Road Freight Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433612 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Road Freight Market Size

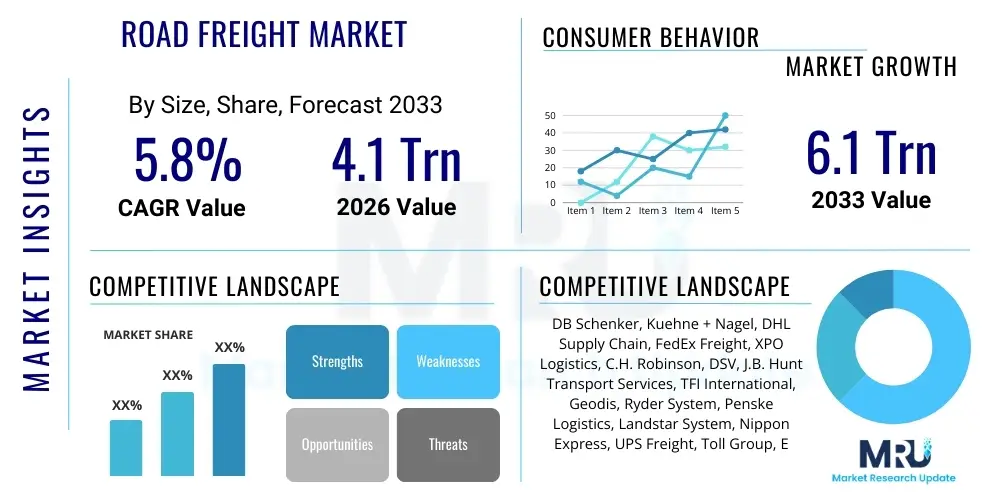

The Road Freight Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Trillion in 2026 and is projected to reach USD 6.1 Trillion by the end of the forecast period in 2033.

Road Freight Market introduction

The Road Freight Market encompasses all services related to the transportation of goods and cargo using motor vehicles over established road networks. This critical logistics backbone facilitates domestic and cross-border trade, serving as the primary link in multimodal supply chains. The market size is heavily influenced by macroeconomic indicators such as GDP growth, industrial output, and consumer spending, which directly correlate with the demand for raw material and finished goods movement. Road freight services are fundamentally necessary for last-mile delivery and localized distribution, making them indispensable for sectors requiring just-in-time (JIT) delivery and inventory optimization. The inherent flexibility and accessibility of road transport, especially across diverse geographical terrains, cement its dominance over other modes of transport for distances typically under 1,000 kilometers, though long-haul routes are also significant in large continents.

Product description within this market includes various services tailored to specific cargo needs, such as Full Truckload (FTL), Less-Than-Truckload (LTL), refrigerated transport (reefer), specialized vehicle transport, and hazardous material (HAZMAT) handling. FTL involves a single shipment occupying the entire trailer, optimizing time and reducing handling, while LTL services consolidate multiple smaller shipments, offering cost efficiencies for lower volume users. Major applications span almost every industry vertical, including retail, e-commerce, manufacturing (especially automotive and industrial), pharmaceuticals, and agriculture. The reliance of e-commerce on rapid and reliable parcel delivery has dramatically increased the demand for specialized, high-frequency short-haul and last-mile road freight solutions globally.

The primary benefits driving the market’s growth include superior geographical coverage, door-to-door service capability, schedule flexibility, and lower infrastructure setup costs compared to rail or air freight. Furthermore, the increasing adoption of telematics, route optimization software, and digitized documentation processes is enhancing operational efficiency and reducing transit times. Driving factors stimulating market expansion include the rapid globalization of supply chains requiring seamless cross-border road movement, the escalating consumer expectation for faster delivery fueled by e-commerce penetration, and substantial government investments in road network infrastructure development, particularly in emerging economies of Asia Pacific and Latin America. However, challenges related to driver shortages, fuel price volatility, and stringent environmental regulations necessitate continuous innovation in fleet management and vehicle technology.

Road Freight Market Executive Summary

The global Road Freight Market is entering a phase defined by digital transformation and sustainability imperatives, transitioning from traditional operational models toward highly optimized, data-driven logistics networks. Business trends indicate a strong move toward third-party logistics (3PL) providers offering integrated end-to-end solutions, leveraging advanced technologies like AI-powered route planning and autonomous vehicles for enhanced competitiveness. Large carriers are focusing on strategic mergers and acquisitions to consolidate regional market shares and expand service portfolios, particularly into specialized segments such as cold chain logistics and heavy haulage. Economic volatility, particularly inflation and interest rate hikes, poses near-term challenges to operational costs (fuel and labor), pushing companies toward greater fleet electrification and alternative fuel adoption to mitigate these external pressures and comply with increasingly strict global emissions standards set by regulatory bodies like the European Union's Green Deal initiatives.

Regional trends highlight divergence in market maturity and growth drivers. North America and Europe, characterized by highly developed infrastructure, are leading the charge in adopting sophisticated telematics and automation technologies, focusing on efficiency gains and reducing carbon footprints through regulatory frameworks like the Mobility Package in the EU. Conversely, the Asia Pacific (APAC) region, driven by immense manufacturing activity and booming domestic consumption, exhibits the highest growth rates. Countries like India, China, and Southeast Asian nations are undergoing massive infrastructure upgrades (e.g., dedicated freight corridors), rapidly expanding their road networks, and simultaneously integrating logistics technology to manage congestion and improve last-mile connectivity. Latin America and the Middle East & Africa (MEA) are also experiencing robust growth, primarily fueled by urbanization, commodity exports, and increased intra-regional trade agreements facilitating smoother cross-border trucking operations.

Segmentation trends reveal significant shifts in consumer preference and industry requirements. The LTL segment is witnessing exceptional growth, propelled by the fragmentation of order sizes and the increasing frequency of e-commerce shipments, which require sophisticated hub-and-spoke networks for efficient consolidation. The vertical segmentation underscores strong growth in the Healthcare and Pharmaceutical sectors, specifically demanding high-compliance, temperature-controlled road freight solutions, elevating the importance of certified cold chain logistics. Furthermore, the push towards sustainability is creating a distinct high-growth sub-segment focused on green logistics, utilizing electric vehicles (EVs) and optimized scheduling to minimize empty miles, thereby commanding premium pricing and attracting environmentally conscious shippers. The convergence of hardware technology (e.g., advanced driver-assistance systems – ADAS) and software (e.g., TMS integration) is defining future competitiveness across all segments.

AI Impact Analysis on Road Freight Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Road Freight Market center predominantly on the feasibility and timeframe of autonomous trucking deployment, the efficacy of AI in dynamic pricing and capacity planning, and the potential displacement of human drivers. Users frequently question how AI algorithms can effectively manage the inherent complexity of real-world logistics, including unpredictable road conditions, weather variability, and regulatory compliance across different jurisdictions. A core theme is the expectation that AI will deliver substantial operational cost reductions, primarily through optimization of fuel consumption via predictive maintenance and highly efficient route sequencing, addressing the persistent industry issue of operational margins. There is also significant interest in AI's role in improving safety, reducing accident rates through real-time driver monitoring and enhanced navigational assistance, thereby mitigating one of the sector's most substantial risk factors and insurance costs.

The key themes emerging from this analysis confirm that AI is perceived as an existential disruptor, moving the industry toward predictive, rather than reactive, operations. Users are keenly observing the integration of Machine Learning (ML) models for demand forecasting, allowing carriers to better allocate resources and manage seasonal fluctuations in freight volume, thus reducing the number of empty backhauls, which is a significant source of inefficiency. Furthermore, concerns about cybersecurity are rising in parallel with AI adoption, as highly connected, automated fleets present larger, more attractive targets for malicious actors. Companies are therefore seeking AI solutions that not only optimize logistics but also incorporate robust security protocols to protect sensitive shipment data and control systems from unauthorized access or manipulation, ensuring supply chain integrity.

In summary, the consensus among market stakeholders is that AI will fundamentally redefine competitiveness in road freight, moving beyond simple automation to enable a sophisticated level of systemic intelligence. This intelligence will manifest in the creation of 'smart contracts' leveraging blockchain technology combined with AI verification for automated settlements, dynamic negotiation of rates based on real-time factors like traffic and capacity, and predictive maintenance scheduling to maximize vehicle uptime. The gradual introduction of Level 4 and Level 5 autonomous capabilities, even starting only on dedicated highway corridors, represents the ultimate long-term expectation, promising to alleviate the critical driver shortage and drastically alter the labor market dynamics of the industry.

- AI-powered Route Optimization: Real-time traffic analysis and predictive modeling to minimize distance, fuel consumption, and transit time, crucial for AEO performance.

- Demand Forecasting and Capacity Planning: Machine Learning algorithms predicting seasonal and regional freight volumes to optimize fleet allocation and reduce empty miles.

- Predictive Maintenance: Analyzing sensor data from vehicle components to anticipate failures, maximizing uptime and reducing unplanned maintenance costs.

- Autonomous Trucking Systems: Development and phased deployment of self-driving capabilities (L3 to L5) aimed at mitigating the chronic driver shortage on long-haul routes.

- Dynamic Pricing Models: AI-driven adjustments to freight rates based on supply, demand, capacity utilization, and competitive analysis in real-time.

- Enhanced Safety and Driver Monitoring: Utilizing computer vision and telematics to monitor driver fatigue, adherence to safety standards, and real-time hazard detection.

- Automated Documentation and Compliance: AI processing of cross-border paperwork, ensuring rapid customs clearance and regulatory adherence, particularly critical in complex trade zones.

DRO & Impact Forces Of Road Freight Market

The Road Freight Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) that shape its competitive landscape and future trajectory. A primary driver is the accelerating growth of the e-commerce sector globally, necessitating higher frequency, lower volume, and faster last-mile delivery services, fundamentally increasing the demand for road transport flexibility. Coupled with this is rapid urbanization, which concentrates consumer markets and manufacturing activities, placing strain on existing urban logistics infrastructure but simultaneously boosting demand for efficient intra-city road freight. Furthermore, government initiatives focused on infrastructure development, especially in developing regions like APAC, which include the construction of new expressways and logistic hubs, directly reduce transit times and operational friction, thereby making road freight a more viable and efficient transport mode. The need for supply chain resilience following global disruptions also drives companies to invest more heavily in regional road networks rather than relying solely on globalized deep-sea shipping.

However, significant restraints temper this expansion. The persistent and globally recognized shortage of qualified commercial drivers represents a critical constraint, driving up labor costs and limiting the capacity utilization of existing fleets across major economies in North America and Europe. This issue is compounded by stringent and evolving environmental regulations (e.g., carbon taxes, zero-emission zones) forcing expensive fleet renewals toward electric or hydrogen vehicles, burdening smaller carriers with high capital expenditure. Furthermore, the volatility of diesel fuel prices, often linked to geopolitical instabilities, creates operational budget uncertainty, directly impacting profit margins. Infrastructure constraints, such as port congestion, inadequate parking facilities for trucks, and traffic bottlenecks in metropolitan areas, lead to significant delays and inefficiencies, increasing the effective cost of transport.

Opportunities for growth are primarily concentrated around technological adoption and strategic segment expansion. The adoption of autonomous and platooning technology, while challenging in the short term, offers a long-term solution to the driver shortage and efficiency problems, representing a major investment opportunity. The burgeoning demand for cold chain logistics, particularly for perishable foods and temperature-sensitive pharmaceuticals (including vaccines), offers high-margin specialization for carriers capable of meeting rigorous compliance standards. Furthermore, the penetration of sophisticated Transport Management Systems (TMS) and IoT devices allows smaller and medium-sized carriers to compete effectively by optimizing their resources, enabling real-time visibility and transparency, which is highly valued by modern shippers. The strategic opportunity lies in providers moving up the value chain by offering integrated 4PL services, managing the entire logistics process rather than merely providing physical transportation.

The combined impact forces demonstrate a shift toward optimization and compliance. Technology acts as the central leverage point, allowing carriers to navigate restraints like high fuel costs and driver shortages. The immediate impact forces include high operational expenditure driven by fuel and labor, countered by efficiency gains from digitalization. The medium-term force is regulatory pressure toward decarbonization, compelling large-scale capital investment in green fleets. The long-term force is the transformative impact of full autonomy and integrated AI, which promises structural changes in cost basis and service delivery, potentially collapsing the operational cost structure while elevating service predictability and speed across the market.

Segmentation Analysis

The Road Freight Market is analyzed across various dimensions, primarily categorized by Type of Load, Distance, and End-Use Vertical. This detailed segmentation allows stakeholders to accurately gauge market maturity, identify high-growth niches, and tailor strategies to specific demand characteristics. The core distinction between FTL and LTL services drives operational strategy; FTL focuses on point-to-point speed and dedicated service reliability, commanding higher prices based on guaranteed capacity, while LTL requires complex networking, consolidation hubs, and advanced software to maximize trailer density and ensure cost-effective delivery of smaller consignments. The balance between these two segments is shifting due to e-commerce, which disproportionately boosts LTL and parcel delivery segments, requiring substantial investment in sorting and cross-docking facilities to manage high volumes of small, fragmented orders efficiently.

Distance segmentation, distinguishing between Long Haul and Short Haul (including regional and urban delivery), highlights distinct operational profiles. Long Haul trucking is most susceptible to disruption from autonomous technologies and is driven by the movement of raw materials and mass-produced goods between major industrial centers. Short Haul logistics, however, is intensely focused on high frequency, rapid turnaround, and density optimization within congested urban environments, where factors like time-window delivery, local environmental restrictions, and vehicle size limitations are paramount. The Short Haul segment, particularly in dense metropolitan corridors, requires more flexible, smaller electric vehicles and sophisticated last-mile routing software to maintain profitability amidst increasing logistical complexity.

End-Use Vertical segmentation is critical for understanding market resilience and specific service needs. The Retail and E-commerce segments demand high variability and speed, often requiring reverse logistics capabilities. In contrast, the Automotive and Industrial sectors require high-precision, sequenced deliveries to production lines (JIT), emphasizing reliability and integration with manufacturing schedules. The Healthcare and Pharmaceutical vertical mandates stringent compliance, temperature monitoring, and high security, commanding a premium for specialized handling. Analyzing these segments reveals varying resilience to economic cycles; for instance, healthcare logistics tends to be relatively stable, while industrial freight is highly correlated with global manufacturing indices and prone to volatility during periods of industrial slowdown or expansion.

- By Type:

- Full Truckload (FTL)

- Less-Than-Truckload (LTL)

- Parcel and Express Delivery

- By Distance:

- Long Haul

- Short Haul/Regional

- Last-Mile Delivery

- By Vehicle Type:

- Heavy Trucks

- Medium Trucks

- Light Trucks and Vans

- By End-Use Vertical:

- Retail and E-commerce

- Manufacturing and Automotive

- Food and Beverage

- Healthcare and Pharmaceutical (Cold Chain)

- Energy and Chemicals

Value Chain Analysis For Road Freight Market

The value chain for the Road Freight Market is characterized by highly integrated, sequential steps, beginning with the upstream supply of necessary inputs and extending through the core operational stages to the final delivery to the consignee. Upstream analysis focuses on key suppliers vital for maintaining fleet operations. This includes manufacturers of trucks and trailers (OEMs), suppliers of fuel and alternative energy sources (diesel, natural gas, batteries), and providers of advanced telematics and logistics software (TMS, route optimization). The cost structure is significantly impacted by steel and rubber prices for vehicle manufacturing and the volatility of global oil markets. Strong relationships with reliable equipment suppliers are crucial, especially as carriers transition to high-cost electric fleets, requiring robust financing and maintenance partnerships to secure specialized components and servicing expertise.

The core of the value chain involves transportation services, brokering, and logistics management. Direct distribution channels involve asset-based carriers (owning the vehicles and employing drivers) dealing directly with shippers. Indirect channels predominantly rely on freight brokers and 3PL/4PL providers who act as intermediaries, aggregating demand and coordinating transportation using a network of asset-light or non-asset-based carriers. These intermediaries introduce value by offering expertise in multi-modal solutions, customs brokerage, and complex supply chain consulting, effectively outsourcing the logistics management function for shippers. The proliferation of digital freight brokerage platforms, utilizing AI to match capacity and load instantly, is a disruptive force in this middle segment, increasing price transparency and efficiency but potentially squeezing margins for traditional brokers.

Downstream analysis centers on the customers and the final delivery process. The downstream activities include warehousing, cross-docking, consolidation, and the critical last-mile delivery phase. Value is captured by offering integrated services that minimize inventory holding time and maximize delivery speed and accuracy. Potential customers span virtually all economic sectors, necessitating tailored service levels. For instance, pharmaceutical deliveries require validation and tracking systems, while retail deliveries demand proof-of-delivery (PoD) and reverse logistics capability. The final stage involves financial settlement and performance measurement, where technology-driven invoicing and key performance indicator (KPI) tracking (e.g., on-time delivery percentage, damage rates) determine long-term carrier-shipper relationships and profitability. Efficient management of the entire chain, often through platform integration and data sharing, is essential for maintaining competitive edge.

Road Freight Market Potential Customers

Potential customers for the Road Freight Market are characterized by their diverse needs regarding volume, frequency, compliance, and geographical reach, spanning all sectors of the global economy. The largest volume consumers of road freight services remain large-scale retailers and e-commerce giants, such as Amazon, Walmart, and regional equivalents, which require continuous, high-volume capacity for both trunking (moving goods between distribution centers) and final-mile delivery to consumers or stores. These customers prioritize speed, network density, real-time tracking visibility, and robust reverse logistics infrastructure, often seeking dedicated contracts or deep integration with 3PL providers that can offer guaranteed capacity and technological sophistication.

The manufacturing sector, encompassing automotive, aerospace, and general industrial producers, represents another critical customer base. These entities require highly precise, time-sensitive road freight movements to feed production lines, operating on strict JIT principles. They often contract specialized carriers capable of handling specific equipment, utilizing flatbed or specialized heavy-haul trucks, and adhering to strict quality and sequencing requirements. Reliability and minimizing downtime due to logistical failures are paramount for these customers, making carriers with strong asset control and maintenance records highly preferred partners in their complex supply chains across diverse geographical manufacturing hubs.

Furthermore, the high-growth segments of Pharmaceuticals and Food & Beverage industries represent customers with stringent cold chain and regulatory compliance needs. Pharmaceutical companies require highly secure, temperature-controlled road transport that maintains specific validated temperature ranges throughout transit, demanding specialized refrigerated trailers (reefers) and documented audit trails for regulatory compliance. Similarly, the food industry relies on road freight for both chilled and frozen goods distribution, requiring strict adherence to food safety standards and rapid transit times to prevent spoilage, making operational excellence in temperature management and hygiene a non-negotiable requirement for securing contracts with these specialized, high-value end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Trillion |

| Market Forecast in 2033 | USD 6.1 Trillion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DB Schenker, Kuehne + Nagel, DHL Supply Chain, FedEx Freight, XPO Logistics, C.H. Robinson, DSV, J.B. Hunt Transport Services, TFI International, Geodis, Ryder System, Penske Logistics, Landstar System, Nippon Express, UPS Freight, Toll Group, Expeditors International, Schneider National, Knight-Swift Transportation, Werner Enterprises. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Road Freight Market Key Technology Landscape

The technological landscape of the Road Freight Market is rapidly evolving, driven by the need for operational efficiency, safety enhancements, and compliance with sustainability mandates. Telematics systems form the foundation of modern fleet management, providing real-time data on vehicle location, speed, engine diagnostics, and driver behavior. This data is critical for insurance risk assessment, fuel efficiency management, and compliance with Hours of Service (HOS) regulations through mandated Electronic Logging Devices (ELDs). The integration of sophisticated sensors and IoT connectivity allows carriers to move toward predictive maintenance, minimizing unexpected downtime and maximizing asset utilization, which is a key profitability lever in an industry characterized by tight margins.

A second major technological area involves advanced software solutions, primarily Transport Management Systems (TMS) and digital freight platforms. Modern TMS solutions go beyond basic scheduling, incorporating AI and machine learning for dynamic route planning that considers real-time variables like weather and traffic congestion, and optimizing load configuration to maximize capacity utilization (cubing and weighing). Digital freight platforms are transforming the traditional brokerage model, using algorithms to instantly match available capacity with shipper demand, dramatically reducing transaction friction and eliminating the need for extensive human intervention in load matching, thereby increasing market liquidity and transparency. This digitization enhances the speed of payment and documentation, crucial for efficient cross-border operations.

Furthermore, sustainable and autonomous technologies represent the future trajectory. The push for decarbonization necessitates substantial investment in Electric Vehicles (EVs) and Hydrogen Fuel Cell Electric Vehicles (FCEVs) for middle- and heavy-duty applications. While charging infrastructure and vehicle range remain operational challenges, the technology is advancing rapidly, particularly for regional haul and last-mile applications. Simultaneously, the deployment of Advanced Driver-Assistance Systems (ADAS) and semi-autonomous driving capabilities (platooning technology) is improving safety and fuel economy by automating certain driving tasks. The long-term vision involves Level 4 and Level 5 autonomous trucks operating on designated highway segments, poised to fundamentally reshape the economics of long-haul logistics by removing the variable cost associated with human labor.

Regional Highlights

The Road Freight Market exhibits diverse dynamics across key geographical regions, reflecting varying levels of infrastructural maturity, regulatory environments, and economic drivers. North America, dominated by the United States, is characterized by extensive long-haul trucking and a strong reliance on FTL services to move goods across vast distances. The region is a leader in adopting advanced telematics and is rapidly testing autonomous trucking solutions on interstate highways, largely driven by the severe chronic shortage of long-haul drivers. Regulatory alignment, particularly between the US, Canada, and Mexico through trade agreements, facilitates substantial cross-border road freight, requiring advanced customs and security technologies to maintain flow efficiency.

Europe’s road freight sector is defined by high regulatory complexity, significant cross-border trade within the EU single market, and an aggressive push towards sustainability. The Mobility Package introduced by the EU impacts driver working conditions and competition, necessitating strict compliance from all carriers operating within the bloc. This region leads in the adoption of electrification for middle-mile and urban logistics due to stringent urban emission zones. Furthermore, the necessity of navigating numerous national borders makes technology that simplifies documentation, tracking, and multi-lingual communication indispensable for ensuring timely delivery and operational fluidity throughout the continent.

Asia Pacific (APAC) stands out as the highest growth region globally, primarily fueled by massive manufacturing exports, surging domestic consumption in populous nations like India and China, and the e-commerce explosion. Government investment in infrastructure, such as dedicated economic corridors and upgrading secondary roads, is rapidly professionalizing logistics services. While technology adoption is accelerating, especially in developed markets like Japan and South Korea, many emerging APAC markets still rely heavily on fragmented, smaller carriers, creating a significant opportunity for large 3PLs to introduce aggregation platforms and standardized operational practices. The complexity of regulatory variations and poor road quality in some developing areas presents persistent operational challenges that technology is beginning to address through localized mapping and predictive maintenance.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets showing accelerated growth driven by urbanization and commodity trade. In LATAM, inter-country logistics is often complicated by diverse customs procedures and security concerns, making secure and tracked road freight highly valued. Brazil and Mexico represent the largest road freight markets in the region. The MEA region, particularly the Gulf Cooperation Council (GCC) states, is investing heavily in smart city and logistics infrastructure, utilizing road networks to connect new economic zones and ports. The movement of energy products and construction materials heavily influences the road freight sector in this area, necessitating robust asset security and sophisticated tracking capabilities across challenging desert terrains.

- North America: Focus on automation, cross-border efficiency (USMCA), and mitigating acute driver shortages through autonomy trials.

- Europe: Dominated by strict environmental regulations (EV adoption), high cross-border transactional complexity, and adherence to the EU Mobility Package.

- Asia Pacific (APAC): Highest volume growth driven by e-commerce, significant government infrastructure investment, and rapid technological leapfrogging in fleet management systems.

- Latin America (LATAM): Growth tied to raw material exports and internal market expansion; security and regulatory harmonization remain key challenges.

- Middle East & Africa (MEA): Strategic logistics hub development, high dependency on energy and construction sector freight, and increasing investment in digitized logistics networks in the GCC.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Road Freight Market.- DB Schenker

- Kuehne + Nagel

- DHL Supply Chain

- FedEx Freight

- XPO Logistics

- C.H. Robinson

- DSV

- J.B. Hunt Transport Services

- TFI International

- Geodis

- Ryder System

- Penske Logistics

- Landstar System

- Nippon Express

- UPS Freight

- Toll Group

- Expeditors International

- Schneider National

- Knight-Swift Transportation

- Werner Enterprises

Frequently Asked Questions

Analyze common user questions about the Road Freight market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected long-term growth rate (CAGR) for the Road Freight Market?

The Road Freight Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven primarily by the sustained global expansion of e-commerce and subsequent demand for last-mile logistics efficiency.

How is AI specifically impacting the operational costs within road freight?

AI significantly impacts operational costs by optimizing route planning to minimize fuel consumption, enabling predictive maintenance to reduce costly vehicle downtime, and automating dynamic pricing models to maximize revenue per load based on real-time market capacity and demand factors.

Which segmentation segment is expected to show the highest growth in the coming years?

The Less-Than-Truckload (LTL) and Parcel/Express delivery segments are expected to show the highest growth, fueled directly by the fragmentation of shipments resulting from increasing B2C and e-commerce transactions that require complex consolidation and high-frequency delivery networks.

What is the most significant operational restraint currently facing road freight carriers globally?

The most significant operational restraint is the chronic and worsening shortage of qualified commercial truck drivers across North America and Europe, leading to elevated labor costs, capacity constraints, and increasing operational risks for long-haul routes.

How are environmental regulations influencing technology adoption in road freight?

Strict environmental regulations, particularly in Europe and parts of North America, are forcing carriers to rapidly adopt zero-emission vehicles, leading to increased investment in electric and hydrogen fuel cell truck technology and advanced telematics to report and optimize carbon footprint metrics accurately.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Wheels and Axles for Railways Market Statistics 2025 Analysis By Application (High-speed Train, Locomotives, Railroad Passenger Cars, Railroad Freight Cars, Metro), By Type (Rolled Wheels & Axles, Forged Wheels & Axles), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Road Freight Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Express delivery, Logistics, Other), By Application (Agricultural, Automotive, Beverage, Electronic, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Artificial Intelligence (AI) in the Freight Transportation Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Hardware, Software), By Application (Road Freight Transportation, Rail Freight Transportation, Air Freight Transportation, Ocean Freight Transportation), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager