Ring Terminal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432624 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Ring Terminal Market Size

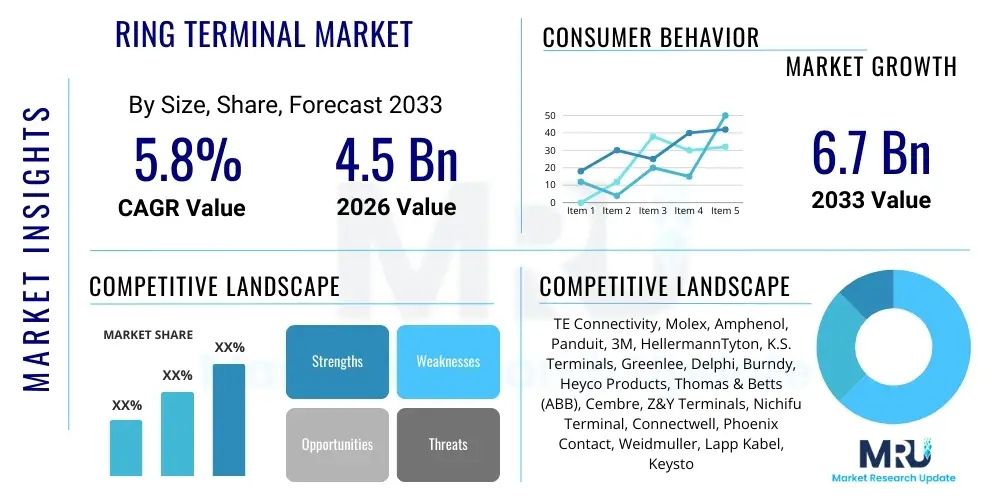

The Ring Terminal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Ring Terminal Market introduction

The Ring Terminal Market encompasses the global production and distribution of specialized electrical connectors designed to establish secure, high-integrity connections between wires and power sources or grounding points. Ring terminals, characterized by their circular shape that fits snugly around a screw or stud, are fundamental components in electrical systems where mechanical robustness and vibration resistance are paramount. These connectors ensure maximum contact surface area and secure fastening, crucial for handling high current loads and maintaining system reliability over extended operational periods. The primary function of a ring terminal is to prevent accidental disconnection, making them indispensable in harsh environments like automotive engines, heavy machinery, and industrial control panels.

Major applications of ring terminals span across vital sectors including automotive manufacturing, where they are used extensively for battery connections and vehicle wiring harnesses; industrial machinery, ensuring reliable power transmission in motors and control systems; telecommunications infrastructure; and renewable energy installations, particularly in solar panel wiring and inverter connections. The inherent benefits of using ring terminals include superior strain relief, enhanced durability compared to spade or fork terminals in high-vibration settings, and consistent electrical conductivity. They are available in various materials such as copper, brass, and aluminum, often coated or plated (e.g., tin) to resist corrosion and optimize electrical performance, catering to diverse environmental and current requirements.

The market growth is primarily driven by the escalating demand for reliable electrical infrastructure globally, especially in emerging economies undergoing rapid industrialization and urbanization. Furthermore, the proliferation of electric vehicles (EVs) and hybrid vehicles, which utilize complex high-voltage battery systems requiring extremely secure terminal connections, provides a substantial growth impetus. Strict regulatory standards concerning electrical safety and performance in industrial and automotive applications further compel manufacturers to utilize certified, high-quality ring terminals, thereby sustaining market momentum and technological evolution within the connector industry.

Ring Terminal Market Executive Summary

The Ring Terminal Market is exhibiting robust growth, driven by key macro-economic trends including the global push for electrification, particularly in the transportation and energy sectors. Business trends indicate a strong emphasis on automation in terminal installation and the development of specialized high-temperature and high-vibration resistant terminals to meet the evolving requirements of advanced industrial automation and aerospace applications. Strategic shifts among leading manufacturers involve focusing on vertical integration, enhancing production efficiency, and expanding product portfolios to include proprietary insulation materials and enhanced locking mechanisms. Furthermore, sustainability initiatives are influencing the market, leading to increased demand for lead-free materials and terminals designed for easy recycling and efficient energy transfer in green technology installations.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market, propelled by massive investments in automotive manufacturing, particularly EV production in China and India, and rapid expansion of industrial robotics and consumer electronics manufacturing bases. North America and Europe maintain significant market shares, characterized by demand for high-specification, premium terminals driven by stringent safety regulations and modernization of aging infrastructure. The market in Latin America, Middle East, and Africa (LAMEA) is growing steadily, supported by energy sector investments, including oil and gas operations and burgeoning renewable energy projects requiring reliable electrical connection components.

Segment trends reveal that the insulated ring terminals segment, particularly those utilizing heat-shrink technology, is experiencing accelerated adoption due to their ability to provide environmental sealing and strain relief, crucial for outdoor and marine applications. Copper terminals dominate the material segment owing to their superior conductivity and malleability, while aluminum terminals are gaining traction in large gauge applications where weight reduction and cost efficiency are prioritized, especially in high-voltage utility connections. The automotive application segment remains the largest consumer, but industrial machinery and renewable energy are emerging as high-growth segments, demanding customized terminal sizes and robust plating options.

AI Impact Analysis on Ring Terminal Market

User inquiries regarding AI's influence on the Ring Terminal Market primarily focus on three areas: how AI can optimize the manufacturing process (quality control, predictive maintenance), the role of AI in supply chain resilience (demand forecasting, inventory management), and the potential for AI-driven design iteration (simulations, material optimization). Users are concerned about maintaining high precision and quality in high-volume production, asking if AI-powered vision systems can significantly reduce defective rates beyond traditional automated inspection methods. Furthermore, there is interest in how machine learning algorithms can predict wire degradation or terminal failure in high-stress applications, signaling a shift from reactive maintenance to proactive monitoring, although this is more relevant to the application of the terminal rather than the terminal itself. The overarching expectation is that AI will drive efficiency gains in production and potentially inform the development of next-generation smart connectors, though ring terminals themselves remain passive components.

The primary impact of AI is operational rather than product-centric. In manufacturing plants producing billions of terminals annually, AI-driven quality assurance systems utilizing deep learning for image recognition significantly improve defect detection rates, catching microscopic flaws in plating thickness, crimp integrity, or insulation placement that human inspectors or traditional machine vision might miss. This enhanced quality control directly translates to reduced scrap rates and increased customer trust. Furthermore, AI and machine learning are crucial for optimizing the complex die-casting and stamping processes involved in terminal manufacturing, predicting tool wear, and adjusting machinery parameters in real-time, thereby maximizing throughput and equipment longevity.

AI also plays a critical role in the strategic side of the business. Predictive analytics, fueled by large datasets of historical sales, regional infrastructure projects, and commodity price fluctuations, allow manufacturers to forecast demand for specific terminal types (e.g., heavy gauge copper vs. lightweight aluminum) with greater accuracy. This improves inventory management, minimizes holding costs, and ensures robust supply chain response times, particularly crucial for just-in-time delivery models required by major automotive and aerospace clients. While the ring terminal product itself is simple, AI optimizes the value stream that supports its massive global deployment.

- AI enhances quality control through deep learning-based vision inspection systems, minimizing manufacturing defects.

- Predictive maintenance algorithms optimize stamping and molding machine uptime, increasing operational efficiency.

- Machine Learning models improve demand forecasting accuracy for raw materials (copper, brass) and finished goods inventory.

- AI-driven simulation tools assist in designing optimal crimp barrels and insulation geometries for maximum electrical integrity.

- Integration of AI in manufacturing robotics leads to faster, more consistent automated terminal assembly and packaging.

DRO & Impact Forces Of Ring Terminal Market

The Ring Terminal Market is fundamentally driven by the global imperative for secure electrical connections, fueled by rapid industrialization, the exponential growth of the Electric Vehicle (EV) industry, and substantial global investments in renewable energy infrastructure (solar and wind farms). These sectors require extremely reliable, high-current connectors that can withstand harsh operating conditions and intense vibrations, areas where ring terminals inherently outperform alternative connectors. However, the market faces significant restraints, primarily stemming from volatility in raw material prices, particularly copper and brass, which impacts manufacturing costs and pricing stability. Additionally, the proliferation of alternative connection technologies, such as advanced insulation piercing connectors (IPCs) or spring-cage terminals in specific industrial control applications, presents moderate competitive pressure. Despite these challenges, vast opportunities exist in developing specialized, next-generation terminals, including miniaturized versions for compact electronics and high-performance, shielded terminals for high-frequency or extreme-temperature environments, catering to advanced aerospace and medical device applications.

The major impact forces shaping the market involve technological standardization and stringent regulatory compliance. The push towards international standards (like UL and RoHS compliance) dictates the material composition, plating thickness, and insulation properties of terminals, forcing manufacturers to invest continuously in certification and quality assurance, serving as a barrier to entry for smaller players. Furthermore, the shift towards autonomous and connected vehicle architectures demands terminals that can ensure data integrity as well as power delivery, requiring innovation in design robustness. The economic impact force is driven by the cost of ownership; while terminals are low-cost items individually, their cumulative expenditure in large projects is substantial, making competitive pricing and long-term reliability paramount factors in vendor selection, ultimately favoring manufacturers capable of achieving economies of scale and offering zero-defect quality.

The environmental impact force is increasingly critical. Regulatory mandates focusing on sustainability, coupled with corporate sustainability goals (CSGs), are driving demand for halogen-free insulation materials and the reduction of lead and other hazardous substances in terminal composition. Manufacturers are under pressure to source ethically mined metals and optimize packaging to reduce waste. This sustainability push represents both a challenge and an opportunity, allowing innovative companies to differentiate their products based on environmental performance. The convergence of strict safety regulations (driving quality) and environmental mandates (driving material innovation) creates a high-stakes environment where only technologically advanced and compliance-focused firms can thrive and capture long-term market share.

Segmentation Analysis

The Ring Terminal Market is comprehensively segmented based on product characteristics, material composition, application sectors, and functional attributes, reflecting the diverse and specialized requirements across various end-use industries. Segmentation provides crucial insights into targeted market dynamics, allowing manufacturers to align production capabilities with high-growth sectors. The differentiation by type, such as insulated versus non-insulated, dictates the environmental resilience and safety rating of the terminal, directly influencing adoption in moisture-prone or high-vibration settings. Further segmentation by gauge size is essential, as terminal capacity must match specific wire thicknesses, ranging from micro-gauge consumer electronics to heavy-duty industrial power cables.

The application segmentation is particularly critical for market analysis, dividing demand across automotive, industrial, telecommunications, and energy sectors. The rapid growth in automotive applications, driven by complex wiring harnesses in modern vehicles and the intensive battery requirements of electric vehicles, remains the primary revenue driver. Simultaneously, the industrial segment, characterized by high-volume utilization in machinery, robotics, and control cabinets, demands terminals offering extreme durability and resistance to chemicals and temperature fluctuations. Analyzing these segments helps stakeholders identify lucrative niche markets, such as aerospace, which requires high-specification, military-grade terminals with unique plating materials for high-altitude resilience.

Moreover, segmenting by material (Copper, Brass, Aluminum) reveals underlying cost structures and performance characteristics. Copper, due to its superior conductivity and corrosion resistance when plated, dominates general-purpose and high-performance segments. However, aluminum is gaining traction in utility and large-scale renewable energy installations where weight and cost considerations override the requirement for peak conductivity. Understanding these material-based shifts is vital for raw material procurement and pricing strategy, ensuring market responsiveness to global commodity trends and specialized engineering demands across all geographic regions.

- By Type:

- Insulated Ring Terminals (Vinyl, Nylon, Heat Shrink)

- Non-Insulated Ring Terminals

- By Material:

- Copper Ring Terminals

- Brass Ring Terminals

- Aluminum Ring Terminals

- By Application:

- Automotive (Battery, Wiring Harness, Engine Control)

- Industrial Machinery and Equipment

- Telecommunications Infrastructure

- Consumer Electronics and Appliances

- Aerospace and Defense

- Renewable Energy (Solar, Wind Power)

- By Gauge Size:

- Small Gauge (22 AWG to 10 AWG)

- Medium Gauge (8 AWG to 2 AWG)

- Large/Heavy Gauge (1 AWG and larger)

Value Chain Analysis For Ring Terminal Market

The value chain for the Ring Terminal Market begins with upstream analysis, focusing heavily on raw material suppliers, predominantly copper, brass, and aluminum producers, along with suppliers of specialized insulation polymers (PVC, Nylon, PTFE, and cross-linked polyolefin for heat shrink). The stability and integrity of this upstream segment are critical, as commodity price volatility directly impacts manufacturing costs. Manufacturers engage in high-volume stamping, forming, and plating processes, requiring specialized machinery and tooling. Efficiency in the upstream manufacturing stage, including waste reduction and precision engineering of the barrel and tongue sections, determines the terminal's ultimate performance characteristics and competitive cost positioning in the global market. Strategic relationships with metal suppliers often involve long-term contracts to mitigate price fluctuations and ensure consistent material quality necessary for electrical certification.

The midstream involves the core terminal manufacturing process, including crimping barrel design, insulation application (for insulated terminals), and packaging. Leading players invest heavily in automated production lines utilizing robotics and advanced quality control systems, ensuring compliance with strict industry standards such as UL 486A-486B and military specifications. Distribution channels represent a crucial link in the value chain. Direct sales are common for very large Original Equipment Manufacturers (OEMs) in the automotive and aerospace sectors, allowing for customized specifications, bulk pricing agreements, and dedicated technical support. Indirect distribution, leveraging major industrial distributors (e.g., Grainger, Fastenal) and specialized electrical wholesalers, is essential for reaching Maintenance, Repair, and Operations (MRO) markets and smaller contractors globally.

Downstream analysis focuses on the end-users—the key buyers who integrate the terminals into finished electrical systems. This segment includes wiring harness assemblers, panel builders, industrial maintenance crews, and electrical contractors. The performance of the terminal is validated at this stage, focusing on the quality of the crimp connection, pull-out force, and long-term environmental durability. The competitive success of a terminal supplier often hinges not just on the product quality, but also on the provision of compatible, high-quality crimping tools and application training, ensuring optimal field installation. The growing trend of pre-crimped assemblies and customized harness kits provided by terminal manufacturers highlights a shift towards offering integrated solutions, adding value further downstream and strengthening customer loyalty.

Ring Terminal Market Potential Customers

Potential customers and end-users of ring terminals span a vast spectrum of industries requiring durable and safe electrical connections. The largest customer segment remains the Automotive Industry, encompassing manufacturers of passenger vehicles, commercial trucks, and specialized off-road equipment. These buyers use ring terminals extensively for battery connections, grounding points, primary power distribution lines, and intricate engine control systems, demanding terminals that can withstand continuous vibration, extreme temperatures, and exposure to automotive fluids. The rapid transition to Electric Vehicles (EVs) is creating a new class of high-voltage customers demanding specialized, large-gauge, sealed ring terminals designed for robust battery pack connections and power inversion units.

The second major group comprises Industrial and Machinery Manufacturers. This includes companies producing factory automation equipment, robotics, HVAC systems, and heavy construction machinery. In this segment, customers seek terminals certified for industrial environments, often requiring oil, chemical, and temperature resistance for use in control panels, motor hookups, and large electrical distribution cabinets. MRO (Maintenance, Repair, and Operations) entities and specialized electrical contractors constitute another significant customer base, purchasing terminals for infrastructure upkeep, facility upgrades, and general repair work, prioritizing versatility and wide availability across distributor networks.

Furthermore, the Energy Sector represents a high-growth customer category. This includes utility providers, solar farm developers, wind turbine manufacturers, and backup power system providers. These customers require highly reliable, weather-resistant terminals for outdoor installations, necessitating specialized plating (e.g., heavy tin or nickel) and robust insulation to ensure longevity in harsh environments. The defense and aerospace industries also represent a high-value, albeit smaller, customer segment, demanding terminals meeting strict military specifications (Mil-Spec) regarding material purity, corrosion resistance, and performance under extreme atmospheric pressure and temperature variations, often requiring customized, non-standard terminal geometries and plating.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, Molex, Amphenol, Panduit, 3M, HellermannTyton, K.S. Terminals, Greenlee, Delphi, Burndy, Heyco Products, Thomas & Betts (ABB), Cembre, Z&Y Terminals, Nichifu Terminal, Connectwell, Phoenix Contact, Weidmuller, Lapp Kabel, Keystone Electronics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ring Terminal Market Key Technology Landscape

The Ring Terminal Market, while utilizing a product that is structurally basic, relies heavily on advanced manufacturing and material science technologies to ensure superior electrical and mechanical performance. Key technologies center around precision stamping and forming processes, utilizing high-speed progressive dies capable of handling various metal alloys (E-TP copper, oxygen-free copper, specific brass grades) while maintaining extremely tight tolerances for barrel diameter and tongue alignment. Sophisticated surface treatment technologies, particularly electroplating, are critical, with processes like thick tin plating or nickel plating being essential to enhance conductivity, prevent galvanic corrosion, and improve solderability. The control of plating thickness and uniformity, often measured in microns, is paramount for high-reliability applications, forming a core technological competency among leading manufacturers.

A second major technological area involves insulation and sealing methods for insulated ring terminals. This includes the development of proprietary insulation materials, such as flame-retardant nylon or highly chemical-resistant PVDF, which must be bonded securely to the metallic barrel. Heat-shrink terminal technology represents a significant advancement, utilizing cross-linked polyolefin sleeves lined with adhesive/sealant to create an environmentally sealed, moisture-proof connection upon heating. Furthermore, innovative crimping technologies are essential, moving beyond basic hydraulic or pneumatic presses to include semi-automatic or fully automatic crimping machines integrated with pull-test monitoring and quality feedback loops. These tools ensure that the required pull-out force specifications are met consistently, minimizing field failures and optimizing throughput in harness assembly lines.

Emerging technologies focus on miniaturization and the development of specialized materials for extreme environments. Miniaturization requires highly precise laser welding or micro-stamping techniques to maintain robustness in small gauge sizes utilized in complex sensor systems and compact electronics. For applications in aerospace and high-temperature industrial settings (e.g., near engine manifolds), manufacturers are developing terminals using high-temperature nickel alloys and utilizing specialty ceramic or fiberglass insulation to maintain integrity above 200°C. The adoption of advanced simulation software (FEA - Finite Element Analysis) is also a key technology, allowing engineers to digitally optimize crimp compression and stress distribution, reducing the time required for physical prototyping and accelerating the launch of high-performance product variations.

Regional Highlights

Regional dynamics play a crucial role in shaping the Ring Terminal Market, with demand patterns reflecting local industrialization rates, regulatory environments, and dominant manufacturing sectors. The Asia Pacific (APAC) region stands out as the primary market engine, driven by its massive automotive manufacturing base, particularly the rapid scaling of EV production in China, South Korea, and Japan. Furthermore, APAC's dominance in global electronics manufacturing and its substantial infrastructure development projects, including massive grid modernization and renewable energy installations, fuel enormous demand for both standard and specialized terminals. China, in particular, leads in volume consumption, while nations like South Korea and Japan drive demand for high-specification, automated terminal solutions utilized in precision machinery and advanced robotics.

North America and Europe represent mature markets characterized by stringent quality requirements and a focus on high-reliability applications. North America’s demand is anchored by its robust aerospace and defense sectors, along with significant ongoing investments in industrial automation and oil and gas infrastructure, necessitating military-grade and heavy-gauge terminals. The emphasis here is on compliance with standards like UL and SAE, favoring established manufacturers who can guarantee traceability and certification. Europe is driven by its advanced manufacturing industries, especially in Germany and the Nordic countries, focusing on high-efficiency industrial machinery and sophisticated rail transport systems, leading to strong demand for specialized, environmentally compliant, and halogen-free insulated terminals.

The Middle East and Africa (MEA) and Latin America regions are emerging markets showing accelerated growth, primarily linked to capital investments in resource extraction and infrastructure. In MEA, large-scale oil and gas projects, along with new smart city developments, necessitate large quantities of industrial-grade terminals designed for extreme heat and high salinity environments. Latin America's growth is tied to automotive assembly plants (especially in Mexico and Brazil) and utility expansion projects. These regions often prioritize cost-effectiveness alongside reliability, leading to increased competition between globally certified brands and local producers capable of meeting international quality standards at competitive prices. Overall, the global market sees a trend where mature markets prioritize quality and customization, while emerging markets drive volume and moderate specification requirements.

- North America: Focus on aerospace, defense (Mil-Spec terminals), and high-specification industrial automation. Strong regulatory compliance driver.

- Europe: High demand for halogen-free, sustainable, and high-performance terminals for automotive and rail infrastructure. Germany and Italy are key manufacturing hubs.

- Asia Pacific (APAC): Largest market volume, driven by massive EV production, consumer electronics, and renewable energy build-out (China, India, ASEAN countries).

- Latin America (LATAM): Growth driven by automotive manufacturing and significant infrastructure upgrades, focusing on cost-effective, durable solutions.

- Middle East and Africa (MEA): Demand linked to oil and gas industrial projects, utility expansion, and severe climate requirements (high temperature/corrosion resistance).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ring Terminal Market.- TE Connectivity

- Molex

- Amphenol

- Panduit

- 3M

- HellermannTyton

- K.S. Terminals

- Greenlee

- Delphi

- Burndy

- Heyco Products

- Thomas & Betts (ABB)

- Cembre

- Z&Y Terminals

- Nichifu Terminal

- Connectwell

- Phoenix Contact

- Weidmuller

- Lapp Kabel

- Keystone Electronics

Frequently Asked Questions

Analyze common user questions about the Ring Terminal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Ring Terminal Market?

The market growth is primarily accelerated by the rapid global expansion of the electric vehicle (EV) industry, increasing global investments in renewable energy infrastructure (solar and wind), and the pervasive adoption of sophisticated industrial automation and robotics, all of which require highly secure and vibration-resistant electrical connections.

How is volatility in raw material prices affecting the ring terminal industry?

Volatility, particularly in copper and brass pricing, significantly impacts the manufacturing cost structure of ring terminals. Manufacturers are forced to manage inventory strategically and utilize hedging or long-term supply contracts to stabilize pricing, often leading to slight shifts towards aluminum terminals for large gauge, cost-sensitive applications.

Which application segment accounts for the largest share of the Ring Terminal Market?

The Automotive application segment holds the largest market share, driven by the extensive use of ring terminals in vehicle wiring harnesses, battery connections, and engine control units. The shift toward high-voltage systems in EVs is further solidifying this segment's dominance and driving innovation in terminal design.

What are the technological trends influencing next-generation ring terminals?

Key technological trends include the development of heat-shrink insulated terminals for superior environmental sealing, miniaturization for compact electronic devices, and the use of specialized, high-temperature alloys and plating (e.g., nickel) to withstand extreme operational conditions in aerospace and harsh industrial environments.

Which geographical region exhibits the highest growth potential for ring terminals?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential. This is attributed to massive governmental and private investments in electrification, large-scale automotive manufacturing expansion (especially in China and India), and the rapid build-out of telecommunications and industrial infrastructure across the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager