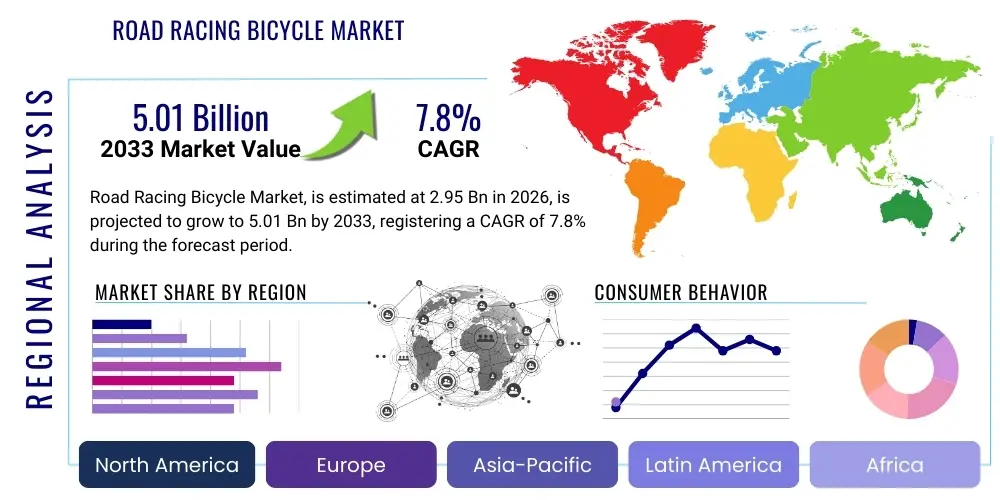

Road Racing Bicycle Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440076 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Road Racing Bicycle Market Size

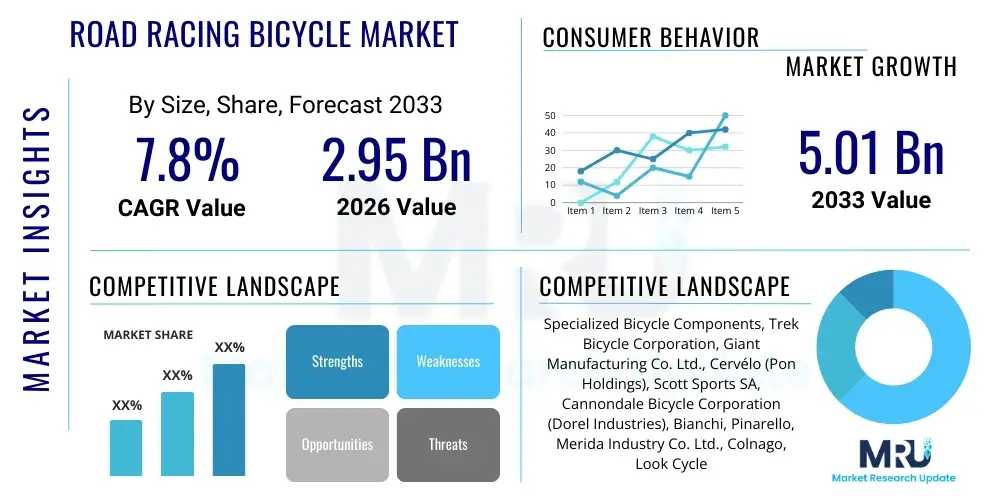

The Road Racing Bicycle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 2.95 Billion in 2026 and is projected to reach USD 5.01 Billion by the end of the forecast period in 2033.

Road Racing Bicycle Market introduction

The Road Racing Bicycle Market encompasses a specialized segment within the broader cycling industry, dedicated to bicycles designed for competitive road cycling, high-performance training, and enthusiastic recreational use where speed, efficiency, and lightweight construction are paramount. These bicycles are engineered to maximize aerodynamic efficiency, power transfer, and rider comfort over long distances and varying terrains, characteristic of road races and endurance rides. Products typically feature advanced frame materials like carbon fiber, sophisticated drivetrain systems, lightweight wheelsets, and ergonomic components optimized for performance. Major applications span from professional cycling teams vying for Grand Tour victories to amateur racers, serious triathletes, and dedicated fitness enthusiasts who demand top-tier equipment for their training and events. The inherent benefits of these machines include unparalleled speed, superior climbing capabilities, responsive handling, and a direct connection between rider effort and forward momentum, all contributing to an enhanced riding experience. Key driving factors propelling market growth include the increasing global popularity of cycling as both a sport and a leisure activity, rising health and fitness consciousness among consumers, continuous technological advancements in bicycle design and materials, the aspirational influence of professional cycling, and a growing emphasis on sustainable and active transportation alternatives in urban and suburban environments.

Road Racing Bicycle Market Executive Summary

The Road Racing Bicycle Market is experiencing dynamic shifts, driven by evolving consumer preferences, technological innovation, and a growing global interest in cycling sports. Business trends highlight a significant move towards direct-to-consumer (DTC) sales models, enabling brands to offer customized solutions and build stronger relationships with their customer base, alongside a sustained presence of traditional independent bicycle dealers (IBDs) that offer specialized fitting and maintenance services. There is also an observable trend towards integration of smart technologies, such as integrated power meters, GPS systems, and electronic shifting, enhancing the overall rider experience and performance tracking. Sustainability initiatives are increasingly influencing manufacturing processes and material choices, with brands exploring recycled components and eco-friendly production methods to appeal to environmentally conscious consumers. Regional trends indicate robust growth in emerging economies within Asia-Pacific, fueled by increasing disposable incomes and a burgeoning middle class adopting cycling as a leisure and fitness activity. Mature markets in North America and Europe continue to be strongholds for high-end and technologically advanced road racing bicycles, characterized by a sophisticated consumer base that prioritizes innovation and premium quality. Latin America and the Middle East & Africa present emerging opportunities, with developing cycling infrastructure and increasing sports participation driving demand. Segment trends reveal a continued dominance of carbon fiber frames due to their superior strength-to-weight ratio, although advanced aluminum alloys remain competitive in mid-range segments. The integration of disc brakes has become a standard feature across all performance levels, offering enhanced stopping power and reliability. Furthermore, the convergence of road racing and gravel riding has led to the emergence of "all-road" or endurance road bikes, catering to riders seeking versatility and comfort over varied terrains without sacrificing too much speed. The e-road bike segment, while still nascent, is showing promising growth, appealing to a broader demographic including older riders or those seeking assistance on challenging climbs, thereby expanding the overall market reach.

AI Impact Analysis on Road Racing Bicycle Market

The advent of Artificial Intelligence (AI) is poised to revolutionize the Road Racing Bicycle Market, addressing user questions centered on performance optimization, personalized experiences, and manufacturing efficiencies. Common user inquiries revolve around how AI can contribute to lighter, stronger, and more aerodynamic frame designs, or how it can provide granular insights into rider performance and training protocols. Enthusiasts and professionals alike are keen to understand if AI can democratize access to high-performance analytics, previously exclusive to elite athletes, or if it can lead to more durable and intelligently maintained components. The overarching themes emerging from these questions are a strong desire for hyper-personalization, enhanced safety features through predictive analytics, and a more data-driven approach to every aspect of the cycling journey, from bike selection and setup to real-time performance adjustments and preventative maintenance. Consumers expect AI to not only make them faster but also to make the sport more accessible, safer, and ultimately more enjoyable through intelligent assistance and insightful feedback. There is also a significant interest in how AI could streamline supply chains and enable more sustainable manufacturing practices.

- Generative Design for Frames: AI algorithms can explore thousands of design iterations for bicycle frames and components, optimizing for weight, aerodynamics, and stiffness beyond human capacity, leading to lighter, stronger, and more efficient bikes tailored to specific performance metrics and rider biometrics.

- Personalized Training and Coaching: AI-powered platforms can analyze vast amounts of rider data (power output, heart rate, speed, cadence, GPS routes) to provide highly personalized training plans, real-time feedback, and predictive performance analytics, helping riders achieve peak condition and prevent overtraining.

- Predictive Maintenance and Diagnostics: Integrated smart sensors combined with AI can monitor component wear and tear, predict potential failures before they occur, and recommend timely maintenance, enhancing safety, prolonging component lifespan, and reducing unexpected breakdowns during critical rides or races.

- Optimized Aerodynamics and Biomechanics: AI can simulate complex airflow patterns around rider and bike systems, identifying optimal riding positions and equipment configurations for minimal drag, alongside analyzing rider biomechanics to prevent injuries and improve power transfer efficiency.

- Supply Chain and Manufacturing Efficiency: AI can optimize inventory management, forecast demand more accurately, and streamline manufacturing processes, leading to reduced waste, faster production cycles, and a more responsive supply chain, ultimately lowering costs and improving product availability.

- Smart Components and Connectivity: AI integration in electronic shifting systems, suspension, and adaptive lighting can provide dynamic adjustments based on real-time road conditions or rider input, creating a more intuitive and responsive riding experience with enhanced safety features.

DRO & Impact Forces Of Road Racing Bicycle Market

The Road Racing Bicycle Market is fundamentally shaped by a complex interplay of drivers, restraints, opportunities, and external impact forces, dictating its growth trajectory and competitive landscape. Key drivers include the escalating global interest in cycling as a professional sport, inspiring a new generation of enthusiasts and driving demand for high-performance equipment. The increasing awareness of health and wellness benefits associated with cycling, coupled with a growing preference for outdoor recreational activities, significantly boosts consumer participation. Continuous technological advancements, such as the development of lighter, stronger carbon fiber composites, more efficient electronic shifting systems, and integrated aerodynamic features, compel consumers to upgrade their equipment, sustaining market dynamism. Moreover, the aspirational influence of professional cyclists and major cycling events worldwide serves as a powerful marketing tool, influencing purchase decisions across various consumer segments. Conversely, several restraints impede market expansion. The high initial cost of premium road racing bicycles, often ranging from several thousands to tens of thousands of dollars, presents a significant barrier to entry for many potential consumers. Limited cycling infrastructure in many urban and rural areas, including safe cycling lanes and secure parking facilities, deters wider adoption. Intense competition from other sports and recreational activities, which might offer lower entry costs or different appeal, also poses a challenge. Additionally, the global supply chain disruptions witnessed in recent years, affecting raw materials and component availability, have led to increased lead times and higher production costs, impacting market stability. Opportunities for growth are abundant, particularly in emerging markets where rising disposable incomes and developing urban infrastructure are creating new consumer bases. The integration of e-bike technology into the road racing segment offers a pathway to attract a broader demographic, including older riders or those seeking assisted performance, expanding the market's total addressable audience. Customization options, facilitated by advanced manufacturing techniques like 3D printing and sophisticated fitting systems, allow brands to cater to individual rider needs, fostering loyalty and premium pricing. Furthermore, the increasing adoption of data analytics and smart connectivity in bicycles provides opportunities for enhanced performance insights and personalized user experiences.

Analyzing the impact forces within the market reveals a moderate to high level of competitive rivalry among established brands and nimble newcomers, as they continuously innovate and vie for market share. The bargaining power of buyers is significant, particularly in mature markets, where consumers are well-informed, price-sensitive for certain segments, and have numerous options. However, for niche high-end products, brand loyalty and perceived performance value can somewhat mitigate this power. The bargaining power of suppliers, especially for critical components like advanced drivetrains and wheelsets (e.g., Shimano, SRAM, Campagnolo), is substantial due to their specialized technologies and economies of scale. The threat of new entrants is moderate; while manufacturing highly specialized road racing bikes requires significant capital investment, R&D, and brand building, the rise of direct-to-consumer models and innovative startups utilizing advanced manufacturing processes can challenge incumbents. Lastly, the threat of substitutes is relatively low within the specific high-performance road racing segment, as no other mode of transport or sport offers the exact combination of athletic challenge, speed, and precision in this context, though hybrid bikes or other cycling disciplines could be considered peripheral substitutes for broader cycling enthusiasts.

Segmentation Analysis

The Road Racing Bicycle Market is meticulously segmented to provide a granular understanding of its diverse components and consumer base, allowing market players to tailor strategies effectively. These segmentations are critical for identifying key growth areas, understanding competitive dynamics, and developing targeted product offerings. The market is primarily dissected by material type, component, application, distribution channel, and price range, each revealing distinct market characteristics and consumer preferences. Understanding these segments helps manufacturers and retailers to align their product development, marketing, and sales efforts with specific demands, from professional-grade carbon fiber machines to accessible entry-level aluminum models, catering to a wide spectrum of cyclists from elite athletes to casual fitness enthusiasts. This layered approach to market segmentation provides a comprehensive framework for strategic planning and competitive positioning within the dynamic road racing bicycle industry, identifying both mature and emerging sub-markets with varying growth potentials and consumer behaviors.

- By Material:

- Carbon Fiber: Dominates the high-performance and professional segments due to its lightweight, stiffness, and vibration-damping properties.

- Aluminum: Popular in mid-range and entry-level performance bikes, offering a good balance of weight, durability, and affordability.

- Steel: Primarily used in niche, classic, or custom builds, valued for its ride quality, durability, and repairability, though heavier.

- Titanium: Premium material offering excellent ride quality, corrosion resistance, and durability, often found in high-end endurance bikes.

- By Component:

- Framesets: The core of the bicycle, varying significantly by material, geometry, and aerodynamic design.

- Drivetrain Systems: Includes gears, cranksets, chains, and cassettes; electronic (e.g., Shimano Di2, SRAM eTap) and mechanical systems are key differentiators.

- Wheelsets: Critical for performance, categorized by material (carbon, aluminum), rim depth (aerodynamic vs. lightweight), and hub technology.

- Braking Systems: Disc brakes have become standard, offering superior stopping power and modulation in all conditions, though rim brakes still exist in some segments.

- Handlebars & Stems: Crucial for rider ergonomics, control, and aerodynamics, varying in material, shape, and integration.

- Saddles & Seatposts: Impact rider comfort and power transfer, with various designs and materials to suit different anatomies and riding styles.

- Pedals: Interface between rider and bike, with clipless designs dominating road racing for efficiency.

- By Application:

- Professional Racing: Bicycles designed for elite competition, prioritizing maximum performance, aerodynamics, and minimal weight.

- Amateur Racing: Performance-oriented bikes for competitive recreational riders and lower-tier events, balancing performance with practicality.

- Training & Fitness: Durable and comfortable bikes used for regular training, endurance rides, and general fitness pursuits.

- Recreational & Enthusiast: High-quality bikes for passionate riders who prioritize ride enjoyment, long-distance comfort, and group rides without explicit competitive goals.

- By Distribution Channel:

- Specialty Bicycle Retailers (SBRs): Offer expert advice, bike fitting services, test rides, and post-sale support, crucial for premium sales.

- Online Retailers: Growing segment offering convenience, wider selection, and competitive pricing, often with direct shipping options.

- Mass Merchandisers & Sporting Goods Stores: Cater to entry-level and recreational segments, emphasizing accessibility and broader appeal.

- Direct-to-Consumer (DTC): Brands selling directly to consumers via their websites, offering potentially lower prices and customized options.

- By Price Range:

- Entry-Level: Generally under USD 1,500, often aluminum frames with reliable but less advanced components.

- Mid-Range: USD 1,500 - USD 4,000, typically feature higher-grade aluminum or entry-level carbon frames with mid-tier components.

- High-End/Premium: Above USD 4,000, characterized by advanced carbon frames, electronic shifting, lightweight carbon wheelsets, and integrated components.

Value Chain Analysis For Road Racing Bicycle Market

The value chain for the Road Racing Bicycle Market is a complex ecosystem spanning multiple stages, from raw material extraction to the end-user experience, characterized by a global network of specialized suppliers and distributors. The upstream analysis begins with the procurement of critical raw materials, primarily carbon fiber, aluminum alloys, steel, and titanium, which are sourced from specialized manufacturers globally. These materials are then processed and transformed into basic components such as tubing, sheets, and billets. A crucial part of the upstream segment involves highly specialized component manufacturers like Shimano, SRAM, and Campagnolo, who design and produce intricate drivetrain systems, braking mechanisms, wheelsets, and other proprietary parts. These suppliers often hold significant market power due to their technological expertise, brand recognition, and economies of scale. Other upstream activities include the design and engineering of frames and components, often involving extensive research and development to achieve optimal aerodynamics, stiffness, and weight. The manufacturing phase then brings these materials and components together, involving precision welding for metal frames or advanced lay-up and molding techniques for carbon fiber frames, followed by assembly of the complete bicycle. Quality control and testing are integral at this stage to ensure product integrity and performance standards are met.

Moving downstream, the value chain focuses on bringing the finished road racing bicycles to the end consumer. This involves warehousing, logistics, and a multifaceted distribution channel. Brands typically distribute their products through a combination of direct and indirect channels. Indirect distribution largely relies on independent bicycle dealers (IBDs), which play a vital role in the market. IBDs offer specialized services such as professional bike fitting, personalized consultations, test rides, and comprehensive after-sales support, including maintenance and repairs. Their expertise and local presence are invaluable for premium and high-performance bicycles, where customer education and tailored solutions are crucial. Wholesale distributors also form part of the indirect channel, facilitating the reach of brands to a wider network of retailers, particularly in fragmented markets. The direct distribution channel involves brands selling directly to consumers (DTC) through their official websites or flagship stores. This channel has gained significant traction, allowing brands to bypass intermediaries, potentially offer more competitive pricing, and foster a direct relationship with their customer base. DTC models also enable greater customization options and efficient feedback loops. Marketing and sales activities are interwoven throughout these channels, encompassing brand storytelling, sponsorship of professional racing teams, digital marketing campaigns, and in-store promotions, all aimed at building brand awareness and driving sales. The final stage involves the consumer's purchase, use, and eventual maintenance or upgrade of the bicycle, completing the value chain loop. Each stage adds value, with the ultimate goal of delivering a high-performance product and an exceptional ownership experience to the road racing enthusiast or professional athlete.

Road Racing Bicycle Market Potential Customers

The Road Racing Bicycle Market caters to a distinct and passionate demographic, primarily characterized by individuals who prioritize performance, speed, and efficiency in their cycling pursuits. The core customer base comprises professional cyclists and elite amateur racers who require state-of-the-art equipment to compete at the highest levels. These athletes are extremely demanding, seeking the lightest, most aerodynamic, and stiffest frames, coupled with the most advanced drivetrain and braking systems available. Their purchase decisions are heavily influenced by marginal gains in performance, technological innovation, and sponsorships. Beyond the competitive sphere, a significant segment of potential customers includes serious amateur riders and high-performance training enthusiasts. These individuals may not compete professionally but are deeply committed to improving their fitness, participating in challenging endurance events like gran fondos or triathlons, and achieving personal bests. They are knowledgeable about cycling technology, often invest substantially in their equipment, and are keen on acquiring bicycles that offer superior ride quality, comfort over long distances, and reliable performance during intense training sessions. This group values durability, advanced features, and reputable brands, often treating their bicycles as an extension of their athletic identity.

Furthermore, the market attracts a substantial number of affluent fitness enthusiasts and high-income individuals who view road cycling as a premium leisure activity, a sophisticated form of exercise, or a means of social engagement. These buyers are drawn to the craftsmanship, engineering excellence, and aesthetic appeal of high-end road racing bicycles. While performance is still a factor, comfort, brand prestige, customization options, and the overall experience of owning a premium product often play a more significant role in their purchasing decisions. They are less driven by competitive necessity and more by the desire for an exceptional ride, often appreciating the blend of cutting-edge technology and elegant design. The emerging segment of e-road bike users also represents a growing pool of potential customers. These individuals may include older riders, those recovering from injuries, or cyclists looking for assistance on challenging terrains, enabling them to keep pace with stronger riders or extend their riding range. This group values the integration of electric assist with the traditional road bike aesthetic and performance characteristics, opening up the market to a broader demographic that might otherwise be deterred by the physical demands of conventional road cycling. Identifying and understanding these diverse customer profiles is crucial for manufacturers and retailers to develop targeted marketing strategies, product lines, and distribution channels that resonate with each specific segment's unique needs and motivations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.95 Billion |

| Market Forecast in 2033 | USD 5.01 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Specialized Bicycle Components, Trek Bicycle Corporation, Giant Manufacturing Co. Ltd., Cervélo (Pon Holdings), Scott Sports SA, Cannondale Bicycle Corporation (Dorel Industries), Bianchi, Pinarello, Merida Industry Co. Ltd., Colnago, Look Cycle, Canyon Bicycles GmbH, Orbea, Argon 18, Wilier Triestina, Factor Bikes, De Rosa, BMC Switzerland, Cube Bikes, Shimano, SRAM, Campagnolo |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Road Racing Bicycle Market Key Technology Landscape

The Road Racing Bicycle Market is a vibrant hub of innovation, consistently integrating cutting-edge technologies to enhance performance, comfort, and rider experience. At the forefront is advanced material science, particularly the relentless development of carbon fiber composites. Manufacturers continuously refine carbon lay-up techniques and resin formulations to create frames that are simultaneously lighter, stiffer, and more compliant, allowing for efficient power transfer while absorbing road vibrations. This precision engineering extends to optimizing aerodynamic profiles, with computational fluid dynamics (CFD) and wind tunnel testing becoming standard tools to minimize drag across entire bike-and-rider systems. Beyond frames, integrated aerodynamic components such as hidden cables, integrated cockpits, and aero wheelsets further contribute to reducing air resistance, which is paramount in racing scenarios. The evolution of drivetrain technology is another critical area, marked by the widespread adoption of electronic shifting systems. Shimano Di2, SRAM eTap, and Campagnolo EPS offer unparalleled precision, faster shifts, and ergonomic advantages over traditional mechanical systems, significantly improving a rider's ability to maintain optimal cadence and power output under varying conditions. These electronic systems are increasingly wireless, simplifying installation and reducing potential points of failure, alongside enabling further customization through companion apps.

Braking technology has seen a transformative shift towards disc brakes, which now dominate the high-performance road bike segment. Disc brakes offer superior stopping power, modulation, and consistent performance in all weather conditions, a significant upgrade from traditional rim brakes, enhancing both safety and control. Integrated power meters, once a niche professional tool, have become more accessible and are increasingly integrated into cranksets or pedals, providing riders with precise, real-time data on their power output for highly effective training and pacing. Furthermore, the integration of smart sensors and connectivity solutions (e.g., GPS, ANT+, Bluetooth) allows for seamless data collection and analysis, feeding into popular cycling platforms like Strava or Garmin Connect. This data-driven approach empowers riders with deeper insights into their performance, training load, and recovery needs. The nascent but growing field of 3D printing is also making inroads, enabling rapid prototyping of components, production of small batches of customized parts, and even the creation of bespoke bicycle frames tailored to individual rider geometries and preferences, offering unprecedented levels of personalization. As AI and machine learning mature, their application in generative design for components, predictive maintenance, and highly personalized training algorithms will further push the boundaries of what is possible in road racing bicycle technology, driving both performance gains and user experience enhancements.

Regional Highlights

- North America: This region represents a significant market for road racing bicycles, characterized by a strong enthusiast base, growing participation in amateur racing events, and a high disposable income. Consumers here often prioritize technological innovation, brand prestige, and performance features. The presence of major cycling brands and an established retail infrastructure, including numerous specialty bicycle retailers, contributes to market dynamism. Investment in cycling infrastructure, particularly in urban areas, also supports market growth, alongside increasing interest in multi-sport events like triathlons.

- Europe: Europe is the historical heartland of road cycling, boasting a deeply ingrained cycling culture, iconic professional races, and a vast network of cycling infrastructure. Countries like Italy, France, Spain, Belgium, and the Netherlands exhibit high rates of participation and a sophisticated consumer base that appreciates heritage, craftsmanship, and cutting-edge performance. The market here is mature but constantly innovates, with strong demand for both high-end racing machines and endurance-focused road bikes. E-road bikes are gaining traction, appealing to a broader demographic.

- Asia Pacific (APAC): The APAC region is a rapidly expanding market for road racing bicycles, driven by rising disposable incomes, urbanization, and a growing interest in health, fitness, and competitive sports, particularly in countries like China, Japan, Australia, and South Korea. While professional racing is developing, the recreational and enthusiast segments are booming. Government initiatives promoting cycling as a sustainable mode of transport and investment in cycling-specific infrastructure are also catalyzing growth. Local manufacturing capabilities, especially in Taiwan and China, play a crucial role in global supply chains.

- Latin America: This region presents an emerging market with substantial growth potential, albeit from a lower base. Increasing urbanization, improving economic conditions, and a burgeoning middle class in countries like Brazil, Mexico, and Colombia are contributing to a rising interest in cycling. The market is influenced by the region's strong passion for sports and the aspirational appeal of international cycling events. Challenges include developing robust cycling infrastructure and addressing pricing sensitivities, though growth in the mid-range and entry-level performance segments is notable.

- Middle East and Africa (MEA): The MEA market for road racing bicycles is currently niche but shows promising signs of growth, particularly in countries with high per capita incomes and investments in sports infrastructure, such as the UAE and Saudi Arabia. Major events and tours hosted in the region are raising the profile of cycling. However, extreme climatic conditions in some areas and less developed cycling cultures in others present unique challenges. As health awareness and recreational activities gain prominence, demand for road racing bicycles is expected to steadily increase.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Road Racing Bicycle Market.- Specialized Bicycle Components

- Trek Bicycle Corporation

- Giant Manufacturing Co. Ltd.

- Cervélo (Pon Holdings)

- Scott Sports SA

- Cannondale Bicycle Corporation (Dorel Industries)

- Bianchi

- Pinarello

- Merida Industry Co. Ltd.

- Colnago

- Look Cycle

- Canyon Bicycles GmbH

- Orbea

- Argon 18

- Wilier Triestina

- Factor Bikes

- De Rosa

- BMC Switzerland

- Cube Bikes

- Shimano

- SRAM

- Campagnolo

Frequently Asked Questions

What are the primary growth drivers for the Road Racing Bicycle Market?

Key growth drivers include the increasing global popularity of cycling as a sport and leisure activity, rising health and fitness consciousness, continuous technological advancements in bike design and materials, and the aspirational influence of professional cycling events and athletes.

How is technology impacting the design and performance of road racing bicycles?

Technology profoundly impacts the market through innovations like advanced carbon fiber composites for lighter and stiffer frames, sophisticated electronic shifting systems for precise gear changes, aerodynamic frame designs, and the widespread adoption of disc brakes for superior stopping power and control. Integrated power meters and smart sensors also provide critical performance data for riders.

What is the projected market size and growth rate for road racing bicycles?

The Road Racing Bicycle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 2.95 Billion in 2026 and is expected to reach USD 5.01 Billion by 2033.

Which regions are key contributors to the Road Racing Bicycle Market?

North America and Europe are mature markets with strong cycling cultures and high demand for premium products. Asia Pacific is a rapidly emerging market driven by increasing disposable incomes and growing interest in fitness, while Latin America and MEA represent developing markets with significant growth potential.

Who are the leading manufacturers in the Road Racing Bicycle Market?

Prominent manufacturers include Specialized Bicycle Components, Trek Bicycle Corporation, Giant Manufacturing Co. Ltd., Cervélo, Scott Sports SA, Cannondale, Bianchi, and Pinarello, alongside major component suppliers like Shimano, SRAM, and Campagnolo, who significantly influence the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager