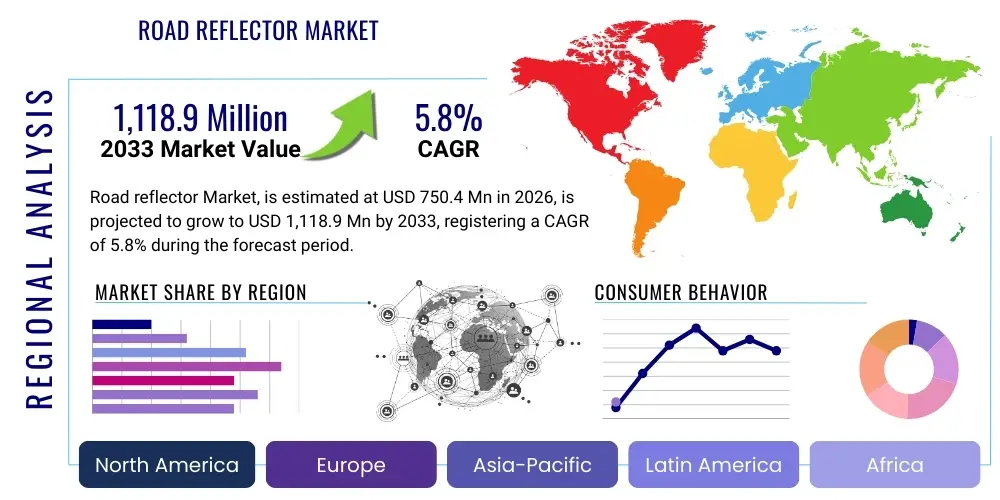

Road reflector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434862 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Road reflector Market Size

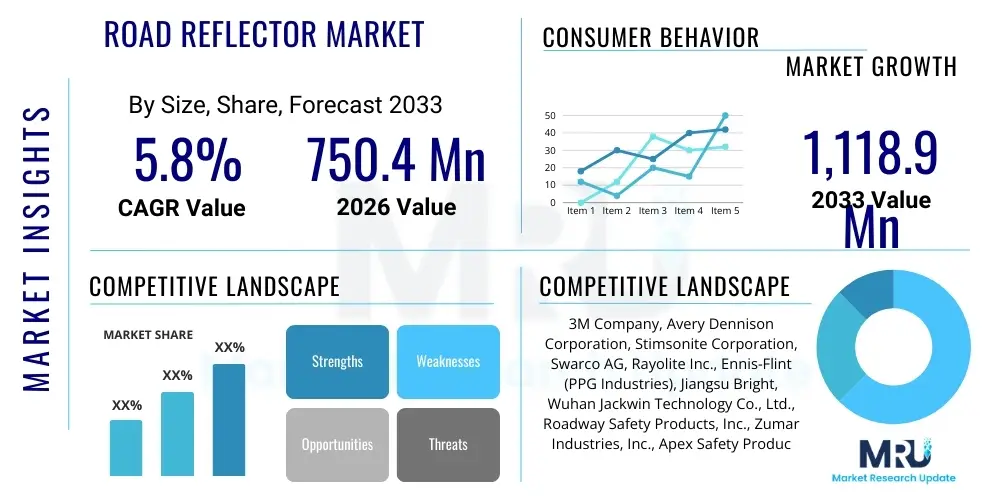

The Road reflector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 750.4 Million in 2026 and is projected to reach USD 1,118.9 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by global governmental mandates prioritizing road safety infrastructure upgrades and the increasing adoption of high-visibility, durable reflective materials across emerging economies.

Road reflector Market introduction

The Road reflector Market encompasses the manufacturing, distribution, and utilization of reflective devices strategically mounted on roadways to enhance visibility and guide drivers, particularly during low-light conditions, adverse weather, or winding routes. Road reflectors, also known as raised pavement markers (RPMs) or cat’s eyes, serve as essential passive safety mechanisms, significantly reducing nighttime accidents by clearly delineating lanes, curves, and edges of the road. These products are crucial components of intelligent transportation systems (ITS) and conventional road infrastructure planning worldwide, integrating various materials such as glass beads, plastic polymers, ceramic components, and specialized solar-powered LED systems to maximize retroreflectivity and longevity under extreme environmental stress.

Product descriptions vary widely based on material and function; for instance, temporary reflectors made of adhesive plastic are used during construction, while highly durable ceramic or aluminum reflectors are permanently installed on major highways. Major applications span high-speed motorways, rural roads lacking consistent lighting, tunnels, bridges, and complex urban intersections where lane delineation is critical. The primary benefit of widespread reflector deployment is the substantial improvement in directional guidance for motorists, leading directly to a reduction in potential head-on collisions and run-off-road crashes, thereby lowering accident severity rates and associated infrastructure damage and healthcare costs.

Driving factors propelling market expansion include robust regulatory support from international bodies like the United Nations (UN) and national transportation departments, mandating minimum safety standards for new road construction and rehabilitation projects. Furthermore, the persistent demand for energy-efficient, long-lasting safety solutions is encouraging the shift toward solar-powered and highly retroreflective prism technologies. Urbanization and rapid infrastructure development in regions like Asia Pacific and Latin America are creating significant deployment opportunities, necessitating large-scale adoption of reliable road safety apparatus to manage burgeoning traffic volumes effectively and ensure compliance with stringent modern safety protocols.

Road reflector Market Executive Summary

The Road Reflector Market is characterized by steady, infrastructure-driven growth, underpinned by increasing global focus on reducing traffic fatalities and modernizing existing road networks. Current business trends indicate a strong move toward advanced, high-performance materials, particularly engineered plastics and specialized glass elements offering superior retroreflectivity and resistance to abrasion and weathering compared to conventional materials. Key industry players are increasingly focusing on strategic acquisitions and partnerships to integrate smart technology, such as embedded sensors and solar charging capabilities, positioning their products as integral elements of future smart road infrastructure. Furthermore, there is a visible trend towards standardization and certification requirements, ensuring product quality and performance reliability across diverse climatic zones, which favors manufacturers capable of achieving high durability standards.

Regional trends reveal that the Asia Pacific region, driven by massive governmental investments in multi-modal transport corridors and rapid urbanization in China, India, and Southeast Asian nations, is poised to demonstrate the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. North America and Europe, while being mature markets, exhibit strong demand for replacements and upgrades, specifically focusing on sustainable, low-maintenance, and highly visible solutions to meet evolving regulatory requirements such as those set by the Federal Highway Administration (FHWA) and relevant European standards. The Middle East and Africa (MEA) region show burgeoning demand linked to major infrastructure projects like the GCC railway network and extensive highway expansion programs, necessitating durable reflectors capable of withstanding extreme heat and sand abrasion.

Segmentation trends highlight that the plastic/polymer reflector segment dominates the market due to its cost-effectiveness, lightweight nature, and ease of installation, although the solar-powered reflector segment is experiencing the fastest growth rate, fueled by the rising emphasis on self-sustaining, zero-maintenance road furniture. Based on application, highway and motorway infrastructure remains the largest end-use segment, absorbing the majority of high-specification, durable pavement markers. The shift towards bidirectionality and multi-color reflectors for specialized applications, such as distinguishing between normal lanes, express lanes, and emergency shoulders, is also becoming a notable trend impacting product design and manufacturing priorities within the market landscape.

AI Impact Analysis on Road reflector Market

User inquiries regarding AI's influence on the road reflector market often revolve around whether advanced computer vision and autonomous vehicle technology will render passive infrastructure like reflectors obsolete, or conversely, if AI can enhance the functionality and deployment efficiency of these devices. Key themes surfacing include the integration potential of AI in monitoring reflector performance, predicting maintenance needs, and optimizing deployment patterns based on real-time traffic flow analysis. Users are particularly concerned about the long-term relevance of traditional reflective markers versus their integration into intelligent road systems that rely heavily on digital signaling and sensor data. The consensus among analysts is that while AI-driven vehicle systems may reduce dependence on visual cues, the fundamental requirement for passive, fail-safe visual guidance, particularly in adverse weather or during system failures, guarantees the continued necessity of high-quality road reflectors.

The application of Artificial Intelligence within the reflector domain is primarily focused on the operational efficiency of road management rather than the product itself. AI algorithms are increasingly being utilized to process data derived from roadside cameras and drones to automatically assess the retroreflectivity levels and physical condition of installed pavement markers. This predictive maintenance approach drastically reduces the manual effort and associated costs involved in routine infrastructure inspections, allowing maintenance teams to prioritize sections of the road network where reflectivity degradation poses the highest safety risk. Furthermore, AI-driven traffic simulation models can recommend optimal spacing, material choice, and placement strategies for reflectors based on specific roadway geometry, typical vehicle speeds, and historical accident data, leading to safer and more cost-effective installations.

Therefore, instead of displacement, AI is serving as an augmenting technology, enhancing the deployment, maintenance, and overall effectiveness of road reflectors as part of a connected infrastructure ecosystem. The integration of AI tools ensures that traditional physical safety measures are maintained at peak efficiency, complementing advanced digital safety features. This blend of passive and active safety measures provides robust resilience, crucial for supporting the transition to semi-autonomous and fully autonomous vehicles, which benefit from clearly marked physical infrastructure even when relying on complex sensor arrays.

- AI algorithms facilitate automated inspection and performance monitoring of reflector retroreflectivity.

- Predictive maintenance schedules are optimized using AI analysis of degradation rates and environmental factors.

- AI models inform the strategic placement and material selection of reflectors based on traffic patterns and risk assessment.

- Reflector manufacturing processes may utilize AI for quality control and defect detection in material formulation.

- Autonomous vehicles use high-definition cameras that rely on the structured visual input provided by pavement markers, validated by AI systems.

DRO & Impact Forces Of Road reflector Market

The Road reflector Market is profoundly shaped by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces influencing market growth and technological direction. The primary drivers stem from rigorous governmental regulations and international standards prioritizing road safety, coupled with massive infrastructure spending dedicated to highway construction and maintenance, especially in rapidly developing economies. These factors create sustained, non-discretionary demand for reliable safety equipment. However, the market faces restraints such as the relatively high initial cost of advanced solar and embedded LED reflectors compared to traditional passive markers, and the challenge of durability, as reflectors are exposed to extreme wear from snowplows, tire abrasion, and harsh chemical de-icing agents. These restraints necessitate continuous investment in material science research to improve product longevity and justify higher procurement prices.

Significant opportunities exist in the development and widespread commercialization of smart reflectors that integrate IoT capabilities, enabling real-time communication of road conditions, temperature variations, and potential hazards directly to traffic management centers and connected vehicles. The shift towards sustainable infrastructure also opens avenues for manufacturers offering recycled, eco-friendly materials and self-sustaining energy solutions (solar power). Furthermore, market penetration remains low in vast stretches of secondary roads globally, presenting a long-term opportunity for mass deployment in underserved rural areas where standard street lighting is often absent or insufficient. Strategic collaboration with autonomous vehicle technology developers to ensure physical road markings complement digital navigation systems is another high-growth area.

The core impact forces driving market evolution include legislative impetus, material science innovation, and technological convergence with Intelligent Transportation Systems (ITS). Legislative demands for lower accident rates enforce mandatory use of highly visible markers, acting as a major pull factor. Innovation in materials, particularly high-performance ceramics and specialized polymer composites, combats the environmental restraints and improves product lifespan. Finally, the integration of electronic components, powered by solar cells, transforms the reflector from a purely passive device into an active data node, significantly increasing its value proposition in smart city infrastructure projects. These combined forces ensure the market’s steady expansion, pushing manufacturers towards advanced, durable, and interconnected product offerings.

Segmentation Analysis

The Road reflector market is comprehensively segmented based on material type, product type, application, and visibility characteristics, providing a nuanced view of demand patterns across different end-user needs and geographical areas. Material segmentation (e.g., plastic, glass, ceramic, aluminum) dictates durability, cost, and retroreflectivity performance, influencing selection primarily by climate and traffic volume. Product type segmentation, which includes raised pavement markers (RPMs), delineators, and specialized in-road lighting systems, reflects specific deployment scenarios ranging from highway lane marking to temporary construction guidance. Application segmentation is crucial for understanding the core market drivers, with highways and motorways representing the largest segment due to the mandatory requirement for high-durability and high-visibility markers to manage high-speed traffic flow effectively. Understanding these segments is key for manufacturers to tailor their production capabilities and marketing strategies to the specific demands of transportation authorities and private developers globally.

- By Product Type:

- Raised Pavement Markers (RPMs)

- Delineators

- Temporary Road Markers

- Active/Solar Road Markers (ARMs)

- By Material Type:

- Plastic/Polymer (e.g., ABS, Acrylic, Polycarbonate)

- Glass

- Ceramic

- Aluminum/Metal Alloys

- By Application:

- Highways and Motorways

- Urban Roads and Streets

- Tunnels and Bridges

- Construction Zones and Temporary Diversions

- By Visibility/Light Type:

- Passive (Non-illuminated, Retroreflective)

- Active (Solar-Powered LED, Embedded Lighting)

- By Retroreflectivity:

- Unidirectional

- Bidirectional

- Omnidirectional

Value Chain Analysis For Road reflector Market

The value chain for the Road Reflector Market commences with the upstream supply segment, which involves the sourcing and preparation of essential raw materials. This includes procuring high-grade plastics such as ABS and polycarbonate, specialized reflective materials like glass beads or micro-prismatic sheeting, and durable materials such as aluminum, steel, or high-performance ceramics. The quality and cost of these raw materials significantly influence the final product cost and performance, driving manufacturers to establish robust supplier relationships and often integrate vertically to secure reliable material inputs. Upstream analysis also considers energy costs associated with processing and molding, emphasizing the need for energy-efficient manufacturing techniques to maintain competitive pricing, particularly for high-volume plastic reflectors.

The core manufacturing and distribution segment involves the design, molding, assembly, and quality control processes. Direct and indirect distribution channels play a pivotal role here. Direct distribution often involves large-scale governmental tenders, where manufacturers sell directly to national or regional transportation authorities responsible for large infrastructure projects, ensuring tighter control over specifications and delivery schedules. Indirect channels utilize specialized infrastructure product distributors, construction material wholesalers, and local road maintenance contractors who service smaller municipal projects and handle replacement and maintenance work. This dual-channel approach is crucial for achieving wide market coverage and ensuring prompt supply for both new construction and ongoing upkeep.

The downstream analysis focuses on installation and end-user deployment, which is typically handled by specialized road construction companies or governmental maintenance crews. Crucially, the long-term value chain extends into the post-installation phase, encompassing regular maintenance, performance monitoring (often leveraging AI-based systems), and eventual product replacement and recycling. Effective recycling programs, particularly for aluminum and certain plastics, are becoming increasingly important due to sustainability mandates. The efficiency of the distribution network, particularly logistics for heavy or large shipments, directly impacts the overall installation cost and project timelines, making optimized supply chain management a significant competitive advantage in this capital-intensive infrastructure market.

Road reflector Market Potential Customers

The primary customer base for the Road Reflector Market consists overwhelmingly of governmental and quasi-governmental bodies responsible for the planning, construction, and maintenance of public roadway networks. This includes national departments of transportation (e.g., FHWA in the US, various Ministry of Transport equivalents globally), state and provincial highway authorities, and local municipal road commissions. These entities are the largest buyers, driven by legislative mandates for road safety and funded through public budgets designated for infrastructure maintenance and expansion. Their purchasing decisions are highly influenced by product longevity, adherence to specific regional safety certifications, and the ability of the supplier to handle large, often multi-year public tenders involving stringent delivery schedules.

A secondary, yet rapidly growing, customer segment includes private developers and construction firms involved in large-scale infrastructure projects such as private toll roads, industrial parks, large shopping centers, and airport runway infrastructure. These private buyers prioritize cost-efficiency alongside performance, often requiring reflectors that integrate seamlessly with proprietary pavement materials or specific aesthetic standards. Furthermore, companies specializing in temporary traffic management, such as those providing signage and safety equipment for construction zones and road closures, represent a consistent demand source for specialized, temporary, high-visibility markers that are easy to install and remove quickly after project completion.

In addition to traditional customers, the emerging market for Intelligent Transportation Systems (ITS) and smart city initiatives is creating a new category of potential customers—technology integrators and communication companies. These customers require advanced, solar-powered, and IoT-enabled reflectors that function as data nodes within a connected road network. For these buyers, connectivity, sensor integration capabilities, and compatibility with existing smart infrastructure platforms are more critical purchasing criteria than basic retroreflectivity, signaling a future expansion of the market beyond purely passive safety applications and towards active, data-generating road furniture.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750.4 Million |

| Market Forecast in 2033 | USD 1,118.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Avery Dennison Corporation, Stimsonite Corporation, Swarco AG, Rayolite Inc., Ennis-Flint (PPG Industries), Jiangsu Bright, Wuhan Jackwin Technology Co., Ltd., Roadway Safety Products, Inc., Zumar Industries, Inc., Apex Safety Products, Carmanah Technologies Corp., Zhejiang Lanbao, Polybrite International, Astucia (Now Clearview Intelligence), ORAFOL Europe GmbH, Reflomax, Potters Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Road reflector Market Key Technology Landscape

The technological landscape of the Road Reflector Market is undergoing a significant transformation, moving beyond simple retroreflection towards active, embedded, and interconnected systems. Traditional technology relies on passive retroreflectivity, where materials like micro-prismatic sheeting or encapsulated glass beads return light from vehicle headlights directly back to the source, ensuring visibility. Modern advancements focus heavily on optimizing the material science of these reflective components, utilizing complex prismatic structures molded into durable polymers (like polycarbonates) to maximize reflectance efficiency and angularity, ensuring visibility across a wider range of approach angles and vehicle types. These passive technologies must balance high reflectivity with exceptional resistance to UV degradation, chemical exposure, and physical wear, necessitating continuous polymer and surface treatment innovation.

The most impactful technological shift involves the development of Active Road Markers (ARMs), particularly solar-powered LED reflectors. These devices incorporate photovoltaic cells to charge internal batteries during daylight hours, allowing integrated LED lights to flash or illuminate consistently at night, thereby generating their own light source independent of vehicle headlights. This significantly enhances visibility, especially in fog or heavy rain, and at greater distances. Key innovations in this sector include maximizing energy harvesting efficiency in low-light conditions, improving battery longevity (often utilizing lithium technologies), and encapsulating electronics within hermetically sealed, robust casings, usually made of aluminum or specialized composites, to withstand extreme loads and harsh weather conditions.

Furthermore, technology is increasingly focused on integrating reflectors into the broader Intelligent Transportation System (ITS) ecosystem. This involves embedding sensors within the marker itself—such as temperature sensors, communication modules, or induction loops—to collect real-time data on road conditions, traffic density, and pavement temperature. This enables the reflectors to potentially change color or flash patterns in response to hazards (e.g., icy patches or congestion), effectively turning them into distributed communication nodes. This convergence of material engineering, solar power generation, microelectronics, and low-power wireless communication represents the forefront of technological advancement in the road reflector sector, positioning these devices as foundational components of future smart infrastructure.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing market segment, primarily driven by massive governmental investments in infrastructure expansion, particularly the construction of new highways, expressways, and connectivity projects across China, India, and ASEAN countries. The rapid rate of urbanization and the subsequent increase in vehicular traffic necessitate urgent improvements in road safety standards, leading to high-volume procurement of both plastic RPMs for cost-sensitive projects and high-durability ceramic/aluminum reflectors for major national corridors. Moreover, safety regulations are evolving rapidly in countries like Japan and South Korea, pushing demand for advanced, active LED-based markers and specialized reflective road furniture to minimize accident rates in high-density areas.

- North America: North America represents a mature, high-value market characterized by stringent product standards, particularly those established by the Federal Highway Administration (FHWA). Demand here is less about new road construction and more focused on replacement cycles, infrastructure upgrades, and implementing sophisticated technology solutions. The U.S. and Canada show robust adoption of high-performance, weather-resistant reflectors, especially those capable of surviving heavy snowplow abuse in northern states, driving demand for specialized aluminum-shelled or recessed markers. Furthermore, significant research and development efforts are focused here on integrating smart reflectors with connected vehicle technology and ITS infrastructure, supporting early adoption of cutting-edge ARMs.

- Europe: The European market is defined by a strong emphasis on quality, sustainability, and adherence to unified EU technical standards. Western European nations, especially Germany, France, and the UK, prioritize reflectors made from recycled materials and those offering exceptional longevity, reflecting their focus on long-term infrastructure sustainability. Demand is high for advanced, durable reflective sheeting on delineators and specialized markers for tunnels and major traffic junctions. Eastern European countries, benefiting from EU infrastructure funding, are rapidly upgrading their road networks, creating sustained demand for reliable, standardized passive and active reflector systems to improve overall regional connectivity and safety metrics.

- Latin America (LATAM): The LATAM region presents a high-potential growth market driven by increasing government focus on addressing high traffic accident rates and improving regional logistics infrastructure. Countries like Brazil, Mexico, and Argentina are undertaking significant road network modernization projects. While cost sensitivity remains a factor, driving substantial demand for standard plastic reflectors, there is growing interest in durable, long-life products to minimize maintenance costs in remote areas. Regulatory standardization is improving, gradually boosting the requirement for certified, higher-quality reflective materials across public works projects.

- Middle East and Africa (MEA): This region is characterized by substantial infrastructure development funded by oil revenues (in the Middle East) and international development aid (in parts of Africa). The Middle Eastern market demands highly durable reflectors capable of resisting extreme heat, UV radiation, and sand abrasion, favoring specialized aluminum and ceramic compositions. The high solar irradiance in the region makes solar-powered Active Road Markers (ARMs) particularly viable and popular. African countries are focusing on basic road connectivity and safety, leading to increasing, though budget-constrained, demand for foundational reflective road safety products as part of large-scale humanitarian and development projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Road reflector Market.- 3M Company

- Avery Dennison Corporation

- Stimsonite Corporation

- Swarco AG

- Rayolite Inc.

- Ennis-Flint (PPG Industries)

- Jiangsu Bright

- Wuhan Jackwin Technology Co., Ltd.

- Roadway Safety Products, Inc.

- Zumar Industries, Inc.

- Apex Safety Products

- Carmanah Technologies Corp.

- Zhejiang Lanbao

- Polybrite International

- Astucia (Now Clearview Intelligence)

- ORAFOL Europe GmbH

- Reflomax

- Potters Industries

Frequently Asked Questions

Analyze common user questions about the Road reflector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between passive and active road reflectors?

Passive road reflectors, such as traditional Raised Pavement Markers (RPMs), rely solely on retroreflection to return light from vehicle headlights to the driver. Active road reflectors, typically utilizing solar-powered LEDs, generate their own light source, significantly enhancing visibility, especially during adverse weather conditions like fog or heavy rain, regardless of headlight strength or angle.

How do road reflectors contribute to Intelligent Transportation Systems (ITS)?

Modern road reflectors are evolving into smart road furniture by integrating IoT sensors, communication modules, and solar power. These Active Road Markers (ARMs) can collect and transmit real-time data on road conditions, temperature, and traffic flow, serving as foundational data nodes for centralized ITS management and connected vehicle applications, enhancing overall systemic safety and efficiency.

Which material type dominates the Road Reflector Market and why?

Plastic and polymer materials currently dominate the market volume due to their cost-effectiveness, lightweight nature, ease of installation via adhesives, and adequate durability for many municipal and low-traffic applications. However, high-traffic highways and regions with severe weather often require more durable, higher-cost materials like aluminum or ceramics to withstand greater physical abrasion and extreme temperature cycles, favoring long-term performance.

What are the main factors driving the high growth rate in the Asia Pacific road reflector market?

The high growth in APAC is primarily driven by extensive national government investments in new infrastructure projects, including expressways and connectivity corridors, particularly in India and China. Additionally, rapidly increasing urbanization and the need to align local road safety standards with international best practices necessitate the mass deployment of effective and visible lane delineation devices across large road networks.

Are autonomous vehicles expected to reduce the necessity for physical road reflectors?

While autonomous vehicles rely heavily on Lidar and computer vision, physical road reflectors remain crucial. Reflectors provide a necessary fail-safe visual reference point for both human drivers and autonomous systems, especially when sensor performance is compromised by snow, fog, or heavy rain. Reflectors are thus seen as complementary safety devices, enhancing the reliability of digital navigation by clearly defining physical road geometry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager