Ring Pull Caps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432311 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ring Pull Caps Market Size

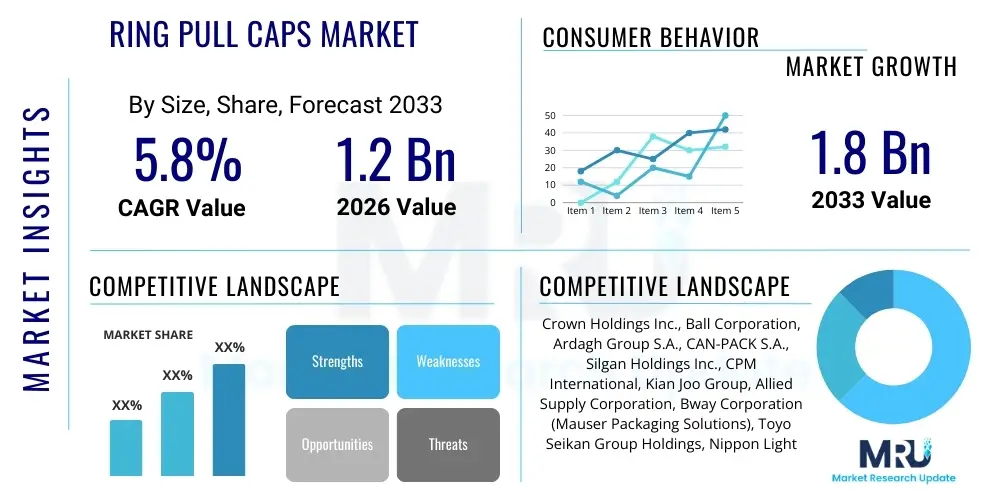

The Ring Pull Caps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.8 Billion by the end of the forecast period in 2033.

Ring Pull Caps Market introduction

Ring pull caps, formally classified as Easy-Open Ends (EOE), represent a monumental achievement in modern metal packaging engineering, designed to offer unparalleled user convenience while maintaining the hermetic seal crucial for product preservation. These closures are typically fabricated from lightweight yet robust aluminum or tinplate steel sheets, undergoing a complex, multi-stage stamping, scoring, and riveting process. The defining feature is the meticulously scored line (or tear strip) and the attached metal ring or tab, engineered to initiate a fracture upon pulling, allowing complete removal of the lid without external tools. The evolution of the ring pull cap has moved beyond simple beer can closures, transitioning from the original full tear-off designs, which sometimes resulted in accidental removals or sharp edges, to the current stay-on tab (SOT) designs for beverages, and increasingly towards full aperture easy-open ends (FAE) for food products, significantly enhancing both safety and functionality. The precise engineering tolerance required for the scoring depth—deep enough to tear easily but shallow enough to withstand internal pressure and logistics stress—is a core technical challenge defining market quality and competition.

The application spectrum of ring pull caps is vast, fundamentally dominating the global canned beverage market, encompassing standard carbonated soft drinks, energy beverages, packaged purified water, and a rapidly diversifying portfolio of alcoholic beverages, including craft beers, hard ciders, and ready-to-drink (RTD) cocktails. In the food sector, their adoption is pervasive across canned vegetables, soups, sauces, meats, and seafood, offering extended shelf life and tamper-evident security. The primary functional benefits are the enhanced consumer experience (convenience), superior product safety through tamper resistance, and the structural integrity provided by the metal base material, which provides optimal barrier protection against light, oxygen, and moisture. This reliability in sealing is paramount, ensuring compliance with stringent food safety regulations globally and mitigating product spoilage risks across long distribution cycles, particularly in regions with fluctuating temperature controls.

The momentum driving the Ring Pull Caps Market is multifaceted. Foremost among these drivers is the persistent global trend toward convenience consumption, fueled by shrinking preparation times and increasing reliance on packaged, portable solutions suited for on-the-go lifestyles, especially prevalent among Millennial and Gen Z demographics. Economically, rising disposable incomes in high-growth regions like Asia Pacific translate directly into higher per capita consumption of packaged beverages and ready meals. Furthermore, the sustained commitment to sustainable packaging solutions acts as a major catalyst; since aluminum and steel cans are indefinitely recyclable, ring pull caps align perfectly with circular economy mandates. Manufacturers continually invest in "lightweighting" technologies—reducing the material thickness while maintaining integrity—to lower costs and environmental footprint, an essential component of meeting large corporate clients' sustainability pledges and securing long-term supply contracts.

Ring Pull Caps Market Executive Summary

The Ring Pull Caps Market is characterized by robust and steady growth stemming from dynamic shifts in consumer packaging expectations, primarily favoring unparalleled convenience, coupled with significant investment in advanced automation within the global canning industry. A prevailing business trend involves the industry-wide transition toward sustainable and highly lightweight metal substrates, predominantly focusing on high-grade aluminum, which offers not only excellent barrier properties but also superior recyclability credentials crucial for meeting global ESG targets. Leading manufacturers are intensely focused on optimization, prioritizing innovations in scoring technology and ergonomic ring designs to minimize material usage per cap—a practice known as lightweighting—while rigorously maintaining functional integrity and ensuring consumer safety standards are exceeded. Strategic and often long-term partnerships between key cap manufacturers and major global beverage and food conglomerates are instrumental in defining the competitive landscape, driving substantial economies of scale, standardizing quality assurance protocols, and securing high-volume supply guarantees across diverse global production lines.

Regionally, the Asia Pacific (APAC) market is unequivocally positioned to exhibit the highest and most accelerated growth trajectory throughout the forecast period. This surge is fundamentally fueled by sweeping demographic changes, including rapid urbanization, the substantial expansion of the middle-class consumer base, and consequently, increasing per capita consumption of canned beverages and packaged, shelf-stable foods, especially in demographic powerhouses such as India, China, and Southeast Asian nations. Conversely, North America and Europe, classified as mature markets, maintain crucial strategic importance and high market shares. Growth in these regions is primarily driven not by volume expansion but by stringent regulatory quality standards, high consumer demand for customization, and the continuous need for premium, specialized packaging solutions, including unique sizes, decorative finishes for craft beer, and functional innovations for energy drinks. Market maturity in these geographies primarily encourages intense competitive pressure focused on maximizing production speed, minimizing operational costs, and pioneering next-generation sealant technologies rather than major fundamental structural changes to the cap design itself.

Analysis of segment trends reveals that the Beverage application sector currently maintains strong market dominance due to its massive, standardized volume throughput, with standard-diameter aluminum caps being the workhorse of the industry. However, the Food packaging segment, which includes highly profitable applications like canned vegetables, prepared soups, and complex ready-to-eat meals, is accelerating its adoption rate rapidly. This acceleration is driven by the modern consumer's increasing reliance on easy-to-store, non-perishable options, often utilizing the Full Aperture End (FAE) design for superior access. Material-wise, aluminum ring pull caps are systematically gaining significant share over traditional steel (tinplate) variants. This shift is attributable to aluminum’s inherent lighter weight, which translates into substantial logistical cost advantages in global shipping and transportation, simultaneously aligning the market with broader global decarbonization and energy-efficiency efforts within the global supply chain, reinforcing its position as the preferred material for future growth.

AI Impact Analysis on Ring Pull Caps Market

Common user inquiries concerning the Ring Pull Caps Market and Artificial Intelligence focus heavily on tangible operational improvements, namely efficiency gains in high-speed manufacturing and proactive defect reduction. Users frequently question how AI can transition manufacturing capabilities beyond conventional Statistical Process Control (SPC) to implement predictive models capable of anticipating and preempting potential failure modes in the complex scoring and riveting processes before they generate scrap, thereby drastically minimizing waste rates. Furthermore, there is significant interest in the application of AI for optimizing complex, multi-plant manufacturing scheduling, streamlining raw material inventory flow, and enhancing global supply chain logistics, tasks crucial given the high-volume, standardized, and time-sensitive nature of cap production. The consensus expectation is that AI will be integrated into sophisticated, high-speed vision inspection systems to achieve unprecedented levels of accuracy and speed in quality assurance, ensuring precise cap dimensional adherence, flawless internal lacquer application, and highly consistent ring function across every unit produced.

The implementation of advanced AI and machine learning (ML) models is strategically positioned to revolutionize the manufacturing lifecycle of ring pull caps by instituting true predictive maintenance protocols, intelligently optimizing volatile raw material usage, and guaranteeing compliance with the industry's most stringent quality standards. Specifically, AI-powered high-resolution vision systems are now capable of analyzing images of scored cap surfaces in milliseconds, identifying microscopic imperfections, minute variations in scoring depth, or material discontinuities that are beyond the detection capabilities of human operators or older generation sensor technologies. This adoption of proactive, real-time quality control dramatically reduces the exposure to costly product recalls or market rejection resulting from catastrophic sealing failures. Moreover, sophisticated ML algorithms are actively being deployed to dynamically modulate production parameters—such as the exact pressure applied by the scoring wheel, the speed of the stamping press, and the consistency of the sealant application—adjusting them instantly based on environmental factors, machine wear metrics, and intrinsic raw material batch variability, thereby maximizing throughput and operational energy efficiency across vast, globally distributed production facilities.

AI integration also extends into the strategic long-term planning and innovation phases. Advanced forecasting models now leverage massive datasets, synthesizing historical sales records, complex seasonal demand variability, and external macroeconomic indicators to predict demand patterns for specific cap formats, sizes, and material requirements (e.g., standard SOT vs. wide-mouth FAE). This granular precision in demand forecasting empowers manufacturers to precisely optimize inventories for base metals (aluminum/steel) and specialized polymeric sealants, substantially reducing expensive inventory holding costs while simultaneously enhancing resilience against major supply chain volatility. Furthermore, the technology enables the creation of highly detailed digital twins of entire manufacturing lines. These simulations allow engineers to virtually test modifications in cap design or material composition, such as testing the structural limits of even lighter gauge aluminum, to assess long-term performance and durability before committing to expensive physical tooling changes, significantly accelerating the cycle of data-driven product innovation.

- AI-driven predictive maintenance utilizes sensor data to anticipate and minimize unplanned downtime on critical high-speed capping lines.

- Machine learning enhances the precision of vision inspection systems for detecting microscopic scoring, rivet, and lacquer defects.

- Optimized production scheduling by AI dynamically balances variable customer demand with optimal resource allocation and machine capacity.

- Digital twin technology facilitates virtual simulation and stress testing of new ring cap designs and alternative material compositions.

- Advanced demand forecasting models enhance raw material procurement accuracy, optimizing inventory levels and minimizing manufacturing waste.

DRO & Impact Forces Of Ring Pull Caps Market

The operational and strategic dynamics of the Ring Pull Caps Market are primarily influenced by strong, foundational consumer demand for convenience coupled with essential operational advancements and standardization in the global packaging industry. Key market drivers include the persistent, aggressive global expansion of the canned beverage sector, which now increasingly encompasses premiumized ready-to-drink (RTD) cocktails, specialized functional waters, and high-growth energy drink formats. The established perception of ring pull caps as the most reliably safe and convenient easy-open system, particularly for pressurized and perishable contents, firmly secures its market position against alternative closure types. Significant opportunities are continuously emerging within rapidly developing economies, where demographic shifts and rising affluence are accelerating consumption patterns favoring standardized, shelf-stable packaged goods, simultaneously promoting the widespread transition towards full-aperture ring pull caps (FAE) which offer superior consumer access and pouring capabilities for both canned food and large beverage formats.

Despite the strong underlying drivers, the market faces several structural and economic restraints. The primary challenge is the acute volatility in the pricing of core raw materials, namely aluminum and tinplate steel. Given that ring pull caps are intrinsically high-volume, standardized commodity items operating on highly refined, tight margins, even moderate fluctuations in the costs of base metals or energy inputs can drastically destabilize profitability metrics and necessitate frequent, complex adjustments to global pricing strategies. Furthermore, the industry is perpetually navigating complex regulatory scrutiny, particularly concerning materials used in food contact applications. Specific historical concerns surrounding BPA (Bisphenol A)-based lacquers, although largely mitigated by the successful development and adoption of next-generation, non-BPA (NBPA) coatings, still mandate substantial and continuous compliance expenditure, intensive material reformulation efforts, and validation processes to satisfy global health authorities. The mounting environmental and legislative pressure to achieve extreme lightweighting also poses a constant technical challenge, requiring cap integrity and safety functionality to be maintained using less material.

The cumulative impact force of these combined factors exerts immense competitive pressure on manufacturers, necessitating relentless pursuit of comprehensive process optimization, often achieved through vertical integration or highly automated 'lights-out' manufacturing facilities. The intensely competitive environment mandates substantial, sustained investment in state-of-the-art, high-speed, precision stamping, and scoring equipment capable of consistently processing thinner, lighter-gauge materials without compromising the critical quality parameters of the cap's functional score. However, the enduring core market driver—consumer preference for instant convenience—complemented by the metal packaging format's intrinsic environmental advantage of near-infinite recyclability, ensures that the ring pull cap segment remains a dominant, technologically relevant, and fundamentally high-growth area, strategically capitalizing on global trends favoring sustainable, reliable, and exceptionally user-friendly packaging solutions across an expanding spectrum of end-use product categories.

Segmentation Analysis

The Ring Pull Caps Market is meticulously segmented across key dimensions including the base material composition, various dimensional specifications (size/diameter), end-use application sectors, and broad geographical regions. This detailed segmentation is instrumental for market participants, enabling them to finely tune their production capacities, strategic investments, and targeted marketing campaigns to align precisely with specific industry demands, whether the focus is on achieving massive volumes in the beverage sector or meeting the customized, stringent sealing requirements of specialized food packaging. The segmentation effectively highlights the market’s dual nature: reliance on industrial standardization for cost efficiency, contrasted with the necessity for highly customized, application-specific solutions regarding seal integrity, which must maintain compatibility with diverse product characteristics, ranging from high-pressure carbonated liquids to dense, viscous food items, consequently driving highly differentiated growth across the entire packaging value chain.

- By Material:

- Aluminum: Preferred for beverages due to lightness and recyclability.

- Steel/Tinplate: Historically used, common in food canning for rigidity.

- By Size/Diameter:

- Standard Diameter (e.g., 200, 202): Predominant in beverage cans (beer, soft drinks).

- Large Diameter (e.g., 300, 307): Used for larger food cans and some specialty beverages.

- Full Aperture Ends (FAE): Large openings, rapidly growing in the food sector (soups, prepared meals).

- By End-Use Application:

- Beverages (Soft Drinks, Beer, Energy Drinks, Juices): Largest volume segment.

- Food (Canned Vegetables, Soups, Seafood, Ready-to-Eat Meals): High growth, driven by FAE adoption.

- Pet Food: Consistent, stable demand for small and large format metal packaging.

- Others (Industrial/Chemicals): Niche applications for small metal containers.

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Ring Pull Caps Market

The foundational value chain for the Ring Pull Caps Market commences with the rigorous upstream process of procuring and preparing primary raw materials, predominantly high-grade aluminum alloys and electrolytic tinplate steel coils. Upstream segments involve major global metal commodity producers who are mandated to supply highly specialized coil stock that adheres to exceptionally strict specifications regarding gauge tolerance, material flatness, and surface quality—parameters crucial for avoiding failure during the high-speed stamping and scoring operations. Crucially, suppliers of specialized sealant compounds (which include complex polymeric lacquers and internal liners, often based on next-generation polyester or acrylic formulations) constitute a vital part of the upstream segment, providing the necessary chemical barrier and mechanical sealing technology required to guarantee product integrity, extend shelf stability, and prevent corrosion and critical gas permeation over long periods, particularly for acidic or carbonated contents.

The midstream phase is fundamentally dominated by specialized cap converters—companies that operate highly capital-intensive, automated facilities. These manufacturers execute the high-precision operations of cutting, shaping, initial scoring, and the crucial step of mechanically attaching the pull-ring tab using highly specialized riveting processes. Following the forming stage, the caps receive sophisticated internal sealants and protective external coatings. This stage demands enormous capital expenditure for advanced stamping presses, customized tooling, and sophisticated high-speed vision systems necessary to ensure the perfect, consistent scoring depth and reliable ring attachment. The distribution network for these finished caps is complex and largely characterized by direct sales, driven by the need to supply massive, consistent volumes directly to large, integrated beverage and food processors who operate on strict Just-In-Time (JIT) delivery schedules to synchronize with their own continuous, high-speed canning and seaming lines.

Downstream activities center on the final integration point: the end-user packaging companies (canners and bottlers) who utilize specialized, high-speed automated seaming machines to affix the ring pull caps onto filled containers. The functional reliability and consistent quality of the ring pull cap are paramount in this stage, as even minor dimensional inconsistencies or sealing defects can immediately trigger line shutdowns, resulting in substantial operational delays and significant financial losses. While direct, contractual sales to multinational brands form the bulk of the market, indirect distribution channels also exist, involving regional packaging distributors and specialized brokers who cater to smaller regional beverage bottlers, contract packers, or niche food producers, often supplying a complete portfolio of secondary packaging components alongside the caps. Operational efficiency, advanced logistics management, and strict inventory control across the entire value chain are critically important due to the highly standardized, massive-volume nature of the product, mandating optimized warehousing and transportation networks to aggressively minimize freight and handling costs.

Ring Pull Caps Market Potential Customers

The core customer base for ring pull caps consists of major multinational food and beverage producers and large-scale contract co-packers who demand consistent, high-volume supply and absolute quality assurance. These entities prioritize supply chain stability, global manufacturing scalability, and consistent product quality that meets or exceeds international food safety standards, leading to a market structure dominated by long-term, highly technical supply contracts. Within the extensive beverage sector, key customers include the world's largest soft drink manufacturers, global brewing giants, and major producers of emerging categories such as hard seltzers, ready-to-drink coffee, and functional energy beverages packaged in sleek, modern metal cans. These buyers require caps specifically engineered to handle significant internal pressures characteristic of carbonation while simultaneously delivering a safe, effortless, and reliably uniform opening experience for the consumer, often demanding specialized coatings to interact effectively with acidic contents.

Beyond the pressurized beverage sector, an equally substantial and rapidly expanding customer segment is found within the food preservation industry. This includes major international manufacturers of processed goods such as canned soups, prepared fruits and vegetables, concentrated sauces, specialty seafood processors (e.g., tuna, salmon), and producers of shelf-stable prepared meals. For food applications, the strategic shift among these customers is strongly centered on the adoption of full-aperture easy-open ends (FAEs), which provide consumers with near-total access to the contents, significantly improving convenience and reducing the need for traditional can openers. Furthermore, pet food manufacturers, managing a vast array of can formats ranging from small retail sizes to large industrial containers, also represent a segment with consistently stable, high demand, where product longevity, tamper-evidence, and reliable sealing facilitated by ring pull technology are critical purchase criteria.

An emerging tier of customers includes regional craft beverage producers (such as microbreweries and small-batch specialty juice companies) and niche industrial manufacturers dealing with non-food items like specialized lubricants, paints, or precision solvents packaged in metal containers. Although these customers typically place lower individual volume orders, they collectively represent a significant opportunity for manufacturers capable of offering greater flexibility in minimum order quantities, expedited delivery, and the provision of customized cap aesthetics or decorative printing for enhanced brand visibility. Across all segments, the paramount requirement remains an absolute assurance of near-zero defects; since the failure of a single cap compromises the hermetic seal of the entire container, robust quality assurance protocols are the central determinant in securing and retaining large, lucrative client contracts, directly impacting the long-term profitability and reputation of the cap supplier.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Crown Holdings Inc., Ball Corporation, Ardagh Group S.A., CAN-PACK S.A., Silgan Holdings Inc., CPM International, Kian Joo Group, Allied Supply Corporation, Bway Corporation (Mauser Packaging Solutions), Toyo Seikan Group Holdings, Nippon Light Metal Co., Ltd., Independent Can Company, CCL Industries Inc., Envases Group, Universal Can Corporation, China Metal Packaging Group, Pactiv Evergreen Inc., Trivium Packaging, Huber Packaging Group, Sonoco Products Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ring Pull Caps Market Key Technology Landscape

The technological sophistication driving the Ring Pull Caps Market is centered on the masterful intersection of ultra-high-precision metal forming and scoring techniques, seamlessly integrated with cutting-edge material science concerning sealing and protective coatings. Contemporary manufacturing relies on advanced, servo-driven high-speed transfer presses, which are engineered to produce thousands of finished caps per minute. These machines demand extremely fine tolerances in the raw metal coil feed—sometimes measured in microns—to ensure functional consistency and prevent costly stoppages on the downstream canning lines. A critical technological innovation is the application of sophisticated laser scoring systems; these modern systems offer dramatically superior precision and repeatability compared to older mechanical scoring wheels. Laser scoring allows manufacturers to etch complex, finer, and more consistent tear lines, critically lowering the necessary opening force for the consumer while simultaneously maximizing the cap’s intrinsic burst resistance under high internal pressures. This precision engineering is fundamental for successfully implementing industry-wide "lightweighting" efforts—reducing metal gauge thickness—thereby ensuring corporate sustainability goals are met without any functional compromise to consumer safety or product protection.

Another area of profound technological advancement involves the continuous research and development of specialized interior coatings and highly resilient sealant compounds, which are indispensable components for guaranteeing product safety and extending the shelf life of highly sensitive goods. The industry has demonstrably achieved a successful migration away from legacy epoxy-based resins that historically contained Bisphenol A (BPA), transitioning toward advanced, validated Non-BPA (NBPA) coatings formulated using next-generation materials such as polyester, acrylics, or vinyl polymer blends. Current research and development efforts are intensely focused on engineering these internal liners to possess superior chemical inertness, optimal flexibility, and powerful adhesion properties. This ensures absolute compatibility with an extraordinarily diverse range of product matrices—including corrosive acidic foods, high-fat oils, or high-salt contents—guaranteeing that the coating prevents metal-product interaction without leaching any components or negatively altering the product’s flavor, texture, or nutritional profile. Furthermore, the specialized technology responsible for attaching the metal pull ring (the riveting process) is subject to ongoing optimization, focusing on maximizing the tensile strength of the attachment point while minimizing localized material stress and deformation on the cap's primary surface.

The wholesale adoption of Industry 4.0 paradigms, which incorporates high-density integrated sensor technology, industrial IoT connectivity, and advanced robotics, is transforming the cap production process into a completely autonomous, digitally monitored ecosystem. Comprehensive real-time data acquisition—tracking every production variable from the exact metal sheet tension to precise thermal curing temperatures and lubricant application rates—is aggregated and fed into highly iterative, self-correcting quality control loops. Specialized optical vision inspection systems, often enhanced by integrated AI algorithms, utilize high-speed, multi-spectral cameras and sophisticated spectroscopic analysis. These systems are capable of instantly checking for minute scoring inconsistencies, detecting infinitesimal pinholes in the metal substrate, or confirming the uniformity of liner compound distribution across the cap's surface. This robust, continuous quality validation ensures that every single cap leaving the facility adheres to the most stringent international dimensional and performance benchmarks, drastically reducing the possibility of systemic manufacturing defects and enhancing overall operational yield.

Regional Highlights

The global marketplace for Ring Pull Caps exhibits heterogeneous growth patterns and dynamics, which are deeply influenced by highly localized factors including regional consumption behaviors, prevailing economic developmental stages, and the scope and enforcement of local packaging and environmental regulations. Asia Pacific (APAC) stands out as the unequivocal leader in volume growth, driven by an exceptional expansion in demand for canned beverages and shelf-stable processed food. This boom is a direct consequence of soaring rates of urbanization and rapidly increasing consumer affluence, particularly across the massive consumer bases of China, India, and Indonesia. The fundamental shift in consumption patterns, moving from traditional, unpackaged goods towards standardized, long-shelf-life canned products, presents cap manufacturers with a scalable opportunity unmatched globally. Consequently, significant capital investment is actively being directed toward establishing localized, high-capacity manufacturing facilities across the region to effectively serve this exponential growth in demand, focusing primarily on high-volume, cost-efficient, and standardized cap formats.

In contrast, North America and Europe are characterized as mature markets, yet they hold disproportionate strategic importance due to their high demand for premiumization and compliance with stringent quality and environmental standards. While absolute growth rates are typically lower than those observed in APAC, these regions are the global drivers of innovation in niche and specialty segments. This includes the widespread adoption of full aperture ends (FAEs) for convenient gourmet prepared meals, and the demand for highly customized, high-specification cap solutions tailored for the rapidly evolving craft beverage market. The strategic focus in these markets is less on brute volume expansion and more on maximizing sustainability metrics. This includes responding to strong regulatory mandates and consumer preference by demanding caps manufactured using high proportions of Post-Consumer Recycled content (PCR) aluminum and the mandatory use of the latest generation, certified environmentally benign NBPA coating technologies, which generally results in a higher average selling price and margin for cap suppliers.

Latin America (LATAM) and the Middle East & Africa (MEA) present distinct market profiles characterized by significant, yet often volatile, growth potential. LATAM, supported by robust, established regional beer and soft drink industries, is experiencing steady growth trajectory, though this is heavily dependent on the economic stability of major regional markets like Brazil and Mexico. Cap manufacturers in LATAM focus on reliable high-volume supply chains and efficient logistics to meet the substantial demand from local beverage giants. The MEA region is demonstrating rapidly increasing demand linked to accelerated industrialization, increased reliance on packaged and imported food goods, and infrastructure development. However, penetrating the MEA market requires navigating complex geopolitical environments, highly variable regulatory landscapes, and often challenging logistics. Globally, the overarching material trend continues to be the sustained migration toward aluminum ring pull caps, predominantly driven by established logistical cost efficiencies and the globally superior recycling infrastructure supporting the metal can format.

- Asia Pacific (APAC): Highest volume market, fueled by demographic shifts, rapid urbanization, and exponential growth in canned beverage and ready-to-eat consumption across key nations.

- North America: Focus remains heavily on product premiumization, mandatory sustainability initiatives (requiring high PCR content), and the continuous need for specialized, customized cap solutions for the high-value craft and specialty beverage sectors.

- Europe: Growth is primarily directed by strict environmental legislation and quality standards, demanding state-of-the-art, certified non-BPA coatings and ultra-efficient, highly optimized manufacturing and supply chain processes.

- Latin America (LATAM): Exhibits consistent, stable growth supported by strong regional consumption of high-volume soft drinks and beer, necessitating stringent focus on supply chain reliability and volume capacity.

- Middle East & Africa (MEA): Represents an emerging market characterized by increasing industrialization and rising consumer acceptance of packaged and preserved goods, offering challenging but significant long-term market expansion opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ring Pull Caps Market.- Crown Holdings Inc.

- Ball Corporation

- Ardagh Group S.A.

- CAN-PACK S.A.

- Silgan Holdings Inc.

- CPM International

- Kian Joo Group

- Allied Supply Corporation

- Bway Corporation (Mauser Packaging Solutions)

- Toyo Seikan Group Holdings

- Nippon Light Metal Co., Ltd.

- Independent Can Company

- CCL Industries Inc.

- Envases Group

- Universal Can Corporation

- China Metal Packaging Group

- Pactiv Evergreen Inc.

- Trivium Packaging

- Huber Packaging Group

- Sonoco Products Company

Frequently Asked Questions

Analyze common user questions about the Ring Pull Caps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material used for manufacturing modern ring pull caps?

The primary material is increasingly aluminum, favored for its light weight, superior recyclability, and ease of use in high-speed manufacturing processes. Steel (tinplate) is also widely utilized, particularly in non-pressurized food canning applications where structural rigidity and cost efficiency are prioritized.

How is market growth tied to sustainability efforts?

Market growth is strongly linked to sustainability, as metal packaging (which utilizes ring pull caps) boasts high recycling rates globally. Demand is critically driven by ongoing "lightweighting" initiatives and the industry-wide shift towards caps utilizing higher Post-Consumer Recycled (PCR) content, aligning directly with major corporate environmental, social, and governance (ESG) goals.

Which end-use application segment accounts for the largest market share?

The Beverage segment, encompassing high-volume products like soft drinks, beer, and energy drinks, accounts for the largest overall market share due to the immense global scale of liquid consumption. However, the Food segment, specifically utilizing full aperture easy-open ends (FAEs), is projected to exhibit the highest annual growth rate.

What technological advancement is most critical for cap quality assurance?

The most critical advancement is the integration of AI-powered vision inspection systems coupled with highly precise laser scoring technology. These systems ensure the consistency and accuracy of the microscopic score depth, which simultaneously dictates the required opening force for the consumer and the burst resistance necessary for product protection under pressure.

What are the main growth opportunities in emerging markets for ring pull caps?

The main opportunities are concentrated in the Asia Pacific (APAC) and Latin American regions, fueled by aggressive urbanization, rapidly increasing middle-class consumption, and the expanding industrial infrastructure that supports the shift from traditional methods to standardized, high-volume, long-shelf-life canned products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager