Ring Laser Gyroscope Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432018 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Ring Laser Gyroscope Market Size

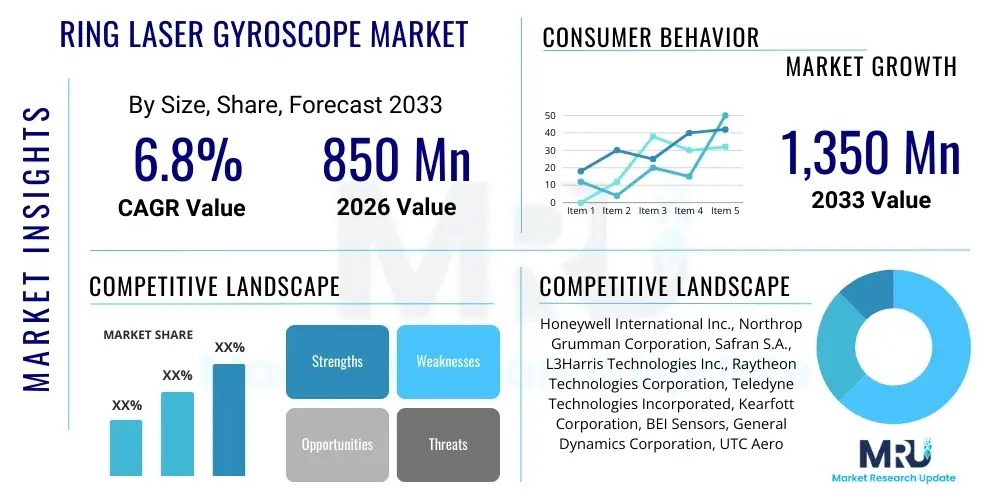

The Ring Laser Gyroscope Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $850 million in 2026 and is projected to reach $1,350 million by the end of the forecast period in 2033.

Ring Laser Gyroscope Market introduction

The Ring Laser Gyroscope (RLG) market encompasses highly sophisticated inertial sensors designed for precise angular rate measurement, primarily utilizing the Sagnac effect within a closed optical path. The core product, the RLG, consists of a resonant cavity, often triangular or square, through which two counter-propagating laser beams travel. When the gyroscope rotates, the path lengths for the two beams differ, resulting in a frequency shift proportional to the rotation rate. This inherent precision, reliability, and durability under harsh environmental conditions define the market's value proposition.

Major applications of RLGs span critical sectors, most notably in aerospace and defense, where they form the backbone of high-accuracy Inertial Navigation Systems (INS) used in aircraft, missiles, ships, and spacecraft. Beyond military applications, RLGs are vital in commercial aviation for flight control and navigation, and increasingly, they are being integrated into large-scale industrial and scientific platforms requiring ultra-stable reference frames, such as deep-sea exploration vessels and specialized testing equipment. The principal benefits RLGs offer include zero warm-up time, high sensitivity, exceptional linearity, and resistance to g-forces and vibration, which traditional mechanical gyroscopes cannot match.

The market growth is substantially driven by escalating global defense spending, particularly for advanced missile guidance systems and modernization of existing aircraft fleets requiring continuous, accurate navigational data. Furthermore, the burgeoning demand for high-performance, long-duration navigational solutions in emerging fields like unmanned aerial vehicles (UAVs) and autonomous submersibles further fuels RLG adoption. Technological advancements leading to reduced size, weight, and power (SWaP) consumption, while maintaining or enhancing accuracy, are key factors facilitating broader market penetration across strategic platforms.

Ring Laser Gyroscope Market Executive Summary

The Ring Laser Gyroscope market is characterized by stability in its core aerospace and defense segments, augmented by strategic investment into miniaturization and enhanced computational integration. Business trends indicate a movement towards vertically integrated supply chains, where key manufacturers are consolidating their expertise from materials science (e.g., specialized glass ceramics) through to complete INS integration. Furthermore, long procurement cycles dictated by defense contracts ensure sustained revenue streams for established players, although competition from fiber optic gyroscopes (FOGs) and advanced micro-electromechanical systems (MEMS) accelerometers continues to pressure pricing and demand for size reduction. Strategic partnerships between hardware providers and software developers specializing in sensor fusion are becoming crucial to delivering comprehensive navigation solutions.

Regionally, North America maintains market dominance due to high defense expenditure, stringent performance requirements for military platforms, and the presence of major RLG technology pioneers and system integrators. Asia Pacific is emerging as the fastest-growing region, driven by extensive military modernization programs in countries like China, India, and South Korea, leading to increased demand for indigenous and imported high-precision guidance technologies. European growth remains robust, anchored by collaborative defense projects and sustained investments in commercial aviation programs, requiring reliable long-term navigational stability.

Segment trends highlight the continued dominance of navigation systems within the application segment, particularly high-grade INS used in strategic missiles and fighter jets, demanding multi-axis RLGs. By end-use, the Aerospace & Defense sector remains the primary revenue generator, commanding over two-thirds of the total market share, necessitating RLGs with superior stability and bias performance over extended mission durations. However, the testing and stabilization segment, encompassing platforms used for surveying and industrial monitoring where extreme accuracy is required, is experiencing above-average growth, reflecting diversification away from purely defense-centric applications.

AI Impact Analysis on Ring Laser Gyroscope Market

Users frequently inquire whether Artificial Intelligence (AI) will replace the need for precise hardware like RLGs or how AI can enhance the performance of existing RLG systems. Key concerns revolve around integrating AI for real-time error correction, compensating for environmental drift, and improving system resilience in GPS-denied environments. The consensus expectation is that AI will not replace the fundamental physics of the RLG but will instead serve as an essential complementary layer. Users anticipate AI algorithms focusing on predictive maintenance, advanced sensor fusion with other lower-grade sensors (like MEMS and FOGs), and optimizing drift calibration processes that historically required extensive manual testing. The overarching theme is leveraging AI to extract maximum performance and operational longevity from highly accurate but expensive inertial systems.

The application of sophisticated machine learning models allows for dynamic recalibration of RLG output based on historical operational data and real-time environmental inputs, moving beyond simple static compensation models. AI can effectively model complex non-linear drift characteristics inherent in RLG performance, providing a higher degree of navigational accuracy over prolonged missions without external corrections. This is critical for strategic platforms requiring extended endurance and resilience against signal jamming or denial.

Furthermore, AI plays a pivotal role in the design and manufacturing process. Optimization algorithms can be used to simulate and refine RLG cavity geometries, mirror coating strategies, and thermal stabilization mechanisms, significantly reducing development cycles and improving manufacturing yields. In operational use, AI-driven diagnostics enable predictive fault detection within the laser source or detector mechanism, facilitating timely maintenance and significantly increasing the Mean Time Between Failures (MTBF) for these mission-critical components, thereby lowering the total cost of ownership.

- AI optimizes RLG calibration routines, enhancing long-term bias stability.

- Machine learning algorithms enable advanced sensor fusion, seamlessly integrating RLG data with FOGs and MEMS for comprehensive navigation solutions.

- Predictive maintenance models, powered by AI, reduce operational downtime and extend the service life of RLG units.

- AI assists in real-time error modeling and compensation, crucial for operations in GPS-denied environments.

- Generative AI models accelerate the design and simulation of highly stable RLG resonant cavities.

DRO & Impact Forces Of Ring Laser Gyroscope Market

The Ring Laser Gyroscope market dynamics are driven primarily by geopolitical necessity and technological advancements, balanced against high entry barriers and competition from alternative technologies. The primary driver is the critical need for ultra-high precision navigation systems in military and strategic platforms where mission success depends entirely on accurate inertial reference, irrespective of external signals. This is underpinned by global rearmament trends and the modernization of aging defense inventories. Conversely, the high procurement and maintenance costs associated with RLGs, alongside intense competition from robust, smaller, and increasingly accurate Fiber Optic Gyroscopes (FOGs), act as significant restraints. FOGs offer superior SWaP characteristics, often challenging RLGs in mid-range performance applications.

Opportunities for market expansion are centered around emerging application areas such as deep space exploration missions, where long-term drift stability is paramount, and the nascent market for high-grade autonomous ground vehicles (AGVs) that operate in complex urban environments or underground. Furthermore, technological leaps in materials science and micro-fabrication present opportunities to significantly reduce the physical size of RLGs (miniaturization), making them viable for smaller missile systems and advanced UAVs that currently rely on lower-grade inertial systems. Strategic partnerships with key defense integrators remain vital for capturing these high-value opportunities.

Impact forces governing the market are dominated by government regulations and strategic procurement policies, particularly the International Traffic in Arms Regulations (ITAR) and similar regional controls that restrict the export of high-accuracy RLG technology. This leads to market fragmentation and encourages localized manufacturing capabilities within major military powers. The technology's impact force is characterized by the ongoing pursuit of ultimate precision and reliability, pushing manufacturers to continuously invest in thermal management, vibration isolation, and advanced beam splitting techniques to overcome environmental noise and maintain competitive superiority over lower-cost alternatives.

Segmentation Analysis

The Ring Laser Gyroscope market segmentation provides a comprehensive view of product diversity, application focus, and end-user consumption patterns, illustrating where value creation is concentrated. Segmentation based on type reveals differences in design complexity and cost, where multi-axis RLGs, typically integrated into complete Inertial Measurement Units (IMUs), command a significant premium due to their enhanced navigational capability and fault tolerance. Application segmentation clearly delineates the market into core navigation uses (highest volume and value) versus stabilization and high-precision testing applications (niche high-accuracy demand). The End-Use sector analysis confirms the intrinsic link between RLG technology and the defense apparatus, though diversification into commercial aerospace continues to be a steady growth factor.

The high-cost structure and specialized manufacturing required for RLGs mean that market participants are often entrenched suppliers to governmental bodies. This influences procurement behavior, favoring established brands with proven long-term reliability records. Future growth in market segments will be tied to successful miniaturization efforts. If RLGs can be produced efficiently in smaller formats, the scope for their use in tactical missiles and advanced commercial drone platforms will increase substantially, potentially shifting the balance between defense and commercial end-use segments.

Regional dynamics play heavily into segmentation, particularly concerning regulatory restrictions. The highest precision (military-grade) RLGs are almost exclusively confined to the North American and European defense end-users, while slightly less stringent but still high-accuracy commercial variants are more readily available for commercial aircraft globally, driving the size of the commercial aviation segment.

- By Type: Single-Axis Ring Laser Gyroscope, Multi-Axis Ring Laser Gyroscope

- By Application: Inertial Navigation Systems (INS), Stabilization Systems, Attitude Heading Reference Systems (AHRS), Testing and Measurement

- By End-Use Industry: Aerospace & Defense (Military Aircraft, Missiles, Naval Vessels, Spacecraft), Commercial Aviation (Airliners, Cargo Planes), Industrial & Scientific (Surveying Equipment, Robotics)

Value Chain Analysis For Ring Laser Gyroscope Market

The RLG value chain is highly specialized, beginning with the upstream supply of ultra-high-purity materials, such as specialized glass-ceramics (like Zerodur) for the resonant cavity and proprietary high-reflectivity mirror coatings, which are critical determinants of RLG performance. The upstream segment is characterized by a limited number of highly specialized suppliers possessing unique material processing expertise. The core manufacturing stage involves extremely precise machining, laser tuning, and cleanroom assembly—a bottleneck dominated by a few major defense contractors.

The downstream analysis focuses on integration and deployment. RLGs are rarely sold as standalone components; instead, they are integrated into complex Inertial Navigation Systems (INS) or Inertial Measurement Units (IMUs) by system integrators. These integrators add significant value through sophisticated software algorithms for calibration, sensor fusion, and navigation output processing. Distribution channels are primarily direct, especially for defense contracts, involving long-term supply agreements and rigorous qualification processes. Indirect channels might exist for lower-grade commercial or scientific testing applications, often through specialized instrumentation distributors.

Direct distribution, characterized by high engagement and long contract periods between the manufacturer and the end-user (e.g., Department of Defense or major aerospace prime contractors), dominates the market due to the mission-critical nature and strict regulatory requirements of the technology. Indirect distribution via third-party integrators or specialized engineering firms is more common in non-military applications where customization and local support are necessary, although these account for a smaller overall market share. The strong focus on proprietary technology throughout the chain ensures high barriers to entry at every stage, reinforcing the position of established industry leaders.

Ring Laser Gyroscope Market Potential Customers

The primary customers for Ring Laser Gyroscopes are governmental defense agencies and major aerospace prime contractors who require fault-tolerant, high-accuracy inertial navigation capabilities for platforms operating in extreme or contested environments. These institutional buyers prioritize long-term performance stability, resilience to vibration and shock, and proven reliability over cost, typically engaging in multi-year, often sole-source, contracts to secure supply. The demand is concentrated among airframe manufacturers, missile system developers, and naval vessel builders seeking strategic navigation advantages.

Secondary but rapidly growing customer segments include commercial aircraft manufacturers (e.g., Boeing, Airbus) requiring high-grade AHRS and INS for airliner navigation where precision dictates fuel efficiency and safety standards. Furthermore, specialized scientific and industrial entities, such as geological surveying companies, deep-sea mapping organizations, and space agencies, constitute a niche segment demanding RLGs for ultra-precise attitude control and measurement applications, valuing absolute zero-drift characteristics in stationary or non-GPS operational conditions. As autonomous vehicle technology advances, high-end automotive and specialized robotics manufacturers represent emerging potential customers, though RLG adoption here is heavily contingent on significant cost reduction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 million |

| Market Forecast in 2033 | $1,350 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Northrop Grumman Corporation, Safran S.A., L3Harris Technologies Inc., Raytheon Technologies Corporation, Teledyne Technologies Incorporated, Kearfott Corporation, BEI Sensors, General Dynamics Corporation, UTC Aerospace Systems (Collins Aerospace), Analog Devices Inc., KVH Industries Inc., CDIC (China Defense Industrial Corporation), Shanghai Jiao Tong University, Systron Donner Inertial |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ring Laser Gyroscope Market Key Technology Landscape

The key technology landscape of the RLG market is defined by continuous pursuit of stability, robustness, and performance improvements across several critical subsystems. Fundamental research focuses on optimizing the resonant cavity geometry—moving beyond traditional triangular and square designs to explore more complex arrangements that mitigate backscattering effects and lock-in phenomena at low rotation rates. Material science advancements, particularly in ultra-low expansion glass ceramics and fused silica, are crucial for manufacturing cavities that maintain dimensional stability across vast temperature fluctuations, thereby minimizing measurement drift and maximizing accuracy over the operational lifespan.

Another area of intense technological focus is the development of next-generation mirror coatings. Achieving near-perfect reflectivity (often >99.999%) is essential to maintain the coherence and intensity of the counter-propagating laser beams, directly impacting the Sagnac signal strength and sensitivity. Innovations include the use of sophisticated dielectric multilayer stacks and ion-beam sputtering techniques to deposit these layers with nanometer precision, minimizing scattering losses and enhancing thermal uniformity. Furthermore, the integration of advanced digital signal processing (DSP) and custom Application-Specific Integrated Circuits (ASICs) is pivotal for converting the optical fringe signal into accurate, real-time digital rate data, often incorporating algorithms to actively compensate for residual environmental noise and mechanical stress.

Miniaturization remains a significant technological challenge and a primary development goal. While RLGs inherently require a certain minimum cavity size to achieve high sensitivity (dictated by the Sagnac area), research efforts are focused on integrating high-precision micro-optical components and advanced thermal stabilization components into smaller, lighter packages without compromising performance. Techniques such as active thermal control systems utilizing high-speed peltier elements and sophisticated vibration isolation mounts are essential technologies to ensure the RLG remains a viable option for Size, Weight, and Power (SWaP)-constrained applications like tactical drones and small satellites.

Regional Highlights

The Ring Laser Gyroscope market exhibits significant regional disparities driven primarily by defense spending and aerospace manufacturing hubs. North America, dominated by the United States, represents the largest market share globally. This supremacy is a direct result of substantial, consistent investment in advanced defense technology, including strategic missile programs, highly sophisticated naval platforms, and next-generation fighter aircraft requiring the absolute highest grade of inertial navigation systems. The region hosts the leading RLG manufacturers and system integrators, benefitting from robust government R&D funding and stringent military procurement standards that favor established, high-reliability technology. Continued modernization efforts and the development of new space-based assets ensure sustained demand throughout the forecast period.

Europe holds the second-largest market share, propelled by major defense initiatives such as the development of next-generation combat aircraft (e.g., FCAS and Tempest programs) and sustained demand from established commercial aviation giants like Airbus. Countries such as France, Germany, and the UK possess strong domestic RLG manufacturing capabilities, focusing heavily on integrating these sensors into both military and civilian platforms, adhering to strict EASA safety and performance protocols. European regional growth is characterized by multinational collaboration on defense platforms, streamlining supply chains for these critical components across borders.

Asia Pacific (APAC) is projected to be the fastest-growing region. This acceleration is attributed to rapid military modernization and geopolitical tensions, driving major defense expenditure increases in countries like China, India, and Japan. These nations are actively investing in local production capabilities and importing advanced RLG-based INS for their expanding fleets of submarines, surface warships, and long-range missiles. The commercial aviation sector in APAC, experiencing rapid expansion, also contributes significantly to demand, particularly for high-end inertial systems required by new large-capacity airliners and cargo carriers. The shift towards indigenous defense manufacturing in APAC represents a substantial opportunity for technology transfer and local joint ventures.

- North America: Dominant market share fueled by expansive U.S. defense budget, aerospace R&D, and established manufacturing base for strategic weapons and platforms.

- Europe: Strong presence in commercial aviation (Airbus) and joint defense modernization projects, focusing on high-accuracy systems for combat air programs.

- Asia Pacific (APAC): Fastest growth rate driven by aggressive military modernization programs in China and India, coupled with booming commercial air travel infrastructure development.

- Latin America and Middle East & Africa (MEA): Emerging markets focused primarily on upgrading existing defense assets and high-end industrial surveying equipment, often relying on imported technologies from North America and Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ring Laser Gyroscope Market.- Honeywell International Inc.

- Northrop Grumman Corporation

- Safran S.A.

- L3Harris Technologies Inc.

- Raytheon Technologies Corporation

- Teledyne Technologies Incorporated

- Kearfott Corporation

- BEI Sensors

- General Dynamics Corporation

- UTC Aerospace Systems (Collins Aerospace)

- Analog Devices Inc.

- KVH Industries Inc.

- CDIC (China Defense Industrial Corporation)

- Shanghai Jiao Tong University

- Systron Donner Inertial

- Trimble Inc.

- Aerosense Inc.

- Roshall Technologies

- Atlantic Inertial Systems Ltd.

- EMCORE Corporation

Frequently Asked Questions

Analyze common user questions about the Ring Laser Gyroscope market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental working principle of a Ring Laser Gyroscope (RLG)?

The RLG operates on the Sagnac effect, where two counter-propagating laser beams travel around a closed optical path (the resonant cavity). When the RLG rotates, the path lengths for the two beams change relative to each other, creating a measurable frequency difference (fringe pattern) directly proportional to the rotation rate being experienced, providing extremely accurate angular velocity data.

How do RLGs compare in performance to Fiber Optic Gyroscopes (FOGs) and MEMS gyroscopes?

RLGs offer superior angular random walk (ARW) and bias stability compared to both FOGs and MEMS, making them the preferred choice for mission-critical, long-duration navigation (like strategic missiles and airliners) where long-term drift must be minimal. While FOGs are lighter and more cost-effective for medium-grade applications, and MEMS dominate low-cost, high-volume consumer markets, RLGs lead the high-performance navigation segment.

Which end-use industry drives the highest demand for Ring Laser Gyroscopes?

The Aerospace and Defense industry is the primary consumer, accounting for the largest share of the RLG market revenue. This segment relies on RLGs for high-grade Inertial Navigation Systems (INS) used in military aircraft, strategic missiles, and naval vessels, requiring unmatched reliability and precision, particularly in environments where GPS/GNSS signals are denied or unreliable.

What technological challenge known as the 'lock-in' effect must RLG manufacturers overcome?

The lock-in effect occurs at very low rotation rates, where scattering within the RLG cavity causes the counter-propagating beams to couple, or "lock-in," leading to zero output signal even though rotation is occurring. Manufacturers mitigate this by actively biasing the RLG (mechanical dither or magnetic field application) to ensure the system is always operating outside the lock-in zone, maintaining low-rate accuracy.

What is the projected growth rate (CAGR) for the Ring Laser Gyroscope Market?

The Ring Laser Gyroscope Market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This growth is primarily supported by rising global defense investments in high-precision guidance technologies and increasing integration into advanced commercial aviation platforms demanding superior navigational accuracy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Gyroscope Market Size Report By Type (MEMS Gyroscope, Fibre Optic Gyroscope(FOG), Ring Laser Gyroscope (RLG), Hemispherical Resonating Gyroscope (HRG), Dynamically Tuned Gyroscopes (DTG), Other Technologies), By Application (Consumer Electronics, Automotive, Aerospace and Defense, Industrial, Marine, Other End-user Verticals), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Ring Laser Gyroscope Optics Assemblies Market Statistics 2025 Analysis By Application (Satellite Communication, Aerospace, Navigation, Military Application, Precision Instrument), By Type (Plane Shape, Concave Shape, Convex Shape), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager