Robotic Polishing Machine Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432581 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Robotic Polishing Machine Sales Market Size

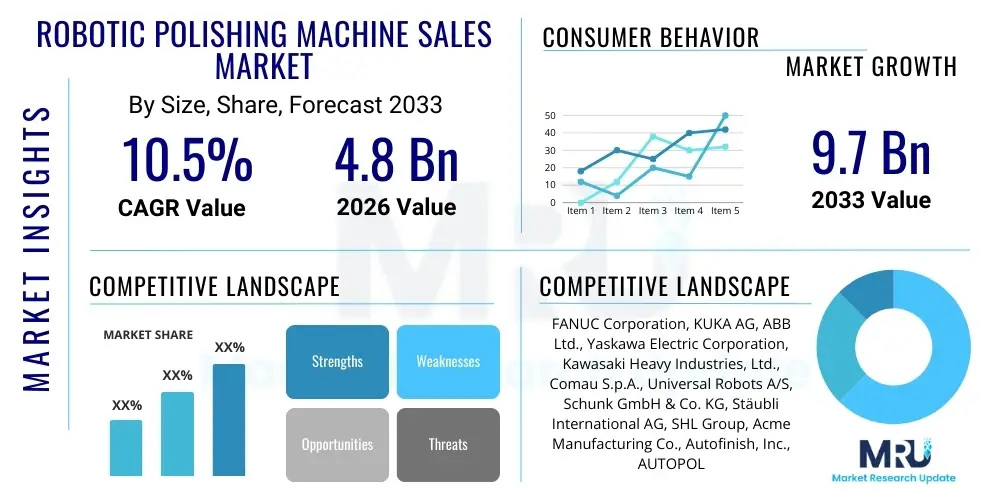

The Robotic Polishing Machine Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.7 Billion by the end of the forecast period in 2033.

Robotic Polishing Machine Sales Market introduction

The Robotic Polishing Machine Sales Market encompasses the manufacturing and distribution of automated systems designed to perform surface finishing operations, including buffing, grinding, and polishing, across various industrial sectors. These machines utilize advanced robotic arms, end-effectors, and sophisticated software control to achieve high-precision, repeatable surface quality, surpassing the limitations inherent in traditional manual polishing processes. The primary objective is to enhance aesthetic quality, improve functional performance by reducing friction, and prepare surfaces for subsequent treatments like coating or plating, all while minimizing human error and associated labor costs.

Major applications of these robotic systems span critical industries, predominantly automotive manufacturing for body panels and interior components, electronics for casing finishing and substrate preparation, and aerospace for turbine blade maintenance and structural component polishing. Key benefits derived from adopting robotic polishing technology include consistently superior surface finish quality, significant increases in throughput due to continuous operation capabilities, improved worker safety by removing personnel from hazardous material handling environments, and substantial long-term operational cost reductions. The integration of force control sensors and vision systems further enhances the adaptability of these robots to handle complex geometries and material variations effectively.

The driving factors propelling this market growth are manifold, centered around the global push for higher product quality standards, the increasing complexity of materials requiring specialized surface treatment, and persistent labor shortages in skilled manufacturing roles globally. Furthermore, the diminishing cost of robotic hardware coupled with advancements in programming and simulation software has lowered the barrier to entry for small and medium-sized enterprises (SMEs). This technological maturation ensures that robotic polishing machines are not just productivity tools but essential elements for achieving competitive manufacturing excellence in high-volume and high-precision segments.

Robotic Polishing Machine Sales Market Executive Summary

The global Robotic Polishing Machine Sales Market is experiencing robust growth, primarily fueled by the accelerating adoption of automation technologies across the manufacturing value chain, particularly in sectors demanding stringent surface finish tolerances like automotive, 3C electronics, and medical devices. Business trends indicate a strong focus on developing collaborative robot (cobot) solutions and highly flexible, modular systems that allow manufacturers to rapidly retool for varying product lines. Investment in software intelligence, specifically incorporating machine vision and adaptive process control, is defining the competitive landscape, shifting the emphasis from sheer robot speed to precision and versatility. Furthermore, major market players are increasingly offering Robotic-as-a-Service (RaaS) models to reduce the initial capital expenditure barrier for smaller firms, broadening market accessibility.

Regional trends reveal Asia Pacific (APAC) as the dominant and fastest-growing market, driven by massive investments in high-tech manufacturing, particularly in China, South Korea, and Japan, which serve as global hubs for electronics and automotive production. North America and Europe maintain significant market shares, characterized by demand for high-end, customized robotic solutions focused on complex aerospace and medical applications where traceability and certified quality are paramount. These mature markets are also spearheading the integration of Industry 4.0 principles, leveraging robotic polishing data for predictive maintenance and overall process optimization. Emerging markets in Latin America and MEA are showing promising adoption rates, primarily in metal fabrication and consumer goods manufacturing seeking efficiency gains.

Segmentation trends highlight the increasing prominence of articulated robots due to their high degree of freedom and suitability for handling complex 3D surfaces found in consumer products and vehicle bodies. In terms of end-use, the automotive industry remains the largest segment, but the electronics sector is demonstrating the highest CAGR, propelled by the relentless demand for flawless finishes on smartphone casings, wearable devices, and display panels. The transition towards fully automatic systems, which require minimal human intervention after initial setup, is gaining traction over semi-automatic solutions, reflecting the industry's commitment to maximizing autonomy and minimizing operational variability. This comprehensive shift underscores the market's evolution towards smarter, more integrated, and application-specific polishing solutions.

AI Impact Analysis on Robotic Polishing Machine Sales Market

User inquiries regarding AI's influence on the Robotic Polishing Machine Sales Market frequently center on concerns about process unpredictability, the difficulty of automating subjective quality checks, and the substantial computational resources required for real-time adaptation. Common questions ask how Artificial Intelligence (AI) and Machine Learning (ML) can reliably handle variations in material hardness, geometric deviations, and tool wear without manual recalibration. Users are specifically keen on understanding how AI facilitates non-contact measurement, automated defect identification (ADI), and the generation of optimal polishing paths that minimize cycle time while maximizing surface uniformity across batches. The consensus expectation is that AI integration will transform robotic polishing from a programmed, fixed sequence into an intelligent, responsive, and self-optimizing manufacturing process.

The fundamental impact of AI lies in enhancing the cognitive capabilities of robotic systems, moving beyond simple programmed movements to true adaptive surface finishing. AI algorithms are trained on vast datasets of successful polishing parameters, surface inspection results, and material response profiles, allowing the robot to dynamically adjust polishing force, velocity, and trajectory in milliseconds. This real-time adaptation ensures consistent quality, especially vital when dealing with materials exhibiting slight structural inconsistencies or when minor fixture errors occur. Furthermore, AI-driven predictive maintenance monitors the acoustic and vibration signature of the end-effector, anticipating abrasive replacement or motor wear, thereby significantly reducing unplanned downtime and improving overall equipment effectiveness (OEE).

Moreover, AI is revolutionizing the pre-processing and post-processing stages. In pre-processing, generative algorithms can automatically analyze complex CAD models and environmental constraints to simulate and generate the most efficient tool path sequences, drastically reducing the programming time typically required by skilled technicians. In post-processing, deep learning-based vision systems replace manual visual inspection, identifying minute defects like pinholes, orange peel texture, or hazing with superhuman consistency and speed. This closed-loop quality control system ensures that every polished part meets strict standards before moving to the next manufacturing stage, directly contributing to higher yield rates and reduced scrap material. This smart automation capability makes AI integration a mandatory consideration for high-value polishing applications.

- AI enables adaptive force and speed control based on real-time surface feedback and material characteristics.

- Machine Learning algorithms optimize tool path generation, minimizing cycle time and maximizing surface coverage efficiency.

- Deep Learning-based vision systems facilitate Automated Defect Identification (ADI) for non-contact quality assurance.

- Predictive maintenance schedules for polishing tools and robot hardware are generated using AI monitoring of operational data.

- AI shortens the commissioning phase by rapidly simulating and validating optimal process parameters for new product geometries.

DRO & Impact Forces Of Robotic Polishing Machine Sales Market

The market for robotic polishing machines is shaped by a powerful confluence of driving forces stemming from industrial necessity and technological maturity, counterbalanced by significant operational and investment restraints, leading to strategic opportunities for market expansion. The core drivers include the urgent need for labor cost reduction and addressing the scarcity of skilled manual polishers, coupled with the escalating demand across industries for ultra-smooth, high-specification surfaces that only robotic precision can reliably deliver. However, the high initial capital expenditure (CAPEX) for sophisticated multi-axis systems and the complexity associated with integrating these robots into existing legacy manufacturing lines act as primary restraints. The potential exists in the form of collaborative robot (cobot) technology, which offers lower upfront costs and easier deployment, enabling SMEs to access automation, alongside geographic opportunities in rapidly industrializing regions where new factory construction allows for greenfield automation implementations.

Impact forces currently influencing the market dynamics are heavily tilted towards technological adoption and global economic shifts. The increasing globalization of supply chains mandates standardized, reproducible quality, which robots guarantee, forcing manufacturers to upgrade their polishing processes to remain competitive internationally. The acceleration of Industry 4.0 paradigms, emphasizing connectivity, data exchange, and cyber-physical systems, pushes manufacturers toward fully automated solutions that generate performance data for continuous improvement. Regulatory demands, particularly in medical device and aerospace manufacturing, require impeccable surface quality documentation and traceability, a task uniquely suited for automated, data-logging robotic systems. Furthermore, the sustained technological advancement in sensor technology, specifically high-resolution 3D scanning and dynamic force feedback, continuously mitigates technical restraints, making robotic polishing more versatile and capable of handling previously impossible tasks.

The interplay of these forces dictates market trajectory. While restraints related to complex programming and integration challenges persist, leading vendors are investing heavily in user-friendly graphical programming interfaces and offline simulation software, easing the implementation barrier. The rising cost of manual labor globally acts as a perpetual driver, ensuring that the return on investment (ROI) for robotic systems shortens significantly over time. The primary opportunity lies in developing highly modular and adaptable polishing work cells that can be quickly repurposed for different products, addressing the volatility and personalization trends observed in consumer markets. Consequently, market participants are focused on delivering holistic solutions that include the robot, the end-effector, the abrasive materials, and the requisite software intelligence, rather than just selling the hardware components.

Segmentation Analysis

The Robotic Polishing Machine Sales Market is comprehensively segmented based on the critical characteristics that define system functionality, material handling capability, and industrial application, providing a granular view of market demand and technology adoption patterns. Key segmentation criteria include the type of robot architecture utilized (e.g., articulated, SCARA, Cartesian), the degree of automation achieved (fully automatic versus semi-automatic), the material being processed (metal, plastic, composite), and the specific end-use industry where the robot is deployed (automotive, electronics, medical). This multifaceted segmentation enables vendors to tailor solutions precisely to the demanding requirements of various sectors, optimizing performance and cost-effectiveness for specific tasks, such as high-volume automotive clear-coat polishing or intricate micro-polishing of medical implants.

The analysis of these segments reveals distinct trends. Articulated robots dominate the market share due to their superior reach, flexibility, and payload capacity, making them ideal for large components like automobile bodies and aerospace parts. However, the SCARA and Cartesian segments are seeing increased demand in 3C electronics manufacturing where speed and precision in a planar environment are critical for small components like smartphone chassis. From an operational perspective, the transition towards fully automatic systems reflects the industry’s pursuit of minimal operational variability and maximum lights-out manufacturing capability, reducing reliance on constant human supervision and intervention. Material-wise, the processing of complex metal alloys and composites, especially in aerospace and defense, is a high-growth niche segment requiring specialized force control algorithms and non-contact inspection methods.

Geographically, market growth is highly uneven, with dense clusters of demand driven by specific regional industry strengths. For instance, the APAC region exhibits peak demand for robotic polishing in the electronics sector due to its concentration of high-volume electronics manufacturers, while North America and Europe show sustained investment in systems capable of handling specialized, small-batch, high-value components for the medical and aerospace industries. Understanding these segment-specific growth vectors is crucial for strategic market positioning, enabling companies to prioritize R&D efforts on crucial areas such as the development of lightweight, highly sensitive end-effectors for polishing delicate plastic components or robust, high-payload manipulators for heavy industrial metal finishing.

- Type:

- Articulated Robots

- SCARA Robots

- Cartesian Robots

- Collaborative Robots (Cobots)

- End-Use Industry:

- Automotive

- 3C Electronics (Computers, Communication, Consumer Electronics)

- Aerospace and Defense

- Medical Devices

- General Industrial (Metal Fabrication, Woodworking)

- Operation Mode:

- Fully Automatic

- Semi-Automatic

- Material Polished:

- Metals

- Plastics and Composites

- Ceramics and Glass

Value Chain Analysis For Robotic Polishing Machine Sales Market

The value chain for the Robotic Polishing Machine Sales Market is complex, involving several distinct stages from core component manufacturing to final system integration and post-sales service, each contributing significantly to the final product value. The upstream segment involves critical suppliers of high-precision components, including robot arm manufacturers (often specializing in multi-axis movement), sensor providers (for force control and vision), and advanced materials suppliers (for specialized abrasives and polishing tools). The efficiency and innovation in this upstream segment—particularly regarding the miniaturization and improved sensitivity of force-torque sensors and the longevity of specialized polishing media—directly impact the capability and cost structure of the final robotic system. Strategic partnerships between robotic manufacturers and advanced sensor developers are essential for maintaining technological superiority.

The central segment of the value chain is dominated by system integrators and original equipment manufacturers (OEMs). These entities are responsible for designing the complete polishing cell, which includes selecting the appropriate robot, designing and manufacturing the custom end-effector (polishing head), developing the necessary programming logic, and integrating the safety systems. Distribution channels are typically bifurcated: direct sales are utilized for large, customized, and high-value projects, especially with major automotive or aerospace clients who require specific post-installation support and training. Indirect channels, involving third-party distributors and regional value-added resellers (VARs), are crucial for reaching small and medium-sized enterprises (SMEs) and standardizing the deployment process in geographically fragmented markets.

The downstream segment focuses heavily on installation, calibration, and long-term servicing, which represents a continuous revenue stream and a vital source of competitive differentiation. Post-sales service includes supplying consumables (abrasives, pads), providing maintenance contracts, and offering software updates and performance optimization services. This final stage is crucial for ensuring high overall equipment effectiveness (OEE) and maximizing the return on investment for the end-user. The success of a robotic polishing machine sale often hinges on the quality of the downstream support, emphasizing the shift in focus from product sales to comprehensive service provision. Furthermore, the feedback loop from downstream users—regarding tool wear rates and surface finish quality variations—is invaluable for informing upstream component design and material selection, ensuring continuous product improvement.

Robotic Polishing Machine Sales Market Potential Customers

The primary customers for Robotic Polishing Machines are industrial manufacturers and specialized finishing service providers operating in sectors where surface quality, precision, and production throughput are non-negotiable competitive advantages. The largest end-user group resides within the automotive industry, encompassing both original equipment manufacturers (OEMs) and Tier 1 suppliers, who utilize these machines for polishing vehicle bodies, engine components, transmission parts, and high-end interior surfaces to achieve perfect aesthetic and functional finishes. The automotive segment demands high-payload, high-speed articulated robots capable of working with large, complex geometric surfaces repeatedly and reliably under high-volume conditions.

Another rapidly expanding customer base is the 3C (Computers, Communication, Consumer Electronics) electronics sector. Companies manufacturing smartphones, tablets, laptops, and smart wearables are crucial buyers, requiring robotic solutions capable of micro-polishing extremely delicate materials like specialized plastics, aluminum alloys, and glass to achieve flawless, scratch-free aesthetic finishes necessary for premium branding. This segment often prioritizes SCARA and collaborative robots due to space constraints and the need for precision polishing of smaller, intricately shaped components. Furthermore, the stringent quality requirements for medical devices—specifically prosthetic joints, surgical instruments, and implants—make medical device manufacturers key niche customers, valuing traceability and the capability to achieve mirror finishes necessary for biocompatibility and reduced friction.

Beyond these core sectors, potential customers include aerospace and defense contractors requiring robotic systems for polishing turbine blades, structural components, and aerodynamic surfaces where finish quality directly affects performance and safety. General industrial sectors, such as mold and die makers, specialized metal fabricators, and luxury goods manufacturers (e.g., jewelry, watches), also represent a significant customer group. These users seek robotic systems not only to improve consistency and reduce labor costs but also to handle materials that are toxic or hazardous for human operators, reinforcing the value proposition across a diverse industrial landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.7 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FANUC Corporation, KUKA AG, ABB Ltd., Yaskawa Electric Corporation, Kawasaki Heavy Industries, Ltd., Comau S.p.A., Universal Robots A/S, Schunk GmbH & Co. KG, Stäubli International AG, SHL Group, Acme Manufacturing Co., Autofinish, Inc., AUTOPOL, Wenzhou Kingstone, CIXI DONGGUAN |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Robotic Polishing Machine Sales Market Key Technology Landscape

The technological landscape of the Robotic Polishing Machine Sales Market is characterized by a drive towards enhanced sensorial feedback, intelligent path planning, and highly specialized end-effector design, enabling robots to mimic the dexterity and responsiveness of highly skilled human operators. A critical technology is the deployment of high-resolution force-torque sensors integrated directly into the robot wrist. These sensors provide instantaneous feedback on the pressure exerted by the polishing tool on the workpiece surface, allowing the robot controller to dynamically adjust trajectories and force to maintain consistent material removal rates. This force control is essential for polishing complex, contoured surfaces and varying material thicknesses, preventing over-grinding or incomplete finishing, particularly important in aerospace and medical applications where tolerances are extremely tight.

Advanced machine vision and non-contact metrology systems constitute another foundational technology. Structured light scanners and laser profile systems are increasingly used for pre-polishing inspection to accurately map the surface topography and identify initial defects or geometric deviations. This data feeds into the robotic path planning software, which utilizes AI and optimization algorithms (e.g., machine learning reinforcement) to generate an adaptive tool path, ensuring comprehensive and efficient coverage while avoiding unnecessary motion. Post-polishing, high-speed camera systems combined with deep learning algorithms are employed for Automated Defect Inspection (ADI), replacing subjective human inspection with objective, quantitative quality assessment, a significant advancement in quality assurance protocols.

Furthermore, the evolution of end-effector technology is crucial. Specialized polishing tools now incorporate features such as active compliance mechanisms, allowing the tool itself to absorb minor robot positioning errors or surface irregularities, ensuring a smoother finish. The rise of collaborative robots (cobots) is also intrinsically linked to safety technologies, including sophisticated collision detection and force limitation features, enabling human workers to safely interact with polishing systems in shared workspaces. Software innovations, including offline programming platforms and digital twin simulation environments, allow manufacturers to validate polishing processes virtually, reducing physical prototyping cycles and accelerating the deployment of new robotic polishing applications, thereby significantly cutting down time-to-market for complex components.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market due to the concentration of global manufacturing hubs, particularly in electronics (China, South Korea) and automotive (Japan, India). Government initiatives promoting industrial automation (e.g., "Made in China 2025") and robust infrastructure investments are driving the high-volume adoption of robotic systems for mass production, especially for consumer goods requiring high-gloss aesthetic finishes.

- North America: This region is characterized by high demand for specialized, high-precision robotic polishing solutions, particularly within the aerospace and medical device sectors. The market focuses on advanced capabilities, including systems for handling superalloys and achieving sterile, mirror finishes on implants, prioritizing system reliability, integration with quality management systems, and compliance with stringent regulatory standards.

- Europe: Europe holds a mature market share driven by advanced automotive manufacturing (Germany, France) and luxury goods production. The region is a leader in adopting collaborative robot technology for polishing tasks and emphasizing energy efficiency and sustainable manufacturing practices. Demand is strong for flexible systems capable of handling smaller batch sizes and complex design geometries typical of high-end manufacturing.

- Latin America (LATAM): The LATAM market is emerging, with adoption primarily focused on metal processing, general fabrication, and automotive assembly in key countries like Brazil and Mexico. Growth is driven by manufacturers seeking to modernize operations and reduce manual labor dependence to compete with global pricing, often preferring cost-effective, easily programmable robotic solutions.

- Middle East and Africa (MEA): Adoption in MEA is concentrated in the energy, petrochemical, and expanding general manufacturing sectors, particularly in the UAE and Saudi Arabia. The market potential lies in infrastructure projects and diversification efforts away from oil, necessitating investment in automated finishing solutions for large structural components and machinery parts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Robotic Polishing Machine Sales Market.- FANUC Corporation

- KUKA AG

- ABB Ltd.

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- Comau S.p.A.

- Universal Robots A/S

- Schunk GmbH & Co. KG

- Stäubli International AG

- SHL Group

- Acme Manufacturing Co.

- Autofinish, Inc.

- AUTOPOL

- Wenzhou Kingstone

- CIXI DONGGUAN

- AETOS Robot Co., Ltd.

- 3M Company (Abrasives and End-Effectors)

- GÜDEL Group

- Daihen Corporation

- Genesis Systems Group

Frequently Asked Questions

Analyze common user questions about the Robotic Polishing Machine Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Robotic Polishing Machine Sales Market?

The market is projected to grow at a strong Compound Annual Growth Rate (CAGR) of 10.5% between the forecast period of 2026 and 2033, driven primarily by automation demands in the automotive and electronics sectors.

Which specific technology provides adaptive control for complex surface polishing?

High-resolution force-torque sensing technology combined with AI-driven path planning algorithms provides the necessary adaptive control, allowing robots to dynamically adjust pressure and trajectory to maintain uniform surface quality on complex geometries.

Which end-use industry holds the largest market share for robotic polishing machines?

The Automotive industry currently holds the largest market share, utilizing robotic polishing for high-volume finishing of body panels, interior components, and functional parts to meet aesthetic and quality standards.

What are the primary restraints hindering the widespread adoption of these robotic systems by SMEs?

The primary restraints are the high initial Capital Expenditure (CAPEX) required for sophisticated multi-axis systems and the necessary investment in specialized programming and integration expertise. Collaborative robots (cobots) are addressing this barrier.

How is Artificial Intelligence (AI) influencing the quality control process in robotic polishing?

AI is influencing quality control through Deep Learning-based vision systems used for Automated Defect Inspection (ADI), providing real-time, objective assessment of surface defects and ensuring superior quality consistency compared to manual inspection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager