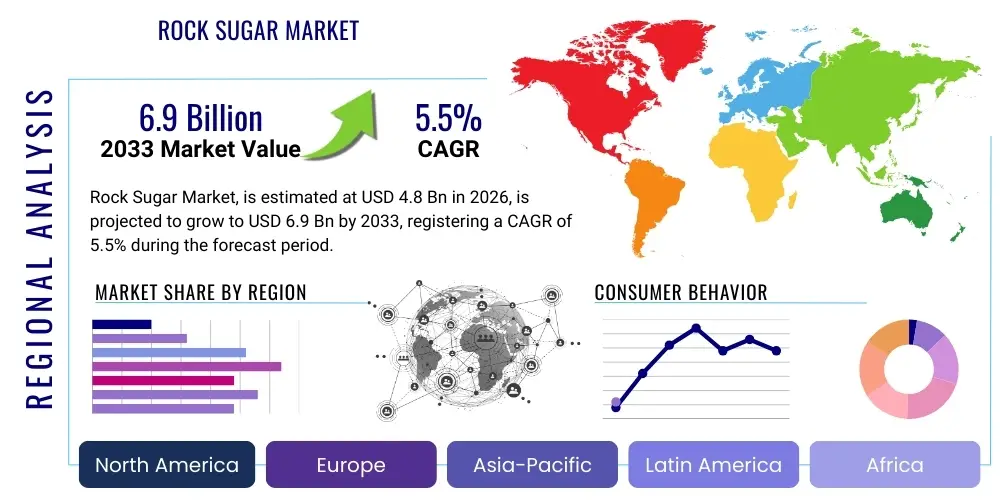

Rock Sugar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436537 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Rock Sugar Market Size

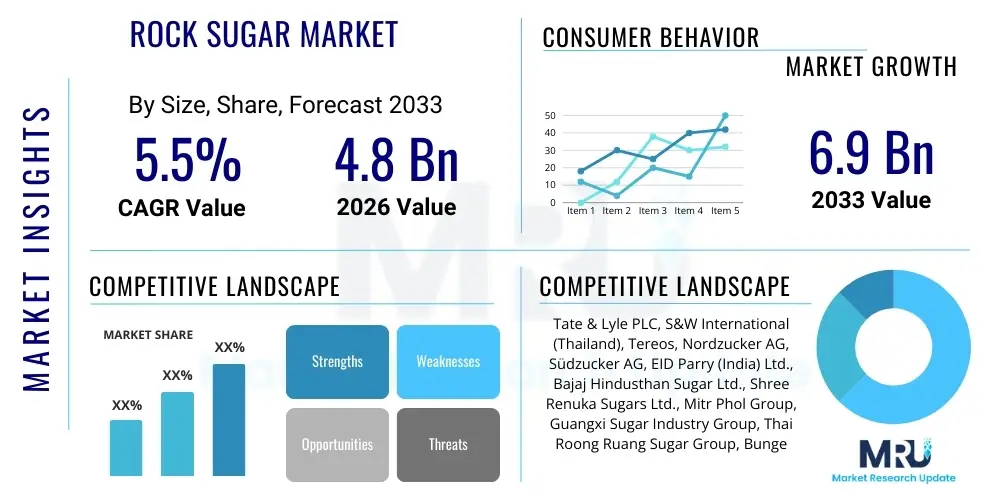

The Rock Sugar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.9 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the increasing consumer preference for natural sweeteners in traditional food preparations and the expanding utilization of rock sugar in pharmaceutical formulations, particularly across Asian economies where it holds significant cultural and medicinal relevance. The demand surge in the food and beverage industry, driven by specialty confectionery and artisanal beverage preparation, further strengthens this growth trajectory, emphasizing premiumization and perceived health benefits over refined white sugar.

Rock Sugar Market introduction

The Rock Sugar Market encompasses the production, distribution, and consumption of large crystals of sucrose, typically obtained through the slow crystallization process of highly saturated sugar solutions. Rock sugar, also known as rock candy or crystal sugar, is chemically similar to granulated sugar but possesses a unique crystalline structure achieved through prolonged cooling and nucleation on strings or specialized surfaces. Major applications include use as a premium sweetener in teas and coffees, a key ingredient in traditional remedies and cough syrups (due to its perceived soothing properties), and as a textural component in high-end confectionery and baking. The primary benefits driving its adoption include a milder, less intense sweetness profile compared to refined table sugar, its aesthetic appeal, and its established role in traditional culinary and medicinal practices, especially in regions like India, China, and Southeast Asia. Driving factors include rising consumer interest in clean-label ingredients, cultural continuity in usage, and the growing demand for specialty ingredients in the global artisanal food movement.

Rock Sugar Market Executive Summary

The global Rock Sugar Market is characterized by moderate but stable growth, anchored significantly by established consumption patterns in the Asia Pacific (APAC) region, which dominates both production and consumption due to deep-rooted cultural and pharmaceutical applications. Business trends indicate a shift towards specialized product offerings, including organic and unrefined variations (like brown rock sugar), catering to health-conscious consumers and premium markets in North America and Europe. Regional trends highlight that while APAC remains the powerhouse, Western markets are seeing accelerated growth rates as ethnic cuisine popularity increases and mixology trends incorporate rock sugar for subtle sweetness and presentation. Segment trends show that the Food & Beverage application segment, particularly beverages and specialty desserts, holds the largest market share, while the Pharmaceutical segment is demonstrating robust growth driven by the formal acceptance of traditional medicine components in regulated healthcare systems. The market structure remains moderately fragmented, with regional suppliers often competing based on product purity and sustainable sourcing practices, increasingly utilizing automated crystallization techniques to ensure consistent crystal size and clarity.

AI Impact Analysis on Rock Sugar Market

User inquiries regarding AI's impact on the rock sugar market primarily revolve around optimizing the complex and time-consuming crystallization process, predicting raw material quality fluctuations (sugarcane/beet harvests), and enhancing supply chain traceability to meet premiumization demands. Key concerns center on whether AI can maintain the integrity and traditional aesthetics of the large crystal formation while drastically reducing the cycle time and energy consumption inherent in slow crystallization. Users also seek information on AI-driven quality control systems capable of distinguishing impurities and ensuring uniform crystal lattice structures, which are vital for pharmaceutical-grade rock sugar. The consensus expectation is that AI will revolutionize backend manufacturing efficiency and logistics rather than fundamentally changing the product itself, thereby preserving the artisanal nature of the final product while enhancing profitability and environmental sustainability through predictive maintenance and resource optimization.

- AI-driven optimization of super-saturation levels and cooling curves to minimize crystallization time while maximizing crystal yield and quality.

- Predictive maintenance analytics applied to vacuum pans and crystallizers, reducing downtime and energy inefficiency in the demanding, long-cycle manufacturing process.

- Enhanced supply chain management using AI algorithms for forecasting demand seasonality and optimizing complex global distribution routes, especially for temperature-sensitive products.

- AI-powered image recognition and quality control systems for automated sorting and grading of rock sugar based on size uniformity, clarity, and structural integrity.

- Demand forecasting models utilizing machine learning to accurately anticipate regional needs, particularly the high seasonal spikes related to traditional festivals and cold remedies, reducing inventory waste.

- Implementation of AI-based traceability platforms (e.g., blockchain integration) to ensure transparency regarding the source of cane/beet and adherence to organic or fair-trade standards for premium consumers.

DRO & Impact Forces Of Rock Sugar Market

The Rock Sugar Market is driven by the growing consumer preference for natural and minimally processed sweeteners, supported by robust traditional usage in Asian cuisine and complementary medicine, which provides a resilient demand base. However, the market faces significant restraints, primarily stemming from the inherent high production cost and time requirement associated with the slow crystallization process, making it less cost-competitive than standard granulated sugar. Additionally, the increasing global awareness regarding sugar consumption and related health issues, such as diabetes and obesity, acts as a general restraint across all sugar markets, forcing manufacturers to innovate or market products as specialty items rather than staple sweeteners. Opportunities lie in expanding geographical penetration into Western gourmet and beverage markets, developing specialized functional rock sugar variants (e.g., infused or fortified), and leveraging sustainability certifications to attract affluent consumer segments willing to pay a premium for artisanal quality. The impact forces show that while market penetration of alternative sweeteners poses a high threat, the moderate price sensitivity for specialty food items and the low substitution threat within specific traditional applications help maintain market stability, driving producers towards process efficiency improvements.

Drivers include the widespread recognition of rock sugar's distinct culinary properties—specifically its ability to dissolve slowly and impart a subtle flavor that does not overpower delicate ingredients, making it preferred in premium tea and certain confectionery items. The historical and cultural embedding of rock sugar, particularly in Chinese Traditional Medicine (TCM) where it is used in herbal decoctions for soothing properties, ensures a steady, inelastic demand within these niche yet substantial segments. Furthermore, manufacturers are increasingly emphasizing the artisanal nature and perceived purity of rock sugar, contrasting it favorably with highly processed, quickly manufactured sweeteners, appealing to the broader 'natural food' movement gaining traction globally, supported by strategic marketing focusing on heritage and craftsmanship.

Conversely, significant restraints are tied to supply chain vulnerabilities, including reliance on consistent cane or beet sugar feedstock supply, which is susceptible to climate variability and commodity price volatility. The regulatory landscape surrounding sugar intake, characterized by increasing taxation and recommended daily limits in developed nations, places continuous downward pressure on overall sugar consumption volumes. The prolonged manufacturing cycle of rock sugar—which can take several weeks to grow large, pure crystals—results in high capital tied up in inventory and significant energy consumption per unit compared to rapid sugar production methods, limiting scalability and margin potential outside of the premium niche. These combined forces necessitate a strategic focus on premiumization and process automation to mitigate cost pressures while preserving consumer perceived value.

Segmentation Analysis

The Rock Sugar Market is comprehensively segmented based on Type, Application, Form, and Distribution Channel, allowing for detailed analysis of consumer preferences and market dynamics across various end-use sectors. The segmentation highlights the intrinsic differences in how rock sugar is utilized—ranging from high-volume industrial applications in beverage processing to low-volume, high-value artisanal consumption. The predominant segments include White Rock Sugar due to its versatility and widespread availability, and the Food & Beverage sector which leverages its superior sweetness profile in drinks and desserts. Detailed segmentation analysis helps market participants tailor product offerings, optimize distribution strategies, and focus R&D efforts on enhancing attributes such as crystal size, color, and purity required by specific end-user industries like traditional medicine.

- By Type:

- White Rock Sugar (Most common, high purity)

- Yellow Rock Sugar (Slightly less refined, retaining some molasses)

- Brown Rock Sugar (Higher molasses content, distinct flavor profile)

- By Application:

- Food & Beverage

- Confectionery and Candies

- Beverages (Tea, Coffee, Specialty Drinks)

- Baking and Desserts

- Preserves and Jams

- Pharmaceuticals/Traditional Medicine

- Cosmetics and Personal Care

- Industrial Use (Textile Sizing, Chemical Feedstock)

- By Form:

- Lumps/Crystals (Traditional form, high demand in premium retail)

- Powder/Granules (Used primarily in industrial and baking applications for easy dissolution)

- By Distribution Channel:

- Supermarkets/Hypermarkets (High-volume retail)

- Convenience Stores

- Online Retail (Growing rapidly for specialty and ethnic products)

- Specialty Stores (Gourmet food stores, ethnic markets)

- Direct Sales (Business-to-Business, largely for industrial applications)

Value Chain Analysis For Rock Sugar Market

The Rock Sugar market value chain begins with the upstream segment involving the cultivation and harvesting of raw materials—primarily sugarcane or sugar beet—and the subsequent processing into highly refined sugar syrup. This foundational stage dictates the final purity and cost of the rock sugar, making reliable sourcing and milling essential. The midstream stage is the core differentiating factor: the complex, temperature-controlled, slow crystallization process, often involving nucleating agents like string or wooden sticks, which requires specialized equipment (crystallizers) and long processing times (up to several weeks). Manufacturers must manage high energy inputs and maintain stringent hygiene standards during this phase to ensure the formation of large, clear crystals.

The downstream activities involve meticulous grading, sorting, packaging, and distribution. Packaging is critical, particularly for the traditional lump forms, as it must protect the delicate crystals from breakage and moisture degradation. Distribution channels include both direct sales to large industrial users (such as pharmaceutical companies and large-scale beverage producers) and indirect distribution through a complex network of wholesalers, retailers, and increasingly, specialized e-commerce platforms catering to niche and ethnic food markets. The length and complexity of the downstream channel vary significantly based on whether the product is targeting mass retail (which requires robust packaging and logistics) or specialty markets (which demand high service levels and product traceability).

Direct channels, though fewer in number, are often utilized for large-volume industrial sales where precise specifications (e.g., specific crystal size for brewing) and bulk pricing are negotiated directly between the manufacturer and the end-user. Indirect channels, encompassing supermarkets, specialty food stores, and online retail, are crucial for reaching the final consumer base. The efficiency of the indirect distribution network is paramount for market reach, especially in Western countries where rock sugar is still considered a specialized ethnic or gourmet product. Managing logistics effectively, particularly maintaining low humidity during transit and storage, is critical throughout the distribution phase to prevent caking and crystal degradation, ensuring product quality is maintained until it reaches the final buyer.

Rock Sugar Market Potential Customers

The potential customer base for the Rock Sugar Market is diverse, spanning multiple industrial and consumer sectors, unified by the desire for a specific sweetness profile, high purity, or traditional application fidelity. Key end-users include manufacturers in the premium confectionery segment who utilize rock sugar for its aesthetic appeal and unique textural properties in hard candies and brittle. The expansive beverage industry, encompassing artisanal tea blenders, specialty coffee houses, and cocktail mixologists, represents a high-growth customer segment valuing the slow dissolution rate and subtle flavor profile of rock sugar. Crucially, the pharmaceutical and traditional medicine industries, particularly in Asia, remain cornerstone customers, where rock sugar is often incorporated as a vehicle or binder in cough syrups, herbal formulations, and lozenges due to its mild taste and perceived soothing qualities.

Beyond these industrial customers, the retail market is driven by two distinct consumer segments: the ethnic consumer base utilizing rock sugar in authentic regional cooking (e.g., Chinese savory dishes, Indian sweets) and the affluent, health-conscious consumer seeking alternatives to highly processed white sugar, often preferring organic or brown rock sugar variants. The cosmetics industry is an emerging customer segment, using finely powdered rock sugar as a gentle exfoliant in premium body scrubs. Targeting these diverse buyers requires customized product formats, from large crystalline lumps for traditional retail to fine, high-purity powder for industrial pharmaceutical compounding, necessitating specialized marketing and compliance strategies tailored to each sector’s regulatory and quality requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.9 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tate & Lyle PLC, S&W International (Thailand), Tereos, Nordzucker AG, Südzucker AG, EID Parry (India) Ltd., Bajaj Hindusthan Sugar Ltd., Shree Renuka Sugars Ltd., Mitr Phol Group, Guangxi Sugar Industry Group, Thai Roong Ruang Sugar Group, Bunge Limited, Cargill Incorporated, Louis Dreyfus Company, AGT Foods, CSC Sugar, Crystal Sugar Company, C&H Sugar Company, Amstar Sugar, Florida Crystals Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Rock Sugar Market Key Technology Landscape

The technological landscape in the Rock Sugar market focuses primarily on optimizing the crystallization process, which is historically a slow and labor-intensive method. Traditional manufacturing relies on natural cooling and seeding in large vessels, often taking weeks to achieve desirable crystal sizes. Modern advancements are centered on improving process control through automated vacuum crystallization and precise temperature profiling systems. These technologies utilize sophisticated sensor arrays and computer-controlled cooling jackets to meticulously manage the supersaturation level and cooling rate, thereby accelerating the nucleation and growth of uniform, defect-free crystals. This technical shift aims to standardize product quality, reduce the cycle time significantly, and minimize energy consumption compared to older, passive cooling techniques, ensuring consistent output for high-volume industrial contracts.

Furthermore, post-processing technologies are critical for maintaining the high-value nature of rock sugar. Advanced sorting and grading equipment, often incorporating high-resolution optical scanners and machine vision systems, are employed to accurately classify crystals based on size, color, and structural integrity. This automated grading replaces manual inspection, reducing human error and improving the consistency required for pharmaceutical and premium food applications where specifications are exceptionally strict. Innovative packaging solutions, including high barrier films and modified atmosphere packaging, are also becoming standard to mitigate moisture absorption, caking, and potential crystal breakage during extended storage and complex international logistics chains, thereby preserving the product's aesthetic and functional quality across diverse climatic conditions.

Another area of focus is sustainability technology, particularly in upstream processing. Manufacturers are increasingly integrating renewable energy sources into their plants and implementing advanced wastewater treatment technologies to minimize the environmental footprint associated with sugar refinement. The use of closed-loop systems for syrup recirculation and sophisticated filtration techniques ensures maximum yield from the initial sugar base while simultaneously reducing waste streams. These technological investments are critical not only for operational efficiency and cost control but also for meeting the escalating regulatory and consumer demand for environmentally responsible production methods, particularly in competitive export markets. The integration of advanced Manufacturing Execution Systems (MES) facilitates real-time monitoring and holistic quality management across the entire production lifecycle.

Regional Highlights

The global rock sugar market exhibits significant geographical disparity in both consumption volume and application specificity, with Asian markets dominating demand. The Asia Pacific (APAC) region is indisputably the largest market segment, driven by the deeply ingrained cultural usage of rock sugar in culinary traditions—from cooking savory dishes (like braised meats) to preparing desserts and utilizing it extensively in traditional Chinese and Ayurvedic medicinal preparations. High population density and established manufacturing bases in China, India, and Thailand ensure that APAC maintains a significant market share and leads in production capacity, often producing both high-purity pharmaceutical grades and traditional, slightly less refined variants.

Europe and North America represent high-growth potential markets, primarily driven by the increasing popularity of ethnic cuisine, the gourmet food movement, and specialty beverage consumption. Although the per capita consumption of rock sugar remains lower than in APAC, these regions are characterized by a high willingness to pay a premium for specialty, imported, or organically certified products. Demand here is concentrated in specialty retail stores, high-end food service sectors, and online gourmet platforms. The market penetration relies heavily on effective marketing that highlights the unique aesthetic and superior quality of rock sugar compared to local alternatives, often positioning it as a luxury or health-conscious sweetener.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but are experiencing steady growth. In Latin America, the rise in confectionery manufacturing and local demand for sugar alternatives drives consumption. The MEA region's growth is often linked to increasing urbanization, rising disposable incomes, and the import of specialized ingredients for growing expatriate and high-end hotel sectors. However, regulatory complexity and reliance on imports can pose logistical challenges in the MEA region. Generally, regional growth strategies must be localized, focusing either on mass availability and competitive pricing (in APAC) or high-value niche marketing and robust supply chain integrity (in Western markets).

- Asia Pacific (APAC): Dominates the market due to deep cultural usage in culinary and traditional medicinal practices; manufacturing hub for both conventional and pharmaceutical-grade rock sugar. Key markets include China, India, and Southeast Asian nations.

- North America: Fastest growing region in terms of CAGR, driven by the gourmet food segment, specialty coffee/tea culture, and the increasing demand for clean-label, artisanal sweeteners, primarily relying on imports.

- Europe: Strong demand in Western European countries (Germany, UK) fueled by ethnic food trends and the use of rock sugar in specific traditional European candies and preserves, with a focus on organic and ethically sourced variants.

- Latin America: Growing industrial use in the local beverage and confectionery sectors, supported by expanding consumer purchasing power and shifts toward refined processing standards.

- Middle East and Africa (MEA): Emerging market characterized by reliance on imports and localized demand driven by luxury food consumption and traditional regional sweet preparations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Rock Sugar Market.- Tate & Lyle PLC

- S&W International (Thailand)

- Tereos

- Nordzucker AG

- Südzucker AG

- EID Parry (India) Ltd.

- Bajaj Hindusthan Sugar Ltd.

- Shree Renuka Sugars Ltd.

- Mitr Phol Group

- Guangxi Sugar Industry Group

- Thai Roong Ruang Sugar Group

- Bunge Limited

- Cargill Incorporated

- Louis Dreyfus Company

- AGT Foods

- CSC Sugar

- Crystal Sugar Company

- C&H Sugar Company

- Amstar Sugar

- Florida Crystals Corporation

Frequently Asked Questions

Analyze common user questions about the Rock Sugar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between rock sugar and granulated sugar?

The primary difference lies in the crystal structure and production method. Rock sugar is formed through a slow, controlled crystallization process, resulting in large, transparent, high-purity sucrose crystals, offering a milder sweetness profile and a unique texture, unlike the small, rapidly formed crystals of standard granulated sugar.

Which geographical region exhibits the highest demand for rock sugar?

The Asia Pacific (APAC) region demonstrates the highest demand due to its pervasive use in traditional culinary preparations, pharmaceutical applications (Traditional Chinese Medicine), and daily consumption in tea and beverages, with countries like China and India being major consumers.

How is the adoption of rock sugar being influenced by health and wellness trends?

Health trends have dual effects: they restrain overall sugar consumption but also drive demand for specialty and minimally processed variants. Consumers perceive rock sugar, particularly the unrefined brown types, as a more natural option, fueling growth in the premium and organic segments of the market.

What role does technology, specifically AI, play in modern rock sugar manufacturing?

AI and advanced technology are crucial for optimizing the slow crystallization process, enabling manufacturers to precisely control temperature and supersaturation levels to reduce production cycle time, enhance crystal uniformity, and ensure high-purity standards essential for pharmaceutical use.

What are the key application areas driving market growth outside of traditional uses?

Beyond traditional culinary uses, growth is primarily driven by the specialty beverage industry (cocktail and tea mixology) and the increasing use of rock sugar powder in high-end cosmetic exfoliants, which value the high purity and gentle abrasive qualities of the fine granules.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager