Robotic Cutting, Deburring and Finishing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433461 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Robotic Cutting, Deburring and Finishing Market Size

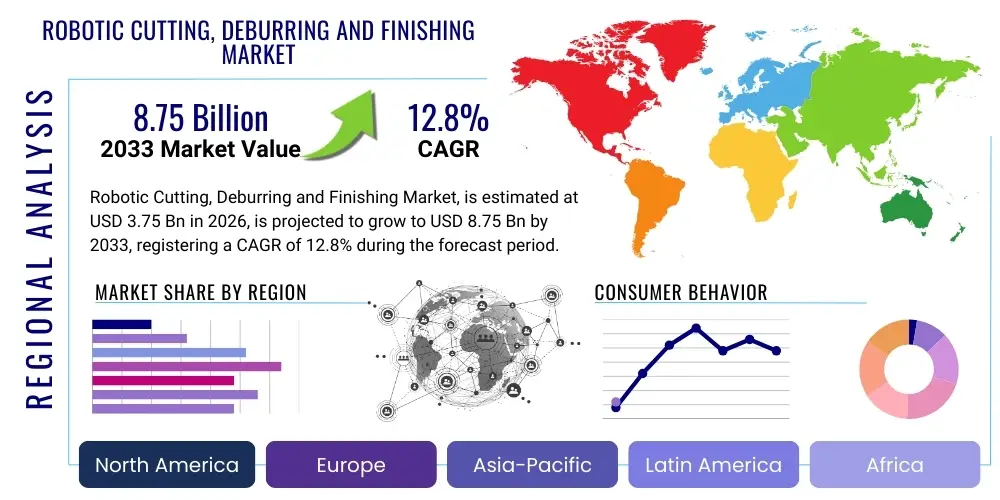

The Robotic Cutting, Deburring and Finishing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at $3.75 Billion in 2026 and is projected to reach $8.75 Billion by the end of the forecast period in 2033.

Robotic Cutting, Deburring and Finishing Market introduction

The Robotic Cutting, Deburring, and Finishing Market encompasses automated systems designed to execute highly precise material removal and surface refinement processes across various manufacturing sectors. These robotic solutions replace traditional manual labor in tasks involving cutting, which requires high dexterity and accuracy; deburring, which involves the removal of sharp edges or flash resulting from machining; and finishing, which includes processes like sanding, polishing, and grinding to achieve specific surface textures or aesthetics. The integration of advanced robotics ensures consistent quality, reduces cycle times, and significantly lowers operational costs, addressing critical needs for efficiency and precision in modern production environments.

The core products within this market include specialized robotic arms (articulated, SCARA, Cartesian) paired with sophisticated End-of-Arm Tooling (EOAT), such as high-speed spindles, laser cutters, abrasive belts, and specialized grippers. These systems are predominantly utilized in industries demanding stringent quality control, such as automotive, aerospace, medical devices, and electronics manufacturing. The versatility of these robots allows them to handle complex geometries and varied materials, including metals, composites, plastics, and ceramics, making them indispensable for high-volume, precision-dependent manufacturing.

Major applications driving the adoption include powertrain component finishing in the automotive industry, complex structural part deburring in aerospace, and intricate surface polishing for consumer electronics. Key benefits derived from robotic implementation are improved worker safety by removing personnel from hazardous environments, enhanced repeatability ensuring zero-defect production, and maximized throughput. The market's growth is fundamentally driven by the ongoing trend of industrial automation, escalating labor costs in developed economies, and continuous technological advancements in robot programming and sensor integration, enabling quicker deployment and easier task adaptation.

Robotic Cutting, Deburring and Finishing Market Executive Summary

The Robotic Cutting, Deburring, and Finishing Market is experiencing robust expansion driven by global manufacturing modernization efforts and the pervasive adoption of Industry 4.0 principles. Business trends indicate a clear shift towards flexible and adaptable robotic solutions, particularly collaborative robots (cobots), which lower the entry barrier for Small and Medium-sized Enterprises (SMEs) seeking automation. Strategic partnerships between robot manufacturers and specialized tooling suppliers are becoming crucial to offer integrated, turnkey solutions, focusing on sophisticated software that simplifies path planning and process optimization, moving beyond traditional teach-pendant programming to advanced simulation and machine learning interfaces. Investment in vision systems and haptic feedback technology is maximizing the precision capabilities of these systems, handling increasingly complex and variable input materials.

Regionally, the Asia Pacific (APAC) stands as the dominant market, propelled by rapid industrialization, high-volume production in electronics and automotive sectors, and substantial government investments in manufacturing automation, particularly in China, Japan, and South Korea. North America and Europe are characterized by high adoption rates of advanced, high-precision robotics, driven by the aerospace, medical device, and defense sectors, where quality assurance and material traceability are paramount. These regions prioritize sophisticated, high-cost systems that offer superior flexibility and integration capabilities within existing production lines, focusing on minimizing waste and maximizing material utilization efficiency to meet strict environmental and regulatory standards.

Segment trends highlight the strong growth of the finishing/polishing segment, fueled by the demand for impeccable aesthetics in consumer goods and critical surface requirements in medical implants. In terms of components, End-of-Arm Tooling (EOAT) and specialized software are showing the highest CAGR, reflecting the continuous need for customized solutions and intelligent process control that dictate the quality of the final product. The automotive industry remains the largest end-user due to the extensive need for repeatable cutting and finishing of engine blocks, chassis components, and body panels, although the aerospace sector is projected to exhibit the fastest growth owing to complex material handling requirements and strict deburring mandates for critical components like turbine blades.

AI Impact Analysis on Robotic Cutting, Deburring and Finishing Market

Common user questions regarding AI's influence in this market center around how machine learning can enhance precision and adaptability, whether AI reduces the complexity of programming for variable geometries, and the expected integration timeline for real-time defect detection and quality control. Users are keen to understand if AI can effectively compensate for material inconsistencies and tool wear automatically, thereby achieving unprecedented levels of process consistency. Key themes identified include the expectation of AI enabling true "lights-out" manufacturing by providing autonomous decision-making capabilities, significantly improving cycle time prediction, and optimizing abrasive material usage.

The implementation of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the capabilities and operational efficiency of robotic cutting, deburring, and finishing systems. AI algorithms are enabling robots to move beyond pre-programmed paths, allowing for real-time adaptive trajectory correction based on sensor input, which is critical when processing parts with high variability or casting inconsistencies. Furthermore, ML models analyze extensive historical performance data—including vibration levels, motor currents, and visual inspection data—to predict tool degradation, schedule proactive maintenance, and dynamically adjust process parameters (speed, pressure, angle) to ensure optimal surface quality, significantly reducing scrap rates and maximizing equipment uptime.

This predictive and adaptive capacity is crucial for sophisticated applications such as aerospace component finishing, where minor deviations can compromise structural integrity. AI-driven vision systems coupled with deep learning are now capable of rapid, non-contact inspection, immediately identifying minor surface defects and communicating corrective actions back to the robot controller instantaneously. This shift from purely reactive error correction to proactive process optimization based on intelligent data interpretation marks a major leap in automation performance, making robotic finishing viable for high-mix, low-volume production environments that previously relied exclusively on highly skilled manual labor.

- AI-driven path optimization: Enables robots to autonomously determine the most efficient trajectory for complex deburring and polishing tasks, reducing programming time from days to hours.

- Real-time adaptive process control: Machine learning algorithms adjust cutting speed, pressure, and orientation instantly to compensate for material variations, tool wear, and temperature changes.

- Predictive maintenance and tool life management: AI analyzes operational data to accurately forecast tooling failure, maximizing utilization and minimizing unscheduled downtime.

- Enhanced quality inspection: Deep learning vision systems identify micro-defects and measure surface roughness simultaneously, integrating quality checks directly into the manufacturing cycle.

- Simplified programming interface: AI reduces the need for expert programmers by generating complex motion paths automatically based on CAD models and desired finishing specifications.

DRO & Impact Forces Of Robotic Cutting, Deburring and Finishing Market

The market is primarily driven by the imperative for manufacturers worldwide to achieve higher precision, speed, and consistency, coupled with rising labor costs and a persistent skills gap in manual finishing roles. Restraints largely center on the significant initial capital expenditure required for sophisticated robotic cells and the technical complexity involved in integrating these systems into existing heterogeneous manufacturing environments. Opportunities are vast, driven by the emergence of smaller, more affordable collaborative robots tailored for finishing tasks and the adoption of advanced AI for enhanced flexibility. The overall market trajectory is significantly influenced by impact forces such such as stringent regulatory demands for product quality, rapid advancements in sensor technology, and the global adoption of networked industrial ecosystems (IoT).

Drivers include the accelerating demand for high-quality, zero-defect products, particularly in safety-critical sectors like medical devices and aerospace. Automation offers the only reliable pathway to achieve sub-micron tolerances consistently. The shift towards light weighting materials (composites, advanced alloys) necessitates specialized, highly controlled processes for cutting and deburring that are difficult or impossible to perform manually with requisite consistency. Furthermore, the global push towards sustainable manufacturing favors robotic solutions, as they optimize material usage and reduce waste compared to less controlled manual processes.

Restraints impeding faster growth involve the necessity for substantial customization for each unique application; a generic robot solution often fails to meet specific finishing requirements, demanding specialized EOAT and intricate programming. This customization increases lead times and implementation costs, making justification challenging for smaller batch runs or enterprises with constrained capital budgets. Additionally, the shortage of personnel skilled in robotics integration, programming, and maintenance acts as a significant limiting factor, particularly in developing economies striving to automate their manufacturing bases rapidly.

Opportunities are abundant through the continuous evolution of collaborative robotics, which are safer, easier to program, and offer a faster Return on Investment (ROI) for SMEs. The growth of cloud robotics and remote monitoring capabilities allows for centralized management and optimization of distributed robotic assets. Furthermore, the integration of non-traditional cutting methods, such as abrasive flow machining combined with robotics or advanced laser trimming techniques, opens up new market segments that require unparalleled process control and complex material handling capabilities.

Segmentation Analysis

The Robotic Cutting, Deburring, and Finishing Market is segmented based on the type of robotic task, the components utilized, the specific applications performed, and the key end-user industries served. This multi-dimensional segmentation provides a nuanced view of market dynamics, revealing specific high-growth areas. Segmentation by component is crucial, differentiating between the core robotic arm hardware, the critical End-of-Arm Tooling (EOAT) that defines the robot's capability, and the advanced software and control systems that enable complex operations and adaptive processing. Analyzing end-user segments allows manufacturers to tailor solutions for specific industry standards, such as AS9100 for aerospace or ISO 13485 for medical devices, which significantly influence design and validation requirements.

The classification by Type highlights the distinction between dedicated cutting robots (e.g., laser, waterjet), deburring robots focused on edge refinement, and finishing robots designed for surface treatment (e.g., polishing, sanding). While many installations perform integrated functions, the underlying technological requirements often differ significantly—cutting demands high speed and power density, whereas finishing requires exceptional sensitivity and force control. Geographic segmentation demonstrates that while high-volume cutting remains dominant in APAC (driven by automotive and general manufacturing), the demand for high-precision finishing is more concentrated in North America and Europe, driven by aerospace and precision medical components.

Detailed segmentation analysis is critical for strategic planning, revealing that the demand for specialized End-of-Arm Tooling, including compliance devices and force/torque sensors, is growing faster than the robotic arms themselves, indicating a mature market focusing on optimization and highly specialized task execution rather than simple hardware acquisition. The automotive industry maintains the largest market share due to sheer volume and the repetitive nature of its tasks, yet the medical device and aerospace sectors offer the highest profitability due to the critical nature and high value of the finished components, requiring the most advanced, sensitive, and validated robotic systems available.

- By Type

- Cutting Robots (Laser, Plasma, Waterjet, Mechanical)

- Deburring Robots (Brushing, Filing, Grinding)

- Finishing/Polishing Robots (Sanding, Buffing, Grinding, Lapping)

- By Component

- Robotic Arms (Articulated, SCARA, Cartesian, Collaborative)

- End-of-Arm Tooling (EOAT) (Spindles, Brushes, Grippers, Force Sensors, Compliance Devices)

- Controllers and Software (Programming Software, Simulation Tools, Vision Software)

- Sensors and Vision Systems (2D/3D Vision, Force/Torque Sensors)

- By Application

- Milling and Machining

- Precision Grinding and Sanding

- Polishing and Buffing

- Laser and Waterjet Trimming

- High-Pressure Deburring

- By End-User Industry

- Automotive and Transportation

- Aerospace and Defense

- Electronics and Consumer Goods

- Medical Devices and Pharmaceuticals

- Heavy Machinery and Construction

- General Manufacturing

Value Chain Analysis For Robotic Cutting, Deburring and Finishing Market

The value chain for the Robotic Cutting, Deburring, and Finishing Market begins with upstream suppliers providing critical raw materials and highly specialized components, primarily high-performance motors, precision bearings, advanced sensors, and complex control electronics. These components are then integrated by core robot manufacturers (Tier 1 suppliers like FANUC and ABB) who focus on producing the robust robotic arm hardware and fundamental operating systems. A critical intermediate step involves specialized End-of-Arm Tooling (EOAT) providers who engineer custom spindles, force sensors, and compliant mechanisms necessary for the specific cutting or finishing task, often working in close partnership with system integrators.

The downstream segment of the value chain is dominated by highly skilled system integrators who customize the robotic solution for the end-user's specific application, integrating the hardware, programming the complex motion paths, and ensuring seamless communication with existing production equipment. Distribution channels are bifurcated, relying heavily on direct sales for large, complex enterprise projects (such as new automotive assembly lines) where manufacturers maintain control over installation and service, and indirect sales via authorized distributors or value-added resellers (VARs) for smaller, localized, or standardized applications, particularly collaborative robot solutions sold to SMEs.

This structure ensures that highly technical support and customized engineering services are available close to the customer. Direct channels allow for tighter feedback loops between the end-user and the robot manufacturer, accelerating product improvements. Indirect channels, primarily through specialized automation integrators, leverage local expertise and provide rapid deployment, especially crucial for post-sales support and maintenance. The ability to provide comprehensive training and ongoing maintenance services is a key competitive differentiator across both direct and indirect distribution strategies.

Robotic Cutting, Deburring and Finishing Market Potential Customers

The potential customer base for robotic cutting, deburring, and finishing solutions spans a wide range of industries unified by the need for high-precision material processing and surface quality control. Primary buyers are large, multinational manufacturers in the automotive and aerospace sectors, focusing on high-volume production of geometrically complex components requiring strict finishing tolerances, such as engine blocks, turbine blades, and structural frames. These enterprises invest heavily in automation to ensure product consistency, meet stringent safety standards, and counteract rising global manufacturing competition, utilizing robots for 24/7 operations in high-throughput environments.

A rapidly expanding segment of buyers includes manufacturers of high-end consumer electronics and medical devices. In electronics, robots are essential for the cosmetic finishing of casings and the intricate cutting of delicate materials. For medical devices, applications involve the mirror-like polishing of orthopedic implants and the precise deburring of surgical instruments, tasks where quality deviation is zero-tolerance and manual processes introduce contamination risk. These customers prioritize validation, repeatability, and compliance with regulatory bodies like the FDA and European Commission, making advanced software traceability and control systems mandatory requirements.

Furthermore, SMEs across general manufacturing, particularly job shops involved in custom machining, are emerging as significant potential customers, primarily adopting collaborative robotic solutions. These smaller firms are motivated by reducing reliance on scarce skilled manual labor and increasing operational flexibility to handle high-mix production orders. While initial costs remain a barrier, the improved affordability and ease of use of cobots, coupled with flexible financing options, are making high-quality finishing and deburring automation accessible to a broader base of industrial producers seeking to modernize their operations and improve competitive positioning.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.75 Billion |

| Market Forecast in 2033 | $8.75 Billion |

| Growth Rate | CAGR 12.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, KUKA, FANUC Corporation, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Mitsubishi Electric Corporation, Staubli International AG, Comau, Sepro Group, Universal Robots (Teradyne), Rethink Robotics, Genesis Systems, Apex Automation, Fastems, Electro-Nite, ARGO-HYTOS, ATI Industrial Automation, Applied Robotics, Techniweld, Nachi-Fujikoshi |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Robotic Cutting, Deburring and Finishing Market Key Technology Landscape

The technology landscape of the Robotic Cutting, Deburring, and Finishing Market is defined by the convergence of advanced mechanical systems with sophisticated software and sensor technologies. A fundamental technological pillar is the evolution of End-of-Arm Tooling (EOAT), which now incorporates compliance devices, such as pneumatic or spring-loaded buffers, that allow the tool to maintain consistent contact force against complex, irregular surfaces, mimicking the dexterity of human hands. High-speed, high-frequency spindles and specialized abrasive tools made from diamond or ceramic materials are also crucial, enabling rapid material removal while preserving surface integrity, essential for applications like turbine blade polishing or orthopedic implant finishing.

Another critical area of innovation is the proliferation of high-resolution 3D vision systems and force/torque sensors. 3D vision allows robots to accurately locate and recognize irregularly shaped parts, compensating for placement errors, while force sensors provide real-time feedback on the interaction between the tool and the workpiece. This sensory input is processed by advanced robotic controllers utilizing dedicated processing power, enabling complex, adaptive control algorithms that adjust trajectory and speed dynamically, ensuring uniform material removal and eliminating common defects such as chatter marks or over-grinding, which are typical challenges in manual processes.

Furthermore, the development of specialized simulation and offline programming software is a cornerstone of market growth. These software suites allow manufacturers to create and test complex robot paths virtually, minimizing physical setup time and reducing potential damage to expensive tooling or workpieces. Features such as automatic path generation based on CAD data, collision detection, and digital twinning capabilities significantly accelerate deployment and optimization cycles. The increasing integration of these systems with cloud computing facilitates data logging, remote diagnostics, and continuous process improvement using globally aggregated performance data, aligning perfectly with the principles of Industry 4.0.

Regional Highlights

The global market for Robotic Cutting, Deburring, and Finishing solutions exhibits distinct geographical growth patterns driven by regional manufacturing concentration and technological maturity. Asia Pacific (APAC) dominates the market in terms of installed base and volume, primarily fueled by the sheer scale of the automotive, electronics, and general manufacturing industries in China, Japan, and South Korea. Rapid industrial modernization, favorable government initiatives promoting factory automation, and a strong emphasis on reducing dependence on manual labor contribute to APAC's leadership. The region sees significant demand for both high-throughput cutting applications (like stamping and trim lines) and high-volume component polishing in the consumer electronics supply chain.

North America holds a substantial market share and is characterized by its high adoption of sophisticated, high-value robotics, particularly within the aerospace and defense and medical device sectors. These industries prioritize extreme precision, traceability, and compliance with stringent quality standards, necessitating advanced sensor integration, proprietary software, and custom EOAT. Innovation in this region is focused heavily on collaborative robotics and the integration of AI/ML for complex task execution, driven by high labor costs and the need to maintain a technological edge in specialized manufacturing processes.

Europe represents a mature market with high penetration rates, concentrating on maintaining manufacturing competitiveness through efficiency and quality. Germany, Italy, and France are key contributors, driven by the premium automotive sector and precision engineering. The European market places a strong emphasis on sustainability and energy efficiency, favoring highly optimized robotic solutions that minimize material waste and energy consumption. Regulatory frameworks, such as CE marking requirements, further necessitate robust, well-documented automated processes, enhancing the demand for advanced robotic finishing systems that ensure repeatable compliance and consistent output quality.

- Asia Pacific (APAC): Highest volume market due to extensive automotive and electronics manufacturing bases in China, Japan, and South Korea; fast growth driven by government-backed automation mandates and high throughput demand.

- North America: Leader in high-value, high-precision applications, particularly aerospace and medical devices; strong focus on R&D in collaborative robotics, AI integration, and advanced sensor technology to combat high operational costs.

- Europe: Mature market focused on precision engineering, premium automotive finishing, and adherence to strict regulatory standards; emphasizing efficiency, sustainability, and quality control systems.

- Latin America (LATAM): Emerging growth market, largely driven by foreign direct investment in the automotive assembly sector in Mexico and Brazil; adoption is focused on proven, cost-effective industrial robots for standardized tasks.

- Middle East and Africa (MEA): Smallest market share but growing due to diversification away from oil dependence, especially in infrastructure and defense manufacturing projects; investment focused on new, greenfield factory deployments incorporating modern automation from the outset.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Robotic Cutting, Deburring and Finishing Market.- ABB

- KUKA AG (A subsidiary of Midea Group)

- FANUC Corporation

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- Staubli International AG

- Comau S.p.A.

- Sepro Group

- Universal Robots (A subsidiary of Teradyne Inc.)

- Rethink Robotics (A division of HAHN Group)

- Genesis Systems (A subsidiary of IPG Photonics)

- Apex Automation Technologies

- Fastems Oy Ab

- Electro-Nite International N.V. (A subsidiary of Xior Student Housing NV)

- ARGO-HYTOS (A member of the Voith Group)

- ATI Industrial Automation

- Applied Robotics, Inc.

- Techniweld USA

- Nachi-Fujikoshi Corp.

Frequently Asked Questions

Analyze common user questions about the Robotic Cutting, Deburring and Finishing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the adoption of robotic finishing systems?

The primary driver is the need for consistent, high-precision surface quality demanded by industries like aerospace and medical devices, coupled with rising labor costs and the shortage of skilled personnel capable of performing complex manual finishing tasks consistently.

How does AI technology specifically enhance robotic deburring processes?

AI enhances deburring by enabling real-time adaptive process control. Machine learning algorithms analyze sensor data (force, vision) to adjust the robot's trajectory and tool pressure instantaneously, compensating for material variations and ensuring uniform edge removal across irregularly shaped components.

Which industry segment holds the largest market share for these robotic solutions?

The Automotive and Transportation industry holds the largest market share, driven by high-volume production requirements for powertrain components, body panels, and chassis parts that require rigorous cutting, grinding, and polishing for functional and cosmetic purposes.

What are the main financial barriers to entry for Small and Medium-sized Enterprises (SMEs)?

The main barriers include the high initial capital investment required for specialized robotic cells and tooling, the complexity of system integration, and the associated costs of specialized programming and maintenance training required for successful deployment.

What is the projected Compound Annual Growth Rate (CAGR) for the Robotic Cutting, Deburring, and Finishing Market?

The market is projected to grow at a robust CAGR of 12.8% during the forecast period from 2026 to 2033, driven by accelerated industrial automation trends globally and continuous technological advancements in robot flexibility and sensor technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager