Robot Tool Changers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432350 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Robot Tool Changers Market Size

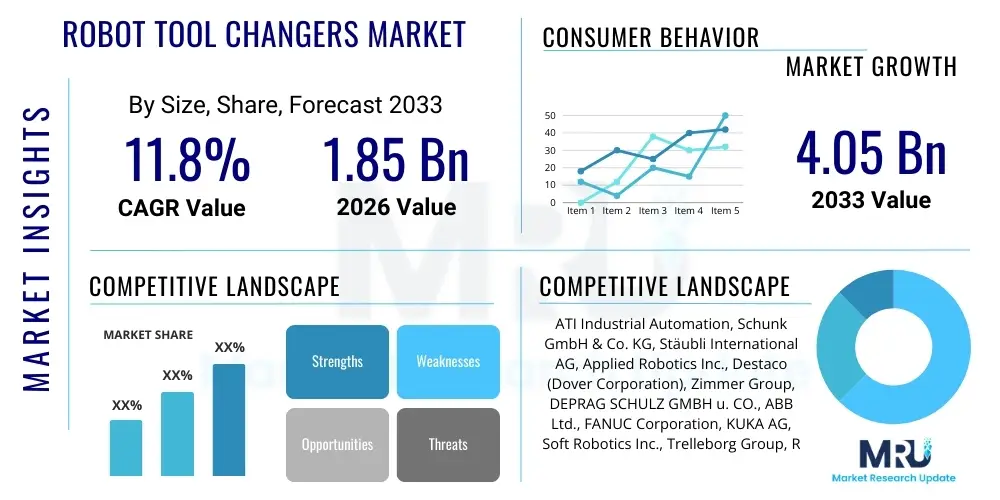

The Robot Tool Changers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 4.05 Billion by the end of the forecast period in 2033.

Robot Tool Changers Market introduction

The Robot Tool Changers Market encompasses systems designed to allow industrial robots to automatically swap end-effectors or peripheral tools, thereby enhancing flexibility and maximizing utilization rates in automated manufacturing environments. These devices, which typically consist of a master unit attached to the robot wrist and a tool unit attached to the end effector, utilize various locking mechanisms—including pneumatic, hydraulic, or electric actuation—to ensure reliable and repeatable connections. The primary function is to enable a single robotic arm to perform multiple, sequential tasks without human intervention, drastically reducing cycle times and capital expenditure required for redundant robotic installations.

Major applications of robot tool changers span across high-throughput industries such as automotive manufacturing, aerospace component production, electronics assembly, and general machinery fabrication. In the automotive sector, they are crucial for transitioning quickly between welding, gripping, dispensing, and inspection tasks on complex assembly lines. Furthermore, the increasing adoption of collaborative robots (cobots) in smaller manufacturing facilities and specialized environments is expanding the application base for lightweight, compact tool changing systems, driven by the need for enhanced versatility and rapid task reconfiguration in smaller batch production.

The core benefits driving market growth include significant improvements in operational efficiency, minimization of downtime associated with manual tool changes, and substantial enhancement of manufacturing flexibility. These systems allow for true mixed-model production, where a robot can handle different products requiring distinct processes instantaneously. Driving factors are primarily the global push toward Industry 4.0, the necessity for high precision and standardization in complex assemblies, and the continuous trend of integrating sophisticated automation solutions into conventional production lines to offset rising labor costs and shortages.

Robot Tool Changers Market Executive Summary

The Robot Tool Changers Market demonstrates robust growth, primarily fueled by global investments in smart factories and the burgeoning demand for high-mix, low-volume manufacturing capabilities across industrialized economies. Business trends highlight a strong shift toward modular, standardized tool changer designs that simplify integration and maintenance across different robot platforms. Key technological advancements center on developing tool changers with integrated sensors for real-time diagnostics, enhanced data communication capabilities, and lightweight materials suitable for high-speed operation and collaborative robot deployments. Strategic partnerships between tool changer manufacturers and robotic system integrators are vital for penetrating niche application markets and ensuring seamless, end-to-end automation solutions for complex manufacturing processes.

Regionally, the Asia Pacific (APAC) area remains the primary engine of market expansion, attributed to massive governmental and private sector investments in factory automation, particularly in countries like China, Japan, and South Korea, which are major hubs for automotive and electronics manufacturing. North America and Europe continue to adopt advanced tool changer technologies rapidly, focusing on improving labor productivity and adopting high-payload systems necessary for aerospace and heavy machinery production. The competitive landscape is characterized by established global players emphasizing proprietary locking mechanisms and communication protocols, while smaller firms focus on niche applications like high-accuracy fluid dispensing or specialized material handling.

Segment trends reveal that the medium-to-high payload segment (100 kg to 500 kg) accounts for the largest market share due to its dominance in traditional heavy industrial applications, such as spot welding and heavy part manipulation in the automotive sector. However, the low payload segment (under 10 kg) is exhibiting the fastest growth rate, directly correlated with the accelerating adoption of collaborative robots (cobots) in small and medium-sized enterprises (SMEs). Furthermore, tool changers incorporating integrated media ports for sophisticated communication (such as Ethernet/IP or Profinet) are increasingly preferred over basic electrical connection types, aligning with the requirements of fully connected industrial IoT (IIoT) ecosystems.

AI Impact Analysis on Robot Tool Changers Market

User inquiries regarding AI's influence on the Robot Tool Changers Market predominantly revolve around how artificial intelligence can optimize the tool changing process itself, enhance predictive maintenance, and facilitate truly autonomous, adaptive manufacturing. Users are keen to understand if AI algorithms can determine the optimal sequence of tool changes in dynamic production environments, minimizing overall cycle time and maximizing energy efficiency. A major concern is the complexity of integrating AI-driven decision-making into safety-critical tool handling procedures. Expectations center on AI enabling condition monitoring to anticipate wear and tear on locking mechanisms and media connections, thus avoiding unexpected failures and ensuring continuous high-uptime performance, leading to the development of "smart tool changers" that self-diagnose and report potential issues before they become catastrophic faults.

AI’s contribution is not in the physical mechanics of the tool changer but in the intelligence layer governing its operation and maintenance. By processing vast amounts of operational data—including coupling force measurements, vibration analysis, temperature readings, and cycle counts—AI models can detect subtle deviations from normal operation, providing highly accurate remaining useful life predictions for critical tool changer components. This shift from reactive or time-based maintenance to true predictive maintenance drastically lowers operational risk. Furthermore, in highly flexible manufacturing cells, AI-powered scheduling and path planning algorithms can autonomously select the correct tool and optimize the robot’s movement sequence for rapid, precise tool acquisition, leading to profound gains in overall equipment effectiveness (OEE).

The implementation of AI also extends to quality control and rapid fault detection during the tool swap. Sophisticated vision systems, coupled with machine learning, can verify the secure coupling and proper alignment of the tool and master units within milliseconds, automatically flagging and resolving any alignment issues. This ensures the integrity of the process before the robot commences the next task, significantly reducing scrap rates and improving process reliability. The integration of edge AI allows tool changers to process sensor data locally, providing immediate feedback to the robot controller and reducing latency in high-speed applications, fundamentally redefining the capabilities and reliability expectations of these critical robotic accessories.

- AI-driven predictive maintenance forecasts component failure, maximizing uptime.

- Optimized tool sequence planning minimizes cycle times and enhances production flow flexibility.

- Machine Vision and AI verify tool coupling alignment, ensuring high repeatability and quality control.

- Real-time anomaly detection identifies deviations in coupling force or media connection integrity.

- Edge AI implementation enables low-latency decision-making for faster, safer tool swaps.

- Autonomous configuration management simplifies setup for high-mix production environments.

DRO & Impact Forces Of Robot Tool Changers Market

The Robot Tool Changers Market is significantly driven by the accelerating global pace of factory automation, particularly within automotive, electronics, and general machinery sectors seeking to maximize robot utilization. The continuous decrease in the average cost of industrial robots combined with the rising complexity of assembly tasks necessitates quick and reliable tool reconfiguration capabilities, directly boosting the demand for advanced tool changing systems. Opportunities are expanding rapidly in the collaborative robotics sector, where lightweight, highly flexible tool changers are essential for SMEs adopting automation for the first time. The rise of specialized applications, such as medical device manufacturing and advanced composite handling, also presents lucrative avenues for customized, high-precision tool changer solutions incorporating specialized media transfer capabilities.

However, the market faces significant restraints, primarily centered around the high initial investment required for sophisticated tool changer systems, especially those incorporating multiple high-speed media connections (e.g., fiber optics, advanced fluid lines). Standardization remains a challenge; while major robot manufacturers offer proprietary solutions, interoperability between different robot brands and tool changer suppliers can be complex, often requiring custom integration work. Furthermore, maintaining the reliability and repeatability of electrical and fluidic connections over millions of cycles presents a technical hurdle, requiring robust design and careful maintenance protocols, which can sometimes deter smaller manufacturers from adopting these advanced accessories.

Impact forces on the market are high, driven strongly by technological advancements (innovation force) focusing on increased payload capacity, reduced weight, and integration of robust industrial communication protocols. The standardization efforts led by major consortia are a stabilizing force, aiming to reduce integration complexity. Economically, the continuous pressure to reduce manufacturing costs and improve quality assurance globally exerts a strong upward pull on the adoption rate. The strongest growth driver remains the pervasive adoption of Industry 4.0 principles, where maximum flexibility and connectivity are paramount, making automated tool changing a foundational element of any future-proof manufacturing strategy.

Segmentation Analysis

The Robot Tool Changers Market segmentation provides a granular view of demand dynamics across various parameters, including payload capacity, actuation mechanism, integrated media capabilities, application type, and end-user industry. Analyzing these segments is crucial for manufacturers to tailor their product development efforts and for investors to understand the fastest-growing niches. The market structure reflects the dichotomy between heavy-duty, high-payload requirements prevalent in traditional industrial settings, and the lightweight, quick-change demands emerging from collaborative and precision robotics applications.

The segment by actuation mechanism (pneumatic, electric, hydraulic) dictates the force and speed of the coupling process. Pneumatic systems currently dominate due to their simplicity and cost-effectiveness, suitable for standard material handling and welding applications. However, electric actuation is gaining traction, especially in precision environments where clean operation and finely controlled locking force are essential, aligning with the demands of electronics assembly and cleanroom applications. Furthermore, the segmentation by integrated media reflects the increasing complexity of robotic tasks, moving from basic electrical signal transfer to sophisticated integrations involving high-pressure fluids, fiber optics, and advanced high-speed industrial Ethernet connections.

Geographically, market segmentation highlights the strategic importance of APAC due to its massive electronics and automotive manufacturing base, leading the demand for high-volume tool changing systems. In contrast, North America and Europe show high demand for high-payload capacity systems necessary for aerospace and defense manufacturing, often requiring specialized features like automated compliance or force-sensing integration into the tool units. Understanding these segment behaviors is critical for accurate forecasting and strategic market penetration, indicating a clear trend towards highly integrated, sensor-equipped, and media-rich tool changer designs across all regions.

- By Payload Capacity:

- Low Payload (Under 10 kg) - Dominant in collaborative robotics and electronics.

- Medium Payload (10 kg - 100 kg) - Standard applications like plasma cutting, light welding, and material handling.

- High Payload (100 kg - 500 kg) - Heavy industrial applications, including spot welding, casting, and large component assembly.

- Very High Payload (Above 500 kg) - Specialized applications such as aerospace tooling and heavy machine tending.

- By Actuation Mechanism:

- Pneumatic - Most common due to reliability and cost.

- Electric - Growing rapidly for cleanroom and precision applications, offering high control.

- Hydraulic - Used primarily for extremely high clamping forces required in very high payload applications.

- By Integrated Media Type:

- Electrical Connections (Signal and Power) - Basic requirement.

- Fluid Connections (Air, Water, Vacuum) - Essential for dispensing and cooling tools.

- Data/Communication Lines (Ethernet, Fieldbus) - Crucial for smart factory integration and sensor data transmission.

- Specialized Media (Fiber Optics, High-Pressure Fluids) - Used in niche aerospace or medical applications.

- By Application:

- Welding (Spot Welding, Arc Welding) - Major historical application.

- Material Handling and Palletizing - High volume usage across logistics and manufacturing.

- Assembly and Fastening - Precision tasks in electronics and automotive.

- Dispensing and Gluing - Requires fluid connection integrity.

- Inspection and Measurement (Non-Contact and Contact) - Demands high repeatability.

- By End-Use Industry:

- Automotive - Largest consumer due to high automation demands.

- Electronics and Semiconductors - Driving demand for precision and low payload changers.

- Aerospace and Defense - Focus on high payload and specialized tooling.

- General Machinery and Manufacturing - Broad application base.

- Food and Beverage - Demand for hygienic and washdown-safe units.

Value Chain Analysis For Robot Tool Changers Market

The value chain for the Robot Tool Changers Market begins with upstream activities, focusing on the sourcing of high-precision raw materials, including specialized alloys (e.g., aircraft-grade aluminum, hardened steel) and robust sealing materials necessary to withstand harsh industrial environments and high cycle counts. Key upstream suppliers include component manufacturers specializing in complex mechanical locking mechanisms, industrial sensor arrays (force/torque sensors, proximity sensors), and robust electrical and fluid connectors. Quality assurance and certification of these components are paramount, as the reliability of the final product hinges entirely on the integrity of the purchased inputs. Strategic partnerships with specialized connector manufacturers are essential to integrate the latest high-speed communication standards seamlessly.

The midstream involves the core manufacturing process, encompassing design, precision machining, assembly, and rigorous testing of the master and tool units. Manufacturers of tool changers differentiate themselves through proprietary locking technologies that guarantee high repeatability and fail-safe operation. This stage involves significant R&D investment focused on minimizing weight, increasing coupling speed, and maximizing media transfer capacity within compact designs. Following manufacturing, products move through distribution channels, which are bifurcated into direct sales to large, established system integrators and indirect sales through specialized industrial automation distributors and local value-added resellers (VARs).

Downstream activities include system integration, installation, commissioning, and post-sales technical support. Direct sales channels are often favored for major OEMs (Original Equipment Manufacturers) or high-volume system integrators requiring customized solutions and intensive training. Indirect channels provide broader market coverage, reaching SMEs and geographically dispersed customers, where distributors offer local expertise in system setup and initial programming. The ultimate downstream segment involves end-users who require ongoing maintenance, calibration, and eventually, the replacement of components. The success of a tool changer product is heavily reliant on its ease of integration with diverse robot brands and the long-term reliability of its media connectors in demanding, multi-shift environments.

Robot Tool Changers Market Potential Customers

Potential customers for Robot Tool Changers are primarily end-users in advanced manufacturing sectors who seek to enhance the flexibility and productivity of their robotic assets. The largest segment of buyers consists of high-volume manufacturers, particularly in the automotive industry, where complex, multi-stage production lines require robots to switch rapidly between tasks such as spot welding, sealant application, and handling. These customers prioritize high repeatability, high payload capacity, and integrated media lines capable of handling pneumatic power and high-speed industrial data communication, often requiring robust, heavy-duty systems designed for continuous operation under severe stresses.

Another rapidly expanding customer base includes Small and Medium-sized Enterprises (SMEs) that are increasingly adopting collaborative robots (cobots). These buyers value ease of programming, quick setup, and lightweight, compact tool changers that integrate easily with lower-payload cobots. Their purchasing decisions are often influenced by the total cost of ownership (TCO) and the ability of the tool changer to enable rapid adaptation to shifting production demands, such as customized batch production or prototype manufacturing. The rise of automation in previously underserved sectors, such as food processing, pharmaceuticals, and logistics, also introduces new buyer profiles requiring tool changers with specific certifications for hygiene, washdown resistance, or cleanroom compatibility.

Furthermore, specialized system integrators (SIs) and automation consultants constitute a crucial layer of customers, as they purchase tool changers in bulk to integrate into turnkey automation cells for various end-users. These SIs act as technology gatekeepers, recommending and sourcing components based on client requirements. Their purchasing criteria are heavily skewed towards standardization, interoperability across different robot platforms (e.g., FANUC, ABB, KUKA), and the availability of comprehensive technical documentation and integration support, making them essential conduits for market penetration. Buyers in the defense and aerospace sectors represent high-value customers, requiring highly specialized tool changers certified for extreme precision and specific material handling requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 4.05 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ATI Industrial Automation, Schunk GmbH & Co. KG, Stäubli International AG, Applied Robotics Inc., Destaco (Dover Corporation), Zimmer Group, DEPRAG SCHULZ GMBH u. CO., ABB Ltd., FANUC Corporation, KUKA AG, Soft Robotics Inc., Trelleborg Group, Radisys Corporation, Nitta Corporation, Hirotec Corporation, Fortress Interlocks, Epsilon Tooling, Robotic Industries Association (RIA) members, JR Automation, QC Tooling. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Robot Tool Changers Market Key Technology Landscape

The technological landscape of the Robot Tool Changers Market is characterized by continuous innovation focused on enhancing reliability, connectivity, and intelligence. A critical area of development is the mastery of quick-disconnect technology for media ports. Modern tool changers utilize specialized contact materials and geometry to ensure that electrical power, signal lines, and high-pressure fluids can be reliably connected and disconnected millions of times without wear or degradation of signal quality. Advances in magnetic and pneumatic locking mechanisms are also prevalent, moving toward designs that offer inherent safety features, such as dual-locking systems or positive pressure monitoring, ensuring the tool cannot detach accidentally under load or during emergency stops.

The integration of advanced sensors represents another foundational technology. Contemporary tool changers are increasingly equipped with integrated proximity sensors and position feedback systems to confirm successful coupling before operation commences. More sophisticated models incorporate force and torque sensors within the master unit, allowing the robot controller to monitor the force applied during tool pickup and verify the integrity of the connection in real time. This sensor integration is crucial for maintaining process quality in high-precision tasks and is a prerequisite for advanced condition monitoring and predictive maintenance strategies, essential for maximizing operational uptime in fully automated facilities.

Furthermore, the shift towards Industry 4.0 necessitates advanced communication capabilities. Tool changers are evolving from simple mechanical/electrical devices into fully networked components. This involves integrating Fieldbus communication standards (like EtherCAT, Profinet, or Ethernet/IP) directly into the master unit, allowing the tool unit (carrying embedded sensors or specialized end effectors) to communicate directly with the central PLC or robot controller instantaneously. This enhanced communication capability supports the transmission of voluminous data necessary for sophisticated monitoring, self-diagnostics, and enabling tool memory, which stores calibration and usage data directly on the physical tool unit, simplifying setup and changeover in highly flexible manufacturing cells.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, propelled by high investment levels in manufacturing automation across China, Japan, and South Korea. China, driven by ambitious governmental goals for industrial modernization (Made in China 2025), is the epicenter of demand, particularly in the electronics and electric vehicle (EV) manufacturing sectors, demanding large volumes of low and medium-payload tool changers. Japan and South Korea focus heavily on high-precision and high-speed changers for semiconductor and advanced automotive component production. The region’s growth is sustained by low manufacturing overheads relative to Western nations, encouraging massive scale-up of robotic installations and, consequently, tool changer adoption.

- North America: North America represents a mature yet dynamic market, characterized by high demand for complex, high-payload tool changing solutions, particularly within the aerospace, defense, and heavy truck manufacturing industries. The US market emphasizes robust design and compliance with stringent quality and safety standards. There is a strong trend toward integrating advanced sensor technology (force sensing, vision systems) within the tool changer ecosystem to enable greater adaptive capability and autonomous task execution. Adoption is also surging in non-traditional sectors like pharmaceuticals and logistics automation, seeking versatile solutions to handle diverse packaging and material flow requirements.

- Europe: Europe maintains a strong position, driven primarily by Germany, Italy, and the Nordic countries, which are leaders in advanced engineering and automotive manufacturing. The European market is highly quality-conscious, prioritizing reliability, long operational lifespan, and adherence to European safety standards (CE certification). Growth is fueled by the widespread adoption of collaborative robots in the Mittelstand (SMEs), which requires easy-to-integrate, low-maintenance tool changers. European manufacturers are strong innovators in modular tool changer design and media connection integrity, focusing heavily on solutions that minimize environmental impact and maximize energy efficiency during operation.

- Latin America (LATAM): LATAM is an emerging market with moderate growth, centered predominantly in Mexico and Brazil, supported by the presence of large multinational automotive and consumer goods assembly plants. Demand is typically focused on cost-effective, medium-payload pneumatic tool changers for established material handling and basic welding applications. Market growth is constrained by fluctuating economic conditions but is expected to accelerate as foreign direct investment (FDI) in regional manufacturing facilities increases, necessitating greater automation efficiency and robotic flexibility to remain competitive globally.

- Middle East and Africa (MEA): The MEA market is small but poised for significant future growth, tied to regional industrial diversification efforts (e.g., Saudi Arabia’s Vision 2030). Current demand is focused on heavy-duty applications in the oil and gas sector (for inspection and maintenance) and infrastructure construction. Adoption is highly project-based, requiring robust, environmentally resistant tool changers capable of operating in challenging climate conditions. The market for general manufacturing automation is nascent but growing, particularly in technologically advanced hubs within the UAE and Israel.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Robot Tool Changers Market.- ATI Industrial Automation

- Schunk GmbH & Co. KG

- Stäubli International AG

- Applied Robotics Inc.

- Destaco (Dover Corporation)

- Zimmer Group

- DEPRAG SCHULZ GMBH u. CO.

- Nitta Corporation

- Radisys Corporation

- FANUC Corporation

- ABB Ltd.

- KUKA AG

- Soft Robotics Inc.

- Trelleborg Group

- Hirotec Corporation

- QC Tooling

- Robot System Products (RSP)

- Epsilon Tooling

- Weiss GmbH

- Apex Dynamics

Frequently Asked Questions

Analyze common user questions about the Robot Tool Changers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a robot tool changer in modern automation?

The primary function is to provide industrial robots with the capability to automatically exchange end-effectors, such as grippers, welders, or measurement probes. This maximizes the utilization of the robotic asset by enabling one robot to perform sequential, multi-task operations without manual intervention, thereby boosting production flexibility and minimizing downtime.

Which payload capacity segment is experiencing the fastest growth in the market?

The Low Payload segment (under 10 kg) is experiencing the fastest growth rate. This accelerated demand is directly attributed to the rapid proliferation of collaborative robots (cobots) across Small and Medium-sized Enterprises (SMEs) and in the electronics assembly sector, where lightweight, highly flexible tooling is critical for versatile operations.

How does the integration of Industry 4.0 technologies affect tool changer selection?

Industry 4.0 demands tool changers with advanced integrated media, specifically high-speed data connections (like industrial Ethernet) and embedded sensors. This allows the tool changer to communicate real-time status, enabling centralized monitoring, predictive maintenance, and seamless integration into interconnected smart manufacturing ecosystems.

What are the key differences between pneumatic and electric tool changer actuation?

Pneumatic actuation is prevalent due to its high speed, robust clamping force, and cost-effectiveness for standard industrial tasks. Electric actuation, conversely, provides higher precision control over the locking force, offers clean operation (no air residue), and is increasingly preferred for cleanroom applications, medical, and precision assembly environments.

Which geographical region dominates the demand for Robot Tool Changers?

The Asia Pacific (APAC) region currently dominates the demand landscape, driven primarily by massive investments in factory automation, particularly in China's automotive and electronics manufacturing bases, where there is immense pressure for high-volume, flexible production capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager