes bidding and sourcing activities. The core purpose of these solutions is to minimize manual effort, accelerate turnaround times, and enhance the quality of proposals submitted or solicited by organizations, thereby maximizing win rates for responders and ensuring optimal vendor selection for issuers.

Major applications of RFP software span various functional areas, including sales enablement, procurement management, vendor management, and contract lifecycle management. In sales, the software allows teams to quickly tailor compelling proposals by accessing pre-approved, accurate content, dramatically reducing the time spent on repetitive tasks. For procurement departments, the tools facilitate the structured creation, distribution, and objective evaluation of RFPs, ensuring transparency and reducing compliance risks associated with vendor selection. The increasing complexity of regulatory environments and the global shift towards digital procurement strategies are fundamental drivers supporting the widespread adoption of these solutions across Small and Medium-sized Enterprises (SMEs) and large enterprises alike.

The primary benefit derived from adopting RFP software is the substantial improvement in operational efficiency and strategic decision-making. By consolidating fragmented data and automating the most time-consuming steps—such as content search, document formatting, and stakeholder review—organizations gain valuable competitive advantages. Furthermore, the integration capabilities of modern RFP platforms with existing Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems ensure data synchronization, providing comprehensive insights into proposal performance metrics. This integration capability, coupled with the rising demand for sophisticated content management and knowledge retention within enterprises, solidifies the market's robust growth trajectory over the forecast period.

RFP Software Market Executive Summary

The RFP Software Market is characterized by intense innovation driven primarily by the integration of Artificial Intelligence (AI) and Machine Learning (ML), fundamentally shifting how businesses manage strategic procurement and sales processes. Business trends indicate a strong move towards cloud-native, SaaS-based platforms offering enhanced scalability and flexibility, appealing particularly to global enterprises seeking seamless cross-functional collaboration. The competitive landscape is becoming increasingly concentrated, with larger players actively acquiring niche AI-focused solution providers to bolster their offerings, resulting in platforms that are evolving from mere content repositories into intelligent proposal generation and strategic sourcing engines. This evolution is underpinned by the growing recognition that centralized, high-quality proposal content is a critical sales asset.

Regional trends show North America maintaining its dominance due to high technological adoption rates, the presence of major solution vendors, and a mature ecosystem for digital business transformation. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapid industrial digitalization, increased foreign investment, and the expanding presence of multinational corporations requiring standardized global sourcing processes. Europe continues to be a significant market, although growth is moderated by diverse national regulations and stringent data privacy requirements (like GDPR), prompting regional vendors to focus heavily on compliance features and localized language support. The increasing prevalence of remote work catalyzed by recent global events further accelerated the necessity for robust, cloud-accessible collaboration tools, driving market penetration across all geographies.

Segment trends highlight the significant growth in solutions targeted towards large enterprises, driven by the complexity and volume of their sourcing needs, demanding advanced features like complex workflow automation and deep API integrations with multiple backend systems. Conversely, the segmentation by deployment type confirms the accelerating shift from on-premise solutions to cloud-based (SaaS) models, offering lower total cost of ownership (TCO) and rapid deployment benefits essential for scalability. Furthermore, the segmentation based on application reveals strong demand from the IT and Telecom sectors, followed closely by Financial Services and Healthcare, all of which handle high volumes of sensitive or technically detailed RFPs requiring specialized compliance and accuracy features provided by advanced RFP software.

AI Impact Analysis on RFP Software Market

Users frequently inquire about how AI can move RFP software beyond basic automation, specifically asking about intelligent content suggestion, predictive win-rate analysis, and the ethical implications of using generative AI for proposal writing. Key themes emerging from these questions center on enhancing content relevance, reducing the time spent on customization, and leveraging predictive insights to prioritize opportunities. Users are highly concerned with AI’s ability to maintain factual accuracy and company voice while accelerating the response process, viewing AI not just as a labor-saving tool but as a strategic asset for quality control and competitive advantage. Expectations are high regarding AI’s capacity to dynamically tailor responses based on specific client needs identified through prompt analysis and historical data.

- AI-powered content tagging and semantic search drastically improve content retrieval speed and relevance within knowledge libraries, ensuring responders use the most accurate and up-to-date information.

- Generative AI models automate the drafting of initial proposal sections and boilerplate language, reducing manual writing time by up to 60%.

- Machine Learning algorithms enable predictive scoring of RFP documents, identifying critical requirements and risks early in the process, thus prioritizing resources effectively.

- Natural Language Processing (NLP) facilitates sophisticated analysis of complex RFP requirements, ensuring 100% adherence to compliance mandates and technical specifications.

- AI tools customize content variation based on the issuing organization's known preferences and historical interactions (CRM data integration), significantly enhancing personalization and engagement.

- Automation of tedious tasks such as formatting, cross-referencing, and final document assembly frees up strategic personnel (e.g., proposal managers) to focus on high-value strategic input rather than administrative duties.

- Risk assessment capabilities utilizing AI analyze contractual terms and conditions (T&Cs) within the RFP document, flagging potentially unfavorable clauses or non-standard requests for immediate review.

DRO & Impact Forces Of RFP Software Market

The RFP Software Market is being powerfully influenced by a confluence of driving factors centered around digital transformation and efficiency mandates, offset by significant restraints primarily related to implementation complexity and data security concerns. The overarching driver is the increasing complexity and volume of regulatory compliance requirements (especially in regulated industries like finance and healthcare), which necessitates audit trails and standardized processes that only specialized software can provide efficiently. This market dynamic is further amplified by the competitive pressure across various industries, forcing companies to seek technological solutions that can drastically cut the time-to-proposal while simultaneously increasing the quality and strategic relevance of their bids. The transition to cloud infrastructure facilitates easier deployment and scalability, acting as a major positive impact force.

Key market restraints include the high initial investment required for enterprise-grade RFP software deployment, which often involves integrating the platform with legacy ERP or CRM systems—a process that can be resource-intensive and lengthy. Furthermore, resistance to change within organizations, particularly concerning the shift from established manual or spreadsheet-based processes to automated workflows, can slow down adoption and dilute the software's intended return on investment (ROI). Data security and governance represent continuous challenges, as RFP documents often contain proprietary pricing strategies, sensitive technical specifications, and client confidentiality clauses, demanding rigorous security protocols from software vendors, especially those operating in a multi-tenant cloud environment.

Opportunities for growth are abundant, particularly in enhancing interoperability through open APIs and focusing on niche industry-specific features that address unique compliance or technical requirements. The rising interest in generative AI for content automation presents a significant opportunity for vendors to differentiate their products by offering truly intelligent content generation and optimization services, moving beyond simple repository management. The expansion into untapped emerging economies, especially in APAC and parts of Latin America, where digitalization of procurement is accelerating, offers substantial greenfield potential. The major impact forces thus include the unstoppable momentum of enterprise digital transformation (positive driver) and the critical necessity for robust data governance (moderating restraint) shaping product development.

Segmentation Analysis

The RFP Software Market is primarily segmented based on Deployment Type, Enterprise Size, Application, and Industry Vertical. Analyzing these segments provides a clear understanding of market penetration and growth opportunities across diverse organizational profiles and operational needs. The proliferation of Software as a Service (SaaS) models has fundamentally redefined the deployment landscape, offering accessibility and lower barrier to entry for smaller organizations, while the segmentation by Enterprise Size highlights the differential feature demands between large corporations requiring sophisticated integrations and SMEs prioritizing speed and ease of use. The diversity across industry verticals, from technology requiring technical depth to finance demanding regulatory compliance, shapes the customization and specialization of software offerings.

- By Deployment Type:

- Cloud-based (SaaS)

- On-premise

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Application:

- RFP Response Management

- RFP Creation/Issuance (Sourcing)

- Contract Lifecycle Management Integration

- By Industry Vertical:

- Information Technology (IT) and Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Pharmaceuticals

- Manufacturing

- Government and Public Sector

- Others (Retail, Education)

Value Chain Analysis For RFP Software Market

The value chain of the RFP Software Market begins with the Upstream component providers, primarily centered around technological infrastructure and data services. This includes cloud platform providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, which furnish the scalable hosting environment necessary for SaaS solutions. Furthermore, specialized providers of AI/ML models, Natural Language Processing (NLP) toolkits, and robust cybersecurity frameworks are crucial upstream suppliers, as the intelligence and security capabilities of the final product depend heavily on these components. The ability of RFP software vendors to secure cost-effective and high-performance infrastructure dictates their overall operational efficiency and margin potential.

The Midstream phase involves the core activities of the RFP software vendors themselves, focusing on product development, solution design, and proprietary feature implementation, particularly workflow automation and content management system (CMS) architecture. This stage includes significant investment in research and development (R&D) to integrate cutting-edge technologies like generative AI and predictive analytics. Key strategic decisions at this level involve establishing robust API frameworks to ensure seamless integration with prevalent enterprise systems (CRM, ERP, SCM). Efficiency in the midstream—managing agile development cycles and maintaining software reliability—is vital for competitive positioning and client retention in this rapidly evolving market.

The Downstream activities focus on market penetration, distribution, implementation, and post-sales support. Distribution channels are typically a mix of direct sales teams targeting large enterprises and channel partners (resellers, system integrators) extending reach to SMEs and specific geographic markets. Direct distribution allows vendors to maintain tighter control over customer relationships and deployment quality, especially for highly customized solutions. Post-implementation support, including training, content migration assistance, and continuous technical maintenance, is a critical value-added service, influencing customer satisfaction and renewal rates. Effective downstream management, focusing on rapid deployment and high-quality customer success, is essential for maximizing the platform's lifetime value (LTV).

RFP Software Market Potential Customers

Potential customers for RFP software solutions are broadly defined as any organization, regardless of size or sector, that regularly engages in complex sourcing processes or high-volume bid responses. These organizations fall into two primary user groups: companies responding to RFPs (vendors, service providers, sellers) and companies issuing RFPs (procurement departments, government agencies, large corporate buyers). The strongest demand originates from large enterprises that manage hundreds of bids or sourcing events annually, recognizing the significant administrative burden and strategic risk associated with manual processes. Industries characterized by strict regulation, such as BFSI and Healthcare, represent highly lucrative customer segments due to their non-negotiable need for comprehensive audit trails and compliance verification embedded within the software.

Furthermore, Small and Medium Enterprises (SMEs), particularly those operating in rapidly scaling technology and professional services sectors, are increasingly becoming crucial customers, driven by accessible, subscription-based SaaS models. For SMEs, the immediate benefit lies in professionalizing their proposal process to compete effectively against larger incumbents without the need for dedicated proposal management teams. These buyers prioritize speed, ease of use, and out-of-the-box integrations with common platforms. Government agencies globally also constitute a massive potential customer base, motivated by mandates for transparency in public procurement and the requirement to handle intricate, often politically sensitive, tenders efficiently and securely.

The trend towards specialized enterprise software means that the modern potential customer is looking beyond generic content management toward solutions offering vertical-specific intelligence—for instance, a financial institution needs software that natively handles global financial disclosure requirements, while a pharmaceutical company requires validation features for clinical trial documentation. Therefore, the most attractive customers are those with high strategic value placed on either reducing procurement costs (issuers) or increasing contract win rates (responders), viewing RFP software as a strategic tool for revenue growth and operational risk mitigation rather than merely an administrative expense. The integration of RFP software within the broader Sales Enablement and Procure-to-Pay ecosystems reinforces its necessity across the entire corporate lifecycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 352.8 Million |

| Market Forecast in 2033 | USD 901.5 Million |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qvidian (Upland Software), RFPIO (Loopio), Loopio, PandaDoc, Responsive (formerly RFPIO), QorusDocs, Proposify, Conga, RocketDocs, Proposal Software, Igloo Software, Salesforce, Oracle, SAP Ariba, Avnio, Better Proposals, Quotient, GetAccept, Accelo, BidPrime |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

RFP Software Market Key Technology Landscape

The technology landscape of the RFP Software Market is rapidly converging on advanced intelligence, seamless integration, and cloud-native architecture. Central to this evolution is the pervasive adoption of Artificial Intelligence (AI) and Machine Learning (ML), particularly for content matching, automatic response generation, and performance prediction. Modern RFP platforms leverage Natural Language Processing (NLP) to parse complex requirements documents and intelligently map them to pre-approved answers stored in centralized content libraries, dramatically speeding up the initial draft phase. Furthermore, ML algorithms continuously learn from historical win/loss data and user edits to refine content suggestions, ensuring higher relevance and accuracy over time, transforming the software into a truly strategic decision-support tool.

Beyond core AI capabilities, the market is heavily reliant on robust integration technologies. The effectiveness of an RFP solution is increasingly defined by its ability to integrate bid data with the broader enterprise technology ecosystem. Key integration points include CRM platforms (Salesforce, Dynamics 365) to link proposals directly to opportunities and sales forecasts, and ERP/SCM systems (SAP Ariba, Oracle) for sourcing-focused solutions to ensure compliance with procurement regulations and vendor data synchronization. This interoperability, facilitated by open APIs and webhook structures, minimizes data silos and ensures that the proposal management process is fully embedded within the organization’s overall sales and procurement workflow, supporting a unified digital thread across departments.

Finally, security, scalability, and user experience (UX) remain critical technological differentiators. The overwhelming preference for Software as a Service (SaaS) necessitates advanced cloud security features, including robust encryption, multi-factor authentication, and compliance certifications (e.g., SOC 2, ISO 27001), crucial for handling sensitive business data. Scalability, achieved through microservices architecture, ensures the platform can handle peak loads common during high-volume bidding cycles. Vendors are also investing heavily in modern, intuitive user interfaces and mobile accessibility to enhance collaboration among globally distributed teams, thereby maximizing user adoption and ensuring a positive return on technology investment.

Regional Highlights

The RFP Software Market exhibits varied growth dynamics across major global regions, reflecting differences in technological maturity, digitalization mandates, and regulatory environments. North America dominates the global market, largely due to the early and aggressive adoption of enterprise software solutions, coupled with the high concentration of both major technology solution providers and large corporations with complex, frequent RFP requirements. The region's robust venture capital funding environment fosters continuous innovation, particularly in AI-driven proposal automation tools, maintaining its leadership in terms of market size and technological development.

Europe represents the second-largest market, characterized by strong regulatory compliance demands, especially concerning data protection (GDPR) and public sector transparency, which mandate the use of formalized, auditable software solutions for both issuing and responding to RFPs. While the adoption rate is high, the market is somewhat fragmented by national preferences and linguistic requirements. Growth in Europe is steady, driven by the need for localized content management capabilities and systems that can easily comply with diverse regional sourcing standards.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid digital transformation initiatives across emerging economies like India, China, and Southeast Asia. Increasing foreign direct investment, the establishment of large multinational operations, and governments pushing for digital public procurement are accelerating the demand for structured RFP solutions. While initial adoption focused on basic automation, the market is quickly moving towards sophisticated, AI-enabled solutions, representing significant long-term growth opportunities for vendors.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets currently characterized by lower overall market penetration but substantial potential. In LATAM, growth is tied to economic stabilization and the push for greater efficiency in industrial sectors. In MEA, particularly the Gulf Cooperation Council (GCC) countries, massive infrastructure projects and government-led digitalization strategies are creating strong pockets of demand for robust, secure RFP and sourcing software.

- North America: Market leader; high adoption of SaaS and AI; focus on maximizing sales enablement and win rates. Key countries: United States, Canada.

- Europe: Mature market; growth driven by regulatory compliance (GDPR, public procurement laws); emphasis on multilingual support and robust audit trails. Key countries: Germany, UK, France.

- Asia Pacific (APAC): Highest CAGR; accelerated digitalization in emerging markets; strong growth in IT, Telecom, and Government sectors. Key countries: China, India, Japan, Australia.

- Latin America (LATAM): Emerging market; growing demand spurred by industrial efficiency mandates and cross-border trade complexity. Key countries: Brazil, Mexico.

- Middle East and Africa (MEA): Growth driven by government digital initiatives and large-scale infrastructure and energy projects requiring formal sourcing tools. Key regions: UAE, Saudi Arabia, South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the RFP Software Market.- Responsive (formerly RFPIO)

- Loopio

- Qvidian (Upland Software)

- QorusDocs

- PandaDoc

- Proposify

- Conga

- RocketDocs

- Proposal Software

- Igloo Software

- Salesforce (via integrated offerings)

- Oracle (via Procurement Cloud)

- SAP Ariba

- Avnio

- Better Proposals

- Quotient

- GetAccept

- Accelo

- BidPrime

- XaitPorter

Frequently Asked Questions

Analyze common user questions about the RFP Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the RFP Software Market?

The RFP Software Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. This growth is primarily fueled by the accelerating enterprise demand for proposal automation, centralized content governance, and integration of generative AI technologies to enhance sales and procurement efficiency.

How is Artificial Intelligence (AI) specifically transforming RFP response efficiency?

AI is transforming RFP efficiency by automating key tasks such as semantic content search and mapping, analyzing complex solicitation documents (NLP), and generating accurate, personalized draft responses. This intelligence drastically reduces manual effort, ensures the use of compliance-approved information, and improves proposal quality, directly boosting competitive win rates.

Which segmentation dominates the RFP Software Market based on deployment type?

The Cloud-based (SaaS) deployment segment currently dominates the RFP Software Market. SaaS models are preferred across both SMEs and large enterprises due to their flexibility, reduced initial investment cost, instant scalability, and ease of access for distributed, remote teams, aligning perfectly with modern digital workplace strategies.

What are the primary challenges restraining the widespread adoption of RFP software?

The primary restraints hindering the adoption of RFP software include the high initial costs associated with enterprise-level licensing and integration into existing CRM/ERP systems (legacy integration complexity). Additionally, organizations often face resistance to change from internal stakeholders accustomed to manual, traditional proposal processes, requiring substantial change management efforts.

Which geographical region demonstrates the highest growth potential in the RFP Software Market?

The Asia Pacific (APAC) region is forecasted to demonstrate the highest growth potential (CAGR) in the RFP Software Market over the forecast period. This rapid expansion is driven by massive governmental and private sector investments in digital procurement infrastructure and the increasing need for formal, standardized sourcing processes across rapidly industrializing economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager