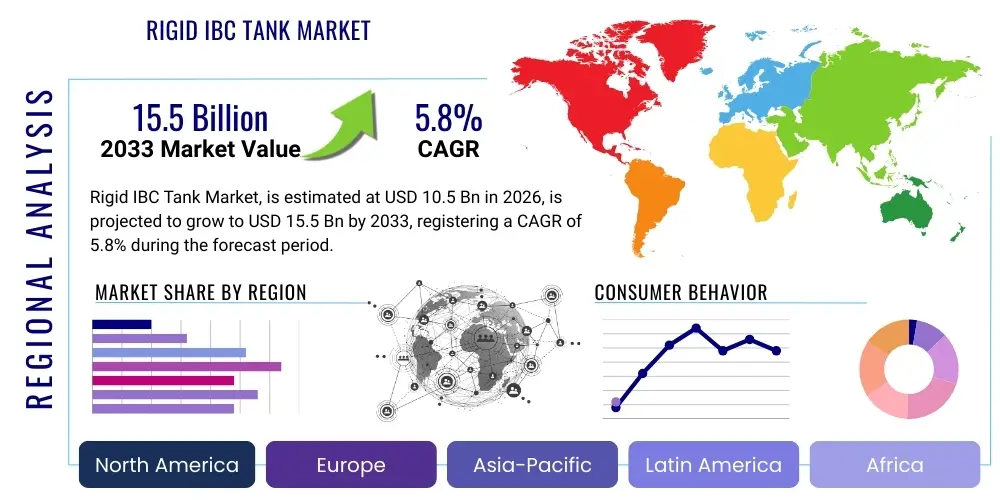

Rigid IBC Tank Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434650 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Rigid IBC Tank Market Size

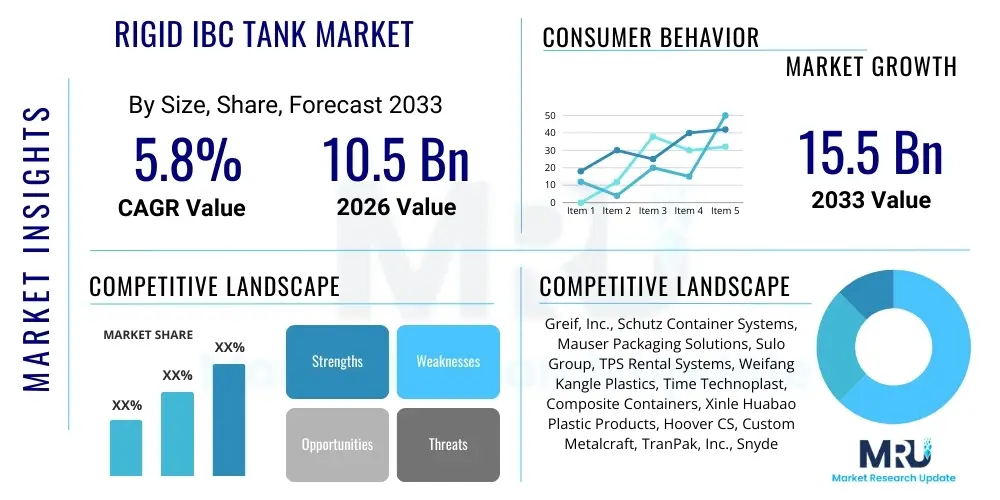

The Rigid IBC Tank Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 15.5 Billion by the end of the forecast period in 2033.

Rigid IBC Tank Market introduction

The Rigid Intermediate Bulk Container (IBC) Tank Market encompasses specialized packaging solutions designed for the safe, efficient storage and transportation of bulk liquids, semi-solids, powders, and granular substances. Rigid IBCs are characterized by their fixed structure, typically constructed from high-density polyethylene (HDPE) encased in a galvanized steel cage (composite IBCs), or entirely from steel or rigid plastic, ensuring structural integrity and protection for sensitive contents. These containers bridge the gap between drums and bulk tank containers, offering substantial volumetric capacity (typically ranging from 500 to 3,000 liters) which optimizes logistics and minimizes handling costs compared to smaller containers.

Major applications of Rigid IBC tanks span critical industrial sectors including chemicals, petrochemicals, pharmaceuticals, food and beverage, and paints and coatings, where regulatory compliance regarding safety and material compatibility is paramount. In the chemical industry, IBCs are essential for transporting corrosive or hazardous materials, while the food and beverage sector relies on specialized food-grade IBCs for ingredients like syrups, oils, and concentrates. The standardized footprint of these tanks allows for efficient stacking and maximized utilization of storage and shipping space, directly contributing to operational efficiencies within complex global supply chains.

Key benefits driving market expansion include their reusability, which aligns with circular economy principles and reduces overall packaging waste, and their ease of handling via forklifts or pallet jacks. The stringent regulations governing the transport of dangerous goods (such as UN certification requirements) further solidify the demand for certified rigid IBCs. Driving factors involve the sustained growth in global chemical production, increased adoption of large-scale logistics solutions in emerging economies, and the continuous trend toward sustainable, multi-trip packaging alternatives over single-use drums, propelling market trajectory throughout the forecast period.

Rigid IBC Tank Market Executive Summary

The Rigid IBC Tank Market is witnessing robust growth, primarily driven by escalating international trade volumes and the imperative for optimized bulk packaging solutions across diverse industries. Current business trends indicate a strong shift toward composite IBCs, favored for their balance of durability, cost-effectiveness, and chemical resistance, positioning them as the dominant material type. Furthermore, sustainability is a major strategic focus, compelling manufacturers to invest in recycling programs and design improvements that extend product lifecycle, thereby enhancing the economic viability of reusable rigid tanks over disposable alternatives. This competitive environment is characterized by intense innovation in tracking technologies, such as IoT integration, to improve fleet management and compliance monitoring.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, propelled by rapid industrialization, expansion of the chemical manufacturing base in countries like China and India, and increasing demand from the burgeoning food processing and pharmaceutical sectors. North America and Europe maintain significant market shares, characterized by stringent regulatory landscapes that mandate high-quality, certified packaging, driving consistent demand for UN-approved IBCs. In these mature markets, replacement cycles and the adoption of advanced tracking systems are key growth levers, while Latin America and MEA show promising long-term growth tied to infrastructure development and increased resource extraction activities.

Segment trends underscore the dominance of the 501-1000 liter capacity segment, which represents the optimal trade-off between volume and logistical manageability for standard industrial use. By content type, non-hazardous materials still command the largest volume share, but the hazardous material segment is experiencing accelerated value growth due to higher certification costs and specialized requirements associated with transporting dangerous chemicals. The chemicals and petrochemicals end-user segment remains the primary revenue generator, although the food and beverage industry is rapidly increasing its market contribution, driven by global supply chains requiring safe, aseptic transportation for liquid food products.

AI Impact Analysis on Rigid IBC Tank Market

User queries regarding AI's influence on the Rigid IBC Tank Market frequently center on themes of operational efficiency, predictive maintenance, and supply chain visibility. Key concerns revolve around how Artificial Intelligence (AI) can optimize IBC fleet utilization, predict container failure or damage, and enhance the tracking of reusable assets globally, especially concerning regulatory compliance and cleaning schedules. Users are keen to understand the shift from traditional reactive logistics management to proactive, data-driven decision-making enabled by integrating AI with IoT sensors embedded within or attached to the IBCs. This analysis suggests a strong market expectation for AI to significantly reduce operational downtime, improve inventory accuracy, and provide enhanced safety protocols through pattern recognition of potential risks during storage or transit, ultimately transforming how IBC fleets are managed and maintained throughout their multi-trip lifecycle.

- AI-driven predictive maintenance scheduling for IBC assets reduces unplanned downtime and extends lifespan by forecasting material fatigue and potential failure points.

- Optimization of reverse logistics routes and fleet sizing using AI algorithms minimizes empty runs, lowering transportation costs and carbon emissions.

- Enhanced regulatory compliance monitoring through AI analysis of sensor data (temperature, pressure, shock) ensures contents are maintained within specified safety limits during transit.

- Improved inventory management and tracking precision via machine learning models analyzing real-time GPS and RFID data, minimizing losses and improving asset utilization rates.

- Automated damage detection and grading of returned IBCs using computer vision and AI, streamlining inspection processes and ensuring only structurally sound containers are reintroduced to the supply chain.

DRO & Impact Forces Of Rigid IBC Tank Market

The dynamics of the Rigid IBC Tank Market are shaped by a confluence of driving factors (D), inherent restraints (R), compelling opportunities (O), and potent impact forces. The primary drivers revolve around the continuous expansion of global chemical manufacturing and the growing emphasis on sustainable packaging solutions that favor reusable IBCs over traditional drums. Market restraints include the substantial initial capital investment required for purchasing high-quality rigid IBCs and the complex logistical challenges associated with managing the cleaning, repair, and return cycles of multi-trip containers, particularly across disparate geographical regions. However, significant opportunities exist in developing smart IBCs integrated with IoT technology, expanding into high-growth vertical markets like specialty chemicals and biopharmaceuticals, and increasing adoption in developing economies currently transitioning from conventional packaging methods.

Impact forces govern the velocity and direction of market growth. Technological advancements in material science, leading to lighter yet more durable plastics and composites, continuously drive product innovation, addressing industry demands for enhanced chemical compatibility and reduced tare weight. Furthermore, regulatory tightening, particularly around the transport of hazardous substances (e.g., ADR, IMDG codes), acts as a strong positive force, compelling end-users to adopt certified, high-quality rigid IBCs, weeding out non-compliant or inferior alternatives. Conversely, volatile raw material prices, specifically for HDPE and steel, represent a recurrent impact force that can compress manufacturing margins and necessitate periodic price adjustments across the value chain, affecting overall market stability.

The interplay between these forces necessitates strategic resilience from market participants. Companies focused on integrated services—offering rental, maintenance, and logistics tracking alongside manufacturing—are best positioned to mitigate the restraints associated with operational complexity, transforming high initial costs into predictable operational expenses for end-users. The pervasive need for supply chain optimization, coupled with global regulatory pressures favoring safe and reusable packaging, ensures that the overall impact force net favors sustained market expansion, particularly in segments focused on specialized, high-value content.

- Drivers: Global expansion of chemical and pharmaceutical manufacturing; rising demand for sustainable, reusable packaging; logistical efficiencies derived from standard container size; growth in bulk liquid transport.

- Restraints: High initial investment cost compared to drums; complexity of reverse logistics and cleaning processes; volatility in raw material (HDPE and steel) prices; risk of contamination requiring strict quality controls.

- Opportunities: Development and adoption of smart IBCs (IoT integration); expansion into emerging markets; increased use in aseptic and high-purity applications (e.g., biopharma); service model expansion (rentals, pooling).

- Impact Forces: Stringent international regulations (UN standards) for dangerous goods transport; ongoing innovation in composite materials; supply chain digitization trends; increasing focus on corporate sustainability goals (ESG).

Segmentation Analysis

The Rigid IBC Tank Market is systematically segmented based on material, content, capacity, and the specific end-user industry, providing a granular view of demand patterns and strategic market entry points. Material segmentation differentiates between plastic (HDPE), metal (steel/stainless steel), and composite IBCs, with the latter currently dominating due to their optimal balance of cost, durability, and resistance. Content segmentation separates applications transporting hazardous vs. non-hazardous materials, reflecting the differential regulatory and manufacturing requirements for each. Capacity segmentation categorizes tanks generally into small (<=500L), medium (501-1000L), and large (>1000L), reflecting variations in logistical scale and end-user requirements.

The segmentation structure is crucial for stakeholders to tailor product offerings and marketing strategies effectively. For instance, the demand for metal IBCs is predominantly driven by specialized segments requiring extreme temperature resistance or highly corrosive chemical transport, whereas plastic and composite IBCs serve the mass market for standard chemicals and food products. The capacity segment of 501-1000 liters is the volume leader, aligning with standard pallet configurations and optimizing warehouse storage, whereas the >1000L segment is favored in industries managing extremely high-volume products internally or across short distances.

- By Material: Plastic Rigid IBC Tanks (HDPE), Metal Rigid IBC Tanks (Steel, Stainless Steel), Composite Rigid IBC Tanks.

- By Content: Hazardous Materials, Non-Hazardous Materials.

- By Capacity: Below 500 Liters, 501–1000 Liters, Above 1000 Liters.

- By End-User Industry: Chemicals & Petrochemicals, Food & Beverage, Pharmaceuticals, Paints & Coatings, Oil & Gas, Cosmetics & Personal Care, Others (Agriculture, Water Treatment).

Value Chain Analysis For Rigid IBC Tank Market

The Rigid IBC Tank value chain begins with upstream activities focused on raw material procurement, primarily High-Density Polyethylene (HDPE) resins, galvanized steel, and specialized coatings. Manufacturers in the upstream segment must manage significant exposure to commodity price volatility and establish reliable long-term supply agreements. The midstream segment involves the core manufacturing process, encompassing blow molding or injection molding for plastic components, welding and forming for metal cages/tanks, and final assembly, certification, and quality control. Successful midstream operations depend heavily on precision engineering, adherence to international standards (UN certification), and economies of scale achieved through automated production lines.

The distribution channel is multifaceted, relying on both direct and indirect sales strategies. Direct sales are common for large volume orders or highly customized tanks sold directly to major end-users (e.g., large chemical corporations or pharmaceutical manufacturers). Indirect distribution utilizes a global network of specialized distributors, packaging brokers, and, increasingly, IBC rental and pooling providers. These third-party logistics (3PL) providers not only handle the sale or rental but also manage the downstream complexity of reverse logistics, cleaning, inspection, and maintenance, adding significant value and acting as a critical link between manufacturers and smaller or geographically dispersed end-users.

Downstream activities center on the end-user adoption, utilization, and subsequent lifecycle management of the IBCs. This includes filling, storing, transporting, emptying, and, critically, the maintenance or disposal phase. The shift toward reusable IBCs has amplified the importance of robust downstream service infrastructure, driving consolidation among service providers who offer end-to-end management solutions. Efficient downstream processes ensure high asset turnover, maximize container lifespan, and reduce environmental footprint, directly influencing the overall profitability and sustainability profile of the rigid IBC market.

Rigid IBC Tank Market Potential Customers

The primary customers for Rigid IBC Tanks are large-scale industrial enterprises requiring safe, efficient, and cost-effective methods for storing and transporting medium to high volumes of liquid or semi-solid materials. The largest consumer base resides within the Chemicals and Petrochemicals sector, including manufacturers of industrial solvents, corrosive agents, specialized intermediates, and bulk petrochemical products. These customers prioritize UN certification, chemical compatibility, and durability, often requiring specialized coatings or stainless steel options for handling aggressive substances. Their purchasing decisions are heavily influenced by regulatory compliance and safety track records.

Another major segment comprises the Food and Beverage industry, encompassing producers of edible oils, fruit concentrates, sweeteners, dairy bases, and bulk wine or beer. These buyers demand food-grade, sometimes aseptic, tanks that comply strictly with FDA and equivalent international standards, ensuring zero contamination. The pharmaceutical and biopharmaceutical sector represents a high-value niche, requiring ultra-high purity, certified stainless steel IBCs, or specialized single-use liners within rigid outer cages, driven by GMP (Good Manufacturing Practices) and validation requirements for highly sensitive active pharmaceutical ingredients (APIs) and buffer solutions.

Furthermore, industries such as Paints, Coatings, and Inks, along with the Oil and Gas sector (for specialized drilling fluids and lubricants), form substantial customer groups. These customers value the standardization and stacking capabilities of rigid IBCs, which optimize inventory management and reduce the risk of spills associated with handling numerous small drums. The increasing need for supply chain optimization across all these verticals ensures a sustained base of potential customers seeking reliable, durable, and easily traceable bulk packaging solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 15.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Greif, Inc., Schutz Container Systems, Mauser Packaging Solutions, Sulo Group, TPS Rental Systems, Weifang Kangle Plastics, Time Technoplast, Composite Containers, Xinle Huabao Plastic Products, Hoover CS, Custom Metalcraft, TranPak, Inc., Snyder Industries, WERIT Kunststoffwerke, BZ Plastic, P-Group, Maschiopack, Pensteel, Inc., Shandong Ruisheng Packing, Jiangyin Golden Ring |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rigid IBC Tank Market Key Technology Landscape

The technological evolution within the Rigid IBC Tank market is primarily focused on enhancing product durability, ensuring regulatory compliance, and integrating digitalization to optimize logistics management. Core manufacturing technologies rely heavily on advanced blow molding and rotational molding techniques for HDPE plastics, allowing for precise wall thickness control and seamless construction, which is vital for chemical resistance and structural integrity. For composite IBCs, innovation centers on developing stronger, lighter galvanized steel cages and improved valve and fitting designs that minimize leakage risk and facilitate quicker, safer filling and discharge processes. Material science advancements, particularly in barrier plastics and anti-static additives, are crucial for broadening the range of compatible contents, including highly volatile or sensitive substances.

A significant technological shift involves the integration of Smart Packaging solutions. This includes embedding IoT sensors, RFID tags, and GPS tracking modules directly into the IBC structure or cage. These technologies enable real-time monitoring of critical parameters such as location, temperature, pressure, fill level, and shock events during transit. This continuous data stream facilitates predictive maintenance, improves cold chain logistics management for sensitive materials (like biopharma ingredients), and provides forensic evidence in case of damage or non-compliance. The adoption of these digital tools is transforming IBCs from simple containers into active data points within the supply chain, significantly increasing their asset value and operational efficiency.

Furthermore, technology is playing a vital role in enhancing the sustainability profile of the market. This involves specialized cleaning and reconditioning technologies utilizing automated, high-pressure, and chemical-neutralizing systems to ensure multi-trip containers meet rigorous hygiene and safety standards before reuse. Innovations in liner technology, specifically the use of high-barrier film liners, allow standard rigid IBCs to safely transport highly sensitive or difficult-to-clean materials, extending the lifespan of the rigid outer container and minimizing contamination risks. These technological advancements collectively drive greater efficiency, reliability, and regulatory adherence throughout the lifecycle of the Rigid IBC Tank.

Regional Highlights

Geographically, the Rigid IBC Tank Market exhibits diverse growth trajectories influenced by regional industrial maturity, regulatory environment, and economic development. North America, encompassing the US and Canada, maintains a mature and high-value market share. This region is characterized by highly sophisticated logistics infrastructure and stringent environmental regulations that necessitate the use of certified, multi-trip IBCs. The robust chemical, oil and gas, and burgeoning specialty pharmaceutical industries drive consistent demand, with a high propensity for adopting cutting-edge technologies like smart IBCs for fleet management and safety compliance. Replacement demand and the operational shift towards rental and pooling services are key market expansion strategies in this region.

Europe represents another cornerstone of the global market, strongly supported by established chemical production hubs in Germany and the Benelux region, and a massive food and beverage sector. European demand is heavily governed by strict REACH regulations and ADR standards for hazardous goods transport, favoring high-quality composite and stainless steel IBCs. The region leads in sustainability initiatives, promoting container reusability and closed-loop logistics systems, which boosts the market for premium, long-lasting rigid tanks. Furthermore, Eastern European nations are increasing their industrial output, providing new avenues for market penetration, albeit with a stronger focus on cost-competitive plastic and composite options.

Asia Pacific (APAC) is projected to be the engine of market growth, demonstrating the highest Compound Annual Growth Rate over the forecast period. This rapid expansion is fueled by accelerated industrialization, massive investments in infrastructure, and the relocation of chemical and pharmaceutical manufacturing bases to countries like China, India, and Southeast Asian nations. The region's vast population and rising disposable incomes also spur tremendous growth in the food processing and cosmetics industries, generating immense demand for bulk packaging solutions. While price sensitivity remains a factor, increasing regulatory harmonization and a greater focus on supply chain efficiency are gradually shifting regional preferences toward higher quality, standardized rigid IBCs rather than cheaper alternatives.

Latin America (LATAM) and the Middle East and Africa (MEA) offer substantial long-term potential. In LATAM, growth is tied to the expansion of agriculture (fertilizers, chemicals) and resource extraction industries (mining, oil & gas), driving demand for durable, often metal-based, IBCs suitable for harsh conditions. The MEA region's market dynamics are heavily influenced by petrochemical production in the Gulf Cooperation Council (GCC) countries and pharmaceutical and industrial growth in South Africa and North Africa. Infrastructure development is paramount in these regions, and as logistics networks mature, the adoption of standardized rigid IBCs will accelerate, reducing reliance on traditional drum usage and improving transport safety protocols.

- North America: High regulatory compliance, strong adoption of smart IBC technology, major demand from chemical and specialty pharmaceutical sectors, maturity in rental/pooling services.

- Europe: Driven by strict environmental and safety regulations (REACH, ADR), leading the focus on container reusability, high concentration of premium manufacturing hubs (Germany, France).

- Asia Pacific (APAC): Fastest growing region due to rapid industrialization, massive expansion of chemical and F&B manufacturing in China and India, increasing focus on standardized logistics.

- Latin America (LATAM): Growth linked to agricultural chemicals, mining, and oil & gas sectors, preference for robust containers capable of handling diverse logistical environments.

- Middle East and Africa (MEA): Demand stimulated by petrochemical refinement activities, infrastructure investment, and rising need for bulk transport solutions in emerging industrial zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rigid IBC Tank Market.- Greif, Inc.

- Schutz Container Systems

- Mauser Packaging Solutions

- Sulo Group

- TPS Rental Systems

- Weifang Kangle Plastics

- Time Technoplast

- Composite Containers

- Xinle Huabao Plastic Products

- Hoover CS

- Custom Metalcraft

- TranPak, Inc.

- Snyder Industries

- WERIT Kunststoffwerke

- BZ Plastic

- P-Group

- Maschiopack

- Pensteel, Inc.

- Shandong Ruisheng Packing

- Jiangyin Golden Ring

Frequently Asked Questions

Analyze common user questions about the Rigid IBC Tank market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Rigid IBC Tank Market?

The primary driver is the accelerating global shift from traditional drums to reusable Rigid Intermediate Bulk Containers (IBCs) due to their superior logistical efficiency, standardized footprint, and capacity for optimizing storage space, coupled with stringent international regulations promoting safer transport of bulk liquids, particularly in the chemical and food industries.

How do composite IBC tanks compare to plastic or metal IBCs in terms of market dominance?

Composite IBCs, typically featuring an HDPE bottle encased in a galvanized steel cage, dominate the market share. They offer an optimal balance of structural integrity, chemical resistance, reusability, and cost-effectiveness compared to all-plastic designs, while being significantly lighter and more economical than pure stainless steel tanks, making them suitable for the majority of non-hazardous and some hazardous applications.

What role does IoT technology play in enhancing the value of Rigid IBC Tanks?

IoT technology, including integrated sensors and GPS tracking, transforms Rigid IBCs into 'smart' assets. This allows for real-time monitoring of location, temperature, pressure, and impact, significantly improving supply chain visibility, enabling predictive maintenance schedules, ensuring regulatory compliance during transit, and maximizing asset utilization through efficient fleet management systems.

Which end-user segment accounts for the largest demand for Rigid IBC Tanks globally?

The Chemicals and Petrochemicals industry remains the largest end-user segment, utilizing rigid IBCs for bulk storage and transport of a wide variety of industrial chemicals, solvents, and corrosive materials. However, the Food and Beverage segment is experiencing the fastest proportional growth, driven by the increasing need for high-capacity, food-grade, aseptic packaging solutions in global supply chains.

What are the key constraints impacting the adoption rate of Rigid IBCs, especially in emerging markets?

The main constraint is the substantial initial capital investment required for purchasing high-quality, certified rigid IBCs compared to single-trip packaging options. Furthermore, the complexity and cost associated with establishing efficient reverse logistics networks for cleaning, repairing, and reconditioning multi-trip IBCs pose a significant logistical barrier, particularly in regions with underdeveloped infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager