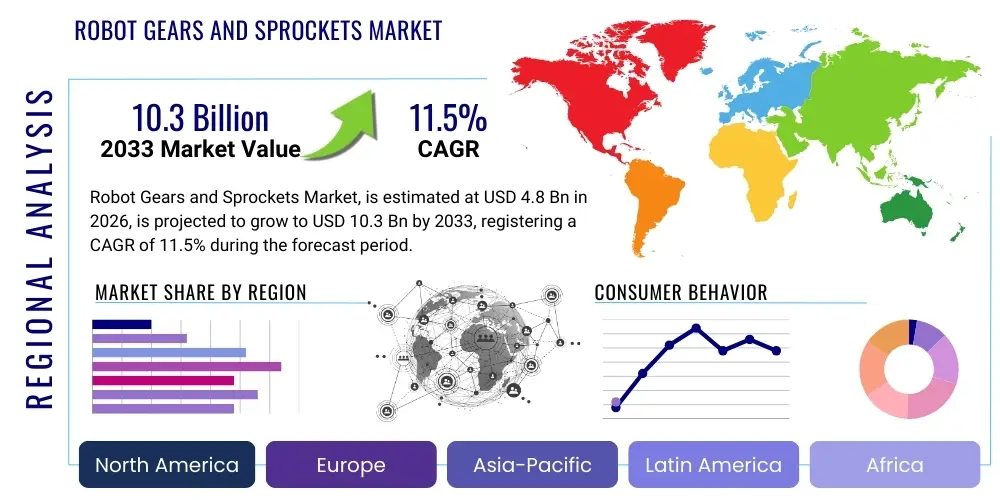

Robot Gears and Sprockets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436459 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Robot Gears and Sprockets Market Size

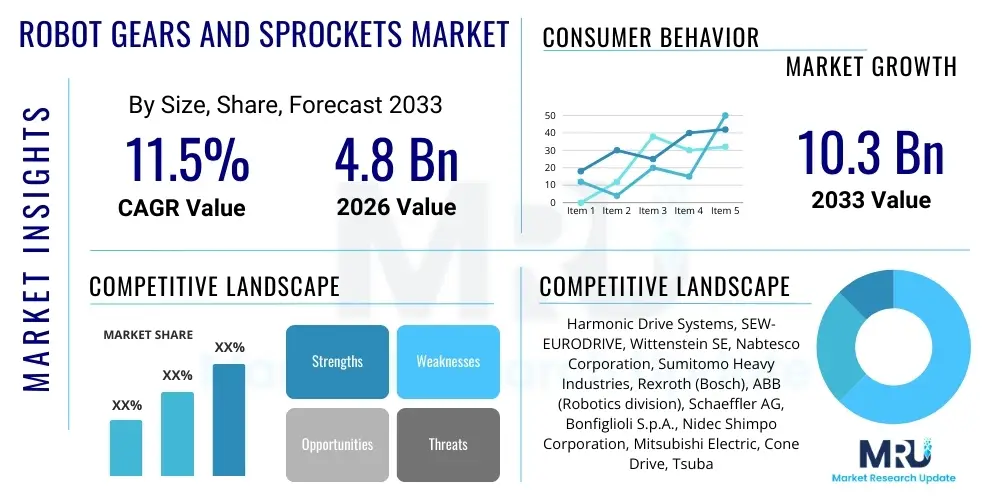

The Robot Gears and Sprockets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Robot Gears and Sprockets Market introduction

The Robot Gears and Sprockets Market encompasses the design, manufacturing, and distribution of high-precision mechanical components essential for motion control and power transmission in various robotic systems, including industrial, collaborative, surgical, and defense robots. These components, primarily gears (such as spur, helical, bevel, and harmonic drive gears) and sprockets, are critical determinants of a robot's speed, torque, accuracy, repeatability, and overall operational longevity. The demand is intrinsically linked to the global expansion of automation across manufacturing, logistics, and healthcare sectors, where the requirement for robust, lightweight, and backlash-free motion systems is paramount.

The core product offerings within this specialized market segment include miniature precision gears used in surgical robots, heavy-duty sprockets for automated guided vehicles (AGVs), and specialized gear sets for high-ratio reduction units necessary for six-axis industrial arms. Key materials utilized range from high-strength alloys (like hardened steel and titanium) to advanced engineering plastics and composites, selected based on the specific load requirements, noise reduction needs, and environmental operating conditions of the robotic application. The continuous miniaturization of components without sacrificing torque density drives constant innovation in material science and manufacturing processes, particularly in areas like 3D printing of metal alloys and precision grinding techniques.

Major applications for these sophisticated components span automotive production lines, where speed and consistency are vital; e-commerce fulfillment centers, relying on AGVs and sorting robots; and intricate medical procedures facilitated by highly accurate robotic surgical tools. The primary benefits of advanced robot gears and sprockets include enhanced energy efficiency, reduced maintenance costs due to increased durability, and significantly improved positional accuracy, which is non-negotiable in precision assembly and handling tasks. The market is primarily driven by the increasing adoption of Industry 4.0 initiatives globally, rising labor costs pushing manufacturers toward automation, and rapid technological advancements in collaborative robotics (cobots) which necessitate exceptionally precise and safe gearing mechanisms.

Robot Gears and Sprockets Market Executive Summary

The Robot Gears and Sprockets Market is characterized by intense technological competition focused on achieving higher torque density, lower backlash, and superior material wear resistance. Current business trends indicate a significant shift towards customized and highly integrated gear solutions, moving away from off-the-shelf components, especially within the high-payload industrial robotics segment and the nascent humanoid robotics sector. Manufacturers are heavily investing in vertical integration and automated inspection technologies (like computerized numerical control, CNC, and coordinate measuring machines, CMM) to meet the stringent quality control requirements mandated by applications such as surgical robotics, ensuring zero defects and maximum operational reliability. Mergers and acquisitions remain a notable strategy, particularly as major robotics manufacturers seek to secure proprietary gear technology suppliers, thereby consolidating control over critical supply chain elements.

Regionally, the Asia Pacific (APAC) continues to dominate the market, propelled by massive governmental investments in manufacturing automation in China, South Korea, and Japan, which are the global hubs for industrial robot installation. However, North America and Europe show robust growth in the adoption of collaborative robots and advanced surgical systems, leading to high demand for specialized miniature and low-noise gearing solutions. Furthermore, emerging markets in Latin America and the Middle East are experiencing accelerated adoption of automated logistics systems, thereby driving demand for medium-duty gears and sprockets used in warehouse automation equipment. Geopolitical factors influencing trade policies and localized manufacturing incentives are increasingly shaping regional production footprints for key components.

Segmentation analysis reveals that the Harmonic Drive Gears segment holds a commanding lead in value due to their indispensable role in high-precision, articulated robots, commanding premium pricing based on their zero-backlash capabilities. By application, the Automotive and Electronics sectors remain the primary revenue drivers, although the Medical and Healthcare segment is exhibiting the highest growth trajectory, fueled by the accelerating deployment of surgical and rehabilitation robots. Material trends highlight the increasing preference for composite materials and advanced ceramics in applications where weight reduction and non-magnetic properties are essential, further fragmenting the market based on end-use specific material requirements and processing sophistication.

AI Impact Analysis on Robot Gears and Sprockets Market

User inquiries regarding AI's impact on the Robot Gears and Sprockets Market frequently center on predictive maintenance, design optimization, and autonomous manufacturing. Users are primarily concerned with how AI can minimize component failure rates, thereby extending the Mean Time Between Failures (MTBF) for expensive robotic systems. Key themes include the implementation of AI-driven sensor data analysis to predict wear patterns in gear teeth, the use of generative design algorithms to create lighter, stronger gear geometries impossible to conceive manually, and the integration of machine learning into precision machining processes to minimize thermal expansion errors and enhance surface finish quality. Expectations revolve around achieving 'zero downtime' through highly accurate diagnostics and accelerating the design-to-production cycle for custom components using simulation and optimization tools powered by artificial intelligence.

- AI enables predictive maintenance, analyzing vibration and acoustic data from gearboxes to forecast imminent failures, shifting maintenance from reactive to proactive strategies.

- Generative design AI optimizes gear tooth profiles and material usage, resulting in components with superior strength-to-weight ratios and reduced inertia.

- Machine learning algorithms enhance quality control by processing high-resolution images and CMM data faster and more reliably than traditional inspection methods, ensuring stringent backlash specifications are met.

- AI-driven simulation reduces the physical prototyping cycle time by accurately modeling load stresses, thermal effects, and lubrication dynamics on complex gear train systems.

- Autonomous manufacturing systems, guided by AI, optimize tooling paths and machine parameters in real-time, leading to increased precision and efficiency in high-volume gear production.

DRO & Impact Forces Of Robot Gears and Sprockets Market

The dynamics of the Robot Gears and Sprockets Market are fundamentally governed by the increasing global emphasis on automation (Driver), stringent technical requirements regarding backlash and precision (Restraint), the emergence of new robotic application fields like logistics and healthcare (Opportunity), and the intense competitive pressure driven by technological differentiation (Impact Force). The persistent need for higher operational speeds and heavier payloads in industrial settings directly translates into demand for extremely durable, high-torque gears, while the proliferation of collaborative robots creates a specific niche requiring low-noise, lightweight, and safety-compliant gearing mechanisms. This dichotomy forces manufacturers to invest heavily in diverse R&D streams simultaneously.

Restraints primarily revolve around the inherent manufacturing complexity and the high cost associated with achieving micron-level precision and minimal backlash in components like cycloidal and harmonic drives. Furthermore, the selection of appropriate materials presents a challenge, as engineers must balance requirements for wear resistance, weight, cost, and damping capabilities. The long design and validation cycles required for certifying gear components for critical applications, such as surgical robotics, also act as a constraint on rapid market entry and expansion. Counterfeiting and intellectual property theft concerning proprietary gear designs also pose a continuous threat, particularly in regions with less stringent enforcement mechanisms, impacting legitimate manufacturers' profitability.

Opportunities are significant, driven by the explosive growth in non-traditional robotic sectors, specifically drone technology requiring lightweight, durable miniature gears, and the expanding industrial application of mobile robotics (AMRs/AGVs) necessitating robust, high-efficiency sprockets and drive systems for continuous duty cycles. Moreover, the push toward sustainable manufacturing opens opportunities for gear makers specializing in highly efficient designs that minimize energy dissipation and the use of eco-friendly lubrication systems. Impact forces, characterized by fierce patent battles and rapid product obsolescence due to technological leaps, necessitate continuous innovation and substantial capital expenditure to maintain a competitive edge and secure long-term supply agreements with tier-one robot integrators.

Segmentation Analysis

The Robot Gears and Sprockets Market segmentation provides a granular view of component types, materials used, application industries, and regional adoption patterns, reflecting the specialized nature of robotic motion control requirements. This market is highly stratified based on the required precision level and load capacity. Component type segmentation is dominated by sophisticated gear reduction units, which are crucial for magnifying the torque output of servo motors while drastically reducing the rotational speed to achieve controlled, precise motion necessary for robotic manipulation. Material segmentation showcases the transition from traditional ferrous metals to advanced composites tailored for applications demanding weight minimization and high dynamic performance.

The segmentation by application reveals that traditional heavy industries like Automotive and Metal Fabrication still represent the bulk of the volume demand for standard industrial robot gearing. However, high-growth segments such as Healthcare (surgical robots) and Logistics (warehouse automation) are driving demand for technologically advanced, specialized gears, including high-ratio reduction gears and miniaturized planetary systems. Geographic segmentation underscores the strategic importance of the APAC region as both a manufacturing powerhouse and the largest end-user market due to extensive factory automation initiatives, while North America and Europe prioritize the quality and precision of collaborative and specialized niche robotics.

- By Component Type:

- Harmonic Drive Gears

- Planetary Gearboxes

- Cycloidal Drive Gears

- Worm Gears

- Spur Gears and Helical Gears

- Sprockets and Chains

- By Material:

- Steel and High-Strength Alloys (Stainless Steel, Hardened Steel)

- Engineering Plastics and Polymers (Nylon, PEEK, Polycarbonate)

- Composites and Ceramics

- By Application/Industry:

- Automotive

- Electronics and Semiconductors

- Logistics and Warehouse Automation (AMRs/AGVs)

- Medical and Healthcare (Surgical and Rehabilitation Robots)

- Aerospace and Defense

- Food and Beverage

- By Robot Type:

- Industrial Robots (Articulated, SCARA, Delta)

- Collaborative Robots (Cobots)

- Service Robots (Professional and Personal)

- Mobile Robots (AGVs/AMRs)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Robot Gears and Sprockets Market

The value chain for robot gears and sprockets begins with the Upstream segment, dominated by highly specialized raw material suppliers providing aerospace-grade metals, advanced ceramics, and high-performance polymers, which are indispensable for achieving the required durability and precision. Key activities at this stage include material sourcing, specialized heat treatment, and precision casting/forging to create blanks ready for subsequent machining. This segment is characterized by relatively high entry barriers due to strict material quality specifications and long qualification cycles, ensuring materials can withstand the high torque and cyclical loading inherent in robotic operations.

The Core Manufacturing stage involves sophisticated processes such as precision CNC machining, gear hobbing, grinding, honing, and lapping, which are critical for achieving the necessary geometric tolerances and surface finishes—often down to sub-micron levels—required for zero-backlash performance. This stage also includes the highly proprietary assembly and testing of complex gear reduction units, such as harmonic drives. Distribution channels involve a mix of Direct and Indirect sales; high-volume standard components often move through specialized industrial distributors and system integrators (Indirect), while complex, custom-engineered components for major robot manufacturers are typically sold via long-term contracts (Direct).

The Downstream segment comprises the end-users: the robot manufacturers (OEMs) who integrate these components into their final products, and the system integrators who customize and install robotic solutions for specific industrial clients. Post-sale activities, including maintenance, repair, and replacement (MRO) services, form a crucial component of the value chain, often providing stable, high-margin revenue streams for gear manufacturers due to the necessity of using genuine, certified replacement parts to maintain robot performance guarantees. Effective supply chain management, minimizing lead times for highly customized components, is a major competitive advantage across the entire value chain.

Robot Gears and Sprockets Market Potential Customers

The primary customers for the Robot Gears and Sprockets Market are the Original Equipment Manufacturers (OEMs) of robotic arms and motion systems, ranging from global leaders in industrial automation to niche startups specializing in specific service robotics. These customers demand highly reliable, certified components that align perfectly with their proprietary motor and control systems, often seeking exclusivity or custom designs. Secondary potential customers include large-scale industrial companies, particularly in the automotive and electronics sectors, which operate extensive in-house automation maintenance departments and require replacement parts, though the direct purchase volume is usually lower than that of the OEMs.

A rapidly expanding customer base resides within the booming logistics and warehouse automation industry, consisting of manufacturers of Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), and specialized sortation systems. These buyers prioritize components offering high efficiency, robust durability for 24/7 operation, and lower maintenance needs. Furthermore, hospitals and specialized medical device companies constitute a high-value customer segment, particularly seeking miniaturized, non-magnetic, and extremely high-precision gear assemblies for use in MRI-compatible and sterile surgical robots, where component failure is unacceptable under any circumstance.

Lastly, defense contractors and aerospace manufacturers represent specialized clientele that demands components adhering to exceptionally high regulatory standards and specific environmental robustness requirements, often needing custom materials capable of handling extreme temperatures or radiation exposure. System integrators, who combine various third-party components to create bespoke automation solutions for SMEs (Small and Medium-sized Enterprises), also function as influential intermediaries and buyers, often selecting components based on cost-efficiency, availability, and ease of integration into diverse motor platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Harmonic Drive Systems, SEW-EURODRIVE, Wittenstein SE, Nabtesco Corporation, Sumitomo Heavy Industries, Rexroth (Bosch), ABB (Robotics division), Schaeffler AG, Bonfiglioli S.p.A., Nidec Shimpo Corporation, Mitsubishi Electric, Cone Drive, Tsubakimoto Chain Co., Gearing Solutions Inc., HD Kinex, Cleveland Gear, Oerlikon Graziano, HPC Gears, Anaheim Automation, and Sanyo Denki. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Robot Gears and Sprockets Market Key Technology Landscape

The technology landscape for robot gears and sprockets is defined by relentless innovation aimed at improving efficiency, reducing noise, and maximizing power density within constrained volumes. Key advancements focus heavily on the manufacturing methodologies used for gear cutting and finishing, specifically leveraging 5-axis CNC machining, advanced gear grinding, and super-finishing techniques to achieve smoother contact surfaces, which minimizes friction and wear. A critical technological trend is the maturation of additive manufacturing (3D printing), particularly in metal alloys like titanium and aluminum, which allows for complex internal geometries that drastically reduce mass while maintaining structural integrity, especially crucial for end-of-arm tooling and lightweight cobots.

Another dominant technological force is the development and optimization of proprietary gear reduction mechanisms, notably the refinement of Harmonic Drive and Cycloidal drive systems. Manufacturers are focusing on reducing the internal complexity of these high-ratio mechanisms and enhancing the elastic element (flexspline or pin wheel) life through novel material science and surface treatments like plasma coatings or specialized PVD/CVD processes. Furthermore, the integration of smart components is accelerating, where miniature sensors (e.g., thermal, strain, and vibration sensors) are embedded directly into the gearboxes to provide real-time condition monitoring data, supporting AI-driven predictive maintenance strategies.

In terms of materials, the focus has shifted toward high-performance ceramics and specialized engineering plastics for applications requiring chemical inertness, high damping capacity, or specific electrical insulation properties, such as cleanroom or vacuum environments in semiconductor manufacturing. Lubrication technology is also evolving, with new solid lubricants and synthetic oils designed to handle extreme pressures and temperature variations while reducing particulate contamination. These technological advancements collectively aim to solve the long-standing challenge of achieving high torque with zero backlash in a compact, reliable package, which is the foundational requirement for modern robotic precision.

Regional Highlights

Regional dynamics heavily influence the demand for specific types of robot gears and sprockets, reflecting local industrial priorities and regulatory environments. Asia Pacific (APAC) dominates the global market, primarily due to the overwhelming volume of industrial robot installations in China, driven by the 'Made in China 2025' strategy, and continuous automation investments in Japan and South Korea, which are major global robotics manufacturers. The high demand in APAC is mainly for heavy-duty industrial robot gears used in automotive assembly and electronics fabrication, prioritizing cost-efficiency alongside performance.

North America and Europe represent mature markets characterized by stringent quality demands and a focus on high-value, niche applications. North America leads in the adoption of complex surgical robotics and aerospace automation, driving premium demand for miniaturized, ultra-high-precision harmonic drives and specialized, certified components. European markets, particularly Germany, emphasize collaborative robotics (cobots) and advanced logistics systems, necessitating components that offer exceptional safety features, low noise operation, and high efficiency to comply with energy consumption regulations and factory workplace standards.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging as significant growth markets, driven primarily by investments in resource extraction, energy infrastructure, and the modernization of logistics networks. While starting from a lower base, the accelerating pace of warehouse automation and the deployment of inspection and maintenance robots in these regions create a rapidly expanding customer base for standard and medium-precision gearboxes and sprockets, indicating potential for high compound growth rates over the forecast period as industrialization intensifies.

- Asia Pacific (APAC): Market leader by volume, driven by industrial automation in China, South Korea, and Japan, focusing on high-volume production of industrial robot components.

- North America: High-value market focused on medical robotics, aerospace, and advanced R&D, demanding proprietary, ultra-precision, certified gear components.

- Europe: Strong focus on collaborative robotics (cobots) and advanced logistics, emphasizing low-noise, high-efficiency, and safety-compliant gearing mechanisms.

- Latin America (LATAM): Rapidly increasing adoption in logistics, mining, and manufacturing sectors, driving demand for robust, medium-duty sprockets and planetary drives.

- Middle East and Africa (MEA): Emerging market driven by oil and gas inspection robotics, infrastructure development, and nascent warehouse automation projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Robot Gears and Sprockets Market.- Harmonic Drive Systems Inc.

- Nabtesco Corporation

- Wittenstein SE

- Sumitomo Heavy Industries, Ltd. (through various divisions)

- Nidec Shimpo Corporation

- SEW-EURODRIVE GmbH & Co KG

- Rexroth (A Bosch Company)

- Schaeffler AG

- Bonfiglioli S.p.A.

- Tsubakimoto Chain Co.

- Cone Drive Operations Inc.

- Gearing Solutions Inc.

- HD Kinex

- Cleveland Gear

- Oerlikon Graziano S.p.A.

- HPC Gears

- Alpha Gear Drive (A Wittenstein Group Company)

- Mitsubishi Electric Corporation

- Sanyo Denki Co., Ltd.

- Precision Gears, Inc.

Frequently Asked Questions

Analyze common user questions about the Robot Gears and Sprockets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Robot Gears and Sprockets Market?

The primary driver is the accelerating global adoption of industrial and service automation technologies, particularly the exponential installation rate of articulated industrial robots and collaborative robots (cobots) across the manufacturing, logistics, and healthcare sectors. This mandates continuous demand for high-precision motion control components.

What are the key technical differences between Harmonic Drives and Planetary Gearboxes in robotics?

Harmonic Drives are preferred for high-precision, zero-backlash, and compact applications, such as joints in six-axis robot arms, offering very high reduction ratios in a small form factor. Planetary Gearboxes, while highly efficient, typically exhibit measurable backlash but are favored for their high torque density and robustness in heavy-duty or continuous-duty applications like AGV wheel drives.

Which materials are increasingly replacing traditional steel in advanced robotic gearing?

Advanced engineering plastics (like PEEK and specialized composites) and high-performance ceramics are increasingly used. These materials offer benefits such as significant weight reduction, chemical resistance, low noise operation, and non-magnetic properties essential for medical and cleanroom robotics, compensating for lower absolute strength via optimized gear design.

How does the backlash specification impact the cost of robot gears?

Backlash, or the amount of free play in the gear mesh, is the single most critical precision metric. Achieving ultra-low or zero backlash requires specialized manufacturing processes (e.g., precision grinding, lapping) and materials, dramatically increasing production complexity and cost. Thus, components with backlash specified below 1-3 arc minutes command a significant price premium.

Which region currently leads the demand for robot gears and sprockets?

The Asia Pacific (APAC) region currently leads the demand due to the immense scale of manufacturing automation, particularly driven by large-volume industrial robot deployment in countries like China, Japan, and South Korea, across automotive and electronics supply chains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager