Robot Controllers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432343 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Robot Controllers Market Size

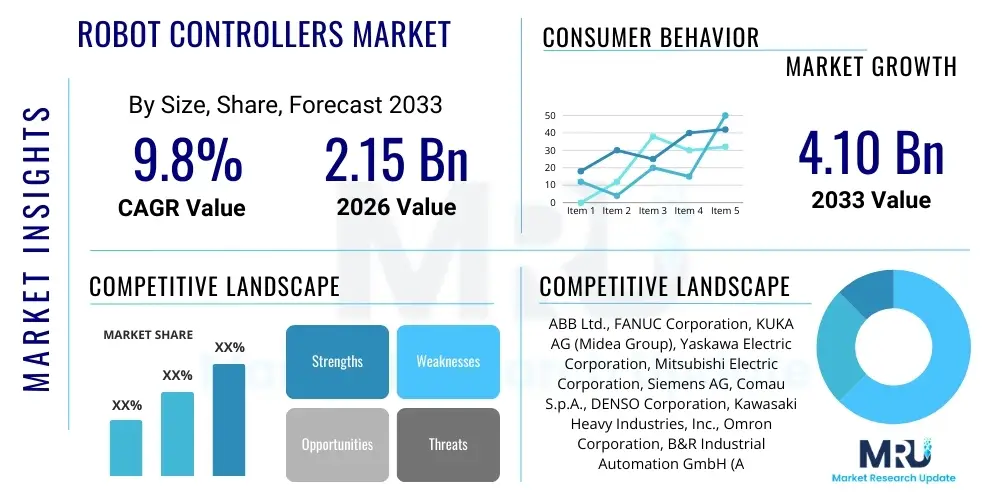

The Robot Controllers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.85% between 2026 and 2033. The market is estimated at $2.15 Billion in 2026 and is projected to reach $4.10 Billion by the end of the forecast period in 2033.

Robot Controllers Market introduction

The Robot Controllers Market encompasses the hardware and software systems essential for managing the motion, sequencing, and peripheral interactions of industrial and service robots. These controllers function as the central nervous system, providing real-time processing capability, deterministic control, safety monitoring, and communication interfaces required for complex automation tasks. Modern robot controllers are characterized by high computational power, often featuring multi-core processors, real-time operating systems (RTOS), and sophisticated network protocols like EtherCAT and PROFINET, enabling seamless integration into Industry 4.0 ecosystems. The fundamental role of the controller is to translate high-level programming instructions into precise physical movements, manage sensory feedback, and execute complex path planning algorithms to ensure accuracy and repeatability in manufacturing and logistics applications.

Key products within this domain include traditional cabinet controllers designed for heavy-duty industrial robots, compact integrated controllers suitable for collaborative robots (cobots), and specialized software-based controllers utilized in PC-based or cloud-integrated architectures. Major applications span across automotive manufacturing (welding, painting), electronics assembly (pick-and-place), pharmaceuticals (precision handling), and logistics (sorting, packaging, and autonomous mobile robots - AMRs). The continuous demand for higher throughput, greater flexibility in production lines, and the necessity for human-robot collaboration are significantly driving product evolution towards modular, decentralized, and network-enabled control solutions.

The primary benefits delivered by advanced robot controllers include enhanced operational efficiency through faster cycle times, improved product quality via superior motion control accuracy, and reduced downtime owing to integrated diagnostic and predictive maintenance capabilities. Driving factors fueling market expansion involve the accelerated adoption of automation in developing economies, the severe labor shortage in high-cost manufacturing regions, and technological breakthroughs such as the convergence of machine vision, artificial intelligence (AI), and robotics, demanding more sophisticated and adaptive control platforms. Furthermore, the standardization of communication interfaces and the emphasis on cybersecurity within connected factory environments are reshaping controller design and deployment strategies across all industrial sectors.

Robot Controllers Market Executive Summary

The Robot Controllers Market is experiencing robust growth, primarily fueled by the global shift towards smart manufacturing and the proliferation of collaborative robotics (cobots) that necessitate decentralized, highly integrated, and user-friendly control architectures. Business trends highlight a strong movement away from proprietary hardware toward open, software-defined control platforms that offer greater flexibility and easier integration with external factory management systems (MES/ERP). Key industry players are focusing on developing hybrid controllers capable of managing both industrial and service robotics, emphasizing connectivity standards (e.g., OPC UA) and enhancing onboard processing power to handle sophisticated AI-driven tasks such as adaptive path planning and complex machine vision processing at the edge. Strategic mergers, acquisitions, and partnerships aimed at strengthening software capabilities and expanding regional distribution networks are prominent competitive dynamics.

Regionally, the Asia Pacific (APAC) continues to dominate the market, driven by massive investments in automation across China, Japan, and South Korea, particularly in the automotive and electronics sectors, which rely heavily on high-speed, precision control. North America and Europe demonstrate mature market growth, characterized by significant uptake of collaborative robots and advanced safety controllers to meet stringent worker protection standards. These Western markets prioritize retrofit solutions and software upgrades that extend the life and capability of existing robot fleets. Emerging regional trends indicate increasing adoption rates in countries such as India and Brazil, driven by establishing new localized manufacturing bases and improving supply chain resilience through automation, demanding cost-effective and scalable control solutions.

In terms of segment trends, hardware-based controllers, particularly dedicated embedded systems, maintain the largest market share due to their reliability and real-time performance in high-stakes manufacturing environments. However, the software and programming segment is projected to exhibit the highest CAGR, driven by the increasing complexity of robot tasks and the need for simplified, graphical user interfaces and simulation software for quicker deployment and reprogramming. By application, the handling and assembly segment holds the largest portion, while the inspection and testing segment is rapidly gaining traction, propelled by the integration of high-resolution vision systems that require specialized controller communication and synchronization capabilities. The shift towards modular industrial PCs (IPCs) serving as robot controllers is also a significant technical trend, offering enhanced computational flexibility compared to traditional vendor-specific cabinets.

AI Impact Analysis on Robot Controllers Market

User inquiries regarding AI's influence on robot controllers typically center on four key themes: the transition from predefined programming to adaptive, learning-based control; the hardware requirements necessary to run deep learning models at the edge; the implications for cybersecurity when integrating self-learning systems; and the practical implementation of predictive maintenance and fault diagnosis using AI algorithms. Users are concerned about whether existing controller hardware can support computationally intensive AI algorithms and how communication latency will be managed when using cloud-based AI services versus decentralized, on-robot processing. Furthermore, there is significant interest in how AI will simplify robot programming, making robotics accessible to non-specialist users through reinforcement learning or demonstration-based teaching methods, ultimately redefining the software stack of the modern robot controller.

The integration of artificial intelligence is fundamentally transforming the design and functionality of robot controllers, moving them beyond mere deterministic motion execution to sophisticated decision-making platforms. AI algorithms, particularly deep learning models, enable robots to handle unstructured environments, recognize complex patterns (e.g., in quality inspection), and dynamically adjust their path planning and gripping forces based on real-time sensory input, leading to true adaptive automation. This requires controller hardware to incorporate specialized computational units, such as GPUs, FPGAs, or dedicated AI accelerators (like NPUs), directly into the control cabinet or even onto the robot arm itself (decentralized control), dramatically increasing the processing requirements over traditional CPU/microcontroller-based systems.

For market players, this transition means investing heavily in software optimization for AI applications, focusing on creating development environments that allow engineers to deploy, train, and manage AI models alongside traditional PLC or motion control codebases. AI-driven predictive maintenance is becoming a standard feature, where the controller continuously analyzes operational data (vibration, temperature, power consumption) to forecast potential component failures, significantly improving uptime and reducing maintenance costs. This evolution mandates robust, high-bandwidth communication protocols and stringent cybersecurity measures to protect the integrity of the learned models and the operational data streams utilized by the intelligent controller.

- AI enables adaptive motion control and complex path optimization in unstructured environments.

- Requires integration of specialized hardware (GPUs, NPUs) into the controller for edge processing.

- Facilitates advanced machine vision processing, enhancing quality control and object recognition accuracy.

- Drives the development of predictive maintenance features through real-time data analysis.

- Simplifies robot programming via machine learning, reducing reliance on expert coding (Learning by Demonstration).

- Increases demand for open-source and flexible software architectures capable of deploying third-party AI frameworks.

- Enhances human-robot interaction by allowing robots to interpret human intentions and safely adapt movements.

DRO & Impact Forces Of Robot Controllers Market

The Robot Controllers Market is shaped by powerful Drivers, facing specific Restraints, and offering substantial Opportunities, all filtered through significant Impact Forces that dictate strategic investment and technological prioritization. The core driver is the escalating global competition in manufacturing, which compels industries to adopt automation to optimize efficiency and minimize variable labor costs. This is synergized by the technological push towards Industry 4.0 and smart factory integration, where controllers must act as fully networked nodes, facilitating real-time data exchange and centralized management. However, market growth is often restrained by the high initial capital investment required for advanced robotic systems, especially for Small and Medium Enterprises (SMEs), and the complexity associated with integrating heterogeneous controllers from various vendors, requiring specialized programming expertise.

Key opportunities emerge from the surging demand for collaborative robots (cobots), which necessitate smaller, safer, and more intuitive controllers that democratize automation deployment. Furthermore, the massive expansion of the e-commerce and logistics sector, particularly the rapid adoption of Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs), opens lucrative avenues for suppliers of mobile, decentralized, and power-efficient control systems. Another major opportunity lies in the retrofitting and upgrading of legacy robot systems, where replacing or upgrading older, proprietary controllers with modern, open-architecture IPC-based solutions offers substantial performance improvements and lifecycle extension without full mechanical replacement.

The impact forces currently restructuring the market include intense pressure for standardization (e.g., development of standardized interfaces like ROS 2 and OPC UA for controller communication), forcing vendors to adopt more open architectures. The relentless miniaturization of electronics and advances in processor technology consistently drive down the size and cost of controllers while dramatically increasing their computational throughput, making sophisticated control accessible to smaller robotic platforms. Finally, regulatory impact forces related to functional safety (e.g., ISO 10218, ISO/TS 15066 for cobots) are paramount, compelling manufacturers to embed advanced safety features, redundant circuits, and deterministic safety software directly into the controller design, thereby increasing complexity but assuring market acceptance in regulated industrial environments.

Segmentation Analysis

The Robot Controllers Market is comprehensively segmented based on the component type, the nature of the controller (hardware vs. software), the type of robot it manages, and the end-user industry utilizing the controlled robotic system. Understanding these segmentations is critical for market participants to tailor their product development and distribution strategies, addressing the varying technical requirements across different robotic applications, ranging from high-precision handling in electronics to heavy-duty tasks in automotive manufacturing.

The segmentation by component type (hardware vs. software) reveals a traditional dominance of hardware due to the embedded, real-time necessity of motion control, yet the software segment, including programming environments, simulation tools, and AI algorithms, is growing fastest. Robot type segmentation (Industrial vs. Service Robots) shows industrial controllers holding the larger share, but the rapid deployment of service robots (e.g., logistics AMRs, surgical robots) is creating demand for highly flexible, modular, and sometimes PC-based controllers optimized for mobility and sensor fusion. Furthermore, the segmentation by functional capability, such as 3-axis, 4-axis, or 6-axis controllers, reflects the complexity of the kinematic structure being managed, with 6-axis controllers dominating the industrial space.

The end-user segmentation is vital, identifying automotive, electronics, logistics, and healthcare as major revenue generators. Each sector imposes unique demands: automotive requires robust, high-speed, safety-critical controllers; electronics demands extreme precision and cleanliness; and healthcare (surgical and rehabilitation robotics) mandates ultra-reliable, certified controllers with advanced haptic feedback and real-time responsiveness. This diverse application landscape ensures continuous innovation tailored to industry-specific standards and performance metrics, driving market segmentation complexity and opportunity.

- Component Type:

- Hardware (Control Cabinet, Power Supply, I/O Modules, Embedded PC)

- Software (Operating System, Programming Interface, Simulation Software, Communication Stacks)

- Controller Architecture:

- Centralized Control

- Decentralized/Distributed Control

- PC-Based/Open Architecture Control

- Robot Type:

- Industrial Robots (Articulated, SCARA, Delta, Cartesian)

- Collaborative Robots (Cobots)

- Service Robots (AMRs, Medical Robots, Logistics Robots)

- Axis Count:

- Less than 4-Axis

- 4-Axis to 6-Axis

- 7-Axis and Above

- End-Use Industry:

- Automotive

- Electrical and Electronics

- Metal and Machinery

- Chemical, Rubber, and Plastics

- Logistics and Warehouse Automation

- Food and Beverage

- Healthcare and Pharmaceuticals

Value Chain Analysis For Robot Controllers Market

The value chain for the Robot Controllers Market starts with the upstream suppliers providing essential technological components, primarily semiconductor manufacturers (microprocessors, FPGAs, ASICs, power transistors), high-precision sensor manufacturers (encoders, vision sensors), and specialized module vendors (power supplies, communication interfaces). These foundational component suppliers dictate the performance limits, cost structure, and energy efficiency of the final controller unit. Key challenges in this upstream segment include managing supply chain volatility, particularly in the global semiconductor market, and ensuring long-term availability of critical proprietary components vital for the deterministic operation required by robot controllers.

The middle segment involves the core activities of the controller manufacturers (OEMs like FANUC, ABB, KUKA, Yaskawa). This segment focuses on proprietary software development (RTOS, motion control algorithms, programming languages), hardware design (PCBs, cabinet construction, thermal management), and system integration. High value is added here through specialized expertise in deterministic real-time control, functional safety certification, and developing user-friendly programming interfaces. The trend is moving towards modular hardware platforms and highly customizable software stacks that allow faster integration of new features, such as advanced vision processing and AI capabilities.

The downstream segment involves distribution, integration, and final deployment. Distribution channels are typically a mix of direct sales to large, established end-users (e.g., major automotive manufacturers) and indirect channels utilizing system integrators, value-added resellers (VARs), and specialized distributors who provide regional technical support, customization, and integration services. System integrators play a crucial role as they bridge the gap between the robot controller’s capabilities and the specific requirements of the factory floor, providing training, calibration, and maintenance. The choice of channel depends heavily on the robot type; large industrial robots often rely on direct sales or major integrators, while cobots and service robots are increasingly sold through specialized e-commerce platforms and smaller regional distributors offering turn-key solutions.

Robot Controllers Market Potential Customers

The primary customers for advanced robot controllers are manufacturers and operators engaged in high-volume, precision, or hazardous operations where automation is non-negotiable for competitive advantage and safety. Within the industrial sector, Tier 1 and Tier 2 suppliers in the Automotive Industry represent the largest buyer segment, utilizing controllers extensively for welding, painting, assembly, and materials handling, often demanding controllers capable of managing multiple axes simultaneously and adhering to stringent quality control standards. These customers prioritize robustness, cycle time, and global service support.

The Electrical and Electronics Industry, particularly manufacturers of smartphones, semiconductors, and consumer electronics, constitutes another critical customer base. Their demand is centered around ultra-high-speed, high-accuracy controllers (often paired with SCARA or Delta robots) essential for intricate pick-and-place, micro-assembly, and dispensing tasks. These customers are leading the adoption of PC-based controllers and open-architecture software due to the rapid obsolescence cycle of their products and the need for frequent, flexible reprogramming.

Rapidly growing customer segments include Logistics and Warehouse Automation Companies and players within the Healthcare and Life Sciences Sector. Logistics customers are high-volume buyers of controllers for AMRs, AGVs, and sorting robots, prioritizing low power consumption, connectivity, and fleet management capabilities. Healthcare customers, encompassing surgical robotics, laboratory automation, and rehabilitation devices, demand controllers characterized by extreme precision, redundancy for safety (fail-safe operation), and compliance with medical device regulations, making the certification process a key purchasing consideration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 Billion |

| Market Forecast in 2033 | $4.10 Billion |

| Growth Rate | 9.85% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., FANUC Corporation, KUKA AG (Midea Group), Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Siemens AG, Comau S.p.A., DENSO Corporation, Kawasaki Heavy Industries, Inc., Omron Corporation, B&R Industrial Automation GmbH (ABB), Beckhoff Automation GmbH & Co. KG, Estun Automation Co., Ltd., Nachi-Fujikoshi Corp., Stryker Corporation (Medical Robotics), Universal Robots A/S (Teradyne), Techman Robot Inc., Stäubli International AG, Rockwell Automation, Inc., TQ-Systems GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Robot Controllers Market Key Technology Landscape

The technological landscape of the Robot Controllers Market is rapidly evolving, driven by the demand for higher connectivity, computational density, and intrinsic safety. Central to modern controllers is the reliance on Real-Time Operating Systems (RTOS) or specialized extensions of commercial operating systems (like Linux RT patches) to guarantee deterministic execution of motion control loops, typically running at high frequencies (e.g., 1 kHz or higher). Advanced processing is increasingly handled by heterogeneous computing architectures, combining powerful CPUs (often Intel or ARM-based) for overall system management and specialized co-processors (DSPs, FPGAs, or GPUs) dedicated to complex tasks such as kinematics calculation, inverse dynamics, and high-volume data processing from integrated machine vision systems.

Connectivity standards are paramount in the context of Industry 4.0. The shift toward standardized industrial Ethernet protocols—such as EtherCAT, PROFINET, and Sercos—is critical for ensuring low latency and high synchronization between the robot controller, peripheral devices (grippers, sensors), and the wider factory network (PLCs, HMIs). Furthermore, the adoption of middleware standards like ROS (Robot Operating System) and OPC UA is crucial for achieving vendor-neutral communication and enabling seamless data flow to enterprise-level systems and cloud analytics platforms, facilitating edge-to-cloud control strategies and data monetization.

Safety technology represents another core focus area. Modern controllers incorporate sophisticated functional safety features conforming to standards like IEC 61508 and ISO 13849. This includes Safety-Rated Stoppage (SRS), Safety-Rated Monitored Speed (SMS), and Zone Safety features crucial for human-robot collaboration. The move towards decentralized and modular controllers allows for distributing control and safety logic closer to the point of action, enhancing responsiveness and system scalability. Future technological advancements are expected to focus on quantum-resistant cryptographic security for connected controllers and further miniaturization, enabling controller components to be fully embedded within the robot joints (joint controllers).

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and technological preference for robot controllers worldwide. Asia Pacific (APAC) stands as the dominant market, driven overwhelmingly by manufacturing powerhouses like China, Japan, and South Korea. China's "Made in China 2025" initiative has spurred massive domestic investment in robotics and automation, creating a massive end-user base for both high-end imported controllers and rapidly advancing domestic products. Japan and South Korea, established leaders in automotive and electronics production, demand controllers focused on ultra-precision, reliability, and complex multi-axis control, often setting the global benchmark for performance and quality assurance in industrial applications.

North America and Europe represent mature, high-value markets characterized by a strong emphasis on integration, safety, and flexibility. In North America, the market is buoyed by reshoring trends in manufacturing and a significant push for logistics automation, leading to high demand for controllers specialized in cobots and AMRs. European markets, particularly Germany and Italy, focus heavily on advanced industrial automation (Industry 4.0), demanding controllers that comply with stringent CE certification, feature integrated functional safety, and support advanced fieldbus communication standards like EtherCAT and PROFINET, largely driven by high labor costs and regulatory requirements for worker protection.

The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets exhibiting accelerated growth potential, albeit from a smaller base. Growth in MEA is concentrated in sectors like oil & gas, infrastructure, and early-stage logistics facilities, requiring rugged and often customized controllers. LATAM, led by Brazil and Mexico, benefits from significant foreign direct investment into automotive and consumer goods manufacturing, driving steady demand for traditional industrial robot controllers and increasingly for flexible automation solutions to cope with evolving market demands and internal supply chain modernization efforts.

- Asia Pacific (APAC): Dominates global consumption, fueled by China's aggressive automation agenda, high-volume electronics, and automotive manufacturing in Japan and South Korea. Focus on speed, cost-efficiency, and localized production.

- North America: Strong market for collaborative robotics and logistics automation (AMRs/AGVs). Emphasis on open architecture systems, software flexibility, and addressing labor shortages through automation.

- Europe: Focus on high-end, safety-certified controllers adhering to Industry 4.0 standards. Significant demand in general manufacturing, machinery, and food and beverage sectors, prioritizing integrated safety and decentralized control systems.

- Latin America: Growth driven by automotive manufacturing and supply chain modernization, requiring reliable, mid-range industrial controllers.

- Middle East & Africa (MEA): Nascent growth concentrated in key industrial zones and infrastructure projects, favoring controllers with robust performance in harsh operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Robot Controllers Market.- ABB Ltd.

- FANUC Corporation

- KUKA AG (Midea Group)

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- Comau S.p.A.

- DENSO Corporation

- Kawasaki Heavy Industries, Inc.

- Omron Corporation

- B&R Industrial Automation GmbH (ABB)

- Beckhoff Automation GmbH & Co. KG

- Estun Automation Co., Ltd.

- Nachi-Fujikoshi Corp.

- Universal Robots A/S (Teradyne)

- Stäubli International AG

- Techman Robot Inc.

- Epson Robots (Seiko Epson Corp.)

- Rockwell Automation, Inc.

- ADLINK Technology Inc.

Frequently Asked Questions

Analyze common user questions about the Robot Controllers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between centralized and decentralized robot controllers?

Centralized controllers house all processing power and control logic in a single cabinet, ensuring strict synchronization for high-speed industrial robots. Decentralized control, often used in cobots or modular systems, distributes control elements (like servo drives and microprocessors) closer to the robot joints, improving modularity, reducing cabling, and enhancing scalability.

How is Industry 4.0 influencing the design requirements for modern robot controllers?

Industry 4.0 mandates that controllers be highly connected, using standard industrial protocols (e.g., EtherCAT, OPC UA) to communicate seamlessly with factory systems (MES/ERP). Design emphasis is placed on edge computing capabilities, cybersecurity features, and the ability to exchange real-time data for analytics, remote monitoring, and predictive maintenance.

Which robotic applications drive the highest demand for advanced controller software?

Applications requiring complex, non-deterministic tasks such as bin picking, advanced machine vision inspection, and human-robot collaboration demand the most advanced controller software. These tasks require sophisticated AI integration, real-time sensor fusion, and complex path planning algorithms that necessitate high-level programming environments and simulation tools.

Why are safety standards crucial for robot controller market growth, especially regarding cobots?

Safety standards (e.g., ISO/TS 15066) are crucial because they ensure robots can operate safely alongside human workers. Cobot controllers must integrate certified functional safety features (safe speed monitoring, safe torque off) that allow immediate, precise reaction to intrusion, driving innovation in redundant hardware and specialized safety RTOS implementations.

What role do PC-based controllers play in comparison to traditional embedded controllers?

PC-based controllers offer high computational flexibility, easier integration of third-party software (including AI/vision tools), and standardized hardware components, making them ideal for rapidly changing or specialized applications in electronics and research. Traditional embedded controllers, conversely, provide superior real-time performance, determinism, and ruggedness required for high-volume, repetitive industrial tasks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager