Rock Drilling Jumbo Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434026 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Rock Drilling Jumbo Market Size

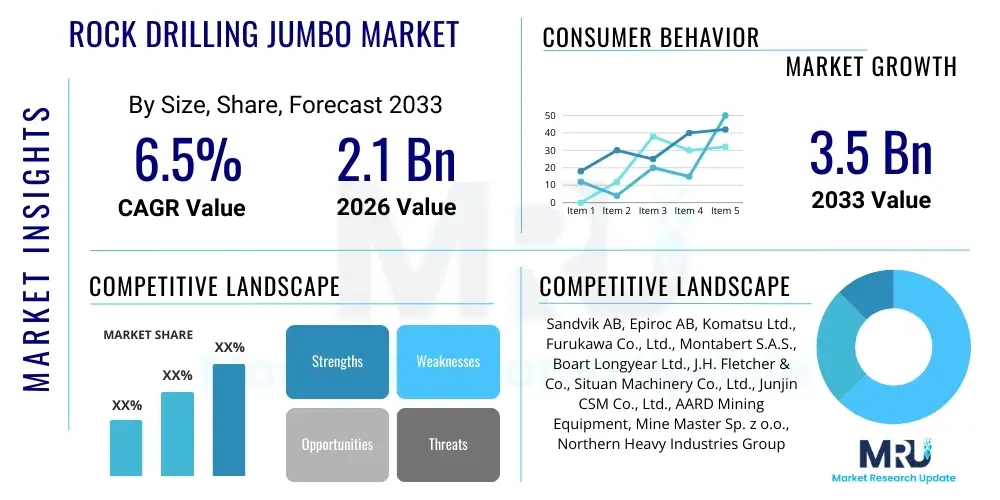

The Rock Drilling Jumbo Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033.

Rock Drilling Jumbo Market introduction

Rock drilling jumbos are highly sophisticated, self-propelled hydraulic drilling rigs designed specifically for underground hard rock mining and tunneling operations. These machines are essential for efficiently creating drill holes for blast preparation, excavation, and subsequent bolting processes in confined spaces. The core function of a rock drilling jumbo is to provide high penetration rates, precision drilling accuracy, and enhanced safety compared to conventional manual drilling methods. Their operational efficiency is critical in large-scale infrastructure projects and high-volume mining environments where minimizing cycle time is paramount to overall project profitability and timely execution.

The product portfolio within this market includes a range of specialized equipment, primarily categorized into face drilling jumbos, long-hole drilling jumbos, and bolting jumbos. Face drilling jumbos are used for creating the blast pattern in the tunnel face, ensuring precise hole alignment for optimal fragmentation. Long-hole jumbos are employed in production drilling in sub-level caving or stoping applications, demanding accuracy over much greater distances. Bolting jumbos, often integrated systems, are vital for installing ground support immediately after excavation, reinforcing the stability of the underground structure and ensuring operator safety.

Major applications driving the demand for rock drilling jumbos include the construction of extensive urban transit systems, hydroelectric projects, and significant increases in global mineral extraction activities, particularly for transition metals required for electric vehicles and renewable energy infrastructure. Key benefits derived from adopting these technologies include reduced labor costs, significant improvements in drilling productivity, enhanced workplace safety through automation and remote operation capabilities, and a substantial reduction in operational downtime due to robust mechanical and hydraulic designs. Driving factors center on global infrastructure investment mandates and the increasing depth and complexity of modern mining operations, necessitating more powerful and automated drilling solutions.

Rock Drilling Jumbo Market Executive Summary

The Rock Drilling Jumbo Market is experiencing robust growth driven primarily by escalating global demand for mineral resources, coupled with significant governmental and private investment in large-scale underground infrastructure. Business trends indicate a strong move toward digitalization, focusing heavily on integrating sophisticated monitoring systems, real-time data analytics, and teleoperation capabilities into new jumbo models. Original Equipment Manufacturers (OEMs) are prioritizing the development of battery-electric jumbos (BEVs) to address stringent environmental regulations, particularly regarding diesel particulate matter and noise reduction in underground environments. Furthermore, consolidation among major mining and construction companies is leading to larger, more complex project contracts, favoring suppliers capable of providing comprehensive service packages, high-capacity equipment, and sustainable operational solutions.

Regionally, the market exhibits divergent growth trajectories. Asia Pacific (APAC) stands as the dominant growth engine, fueled by massive ongoing infrastructure development in China and India, particularly in rail and road tunneling, and extensive coal and metal mining operations in Australia and Southeast Asia. North America and Europe demonstrate a focused investment in technology upgrades, moving away from legacy diesel fleets towards automated, electric, and hybrid jumbos, driven by stricter occupational health and safety standards and commitments to decarbonization within the mining sector. Latin America, rich in copper and iron ore reserves, represents significant potential, with large mining companies demanding robust, high-performance equipment capable of operating efficiently in challenging geological conditions and high-altitude mines.

Segment trends highlight the growing dominance of the electric-powered segment, which offers zero local emissions and lower operating costs compared to traditional diesel variants. In terms of application, the hard rock mining sector continues to be the largest consumer, though the infrastructure and tunneling segment is rapidly expanding due to global urbanization patterns and the necessity of building deeper and longer tunnels for transport and utilities. Technology-wise, multi-boom jumbos (three or more drilling arms) are gaining preference in large-cross-section tunneling projects, maximizing drilling coverage and reducing cycle times, thereby cementing automation and multi-functionality as core competitive advantages across all major product lines.

AI Impact Analysis on Rock Drilling Jumbo Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Rock Drilling Jumbo Market primarily revolve around operational efficiency gains, predictive maintenance capabilities, and the potential for fully autonomous drilling cycles. Users frequently ask about the transition from automated operation (pre-programmed cycles) to intelligent, adaptive drilling (AI-optimized penetration rates based on real-time rock strength analysis). Key themes emerging from these questions include concerns regarding data security in remote operations, the need for standardized communication protocols (interoperability between different OEM systems), and the required skill transformation for operators who must evolve into high-level supervisors managing multiple machines simultaneously. Expectations are high regarding AI's ability to minimize unplanned downtime, significantly reduce drill wear, and precisely model complex geological formations to optimize blast design, thereby ensuring maximum material yield per drilling meter.

The integration of AI algorithms facilitates a paradigm shift from reactive maintenance schedules to predictive maintenance. Machine learning models, fed continuously with sensor data regarding vibration, pressure, heat, and hydraulic fluid performance, can accurately forecast component failure with high confidence. This proactive approach ensures that maintenance interventions are scheduled precisely when needed, extending the Mean Time Between Failures (MTBF) and dramatically reducing overall life-cycle costs for the high-value drilling rigs. Furthermore, AI optimizes energy consumption by dynamically adjusting the power output and hydraulic flow based on instantaneous drilling requirements, contributing to lower fuel or electricity consumption per meter drilled.

Advanced AI is also central to enhancing drilling accuracy and speed. Computer Vision systems and Machine Learning classifiers enable jumbos to automatically recognize geological markers, adjust boom positioning with millimeter precision, and adapt the drilling parameters (thrust, rotation speed, percussion) in real time to counter variations in rock hardness and fracturing, ensuring optimal advance rates. This level of adaptive control, powered by AI, minimizes deviation, reduces bit consumption, and ensures blast holes are placed exactly according to the engineer's plan, which is crucial for safety and maximizing the fragmentation effectiveness of the subsequent blast. The move toward true autonomy hinges heavily on these AI-driven decision-making systems.

- AI-Driven Predictive Maintenance: Forecasting component failure based on real-time operational telemetry, minimizing unplanned downtime.

- Real-Time Drilling Optimization: Machine learning algorithms adjust thrust, torque, and percussion frequency instantaneously based on rock type and conditions.

- Autonomous Navigation and Positioning: AI-enhanced inertial navigation systems for high-precision, automatic boom setup and drilling cycle execution without human intervention.

- Blast Design Optimization: Utilizing historical drilling data and rock mass characterization via AI to recommend optimal blast patterns and charge loading.

- Enhanced Safety Protocols: AI systems monitor operator fatigue and maintain exclusion zones during autonomous operations, improving workplace safety.

- Data Integration and Analytics: Centralized cloud platforms leveraging AI to analyze fleet performance metrics across multiple sites for benchmarking and continuous improvement.

DRO & Impact Forces Of Rock Drilling Jumbo Market

The dynamics of the Rock Drilling Jumbo Market are shaped by a complex interplay of global economic trends, technological advancements, and stringent operational requirements inherent to the mining and infrastructure sectors. The principal drivers revolve around the accelerated pace of urbanization globally, necessitating large-scale tunneling projects for metro rail, water supply, and road networks, coupled with the critical need to increase global supply of base metals (copper, nickel) and precious metals, which require deeper and more mechanized underground extraction techniques. Restraints predominantly involve the high initial capital expenditure associated with purchasing and implementing sophisticated drilling jumbos, especially those featuring advanced automation, creating significant barriers to entry for smaller contractors. Furthermore, the volatility in commodity prices can directly impact mining investment decisions, leading to deferred purchases of new equipment during downturns. Opportunities are substantial, centered on the expansion of electrification (battery-electric jumbos) and the development of retrofittable automation kits, allowing existing fleets to be modernized, catering to the growing need for environmentally sustainable and efficient operations.

Impact forces within the market are exerted primarily by regulatory mandates and technological disruption. Stringent government regulations, particularly in developed regions like the EU and North America, demanding reduced diesel emissions and improved worker safety (reducing exposure to dust and vibration), force rapid technological shifts towards electric and remote-controlled jumbos. This regulatory pressure accelerates the obsolescence of older equipment and drives innovation in ventilation systems and noise reduction. Simultaneously, the force of technological advancement, specifically the mature adoption of teleoperation, remote sensing, and 5G connectivity in mining, fundamentally changes the utilization model of drilling jumbos, enabling centralized control rooms to manage drilling fleets located thousands of kilometers away, thereby optimizing labor costs and improving utilization rates.

A secondary, yet significant, impact force is the evolving operational landscape in mining. As easily accessible shallow ore bodies become depleted, mines are extending deeper and into more geologically challenging environments. This necessitates jumbos engineered for extreme conditions—high pressure, temperature, and abrasive rock—demanding higher structural integrity, increased power, and advanced drilling precision to maintain economic viability. The supply chain constraints impacting hydraulic components, specialized steel alloys, and electronic control units also exert pressure, leading OEMs to vertically integrate or diversify their sourcing strategies. The constant push for productivity gains in competitive construction and mining markets ensures that only jumbos offering superior availability and low total cost of ownership (TCO) will secure market leadership.

Segmentation Analysis

The Rock Drilling Jumbo Market is systematically segmented based on key functional attributes, power source, and end-user application, allowing for a precise analysis of demand patterns and technological focus areas. Understanding these segments is critical for manufacturers to tailor product development and market entry strategies. The fundamental split exists between the type of drilling operation—face drilling for development work, long-hole drilling for production, and utility/bolting for infrastructure support. Each segment demands unique hydraulic systems, boom structures, and control software tailored to specific performance metrics like penetration rate versus angular precision.

The segmentation by power source, encompassing electric, diesel, and emerging hybrid/battery-electric variants, reflects the current transition within the heavy machinery sector toward decarbonization. Electric jumbos are gaining significant traction due to lower energy costs and zero underground emissions, aligning with global environmental, social, and governance (ESG) standards, especially in high-volume, deep mine operations. Diesel units, while maintaining a presence due to their flexibility in initial setup phases and remote locations lacking established electrical infrastructure, are facing increasingly severe regulatory and competitive pressures.

Application segmentation remains central to market analysis, distinguishing between hard rock mining (which typically requires the highest power and deepest penetration), and construction and tunneling (which prioritizes mobility, rapid deployment, and precision in confined urban environments). The infrastructure segment, specifically for large public works such as rail and water tunnels, shows high growth due to predictable government funding cycles and large project pipelines across APAC and Europe, driving demand for multi-boom face drilling machines capable of handling large cross-sectional areas efficiently.

- By Type:

- Face Drilling Jumbos

- Long Hole Drilling Jumbos

- Bolting/Utility Jumbos

- By Power Source:

- Electric Powered

- Diesel Powered

- Hybrid/Battery Electric Vehicles (BEV)

- By Application:

- Mining (Metal, Coal, Non-metal)

- Construction and Tunneling

- Infrastructure Development (Hydroelectric, Road, Rail)

Value Chain Analysis For Rock Drilling Jumbo Market

The value chain for the Rock Drilling Jumbo Market begins with upstream activities focused on the procurement of high-specification raw materials and precision components. This includes specialized steel alloys for booms and chassis to withstand extreme operational stresses, high-performance hydraulic pumps and valves crucial for power delivery, and advanced electronic control units (ECUs) and sensors for automation and safety systems. Key upstream suppliers include manufacturers of specialized cylinders, rock drills (drifters), and premium engine or battery systems. OEMs maintain close, often proprietary, relationships with these specialized component providers to ensure quality, reliability, and access to the latest hydraulic and electric drive technologies, which are fundamental to the jumbo's performance metrics and longevity.

The core manufacturing stage involves the assembly and integration of these complex components into the final robust machine. This stage is capital-intensive and requires highly skilled engineering, particularly in integrating the automation software with the physical hardware. Downstream activities involve global distribution, which is often managed through a hybrid network of direct sales channels for major mining clients and authorized regional dealerships that handle smaller contractors and provide immediate local support. Due to the high investment cost and specialized nature of the equipment, after-sales service, including comprehensive maintenance contracts, spare parts supply, and rapid on-site technician deployment, forms a crucial and high-margin part of the downstream value chain. Lifetime service support is often a deciding factor in major procurement decisions.

The distribution channel heavily favors indirect channels in dispersed markets, utilizing reputable dealerships that can provide localized technical training and rapid parts inventory management, minimizing the client’s Mean Time To Repair (MTTR). Direct sales are primarily reserved for tier-one mining houses globally, where OEMs can establish long-term framework agreements covering fleet supply, training, and total lifecycle management, often incorporating remote monitoring and performance optimization services directly managed by the OEM’s global technical team. The shift toward digitalization enhances this downstream connectivity, enabling remote diagnostics and predictive scheduling, thereby increasing the value captured in the service portion of the chain and strengthening the relationship between manufacturer and end-user.

Rock Drilling Jumbo Market Potential Customers

The primary consumers and end-users of Rock Drilling Jumbos are major entities engaged in high-volume, capital-intensive underground excavation and extraction operations across various sectors globally. These buyers prioritize total cost of ownership (TCO), machine availability, drilling precision, and adherence to increasingly stringent safety standards. The largest group of customers consists of multinational mining corporations specializing in hard rock extraction for minerals such as gold, copper, iron ore, and potash. These Tier 1 miners operate large fleets and often demand highly customized, automated, and often electric-powered jumbos capable of operating continuously in harsh and deep environments, making purchasing decisions based on detailed operational performance guarantees and long-term service agreements.

A second major customer base comprises large-scale civil engineering and construction firms, particularly those specializing in infrastructure development like subway and railway tunnels, highway bypasses, and underground hydroelectric power projects. These contractors require flexible, high-mobility jumbos that can be quickly deployed and decommissioned, emphasizing speed of advance and precision in geological environments that may be close to urban settings. Their buying decisions are heavily influenced by project timelines and the ability of the equipment to meet specific tunneling specifications, often favoring multi-boom jumbos for maximizing cross-section coverage and efficiency.

The third group includes specialized tunneling and contract drilling companies that serve both the mining and infrastructure sectors on an outsourced basis. These companies require robust, reliable, and versatile jumbos, often purchasing standardized models that can be rapidly relocated between different short-term contracts. Furthermore, government agencies or public-private partnerships responsible for massive, long-term national infrastructure programs, such as water conveyance or major rail links, act as indirect influential customers, driving procurement specifications and financing models for the specialized equipment used in their projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB, Epiroc AB, Komatsu Ltd., Furukawa Co., Ltd., Montabert S.A.S., Boart Longyear Ltd., J.H. Fletcher & Co., Situan Machinery Co., Ltd., Junjin CSM Co., Ltd., AARD Mining Equipment, Mine Master Sp. z o.o., Northern Heavy Industries Group Co., Ltd., CAT (Caterpillar Inc.), Dalian Juxin Mining Equipment Co., Ltd., Zhengzhou Dingsheng Engineering Technology Co., Ltd., Changsha Sinocare Industrial Co., Ltd., Jining Bafang Mining Machinery Group, Kramp Group B.V., CNH Industrial N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rock Drilling Jumbo Market Key Technology Landscape

The technology landscape of the Rock Drilling Jumbo Market is rapidly evolving, moving away from purely mechanical operations towards integrated digital ecosystems. Central to this transformation is the advanced automation of the drilling cycle. Modern jumbos utilize sophisticated PLC (Programmable Logic Controller) systems coupled with laser scanning and inertial navigation systems (INS) to achieve high levels of precision in boom positioning and hole alignment, minimizing the risk of over-break or under-break in tunneling projects. Furthermore, technologies focusing on operator comfort and safety, such as vibration dampening systems and climate-controlled cabins, remain standard, but the key technological differentiating factor is the shift to remote and semi-autonomous operation, facilitated by high-speed, reliable wireless networks underground.

The adoption of Battery Electric Vehicle (BEV) technology represents a significant technological leap, particularly for large-scale mining operations committed to eliminating fossil fuels underground. BEV jumbos replace high-maintenance diesel engines with powerful electric motors and large lithium-ion battery packs, necessitating the development of fast charging infrastructure and optimized battery management systems (BMS) to ensure operational continuity throughout a shift. This shift requires specialized component design to manage higher torque loads and heat dissipation inherent to electric drive systems while integrating regenerative braking systems to maximize energy efficiency. Manufacturers are competing heavily on battery life, charging speed, and modularity for easier maintenance and replacement of power packs.

Moreover, the integration of advanced sensor technology, including complex monitoring of rock drill performance (drifter health), drill steel life, and hydraulic system integrity, forms the basis of the Internet of Things (IoT) environment in modern jumbos. These connected systems facilitate predictive analytics and remote diagnostics, allowing OEMs to offer performance-based service contracts. The continuous development of specialized rock drills (drifters) designed for high frequency and minimal maintenance, alongside sophisticated drilling consumables (bits and rods) optimized for specific geological conditions, underscores the continuous incremental improvement necessary to maintain superior penetration rates and equipment longevity in abrasive environments. These technologies collectively drive the total productivity improvements expected by leading end-users.

Regional Highlights

The regional market dynamics for Rock Drilling Jumbos are intrinsically linked to localized infrastructure spending, mineral exploration activity, and the regulatory environment governing underground safety and emissions.

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven by unparalleled levels of infrastructure investment, particularly in China (extensive high-speed rail and metro networks) and India (major road tunneling and hydroelectric projects). Furthermore, resource-rich countries like Australia and Indonesia fuel high demand for large-capacity jumbos for deep and complex metal mining operations. The region demonstrates a growing acceptance of automation to counter labor shortages and improve productivity.

- North America: Characterized by stringent safety and environmental regulations, the North American market is highly focused on replacing aging diesel fleets with advanced electric and automated jumbos. Key demand drivers include renewed investment in critical mineral extraction (lithium, copper) to support the clean energy transition and substantial governmental funding for infrastructure revitalization (e.g., replacement of outdated water and transport tunnels).

- Europe: Europe is a mature market exhibiting steady demand, heavily influenced by decarbonization mandates. The European market leads in the adoption of Battery Electric Vehicles (BEVs) in both tunneling and mining, driven by powerful EU environmental directives. Norway, Sweden, and Finland, with their advanced hard rock mining sectors, serve as key innovation hubs for remote operation and automation technologies.

- Latin America: This region is crucial due to its vast reserves of copper (Chile, Peru) and iron ore (Brazil). Market growth is cyclical, highly dependent on global commodity prices, but sustained large-scale deep mining projects necessitate continuous investment in powerful, high-performance face drilling and long-hole jumbos designed for high altitude and challenging rock mechanics.

- Middle East and Africa (MEA): Growth in MEA is bifurcated; the Middle East sees sporadic, large-scale infrastructure and utility tunneling projects (e.g., megacity development in Saudi Arabia), while Africa offers long-term growth potential through the expansion of gold, platinum, and diamond mining operations, often favoring robust, easy-to-maintain equipment suitable for remote and challenging logistics environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rock Drilling Jumbo Market.- Sandvik AB

- Epiroc AB

- Komatsu Ltd.

- Furukawa Co., Ltd.

- Montabert S.A.S. (P&H MinePro)

- Boart Longyear Ltd.

- J.H. Fletcher & Co.

- Situan Machinery Co., Ltd.

- Junjin CSM Co., Ltd.

- AARD Mining Equipment

- Mine Master Sp. z o.o.

- Northern Heavy Industries Group Co., Ltd.

- Caterpillar Inc. (CAT)

- Dalian Juxin Mining Equipment Co., Ltd.

- Zhengzhou Dingsheng Engineering Technology Co., Ltd.

- Changsha Sinocare Industrial Co., Ltd.

- Jining Bafang Mining Machinery Group

- TBEA Co., Ltd.

- Shandong Energy Group Co., Ltd.

- Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

Frequently Asked Questions

Analyze common user questions about the Rock Drilling Jumbo market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Battery Electric Vehicle (BEV) Rock Drilling Jumbos over traditional diesel models?

BEV rock drilling jumbos offer zero tailpipe emissions, significantly improving underground air quality and reducing the reliance on costly ventilation systems. They also feature lower noise levels, reduced maintenance costs due to fewer moving parts, and decreased operational expenses compared to high-cost diesel fuel and associated filters. This aligns directly with strict environmental and safety regulations globally.

How does automation technology impact the utilization and productivity of rock drilling jumbos?

Automation enables jumbos to execute pre-programmed drilling patterns with enhanced precision and consistency, minimizing human error and maximizing rock fragmentation effectiveness. Autonomous operation allows for continuous drilling during shift changes and blast cycles, significantly increasing machine utilization rates (up to 90% or higher) and overall productivity per shift compared to manually operated units.

Which regional market shows the highest growth potential for rock drilling jumbos through 2033?

Asia Pacific (APAC) is projected to exhibit the highest growth potential. This growth is underpinned by massive government-led infrastructure investments in tunneling for urban transit and hydroelectric projects, particularly in rapidly developing economies like China and India, coupled with stable, high-volume hard rock mining activity across Oceania and Southeast Asia.

What role does predictive maintenance play in reducing the total cost of ownership (TCO) for drilling jumbos?

Predictive maintenance utilizes AI and sensor data to monitor critical component health (drifters, hydraulics) in real time, accurately forecasting potential failures. By enabling scheduled, non-catastrophic repairs rather than reactive fixes, predictive systems minimize unplanned downtime, extend the lifespan of high-value parts, and significantly lower emergency repair costs, thereby optimizing the TCO.

What are the most critical factors driving the demand for specialized long-hole drilling jumbos?

Demand for long-hole jumbos is primarily driven by the need for bulk extraction methods in deep underground hard rock mines (such as sub-level caving and stoping). These methods require exceptional drilling accuracy over long distances (up to 100 meters) to ensure optimal blast results and safety, essential requirements met only by high-performance, precision-guided long-hole drilling technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager