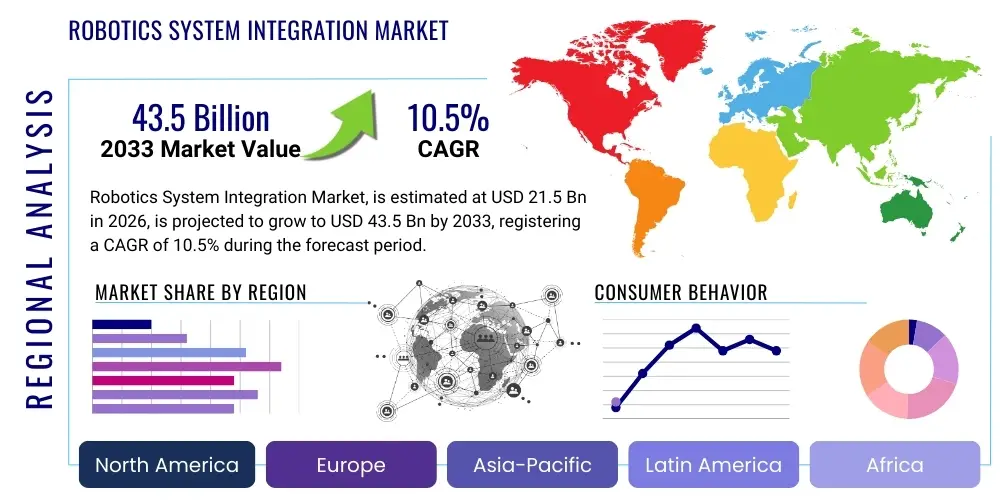

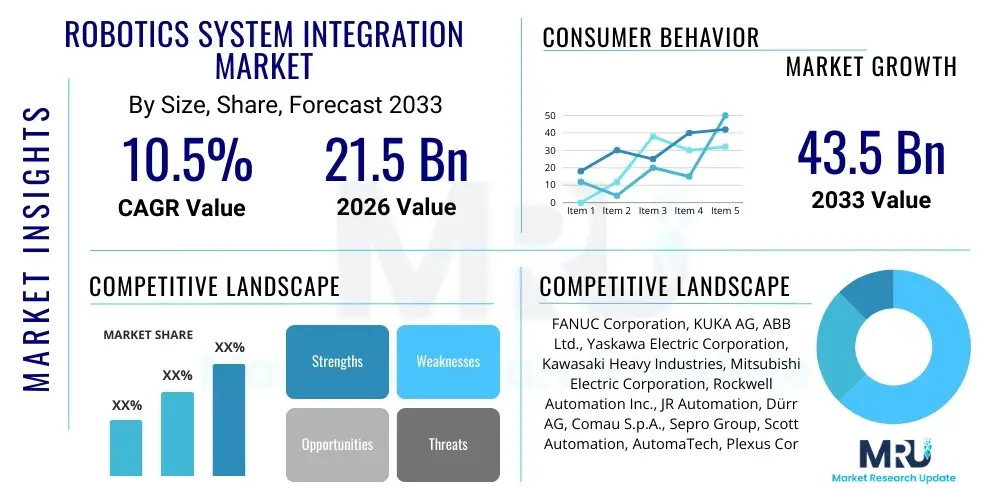

Robotics System Integration Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435362 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Robotics System Integration Market Size

The Robotics System Integration Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 21.5 Billion in 2026 and is projected to reach USD 43.5 Billion by the end of the forecast period in 2033.

Robotics System Integration Market introduction

The Robotics System Integration Market encompasses the specialized services required to design, develop, install, and maintain complex robotic solutions tailored for specific industrial or commercial applications. System integrators act as a critical intermediary between robotics manufacturers and end-users, providing expertise in selecting appropriate hardware (robots, end-effectors, sensors), developing customized software interfaces, and ensuring seamless integration into existing production lines or operational frameworks. This professional service is essential for maximizing the return on investment (ROI) in automation technology, as it addresses the complexities associated with diverse manufacturing environments, safety compliance, and operational efficiency requirements across various sectors such as automotive, electronics, logistics, and food processing.

Key products within this market include turnkey automated cells, modular robotic workstations, specialized vision and control systems integration, and the implementation of software solutions for monitoring and optimization. The major applications span material handling, intricate assembly operations, precision welding, painting and coating, and quality inspection using advanced vision systems. The primary benefits derived from system integration services include enhanced throughput, improved product quality consistency, significant reduction in operational costs over time, and the mitigation of risks associated with manual labor in hazardous environments. System integration facilitates the transition to Industry 4.0 principles, enabling data-driven manufacturing and flexible production capabilities tailored to fluctuating market demands.

The market is primarily driven by the escalating global demand for process automation and efficiency gains in manufacturing and warehousing logistics. Factors such as rising labor costs, the critical need for supply chain resilience, and the rapid advancements in collaborative robotics (cobots) and artificial intelligence (AI) technologies substantially fuel market expansion. Furthermore, stringent regulatory environments emphasizing worker safety and the competitive pressures faced by manufacturers to achieve faster time-to-market necessitate expert system integration to deploy advanced automation solutions effectively and safely. The shift towards mass customization and high-mix, low-volume production also increases the complexity of automation projects, cementing the essential role of specialized integrators.

Robotics System Integration Market Executive Summary

The Robotics System Integration Market is exhibiting robust growth, propelled by global manufacturing modernization initiatives and a significant influx of digitalization across major industrial sectors. Business trends emphasize the shift towards modular and scalable integration solutions, driven by end-users demanding flexibility to adapt to changing product cycles and manufacturing volumes. There is a marked consolidation trend among smaller regional integrators being acquired by larger global engineering firms, seeking to expand their geographical reach and technical specialization, particularly in advanced areas like machine vision and AI-driven control systems. Moreover, service models are evolving, with an increasing focus on subscription-based support and predictive maintenance contracts following initial system installation, thereby ensuring long-term revenue streams and maximizing system uptime for clients.

Regionally, the Asia Pacific (APAC) region stands as the dominant and fastest-growing market, largely due to extensive government support for automation in countries like China, Japan, and South Korea, coupled with massive investments in electronics manufacturing and automotive production capacity expansion. North America and Europe, characterized by high labor costs and established industrial bases, are driving demand for highly sophisticated, high-precision integration services, particularly in aerospace, pharmaceuticals, and logistics. The Middle East and Africa (MEA) and Latin America are emerging markets, primarily focusing on automating core resource extraction processes and early-stage manufacturing sectors, often relying on global integrators for complex deployments.

Segment trends highlight the dominance of material handling applications, reflecting the surge in e-commerce and subsequent warehouse automation needs. Technology-wise, the integration of advanced 3D vision systems and sophisticated software for offline programming and simulation is witnessing rapid adoption. The automotive and electronics sectors remain core revenue generators, but the Food & Beverage and Healthcare industries are showing the highest acceleration rates, demanding cleanroom compatibility and stringent traceability integration solutions. Furthermore, the increasing complexity of robotic systems is pushing integrators to invest heavily in specialized training and certification for collaborative robotics integration, a segment anticipated to grow significantly due to its flexibility and safety features.

AI Impact Analysis on Robotics System Integration Market

User queries regarding the impact of AI on the Robotics System Integration Market frequently revolve around how AI enhances robotic capabilities, the necessary skills integrators must acquire, and the return on investment associated with AI-driven automation. Key themes include the use of machine learning for optimized path planning, the integration of deep learning for complex vision tasks (e.g., highly variable pick-and-place), and the implementation of predictive maintenance protocols enabled by AI analytics. Users are also concerned about the cybersecurity implications of connected AI systems and the standardization required to seamlessly integrate diverse AI software platforms into existing robotic hardware infrastructure. The general expectation is that AI will drastically reduce commissioning time and increase the flexibility and autonomy of integrated robotic cells, shifting the focus of system integrators from pure hardware setup to complex data and software orchestration.

- AI-driven machine vision systems enable robots to handle unstructured environments and highly variable products with higher accuracy than traditional vision systems.

- Predictive maintenance implemented via AI analytics minimizes unexpected downtimes, requiring integrators to build robust sensor and data infrastructure.

- Machine Learning algorithms optimize robot programming and path planning, reducing the manual effort and time required for system commissioning and reconfiguration.

- AI enhances human-robot collaboration (HRC) by improving safety responses and contextual awareness, accelerating the deployment of cobots in shared workspaces.

- Integration of advanced natural language processing (NLP) and voice commands is simplifying the user interface for robotic system management and troubleshooting.

DRO & Impact Forces Of Robotics System Integration Market

The Robotics System Integration Market is significantly influenced by a confluence of accelerating demand drivers and complex structural restraints, balanced by transformative long-term opportunities. The primary drivers include the global push for industrial automation coupled with severe labor shortages in skilled manufacturing positions, necessitating automated solutions. Restraints often center around the high initial capital expenditure required for sophisticated robotic systems and integration services, alongside the lack of standardized communication protocols between different manufacturers' robotic and peripheral equipment. However, substantial opportunities arise from the proliferation of specialized collaborative robots (cobots), the increasing demand from non-traditional industrial sectors like healthcare and agriculture, and the continuous advancement of sensors and AI integration capabilities.

The impact forces within the market are predominantly technological and economic. Economically, the need for enhanced productivity to remain competitive globally acts as a strong upward force, pushing businesses towards automation investments regardless of initial cost barriers. Technologically, the exponential growth in computational power and software capability allows integrators to offer solutions that are more flexible, adaptive, and easier to reprogram than previous generations, drastically improving the perceived value proposition. Conversely, the market faces strong restraining forces related to the scarcity of highly specialized integration engineers capable of handling complex vision and control systems, which can limit the pace of large-scale deployment.

In summary, the market's trajectory is defined by robust growth (Driver) counteracted by the challenge of managing diverse system complexity and upfront investment (Restraint). The long-term outlook remains highly positive due to the accelerating adoption of modular and flexible automation approaches (Opportunity), sustained by the technological force of AI and improved connectivity protocols. The overall impact forces lean towards expansion, driven by necessity (labor shortages) and technological advancement, despite short-term financial and skill-gap hurdles.

Segmentation Analysis

The Robotics System Integration market is comprehensively segmented based on service type, technology deployed, application area, and the specific industry vertical served by the integrators. Analyzing these segments provides critical insights into the areas of highest growth potential and the evolving technological requirements of end-users. Service types range from initial consultation and design to critical post-installation maintenance and dedicated support, reflecting the lifecycle engagement between integrators and clients. Technology segmentation highlights the growing importance of advanced software and peripheral systems, particularly specialized control hardware and high-definition vision systems necessary for complex automation tasks.

Application-based segmentation reveals the historical reliance on fundamental manufacturing tasks such as material handling and welding, while the highest growth rates are now observed in precise assembly and sophisticated inspection roles, particularly in microelectronics. The end-user industry segmentation shows a mature penetration in automotive and metals, contrasted with rapid, emerging adoption in sectors like food and beverage, driven by hygiene and traceability requirements, and logistics, fueled by the massive growth in e-commerce fulfillment centers and automated warehousing. This multi-faceted segmentation underscores the highly specialized nature of the system integration ecosystem, where expertise in a particular vertical often defines market success.

- Service Type: Consulting, Installation & Commissioning, Maintenance & Support, Training & Programming.

- Technology: Control Systems, Vision Systems, Simulation & Programming Software, Safety Systems, End-Effectors.

- Application: Material Handling (Palletizing, Depalletizing, Pick & Place), Assembly & Disassembly, Welding & Soldering, Painting & Dispensing, Cutting & Processing, Inspection & Quality Control.

- End-User Industry: Automotive, Electronics & Semiconductor, Food & Beverage, Healthcare & Pharmaceuticals, Logistics & Warehouse, Metals & Machinery, Aerospace & Defense.

Value Chain Analysis For Robotics System Integration Market

The value chain for the Robotics System Integration Market is highly complex, involving multiple specialized tiers from upstream component suppliers to downstream end-users. Upstream activities begin with the manufacturing of core robotic components, including industrial robots, collaborative robots, sophisticated sensors, and specialized software platforms provided by original equipment manufacturers (OEMs). The quality and interoperability of these foundational hardware and software components directly influence the complexity and efficiency of the integration process. Key upstream players include major robotics manufacturers and specialized providers of advanced peripheral technology such as machine vision cameras and controllers. Supply chain resilience and the ability to source diverse components promptly are critical success factors at this stage.

The core of the value chain is occupied by the system integrators themselves. These firms add significant value by performing detailed needs assessment, system design, customization, software development, installation, and rigorous testing. Integrators act as the critical link, transforming generic robotic arms into highly productive, application-specific manufacturing assets. Downstream activities involve the distribution channel, which often consists of direct engagement by integrators with large manufacturing clients, or through partnerships with distributors who specialize in industrial equipment. Post-installation services, including maintenance, upgrades, and troubleshooting, constitute a significant long-term revenue stream and are crucial for ensuring high customer retention and system longevity.

Distribution channels are typically mixed. Direct channels are preferred for highly customized, large-scale projects, allowing integrators to maintain direct control over project execution and quality. Indirect channels, involving authorized distributors or value-added resellers (VARs), are often used for standardized, smaller, or modular integration packages, particularly reaching small and medium-sized enterprises (SMEs). Successful integrators manage robust supplier relationships (upstream analysis) and build strong long-term service agreements (downstream analysis), ensuring that the complex, integrated systems maintain peak performance over their operational lifespan.

Robotics System Integration Market Potential Customers

The core potential customers for Robotics System Integration services are companies undergoing significant digital transformation and automation initiatives across various industrial sectors. Historically, the automotive industry represents the most mature and dominant customer base, requiring intricate assembly, welding, and painting systems to maintain high production volumes and strict quality control standards. These clients prioritize large-scale, high-speed, and complex integration projects that deliver immediate, measurable productivity improvements. Their purchasing decisions are often based on proven integrator track records, safety compliance guarantees, and the capability to integrate systems across multiple global facilities.

Beyond traditional manufacturing, the logistics and e-commerce sectors represent the fastest-growing customer segment. These buyers require integration services focused on high-speed material handling, automated storage and retrieval systems (AS/RS), parcel sorting, and complex vision-guided picking operations. The demand is driven by the need for faster fulfillment, inventory accuracy, and reduced labor reliance in distribution centers. Potential customers in this area seek modular, scalable solutions that can be rapidly deployed and adapted to seasonal volume fluctuations and changing product mixes, prioritizing flexibility and scalability over absolute throughput.

Emerging and specialized customer segments include the pharmaceutical and medical device manufacturing industries, where integration customers prioritize compliance with Good Manufacturing Practices (GMP), cleanroom specifications, and detailed data logging capabilities for traceability. Food and beverage processors require systems capable of handling sensitive, variable products under strict hygiene conditions. Across all sectors, the common characteristic of potential customers is the need to address efficiency gaps, manage rising labor costs, and achieve a level of manufacturing quality consistency that is unattainable through manual processes, making expert system integrators indispensable partners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 21.5 Billion |

| Market Forecast in 2033 | USD 43.5 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FANUC Corporation, KUKA AG, ABB Ltd., Yaskawa Electric Corporation, Kawasaki Heavy Industries, Mitsubishi Electric Corporation, Rockwell Automation Inc., JR Automation, Dürr AG, Comau S.p.A., Sepro Group, Scott Automation, AutomaTech, Plexus Corp., M.A. Mortenson Company, Genesis Systems, Remtec Automation, Concept Systems, Applied Manufacturing Technologies, Geku Automation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Robotics System Integration Market Key Technology Landscape

The Robotics System Integration Market is defined by a rapidly evolving technological landscape focused on enhancing robot dexterity, autonomy, and interoperability. Central to this evolution is the deployment of advanced software tools. Simulation and offline programming software are crucial, allowing integrators to design and validate complex robotic cell layouts, optimize cycle times, and develop precise robot programs in a virtual environment before deployment. This minimizes costly physical downtime and accelerates the commissioning process. Furthermore, sophisticated proprietary control systems, often developed by the integrators or their strategic partners, are used to harmonize the operation of multiple disparate components—robots, conveyors, safety barriers, and sensors—into a single, cohesive manufacturing unit.

Vision systems represent another foundational technology driving high-value integration projects. The move from 2D vision to high-resolution 3D vision systems, often leveraging AI and deep learning capabilities, allows robots to accurately perceive and interact with randomly oriented objects (bin picking) and inspect products with subtle defects. This precision is critical for sectors like electronics and pharmaceuticals. Additionally, the increasing reliance on the Industrial Internet of Things (IIoT) requires integrators to implement robust connectivity protocols, ensuring integrated robotic cells can transmit operational data seamlessly to enterprise resource planning (ERP) systems and cloud analytics platforms, facilitating real-time monitoring and predictive maintenance.

Collaborative robotics (cobots) integration demands specialized safety and control technologies, including sensitive torque sensors and adaptive programming interfaces, which allow the machines to operate safely alongside human workers without extensive guarding. This segment focuses on simplified integration tools and rapid reconfiguration capabilities to support flexible manufacturing. Overall, the technological trend is moving away from fixed, heavily guarded automation toward modular, software-defined, and intelligent robotic systems, placing a premium on integration expertise in data management, cybersecurity, and cross-platform communication.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, driven by massive investments in automation by China, Japan, and South Korea, particularly in the electronics assembly and automotive manufacturing sectors. Government policies promoting high-tech manufacturing and the existence of a robust regional supply chain for components further amplify market expansion. India and Southeast Asian nations are emerging as key growth pockets, focusing heavily on automation to address infrastructure challenges and compete globally.

- North America: This region is characterized by high demand for advanced, customized integration solutions, particularly in high-precision industries such as aerospace, medical devices, and sophisticated logistics. High labor costs and a strong push for reshoring manufacturing operations necessitate advanced automation. The U.S. and Canada are leaders in adopting AI-driven vision systems and complex material handling solutions to maximize operational efficiency and traceability.

- Europe: Europe, particularly Germany, Italy, and Scandinavia, maintains a strong focus on high-quality, flexible manufacturing, often leveraging collaborative robotics (cobots) integration. Environmental sustainability and energy efficiency are key design criteria for integrated systems here. The region has a high density of specialized small and medium-sized enterprises (SMEs) that are increasingly adopting modular robotic systems, demanding integrators with strong sector-specific expertise in fields like pharmaceuticals and food processing.

- Latin America (LATAM): LATAM is a developing market for robotics system integration, with Brazil and Mexico leading the adoption due to their significant automotive and consumer goods manufacturing bases. Integration projects often focus on foundational automation tasks like welding and painting, aiming to modernize aging facilities. Market growth is heavily dependent on foreign direct investment and stabilization of local economic conditions.

- Middle East and Africa (MEA): The MEA market is seeing targeted growth, primarily driven by large-scale government investments in diversification, moving away from oil reliance toward manufacturing and logistics hubs (e.g., UAE and Saudi Arabia). Integration services are focused on advanced logistics for massive warehousing projects and automating essential processes in construction and resource industries, often requiring integration solutions robust enough for harsh operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Robotics System Integration Market.- FANUC Corporation

- KUKA AG

- ABB Ltd.

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries

- Mitsubishi Electric Corporation

- Rockwell Automation Inc.

- JR Automation

- Dürr AG

- Comau S.p.A.

- Sepro Group

- Scott Automation

- AutomaTech

- Plexus Corp.

- M.A. Mortenson Company

- Genesis Systems

- Remtec Automation

- Concept Systems

- Applied Manufacturing Technologies

- Geku Automation

Frequently Asked Questions

Analyze common user questions about the Robotics System Integration market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the accelerated growth of the Robotics System Integration Market?

The market growth is primarily driven by rising global labor costs, severe skilled labor shortages in manufacturing, the imperative for improved production quality and consistency, and the rapid technological maturation of artificial intelligence and collaborative robotics (cobots).

Which industry sector is currently the largest consumer of robotics system integration services?

Historically, the automotive industry remains the largest consumer, requiring extensive integration services for welding, assembly, and painting. However, the logistics and electronics manufacturing sectors are exhibiting the fastest growth rates due to high-volume automation demands.

How does AI technology influence the role of a system integrator?

AI transforms the integrator's role by shifting the focus from purely mechanical installation to software orchestration, data management, and the deployment of intelligent vision systems, enabling robots to handle unstructured environments and conduct predictive maintenance.

What are the main financial challenges associated with adopting integrated robotic systems?

The main financial challenge is the high initial capital investment required for both the hardware (robots, peripherals) and the specialized engineering services needed for customized integration, often necessitating a detailed ROI analysis before project approval.

What is the key differentiator between a robot manufacturer and a system integrator?

A robot manufacturer produces the core robotic arm hardware, while a system integrator provides the specialized expertise to customize, program, integrate, and commission the robot and all necessary peripherals (e.g., end-effectors, sensors, safety fences) into a specific, functional end-to-end automation solution tailored to the customer's needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager