Rigid Mine Dumper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433950 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Rigid Mine Dumper Market Size

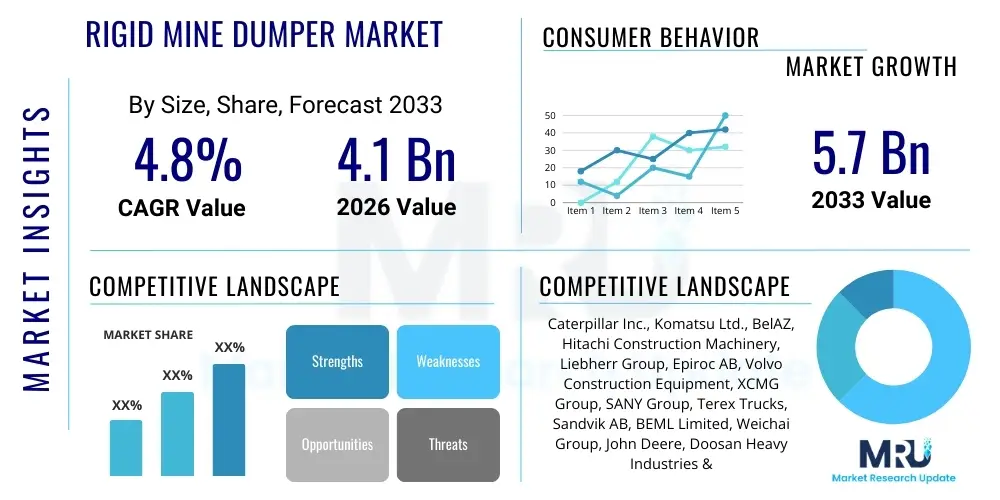

The Rigid Mine Dumper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 5.7 Billion by the end of the forecast period in 2033.

Rigid Mine Dumper Market introduction

The Rigid Mine Dumper Market encompasses heavy-duty, off-highway trucks specifically engineered for high-volume material transportation in severe mining and quarrying environments. Unlike articulated haulers, rigid dumpers feature a fixed chassis and are utilized primarily for long-haul routes in large-scale surface operations, offering superior payload capacity and enhanced speed on well-maintained haul roads. These machines are critical assets in the extraction of coal, metallic minerals (iron ore, copper), and industrial minerals, playing a foundational role in maintaining high production efficiency across global mining operations. The inherent robust design and powerful engine capabilities allow rigid mine dumpers to operate reliably under extreme temperature and altitude variations, making them indispensable components of modern industrial infrastructure development.

The primary applications of rigid mine dumpers revolve around overburden removal, ore transportation from the pit face to processing plants, and material handling at large construction sites requiring the movement of massive volumes of aggregate. Key benefits driving their adoption include high payload-to-weight ratios, operational longevity, reduced cost per ton hauled (in optimal conditions), and increasing integration of safety features like advanced collision avoidance systems. Furthermore, recent technological advancements focusing on electric drive systems and enhanced engine efficiency are addressing historical constraints related to fuel consumption and environmental compliance, broadening the market appeal, particularly in jurisdictions imposing strict emissions standards.

Driving factors for sustained market growth are fundamentally linked to global macroeconomic trends, specifically the increasing demand for base metals necessitated by widespread industrialization and the global energy transition. Major infrastructure projects worldwide require significant quantities of raw materials, propelling mining expansion and consequently boosting the procurement of high-capacity hauling equipment. Furthermore, the necessity for mines to increase operational efficiency and decrease total cost of ownership (TCO) through fleet modernization and the adoption of autonomous hauling solutions further solidifies the demand trajectory for advanced rigid mine dumpers throughout the forecast period.

Rigid Mine Dumper Market Executive Summary

The Rigid Mine Dumper Market is characterized by intense competition among global heavy equipment manufacturers, driven by a persistent focus on maximizing operational uptime and reducing fleet lifecycle costs for mining companies. Business trends indicate a strong shift towards electrification, particularly in high-tonnage classes (above 200 tons), where electric-drive systems offer significant advantages in fuel efficiency and reduced maintenance complexity compared to traditional mechanical drives. Furthermore, strategic alliances between original equipment manufacturers (OEMs) and technology providers are accelerating the deployment of fully autonomous hauling systems, which are currently being trialed and implemented at major Tier 1 mining sites globally, fundamentally transforming labor requirements and safety profiles within the industry. This technological push is influencing procurement decisions, favoring suppliers who can provide comprehensive data analytics and integrated fleet management solutions.

Regionally, the Asia Pacific (APAC) region maintains its dominance in the rigid mine dumper market, primarily fueled by massive coal and iron ore mining activities in China, India, and Australia. These countries are experiencing sustained demand for mineral resources to support rapid urbanization and domestic steel production, requiring continuous investment in new, high-capacity equipment. North America and Europe, while stable, are focusing heavily on fleet modernization to meet stringent environmental regulations (such as Tier 4 Final/Stage V), favoring models incorporating advanced emission controls and, increasingly, alternative power solutions. Latin America, particularly countries rich in copper and gold reserves like Chile and Peru, represents a robust growth area, driven by newly commissioned mining projects and the need to replace aging fleets.

In terms of segment trends, the capacity segment exceeding 200 tons is exhibiting the fastest growth, reflecting the global trend toward ultra-class haulers designed to serve increasingly large mining operations aimed at achieving economies of scale. Within the drive type segmentation, while mechanical drive systems remain prevalent in smaller and medium-capacity dumpers due to their lower initial cost, the electric drive segment is rapidly gaining market share in the high-capacity class (e.g., 300+ tons). This shift is primarily driven by the superior torque characteristics and regenerative braking capabilities offered by electric drives, which are highly beneficial in deep pits and areas with steep gradients, ultimately improving cycle times and energy efficiency.

AI Impact Analysis on Rigid Mine Dumper Market

Users frequently inquire about how Artificial Intelligence (AI) will fundamentally change the rigid mine dumper operational model, focusing primarily on topics such as the speed of autonomous deployment, the return on investment (ROI) derived from AI-driven predictive maintenance, and the necessary integration standards for different OEM fleets. Key concerns revolve around job displacement for human operators, the cybersecurity risks associated with networked, autonomous vehicles, and the ability of existing mine infrastructure to support the required sensor arrays and high-bandwidth connectivity. The general expectation is that AI will move the industry from reactive maintenance and manually optimized haul routes to highly efficient, 24/7 autonomous operations where fleet health is monitored and predicted in real-time, thereby maximizing operational throughput and significantly reducing catastrophic component failures.

- AI facilitates fully autonomous rigid dumper operations, reducing human error and enabling continuous, 24/7 hauling cycles.

- Predictive maintenance algorithms powered by AI analyze sensor data to forecast equipment failure, minimizing unplanned downtime and optimizing component lifecycles.

- Route optimization software uses machine learning to dynamically adjust haul paths based on real-time factors like grade, road conditions, and congestion, maximizing fuel efficiency.

- AI-driven payload management systems ensure dumpers consistently carry maximum safe load limits, enhancing productivity without compromising structural integrity.

- Enhanced safety protocols are established through AI processing of LiDAR and camera inputs for improved collision detection and environmental awareness in congested mine sites.

DRO & Impact Forces Of Rigid Mine Dumper Market

The Rigid Mine Dumper Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) that collectively shape its trajectory and are amplified by distinct impact forces stemming from regulatory mandates and technological evolution. A major driver is the sustained global urbanization trend and the resultant high demand for essential commodities like copper, nickel, and iron ore, pushing mining corporations to invest heavily in modern, high-capacity hauling fleets to meet production targets efficiently. Furthermore, mining operations are increasingly seeking to reduce their operational footprint and achieve lower cost-per-ton metrics; rigid dumpers equipped with advanced telematics and larger capacities directly address this objective by consolidating transport volumes and optimizing haul cycles. This driver is particularly potent in established mining regions like Australia and Brazil, where scale and efficiency dictate profitability.

Conversely, significant restraints impede the growth potential of the market. Foremost among these is the extremely high capital expenditure required for acquiring new, ultra-class rigid dumpers, coupled with substantial ongoing maintenance and tire replacement costs, which can deter investment, especially among junior or mid-tier mining companies facing commodity price volatility. Additionally, the increasing stringency of global environmental regulations, particularly regarding diesel engine emissions (Tier 4 Final/Stage V compliance), forces OEMs to incur higher manufacturing costs for complex after-treatment systems, costs often passed directly to end-users. The shortage of highly skilled technical personnel capable of maintaining complex electric-drive and autonomous systems also acts as a constraint, slowing the full adoption rate of advanced technologies.

The primary opportunities available to market players lie in the widespread adoption of electrification and sustainable mining practices. Developing hydrogen fuel cell or fully battery-electric rigid dumpers offers a pathway for mines to achieve significant decarbonization goals and hedge against volatile diesel prices, presenting a substantial long-term growth avenue for innovative OEMs. Another major opportunity is the expansion of predictive maintenance services and integrated data solutions. By offering comprehensive software packages that maximize uptime and extend asset life through deep analytics, manufacturers can capture high-margin aftermarket service revenue. The impact forces acting on the market are predominantly technological push (autonomy and AI integration) and regulatory pull (global shift toward zero-emission equipment), forcing rapid evolution and investment in research and development across the value chain.

Segmentation Analysis

The Rigid Mine Dumper Market is systematically segmented based on key functional attributes including capacity, drive type, and end-use application, providing clarity on varying demand dynamics across different operational environments. Analyzing these segments is essential for OEMs to tailor product offerings and for mining investors to understand where capital expenditure is concentrated. The market dynamics show a clear preference for large-capacity units in large-scale operations and a pronounced bifurcation in drive technology adoption, with electric drives dominating the ultra-class segment while mechanical drives remain competitive in mid-range applications. The resilience of the metallic mineral mining segment, particularly copper and iron ore, provides the primary demand base for these high-capital assets.

- By Capacity

- Under 100 Ton

- 100-200 Ton

- Above 200 Ton (Ultra Class)

- By Drive Type

- Mechanical Drive

- Electric Drive

- By Application

- Coal Mining

- Metallic Mineral Mining (Iron Ore, Copper, Gold)

- Non-Metallic Mineral Mining and Aggregates

- Quarrying and Construction

Value Chain Analysis For Rigid Mine Dumper Market

The value chain for the Rigid Mine Dumper Market begins with intensive upstream activities involving the sourcing of highly specialized materials and components, including high-strength steel alloys for chassis construction, sophisticated electronic control units (ECUs), and powertrain components (engines, transmissions, and electric motors/generators). Key upstream suppliers include major engine manufacturers (like Cummins and MTU), large tire providers (Michelin, Bridgestone, Goodyear), and advanced hydraulic systems suppliers. Since rigid dumpers are complex, high-value assets, strong relationships with reliable Tier 1 and Tier 2 suppliers are paramount to ensure quality, manage costs, and maintain compliance with stringent performance and emission standards. Global supply chain resilience, especially following recent disruptions, has pushed OEMs to diversify sourcing and potentially regionalize component manufacturing to mitigate risks.

The midstream stage involves the design, manufacturing, and assembly of the rigid mine dumpers, dominated by a few global heavy equipment giants. This stage involves significant R&D investment focused on vehicle intelligence, fuel efficiency, and structural reliability. The assembly process is highly complex, integrating custom-designed chassis with off-the-shelf and proprietary components. Distribution channels are critical and typically involve a mix of direct sales from the OEM to Tier 1 mining houses, particularly for large fleet orders involving high levels of customization or autonomous integrations, and indirect sales through extensive, authorized dealer networks. These dealer networks provide regional presence, local parts inventory, and crucially, initial field service and warranty support, acting as the primary point of contact for routine maintenance and minor repairs.

Downstream activities focus on the operational lifetime of the equipment, encompassing ongoing maintenance, spare parts supply, financing, and ultimately, replacement or refurbishment. The aftermarket services segment is a significant revenue driver, often constituting a higher margin stream than initial equipment sales. OEMs are increasingly shifting their business model toward a "services and solutions" approach, providing long-term maintenance contracts, fleet management software (telematics), and certified rebuild programs to extend the operational life of the dumpers. The end-users, typically large mining companies, rely heavily on OEM or authorized dealer support to ensure maximum equipment uptime, which is directly correlated to production output and profitability, making prompt and reliable aftermarket service a crucial competitive differentiator.

Rigid Mine Dumper Market Potential Customers

The primary customers for rigid mine dumpers are large-scale, open-pit mining operations across various commodity segments, requiring hauling equipment capable of moving millions of tons of material annually. These buyers are typically Tier 1 and Tier 2 global mining corporations, state-owned enterprises, and major contract mining services providers. These entities operate on long-term project horizons, emphasizing total cost of ownership (TCO), fuel efficiency, payload capacity, and vendor stability over initial purchase price. Decision-makers include Fleet Managers, Procurement Executives, and Mine General Managers, who evaluate purchases based on metrics like availability, planned maintenance intervals, and integration capabilities with existing operational infrastructure, particularly fleet management systems and autonomous zones.

A significant customer segment is composed of specialized contract miners, who purchase or lease large fleets to execute mining contracts on behalf of resource owners. These firms prioritize versatility, reliability, and the ability to rapidly deploy and scale their equipment base. For contract miners, financing options and strong, centralized support from the OEM or dealer network are particularly important, as their profitability is highly sensitive to equipment uptime and operational efficiency guarantees stipulated in their service level agreements (SLAs). They often favor proven, robust models with strong aftermarket support coverage in remote operational locations.

Additionally, large quarrying and aggregate operations, although typically utilizing smaller capacity rigid dumpers (Under 100 Ton), represent a steady demand pool. These customers are highly sensitive to initial capital cost and local availability of parts, often favoring established regional suppliers or models known for simplicity and ease of maintenance. The demand from the construction sector, specifically for large infrastructure and earth-moving projects, supplements the core mining demand, particularly in developing economies where massive dam, road, or port construction requires robust material movement capabilities over extended periods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 5.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., BelAZ, Hitachi Construction Machinery, Liebherr Group, Epiroc AB, Volvo Construction Equipment, XCMG Group, SANY Group, Terex Trucks, Sandvik AB, BEML Limited, Weichai Group, John Deere, Doosan Heavy Industries & Construction |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rigid Mine Dumper Market Key Technology Landscape

The rigid mine dumper market is undergoing a profound technological transformation, moving rapidly toward digitalization, automation, and sustainable power sources. Autonomy stands out as the single most critical technological evolution; this involves the integration of sophisticated sensor suites (Lidar, radar, high-definition cameras), precise GPS/GNSS positioning, and advanced control software to allow dumpers to operate without human intervention within designated haul zones. Leading OEMs are deploying full-scale autonomous fleets in remote, large-volume mines, yielding significant gains in safety, predictability, and utilization rates, as autonomous haulers can operate continuously and consistently adhere to optimal speed and loading parameters.

Electrification represents the second major pillar of technological advancement. While mechanical drive systems rely purely on diesel power transmitted through a mechanical driveline, electric drive systems utilize a diesel engine to power an on-board generator, which, in turn, supplies electricity to wheel-mounted motors. The electric drive setup offers tremendous advantages in high-gradient applications due to superior traction control, lower component wear, and most importantly, dynamic retarding (regenerative braking) that can feed energy back into the system, drastically reducing fuel consumption and heat buildup. Furthermore, the industry is actively exploring trolley-assist technology for electric drive dumpers, allowing them to draw power from external overhead lines on uphill segments, effectively achieving zero local emissions and maximizing overall efficiency.

Beyond autonomy and electrification, data intelligence and telematics are standard technologies integrated into all new rigid dumper models. These systems include sophisticated sensors that monitor every aspect of machine health, including engine performance, hydraulic pressures, component temperatures, and tire wear status (TPMS). This wealth of data is processed using cloud-based platforms and AI algorithms to provide real-time performance insights and facilitate predictive maintenance scheduling. By moving away from time-based servicing to condition-based servicing, operators can maximize machine uptime and optimize part replacement cycles, ultimately extending the operational lifespan and lowering TCO. Furthermore, advanced collision avoidance and operator fatigue monitoring systems enhance overall site safety, ensuring regulatory compliance and protecting high-value assets.

Regional Highlights

The global rigid mine dumper market exhibits substantial regional variance driven by differing levels of mining maturity, resource availability, and regulatory frameworks. Asia Pacific (APAC) currently dominates the market both in volume and value, largely attributed to extensive, resource-intensive operations in Australia (iron ore, coal), China (coal, industrial minerals), and India (coal, base metals). The push for large-scale production, particularly in Australia's Pilbara region, drives demand for ultra-class, autonomous-ready dumpers, cementing the region's position as the primary adopter of cutting-edge hauling technology.

North America is a significant, technologically advanced market characterized by high regulatory hurdles regarding emissions (Tier 4 Final) and a strong focus on safety and automation. Mining companies in the U.S. and Canada are actively replacing older fleets with modern, fuel-efficient models, often prioritizing electric drive systems and early-stage autonomous solutions to address labor costs and safety concerns in challenging environments. Europe, though smaller in terms of mining volume, is a crucial market for innovation, particularly in relation to sustainability and the adoption of zero-emission solutions, driven by extremely strict EU environmental mandates.

Latin America, rich in copper and gold deposits (Chile, Peru, Brazil), represents a high-growth region. The sustained high price of copper and gold encourages substantial investment in new mine developments and fleet expansion, specifically demanding dumpers suited for high altitude and challenging terrain. Finally, the Middle East and Africa (MEA) market shows nascent growth, primarily in South Africa and Saudi Arabia, driven by mineral extraction projects. While initial capital investment constraints are higher, the long-term potential fueled by untapped resources and infrastructure development suggests rising demand for robust, reliable hauling equipment in the latter half of the forecast period.

- Asia Pacific (APAC): Market leader due to massive iron ore and coal production in Australia and China, driving early adoption of ultra-class and autonomous fleets.

- North America: Focus on fleet modernization, strict adherence to Tier 4 Final regulations, and high adoption rates for advanced telematics and safety features in gold and copper mines.

- Latin America: High growth potential fueled by major copper and gold mining expansions in the Andean region, requiring robust dumpers for high-altitude operations.

- Europe: Demand centered around environmental compliance and niche applications, driving exploration of trolley-assist and battery-electric concepts.

- Middle East and Africa (MEA): Emerging growth driven by strategic mineral reserves in South Africa and new large-scale projects, emphasizing equipment reliability and durability in harsh climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rigid Mine Dumper Market.- Caterpillar Inc.

- Komatsu Ltd.

- BelAZ

- Hitachi Construction Machinery

- Liebherr Group

- Epiroc AB

- Volvo Construction Equipment

- XCMG Group

- SANY Group

- Terex Trucks (division of Volvo CE)

- BEML Limited

- Sandvik AB

- Weichai Group (SHANTUI)

- John Deere Construction & Forestry

- Doosan Heavy Industries & Construction

- Kress Corporation

- OJSC Volgotsemmash

- Foton Lovol International Heavy Industry Co. Ltd.

- JCB (J.C. Bamford Excavators Ltd.)

- MTU (Rolls-Royce Power Systems) - Component supplier influence

Frequently Asked Questions

Analyze common user questions about the Rigid Mine Dumper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between mechanical and electric drive rigid dumpers?

The core difference lies in the power transmission system. Mechanical drive uses a traditional gearbox and axles, favored for lower initial cost and simpler maintenance. Electric drive converts engine power into electricity to run motorized wheels, offering superior torque, dynamic retarding (regenerative braking), and better efficiency on steep grades, making it dominant in the ultra-class (>200 ton) segment.

How is autonomy impacting the total cost of ownership (TCO) for rigid dumpers?

Autonomy significantly lowers TCO by enabling 24/7 operation and eliminating planned breaks, increasing asset utilization dramatically. It also reduces costs related to operator wages, training, and fatigue-related errors, while AI-optimized haul cycles minimize fuel consumption and prolong component life through smoother operation, ultimately optimizing fleet output.

Which geographical region is leading the adoption of ultra-class rigid mine dumpers?

The Asia Pacific (APAC) region, specifically Australia (for iron ore) and China (for coal and iron ore), is leading the global adoption of ultra-class dumpers (Above 200 Ton). This is driven by the need for economies of scale in massive, highly productive surface mining operations where haul distance and payload capacity are critical profitability factors.

What are the key technological restraints facing the broader adoption of electric rigid dumpers?

The primary restraints include the high initial purchase price of electric drive models compared to their mechanical counterparts, the necessity for robust, specialized site infrastructure (such as high-voltage trolley lines or rapid charging stations), and the limited availability of technical expertise required for complex power electronics maintenance in remote mining locations.

What role does predictive maintenance play in the current Rigid Mine Dumper Market?

Predictive maintenance uses telematics and AI algorithms to analyze real-time operational data, identifying subtle deviations that indicate impending component failure (e.g., engine, transmission, or wheel motors). This allows mining operators to schedule maintenance precisely before failure occurs, maximizing asset uptime and dramatically reducing the frequency and cost of catastrophic, unplanned breakdowns.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager