Rhenium Metal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432127 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Rhenium Metal Market Size

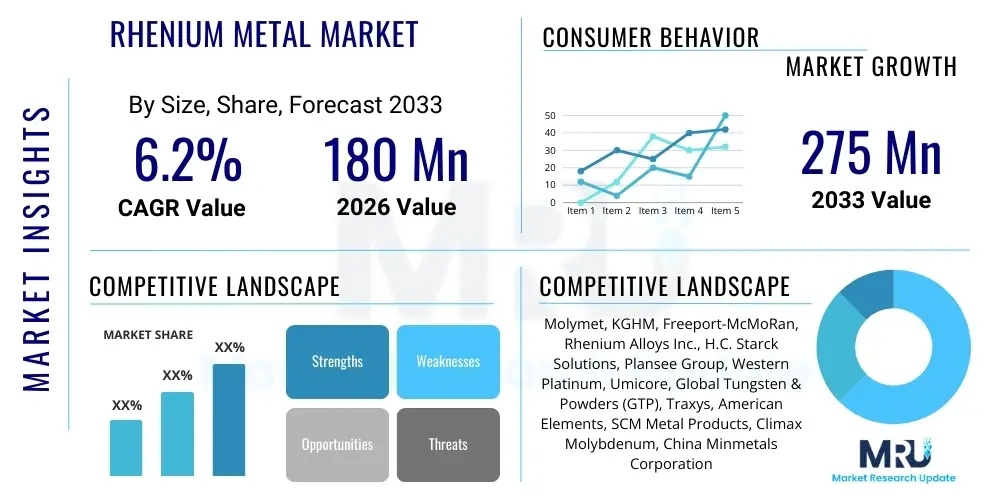

The Rhenium Metal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at $180 Million USD in 2026 and is projected to reach $275 Million USD by the end of the forecast period in 2033.

Rhenium Metal Market introduction

Rhenium (Re) is one of the rarest and most expensive refractory metals, known for its extremely high melting point (3186 °C), superior density, and exceptional resistance to wear and corrosion. Due to these unique properties, the metal is primarily utilized in superalloys destined for high-temperature, high-stress environments, predominantly in the aerospace and defense sectors for manufacturing turbine blades and other critical jet engine components. Rhenium is typically obtained as a byproduct of molybdenum and copper mining, contributing to its constrained supply chain and price volatility. Its applications are critically tied to sectors demanding peak performance under extreme thermal conditions.

The product description encompasses various forms of rhenium, including pure rhenium metal, rhenium powder, ammonium perrhenate (APR), and specialized alloys. Ammonium perrhenate is the primary precursor chemical used for refining the metal or manufacturing catalysts. Major applications extend beyond aerospace superalloys to include platinum-rhenium catalysts used extensively in the petrochemical industry for producing high-octane, lead-free gasoline (catalytic reforming). Other niche applications involve thermocouples, electrical contacts, and heating elements due to its high resistance to oxidation and creep resistance at elevated temperatures.

The market growth is fundamentally driven by the continuous expansion and modernization of global commercial and military aerospace fleets, which rely heavily on Rhenium-containing nickel-based superalloys for increased engine efficiency and thrust-to-weight ratios. The inherent benefits of using rhenium—such as significantly improved high-temperature stability and strength—justify its high cost in mission-critical applications. Furthermore, the increasing focus on cleaner fuels and advanced chemical processing methodologies globally is bolstering demand for highly efficient platinum-rhenium catalysts, sustaining the market's trajectory despite supply chain challenges.

Rhenium Metal Market Executive Summary

The Rhenium Metal Market is characterized by high price elasticity, constrained supply, and demand concentrated in specialized, high-value industries, primarily aerospace and petrochemicals. Business trends indicate a shift toward optimizing rhenium recovery processes from existing sources and exploring potential recycling avenues, given the metal's scarcity. Technological advancements in additive manufacturing (AM) are enabling more efficient use of rhenium powders, potentially reducing scrap generation in superalloy production. Strategic procurement and long-term contracts remain vital for key industrial consumers to mitigate extreme price volatility inherent in this market.

Regional trends highlight North America, particularly the United States, as the dominant consumer, driven by its expansive aerospace manufacturing base (Boeing, Lockheed Martin, General Electric Aviation) and robust defense expenditure. Asia Pacific is emerging as the fastest-growing region, fueled by expanding commercial aviation demand, particularly in China and India, and increasing investment in domestic petrochemical refining capacity. Europe maintains a significant presence, focusing on advanced catalyst manufacturing and niche high-tech applications, supported by key players like Safran and Rolls-Royce.

Segment trends confirm Superalloys as the leading application segment, closely followed by Catalysts. Within the Form segment, Ammonium Perrhenate remains crucial as the primary trading and processing intermediate. The overall market dynamics are tightly linked to global economic stability, military budgets, and fuel demand, making it resilient but sensitive to major shifts in these sectors. Companies are strategically investing in vertical integration, particularly in the recovery and processing stages, to secure supply lines and gain competitive advantages in this oligopolistic market structure.

AI Impact Analysis on Rhenium Metal Market

User inquiries regarding AI's influence on the Rhenium Metal Market primarily center on how AI can optimize discovery and extraction processes, enhance material formulation, and predict demand/price volatility. Key themes include the potential use of machine learning (ML) in predictive maintenance for jet engines, which could alter the replacement cycle for rhenium-containing superalloys, and the application of AI in accelerating the development of next-generation catalysts, potentially reducing the required rhenium loading or identifying suitable substitutes. Concerns revolve around the data intensity required for these models, given the highly confidential and proprietary nature of superalloy compositions and catalyst performance data. Expectations are high regarding AI's ability to provide more accurate, real-time tracking of geopolitical supply disruptions, thereby improving price stability and procurement strategies in this critically constrained commodity market.

- AI-driven optimization of mining and extraction yields for primary molybdenum and copper ores, thereby indirectly increasing rhenium byproduct recovery rates.

- Machine learning algorithms utilized for predictive modeling of superalloy creep and fatigue life, potentially extending the operational lifespan of rhenium-containing components in gas turbines.

- Integration of Generative AI and ML in high-throughput materials science research to rapidly screen and design novel, high-performance rhenium alloys or identify potential low-rhenium substitutes.

- Application of AI-powered forecasting tools to better anticipate global demand fluctuations in aerospace manufacturing and petrochemical refining, aiding in strategic inventory management.

- AI used in supply chain risk management to monitor geopolitical factors and predict disruptions in the concentrated rhenium supply chain (e.g., Chile, Kazakhstan, Poland).

- Automated quality control systems employing computer vision for detecting flaws and ensuring uniformity in high-purity rhenium metal powders and pellets used in additive manufacturing.

DRO & Impact Forces Of Rhenium Metal Market

The Rhenium Metal Market is heavily influenced by a unique set of impact forces stemming from its essential role in high-performance engineering and its extreme scarcity. Key drivers include the mandatory requirements for enhanced fuel efficiency and operational temperature capabilities in modern jet engines, necessitating higher rhenium content in superalloys. Simultaneously, the limited number of primary sources, concentrated production processes, and the metal’s status as a minor byproduct impose significant restraints, mainly manifesting as extreme price volatility and vulnerability to supply shocks. Opportunities reside predominantly in emerging high-tech applications, such as advanced catalysts for hydrogen fuel production and specialized medical isotopes, offering avenues for market diversification beyond traditional aerospace dependency.

Impact forces are predominantly high due to the inelastic demand from mission-critical applications; end-users cannot easily substitute rhenium in advanced jet engine turbine blades without compromising performance standards. Regulatory shifts towards cleaner transportation and energy also act as an indirect force, increasing demand for highly efficient petrochemical catalysts, a key rhenium application. Furthermore, the geopolitical stability of major producing countries directly dictates supply certainty, making political risk a central impact force on the market equilibrium.

The dynamic interplay between sustained aerospace demand, restrictive supply structure, and technological evolution defines the market outlook. While the high initial cost and complex recycling processes act as persistent restraining forces, continuous R&D investment by engine manufacturers and catalyst producers ensures that the demand curve remains robust. Strategic investments in secondary recovery (recycling) and inventory management are critical mitigating strategies against the inherent instability driven by concentrated supply and high extraction costs.

- Drivers (D): Increased demand for high-performance superalloys in commercial and military jet engines; growing requirements for high-efficiency platinum-rhenium catalysts in oil refining; advancements in thermal barrier coatings utilizing rhenium.

- Restraints (R): Extreme price volatility and high cost of Rhenium metal; highly concentrated global supply chain (oligopolistic production structure); difficulties and high costs associated with recycling and secondary recovery.

- Opportunities (O): Expansion in next-generation medical isotope production (e.g., Rhenium-188); application development in green hydrogen catalysts; utilization in advanced semiconductor manufacturing and high-temperature vacuum furnaces.

- Impact Forces (IF): Geopolitical stability of producing nations; stringent aerospace material qualification standards; continuous development cycles for commercial aircraft engine platforms.

Segmentation Analysis

The Rhenium Metal Market is systematically segmented based on its application, form, and end-use industry, reflecting the specialized nature of its consumption patterns. Application segmentation delineates the primary uses of the metal, with nickel-based superalloys dominating the volume and value due to their critical role in gas turbine technology. Catalyst applications, particularly for continuous catalytic reforming (CCR) in petroleum refining, constitute the second most significant segment, driven by global demand for high-octane gasoline. Understanding these distinct application segments is crucial as they exhibit different demand elasticities and price sensitivities.

Segmentation by form details the various intermediate and final products sold in the market, including the precursor chemical Ammonium Perrhenate (APR), pure Rhenium powder, and finished Rhenium metal and pellets. APR is essential for both catalyst and superalloy production pipelines, serving as the foundational traded commodity. The fastest-growing form segment is high-purity Rhenium powder, mandated by the increasing adoption of additive manufacturing techniques (e.g., Laser Powder Bed Fusion) for manufacturing complex, high-performance turbine components with minimal material waste.

End-use industry segmentation confirms the dominance of Aerospace and Defense, followed by the Chemical and Petrochemical sectors. Emerging sectors, such as Nuclear Medicine and specialized Electronics, although smaller in volume, offer significant high-value growth potential. The detailed segmentation analysis provides market participants with precise insight into where growth opportunities are highest and where supply chain resilience is most critical.

- By Application:

- Superalloys (Aerospace, Industrial Gas Turbines)

- Catalysts (Petroleum Refining, Chemical Synthesis)

- Heating Elements & Filaments

- Electrical Contacts

- Medical Isotopes (Rhenium-188)

- Others (Thermocouples, X-ray Targets)

- By Form:

- Ammonium Perrhenate (APR)

- Rhenium Powder (High Purity)

- Rhenium Metal & Pellets

- Rhenium Alloys (e.g., Tungsten-Rhenium, Molybdenum-Rhenium)

- By End-Use Industry:

- Aerospace & Defense

- Petrochemical & Chemical

- Electronics

- Healthcare & Nuclear Medicine

- Industrial Equipment

Value Chain Analysis For Rhenium Metal Market

The Rhenium Metal value chain is characterized by concentration at the upstream mining and processing stages due to Rhenium’s nature as a minor byproduct. The upstream analysis begins with the mining of primary copper and molybdenum ores, predominantly in the Andean region (Chile, Peru) and specific deposits in Kazakhstan, Russia, and the US. Rhenium is recovered during the roasting process of molybdenum sulfide concentrates. This initial extraction and refinement phase, yielding Ammonium Perrhenate (APR), is controlled by a few large multinational mining corporations, establishing significant barriers to entry and dictating supply volatility.

The midstream involves the transformation of APR into various commercial forms, such as high-purity metal powder, pellets, or specific alloys. This step requires highly specialized chemical processing and metallurgical expertise, typically managed by specialized refiners and material science companies. Distribution channels for these refined products are multifaceted: direct sales are common for high-volume consumers like aerospace manufacturers, while indirect channels utilizing specialized metals traders and distributors serve smaller catalyst producers and niche industrial buyers. Direct channels ensure quality control and secure contracts, while indirect channels provide market liquidity.

The downstream segment consists of the end-use manufacturing processes where rhenium is incorporated into final high-value products. This includes melting and casting superalloys for turbine blades, preparing catalysts for refinery operations, or manufacturing specialized electronic components. The end-users in the aerospace and defense sectors demand strict quality assurance and traceability. The complexity and high value added at the downstream stage often outweigh the cost volatility originating upstream, allowing final product manufacturers to absorb price fluctuations, thus reinforcing the inelastic demand characteristic of the Rhenium market.

Rhenium Metal Market Potential Customers

Potential customers for Rhenium metal are highly specialized entities operating in capital-intensive industries where material performance is non-negotiable for safety and efficiency. The largest customer base resides in the aerospace sector, specifically global manufacturers of commercial and military gas turbine engines, including core companies like GE Aviation, Rolls-Royce, Pratt & Whitney, and Safran. These entities are the primary purchasers of rhenium-containing nickel superalloys used for critical hot-section components like turbine blades and vanes, necessitating high-volume, continuous supply contracts.

The second major cohort comprises petrochemical and chemical companies that require high-performance catalysts for hydrocarbon processing. Refiners, such as ExxonMobil, Shell, and Sinopec, rely on platinum-rhenium catalysts for continuous catalytic reforming processes essential for upgrading crude oil fractions into high-octane gasoline components. These customers typically source Ammonium Perrhenate (APR) or pre-manufactured catalysts from specialized chemical companies, focusing on long catalyst lifetimes and high yield rates.

Other significant buyers include specialized metallurgical processors, defense contractors utilizing rhenium in missiles and extreme temperature sensors, and manufacturers of high-end industrial heating elements (e.g., for vacuum furnaces). Furthermore, the burgeoning nuclear medicine sector, focused on therapeutic radioisotopes like Rhenium-188, represents a growing, albeit smaller volume, high-value customer base requiring ultra-high purity materials for pharmacological applications. These various end-users all prioritize supply security, consistent material purity, and robust long-term partnerships with refiners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $180 Million USD |

| Market Forecast in 2033 | $275 Million USD |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Molymet, KGHM, Freeport-McMoRan, Rhenium Alloys Inc., H.C. Starck Solutions, Plansee Group, Western Platinum, Umicore, Global Tungsten & Powders (GTP), Traxys, American Elements, SCM Metal Products, Climax Molybdenum, China Minmetals Corporation, DOWA Holdings, Materion Corporation, Mitsui Mining & Smelting, Reading Alloys, Specialty Metals Processing Inc., SMT Rhenium |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rhenium Metal Market Key Technology Landscape

The technology landscape for the Rhenium Metal market spans the entire value chain, from advanced extraction techniques to sophisticated end-use manufacturing processes. In the upstream sector, crucial technologies involve solvent extraction and ion exchange methods used to efficiently separate Rhenium from highly acidic leach solutions generated during the processing of Molybdenum sulfide concentrates. Continuous optimization of these hydrometallurgical routes is vital for maximizing byproduct recovery rates, especially as ore grades decline. Refiners are increasingly adopting advanced thermal decomposition methods to produce ultra-high purity Rhenium powders and pellets suitable for demanding aerospace specifications.

Midstream technological advancements are focused on enhancing material characteristics. Key technologies here include chemical vapor deposition (CVD) for producing high-purity rhenium coatings and specialized powder metallurgy techniques to manufacture dense, defect-free Rhenium metal components. The stringent purity requirements for Rhenium used in nuclear medicine and electronics mandate state-of-the-art analytical instrumentation, such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS), to ensure minimal contamination down to parts per billion levels, a critical technological bottleneck.

Downstream technology is dominated by nickel-based superalloy manufacturing and catalyst synthesis. Investment casting, often involving directional solidification (DS) and single-crystal (SX) methods, is essential for producing Rhenium-rich turbine blades capable of operating near their melting point. Furthermore, the rapid growth of Additive Manufacturing (AM), specifically directed energy deposition (DED) and powder bed fusion (PBF), is transforming the consumption pattern by enabling the production of highly complex, low-waste components using specialized Rhenium powders, driving the need for tighter control over powder particle size distribution and morphology.

Regional Highlights

- North America: Dominates the global market, primarily driven by the colossal aerospace and defense industry base in the United States. Demand is inherently linked to new commercial aircraft deliveries (e.g., Boeing) and continuous modernization of military platforms (e.g., F-35 program). Furthermore, significant domestic petrochemical refining capacity contributes substantially to catalyst demand.

- Europe: A major consumer focused on high-technology applications and advanced material science research. Demand is supported by key European aerospace firms (Airbus, Rolls-Royce, Safran) and specialized chemical companies producing high-performance catalysts for global export. Strict environmental regulations also push demand for more efficient, Rhenium-catalyzed processes.

- Asia Pacific (APAC): Exhibits the highest growth rate, fueled by unprecedented expansion in commercial aviation, particularly in China and India, alongside vast investments in refining infrastructure. Countries like Japan and South Korea also represent strong markets for high-purity Rhenium used in electronics and specialized industrial heating applications.

- Latin America: Crucial as the primary source region, particularly Chile and Peru, which possess the world's largest recoverable Rhenium reserves, mainly as a byproduct of copper and molybdenum mining. While consumption is low, its role in the global supply chain is paramount, and production stability heavily influences global prices.

- Middle East and Africa (MEA): Demand is largely driven by large-scale petrochemical refining operations, especially in Saudi Arabia and the UAE, where Rhenium-based catalysts are essential for producing transportation fuels. Limited internal consumption beyond this sector; the region's importance is focused on energy infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rhenium Metal Market.- Molymet

- KGHM

- Freeport-McMoRan

- Rhenium Alloys Inc.

- H.C. Starck Solutions

- Plansee Group

- Western Platinum

- Umicore

- Global Tungsten & Powders (GTP)

- Traxys

- American Elements

- SCM Metal Products

- Climax Molybdenum

- China Minmetals Corporation

- DOWA Holdings

- Materion Corporation

- Mitsui Mining & Smelting

- Reading Alloys

- Specialty Metals Processing Inc.

- SMT Rhenium

Frequently Asked Questions

Analyze common user questions about the Rhenium Metal market and generate a concise list of summarized FAQs reflecting key topics and concerns.Why is Rhenium metal so expensive and volatile?

Rhenium is extremely expensive due to its rarity and constrained supply; it is recovered only as a minor byproduct of molybdenum and copper mining, meaning its production volume is inelastic and highly sensitive to external mining operations and geopolitical supply chain stability.

What is the primary driver of demand for Rhenium metal?

The dominant driver is the aerospace and defense sector, where Rhenium is a critical component in nickel-based superalloys utilized for manufacturing high-temperature turbine blades and vanes in advanced commercial and military jet engines, crucial for efficiency and power.

How is Rhenium typically traded or sold in the market?

Rhenium is primarily traded in the form of Ammonium Perrhenate (APR), which is the precursor chemical for producing both pure metal and catalysts. Trading occurs through specialized metal brokers, direct contracts with refiners, and long-term procurement agreements with major end-users.

Does recycling play a significant role in Rhenium supply?

Yes, recycling is increasingly important. Due to its high value and scarcity, secondary recovery from spent catalysts and end-of-life superalloy scrap (known as revert) is a significant source of supply, though the recycling process is complex and costly.

How will Additive Manufacturing (AM) affect Rhenium consumption?

AM technologies, such as laser powder bed fusion, are expected to increase the demand for high-purity Rhenium powder while potentially reducing overall material wastage in the aerospace sector, optimizing the consumption of this highly valuable metal in complex geometries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager